Molded Plastic Packaging Market Size, Growth with Logistics & Distribution Solutions

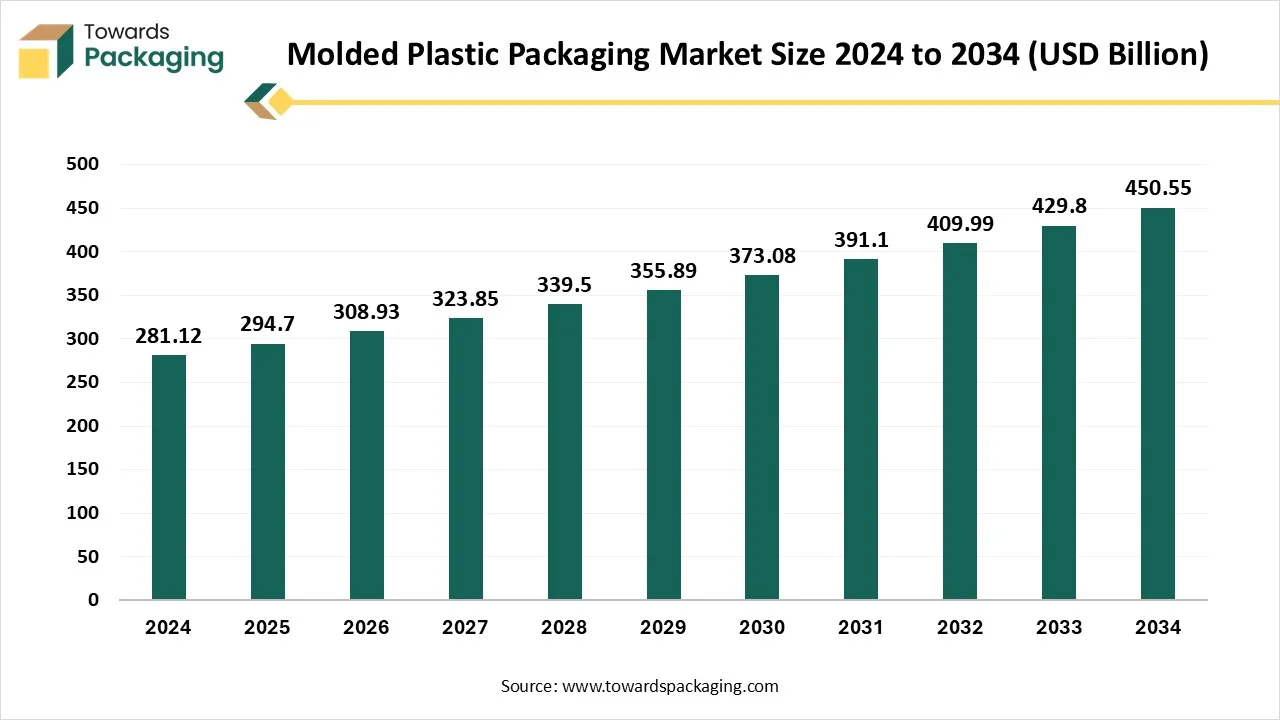

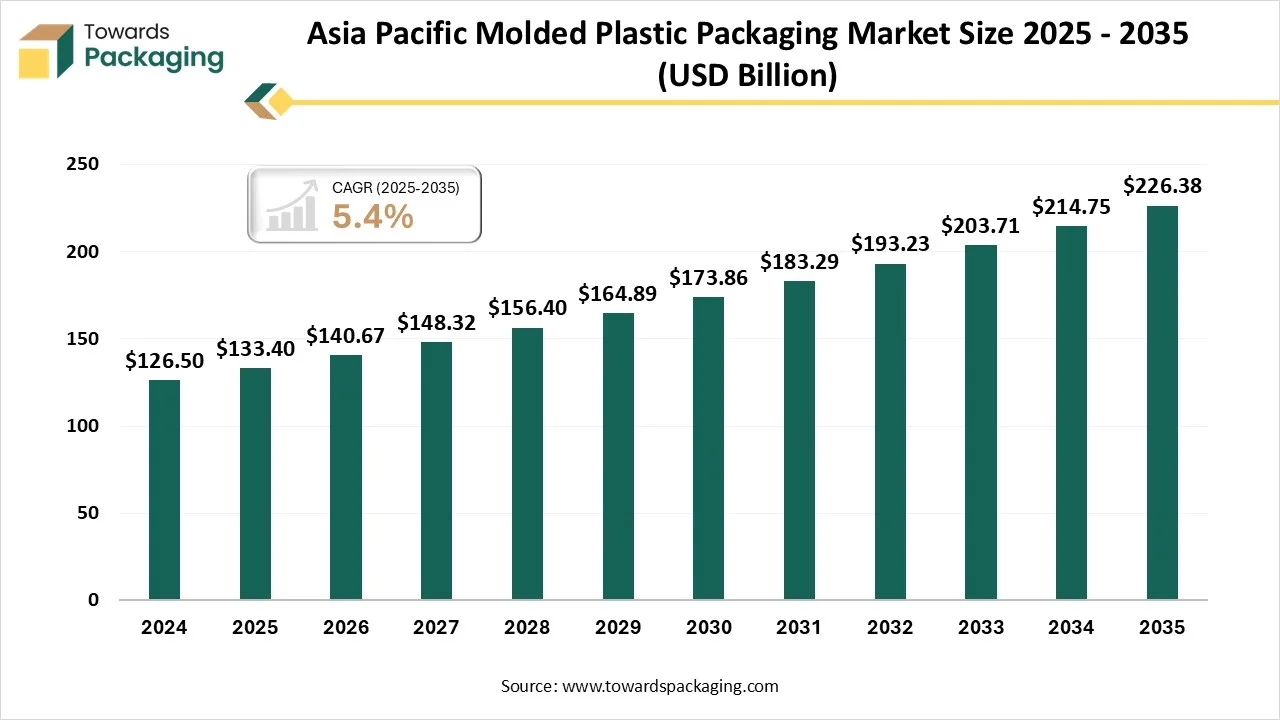

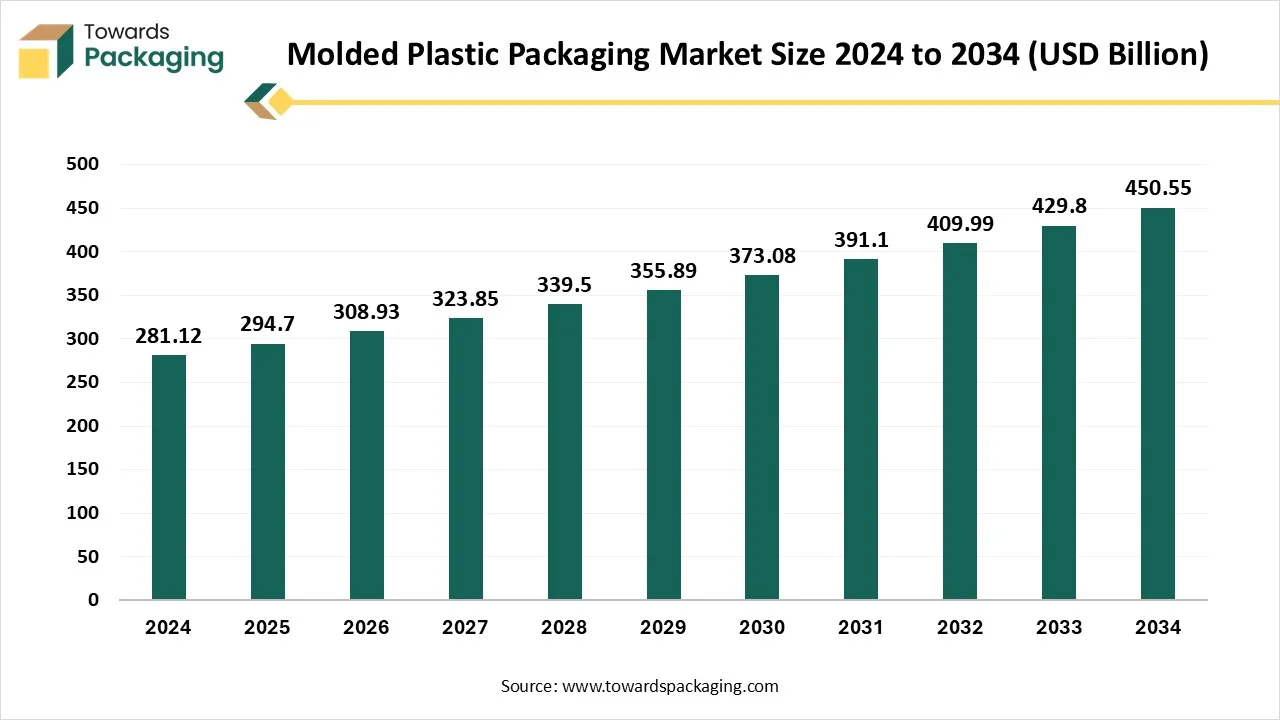

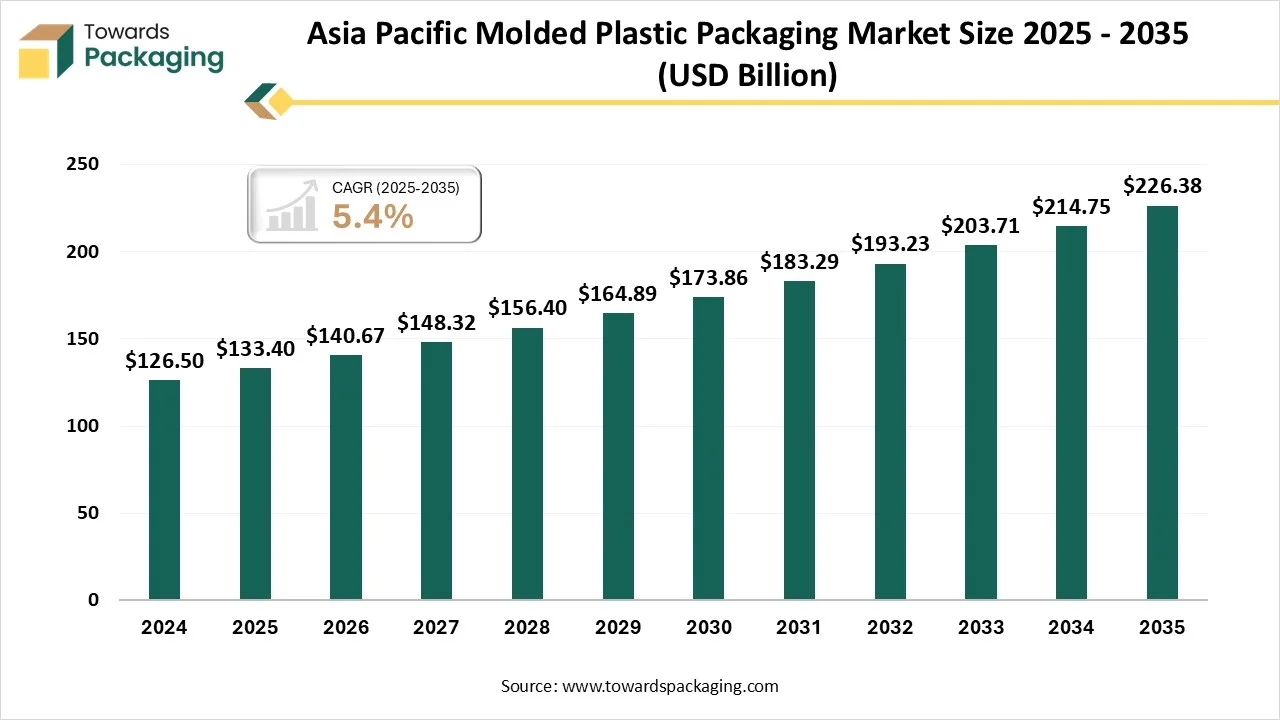

The molded plastic packaging market is valued at USD 294.7 billion in 2025 and is projected to expand from USD 308.93 billion in 2026 to USD 472.31 billion by 2035, registering a CAGR of 4.83% between 2026 and 2035. This comprehensive report covers detailed market size analysis, growth trends, manufacturing processes (injection molding, thermoforming, blow molding), product types, polymers, applications, and distribution channels. It provides in-depth regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific holding a dominant 45% share in 2024 and North America expected to grow at a notable CAGR through 2034.

The study includes trade flow data, production volumes, installed capacity, manufacturing footprint, value chain analysis, supplier and manufacturer mapping, and a competitive analysis of key players such as Amcor, Berry Global, Huhtamaki, Mondi, and Aptar Group, offering a 360-degree industry perspective.

Key Takeaways

- In terms of revenue, the market is valued at USD 294.7 Billion by 2025.

- The market is expected to reach USD 472.31 billion by the year 2035.

- Rapid growth at a CAGR of 4.83% will be observed in the year between 2025 and 2034.

- By region, Asia-Pacific dominated the market with the share of 45% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By manufacturing process, the injection molding segment contributed the largest share of 40% in 2024.

- By manufacturing process, the thermoforming segment will expand at a significant CAGR between 2025 and 2034.

- By product type, the bottles and rigid containers segment contributed the largest share of 40% in 2024.

- By product type, the trays and clamshells segment will grow at a significant CAGR between 2025 and 2034.

- By polymer/material, the PET segment contributed the largest share of 30% in 2024.

- By polymer/material, the Polypropylene segment will expand at a significant CAGR between 2025 and 2034.

- By application, the Food and beverage segment contributed the largest share of 50% in 2024.

- By application, the e-commerce/retail-ready packaging segment will expand at a significant CAGR between 2025 and 2034.

- By distribution channel, the Direct Sales/OEM Contracts segment contributed to the largest share of 55% in 2024.

- By distribution channel, online packaging marketplaces & e-commerce suppliers will grow at a significant share between 2025 and 2034.

Market Overview

The molded plastic packaging market covers the design, manufacture, and sale of packaging products created by molding processes (injection molding, thermoforming, blow molding, compression molding, etc.). These packages include rigid containers, trays, tubs, clamshells, closures, and specialty shapes made from polymers such as PET, PP, HDPE, PS, and newer bio-based/ recycled resins. Molded plastic packaging is used to protect and present food & beverage, personal care, pharmaceuticals, household chemicals, electronics, and more balancing cost, performance, barrier properties, and manufacturability at scale.

Molded Plastic Packaging Market Trends

- Nearshoring Manufacturing: Organizations that source components and molds from regional suppliers significantly advantage by delivering manufacturing procedures closer to us. Nearshoring allows them to decrease supply chain risk and distractions caused by shipping delays, geopolitical pressure, and more. With the assistance of developed checking, quality assurance can be improved while localizing troubleshooting issues.

- Mold Transferability: The potential to shift our molds more conveniently is a benefit factor in less-volume plastic production, as manufacturers must exchange molds more frequently for shorter manufacturing runs. Streamlined molds enable tools and presses to be interchangeable between various plants and machines. This flexibility lowers costs and downtime associated with transferring molds from one place to another, allowing a perfect flow throughout manufacturing.

- Single Minute Exchange of Die and Lean Manufacturing: A smooth move is a crucial advantage of lean manufacturing in injection moulding, which concentrates on developing effectiveness and lowering waste in all elements of the production process. One of the main tools in completing this is the Single-Minute Exchange of Die, which is used to lower the breaks in manufacturing caused by substituting one mold with another. Apart from SMED, other lean practices include reducing waste, counting energy, material, and labor waste. Efficient usage of material and accurate energy tracking lowers costs and allows an eco-friendly production procedure. Decreasing ineffectiveness with labor through lean strategy grows the output level per worker and further lowers operational costs.

- Automation and Smart Systems: Automation and smart systems, driven by Industry 4.0 Technologies, are paving the way for digital change in injection moulding by developing operational effectiveness and product quality. Data transfer and remote control regarding pressure, temperature, and molded conditions are capable of utilizing IoT (Internet of Things) and data-driven manufacturing.

- Just-In-Time Production: Just-in-Time can be used in tracking inventories to showcase industry demands and transform production timelines. Injection moulding depends heavily on tailored services to align with particular customer demands. This move towards automation, even on a small scale, enables manufacturers to quickly adjust manufacturing levels and product quality.

- Sustainability and Recyclable material: Sustainable injection molding practices are gaining attention around us as a huge awareness of the effects of climate change on organizations continues to develop. Molders are heavily utilising recycled and biodegradable plastics to align with compliance and environmental standards. Recycling scrap material, which is known as re-grinding, is one way to lower waste.

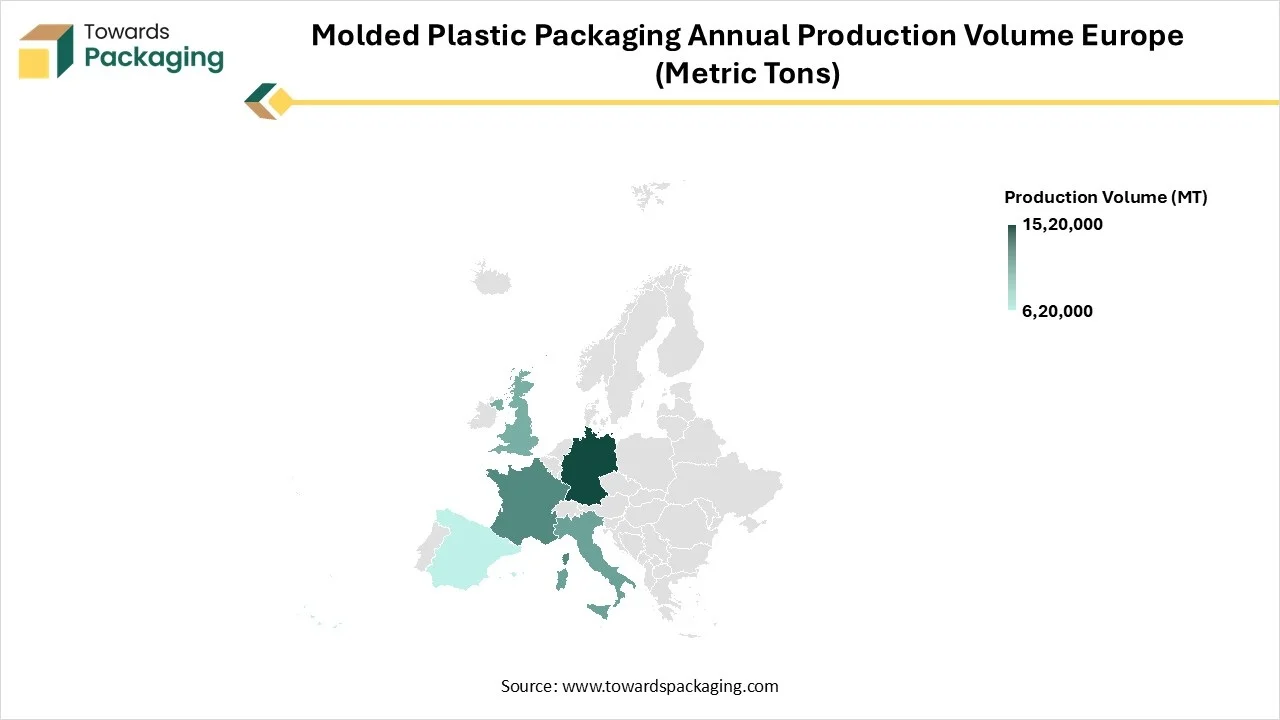

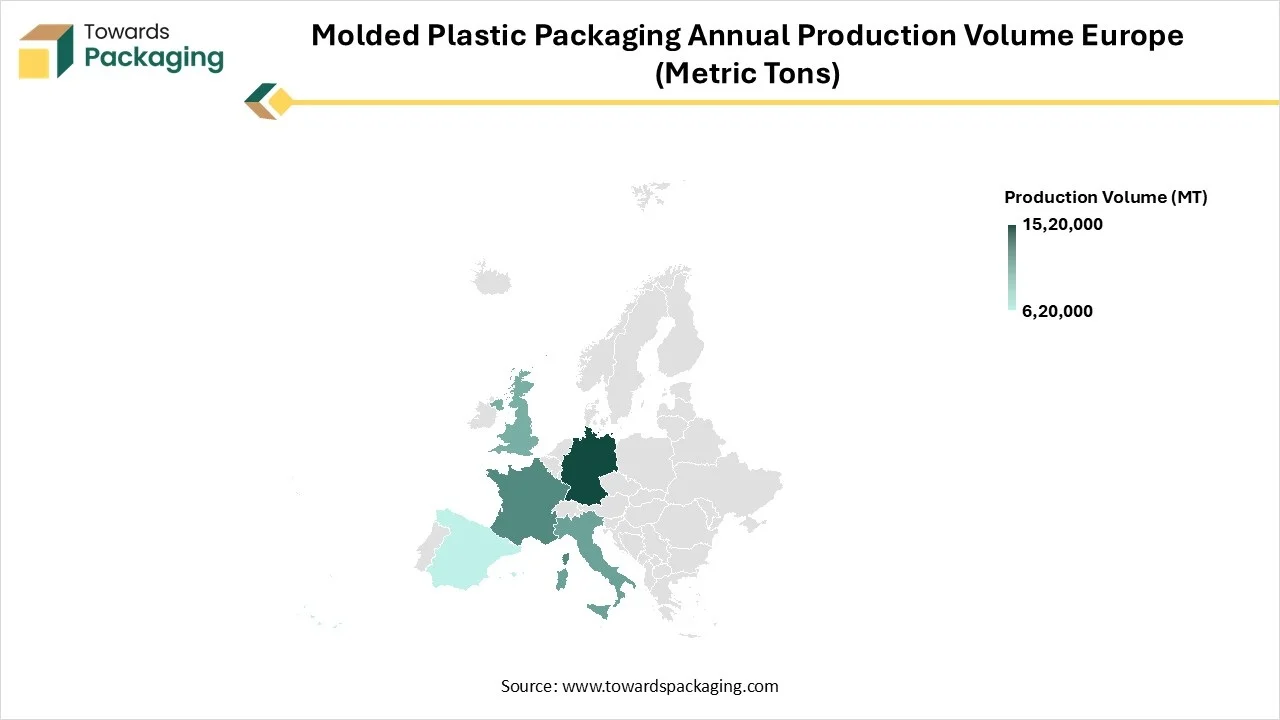

Molded Plastic Packaging Annual Production Volume by Region and Country (Metric Tons)

| Region |

Country |

Production Volume (MT) |

| Europe |

Germany |

1,520,000 |

| Europe |

France |

1,180,000 |

| Europe |

Italy |

1,050,000 |

| Europe |

United Kingdom |

980,000 |

| Europe |

Spain |

620,000 |

| Europe |

Rest of Europe |

1,500,000 |

| Region |

Country |

Production Volume (MT) |

| North America |

United States |

4,100,000 |

| North America |

Canada |

650,000 |

| North America |

Mexico |

450,000 |

AI Integration in the Molded Plastic Packaging Market

Artificial Intelligence (AI) and machine learning are changing quality control and procedure optimization in injection moulding. AI algorithms update statistics to match statistics that analyze anomalies and designs, frequently predicting problems before they arise. Machine Learning models develop quality and consistency by tracking operational elements like pressure, temperature, and cooling time. Robotic automation has also become crucial to injection moulding, which simplifies tasks such as assembly, part removal, and packaging. Cobots work along with elevating productivity and safety, as do human managers. Automated setups show direction to lights-out production, in which manufacturing runs continuously without human intervention, maximizing profitability.

Market Dynamics

Market Driver

Eco-Friendly Power Drives Molded Plastic Packaging

Demand is increasing for eco-friendly manufacturing injection moulding solutions. These include reducing energy usage, utilising sustainable injection moulding, and lowering down on waste. Everyone shows a responsible display of greener and responsible strategies to injection moulding. Such transformation assist in changing producers' carbon footstep and enable customers to create more informed, sustainable choices while deciding who to work with. Sustainable plastic production can assist in changing this unwanted situation by updating injection moulding with environmental practices. An eco-friendly future of injection moulding influences materials such as bio-based resins, biodegradable plastics, and bio-based materials. Along with current strategies to develop energy smoothness and lower waste.

Market Restraint

Plastic Management Leads To Challenges

Growing nations, together with other countries, witness issues in operational plastic waste collection management systems. Inaccurate waste management outcomes in polluted materials, which demote the quality of materials that are perfect for recycling. The lack of perfect collection penetrates and sorting stations, pointing to valuable recyclable plastics that get buried in oceans and landfills. Today's recycled plastic costs are greater than the virgin plastic price, which makes the usage of recycled material pricey for business uses. Recycling technology developments demand large capital funding, while oil industry transformations encourage the sector's position for recycled material.

Market Opportunity

Polymers-The Lead Role

The growth of high-performance polymers, like engineering thermoplastics and liquid crystal polymers, has stretched the capabilities for injection moulding. These properties serve developed properties like chemical resistance, heat resistance, and mechanical power. The rising importance of sustainability has driven the advancement of renewable and biodegradable materials for injection moulding. This counts bioplastics derived from plant-based resources, which serve as an eco-friendlier material alternative to regular plastics. Apart from this, the multi-shot moulding technique enables the injection of several materials or colors into a single mold, making complicated and intricate parts.

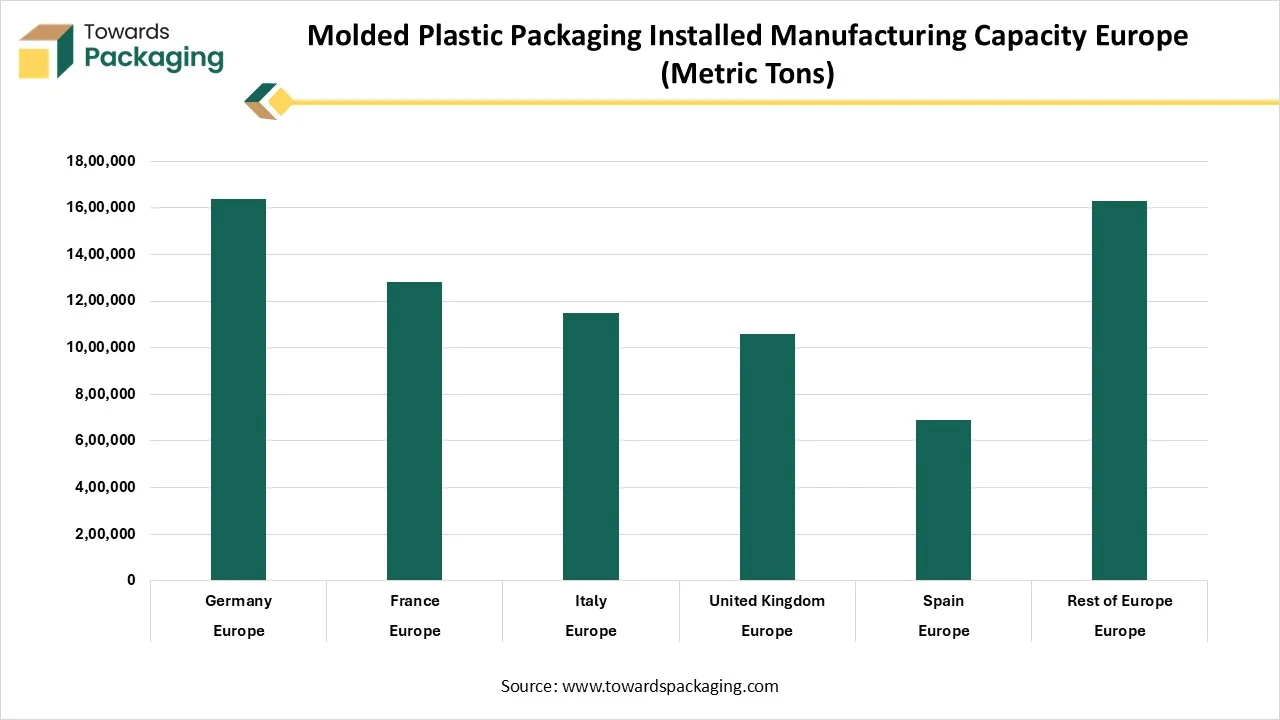

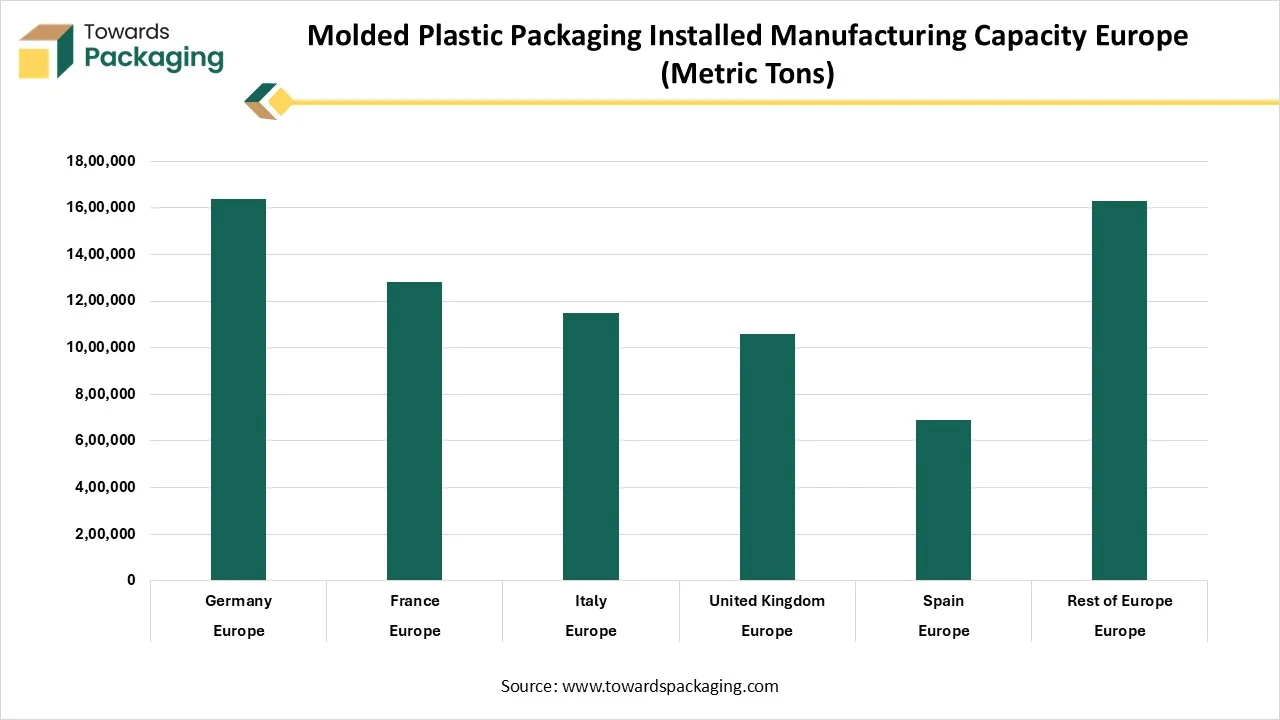

Molded Plastic Packaging Installed Manufacturing Capacity by Region and Country (Metric Tons)

| Region |

Country |

Installed Capacity (MT) |

| Europe |

Germany |

1,640,000 |

| Europe |

France |

1,280,000 |

| Europe |

Italy |

1,150,000 |

| Europe |

United Kingdom |

1,060,000 |

| Europe |

Spain |

690,000 |

| Europe |

Rest of Europe |

1,630,000 |

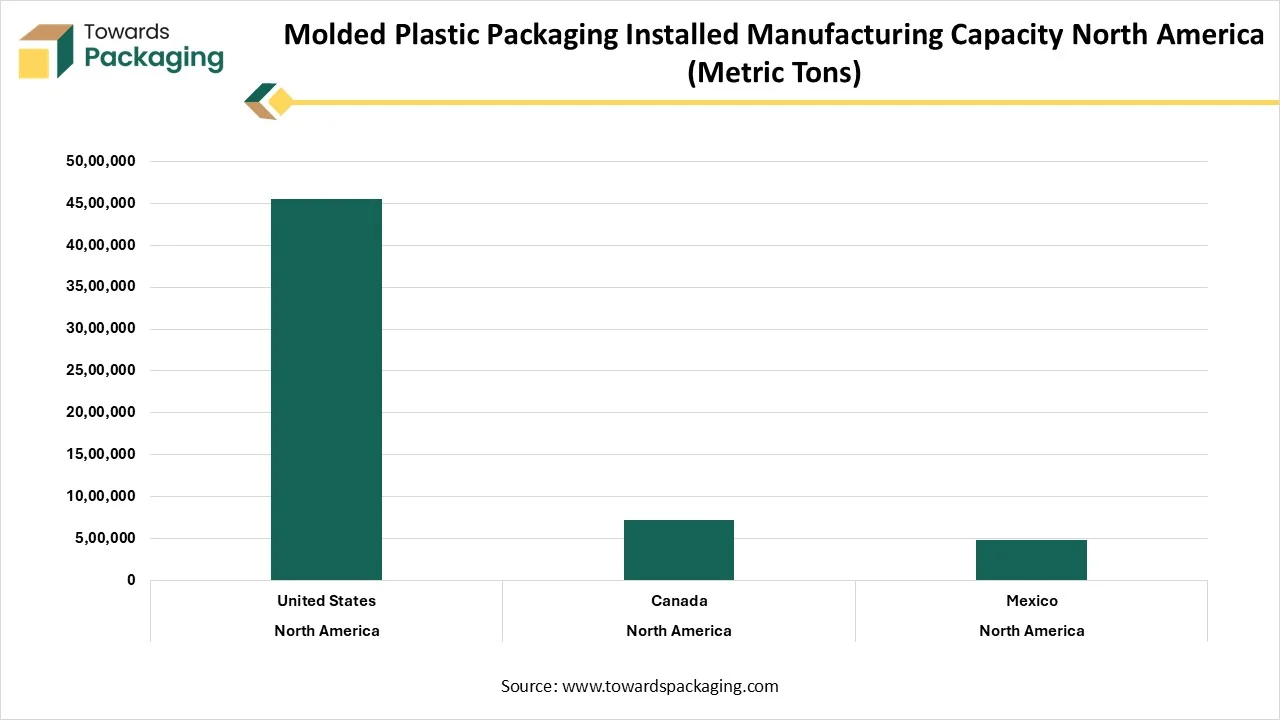

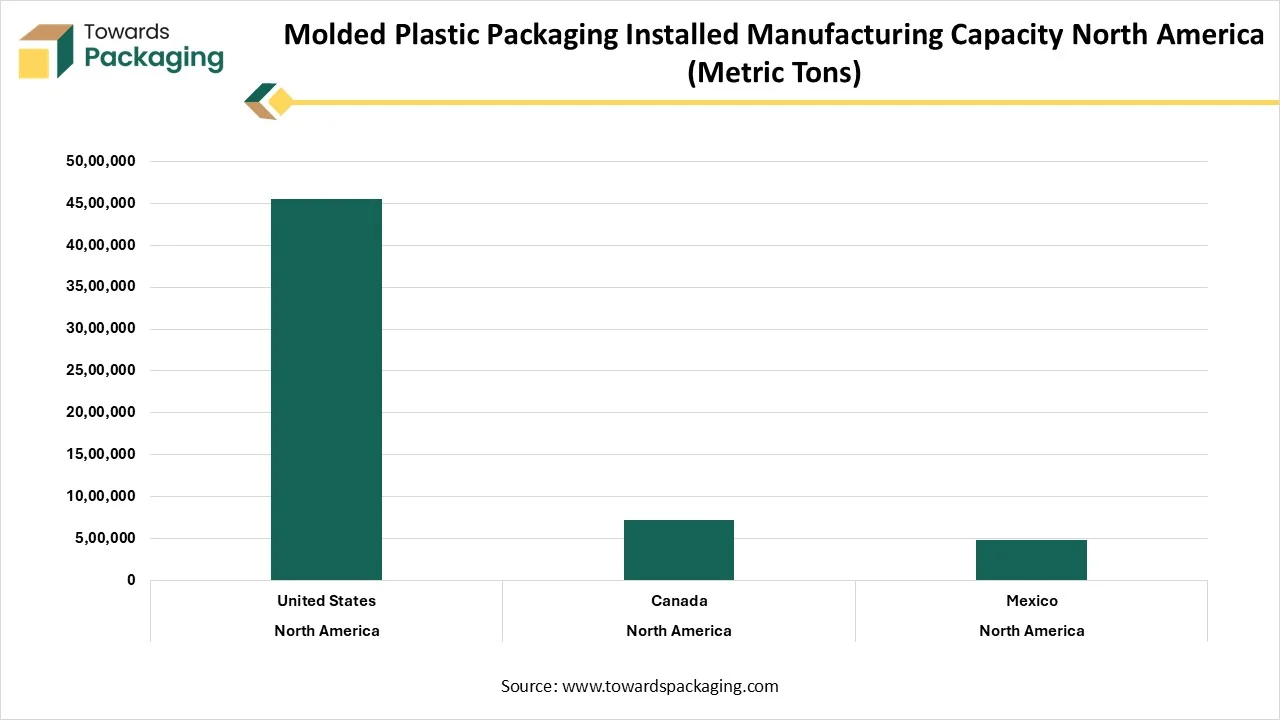

| Region |

Country |

Installed Capacity (MT) |

| North America |

United States |

4,550,000 |

| North America |

Canada |

720,000 |

| North America |

Mexico |

480,000 |

Segmental Insights

Manufacturing Process Insights

How Did Injection Moulding Segment Dominate The Molded Plastic Packaging Market In 2024?

Injection Moulding segment dominated the market in 2024 as it is a production procedure used to make plastic parts quickly and smoothly. The process includes melting plastic pallets and injecting the molten material into a mold. Once the plastic cools and hardens, it takes the shape of the mold, making a reliable and complete product. Plastic manufacturing has a major effect on the environment. Regular plastics take several years to decompose, contributing to pollution and landfill waste. Furthermore, the energy-intensive procedure of creating plastics increases carbon emissions. Sustainable injection moulding serves as a path to lower these environmental effects. By utilising eco-friendly and energy-efficient materials, producers can generate good-quality plastic products while lowering pollution and waste. The transformation towards sustainable practices also assists organisations to align with growing user demand for eco-friendly producers.

The thermoforming segment is expected to grow fastest in the market during the forecast period. It is a production procedure in which a plastic sheet is being heated having a pliable forming temperature, pointe in a vacuum, and pressure formed into a 3-dimensional shape in a mold, and then cut to make the desired product, depending upon the application needed. The most common use of thermoforming is in the user packaging, but it has many other applications such as Aerospace, transportation, Medical ,Electrical and Electronics ,Home appliances, and the construction field as well.

Product Type Insights

How Did The Bottles And Rigid Containers Segment Dominate The Molded Plastic Packaging Market In 2024?

Bottles and rigid containers segment dominated the market in 2024, as rigid packaging is classified by its strong and inflexible pattern and is generally created from hard materials such as plastic, glass, and metal. These materials serve power, resistance, and durability, and of course, the opposition to external elements like light, moisture, and temperature fluctuations. Rigid packaging is crafted to serve maximum protection to its contents, storing them safely during handling, storage, and transportation. Rigid packaging safeguards different rigid containers and counts everything from lever-lid paint tins to plastic buckets, blue plastic barrels, and aluminum bottles, too.

Trays and Clamshells segment are predicted to grow fastest in the market during the forecast period. Plastic trays in moulded packaging are hugely utilised across different industries, specifically in the food and consumer goods sectors, due to their durability, lightweight nature, and cost-effectiveness. Manufactured through processes such as thermoforming and injection moulding, these trays offer accurate shapes, sizes, and compartment designs that securely hold and protect products during transportation and storage. In the food sector, they are prevalently used for fresh produce, bakery items, and ready-to-eat meals as they can be integrated with high-barrier film. The clamshell packaging is the type of packaging that provide enhanced protection to the different types of display products. The clamshell packaging made from transparent material or hinged plastics which can be open and close such as clamshell.

Polymer/Material Insights

How Did The PET Dominate Segment The Molded Plastic Packaging Market In 2024?

Polyethylene Terephthalate (PET) segment dominated the molded plastic packaging market in 2024 as it is an evergreen polymer that is made through the polymerisation procedure, including ethylene glycol and terephthalic acid. PET's initial end-use applications are for packaging and textile manufacturing. Among different uses, beverage bottles show the biggest industry for PET packaging. PET is a top polymer for the packaging of carbonated soft drinks and mineral water, and it is heavily used for the packaging of fruit juices, ready-to-drink teas, sports and isotonic drinks, and particular alcoholic beverages. Various material characteristics and elements contribute to mechanical strength, durability, and transparency that have made it a perfect choice for single-use carbonated beverage bottles.

Polypropylene segment is predicted to grow fastest in the market during the forecast period. They are a commodity thermoplastic having a semi-crystalline structure, perfect resistance to moisture, and oppose bases and some acids. Furthermore, polypropylene has accurate fatigue power, a low coefficient of static friction, and is recyclable. Polypropylene is one of the most cost-efficient thermoplastic that is available and constantly assist CNC machining and injection molding. There are two different variants, like copolymer and homopolymer. Homopolymer polypropylene has perfect strength, heat deflection, and stiffness. Copolymer polypropylene has perfect effect opposition and transparency. Homopolymer polypropylene is more prevalently used, but both classifications have the same injection molding procedure parameters.

Application Insights

How Did The Food And Beverage Industry Segment Dominate The Molded Plastic Packaging Market In 2024?

The food and beverage industry segment dominated the molded plastic packaging market in 2024 as it is constantly growing, with new urges for more sustainable, safer, and more effective products. From packaging and kitchenware to processing machines, food industry molding is playing an important role in driving invention. Developments in plastic innovation have led to rigid, safer, and more eco-friendly solutions that improve food safety, expand product shelf life, and enhance convenience. Plastic injection moulding is a production procedure that generates durable, high-quality, and accurate plastic components. In the food and beverage sector, this process is important for making everything from food-safe packaging to heavy-performance utensils and machines. Also, the move towards eco-friendly materials has led to the growth of recyclable and biodegradable plastics.

E-commerce and retail-ready packaging segment are expected to grow fastest in the market during the forecast period. As they are important in the e-commerce industry, they serve reliable protection, efficient handling, and cost-effective solutions for shipping a huge range of products. Designed through processes such as injection moulding, thermoforming, and blow moulding, these packages provide tailored shapes and sizes that securely hold product, lowering movement and reducing the risk of damage during transit. In e-commerce, moulded plastic packaging is widely used for cosmetics, electronics, and high-value items as it serves excellent shock resistance, moisture protection, nd tamper-evidence features. Its lightweight nature assists in reducing shipping costs. While its durability ensures products arrive intact, it enhances customer satisfaction and reduces return rates.

Distribution Channel Insights

How Did Direct Sales To OEMs Segment Dominate The Molded Plastic Packaging Market In 2024?

Direct sales/OEMs (Original Equipment Manufacturers) contracts segment have dominated the molded plastic packaging market in 2024, as it includes supplying customized, high-quality packaging solutions directly to manufacturers without intermediaries. This sales channel is specifically significant for industries such as automotive, electronics, healthcare, food and beverage, and consumer goods, where OEMs need packaging tailored to particular product dimensions, weights, and protection needs. By working directly with OEMs, molded plastic packaging producers can design and deliver bespoke solutions, such as trays, clamshells, and inserts.

Online packaging marketplaces & e-commerce suppliers segment are expected to grow fastest in the market during the forecast period. Online packaging suppliers have become a main part of the global packaging industry, serving businesses and individuals with convenient access to a wide range of packaging materials through e-commerce platforms and dedicated supplier websites. These suppliers typically provide products such as boxes, bags, tapes, and cushioning materials, molded packaging, and specialty solutions like eco-friendly or customized designs. By operating online, suppliers can reach a broader customer base without the limitations of physical retail, offering features like bulk ordering, instant quotations, and doorstep delivery.

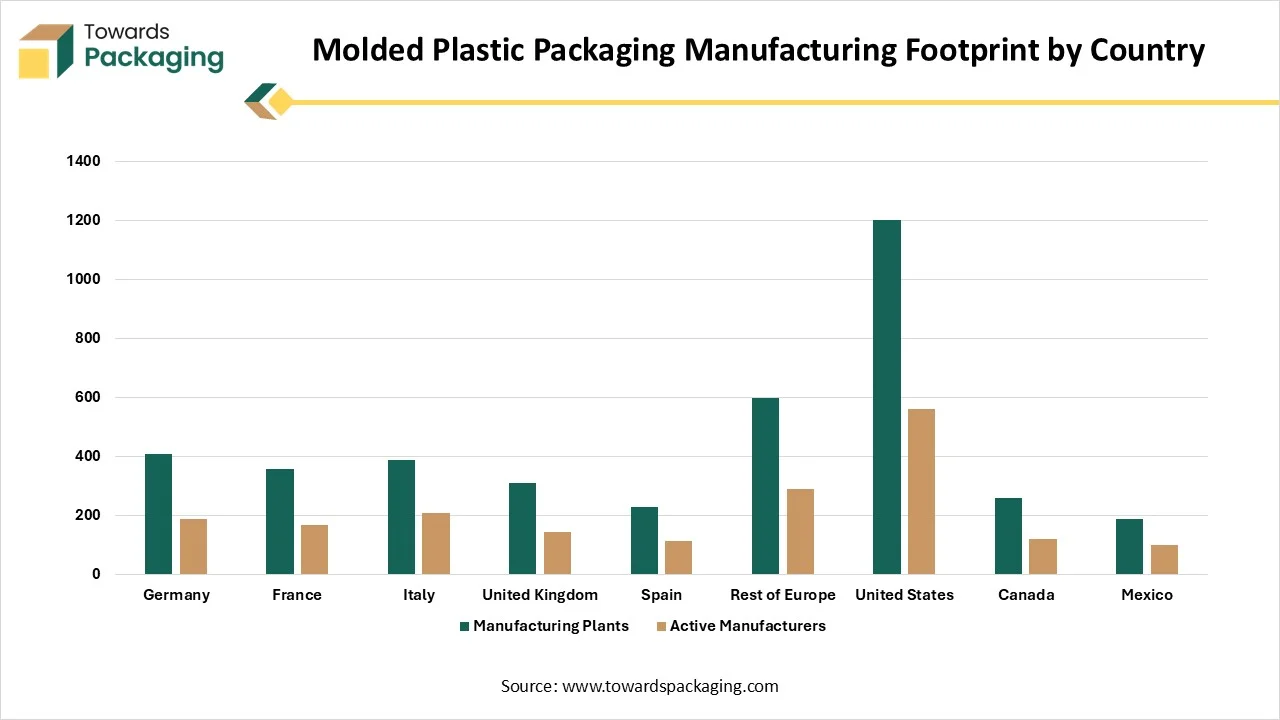

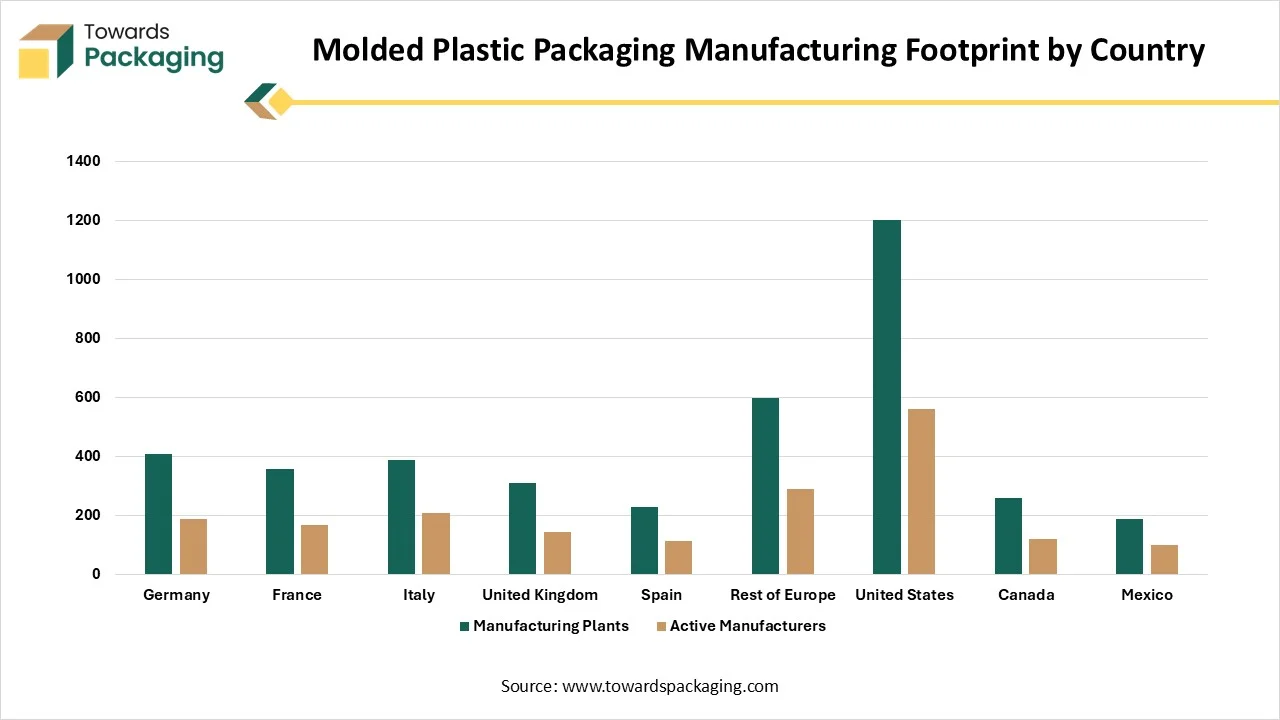

| Region |

Country |

Manufacturing Plants |

Active Manufacturers |

| Europe |

Germany |

410 |

190 |

| Europe |

France |

360 |

170 |

| Europe |

Italy |

390 |

210 |

| Europe |

United Kingdom |

310 |

145 |

| Europe |

Spain |

230 |

115 |

| Europe |

Rest of Europe |

600 |

290 |

| North America |

United States |

1,200 |

560 |

| North America |

Canada |

260 |

120 |

| North America |

Mexico |

190 |

100 |

Regional Insights

How Did The Asia Pacific Region Dominate The Molded Plastic Packaging Market?

Asia Pacific dominated the market in 2024 as the demand for online packaging suppliers is experiencing rapid growth, driven by the booming e-commerce sector, expanding retail networks, and increasing demand for efficient, cost-effective packaging solutions. Countries like China, India, Japan, and South Korea are witnessing a surge in online shopping, which directly fuels the need for readily available packaging materials from online suppliers. Businesses in Asia, especially small and medium-sized enterprises, heavily depend on online platforms to source customizable, bulk, and sustainable packaging without the constraints of physical procurement.

North America is expected to grow fastest in the market during the forecast period. The demand for online packaging supplies is growing steadily, driven by the strong presence of e-commerce, subscription box services, and direct-to-consumer brands. Businesses across the United States and Canada increasingly choose online platforms due to easy, wider product selection and the ability to compare prices and quality instantly. The trend is specifically strong among small and medium-sized businesses that need flexible order quantities, customized designs, and rapid delivery to keep up with fast-changing market demands. Sustainability is also a major driver, with many online suppliers offering eco-friendly packaging solutions like recyclable cardboard boxes, compostable mailers, and biodegradable fillers to meet user demand and comply with evolving environmental regulations.

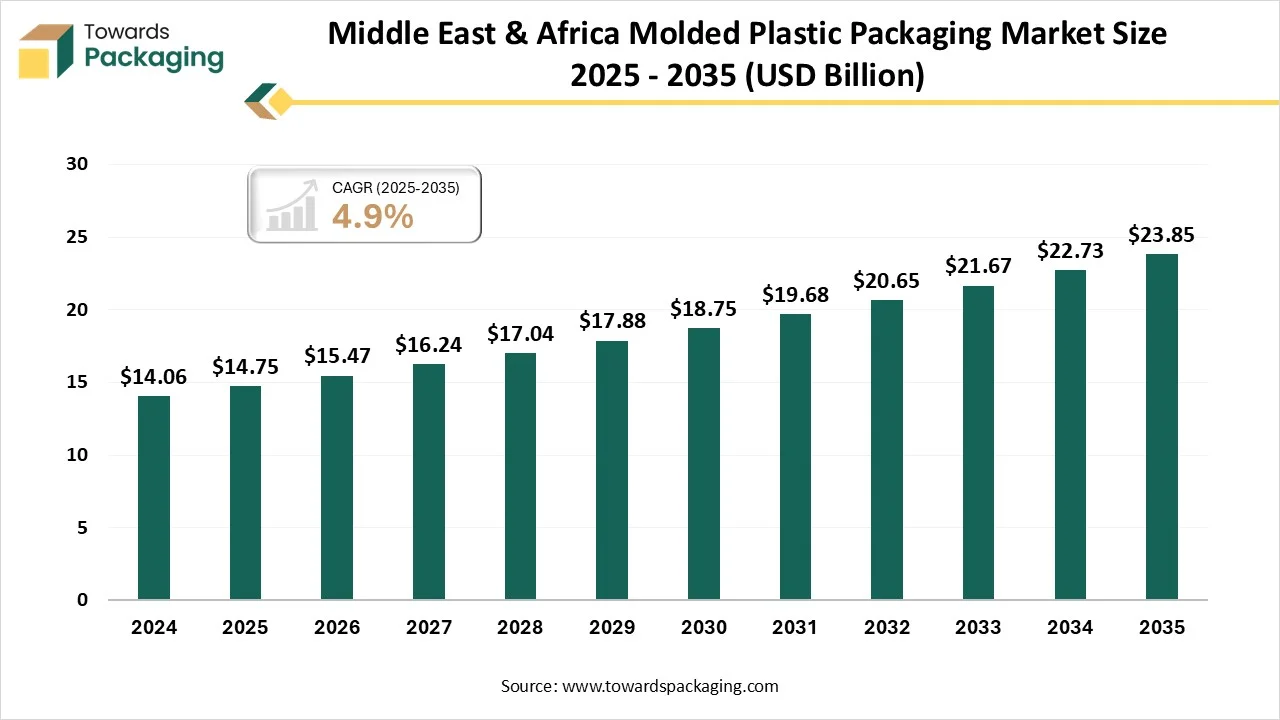

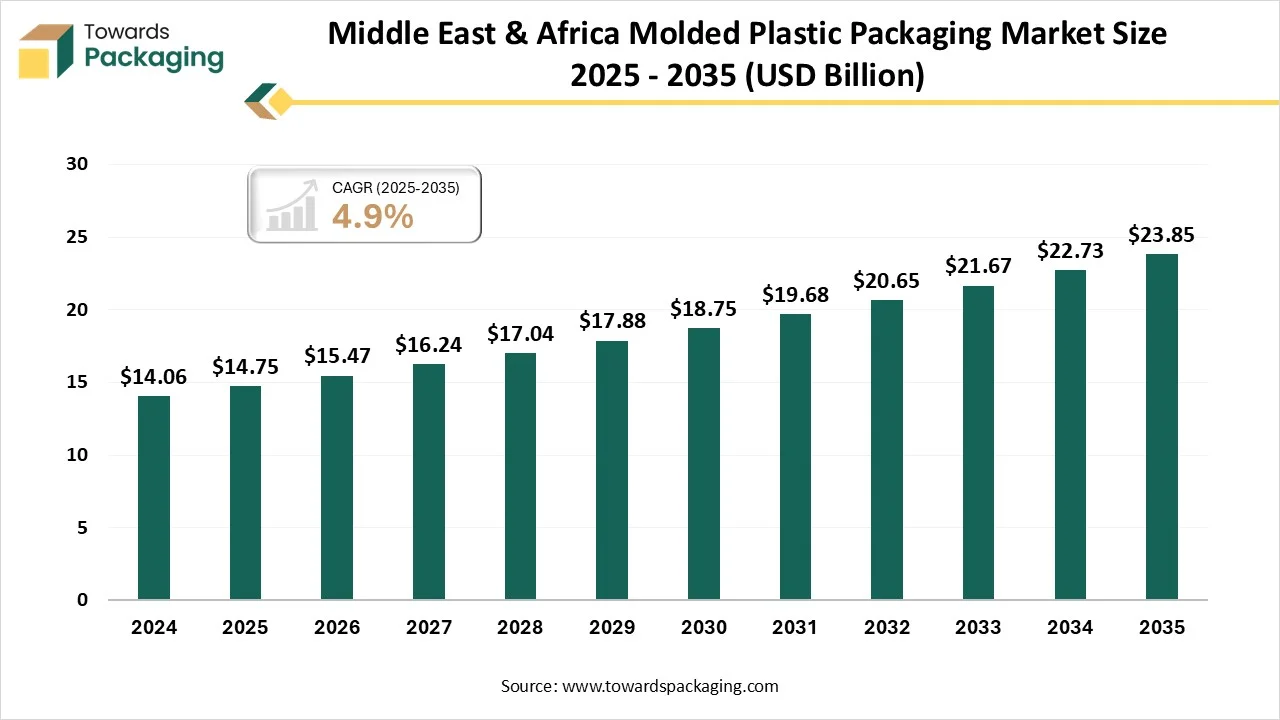

Middle East & Africa Molded Plastic Packaging Market Size 2025 - 2035 (USD Billion)

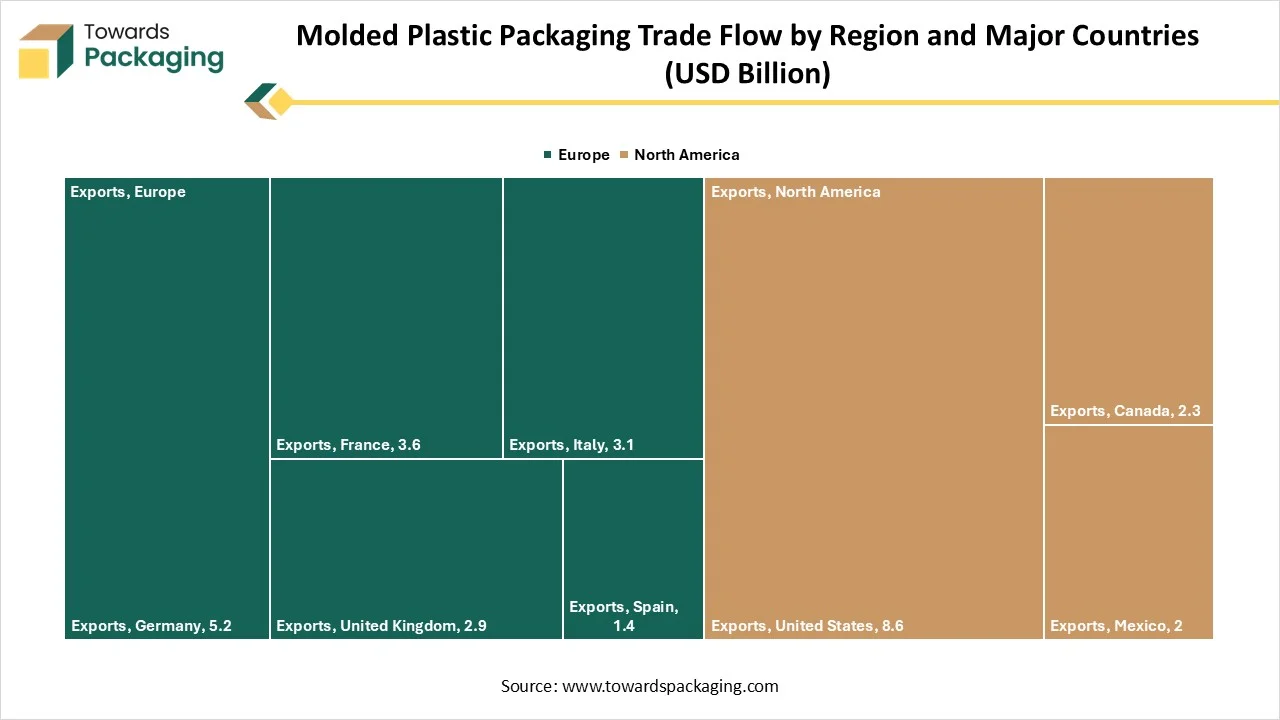

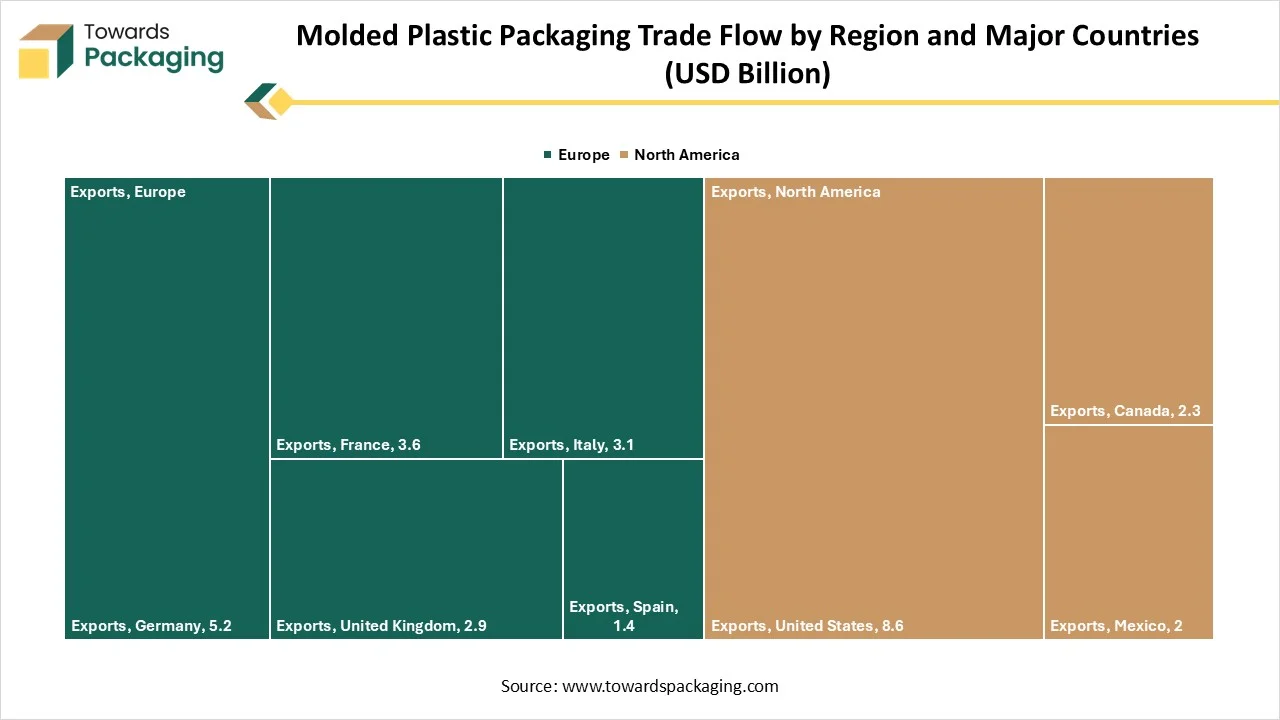

Molded Plastic Packaging Trade Flow by Region and Major Countries (USD Billion)

| Region |

Country |

Exports |

Imports |

| Europe |

Germany |

5.2 |

3.4 |

| Europe |

France |

3.6 |

2.9 |

| Europe |

Italy |

3.1 |

2.4 |

| Europe |

United Kingdom |

2.9 |

3.1 |

| Europe |

Spain |

1.4 |

1.2 |

| North America |

United States |

8.6 |

11.4 |

| North America |

Canada |

2.3 |

2.1 |

| North America |

Mexico |

2 |

2.3 |

Molded Plastic Packaging Market Key Companies

Latest Industry Leader Announcements

- In August 2025, after an overall strategic approach, the Moulded Glass Business, Gerresheimer, which is an inventive solution and system provider and an overall partner for biotech, pharma, and cosmetic industries, has decided to classify sectors and subsequently initiate a sales procedure for the business unit.

- In February 2025, Bain Capital, which is a top private investment company, revealed a majority investment in the Milacron Injection Molding and Extrusion Procedure, which is a worldwide provider of highly engineered plastic processing services and equipment.

Recent Developments

- In March 2025, LyondellBasell, which is the top company in the chemical industry, revealed the launch of Pro-Fax EP649U, and the latest polypropylene effect copolymer crafted for the rigid packaging market. This inventive product is particularly formulated for thin-walled injection moulding, which makes it perfect for food packaging solutions.

- In April 2025, Coveris, a top manufacturing producer, revealed SleeveFlex R stretch, the latest circular stretch sleeve solution that is made up to 75% recycled content. It is being disclosed at Plastics Recycling Show Europe, an invention set at a new sustainable benchmark in the stretch sleeve market and compliance with the Packaging and Packaging Waste Regulation ( PPWR).

- In January 2025, Cirkla revealed a sustainable packaging solution, which is known as the world's primary molded fiber Modified Atmosphere Packaging Trays, that reduces plastic trays by nearly 85%. They are being crafted for storing fresh and frozen food like meat, as their innovative trays serve a high-performance and eco-friendly solution to regular plastic trays.

- In March 2025, the North Rhine-Westphalia-based packaging producer Jokey is expanding its product profile to include a PET Packaging solution generated using the injection stretch blow moulding (ISBM) procedure, which counts the highest possible ratio of recycled rPET plastic, and the raw material for this is derived from post-user waste collection.

Segmentation of the Global Molded Plastic Packaging Market

By Molding/Manufacturing Process

- Injection Molding

- Thermoforming

- Blow Molding (stretch & extrusion blow)

- Compression Molding

- Insert & Overmolding

By Product Type

- Bottles & Jars

- Rigid Containers & Tubs (e.g., yogurt tubs)

- Trays & Clamshells (retail-ready/foodservice)

- Cups & Lids

- Closures & Caps

- Pails, Drums & Intermediate Bulk Containers (IBCs)

- Specialty/Custom Molded Parts (handles, inserts)

By Polymer / Material

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS / EPS)

- Polyvinyl Chloride (PVC)

- Bioplastics / Bio-based Polymers (PLA, bio-PET)

- PCR / Recycled Resin Blends

By Application

- Food & Beverage (fresh prepared foods, dairy, beverages, ready meals)

- Personal Care & Cosmetics

- Pharmaceuticals & Healthcare

- Household & Industrial Chemicals

- E-commerce & Retail-ready Packaging

- Electronics & Industrial Components

By Distribution Channel

- Direct Sales / OEM Contracts (food & beverage manufacturers)

- Packaging Converters & Distributors

- Online Packaging Marketplaces & E-commerce Suppliers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait