Polypropylene Corrugated Packaging Market Forecast 2025-2035, Regional Insights, Trade Statistics, Key Players, Supply Chain Mapping

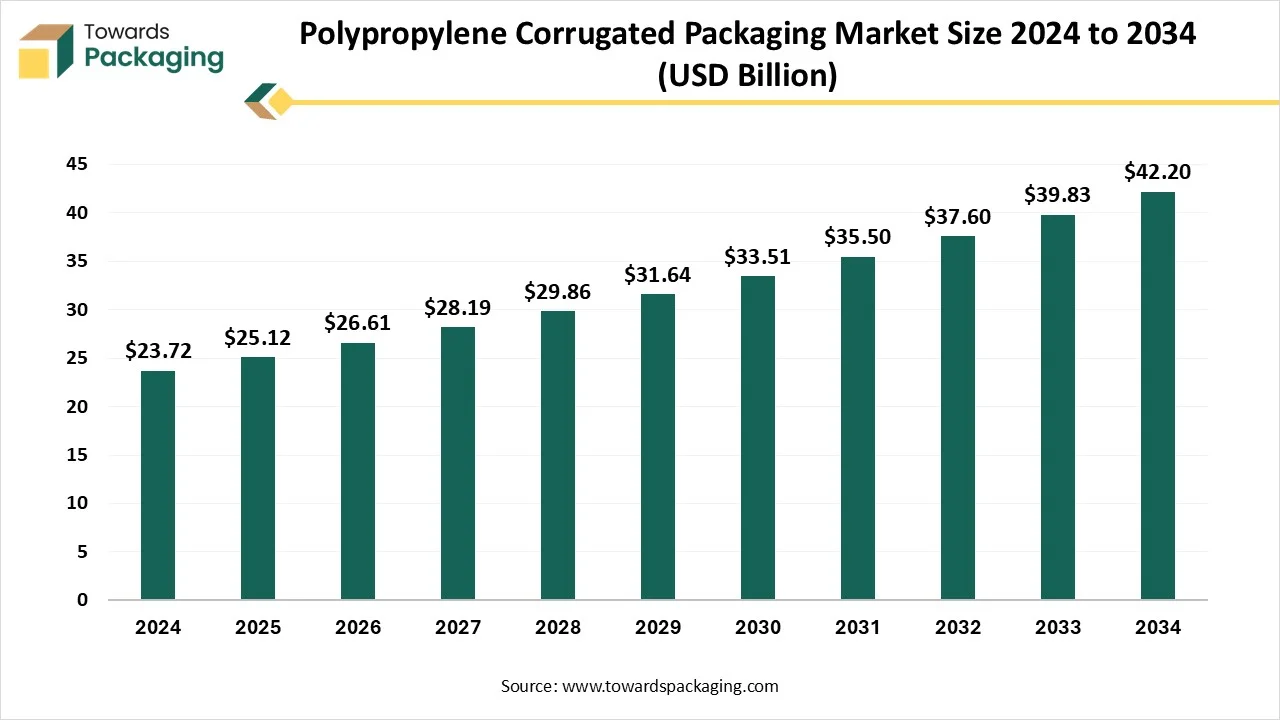

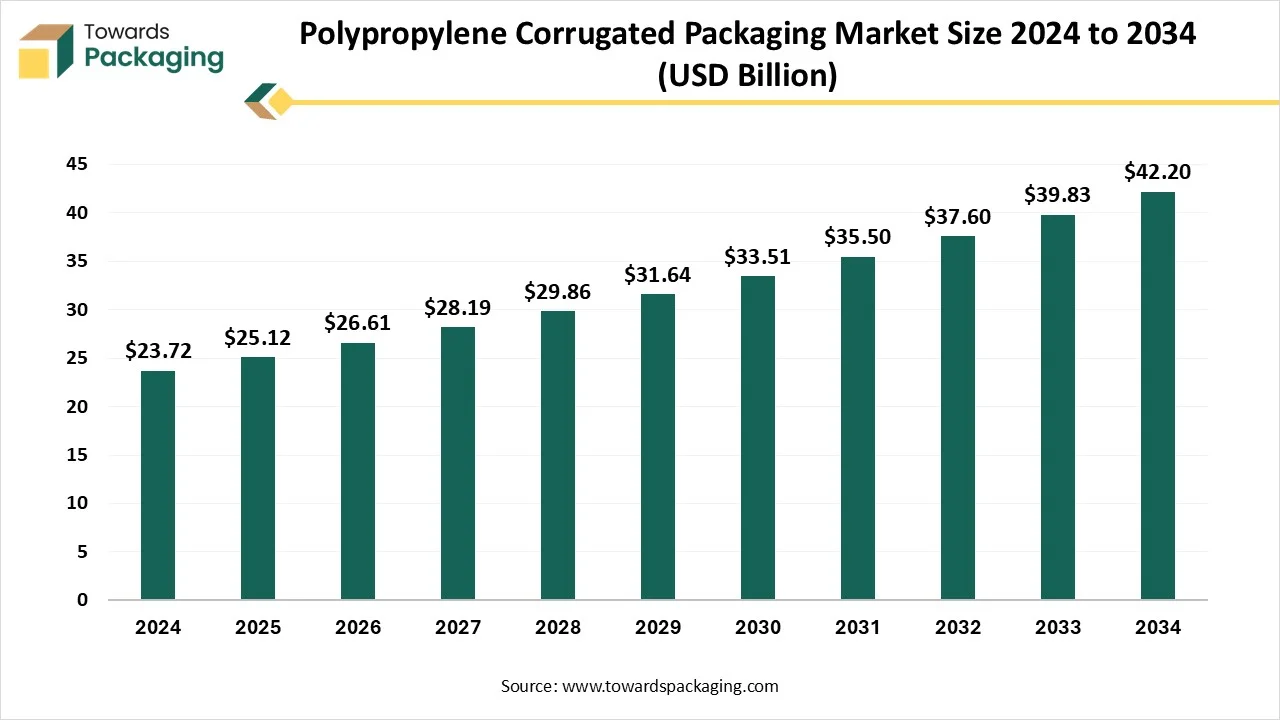

The polypropylene corrugated packaging market is witnessing strong growth as it expands from USD 25.12 billion in 2025 to USD 42.2 billion by 2034, supported by a 5.93% CAGR. This study covers detailed market size, emerging trends, and segment-level data across product types, thickness, packaging functions, end-use industries, and distribution channels. It provides regional insights for North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting APAC’s 48% share and rapid MEA growth.

The report includes a full competitive analysis of global manufacturers such as Coroplast, Primex, Karton, SIBUR, and Distriplast, along with value chain mapping, raw material analysis, trade flows, and supplier/manufacturer intelligence to give a 360° view of the industry.

Key Takeaways

- Asia Pacific dominated the polypropylene corrugated packaging market in 2024 with 48%.

- The Middle East & Africa are expected to grow at a significant rate in the market during the forecast period.

- By product type, the boxes & containers segment held a dominant presence in the market in 2024, with 50%.

- By product type, the dividers & partitions segment accounted for considerable growth in the global polypropylene corrugated packaging market over the forecast period.

- By thickness, the 3–5 mm segment held the major market share of 60% in 2024.

- By thickness, the >5 mm segment is projected to grow at a CAGR between 2025 and 2034.

- By packaging function, the returnable transit packaging (RTP) segment contributed the biggest market share of 55% in 2024.

- By packaging function, the protective packaging segment is expanding at a significant CAGR during the forecast period.

- By end-use industry, the automotive segment registered its dominance with 28% over the global polypropylene corrugated packaging market in 2024.

- By end-use industry, the agriculture segment is expected to experience significant growth during the forecast period.

- By distribution channel, the direct sales segment accounted for the dominating share of 62% in 2024

- By distribution channel, the online retail segment is expected to witness a significant share during the forecast period.

Market Overview

The global polypropylene corrugated packaging market focuses on the development and application of packaging products made from corrugated polypropylene (PP), a lightweight, durable, water-resistant plastic material. PP corrugated packaging serves as an excellent alternative to traditional cardboard and wooden materials due to its reusability, strength, and resistance to chemicals and moisture.

What are the Key Trends Driving the Growth of the Polypropylene Corrugated Packaging Market?

- The rising demand for lightweight and durable packaging materials across various industries is expected to propel the growth of the polypropylene corrugated packaging market. Several industries are increasingly seeking lightweight and durable packaging materials for reducing shipping costs and providing product protection.

- The surging investment in sustainable packaging materials by key players, along with a rising focus on reducing carbon footprints, significantly contributes to the overall growth of the polypropylene corrugated packaging market.

- The surge in international trade and increasing focus of businesses on better protection of goods during shipment are likely to accelerate the market’s revenue during the forecast period.

- The rapid expansion of the e-commerce sector, including online sales of automotive parts, is expected to spur the demand for corrugated packaging boxes, driving the market’s growth in the coming years.

- The rising environmental concerns and a shift toward recyclable materials are expected to accelerate the adoption of these materials is anticipated to fuel the market’s growth during the forecast period.

- The rising technological advancements in polypropylene corrugated packaging solutions are expected to enhance their properties and performance, which include digital printing, advanced structural design, and integration of smart technologies, and are projected to create immense growth opportunities for the polypropylene corrugated packaging market in the coming years.

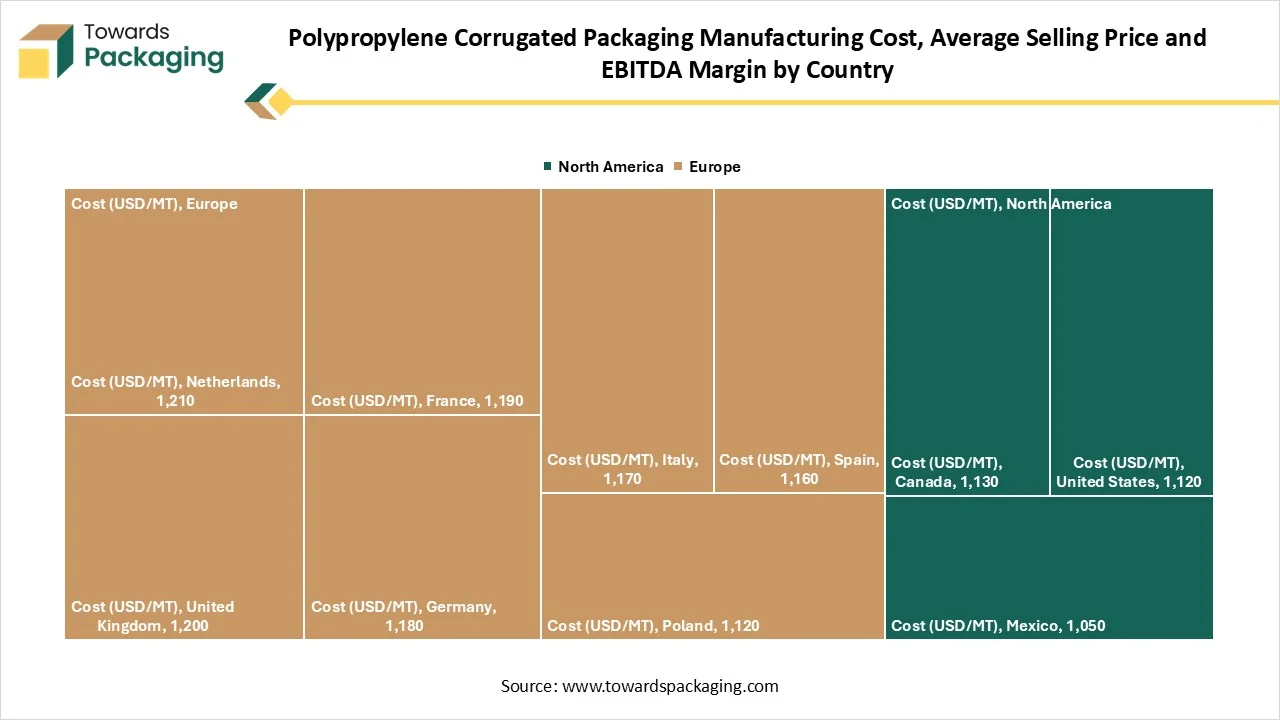

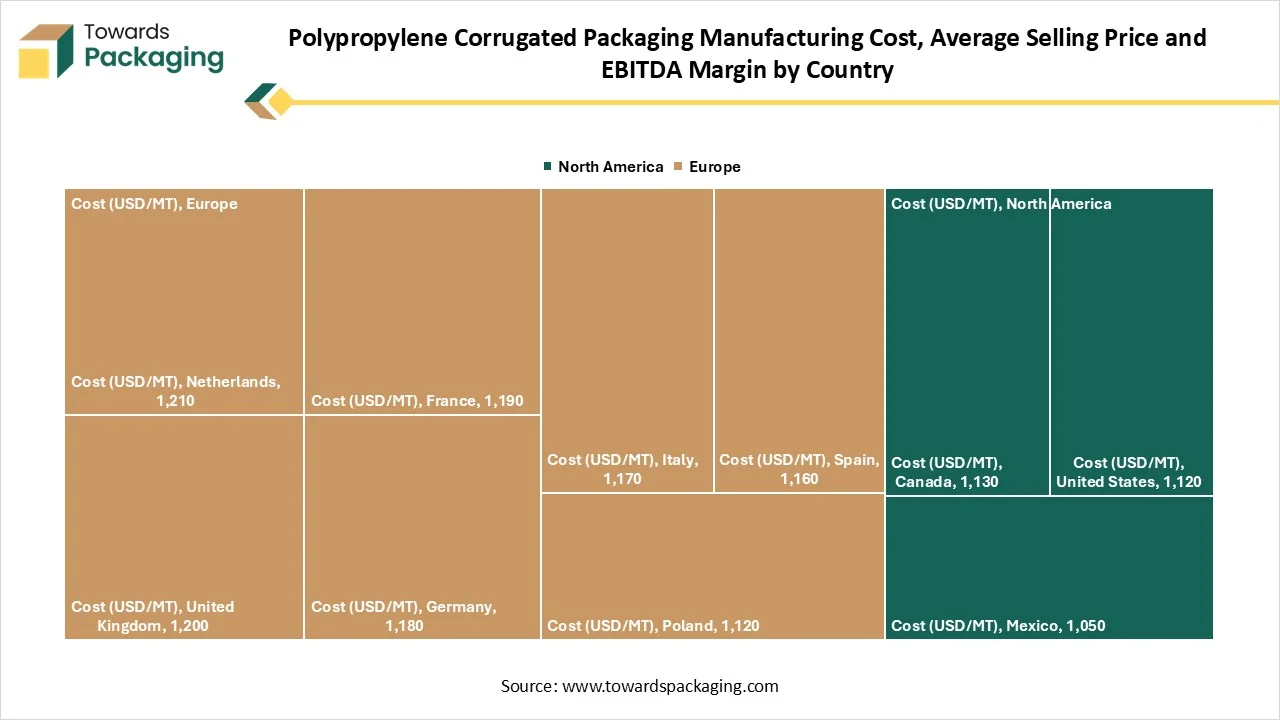

Polypropylene Corrugated Packaging Manufacturing Cost, Average Selling Price, and EBITDA Margin by Country

| Region |

Country |

Cost (USD/MT) |

ASP (USD/MT) |

EBITDA |

| North America |

United States |

1,120 |

1,560 |

18 |

| North America |

Canada |

1,130 |

1,570 |

17 |

| North America |

Mexico |

1,050 |

1,500 |

19 |

| Europe |

Germany |

1,180 |

1,650 |

16 |

| Europe |

France |

1,190 |

1,660 |

15 |

| Europe |

United Kingdom |

1,200 |

1,670 |

15 |

| Europe |

Italy |

1,170 |

1,640 |

16 |

| Europe |

Spain |

1,160 |

1,620 |

16 |

| Europe |

Netherlands |

1,210 |

1,690 |

15 |

| Europe |

Poland |

1,120 |

1,560 |

17 |

How is Artificial Intelligence Integration Impacting the Growth of the Polypropylene Corrugated Packaging Market?

As technology continues to advance, the integration of Artificial intelligence holds great potential to reshape the landscape of the polypropylene corrugated packaging market by improving production speed, optimizing production schedules, reducing costs, predicting maintenance needs, and enhancing the quality of the packaging. AI effectively analyzes customer behavior and preferences and allows the creation of personalized packaging solutions. AI and automation, including robotics and the Internet of Things (IoT), assist in improving production speed, reducing costs, and improving the quality of PP corrugated packaging.

Machine learning (ML) algorithms and computer vision algorithms enable automated quality control that assists in detecting defects or any imperfections that are often overlooked by human inspection. AI can optimize the packaging designs for material efficiency, structural integrity, and recyclability, assisting players in aligning with the sustainability goals.

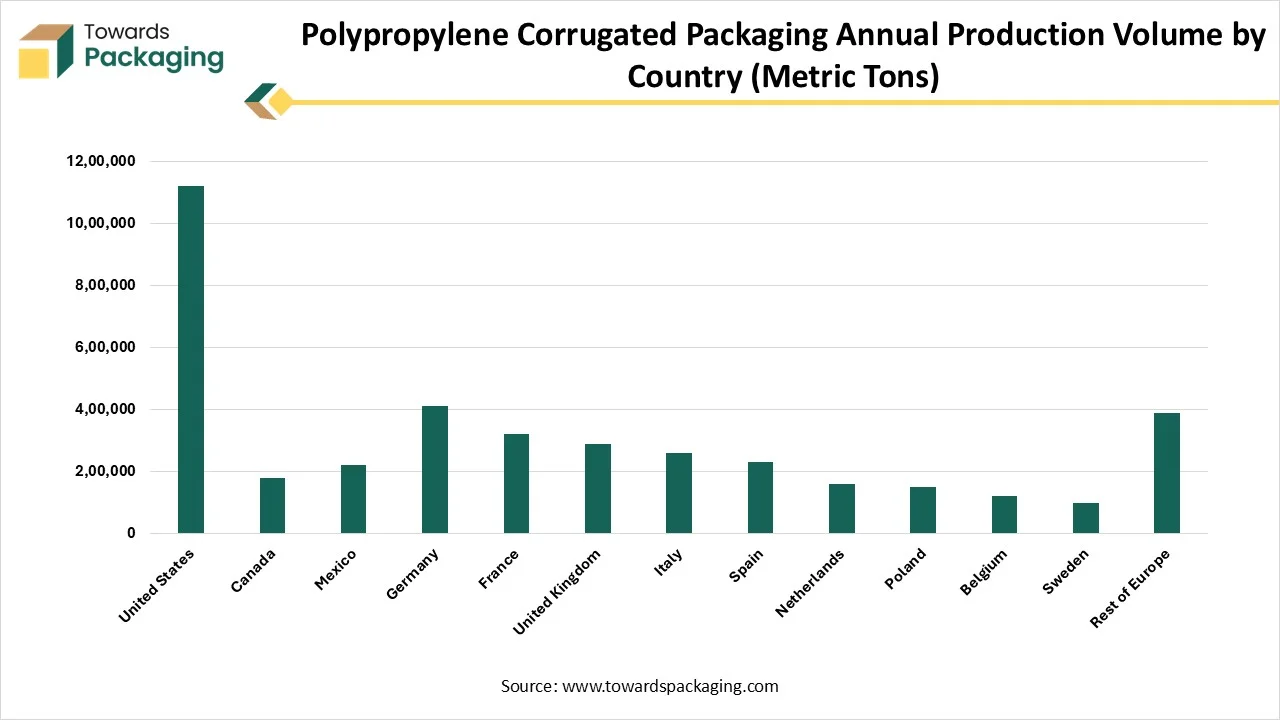

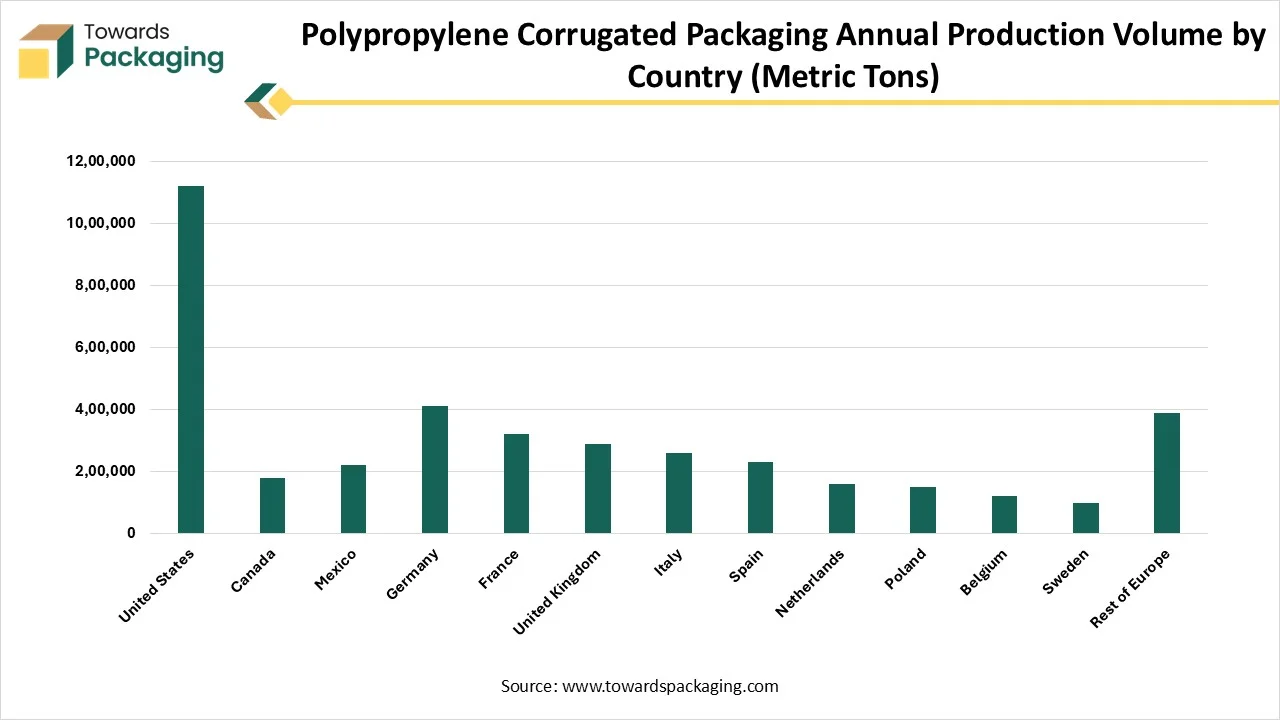

Polypropylene Corrugated Packaging Annual Production Volume by Country (Metric Tons)

| Region |

Country |

Production |

| North America |

United States |

1,120,000 |

| North America |

Canada |

180,000 |

| North America |

Mexico |

220,000 |

| Europe |

Germany |

410,000 |

| Europe |

France |

320,000 |

| Europe |

United Kingdom |

290,000 |

| Europe |

Italy |

260,000 |

| Europe |

Spain |

230,000 |

| Europe |

Netherlands |

160,000 |

| Europe |

Poland |

150,000 |

| Europe |

Belgium |

120,000 |

| Europe |

Sweden |

100,000 |

| Europe |

Rest of Europe |

390,000 |

Market Dynamics

Driver

Rising Demand for Sustainable Packaging Solutions

The growing focus on sustainability is expected to boost the growth of the corrugated automotive packaging market during the forecast period. The rising awareness of circular economy models influences sustainable packaging practices. Polypropylene corrugated packaging is recyclable and reusable, which reduces waste and offers an attractive alternative to traditional packaging materials such as single-use plastics and paper. Polypropylene corrugated packaging boxes offer a balance of cost-effectiveness, strength, and durability.

As sustainability becomes a central focus across various industries, polypropylene corrugated packaging manufacturers are increasingly prioritizing sustainable production methods to meet the evolving consumer demand and comply with environmental regulations. Several manufacturers are increasingly focusing on creating recyclable PP corrugated boxes using recycled polypropylene to reduce wastage and lower their carbon footprint.

With a circularity rate of 11.8% in 2023, Europe consumes a higher proportion of recycled materials than other world regions, although improvements have been limited in recent years. Accelerating the transition to a circular economy has become a policy priority.

Restraint

Fluctuation in Raw Material Prices

The fluctuation in the price of raw materials is anticipated to hinder the market's growth. The price volatility has led to an increasing production cost of corrugated packaging solutions, which can adversely impact the production costs and profitability of manufacturers. In addition, the intense competition from other substitute materials like cardboard or different plastics may hinder the growth of the global polypropylene corrugated packaging market during the forecast period.

Opportunity

Rapid Expansion of the E-commerce Sector

The rising expansion of the e-commerce sector is projected to offer lucrative growth opportunities to the growth of the polypropylene corrugated packaging market during the forecast period. The expansion of e-commerce, particularly in developing and developed nations, has increased the need for protective packaging solutions. In this sector, polypropylene corrugated packaging is widely adopted as it provides product protection, reduces shipping costs, and offers resistance to moisture and other environmental factors.

Polypropylene corrugated packaging is lightweight, durable, and offers customization options for branding. As e-commerce continues to grow, the demand for customized or personalized packaging is expected to increase. PP corrugated boxes can be tailored to specific sizes, shapes, and designs. Several key players are increasingly focusing on providing more personalized packaging to meet the diverse or unique needs of several industries.

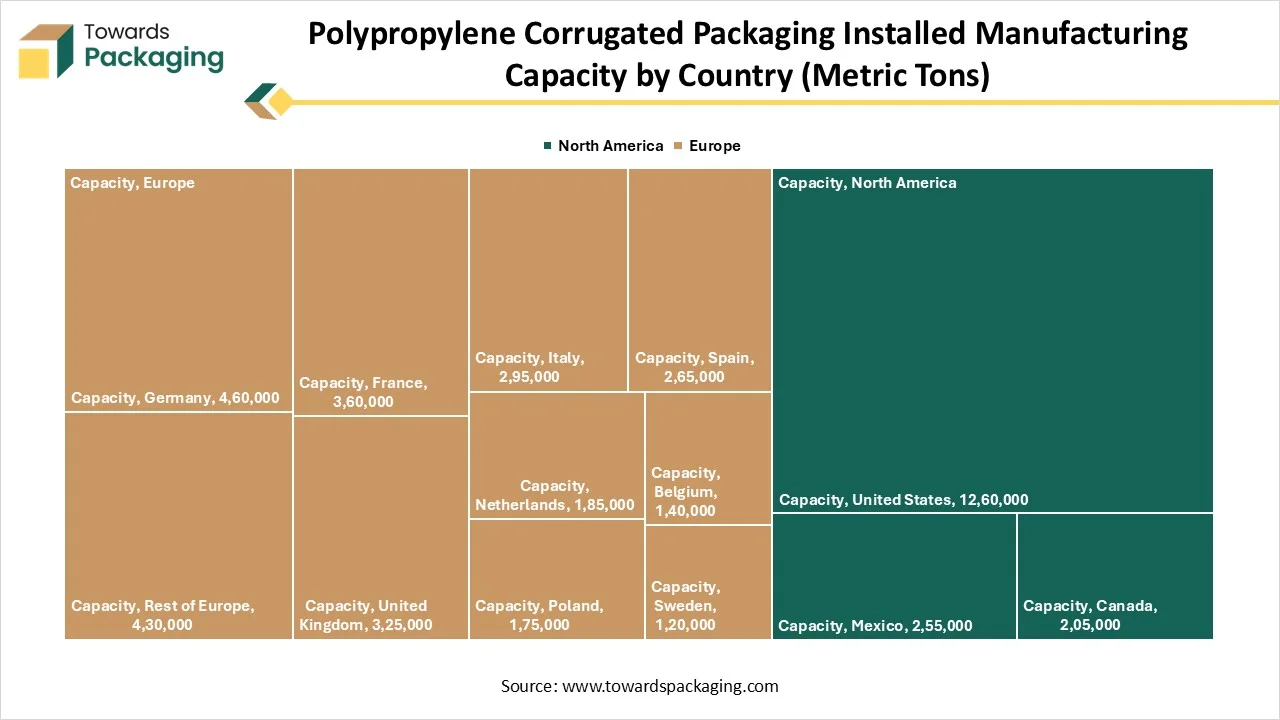

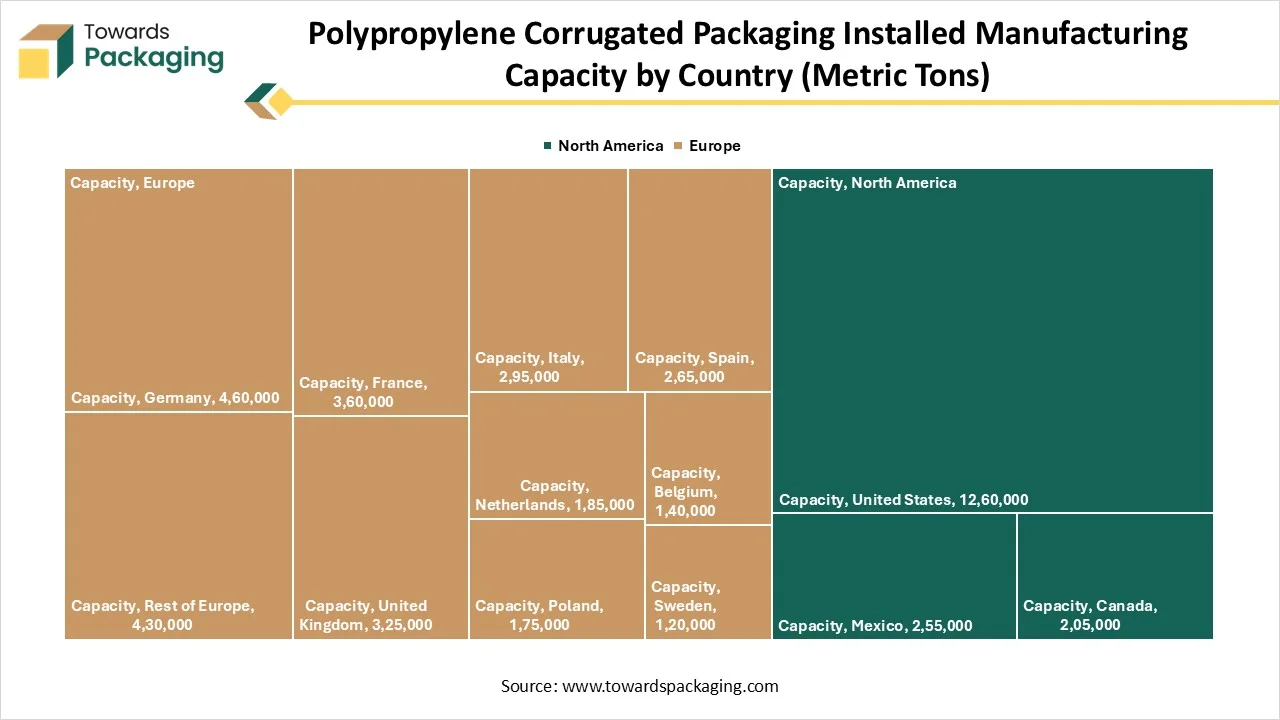

Polypropylene Corrugated Packaging Installed Manufacturing Capacity by Country (Metric Tons)

| Region |

Country |

Capacity |

| North America |

United States |

1,260,000 |

| North America |

Canada |

205,000 |

| North America |

Mexico |

255,000 |

| Europe |

Germany |

460,000 |

| Europe |

France |

360,000 |

| Europe |

United Kingdom |

325,000 |

| Europe |

Italy |

295,000 |

| Europe |

Spain |

265,000 |

| Europe |

Netherlands |

185,000 |

| Europe |

Poland |

175,000 |

| Europe |

Belgium |

140,000 |

| Europe |

Sweden |

120,000 |

| Europe |

Rest of Europe |

430,000 |

Segmental Insights

The 3–5 mm Segment Dominated the Market Share in 2024

- The 3–5 mm segment accounted for the highest revenue share in 2024. Polypropylene (PP) corrugated packaging with a thickness of 3-5mm offers a versatile, durable solution and suitability for various applications. This thickness range is ideal for returnable packaging, layer pads, and warehouse partitions.

- On the other hand, the >5 mm segment is expected to grow at a notable rate. The thicknesses greater than 5mm are experiencing significant demand growth due to the growing demand for durable and protective packaging solutions in various industries. PP corrugated sheets (>5mm) are mainly ideal for heavy-duty packaging.

What Makes the Direct Sales Segment Drive the Market During the Forecast Period?

The direct sales segment is expected to dominate the circular economy in the packaging market. Direct sales play a crucial role as a distribution channel in the polypropylene corrugated packaging market. Several companies are widely adopting direct sales strategies to reach their targeted customer segments and build strong relationships. Direct sales provide better price control and allow for more flexibility in offering customized packaging solutions based on customer requirements.

On the other hand, the online retail segment is growing at the fastest CAGR. The rapid expansion of the e-commerce sector is expected to boost the demand for robust and reliable packaging solutions for online retail. Online retail serves as a key distribution channel in the market, offering a wide availability of various types of polypropylene corrugated packaging solutions at discounted prices.

By Product Type

The boxes segment dominated the market with the largest share in 2024. Boxes are most commonly utilised as a shipping carton, owing to their cost-effectiveness, durability, versatility, moisture resistance, and suitability for various industries such as food, pharmaceuticals, and industrial goods. The boxes are manufactured using polypropylene corrugated material, which is non-toxic and clinically tested to be safe for packaging and does not cause any harmful emissions to the consumables packed in it. These boxes can also be customizable to fit any shape, size, or need to meet unique needs. Moreover, the surge in e-commerce is likely to propel the demand for these packaging solutions as polypropylene corrugated packaging, with its durable and lightweight properties, can fit the diverse needs perfectly.

On the other hand, the dividers & inserts segment is growing at the fastest CAGR. Corrugated dividers and partitions play a crucial role in protecting the products during shipping and handling, as they prevent parts from colliding and reduce the risk of damage. Corrugated dividers and partitions with custom-designed features ensure that products arrive undamaged, contributing to efficient logistics and reducing wastage.

Which Sub-segment Holds the Majority of the Share in the “By Application” Segment?

The returnable transit packaging (RTP) segment accounted for the dominating share in 2024. The growth of the segment is mainly driven by the rising adoption of returnable transit packaging (RTP) as several businesses are seeking to reduce packaging waste and optimize supply chain efficiency. Returnable transit packaging (RTP) is specifically designed for repeated use, which reduces packaging waste and associated costs. RTP also minimizes the environmental impact by reducing the need for new packaging materials.

On the other hand, the protective packaging segment is expected to witness a significant share during the forecast period. Polypropylene corrugated packaging solutions offer a combination of lightweight design, durability, and protective qualities such as resistance and protection against moisture, chemicals, and other environmental factors, which makes them a preferable option for protective packaging across various industries. Moreover, the expansion of the e-commerce sector spurs the demand for robust and reliable packaging solutions.

How Automotive Corrugated Segment Dominate the Market in 2024?

The automotive segment held a dominant presence in the polypropylene corrugated packaging market in 2024. The growth of the segment is attributed to the rapid expansion of the automotive industry, rising sustainability trends, and growing demand for lightweight packaging materials. Polypropylene corrugated packaging plays a vital role in the automotive industry's supply chain, offering robust protection for automotive parts during transit. Polypropylene corrugated packaging can be easily molded and customized into different sizes and shapes, making it ideal for a wide range of automotive components and packaging needs. Additionally, a surge in e-commerce sales of automotive parts is expected to boost the growth of segment’s growth during the forecast period.

On the other hand, the agriculture and food packaging segment is expected to grow at a significant rate. The increasing expansion of the agriculture and food packaging sectors is substantially increasing the demand for polypropylene corrugated packaging solutions owing to their durability, sustainability, and ability to be customized. Polypropylene is a relatively cost-effective packaging material that other alternatives, making it a popular option for industries seeking to optimize their packaging and supply chain costs.

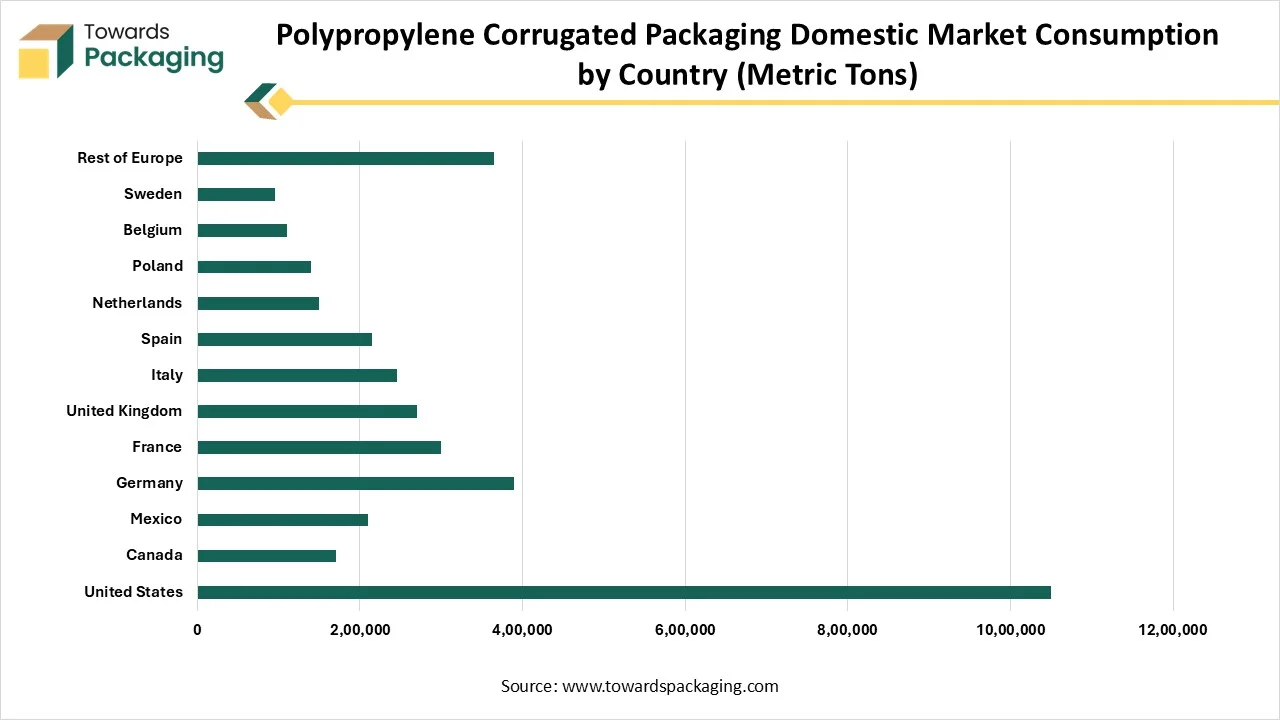

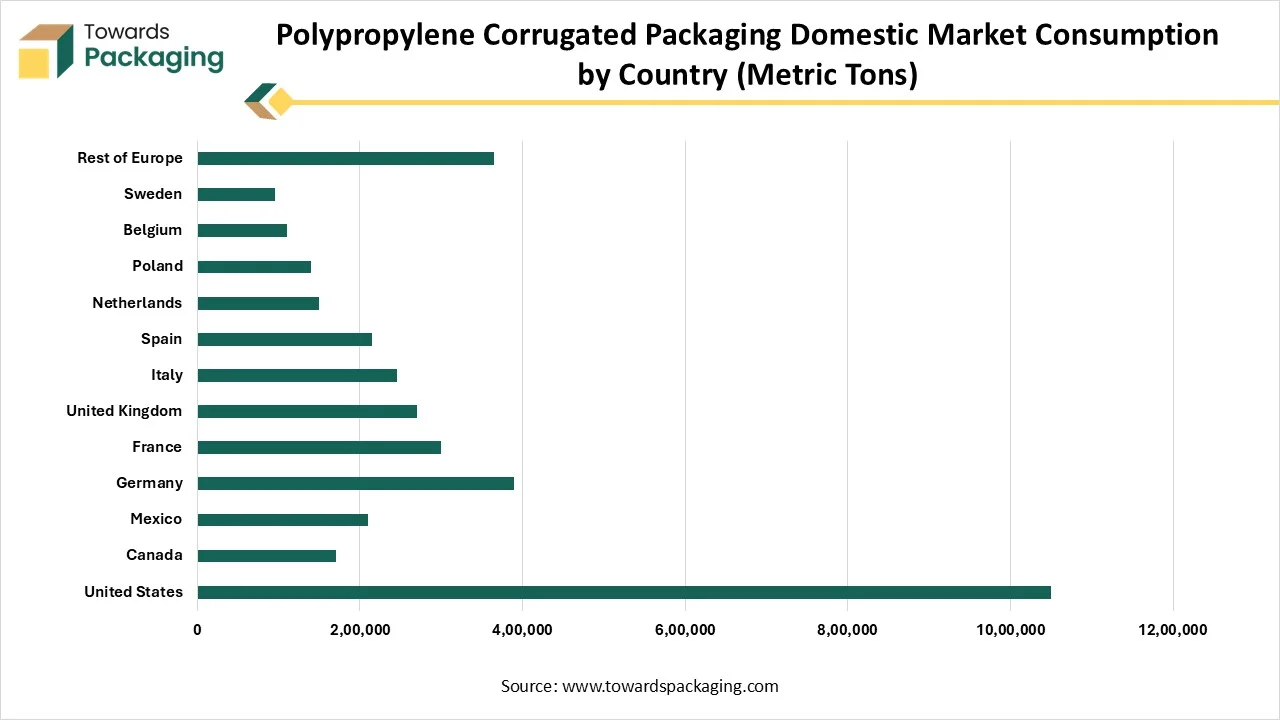

Polypropylene Corrugated Packaging Domestic Market Consumption by Country (Metric Tons)

| Region |

Country |

Consumption |

| North America |

United States |

1,050,000 |

| North America |

Canada |

170,000 |

| North America |

Mexico |

210,000 |

| Europe |

Germany |

390,000 |

| Europe |

France |

300,000 |

| Europe |

United Kingdom |

270,000 |

| Europe |

Italy |

245,000 |

| Europe |

Spain |

215,000 |

| Europe |

Netherlands |

150,000 |

| Europe |

Poland |

140,000 |

| Europe |

Belgium |

110,000 |

| Europe |

Sweden |

95,000 |

| Europe |

Rest of Europe |

365,000 |

Regional Insights

Asia Pacific is Dominating the Market

Asia Pacific held the dominant share of the polypropylene corrugated packaging market in 2024. The Asia Pacific region has a robust presence of industries like automotive, agriculture, food & beverage, pharmaceutical & healthcare, electronics, logistics & warehousing, and retail & e-commerce, which are major users of polypropylene corrugated packaging solutions. Sustainability-led initiatives implemented by governments in countries like China, Japan, India, and South Korea encourage businesses to invest more in sustainable packaging solutions. The region is also experiencing customized and protective packaging to meet the diverse needs across various industries. Recycled packaging materials are gaining immense popularity in the market as sustainable packaging solutions.

E-commerce platforms in the region are increasingly adopting polypropylene corrugated packaging as a reliable and sustainable packaging solution to protect products during transit. The growth of the region is driven by increasing demand for sustainable packaging solutions, growing need for lightweight & durable packaging options, rising integration of smart technologies, and increasing focus on reducing transportation costs and carbon footprints. Interactive packaging allows packaging to include features such as QR codes, RFID tags, and smart sensors, assisting in creating more interactive experiences for consumers.

Industries such as food & beverage and e-commerce are increasingly relying on polypropylene corrugated packaging for its strength, lightweight, versatility, and protective qualities. The rapid urbanization and industrial growth in countries such as China, Japan, India, and Southeast Asian nations are leading to increased demand for packaging solutions across various industries. This combination of factors is expected to propel the polypropylene corrugated packaging market during the forecast period.

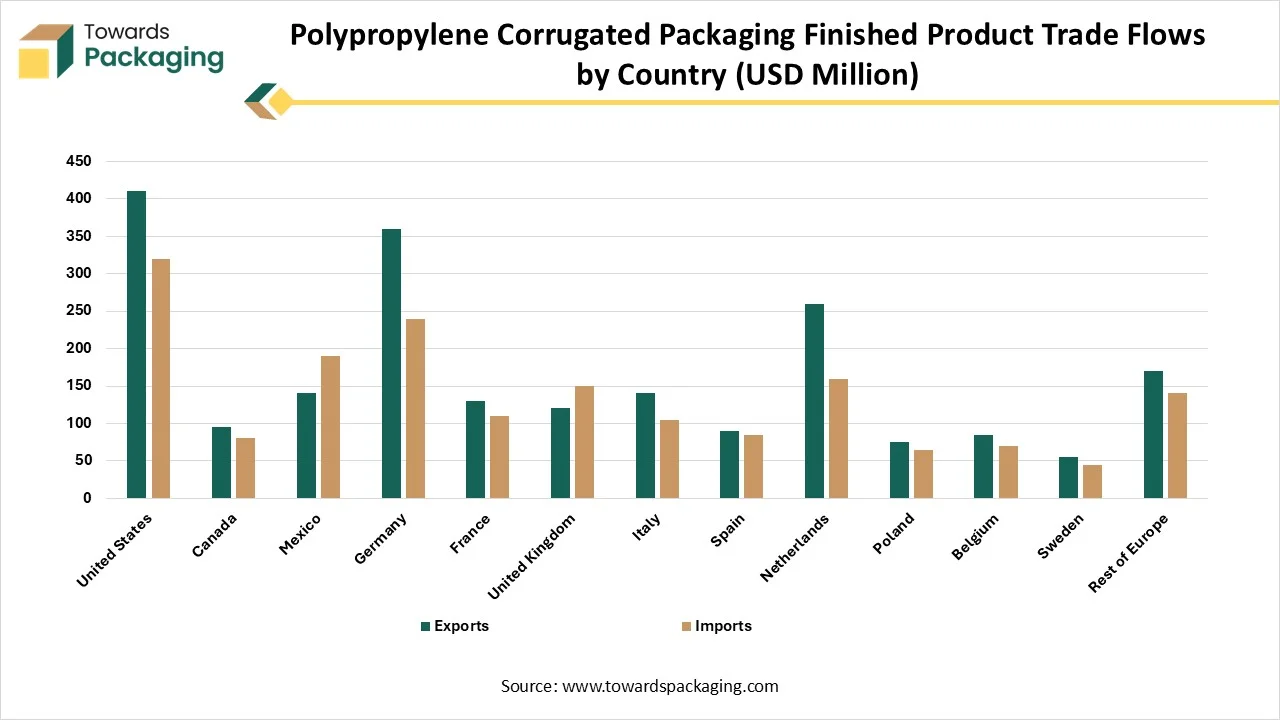

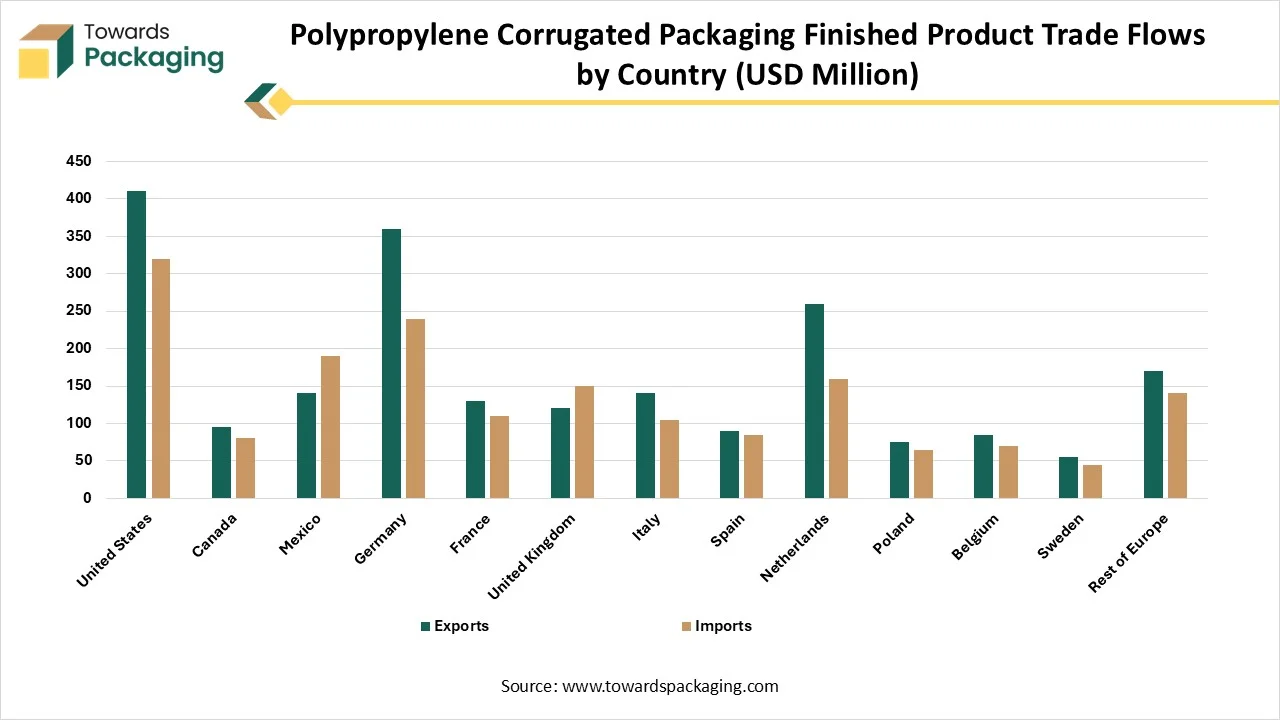

Polypropylene Corrugated Packaging Finished Product Trade Flows by Country (USD Million)

| Region |

Country |

Exports |

Imports |

| North America |

United States |

410 |

320 |

| North America |

Canada |

95 |

80 |

| North America |

Mexico |

140 |

190 |

| Europe |

Germany |

360 |

240 |

| Europe |

France |

130 |

110 |

| Europe |

United Kingdom |

120 |

150 |

| Europe |

Italy |

140 |

105 |

| Europe |

Spain |

90 |

85 |

| Europe |

Netherlands |

260 |

160 |

| Europe |

Poland |

75 |

65 |

| Europe |

Belgium |

85 |

70 |

| Europe |

Sweden |

55 |

45 |

| Europe |

Rest of Europe |

170 |

140 |

Top Polypropylene Corrugated Packaging Market Players

Latest Announcement by Industry Leader

- In March 2025, LyondellBasell, a leader in the global chemical industry, announced the launch of Pro-fax EP649U, a new polypropylene impact copolymer designed for the rigid packaging market. This innovative product is specifically formulated for thin-walled injection molding, making it ideal for food packaging applications.

Recent Developments

- In June 2025, Distriplast, which is a brand of Beaulieu International Group, announced the launch of a new website for polypropylene (PP) corrugated sheets. These sheets are developed with usability, clarity, and speed in mind. This new website provides streamlined access to high-performance PP corrugated sheets, which are widely utilized for protecting construction and buildings. With their new website www.distriplast.com, visitors can easily get all the information regarding the availability of the products and their launches as well.

- In May 2025, SIBUR developed a new grade of polypropylene PPI003 EX, characterized by increased strength, for the production of corrugated pipes. This new grade is designed with increased strength, making it suitable for sewer and drainage systems. The development addresses the need for a reliable, domestically produced alternative to imported polypropylene for Russian pipe manufacturers.

Polypropylene Corrugated Packaging Market Segments

By Product Type

- Boxes & Containers

- Sheets & Rolls

- Totes & Bins

- Dividers & Partitions

By Thickness

By the Packaging Function

- Returnable Transit Packaging (RTP)

- Protective Packaging

- Display & Promotional Packaging

By End-Use Industry

- Automotive

- Agriculture

- Food & Beverage

- Pharmaceutical & Healthcare

- Electronics

- Retail & E-commerce

- Logistics & Warehousing

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait