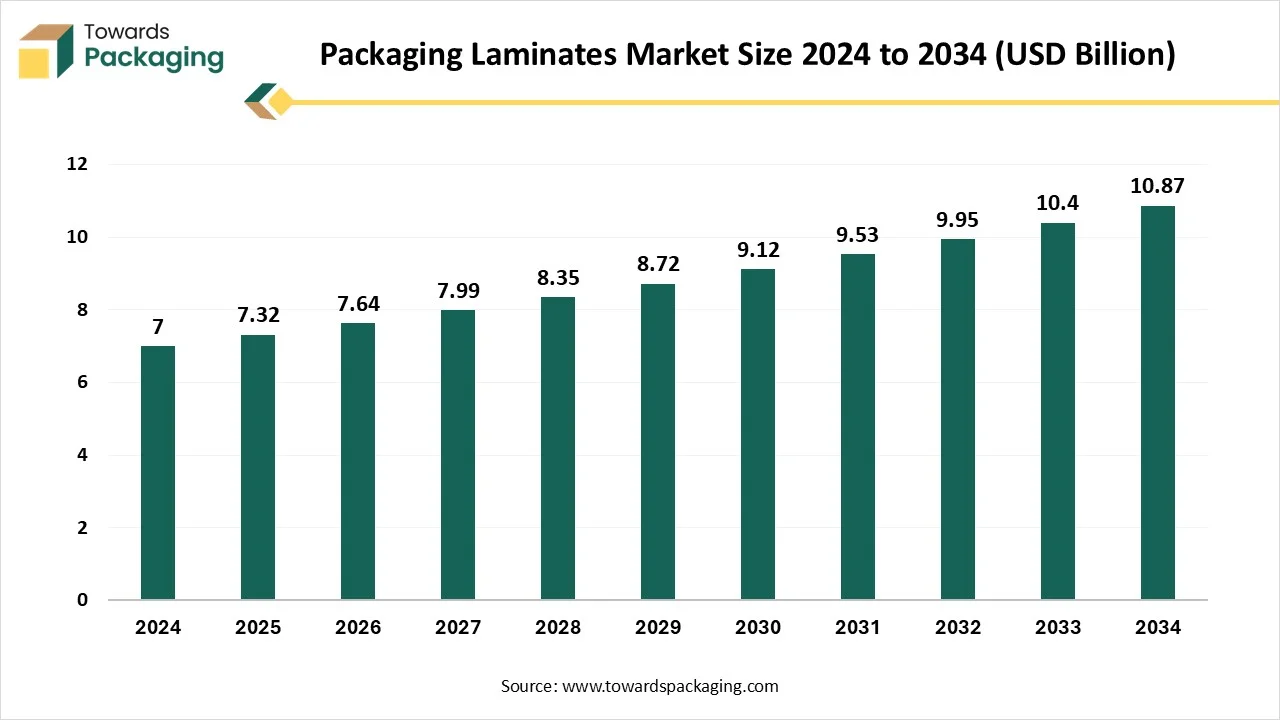

The packaging laminates market is forecasted to expand from USD 7.64 billion in 2026 to USD 11.36 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035. Our report covers comprehensive market trends, including the shift toward recyclable laminates, growing demand for extended shelf life, and investment in high-barrier materials.

It includes full segmentation insights across material type (plastic-based 48% share, paper-based, aluminum foil, bio-based), product structure (3-layer 42%), packaging type (pouches 34%), printing technologies (rotogravure 41%), applications (food 38%, pharma 22%), and end-user industries (FMCG 45%).

We provide detailed regional data for APAC (39% share), North America, Europe, LATAM, and MEA, along with value chain analysis, import–export data, supply chain disruptions, and manufacturing footprints. The report also profiles leading companies including Amcor, Mondi, Berry Global, UFlex, Huhtamaki, Constantia Flexibles, and others.

Packaging laminates are multi-layered flexible materials made by combining different films, foils, and paper to achieve enhanced barrier properties, strength, durability, and printability. These laminates are used to protect products from external factors like moisture, oxygen, light, and contaminants, thereby increasing shelf life and enhancing aesthetic appeal. They are widely used in food and beverages, pharmaceuticals, personal care, and industrial packaging. Packaging laminates or laminating films are prepared from diverse raw resources, mainly personalized based on role and the consumer’s requirements.

These packaging laminates serve as a decent barrier, which defends drugs, food crops, beverages, etc., from severe ecological situations. With the growing efficacy, these packaging laminates are widely utilized in fast manufacturing procedures, mostly for flexible packing. Similarly, the good printing competencies presented by these packaging laminates make the finished product much more attractive, where the barrier properties confirm extended shelf life of the goods. With its extensive profits, packaging laminates are largely utilized in the pharmaceutical, food and beverage, and cosmeceuticals sectors.

| Metric | Details |

| Market Size in 2025 | USD 7.32 Billion |

| Projected Market Size in 2035 | USD 11.36 Billion |

| CAGR (2026 - 2035) | 4.5% |

| Leading Region | Asia Pacific |

| Market Segmentation | Material Type, Aluminum Foil-Based Laminates, Product Structure, Packaging Type, Printing Technology, Application, End-User Industry and Region |

| Top Key Players | Amcor plc, Mondi Group, Berry Global Inc., Huhtamaki Oyj, Constantia Flexibles, Sealed Air Corporation, UFlex Ltd. |

The growing demand for eco-friendly packaging resources has elevated the innovation in this industry to improve customer experience.

The rising trend for affordable products has influenced the demand for packaging laminates with advancements.

The innovation to enhance consumers' experience has influenced the demand for this market.

AI plays an important role in the packaging laminates market by optimizing the quality of the materials utilized for the production process. It analyzes the data gathered and helps to identify the issues that help to bring the required innovation to the market. It helps in enhancing recycling and sorting methods and supports to generate high quality rPP for the usage of the food industry and the design of recycled packages. With the incorporation of advanced technologies, the generation of packaging that can be recycled several times and redesigned in several patterns becomes easy. Artificial intelligence helps to make the recycling process effective and ensure the production of high-quality packages.

Demand for Safe Packaging of Food and Beverages

One of the major growing factors influencing the packaging laminates market is the enhanced extension of the worldwide packaged food and beverage sector. Rapid expansion, changing consumption patterns, and the rising demand for suitability foods are together growing the requirement for high-performance laminated materials that confirm prolonged shelf life, contamination shield, and moisture resistance. Improvements in multilayer laminate expertise are permitting producers to grow packing that can endure multifaceted supply chains, mainly in cold chain logistics. As worldwide retail systems enlarge and e-commerce stations incorporate with direct-to-customer food delivery replicas, laminated packing solutions are becoming essential to confirm product integrity and brand stability. Developing economies such as Brazil, India, Vietnam, and parts of Sub-Saharan Africa show a lucrative opportunity for packaging laminates producers because of increasing reusable profits and developing retail infrastructure.

Strict Guidelines of the Government for Food Safety

The strict guidelines of the government over food safety have hampered the wide extension of the market, as there is marginal profit available in this sector. Strict inspection over packaging results in rejection and wastage of materials, which restricts its growth. The fluctuation in the raw materials has also hindered the growth of the packaging laminates market.

Rising Demand for Pharmaceutical Packaging

With a rising demand for tamper-evident and safe packaging in the pharmaceutical sector are progressively depend on the high-performance of the packaging laminates. These resources provide exceptional protection against light, moisture, and oxygen, critical for preserving the efficiency and safety of pharmaceutical goods. Moreover, the rising worldwide population and the consistent growth in healthcare expenses are anticipated to fuel further development for packaging laminates in this segment. The personal care business also plays an essential role in the growth of the packaging laminates industry. Products like skincare and cosmetics need packaging that protects the contents and improves the aesthetic appeal of the brands. Laminates provide versatile pattern possibilities, allowing brands to generate visually prominent and practical packaging. The growth of this sector is boosted by growing customer interest in personal care goods, influenced by growing disposable earnings and a sharp focus on personal grooming and hygiene.

The plastic-based laminates (esp. BOPP) segment held a considerable share of the packaging laminates market in 2024 due to their cost-efficiency, strong performance, and versatility. Brands in this sector are highlighting durable and lightweight packaging that helps high-speed filling lines and goods' safety at the time of long-haul logistics. The rise in flexible packaging arrangements, exclusively stand-up sachets and pouches, is heavily dependent on multilayer plastic laminates that provide puncture resistance, heat sealability, visual appeal, and puncture resistance. Additionally, new grades of recyclable polypropylene and polyethylene films are strengthening the competitive edge of plastics amongst tightening sustainability goals.

The bio-based and compostable laminates segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is rising significantly due to the increasing concern for ecologically responsible and sustainable packaging of the products. The capacity to biodegrade naturally attracts a huge number of brands towards this segment.

The 3-layer laminates segment was dominant over the packaging laminates market in 2024 as it has high-performance, cost-effective, and versatile properties. These types of packaging have layers with distinct features. The combination confirms excellent mechanical strength, improved protection, and prolonged shelf life. This type of multi-layer structure permits producers to customize packaging according to particular needs.

The multi-layer laminates (>3 layers) segment is anticipated to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its flexibility and capacity to fulfill the demand of the consumers. This more than 3-layer packaging is introduced to provide high protection and durability to the products.

The pouches (stand-up pouches) segment held a considerable share of the packaging laminates market in 2024 due to the demand for efficient, convenience, and versatile packaging. The ability to accommodate a variety of product forms, including granules or powder, solids, and liquids. These pouches are produced by the combination of paper, aluminum, and plastic.

The lidding films ingredients segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These are widely utilized in containers, trays, and cups. The capacity to maintain the quality of food products. Superior performance of the lidding films protects products from ecological conditions such as moisture, air, and water.

The rotogravure segment was dominant over the packaging laminates market in 2024 due to its suitability for long print runs, high-speed production, and excellent print quality. This technique utilizes inscribed cylinders to transmission ink onto substrata, permitting for sharp imageries, reliable colour reproduction, and fine particulars which are important in packaging applications of brand image.

The digital printing segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is driven rapidly due to customization options, a decrease in wastage production, and faster turnaround times.

The food (snacks and dairy) segment held a considerable share of the packaging market in 2024 due to the increasing need for attractive product presentation, enlarged shelf life, and excellent barrier protection. The suitable solution for this segment is the combination of paper, aluminum, PET, and PE, which guarantees the maintenance of the freshness of the products.

The pharmaceuticals (sachets) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is because of the increasing demand for tamper-evident, excellent-barrier, and pollution-resistant packing is a core reason behind the development of the packaging laminate consumption.

The FMCG segment held a considerable share of the packaging laminates market in 2024 due to high product turnover, requirement for durable packaging, and large volume storage. FMCG products are usually packed in lidding films, pouches, sachets, and wrappers. These packages are lightweight and convenient, which enhances the demand in the FMCG packaging segment.

The pharmaceutical and healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is widely used due to its resistance to adverse ecological conditions. The continuing invention in drug transport systems, comprising tailored biologics and medicine, requires progressive packaging that guarantees product integrity through supply.

Asia Pacific held the largest share of the packaging laminates market in 2024, due to the quick urbanization, extension of middle-class demographics, and population growth. This increase boosts both multinational and domestic brands to capitalize on effective, cost-competitive laminates that provide durability, printability, and protection across varied weather zones. Moreover, the enhancing e-commerce network in countries like China, Japan, India, and several others is encouraging acceptance of laminated setups enhanced for last-mile transfer and brand appearance.

North America is projected to grow at the fastest rate in the packaging laminates market during the forecast period. It is due to the continuous expansion of functional food products packaging. Customers are progressively looking for prolonged shelf life, clear labelling, and suitability packaging, which is prompting brands to accept packaging laminates with improved barrier and printability properties.

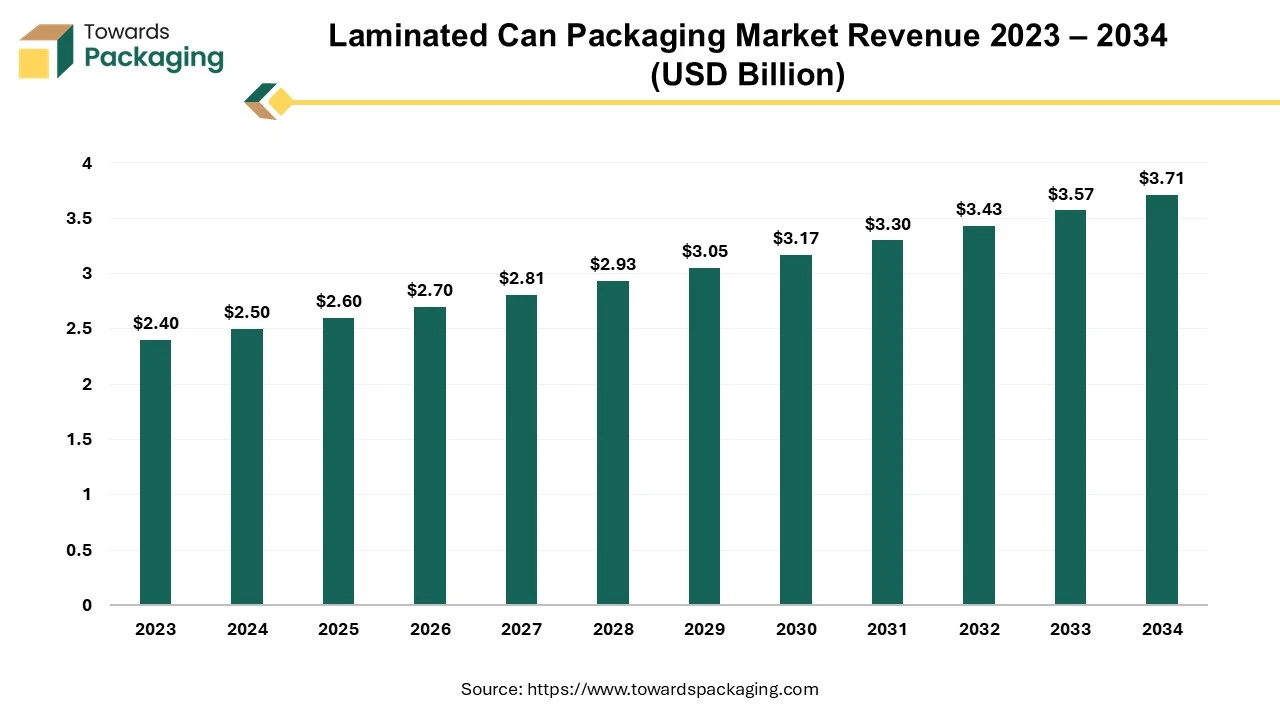

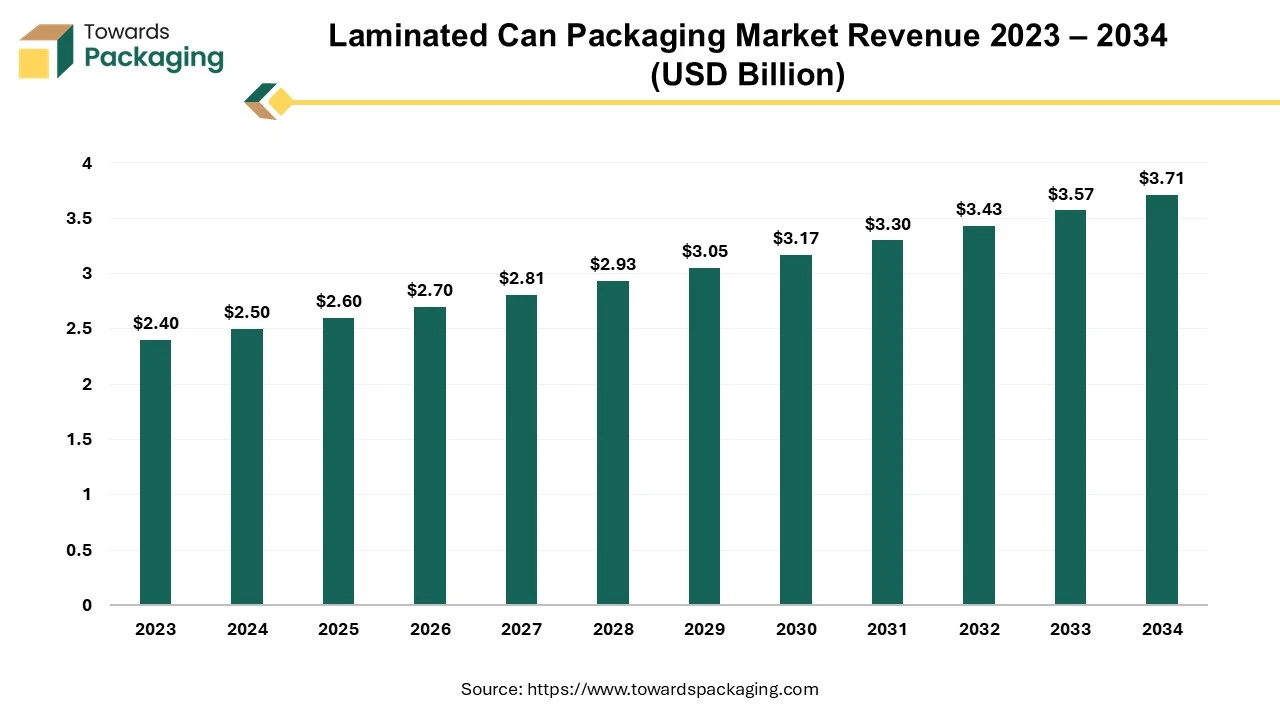

The global laminated can packaging market size reached US$ 2.50 billion in 2024 and is projected to hit around US$ 3.71 billion by 2034, expanding at a CAGR of 4.05% during the forecast period from 2024 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing laminated can packaging which is estimated to drive the global laminated can packaging market over the forecast period.

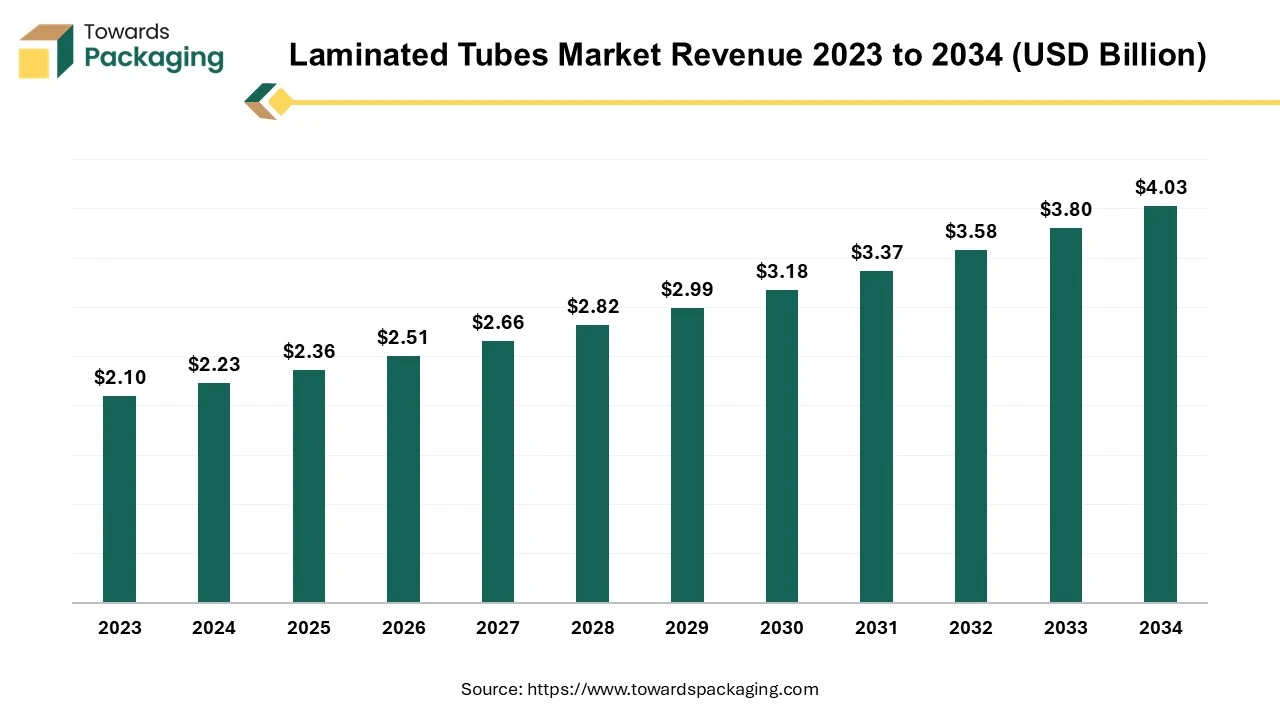

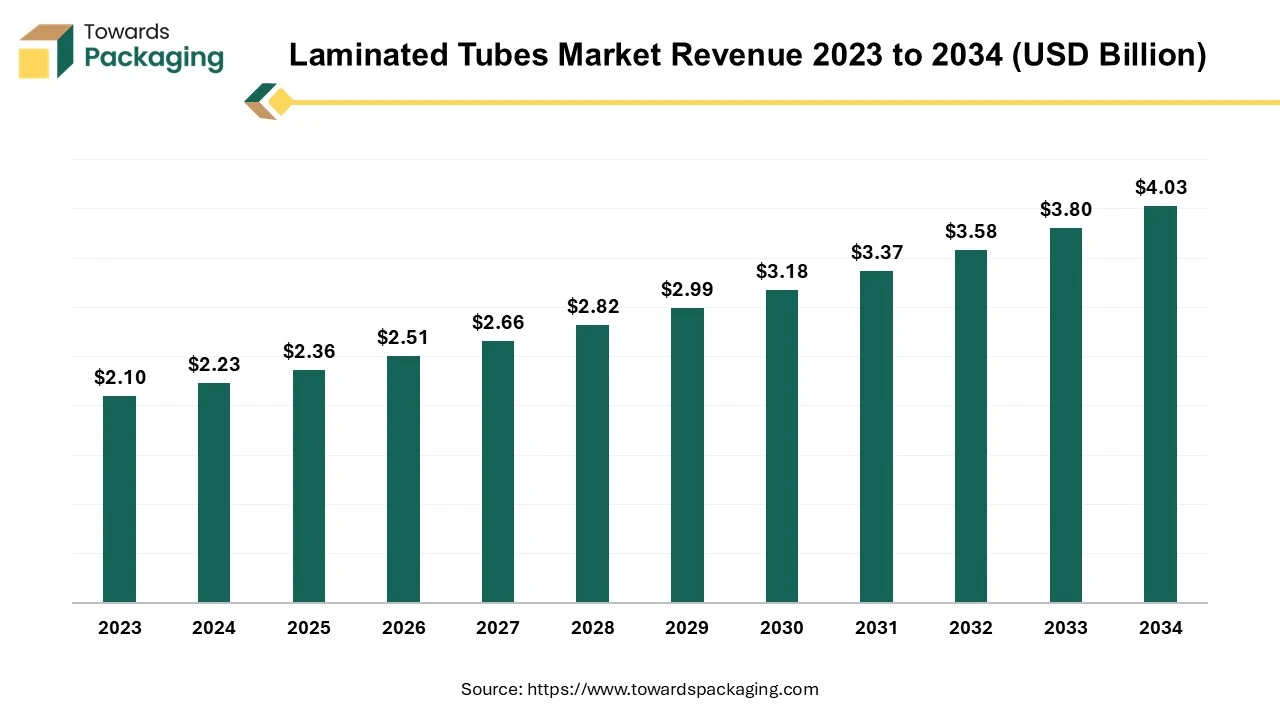

The global laminated tubes market size reached US$ 2.10 billion in 2023 and is projected to hit around US$ 4.03 billion by 2034, expanding at a CAGR of 6.1% during the forecast period from 2025 to 2034. The increasing regulatory support for laminated tubes will continue aiding market growth in the forecast period.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing laminated tubes which is estimated to drive the global laminated tubes market over the forecast period. Emerging markets and trends for laminated tubes is expected to drive the growth of the global laminated tubes market over the forecast period.

Material Type

Aluminum Foil-Based Laminates

Product Structure

Packaging Type

Printing Technology

Application

End-User Industry

Region

February 2026

February 2026

February 2026

February 2026