North America Plastic Packaging Market Share, Detailed Segments, Leading Companies & Supply Chain Intelligence

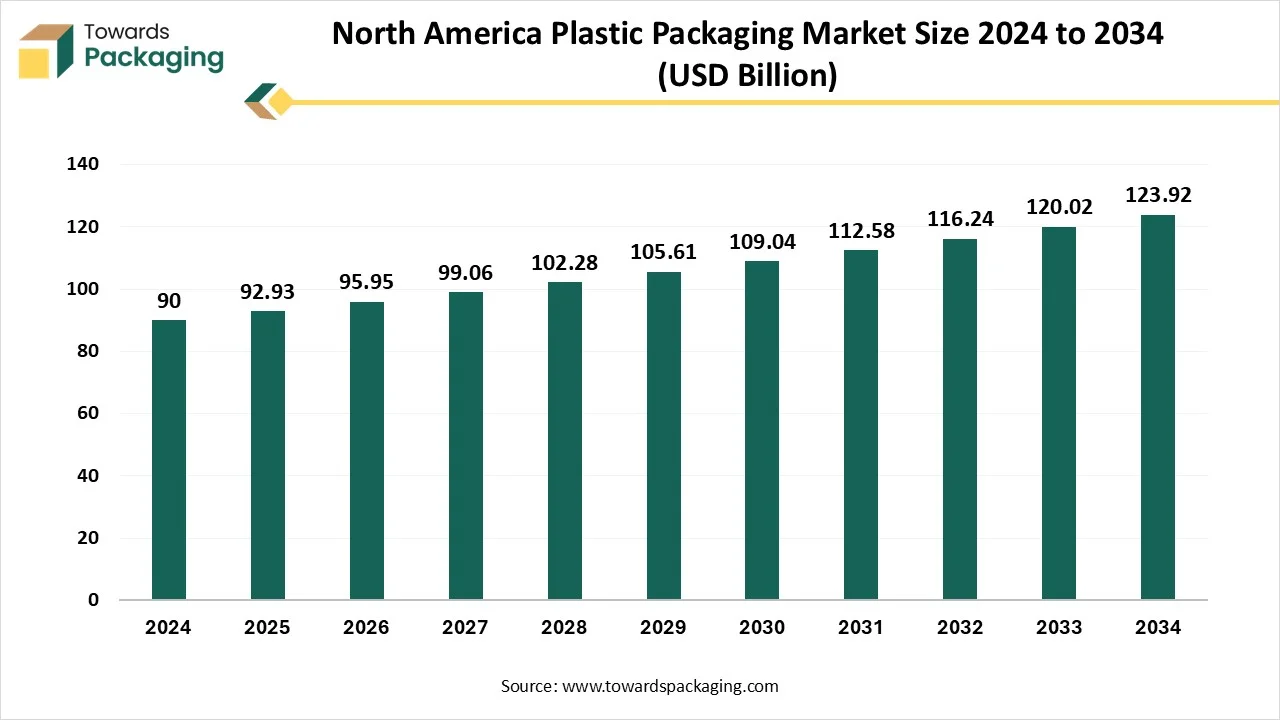

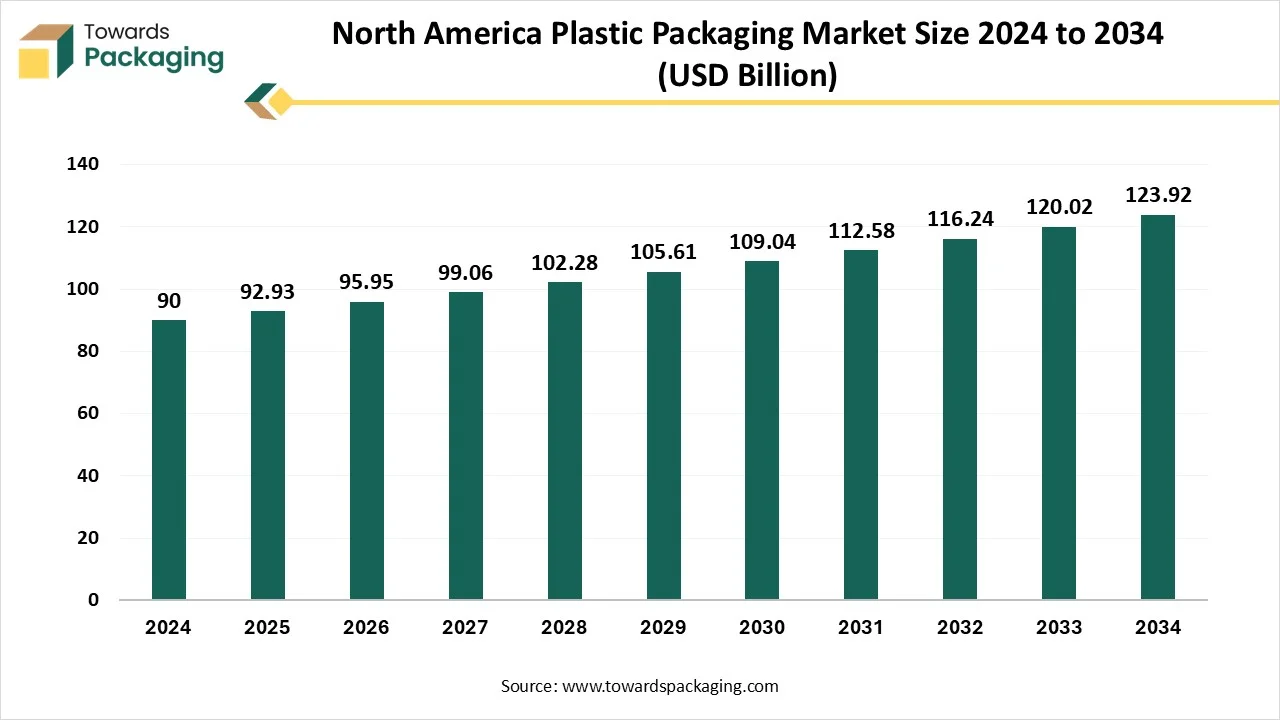

The North America plastic packaging market is forecasted to expand from USD 95.95 billion in 2026 to USD 127.95 billion by 2035, growing at a CAGR of 3.25% from 2026 to 2035. This report provides all key statistics including the USD 92.93 billion valuation in 2025, growth to USD 123.92 billion by 2034, and a 3.25% CAGR along with detailed analysis of rigid and flexible packaging types, materials, technologies, and applications. It also includes competitive analysis of leading companies, value chain assessment, trade flow intelligence, manufacturer profiles, and supplier ecosystem mapping.

Key Insights

- In terms of revenue, the market is valued at USD 92.93 billion in 2025.

- The market is projected to reach USD 127.95 billion by 2035.

- Rapid growth at a CAGR of 3.25% will be observed in the period between 2025 and 2034.

- The United States dominated the global market by holding more than 82% of the market share in 2024.

- Mexico is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the rigid plastic packaging segment contributed the biggest market share of 58% in 2024.

- By packaging type, the flexible plastic packaging segment is expected to expand at a significant CAGR between 2025 and 2034.

- By material, the polyethylene (PE) segment contributed the biggest market share of 35% in 2024.

- By material, the bioplastics and recyclable plastics segment will be expanding at a significant CAGR between 2025 and 2034.

- By technology, the blow molding segment held the major market share of 30% in 2024.

- By technology, the thermoforming segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the food and beverage segment contributed the biggest market share of 45% in 2024.

- By application, the healthcare and pharmaceuticals segment is expanding at a significant CAGR between 2025 and 2034.

- By end-user, the food and beverage segment contributed the biggest market share of 48% in 2024.

- By end-user, the e-commerce and personal care segment will be expanding at a significant CAGR between 2025 and 2034.

- By distribution, the direct sales (B2B) segment contributed the biggest market share of 60% in 2024.

- By distribution, the e-commerce packaging supply segment will be expanding at a significant CAGR between 2025 and 2034.

Market Overview

The North America plastic packaging market includes the production, transformation, and application of plastic-based materials used for packaging goods across various sectors. Plastic packaging provides a lightweight, durable, and versatile solution for preserving product integrity, enhancing shelf life, and reducing transportation costs. It is widely adopted in industries such as food and beverage, pharmaceuticals, personal care, and e-commerce. Plastic packaging formats include both rigid (e.g., bottles, containers) and flexible (e.g., films, pouches) options, with innovations focused on sustainability and recyclability.

Future Demands in North America Plastic Packaging Market

- Polyethylene continues to lead, with bioplastics and recycled plastics gaining traction.

- Key applications: food, personal care, and e-commerce packaging.

- E-commerce and delivery demand drive lightweight and protective packaging adoption.

- Regulations encouraging recycled content to push brands toward circular solutions.

- Growing consumer preference for convenience (resealable, easy-open, portion-controlled designs).

- Companies focus on reducing plastic use while maintaining durability, supporting sustainable growth.

- Rising adoption of multi-layer recyclable plastics allows high performance while meeting sustainability goals.

- Technological innovations in biodegradable plastics and sustainable coatings are creating new market opportunities.

- Increased adoption of reusable and returnable transport packaging (RTP), particularly in closed-loop supply chains within the automotive, food & beverage, and healthcare sectors, to meet corporate sustainability goals and reduce overall operational costs.

- Integration of smart packaging technologies like QR codes, RFID tags, and IoT sensors to enhance product traceability, improve inventory management, and boost consumer engagement regarding product origins and recycling information

Emerging Technologies in North America Plastic Packaging Market

- Chemical recycling expansion: Breaking plastics to their original molecules for reuse.

- High-barrier mono-materials: Single-material plastics with improved protection levels.

- AI and robotic sorting: Faster, more accurate sorting in recycling centers.

- Closed-loop PCR systems: Brand takeback programs that turn used packaging into new packaging.

- Bio-attributed polymers: Plastics are made partly from renewable feedstocks but identical in performance to regular plastics.

- Carbon-neutral packaging lines: Factories using renewable power and energy-saving equipment to lower carbon footprints

Sustainability and Compliance

North American plastic packaging manufacturers are increasingly using compostable and recyclable materials, cutting back on single-use plastics and boosting post-consumer recycled content. Among the frameworks for compliance are the U.S. In the U.S. Plastics Pact, EPA regulations, ISO standards, and local EPR legislation guarantee that packaging satisfies sustainability and circular economy goals. These initiatives enhance public perception while reducing the negative effects on the environment. Additionally, businesses can use these sustainable practices to support national objectives for resource efficiency and plastic waste reduction, innovate in design, and enter eco-conscious markets.

What are the New Trends in the North American Plastic Packaging Market?

Rising Demand for Sustainability and Packaging Regulatory

- The rising demand for sustainable packaging and changing packaging guidelines have influenced the market development.

Advancing Technology and Innovation Process

- The rising advancement in packaging technology has enhanced innovation in this market and increased its demand.

E-Commerce and Flexible Packaging Demand

- The increasing demand for e-commerce and the personal care sector has raised the production process of the market.

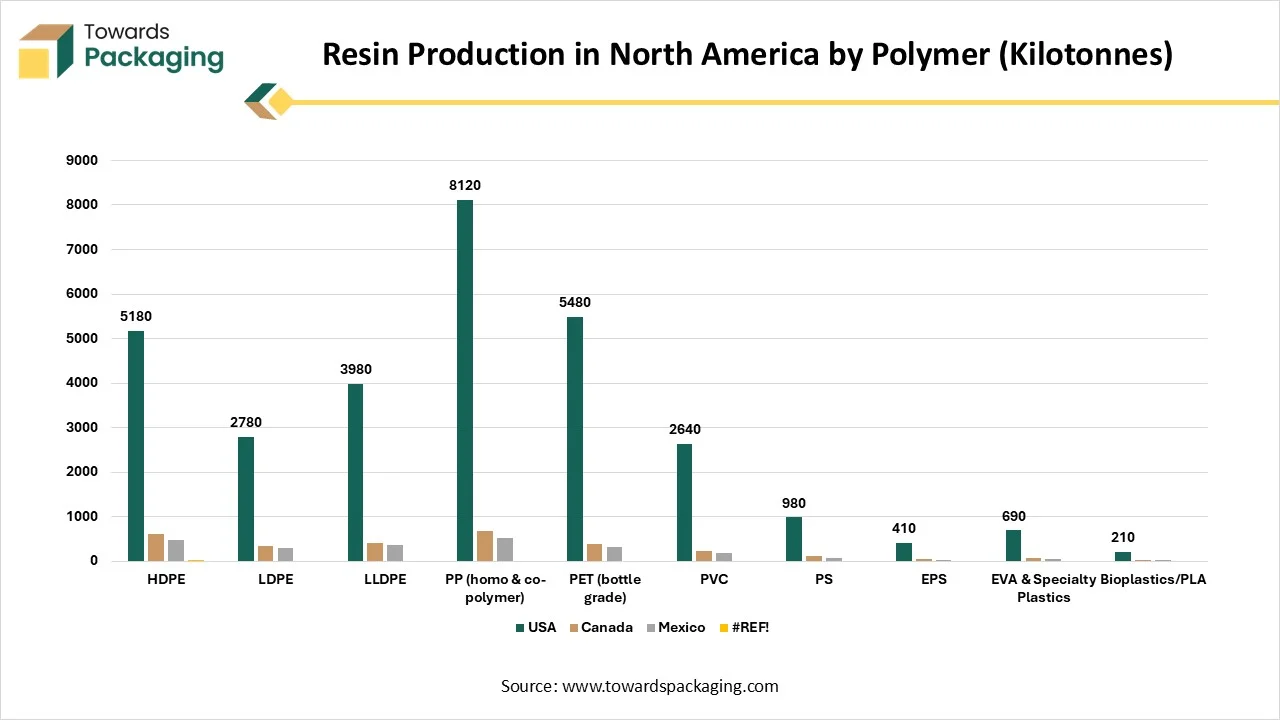

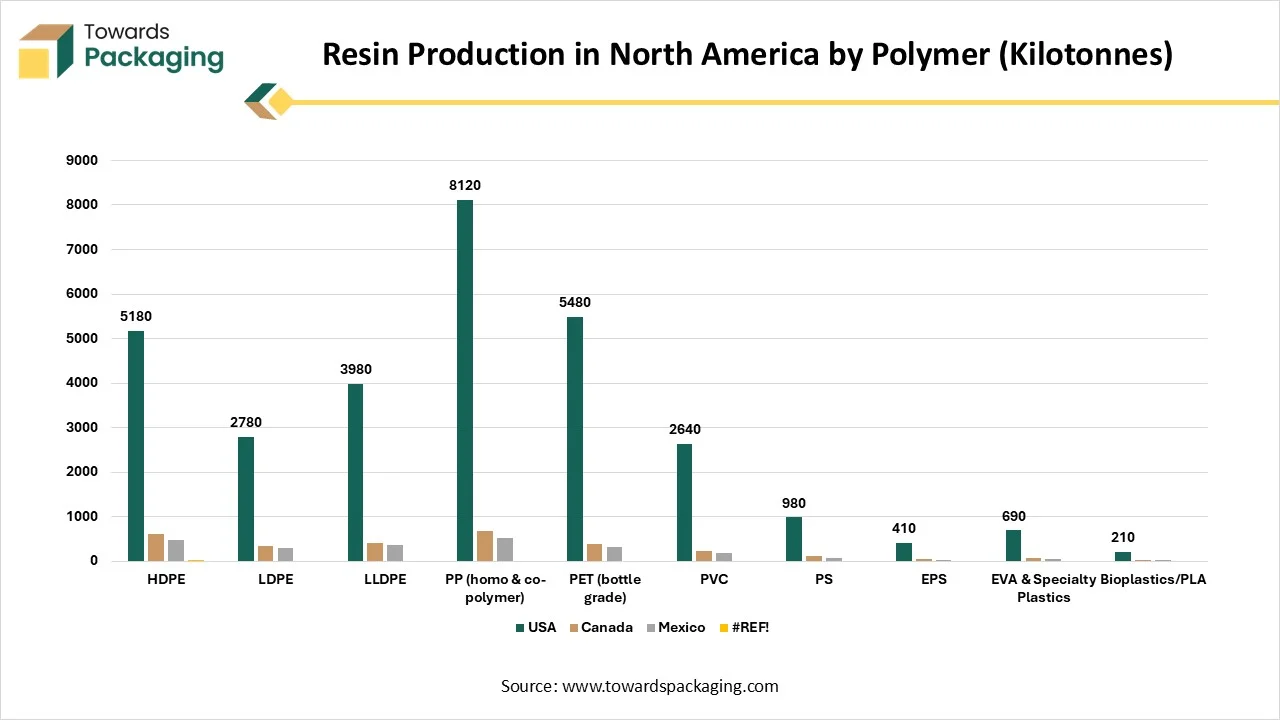

Resin Production in North America by Polymer (kilotonnes)

| Resin Type | USA | Canada | Mexico |

| HDPE | 5180 | 620 | 480 |

| LDPE | 2780 | 350 | 290 |

| LLDPE | 3980 | 410 | 360 |

| PP (homo & co-polymer) | 8120 | 680 | 520 |

| PET (bottle grade) | 5480 | 390 | 310 |

| PVC | 2640 | 230 | 190 |

| PS | 980 | 110 | 75 |

| EPS | 410 | 52 | 34 |

| EVA & Specialty Plastics | 690 | 70 | 48 |

| Bioplastics/PLA | 210 | 22 | 14 |

How Can AI Improve the North America Plastic Packaging Market?

The incorporation of AI in the North America plastic packaging market plays an important role by enhancing the innovation process and improving the sustainability of the packaging. It is widely used for the optimization of the materials utilized for the packages. It can easily detect any defect in the packages, which reduces the chances of error in the packaging process. It helps to optimize the designs of the packaging and maintain delivery charges. With the incorporation of AI in companies present in North America, it helps to fulfill plastic and carbon emission reduction goals.

Top North America Manufacturers Metrics

(More companies + expanded parameters)

| Company | NA Revenue (USD millions) | NA Plants (count) | Output (kt/year) |

| Amcor | 8420 | 19 | 1670 |

| Berry Global | 6920 | 23 | 1580 |

| Sealed Air | 3020 | 14 | 620 |

| Novolex | 2250 | 16 | 510 |

| Plastipak | 1960 | 11 | 440 |

| Sonoco | 2550 | 13 | 480 |

| ALPLA | 1840 | 10 | 390 |

| Huhtamaki | 1510 | 9 | 330 |

| Pactiv Evergreen | 3410 | 15 | 720 |

| Printpack | 1740 | 8 | 350 |

Market Dynamics

Driver

Rising Demand for Packaged Food

The continuous demand for packaged food products due to several reasons, such as a huge number of working individuals, shortage of time, busy lifestyle, and many others, has influenced the development of the North America plastic packaging market. This packaging market is being determined mainly by amplified consumption of packaged and managed foods. Busy routines and changing customer preferences for suitability have encouraged demand for foodstuffs that are modest to stock and ship. The rapid increase of e-commerce in North America has formed a substantial requirement for safe and protected packaging solutions. Plastic packing is important for the safe transportation of things with potential like impact resistance, tamper-proofing, and lightweight plans.

Restraint

Increasing Regulatory Pressure and Sustainability Mandates

The North America plastic packaging market faces a significant restraint due to tightening environmental regulations and shifting consumer expectations around sustainability. Governments across the U.S. and Canada are implementing stricter rules on single-use plastics, recycling targets, and extended producer responsibility (EPR) frameworks. These policies increase compliance costs for packaging manufacturers while pushing them to redesign products, invest in recyclable or biodegradable materials, and adapt production lines.

Opportunity

Growth of Recyclable & Bio-Based Plastic Packaging

A major opportunity emerging in the North American market lies in the rapid expansion of recyclable, compostable, and bio-based plastic packaging. Consumer brands are committing to ambitious sustainability goals, fueling demand for high-performance materials made from renewable sources such as biopolymers and plant-derived resins. Additionally, advancements in chemical recycling technologies are enabling the creation of high-quality, food-grade recycled plastics, opening new possibilities for circular packaging systems. This shift is creating strong growth potential for manufacturers capable of delivering eco-friendly solutions without sacrificing durability, barrier properties, or cost efficiency.

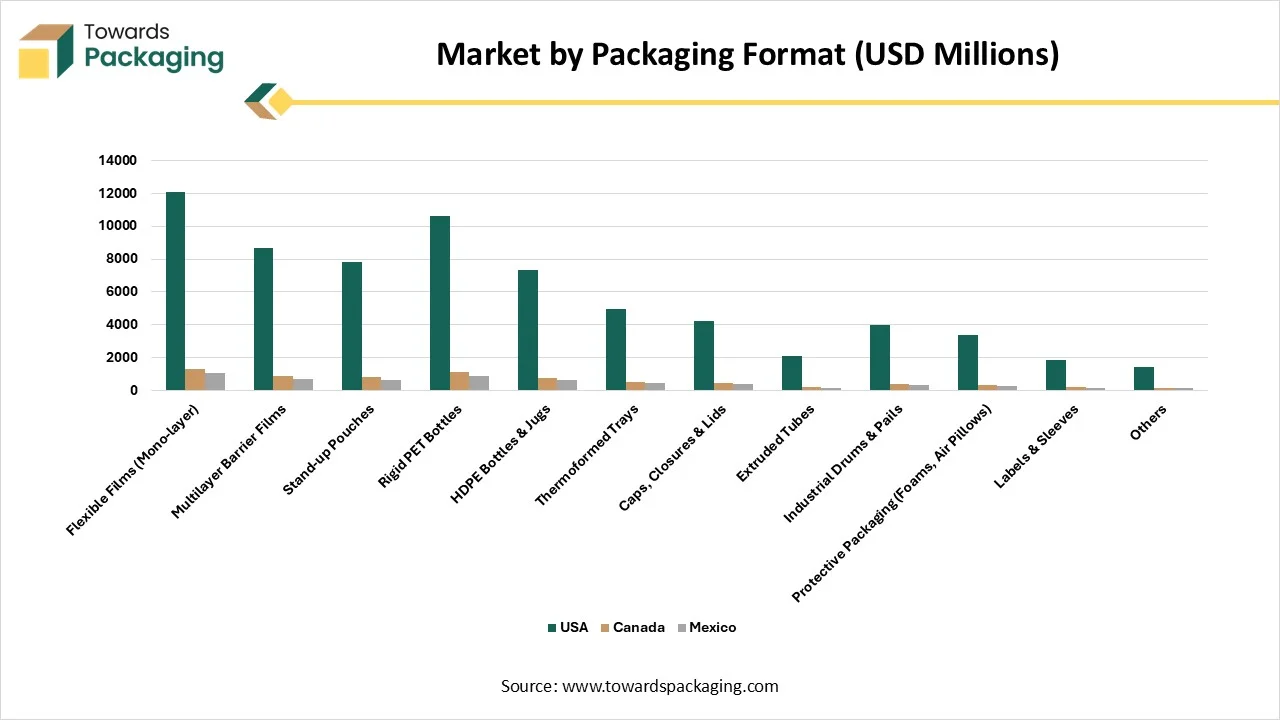

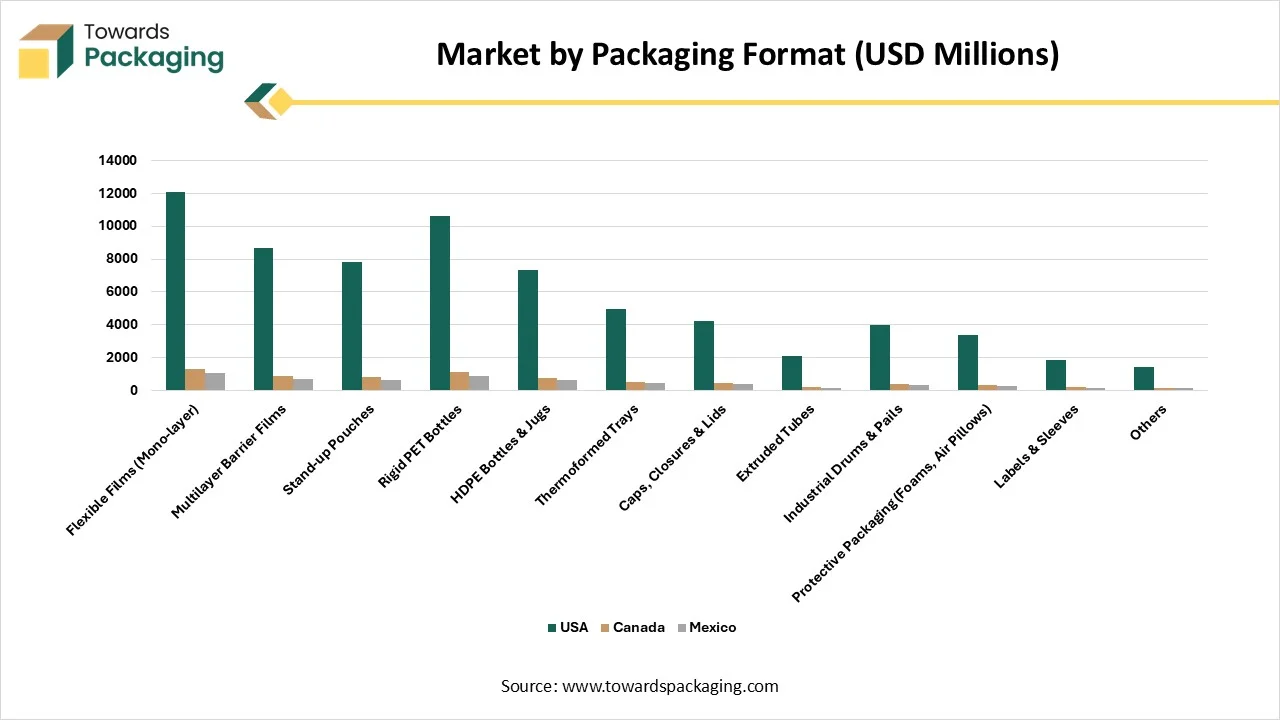

Market by Packaging Format (USD millions)

(More segments, more detail)

| Format | USA | Canada | Mexico |

| Flexible Films (Mono-layer) | 12100 | 1280 | 1080 |

| Multilayer Barrier Films | 8650 | 880 | 720 |

| Stand-up Pouches | 7820 | 840 | 670 |

| Rigid PET Bottles | 10620 | 1130 | 880 |

| HDPE Bottles & Jugs | 7320 | 760 | 620 |

| Thermoformed Trays | 4930 | 530 | 430 |

| Caps, Closures & Lids | 4210 | 470 | 380 |

| Extruded Tubes | 2120 | 220 | 170 |

| Industrial Drums & Pails | 3980 | 420 | 330 |

| Protective Packaging (Foams, Air Pillows) | 3380 | 360 | 290 |

| Labels & Sleeves | 1870 | 210 | 170 |

| Others | 1450 | 150 | 130 |

Segmental Insights

Rigid Plastic Packaging Segment Dominated the North America Plastic Packaging Market in 2024?

The rigid plastic packaging segment contributed a considerable share of the North America plastic packaging market in 2024 due to its versatility, food and beverage, and strength. It is extensively utilized in segments such as customer goods, food and beverage, and healthcare, where product defense and structural integrity are essential. Rigid plastic packing, comprising jars, bottles, and containers, safeguards longer shelf life and avoids pollution, making it suitable for fragile and sensitive goods. Moreover, its compatibility with progressive labelling and branding methods makes it extremely favored by producers targeting customer appeal.

The flexible plastic packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is cost-efficient and has a lightweight nature, which influences the growth of this segment. Amplified demand from segments such as cosmetics, packaged foods, pharmaceuticals, and online retail is fuelling the industry’s development.

U.S. Government Laws for the North American Plastic Packaging Market

Manufacturers of packaging, food serviceware, and paper products sold or distributed in Minnesota should contribute to a PRO or submit their self-plan. By the year 2032, producers will be capable of investing in and using a system in order to lower the packaging waste and develop recycling and composting too.

Why Polyethylene (PE) Segment Dominated the North America Plastic Packaging Market in 2024?

The polyethylene (PE) segment held a considerable share of the North America plastic packaging market in 2024 due to its superior material quality, cost-efficiency, and versatility. This type of material is extensively utilized in several packaging applications such as bags, flexible films, bottles, and containers. Its lightweight, durability, and moisture-resistant nature have made it suitable for personal care, food and beverages, industrial packaging, and the pharmaceutical sector.

The bioplastics and recyclable plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is influenced by increasing regulatory pressures, changing consumer demand, and rising ecological consciousness. The growing demand for biodegradable and recyclable packaging has enhanced the demand for this segment.

Why the Blow Molding Segment Dominated the North America Plastic Packaging Market in 2024?

The blow molding segment held a considerable share of the North America plastic packaging market in 2024 due to the durable, high-volume, and lightweight packages. The production process is extensively utilized for generating empty plastic containers like drums, bottles, and jugs. These are essential in sectors such as personal care, food and beverages, pharmaceuticals, and household chemicals.

The thermoforming segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These are widely accepted due to their designing flexibility and cost-efficiency. Thermoforming includes heating plastic sheets and then molding them into different shapes.

Why Application Dominated the North America Plastic Packaging Market in 2024?

The food and beverage segment was dominant the North America plastic packaging market in 2024 due to its important role in protecting product quality, encompassing shelf life, and confirming security. The demand is influenced by the area’s flourishing food business, growing consumption of packed and processed food products, and the rising acceptance of beverages and ready-to-eat meals. Plastic packaging includes cost-efficacy, versatility, and durability, making it a suitable choice for an inclusive variety of food and beverage products.

The healthcare and pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is influenced by strict regulatory standards, increasing healthcare demands, and the requirement for safe, tamper-proof, and sterile packaging resolution. Plastic packaging provides benefits like excellent barrier, durability, and lightweight structure has raised the demand for this market.

Why the Food and Beverage Segment Dominated the North America Plastic Packaging Market in 2024?

The food and beverage segment held a considerable share of the North America plastic packaging market in 2024 due to the changing lifestyle, convenience, and search for healthy food habits. Plastic packaging provides several benefits to this industry, such as high barrier properties, cost-efficacy, and lightweight. Packaging materials like polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET) are extensively utilized for containers, bottles, films, and pouches.

The e-commerce and personal care segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is influenced due to increasing grooming, haircare, cosmetics, and skincare usages. These are lightweight packages available in various shapes, such as bottles, pouches, tubes, pumps, and many others have enhanced the demand for this segment.

Why Direct Sales (B2B) Segment Dominated the North America Plastic Packaging Market in 2024?

The direct sales (B2B) segment is noted for having a considerable share of the North America plastic packaging market in 2024 due to the strong relationship between producers and customers of the industry, like industrial goods, personal care, food and beverages, and pharmaceuticals. This segment directly deals with packaging manufacturers, which help in easy delivery and customization of products. Such a wide customization option has influenced the growth of this sector.

The e-commerce packaging supply segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. With the rising acceptance of online shopping, there is a huge growth in e-commerce packaging. It has a major focus on packaging that can withstand the adverse effects of the ecology.

Regional Insights

Rising Demand for Convenience United States Promotes Dominance

The United States region held the largest share of the North America plastic packaging market in 2024, due to the rising demand for convenience in carrying and utilising products. This market is growing significantly in this country, as there are various people travelling across the world who want products with easy packaging. Plastic protects products from spillage and has huge customization options.

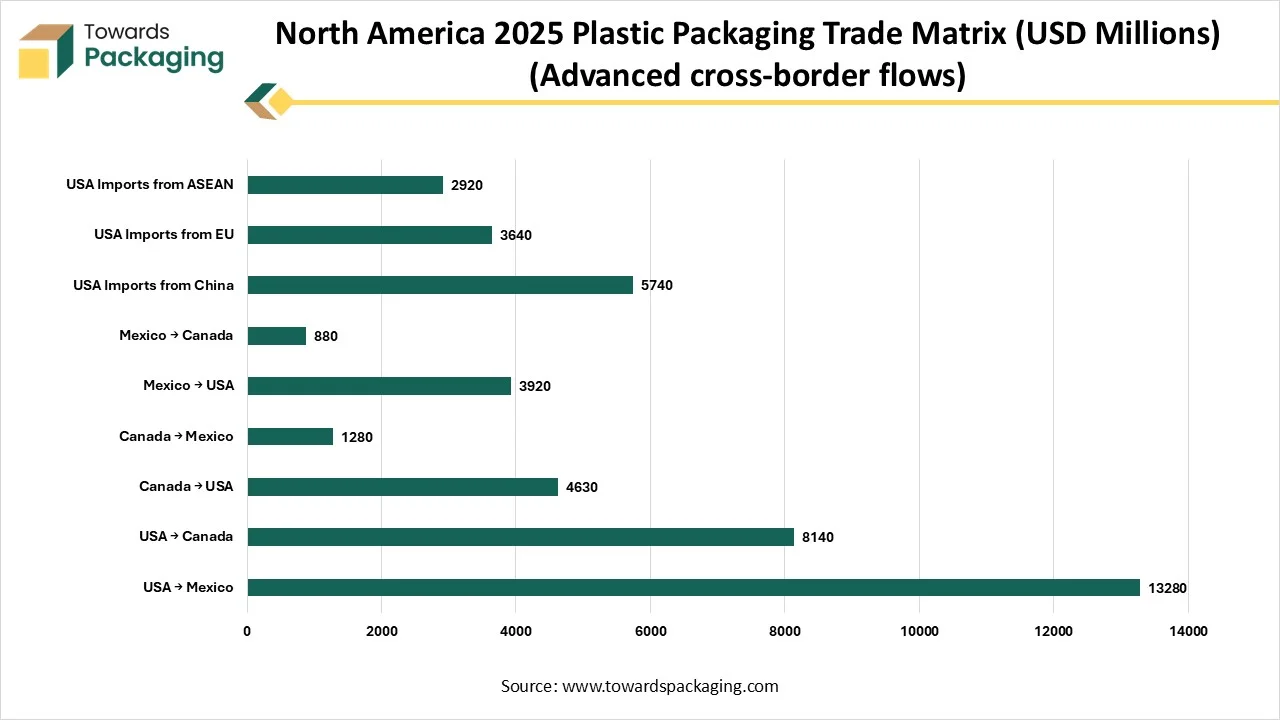

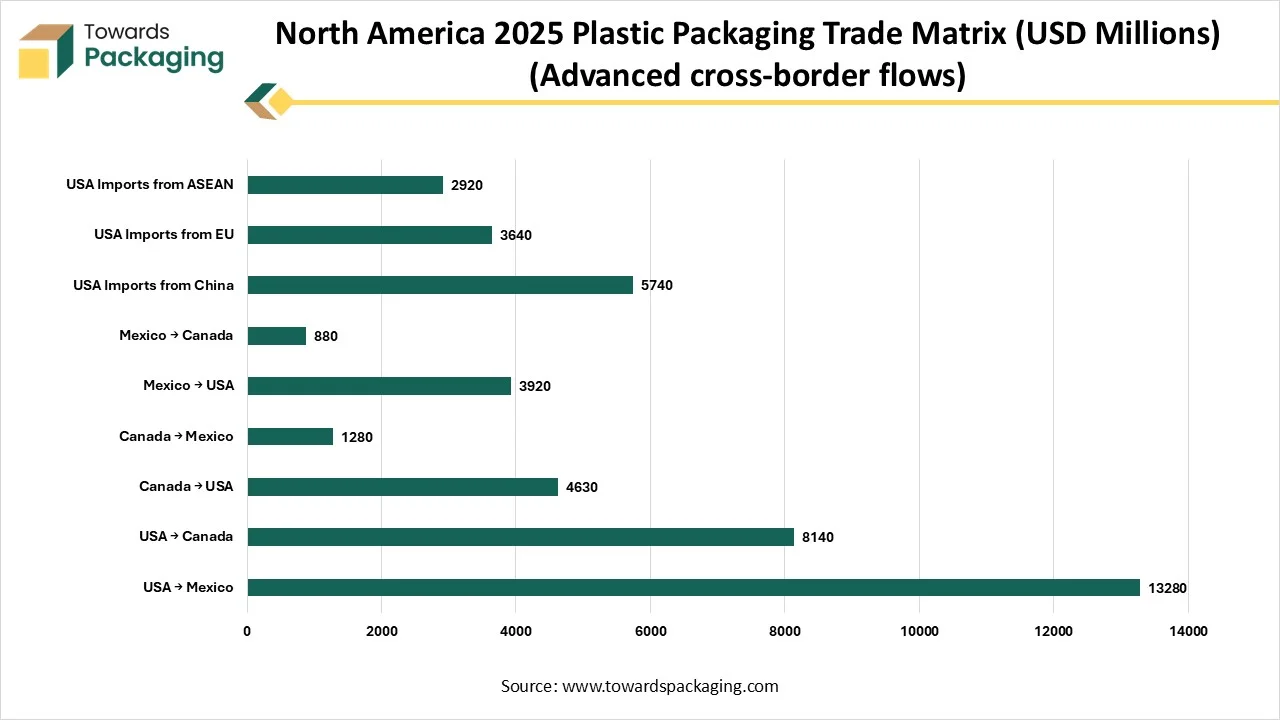

North America 2025 Plastic Packaging Trade Matrix (USD millions) (Advanced cross-border flows)

| Trade Flow | Value (USD millions) |

| USA → Mexico | 13280 |

| USA → Canada | 8140 |

| Canada → USA | 4630 |

| Canada → Mexico | 1280 |

| Mexico → USA | 3920 |

| Mexico → Canada | 880 |

| USA Imports from China | 5740 |

| USA Imports from EU | 3640 |

| USA Imports from ASEAN | 2920 |

Mexico’s Rising Ecological Concerns Support Growth

The Mexico region is estimated to grow at the fastest rate in the North America plastic packaging market during the forecast period. This is due to its strategic location as a main transportation center and its focus on production processes. It is majorly influenced in this area due to strong manufacturing and distribution abilities. The rapid growth in the e-commerce sector has highly influenced the innovation process in this market.

Vale-Chain Analysis

- Material Processing and Conversion: The plastic packaging is produced by using several main procedure that transforms the raw polymer pellets into the final results and high-level procedures to recycle the waste plastic. The particular material and conversion process rely on the packaging’s desired characteristics, like rigidity, flexibility, and barrier protection.

- Package Design and Prototyping: Sustainability is the crucial driving element for the future of the packaging sector. Beyond paging, sustainability was already a perfect trend within several industries. Users were already shifting to a more eco-friendly shopping experience, and this is becoming a more normal thing.

- Logistics and distribution: The move towards sustainability needs companies to check the long-term material feasibility. While the alternative materials can be marketed as "greener solutions,” they constantly come with higher energy costs and other supply constraints. The strategic funding in high-level recycling technologies and sustainable polymers enables the plastic packaging to stay acceptable to future market moves and the regulations, too. By selecting to use invention instead of completely resigning plastic, organizations can develop persistence and continue to develop sustainability goals.

Top Companies in the North America Plastic Packaging Market

- Berry Global Group Inc

- International Paper Co

- Ball Corp

- Westrock Co

- Crown Holdings Inc

- Avery Dennison Corp

- Domtar Corp

- Silgan Holdings Inc.

- Graphic Packaging Holdings Co.

Latest Announcements by Industry Leaders

- In May 2025, Regional sales manager at Futamura, Joachim Janz, expressed, “Small-portion sachets have always been the tricky ones for recycling, so this success in compostability is good news.”

New Advancements in the Market

- In December 2025, Earthrings® Launches Cost-Effective, Sustainable Alternative to Plastic Beverage Packaging in North America.

- In October 2025, Braskem, a top company in the manufacturing of biopolymers on an industrial scale, will be present at K 2025, which is the globe's top trade fair for rubber and plastics in Düsseldorf, Germany. On the beginning day, Braskem displayed a new generation of bio-based and circular product solutions, whose sole goal is to develop the plastic sector.

- In May 2025, Wisconsin-based SC Johnson launched its first refillable packaging system in North America for its Method and Mrs. Meyer’s Clean Day products, in partnership with Canadian retailer London Drugs.

- In January 2025, to update the beverage packaging sector, Earthings has made a sustainable alteration to regular plastic packaging options. The organization has officially opened its gate in Illinois, Elgin, and is currently transporting its items to breweries across Canada, the US, and the Caribbean.

North America Plastic Packaging Market Segments

By Packaging Type

- Rigid Plastic Packaging

- Bottles and Jars

- Trays and Containers

- Caps and Closures

- Flexible Plastic Packaging

- Pouches

- Wraps and Films

- Sachets

- Bags

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Bioplastics and Recyclable Plastics

By Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Lamination

By Application

- Food and Beverage

- Dairy Products

- Snacks and Confectionery

- Beverages (Bottled Water, Juices, Soft Drinks)

- Ready-to-Eat Meals

- Pharmaceuticals and Healthcare

- Blister Packs

- Liquid Medicine Bottles

- Medical Devices

- Personal Care and Cosmetics

- Industrial and Chemical Packaging

- Household Products

By End-User Industry

- Food and Beverage

- Healthcare and Pharmaceuticals

- Personal Care and Cosmetics

- E-commerce and Retail

- Chemicals

- Agriculture

By Distribution Channel

- Direct Sales (B2B)

- Distributors and Wholesalers

- Retail (DIY/Consumer Packaging Use)

By Country

- United States

- Canada

- Mexico

Tags

FAQ's

Select User License to Buy

Figures (5)