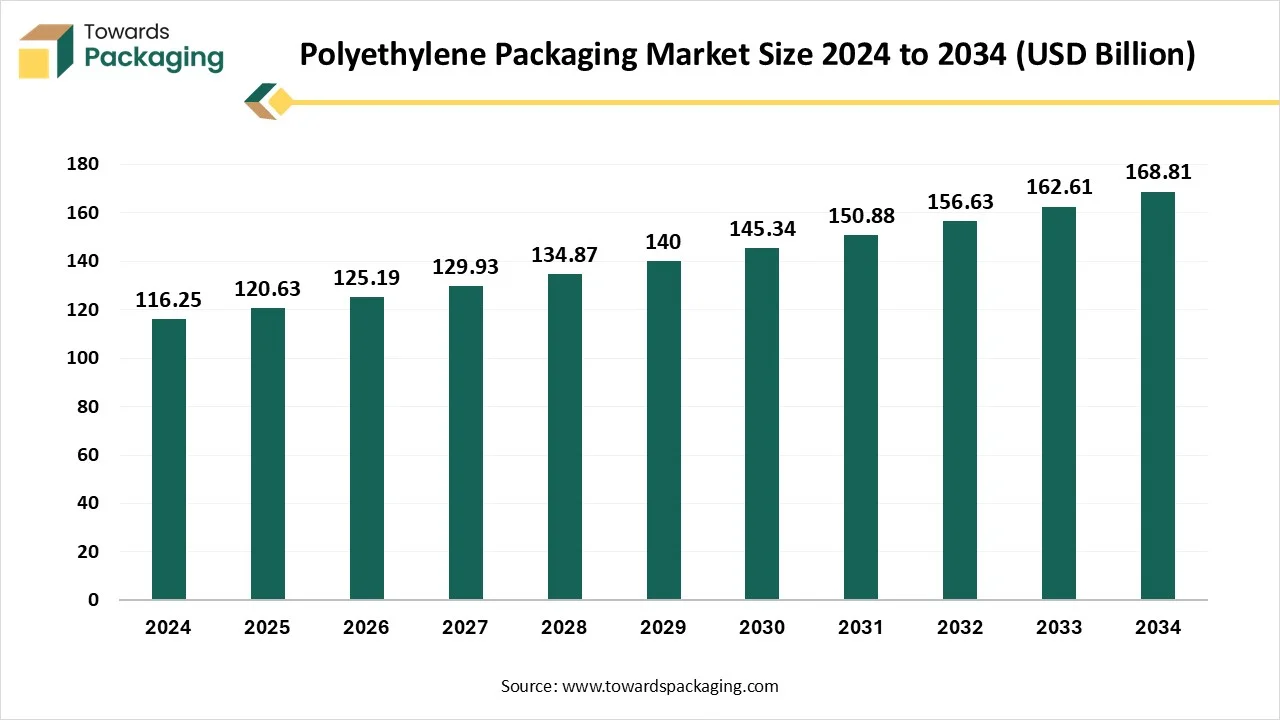

The polyethylene packaging market is forecasted to expand from USD 125.18 billion in 2026 to USD 174.66 billion by 2035, growing at a CAGR of 3.77% from 2026 to 2035. Regional insights include the dominance of Asia Pacific, notable growth in North America, and trends in Europe, Latin America, and MEA. The analysis highlights competitive strategies of top players such as Uflex Limited, Sealed Air Corporation, Berry Global, Packaging Corporation of America, and AMCOR PLC. Key market drivers, recycling initiatives, and value chain insights provide a comprehensive view for manufacturers, suppliers, and stakeholders.

Polyethylene packaging is widely used for the packaging of household products, and primarily in the online delivery of products. Polyethylene is a thermoplastic resin that is extracted from the polymerization of ethylene gas. This material is valued due to its lightweight nature, resistance to chemicals, and strength. It is available in various forms, comprising linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), and high-density polyethylene (HDPE), each with its own set of qualities and compensations. There are several benefits associated with this material, such as low shipping charges, safety, and durability. These packages provide enhanced protection, non-toxicity, and versatility, which makes them suitable and attract a huge variety of brands.

| Metric | Details |

| Market Size in 2025 | USD 120.63 Billion |

| Projected Market Size in 2035 | USD 174.66 Billion |

| CAGR (2025 - 2035) | 3.77% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Application and By Region |

| Top Key Players | Uflex Limited, Sealed Air Corporation, Berry Global, Packaging Corporation of America, AMCOR PLC, Cosmo Films, Flexible Packaging, Mondi |

Polyethylene (PE) is considered to be light lightest-weight polymer available. These can be administered at very low temperatures and pressures. It has reduced the shipping charges in the growing online ordering trend.

With the rising demand for flexible packaging films, malleability plays a significant role. It provides sufficient space for the packaging of the products.

Polyethylene packaging films have a high moisture absorption capacity, which has encouraged their demand in the market. It is considered a suitable medium for physical harm and microbial growth.

AI plays a significant role in analysing the material durability, ecological impact, and strength of the packaging. It can detect the flaws of the patterns and decrease the production of waste. In testing, IoT plays an important role. Real-time movement, humidity, and temperature tracking systems are the crucial functions performed by artificial intelligence. Advanced technologies such as machine learning and several others are useful in the packaging of sensitive products, food, and medicine. Visual intelligence technology is utilized for the packaging of elements such as text, colour, and logo placement. AI is also used for maintaining the integrity of products, user interaction, and changes in temperature. By utilizing predictive eye-tracking and advanced visual analytics, the brand verified several design essentials, such as QR code positioning, color placement, and font size.

Rising Recycling Activities

The rising recycling activities and the aim to generate a circular economy have enhanced the demand for the polyethylene packaging market. As ecological concerns for plastic waste rise, many corporations and industries are capitalizing on plans to improve recycling rates and encourage the accountable use of resources. These initiatives emphasis refining collection structures, emerging advanced categorization technologies, and growing customer consciousness about the status of recycling. By enabling the effective recovery of polyethylene resources, these efforts not only decrease landfill waste but also offer a sustainable source of raw materials for producers.

As more industries identify the financial and ecological profits of a circular economy, the demand for recyclable polyethylene goods is anticipated to grow, resulting in innovations in production and designing procedures. This change not only aids in mitigating the ecological impact of plastic wastage but also places polyethylene packaging as a more maintainable choice in a progressively environment-conscious market. The growing customer preference for packaged and ready-to-eat foods significantly determinations the demand for polyethylene packaging. As demanding lifestyles become more dominant, customers seek suitable meal resolutions that require negligible preparation.

Rising Ecological Consciousness

The continuous growing consciousness of ecological issues has raised awareness towards materials utilized in packaging, hindering the development of the polyethylene packaging market. With the rising awareness about the significant adversities of plastic material, the regulatory bodies as well as customers are constantly looking for a sustainable packaging substitute. The evolution to sustainable practices can be costly and complex, resulting in challenges for corporations dependent on old, cultured polyethylene packaging.

Increasing Focus on Product Safety

There is an improved focus on food security and hygiene that generates substantial chances for polyethylene packaging in the food sector. Customers are progressively worried about the integrity and safety of their food items, which influences producers to accept packaging solutions that offer enhanced protection against infection. Companies that study packaging solutions are inventing to provide to this rising section, emerging resources that are useful and also maintainable, additionally increasing their attraction in intensifying home delivery services and generating chances for market development.

The high-density polystyrene (HDPE) segment is expected to have a considerable share of the polyethylene packaging market in 2024 due to the rising consumption of packed beverages such as juices, milk, and other products. The continuous demand for flexible, moisture-resistant, and ductile packaging has influenced the growth of this segment. Ecological concern is also enhancing the demand for bio-based and recycling substitutes for more exclusive plastic. It significantly contributes towards specialized packaging, high-performance usage to secure its impact in the transforming resources landscape.

Locked low-density polyethylene (LLDPE) is mainly utilized for packaging purposes in food, agriculture, carriage bags, and stretch wrap. This formulation provides enhanced sealing performance, increased film potential, and improved clarity, making it compatible for packaging and increased applications such as heavy snacks and frozen food. The capacity to maintain flexibility, cost effectiveness, and balance strength.

The food segment dominates the polyethylene packaging market in 2024 due to its enhanced protection, cost-effectiveness, and versatility. This material manufactures products such as pouches, bags, bottles, and films, which provide a wide range of utilisation. The rising concern for sustainability, convenience, and protection has raised the usage of polyethylene packaging in the food and beverage sector. The incorporation of advanced technology for packaging, such as real-time monitoring, RFID tags, and QR codes, has influenced the usage of polyethylene packaging.

The electronics segment is expected to grow rapidly. The rising packaging concern for sensitive electrical components, cost-effective solutions, and lightweight nature has increased the adoption of polyethylene packaging in the electronics sector. It is mainly used in the form of conductive and antistatic films, foams, and bags. These resources are important for the packaging of components such as integrated circuits, semiconductors, and circuit boards. The rapid development in consumer electronics such as wearables, smartphones, and tablets has enhanced the requirement for polyethylene packaging.

Asia Pacific held the largest share of the polyethylene packaging market in 2024, due to the increasing demand for LDPE packaging in the food and packaging industry. In Countries such as Japan, India, China, and South Korea, the expansion of industries such as food and beverages, automotive, consumer electronics, and several others has raised the usage of polyethylene packaging. The constant collaboration among the major market players available at this place has influenced the development of this market in this region.

North America is estimated to grow at the fastest rate in the polyethylene packaging market during the forecast period. The strict rules associated with the packaging industry in countries such as the U.S. and Canada, due to growing ecological adversities, promote the development of this market. The major market players use advanced technology for the resource checking of the packages, which makes their production reliable and increases the demand for the market.

The availability of local polyethylene production also means lower shipping costs for raw materials, which can result in more competitive prices for polyethylene mailers compared to imports. Polyethylene mailers in the U.S. are highly customizable to suit a variety of industries and end uses, including fashion, electronics, pharmaceuticals, and food delivery. This versatility allows manufacturers to cater to specific market demands while maintaining efficiency in production.

By Product

By Application

By Region

January 2026

January 2026

January 2026

January 2026