Recycled Materials Packaging Solutions Market Regional Insights, Segment Breakdown, Manufacturers Data, Trade Statistics, and Competitive Assessment

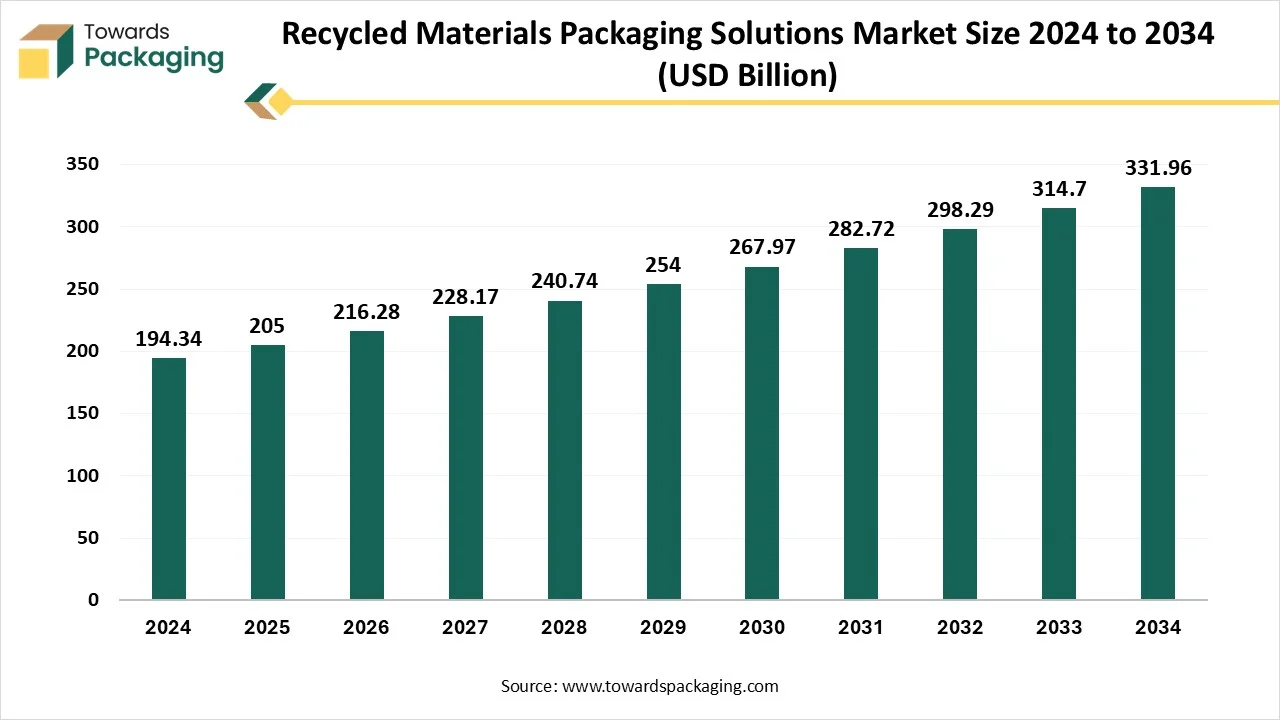

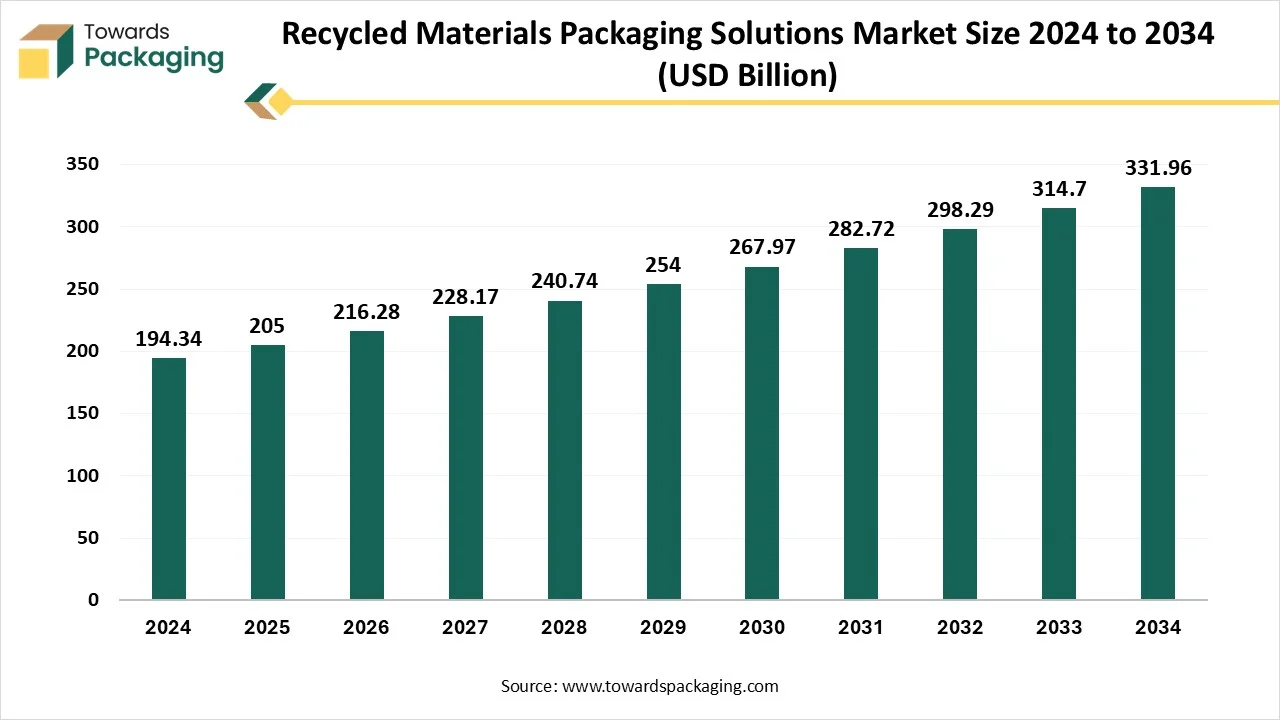

The recycled materials packaging solutions market is forecasted to expand from USD 216.31 billion in 2026 to USD 350.22 billion by 2035, growing at a CAGR of 5.5% from 2026 to 2035. This report covers full market size, growth trends, and segment-level insights across material types (recycled paper & cardboard 38%, plastics 30%, metals 15%, glass 17%), packaging formats (corrugated boxes 34%, rigid packaging 28%, flexible packaging 25%), recycling sources (PCR 60%, PIR 40%), and industries (food & beverage 42%, cosmetics 15%, e-commerce 13%). It provides regional analysis for North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting Europe’s 30% share, APAC’s high growth, and region-wise CAGR.

The study also includes top companies, competitive structure, value chain mapping, trade data, and manufacturer & supplier profiling across global markets.

Key Insights

- In terms of revenue, the market is valued at USD 205 billion in 2025.

- The market is projected to reach USD 350.22 billion by 2035.

- Rapid growth at a CAGR of 5.5% will be observed in the period between 2025 and 2034.

- Europe dominated the global market by holding more than 30% of the market share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the recycled paper & cardboard segment contributed the biggest market share of 38% in 2024.

- By material type, the recycled plastic segment is expected to expand at a significant CAGR between 2025 and 2034.

- By packaging type, the corrugated & paperboard boxes segment contributed the biggest market share of 34% in 2024.

- By packaging type, the flexible pouches segment will be expanding at a significant CAGR between 2025 and 2034.

- By recycling source, the post-consumer recycled segment contributed the biggest market share of 60% in 2024.

- By recycling source, the post-consumer recycled segment is expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major market share of 42% in 2024.

- By end-use industry, the e-commerce & retail segment is projected to grow at a CAGR between 2025 and 2034.

- By distribution channel, the direct (B2B) segment contributed the biggest market share of 55% in 2024.

- By distribution channel, the online platforms segment is expanding at a significant CAGR between 2025 and 2034.

Market Overview

The global recycled materials packaging solutions market comprises packaging solutions made from materials that have been previously used and processed through industrial recycling. These materials include paper, plastic, metal, and glass that are collected, sorted, cleaned, and remanufactured into new packaging products. These solutions are increasingly adopted across industries to minimize environmental impact, comply with regulations, and meet sustainability goals.

What are the New Trends in the Global Recycled Materials Packaging Solutions Market?

Rising Demand for Mono-material Design

- The rising demand for mono-material design has raised the utilization of this type of material in the packaging industry.

Progression in the Recycling Technology

- The rising progression in recycling technology has increased the demand for this packaging.

Growing Focus on Eco-friendly Substitutes

- The increasing focus on eco-friendly substitutes in several industries, such as plant-based paper boxes, is to fulfill the rising demand of consumers.

How Can AI Improve the Global Recycled Materials Packaging Solutions Market?

The incorporation of AI in the global recycled materials packaging solutions market plays a crucial role in optimizing the materials utilized for the packaging of products. It also predicts the demand of the market, which reduces the wastage of materials. AI is widely used for improving printing technology in packaging. With the incorporation of advanced technologies, the labour charges are deducted while manufacturing packaging.

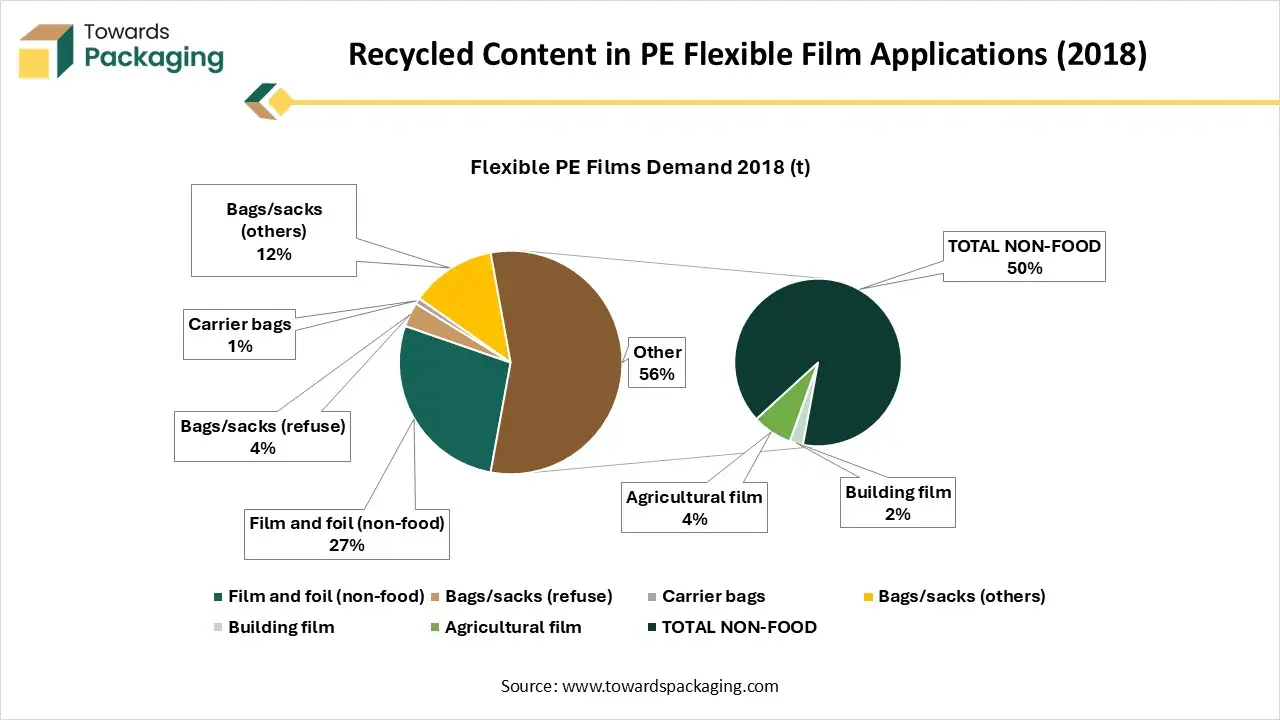

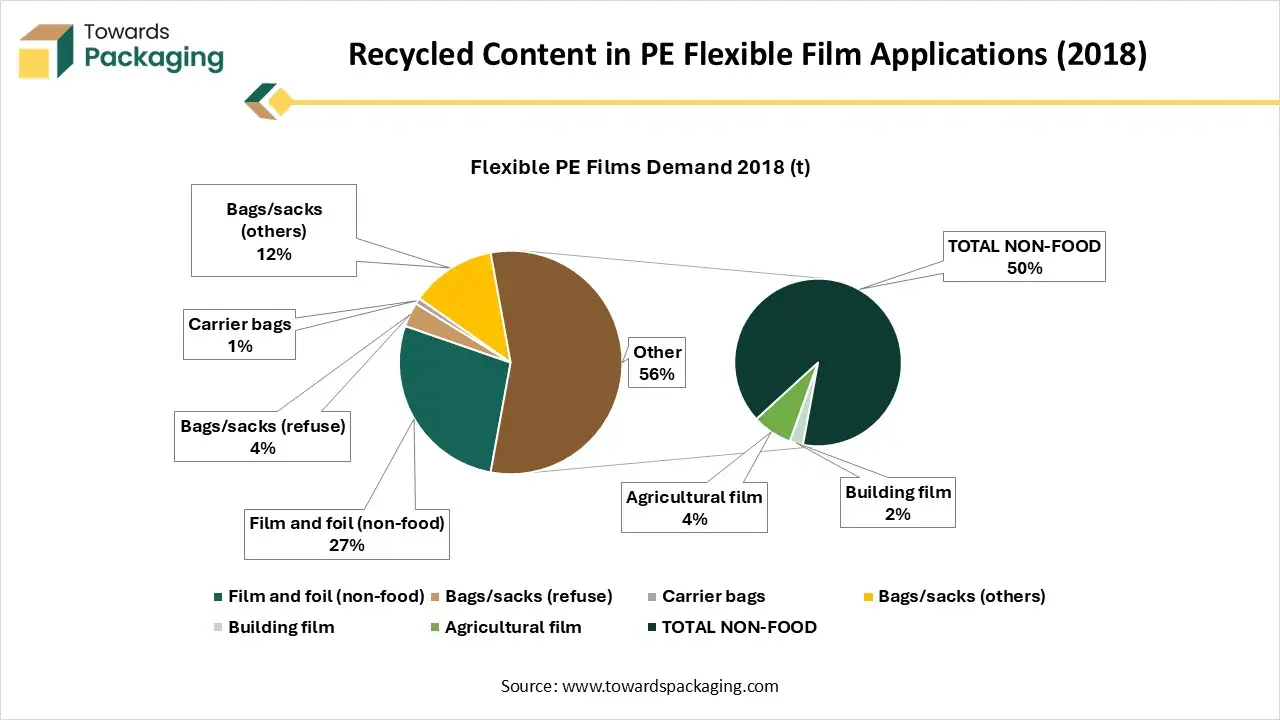

Recycled Content in PE Flexible Film Applications (2018)

In 2018, the European market produced 1.8 million tonnes of recycled PE films, which represented roughly 20% of total PE flexible film demand. Of this, an estimated 1.2–1.3 million tonnes were high enough quality to be reused in film applications again, about 20% of all non-food film demand.

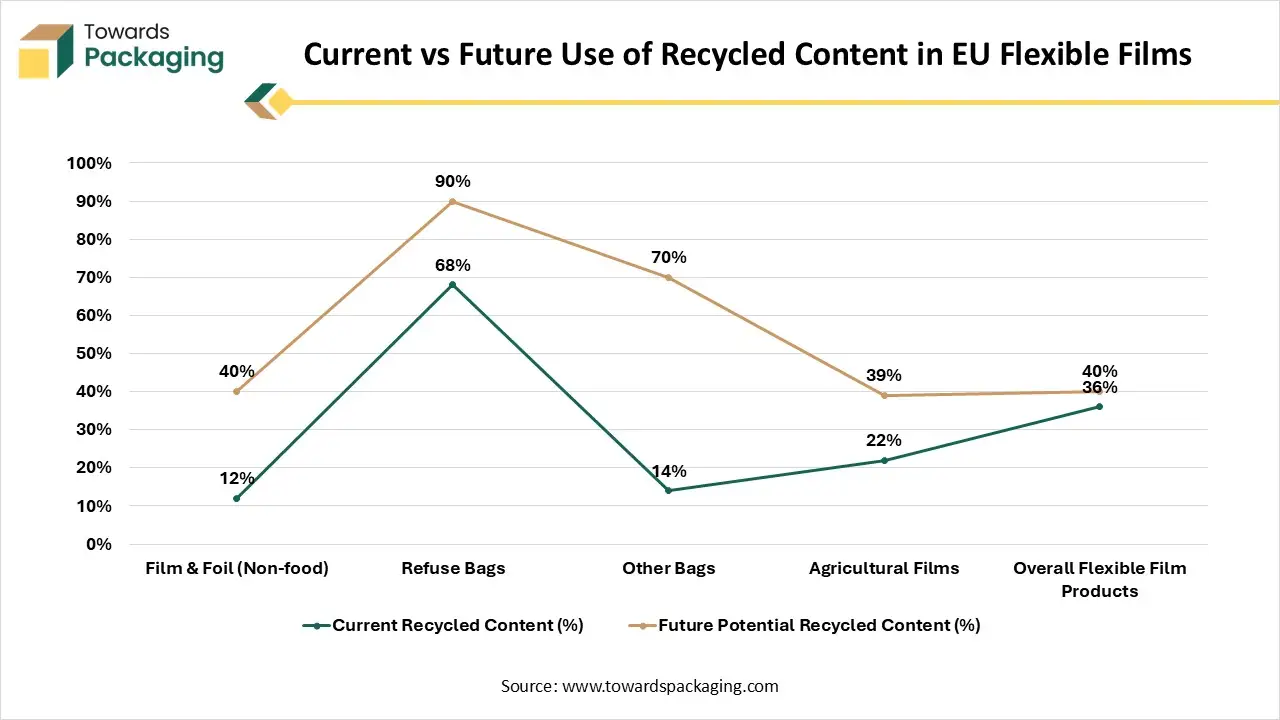

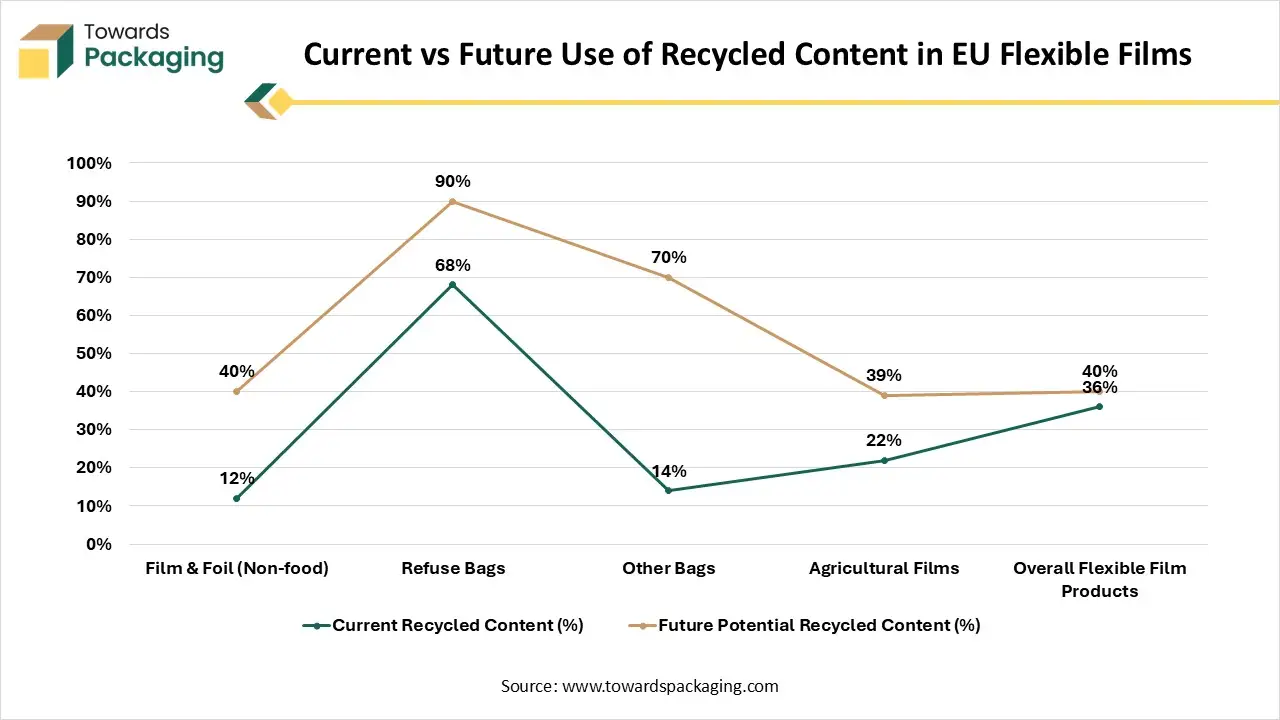

Current vs Future Use of Recycled Content in EU Flexible Films

Recycled PE from films cannot currently be used in food-contact packaging, but there is significant untapped potential in almost all other flexible film sectors.

Refuse bags already use large amounts of recycled material (68%) and could reach 90% in the future.

- Non-food film & foil uses just 12% recyclate today but could scale up to 40% as quality improves.

- Other bags have substantial headroom, rising from 14% today to 70% in the future.

- Agricultural films could increase from 22% to nearly 40%.

| Growth Scenario (PE Film Production) | Estimated Demand for Recyclate (2030) |

| 1% Annual Growth | 3.6 million tonnes (Mt) |

| 4% Annual Growth | 5.0 million tonnes (Mt) |

| Additional recyclate usable in refuse bags | Up to 200 kt |

Across all flexible films, recyclate uptake could be dramatically expanded if technical and quality barriers are addressed. By 2030, depending on the growth of PE flexible packaging production, Europe could require between 3.6 Mt and 5 Mt of PE recyclate for flexible film applications alone.

Market Dynamics

Driver

Stringent Government Regulations in the Packaging Industry

The implementation of stringent government regulations in the packaging industry has driven the growth of the global recycled materials packaging solutions market. These creativities command the phasing out of single-utilization of plastics, ban injurious materials such as imposing taxes on non-recycled plastic and PFAS in packing convincing businesses to accept sustainable choices. As a consequence, there is a rising demand for packing solutions that use recycled resources and lessen ecological impact. The supervisory countryside not only applies acquiescence but also inspires invention in environment-friendly packaging resolutions. It is driving producers to grow and accept new skills and resources, thus nurturing a sustainable future for the packing business worldwide.

Restraint

High Charges Linked with Recycling Infrastructure

The high charges connected with recycling organizations and skills pose important barriers to the development of the global recycled materials packaging solutions market. These charges comprise investment in gathering organizations, sorting skills, and processing services needed to recycle packaging resources proficiently. Such expenses discourage extensive acceptance of recycled resources, despite their ecological benefits.

Opportunity

Rising Collaboration among Market Players

The rising collaboration among shareholders for enhanced recycling procedures can result in cost-effective resolutions, additionally influencing the acceptance in several businesses. Developing sectors also show an important possibility, as the influence for sustainability generates a fertile ground for presenting recycled packaging resolutions in emerging areas. In current times, movements show a change in the direction of circular economy principles, where packing is intended for reuse and recyclability. Companies are progressively transparent about their tracking and manufacturing procedures, further endorsing customer belief.

The growth of e-commerce has also inclined the packaging aspect with demand for resources that can resist shipping while being ecologically friendly. Moreover, customer preferences are developing, with greater stress on minimalistic and practical design in packing that uses recycled content. This tendency imitates a broader societal change in the direction of accountable consumption and waste decrease, inspiring ongoing invention in the packaging segment.

Segmental Insights

Why Recycled Paper & Cardboard Segment Dominated the Recycled Materials Packaging Solutions Market in 2024?

The recycled paper & cardboard segment contributed a considerable share of the global recycled materials packaging solutions market in 2024 due to its high biodegradability and recyclability. Technological advancements in this sector have influenced the growth of the segment by enhancing the reliability of the consumers. The rising ecological concern among consumers due to increasing environmental issues has enhanced the demand for this market. Rapid growth in the e-commerce sector has inclined consumers towards this type of packaging.

The rPET (Recycled Plastic) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising demand for sustainable packaging has influenced the development of this segment. The strength, durability, safety, and clarity of products have helped to expand this segment rapidly. The increasing commitment of the food & beverage industry towards sustainable packaging has raised the usage of this market.

Why Corrugated & Paperboard Boxes Segment Dominated the Recycled Materials Packaging Solutions Market in 2024?

The corrugated & paperboard boxes segment held a considerable share of the global recycled materials packaging solutions market in 2024 due to its widespread cost-effectiveness and accessibility. Easily availability of such boxes is the major reason behind the growing demand for this market. These are widely used in e-commerce, food & beverages, cosmetics, electronics, and pharmaceutical industries. Advancements in printing technology have also improved the demand for recycled materials and packaging solutions.

The flexible pouches segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The lightweight, consumer-friendly, and cost-effective properties help this segment to grow rapidly. The enhanced recyclability demand in the packaging sector has increased the adoption of this segment in various sectors.

Why Post-Consumer Recycled Segment Dominated the Recycled Materials Packaging Solutions Market in 2024?

The post-consumer recycled segment was dominant over the low-carbon footprint packaging market in 2024 due to the corporate sustainability goals, technological advancements, and strict regulatory compulsion. Rigid bottles and pouches are high in demand in this segment. Both mechanical and chemical recycling process advancements have influenced the demand for this market. The enhanced materials performance demand has increased the development of this sector.

The post-industrial recycled (PIR) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is because of the circular economy, scalability, and consistency of the market. The advancement in the recycling industry and stringent ecological guidelines have raised the demand for this market. It safeguards uniform quality, lower infection, and ensures easier obedience.

Why the Food & Beverages Segment Dominated the Recycled Materials Packaging Solutions Market in 2024?

The food & beverages segment held a considerable share of the global recycled materials packaging solutions market in 2024 due to the regulatory guidelines and customer demand. Recycled jars and bottles provide clarity, safety, and provide high barrier from adverse ecological conditions. It has properties to provide safety to perishable food products have raised the demand for this market. The strict guidelines of the food packaging industry have compelled brands the adoption such packaging materials.

The e-commerce & retail segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to the increasing regulatory pressure and sustainability demand of the market. E-commerce -platforms such as Flipkart, Amazon, Myntra, and several others have raised major concerns about packaging waste. Such awareness and brand image consciousness have influenced the growth of this market.

Why Direct (B2B) Segment Dominated the Recycled Materials Packaging Solutions Market in 2024?

The direct (B2B) segment accounted for a considerable share of the global recycled materials packaging solutions market in 2024 due to the supply-chain innovation, sustainability orders, and cost-effectiveness. Direct (B2B) buyers are adopting biodegradable sources such as bamboo, PCR cardboard, seaweed, molded pulp, and mycelium composites. This section is intensifying dealers across the region to make the most in local construction, and encouraging multi-tier sourcing. Compact waste and direct (B2B) brand positioning has predisposed the expansion of this market.

The online platforms segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing importance of customers in utilizing eco-friendly packaging has improved the demand for this industry. Smart tech amalgamation, like NFC tags and QR codes, has boosted assignment and transparency. Personalization with digital printing has enhanced the expansion of this market.

Regional Insights

Rising Acceptance of Recyclable Materials in Packaging Europe Promotes Dominance

Europe held the largest share of the global recycled materials packaging solutions market in 2024, due to advancements in recycling technology, strict government regulation, and high consumer demand. In countries such as the U.K., Germany, Italy, Sweden, and many others are encouraging recycled packaging materials, which is altering the packaging industry's worth chain, inducing innovation in material obtaining, production procedures, and supply chain logistics. This change not only influences customer behavior and supervisory outlines but also nurtures a more sustainable and global economy within packing.

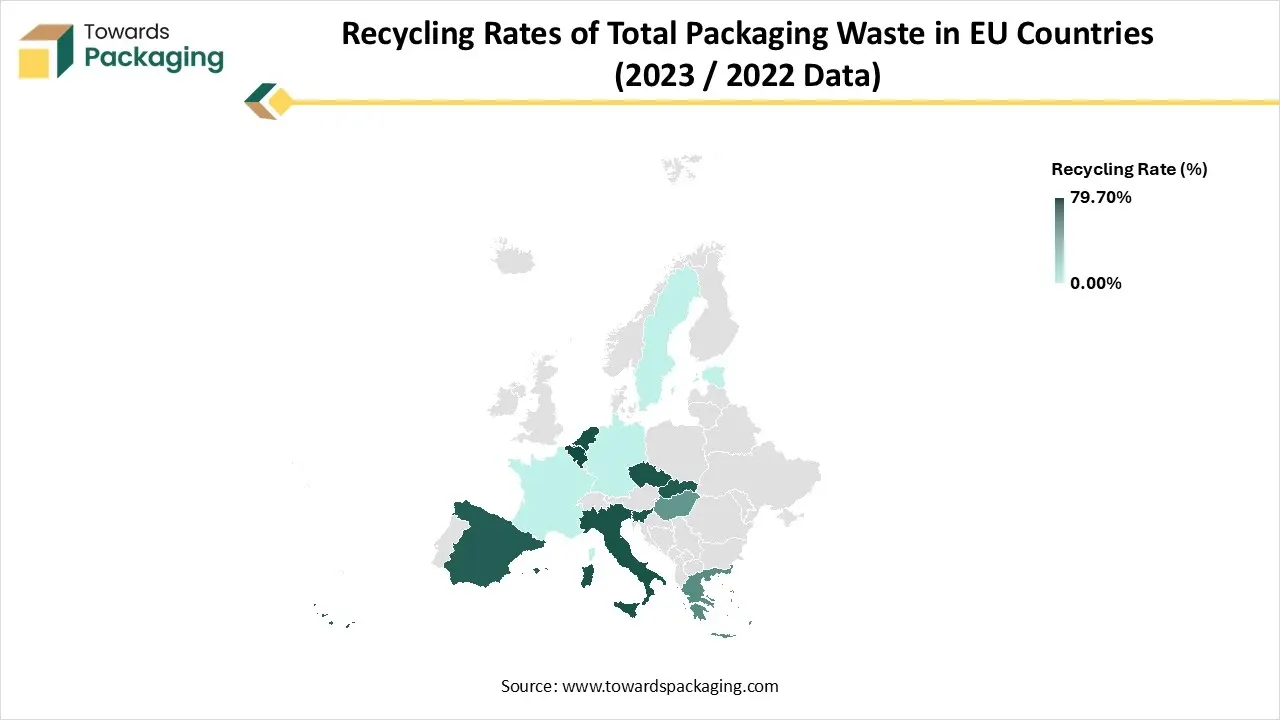

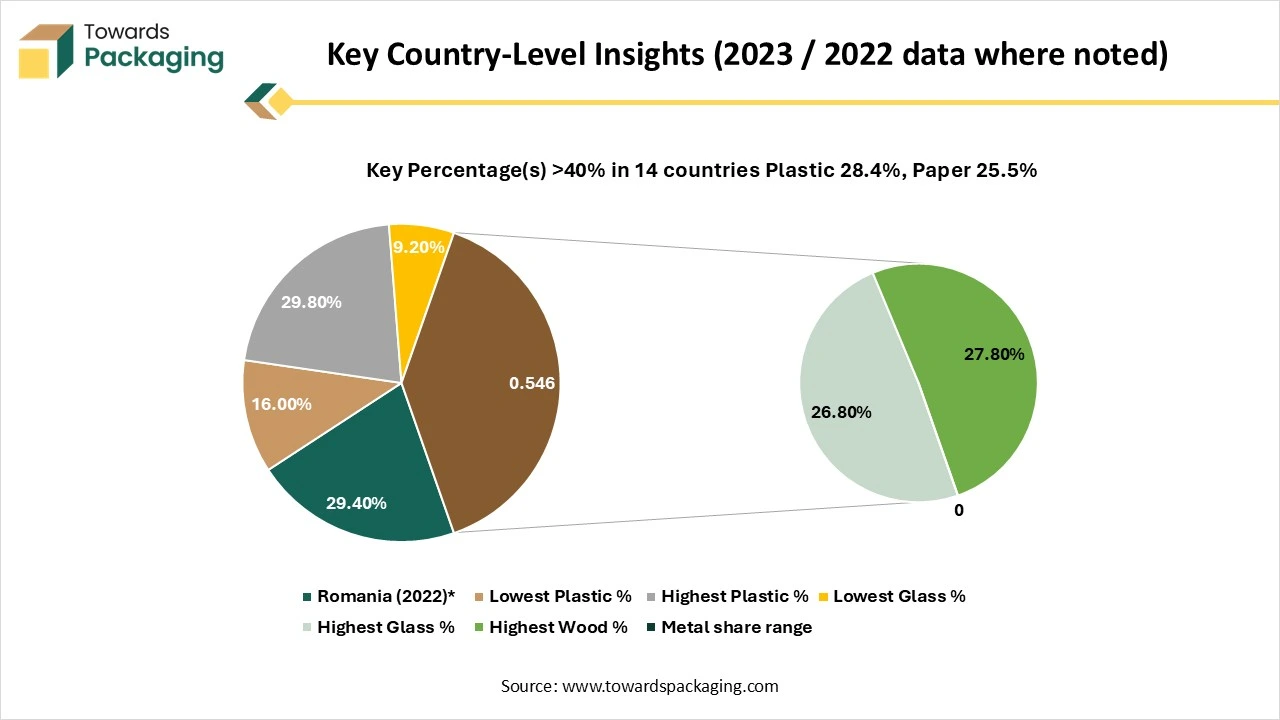

EU Packaging Waste by Material - 2023

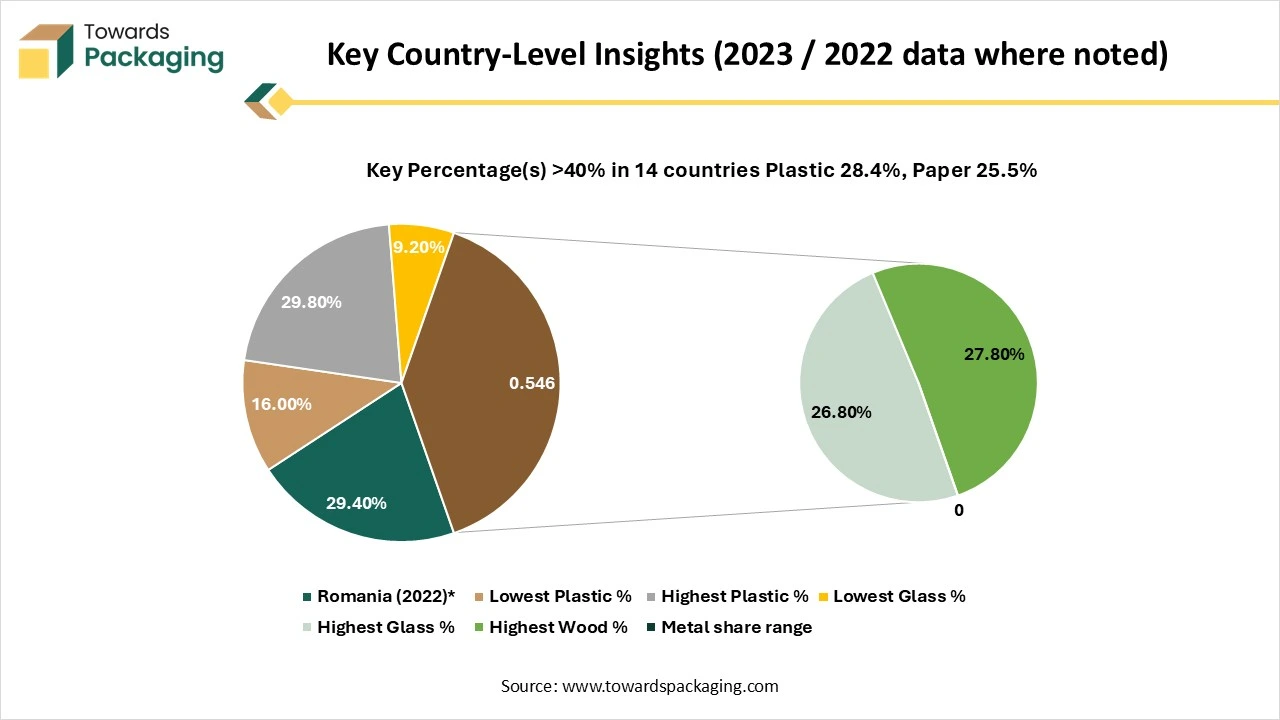

In 2023, the European Union generated 79.7 million tonnes of packaging waste. The majority came from paper and cardboard, which accounted for over 40% of the total. Plastics and glass also contributed significantly, making up 19.8% and 18.8%, respectively. Wood represented about 15.8%, while metals and other materials formed only a small portion.

Across most EU countries, the distribution by material was similar to the EU average. Paper and cardboard were the largest source of packaging waste in 26 out of 27 countries, with Bulgaria being an exception, where plastic waste was slightly higher. Plastic waste contributed as little as 16% in Luxembourg and nearly 30% in Ireland. Glass packaging waste varied widely from 9.2% in Finland to 26.8% in Croatia. Metal waste was generally low everywhere, remaining below 10% in all nations.

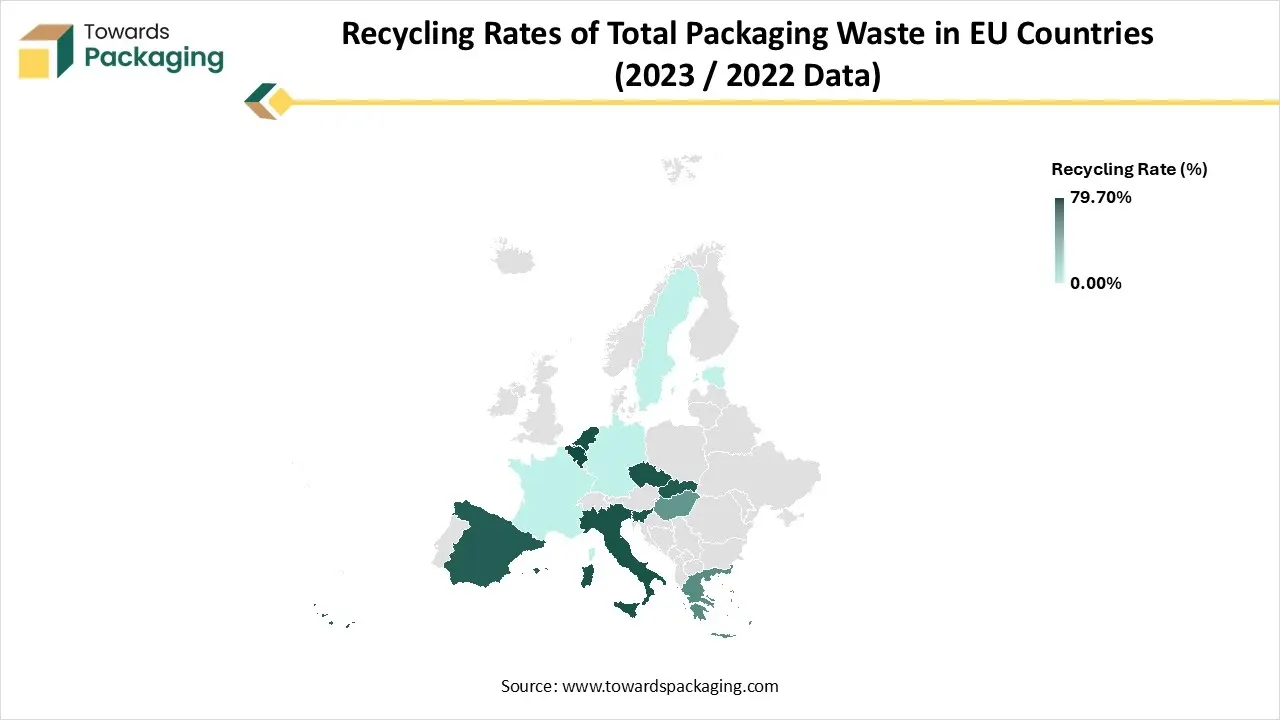

Recycling Targets and Rates for Packaging Waste (2030 Targets & 2023 Performance)

The EU aims to recycle 70% of all packaging waste by 2030, with even higher targets for specific materials like 85% for paper, 75% for glass, and 55% for plastics. In 2023, the EU was close to reaching this goal, achieving a recycling rate of 67.5%.

Seven EU countries have already surpassed the 70% target, including Belgium, Netherlands, Italy, Czechia, Slovenia, Slovakia, and Spain. Many others, such as Germany, France, Estonia, Sweden, and Cyprus, are very close, reporting recycling rates between 68.5% and 69.5%. However, some countries are struggling: Romania, Hungary, Malta, and Greece achieved recycling rates below 50%, far from the EU’s 2030 ambitions.

Asia Pacific’s Rising Ecological Concerns Support Growth

The Asia Pacific region is estimated to grow at the fastest rate in the global recycled materials packaging solutions market during the forecast period. The rising government initiatives towards ecological issues have raised the concern among people to use packaging which are eco-friendly. In countries such as India, Japan, China, Thailand, and several others, the presence of major market players has introduced innovation in this market.

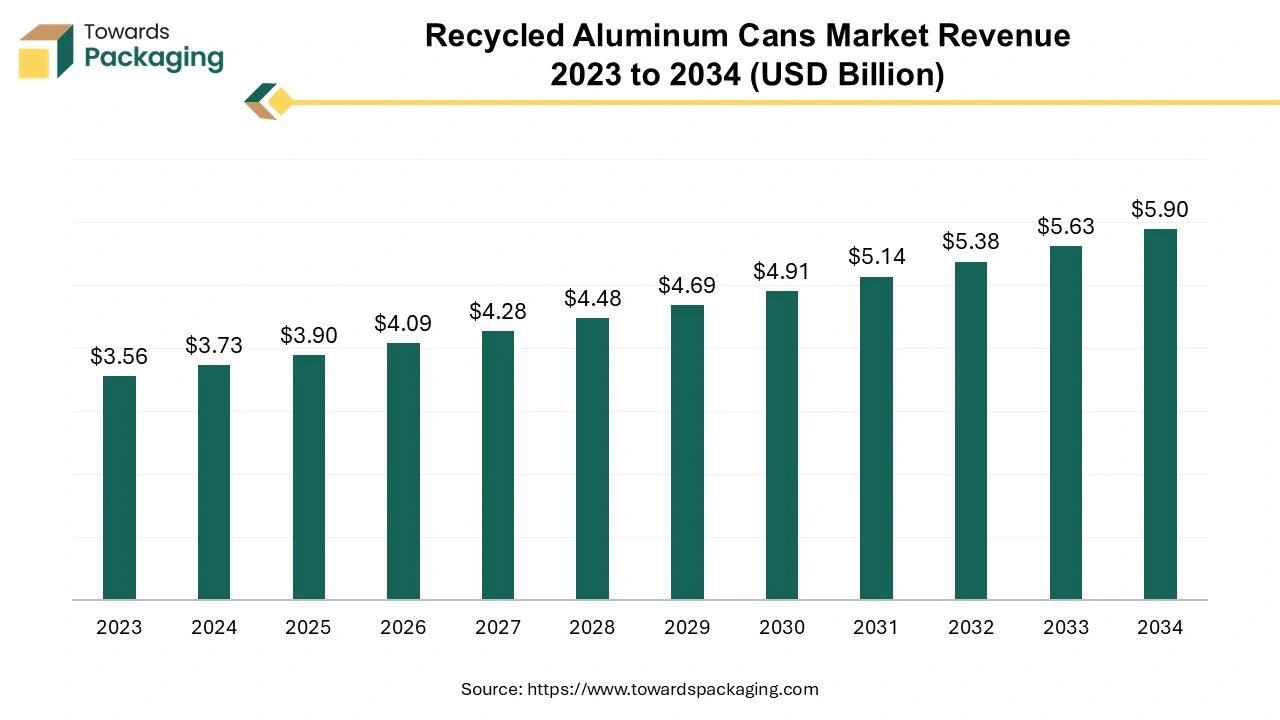

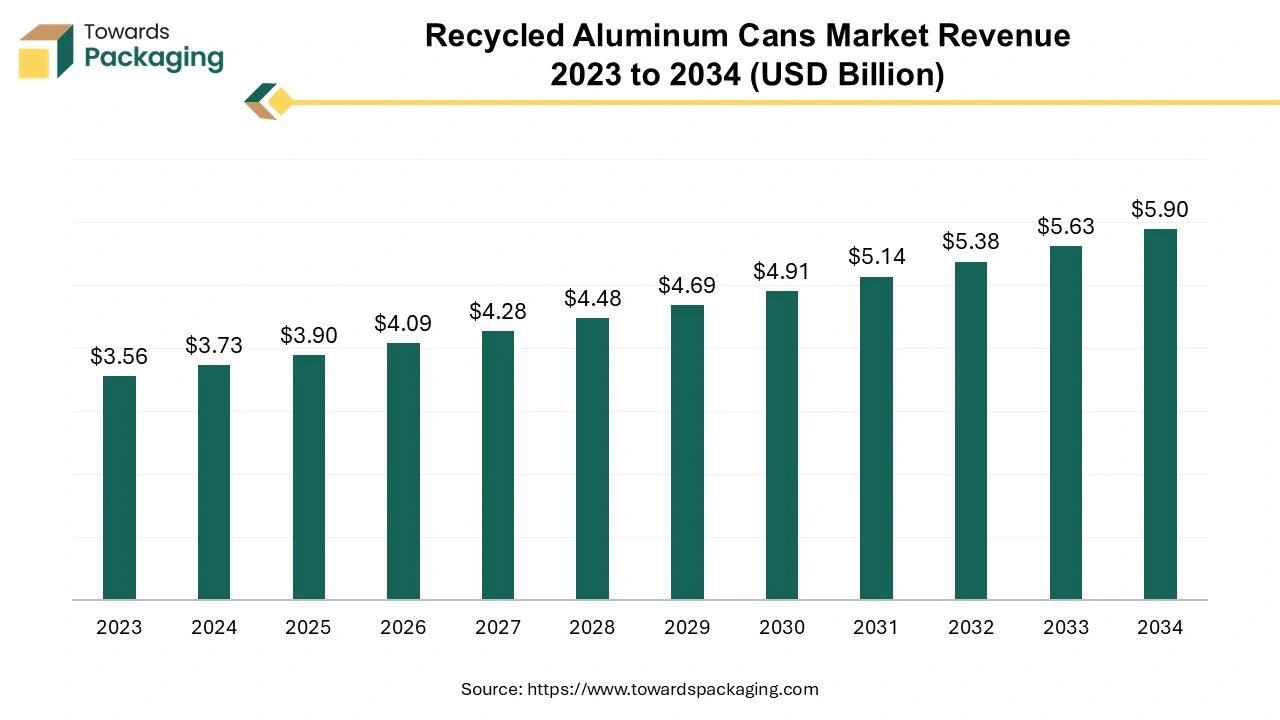

Future of Recycled Aluminum Cans Market

The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The market is flourishing due to the increasing medical sector, food and beverages, beauty and cosmetic brands, and several others which require aluminum cans to store various products in different sectors. The growing concern for health, hygiene, and medical cases is boosting the recycled aluminum cans market.

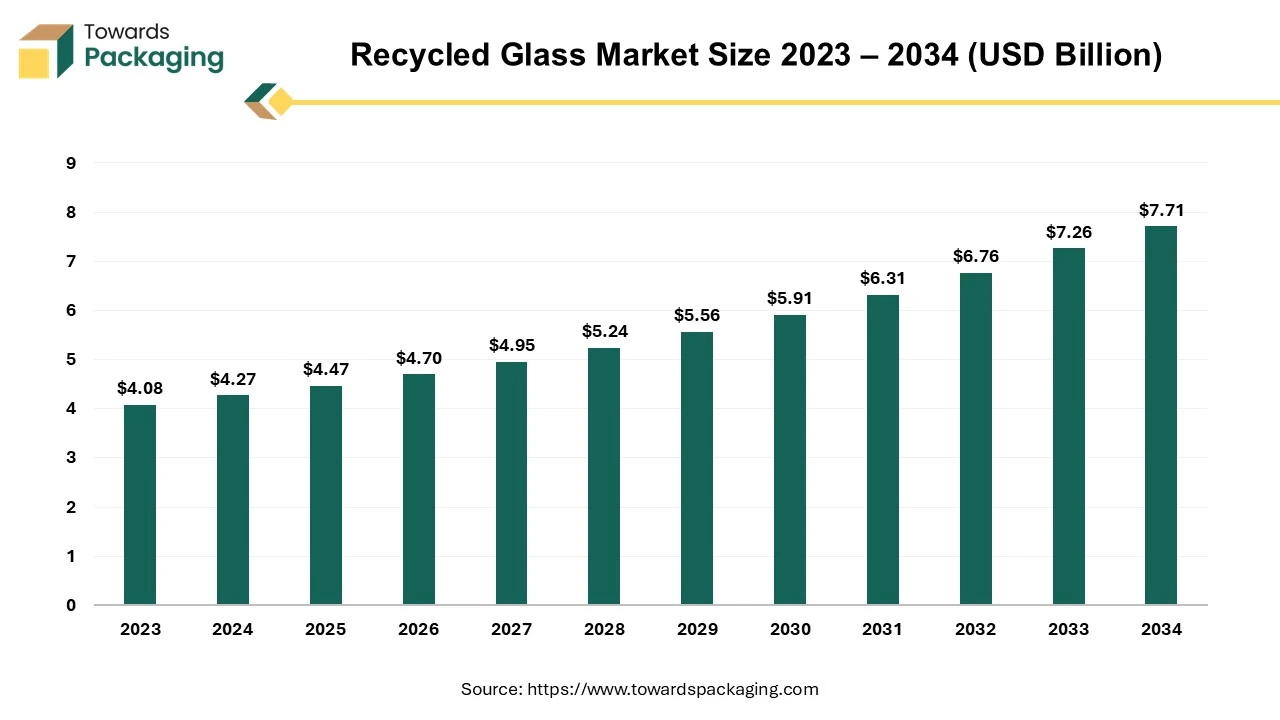

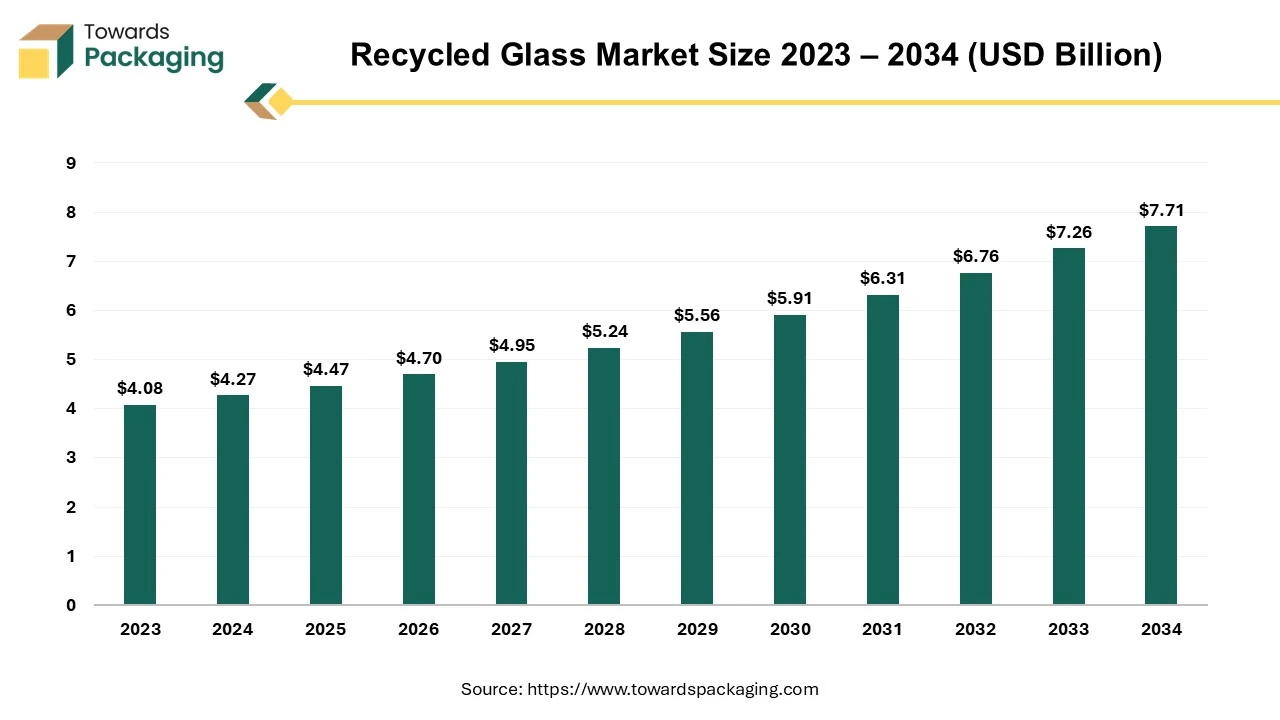

Future of Recycled Glass Market

The recycled glass market is expected to increase from USD 4.47 billion in 2025 to USD 7.71 billion by 2034, growing at a CAGR of 6.09% throughout the forecast period from 2025 to 2034. Market growth is driven by rising recycling initiatives, urbanization, and sustainability efforts, with Asia-Pacific anticipated to experience the fastest expansion.

The recycled glass market is predicted to witness strong growth in the years to come. Recycled glass is glass that has been processed from discarded glass products to be reused in manufacturing new products. Glass can be endlessly recycled without decreasing quality. According to the Glass Recycling Association, 33% of new glass container contains recycled glass and 60% of recycled glass is used for new containers or insulation. Recycling glass reduces the need for raw materials like sand, soda ash and limestone, saving energy as well as natural resources while minimizing the environmental impact. Recycled glass retains the same quality as the new glass while making it a sustainable and cost-effective material to be utilized in the packaging, construction, consumer goods and industrial applications.

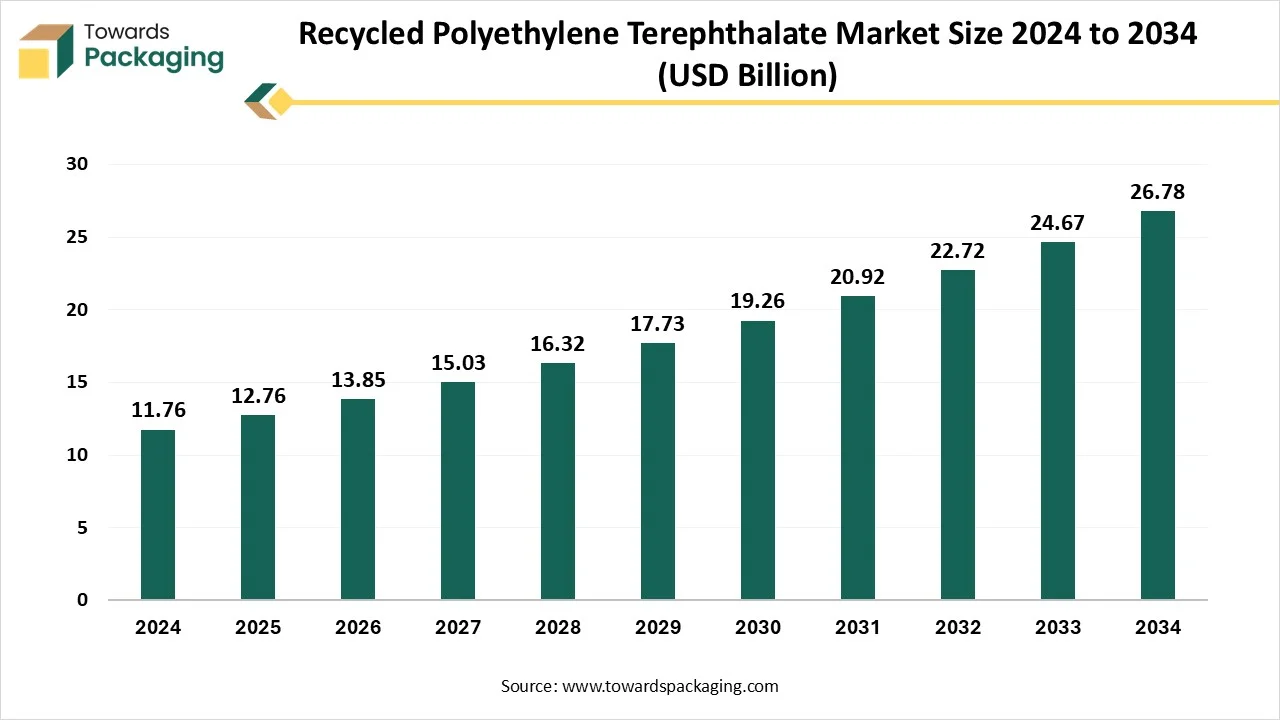

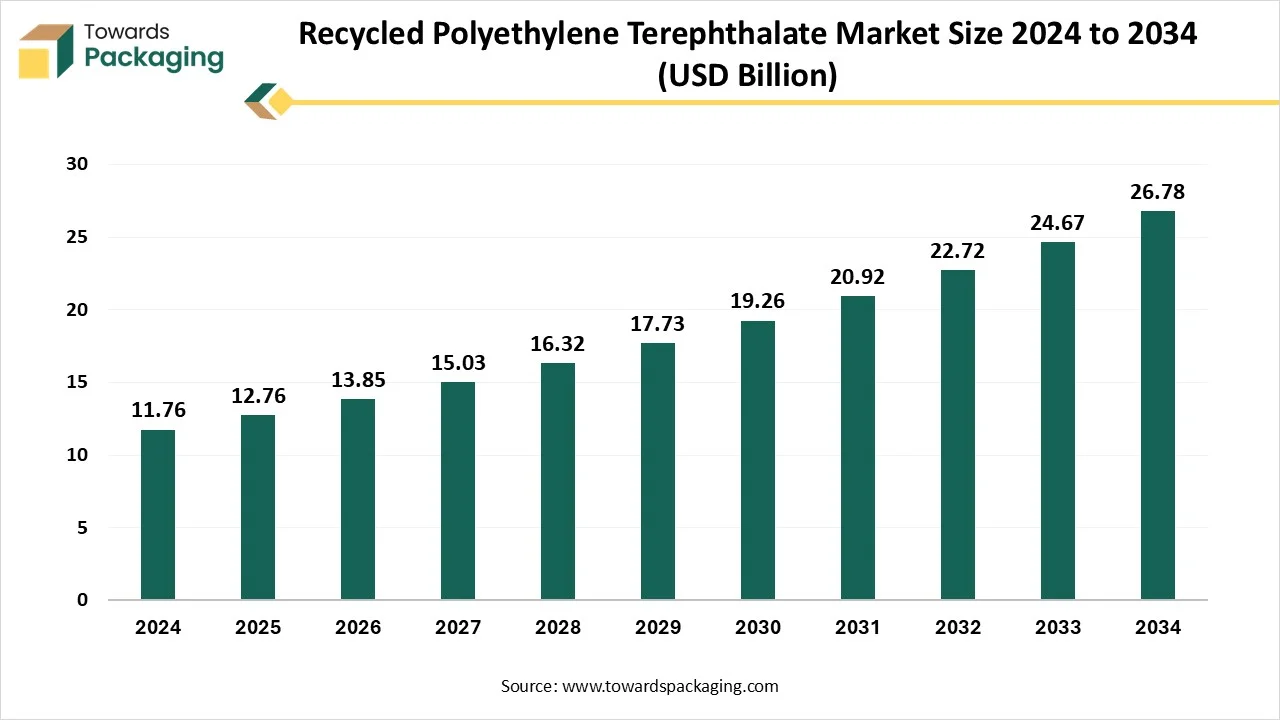

Future of Recycled Polyethylene Terephthalate Market

The recycled polyethylene terephthalate market is set to grow from USD 12.76 billion in 2025 to USD 26.78 billion by 2034, with an expected CAGR of 8.53% over the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing recycled polyethylene terephthalate packaging. The market is growing rapidly due to increasing environmental concerns, rising demand for sustainable packaging, and regulatory support for recycling initiatives.

The beverage, food, and textile industries are major consumers, driven by efforts to reduce plastic waste and carbon footprint. Advancements in recycling technologies and strong consumer preference for eco-friendly products are also contributing to market expansion. Additionally, brand owners and manufacturers are incorporating rPET into their packaging to meet sustainability goals and circular economy targets.

The plastic material made from recycled used PET products, such as water bottles, food containers, and other packaging items, is known as recycled polyethylene terephthalate (rPET). PET (Polyethylene Terephthalate) is a type of clear, strong, and lightweight plastic commonly used for packaging beverages and foods. When these PET products are collected and processed through mechanical or chemical recycling, they are cleaned, melted, and reformed into rPET pellets or flakes, which can then be reused to manufacture new packaging, textiles, automotive parts, and more. Using rPET helps reduce plastic waste, conserve natural resources, and lower greenhouse gas emissions, making it an important component of sustainable materials and the circular economy.

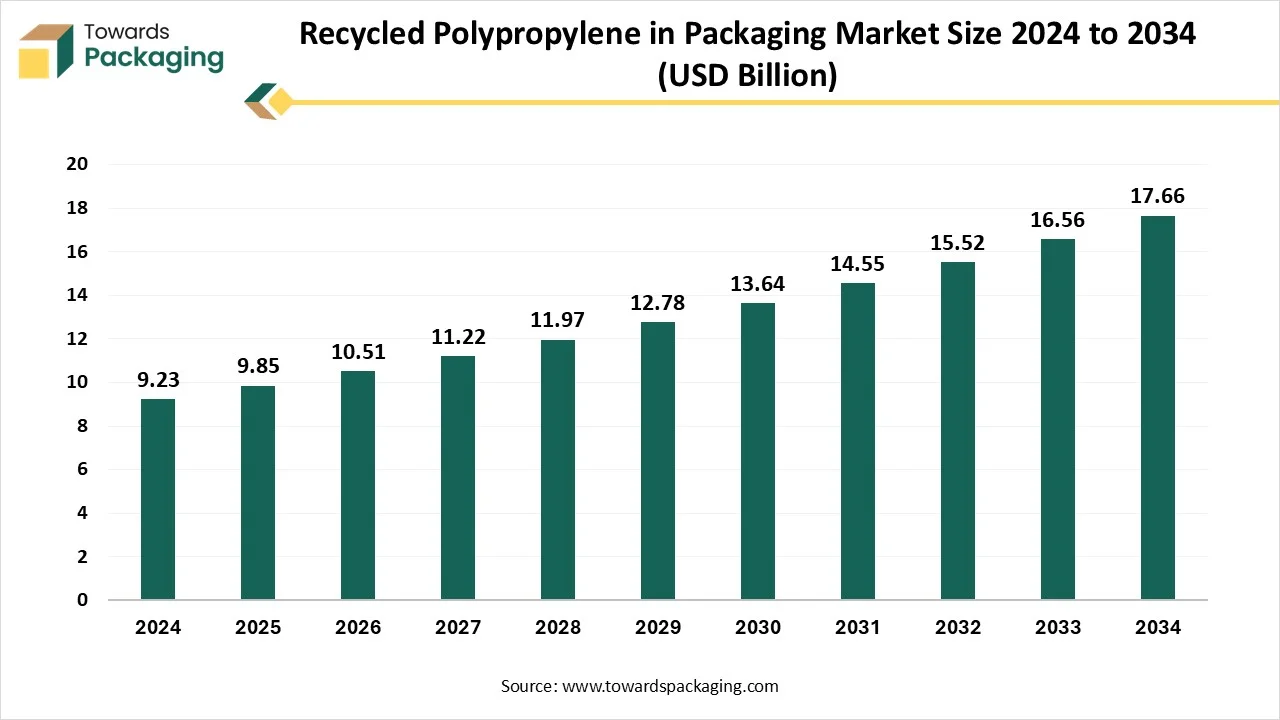

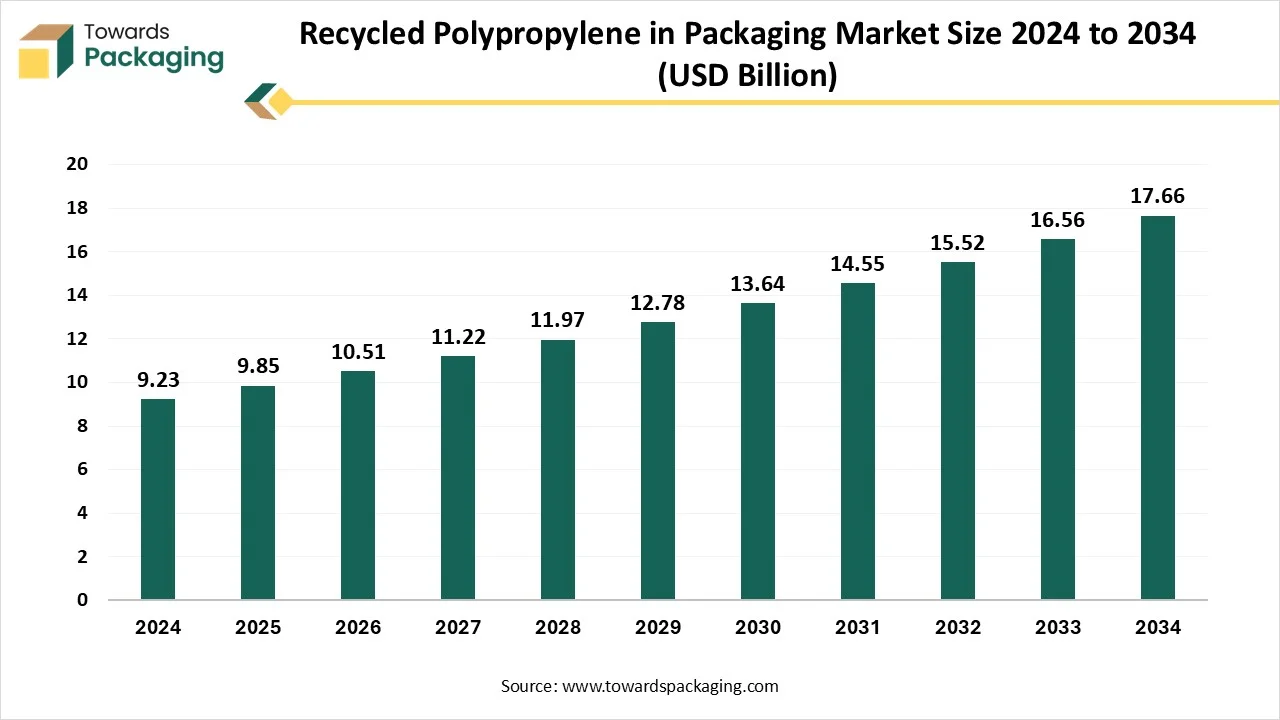

Future of Recycled Polypropylene in Packaging Market

The recycled polypropylene in the packaging market is set to grow from USD 9.85 billion in 2025 to USD 17.66 billion by 2034, with an expected CAGR of 6.73% over the forecast period from 2025 to 2034. The rising ecological regulations promoting sustainable resources and increasing customer demand for durable, compatible, and lightweight packaging have raised the influence of recycled polypropylene in the packaging market. The food and beverages sector has influenced the demand for this packaging for several appliances, such as flexible pouches, containers, caps, and trays. Due to a strong regulatory framework and consumer awareness, North America is dominating this market.

Recycled polypropylene in packaging is the polypropylene plastic that is processed and reutilized instead of being discarded as waste. Growing ecological awareness and laws inspiring the usage of recycled plastics, in which rPP is a general resource in several packaging applications, are influencing this market. Both flexible and rigid packaging exist in the industry, and rPP is used for containers, pouches, films, bottles, and other packaging processes.

Top Companies in the Recycled Materials Packaging Solutions Market

- Amcor plc

- Mondi Group

- Berry Global Inc.

- Sealed Air Corporation

- Smurfit Kappa Group

- DS Smith Plc

- Tetra Pak

- Sonoco Products Company

- International Paper Company

- WestRock Company

- Crown Holdings, Inc.

- Ball Corporation

- ALPLA Group

- Plastipak Holdings, Inc.

- Eco-Products, Inc. (a Novolex brand)

- Uflex Ltd.

- Sabert Corporation

- Pactiv Evergreen Inc.

- Graphic Packaging International

- Trex Company, Inc.

Latest Announcements by Industry Leaaders

- In February 2025, Vice President of Food, Beverage & Spirits for Berry Global’s Consumer Packaging North America Division, Peter Goshorn, expressed, “As companies across the globe commit to transitioning to a circular economy, the ability to deliver products made with recycled materials at scale is crucial. That’s why we’re collaborating with leading brands, like Mars, to significantly increase the use of recycled content to drive responsible business growth without compromising performance or aesthetics.”(Source: Berry Global)

New Advancements in the Global Market

- In February 2025, Berry Global and Mars announced packaging with 100% Recycled Content. (Source: Berry Global)

- In January 2025, ALPLA launches HDPE recycling in Brazil. (Source: ALPLA)

Global Recycled Materials Packaging Solutions Market Segments

By Material Type

- Recycled Paper & Cardboard

- Corrugated Cardboard

- Molded Fiber

- Kraft Paper

- Recycled Plastics

- rPET (Recycled Polyethylene Terephthalate)

- rHDPE (Recycled High-Density Polyethylene)

- rLDPE (Recycled Low-Density Polyethylene)

- rPP (Recycled Polypropylene)

- rPS (Recycled Polystyrene)

- Recycled Metals

- Recycled Aluminum

- Recycled Steel

- Recycled Glass

By Packaging Type

- Rigid Packaging

- Bottles

- Trays

- Containers

- Cans

- Flexible Packaging

- Pouches

- Wraps

- Sachets

- Films

- Corrugated & Paperboard Packaging

- Boxes

- Folding Cartons

- Paper Bags

By Recycling Source

- Post-Consumer Recycled (PCR)

- Post-Industrial Recycled (PIR)

By End-Use Industry

- Food & Beverage

- Packaged Food

- Dairy

- Confectionery

- Beverages

- Personal Care & Cosmetics

- Homecare & Cleaning Products

- Pharmaceuticals

- Electronics & Electricals

- Industrial Goods

- E-commerce & Retail

By Distribution Channel

- Direct (B2B)

- Retailers/Wholesalers

- Online Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Figures

- Global Recycled Materials Packaging Solutions Market Size (2025-2034) - Market Growth, CAGR, and Forecast (100%)

- Regional Market Share of Recycled Materials Packaging Solutions (2024) - Europe (30%), Asia Pacific (25%), North America (20%), Latin America (10%), Middle East & Africa (15%) (100%)

- Material Type Breakdown in Recycled Materials Packaging Solutions Market (2024) - Recycled Paper & Cardboard (38%), Recycled Plastics (30%), Recycled Metals (15%), Recycled Glass (17%) (100%)

- Packaging Type Market Share in Recycled Materials Packaging Solutions (2024) - Corrugated & Paperboard Boxes (34%), Rigid Packaging (28%), Flexible Packaging (25%), Other Packaging Types (13%) (100%)

- Recycling Source Breakdown in Recycled Materials Packaging Solutions Market (2024) - Post-Consumer Recycled (60%), Post-Industrial Recycled (40%) (100%)

- End-Use Industry Market Share in Recycled Materials Packaging Solutions (2024) - Food & Beverage (42%), Personal Care & Cosmetics (15%), E-commerce & Retail (13%), Industrial Goods (10%), Pharmaceuticals (8%), Other Industries (12%) (100%)

- Distribution Channel Market Share in Recycled Materials Packaging Solutions (2024) - Direct (B2B) (55%), Retailers/Wholesalers (30%), Online Platforms (15%) (100%)

- CAGR Growth by Region in the Recycled Materials Packaging Solutions Market (2025-2034) - Europe (5.8%), Asia Pacific (6.4%), North America (4.7%), Latin America (5.0%), Middle East & Africa (5.2%) (100%)

- Top Companies in the Recycled Materials Packaging Solutions Market - Market Share and Competitive Dynamics (100%)

- Forecasted Growth by Material Type in the Recycled Materials Packaging Solutions Market (2025-2034) - Recycled Paper & Cardboard (35%), Recycled Plastics (33%), Recycled Metals (15%), Recycled Glass (17%) (100%)

List of Tables

- Global Recycled Materials Packaging Solutions Market Size and Revenue Forecast (2025-2034) - Total Market Size, CAGR, and Growth (100%)

- Market Share of Recycled Materials Packaging Solutions by Region (2024) - Europe (30%), Asia Pacific (25%), North America (20%), Latin America (10%), Middle East & Africa (15%) (100%)

- Material Type Breakdown in Recycled Materials Packaging Solutions (2024) - Recycled Paper & Cardboard (38%), Recycled Plastics (30%), Recycled Metals (15%), Recycled Glass (17%) (100%)

- Packaging Type Breakdown in Recycled Materials Packaging Solutions Market (2024) - Corrugated & Paperboard Boxes (34%), Rigid Packaging (28%), Flexible Packaging (25%), Other Packaging Types (13%) (100%)

- Recycling Source Breakdown in Recycled Materials Packaging Solutions (2024) - Post-Consumer Recycled (60%), Post-Industrial Recycled (40%) (100%)

- End-Use Industry Breakdown in Recycled Materials Packaging Solutions Market (2024) - Food & Beverage (42%), Personal Care & Cosmetics (15%), E-commerce & Retail (13%), Industrial Goods (10%), Pharmaceuticals (8%), Other Industries (12%) (100%)

- Distribution Channel Breakdown in Recycled Materials Packaging Solutions (2024) - Direct (B2B) (55%), Retailers/Wholesalers (30%), Online Platforms (15%) (100%)

- Top Companies in the Recycled Materials Packaging Solutions Market - Market Share and Competitive Dynamics (100%)

Tags

FAQ's

Select User License to Buy

Figures (12)