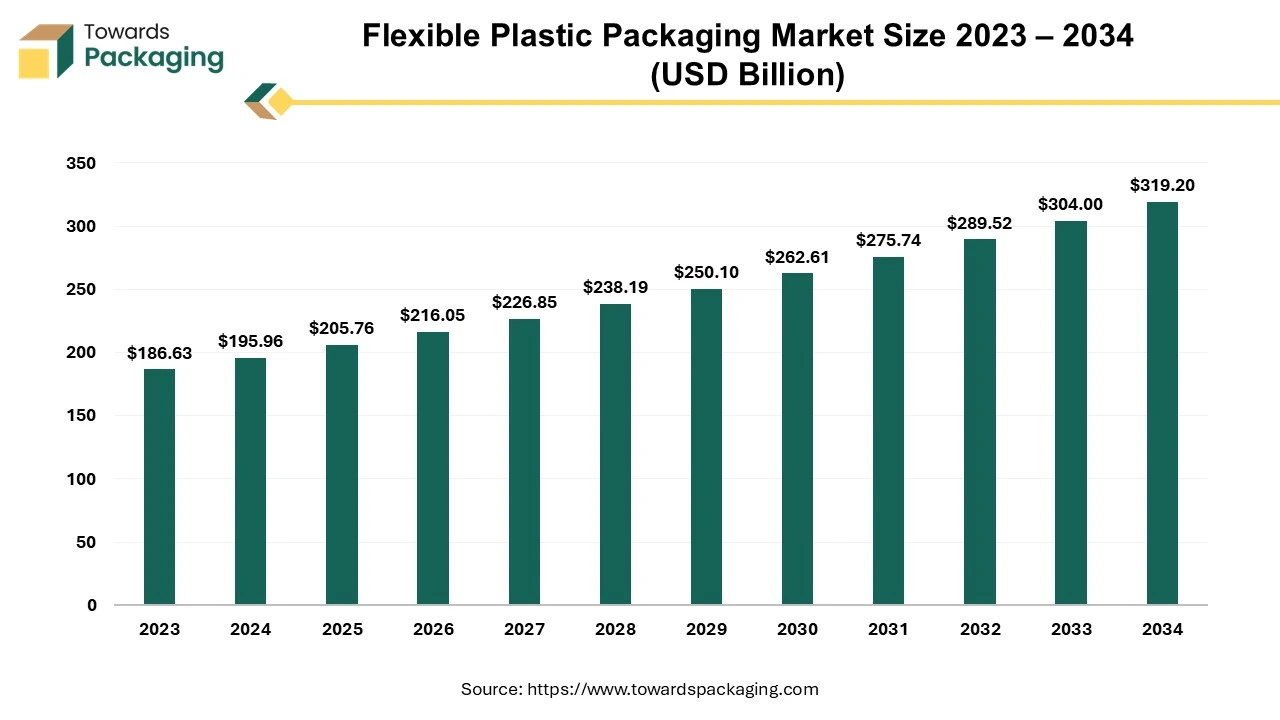

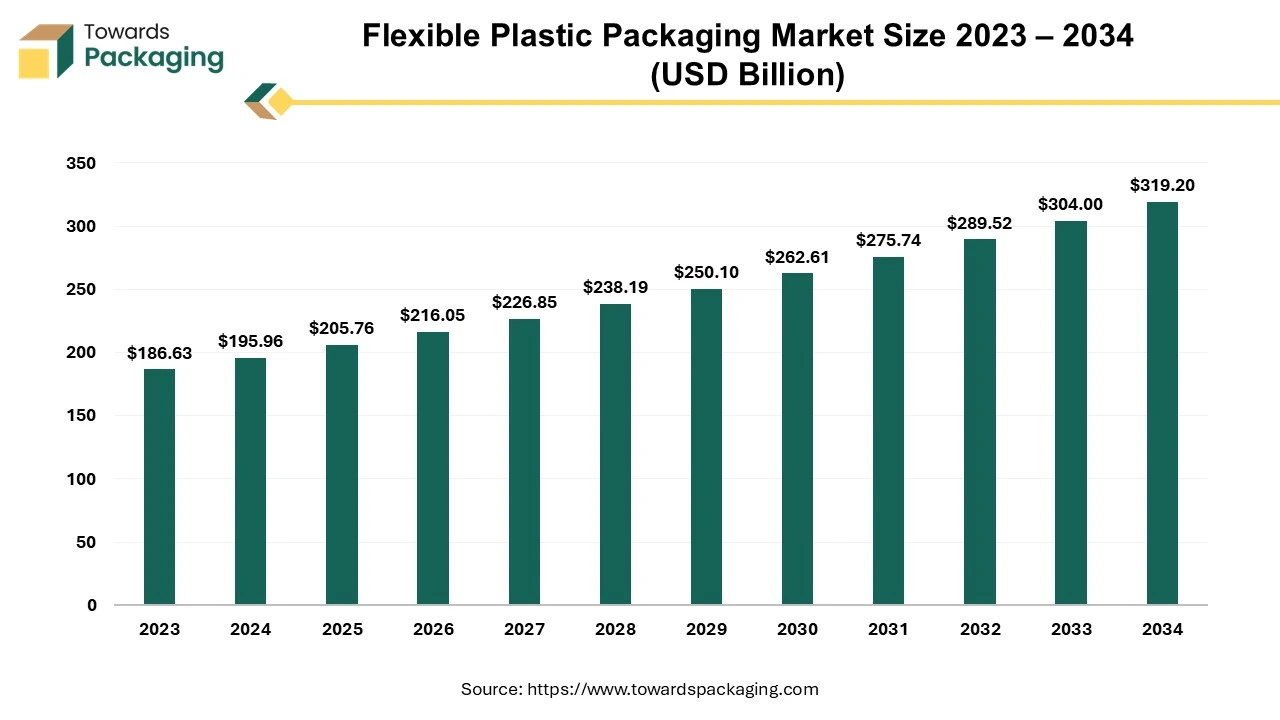

The flexible plastic packaging market is forecasted to expand from USD 216.05 billion in 2026 to USD 335.16 billion by 2035, growing at a CAGR of 5.0% from 2026 to 2035. The market is dominated by food & beverages (58% share), followed by personal care (14%), pharmaceuticals (10%), and industrial applications (8%). Material segmentation shows LLDPE (32%), LDPE (23%), PP (19%), PVC (11%), and others (15%).

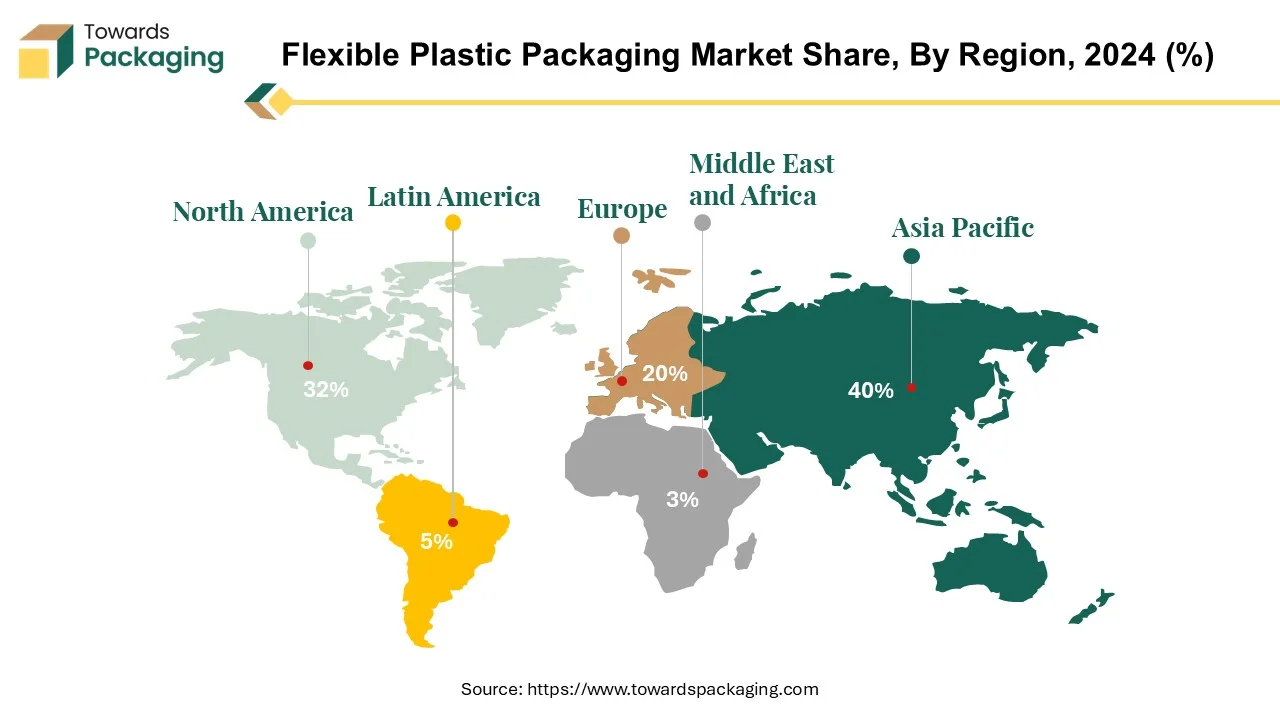

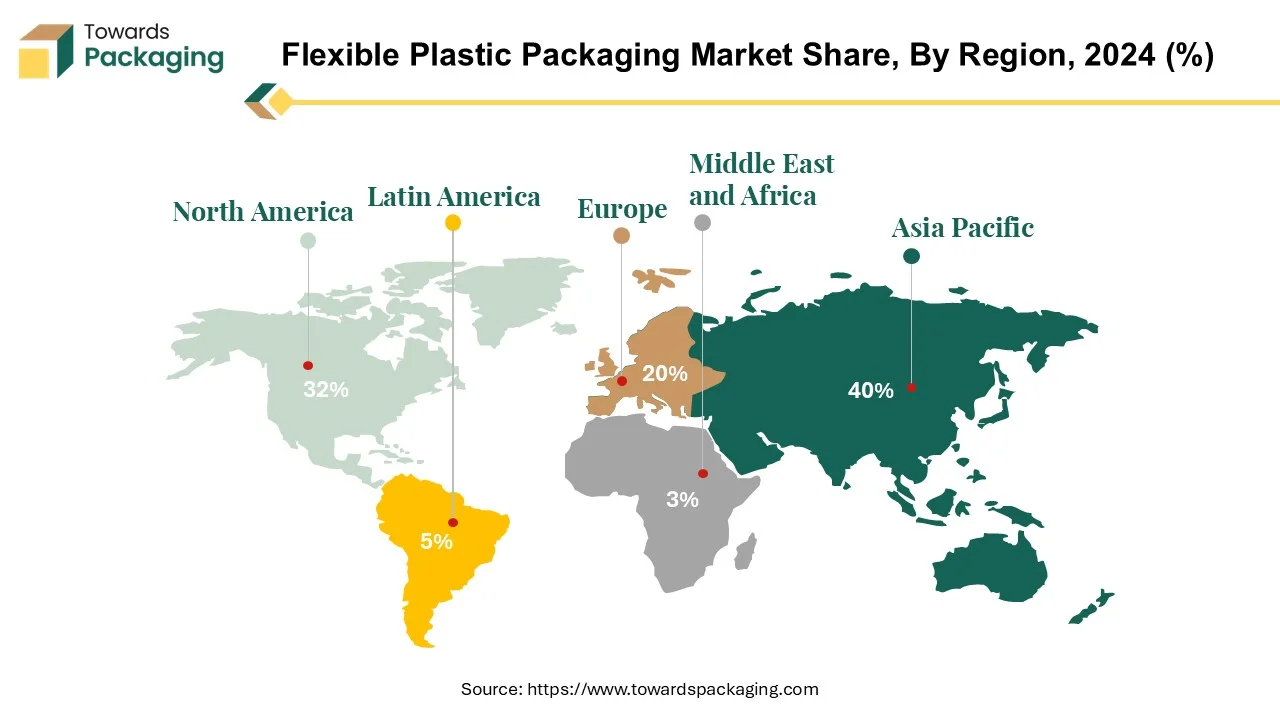

Regionally, APAC leads with 41% market share, followed by Europe (24%), North America (22%), Latin America (8%), and MEA (5%). The study covers top companies including Amcor (9% market share), Mondi (6%), Sealed Air (5%), Berry Global (11%), and Constantia Flexibles (4%). Detailed competitive benchmarking, global value chain flows from polymer producers to converters, and trade data showing China’s 18.6 million tons of annual plastic film exports are included for strategic insights.

Report Highlights: Important Revelations

- Asia Pacific's leading role in the flexible plastic packaging market.

- Anticipated growth of flexible plastics in North America.

- Creative uses of polyethylene in flexible plastic packaging.

- Rising popularity of flexible pouches in the flexible plastic packaging sector.

- Food and beverage industry as key consumers of flexible plastic packaging.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 205.76 Billion |

| Projected Market Size in 2035 |

USD 335.16 Billion |

| CAGR (2025 - 2035) |

5.0% |

| Leading Region |

Asia-Pacific |

| Market Segmentation |

By Material, By Packaging Type, By End Use and By Region |

| Top Key Players |

Sealed Air Corporation, Mondi Group, Berry Global Group, Amcor Ltd., Constantia Flexibles Group GmbH, DS Smith Plc |

Market Outlook

- Industry Growth Overview: The flexible plastic packaging market is growing because so its adaptability, affordability, robustness, and suitability for the FMCG food, beverages, and pharmaceutical industries. Growing packaged food consumption and quick changes in urban lifestyles are driving demand. Due to its lightweight and protective qualities, the market also benefits from strong demand in retail and logistics. Adoption is being accelerated by increasing automation in packaging lines.

- Sustainability Trends: The industry is moving toward packaging made of post-consumer recycled plastic, lightweight designs, and recyclable materials. The shift to circular packaging models is being accelerated by increasing automation in packaging lines

- Global Expansion: The industry is moving toward packaging made of post-consumer recycled plastics, lightweight designs, and recyclable materials. The shift to circular packaging models is being accelerated by regulatory pressure to lessen their impact on the environment. Brands are investing in recycling-friendly structures and bio-based plastics. Brands are recycling companies working together are boost sustainability efforts.

Future Demands

- Rising demand for recyclable, lightweight, and PCR-based packaging as sustainability becomes mandatory for global brands. More manufacturers will upgrade production lines to support high PCR content. Consumer preference for eco-friendly packaging will further strengthen this shift.

- Strong growth is expected in food-grade and barrier-enhanced plastics that improve freshness and safety. Increasing focus on longer shelf life, reduced food waste, and supply-chain efficiency will push barrier technologies.

- Surge in adoption of flexible pouches and films due to convenience, affordability, and reduced transportation costs. Flexible packaging’s ability to offer resealability and portion control will attract more FMCG brands.

- Increased need for e-commerce-ready plastics that offer impact resistance and advanced cushioning. Growth in online grocery and cosmetics will accelerate innovations in protective and durable flexible formats.

Packaging materials composed of various flexible plastic materials that may conform to the shape of the item being packaged are referred to as flexible plastic packaging. It consists of a variety of plastic packaging shapes, mostly meant for home use, that are flexible or semi-flexible, like bags, films, pouches, and tubes. Because of their cost-effectiveness and versatility in the supply chain, plastic polymers generated from fossil hydrocarbons are commonly used to create these packaging solutions.

There are significant economic and ecological benefits to switching from rigid to flexible packaging formats. Because of its decreased weight and lower material consumption, flexible packaging improves supply chain efficiency and reduces costs. The transition to flexible packaging can result in significant environmental benefits, with potential material and energy savings reaching 50% when compared to rigid packaging options.

Two of the most common polymers used in flexible packaging are linear low-density polyethylene (LLDPE) and low-density polyethylene (LDPE). In Australia, almost 223,000 tonnes of LDPE packaging were used; 32 percent of this amount was recycled, according to data from the Plastics and Chemicals Industries Association (PACIA). The market for flexible plastic packaging is witnessing a surge in the significance of sustainability measures, as recycling programmes seek to reduce ecological footprints and foster circular economies.

Shipping & Product Insights for Premium Packaging Solutions

Key Data for Smarter Decisions

| Product |

Country of Origin |

Quantity |

Unloading Port |

Weight |

| Package Film |

China (CN) |

1600 CTN |

Long Beach, CA (2709) |

19,664 KG |

| Plastic Stretch Films |

China (CN) |

1432 CTN |

Long Beach, CA (2709) |

16,904 KG |

| Stretch Films (14 Micron x 750 mm, GI 10 Micron x 500 mm) |

India (IN) |

2160 ROL |

Charleston, SC (1601) |

39,586 KG |

| Bubble Mailer Bag Zipper Bag |

China (CN) |

1023 CTN |

Long Beach, CA (2709) |

14,510 KG |

| Package Film, Package Tape |

China (CN) |

1517 CTN |

Long Beach, CA (2709) |

24,078 KG |

Flexible Plastic Packaging Market Trends

- Smart and Active Packaging: Technological advancements are driving the rise of smart packaging that interacts with the product or environment. Examples include moisture indicators, oxygen scavengers, and antimicrobial films. These functional additives are typically integrated using specialized masterbatches to ensure uniform dispersion and consistent performance. Solutions like Plastic blends are compatible with recycled polymers and bio-based plastics, helping manufacturers transition to circular models without compromising functionality.

- Sustainability and the Circular Economy: Sustainability has shifted from a differentiator to a necessity. Flexible plastic packaging faces growing scrutiny over its environmental impact and recyclability, accelerating innovation toward mono-material films and recyclable barrier coatings.

- E-commerce Growth: The growth of e-commerce is reshaping packaging needs. Flexible formats such as pouches and bags offer lightweight, space-efficient solutions that reduce shipping costs while enhancing shelf appeal. Features like resealable zippers, spouts, and easy-tear notches are increasingly in demand, requiring precise premixing techniques that preserve both performance and appearance.

- Consumers perceive convenience features includes pour spouts, easy-open tear strips, and resealable closures appealing in flexible plastic packaging.

- Unique flexible plastic packaging solutions have been developed as a result of advancements in material research and technology for manufacturing.

- Within the market for flexible plastic packaging, sustainability is becoming more and more important.

- Customization and branding options are made possible by flexible plastic packaging, resulting in product distinction and brand identification.

Revolutionizing the Flexible Plastic Packaging Market with AI Integration

AI integration is set to significantly enhance the Flexible Plastic Packaging Market. By incorporating AI, companies can achieve improved quality control through real-time monitoring, detecting defects with greater precision. AI facilitates optimized design and customization by analyzing consumer preferences and trends, enabling the creation of tailored packaging solutions. Predictive maintenance powered by AI helps anticipate equipment failures, reducing downtime and maintenance costs, which ensures smoother production processes.

AI enhances supply chain management by forecasting demand, optimizing inventory, and streamlining logistics, leading to cost savings and more efficient distribution. Moreover, AI-driven analytics support sustainability by identifying opportunities for using recyclable materials and minimizing plastic waste. Overall, AI's integration will drive innovation, efficiency, and sustainability in the Flexible Plastic Packaging Market, aligning with evolving consumer and environmental expectations.

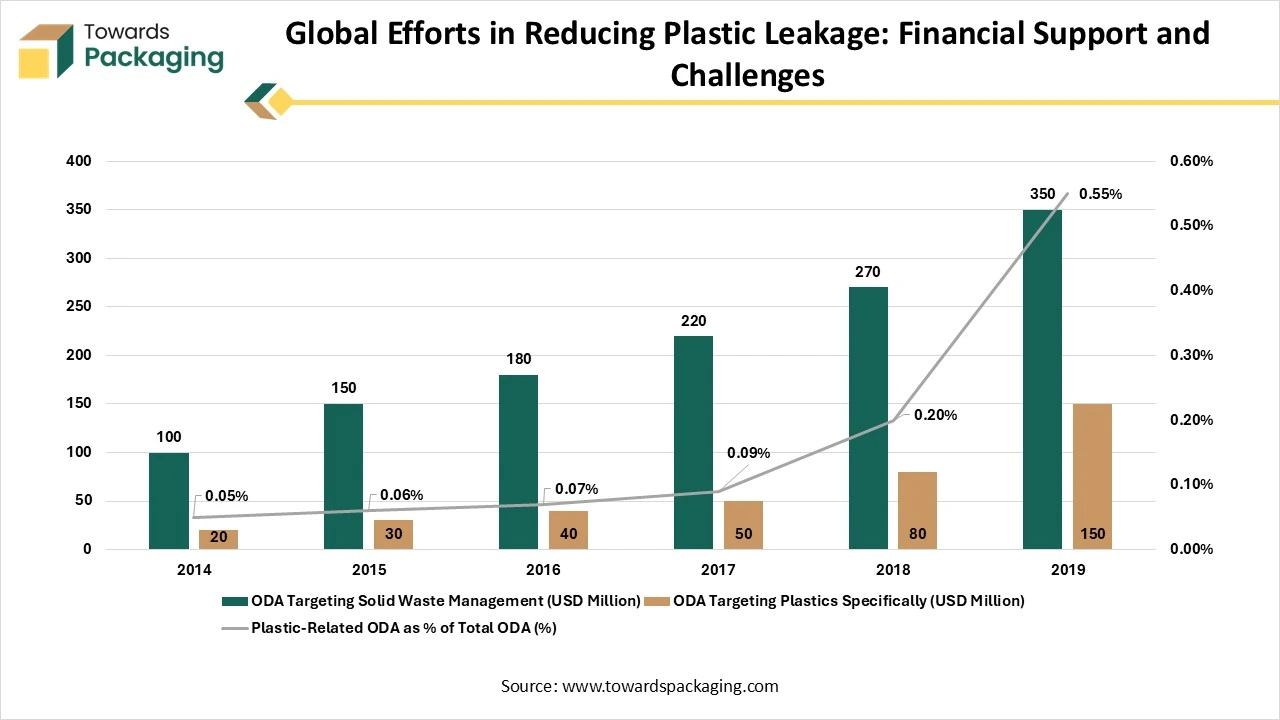

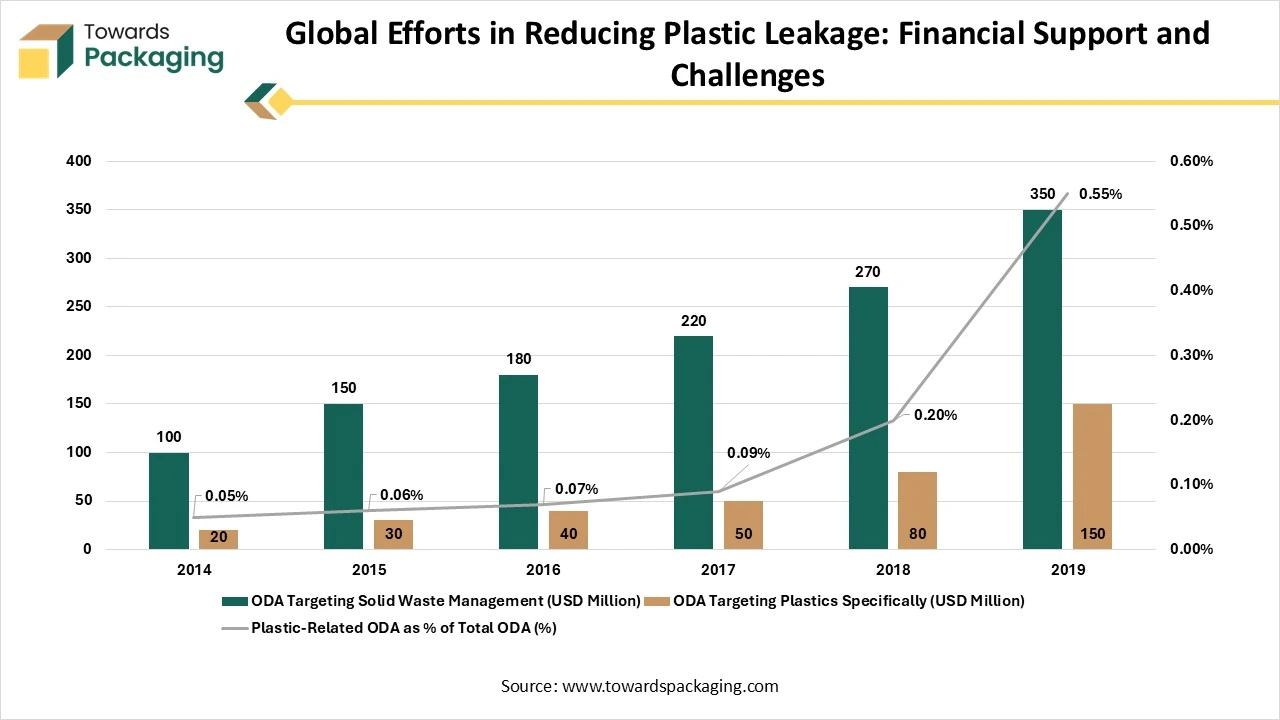

Global Efforts in Reducing Plastic Leakage: Financial Support and Challenges

International collaboration is key to making plastic value chains more circular and reducing plastic leakage into the environment. The design and trade of plastic products should focus on sustainability, addressing health and environmental concerns across their lifecycle. Additionally, policy interventions and cross-border cooperation are essential to improve plastic management and waste recycling efforts.

Although plastic-related Official Development Assistance (ODA) has seen a gradual increase, it still remains a small portion of total ODA. In 2017, only 0.2% of global ODA was dedicated to plastic-related projects. To achieve the necessary reductions in plastic waste, especially in low- and middle-income countries where mismanaged waste is most prevalent, significant investments in infrastructure, waste management practices, and policies are required. While ODA plays a role, other funding sources such as private investment and domestic subsidies will also be critical to addressing these challenges.

Asia-Pacific Dominance in Flexible Plastic Packaging Market

Asia has a dominant position in the flexible plastic packaging market. The Asia-Pacific region offers distinct prospects for brand owners to leverage flexible packaging for their brands, as markets are developing at different rates. US, Australia and New Zealand are developed economies with established customer bases. Similarly, Japan, while mature, faces unusual market dynamics affected by an ageing population, with more than a quarter of the population aged 65 and up. This group prefers lightweight, easy-to-open, and reseal packaging with clear, legible labels, which corresponds to their choice for health-focused items.

Consumers respond to user-friendly packaging that improves their overall experience throughout the region, including China. China's market for flexible packaging is driven mainly by the country's large plastic manufacturing and the growing popularity of packaged food. The flexible packaging industry is expanding due to the combination of China's dominance in plastic manufacture and the desire for easy-to-use packaging solutions. The proliferation of global legislation involving eco-friendly packaging underscores the urgency of resolving environmental problems, particularly those regarding to plastics.

Asia-Pacific's flexible packaging industry is dynamic, with a variety of market situations and shifting client demands. Brand owners must alter their packaging strategies to comply with these the flexible packaging market in the Asia-Pacific area is dynamic, with a range of market conditions and shifting consumer expectations. Owners of brands modify their packaging tactics to meet these with a variety of market circumstances and shifting consumer demands, the flexible packaging industry in the Asia-Pacific area is dynamic. Brand owners need to adjust their packaging strategy to accommodate these distinctions in order to achieve criteria for sustainability while preserving consumer satisfaction. Making use of flexible packaging's benefits is one way to achieve this. nuances, making the most of flexible packaging's advantages to satisfy customer.

China Flexible Plastic Packaging Market Trends

China flexible plastic packaging market is driven by the large scale manufacturing ecosystem. China is home to vast manufacturing sectors like electronics, food & beverage, personal care, and pharmaceuticals all of which are major consumers of flexible plastic packaging. China has access to relatively low-cost raw materials, advanced machinery, and skilled labor, allowing large-scale, affordable production of flexible packaging. Chinese manufacturers have rapidly adopted modern extrusion, printing, and lamination technologies, allowing them to produce high-quality, innovative packaging (like barrier films and resealable pouches). China exports flexible packaging globally, supplying packaging materials to North America, Europe, and Southeast Asia due to its production capacity and competitive pricing.

- In October 2022, PPC Flexible Packaging LLC, a prominent supplier of customisable flexible packaging, has announced the purchase of Plastic Packaging Technologies, LLC (PPT), situated in Kansas City, KS.

Growth Projection for Flexible Plastics in North America

North America region is the second largest in flexible packaging market. Flexible plastics share in north America expected to grow at approx. 2.3% in 2022. Plastics are still a major substrate in the market. New developments in technology and the trend towards lighter clothing are driving this expansion. Because of their lightweight appearance and great consumer appeal, stand-up pouches, for example, are recommended for new product introductions.

Board substrates are expanding in the region, supported in part by the increase of internet retail. But it's important to remember that Americans consume far more plastic on average than people in many other nations. Given the recent increase in consumption, it is evident that the North American market is heavily dependent on plastic packaging.

Flexible plastics continue to remain in high demand primarily because of consumer preferences and their practical advantages, even in the face of growing sustainability concerns. The plastic packaging solutions sector is always innovating and utilising technical developments to improve the functioning and appeal of their products. To lessen the negative effects of plastic usage on the environment in North America, there has been increasing pressure on companies to adopt more ecologically friendly processes and materials, despite the increased focus on sustainability.

U.S. Flexible Plastic Packaging Market Trends

U.S. flexible plastic packaging market is growing owing to strong food & beverage industry and high disposable income. The U.S. is a global leader in packaging research and development, especially in barrier materials, smart packaging, and sustainable solutions, giving it a competitive edge in producing high-performance flexible plastics. Flexible plastic packaging is widely used for snacks, frozen foods, pet foods, and beverages.

The U.S. has a massive processed and packaged food sector, which drives consistent demand. U.S. consumers favor packaging that is resealable, lightweight, and easy to handle key benefits of flexible plastic. This shapes product design across multiple categories. Major Players like Amcor, Sealed Air, Berry Global, and Bemis (Subsidiary of Amcor) are either based in the U.S. or have large operations there, boosting domestic capacity and innovation.

For Instance,

- In January 2024, the acquisition of 100% of the shares of Germany-based Wentus has been agreed to by Sweden-based Trioworld, a producer of plastic packaging products in North America and Europe.

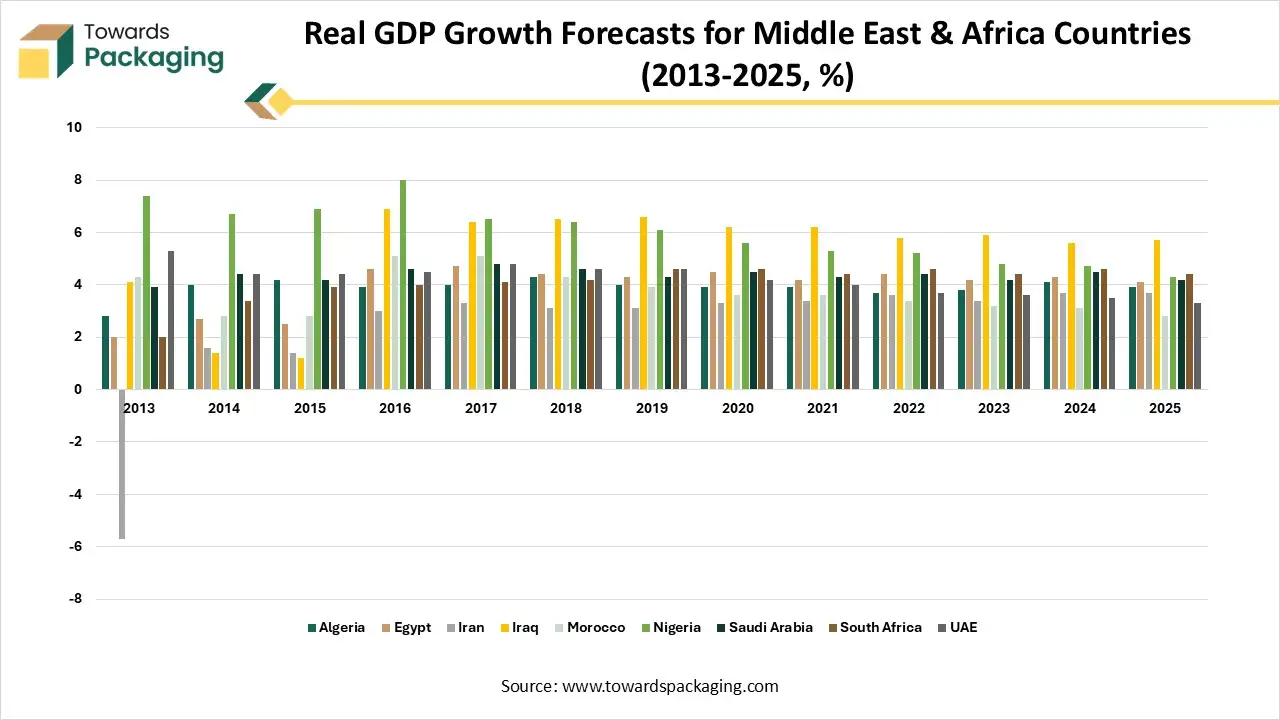

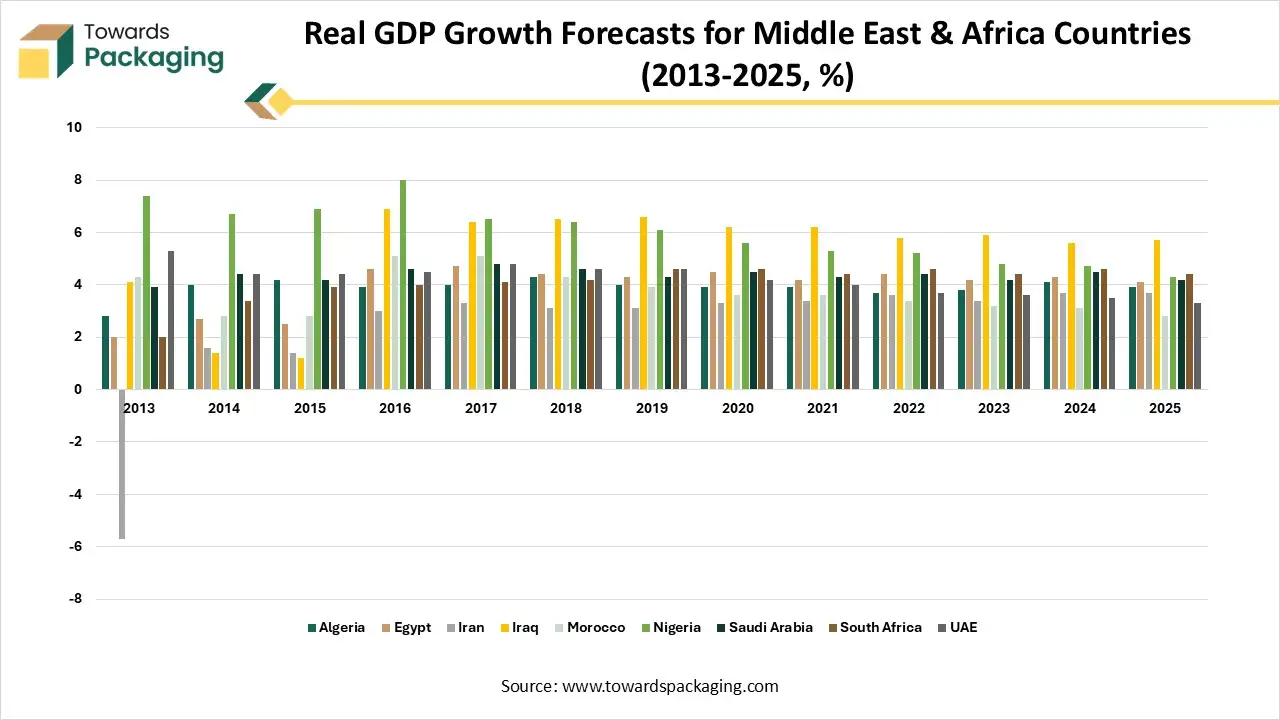

Real GDP Growth Forecasts for Middle East & Africa Countries (2013-2025, %)

| Country |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| Algeria |

2.8 |

4 |

4.2 |

3.9 |

4 |

4.3 |

4 |

3.9 |

3.9 |

3.7 |

3.8 |

4.1 |

3.9 |

| Egypt |

2 |

2.7 |

2.5 |

4.6 |

4.7 |

4.4 |

4.3 |

4.5 |

4.2 |

4.4 |

4.2 |

4.3 |

4.1 |

| Iran |

-5.7 |

1.6 |

1.4 |

3 |

3.3 |

3.1 |

3.1 |

3.3 |

3.4 |

3.6 |

3.4 |

3.7 |

3.7 |

| Iraq |

4.1 |

1.4 |

1.2 |

6.9 |

6.4 |

6.5 |

6.6 |

6.2 |

6.2 |

5.8 |

5.9 |

5.6 |

5.7 |

| Morocco |

4.3 |

2.8 |

2.8 |

5.1 |

5.1 |

4.3 |

3.9 |

3.6 |

3.6 |

3.4 |

3.2 |

3.1 |

2.8 |

| Nigeria |

7.4 |

6.7 |

6.9 |

8 |

6.5 |

6.4 |

6.1 |

5.6 |

5.3 |

5.2 |

4.8 |

4.7 |

4.3 |

| Saudi Arabia |

3.9 |

4.4 |

4.2 |

4.6 |

4.8 |

4.6 |

4.3 |

4.5 |

4.3 |

4.4 |

4.2 |

4.5 |

4.2 |

| South Africa |

2 |

3.4 |

3.9 |

4 |

4.1 |

4.2 |

4.6 |

4.6 |

4.4 |

4.6 |

4.4 |

4.6 |

4.4 |

| UAE |

5.3 |

4.4 |

4.4 |

4.5 |

4.8 |

4.6 |

4.6 |

4.2 |

4 |

3.7 |

3.6 |

3.5 |

3.3 |

The dataset shows GDP growth trends for key Middle Eastern and African economies from 2013 to 2025. High-growth markets like Nigeria, Iraq, and UAE showed strong momentum early in the period, while others such as Egypt and Saudi Arabia maintained stable moderate growth. South Africa shows consistent improvement, whereas Iran and Morocco exhibit slower but steady recovery patterns. By 2025, most countries are projected to settle into moderate and sustainable growth levels, reflecting ongoing economic stabilization and diversification efforts across the region.

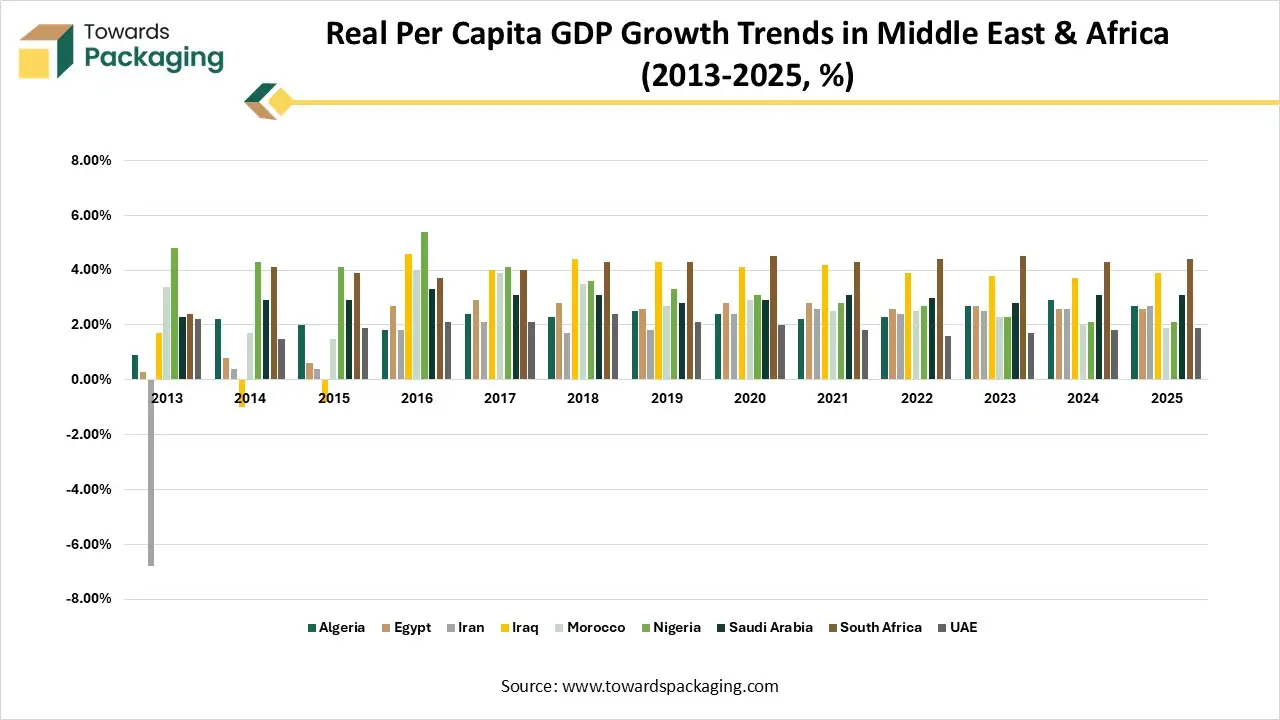

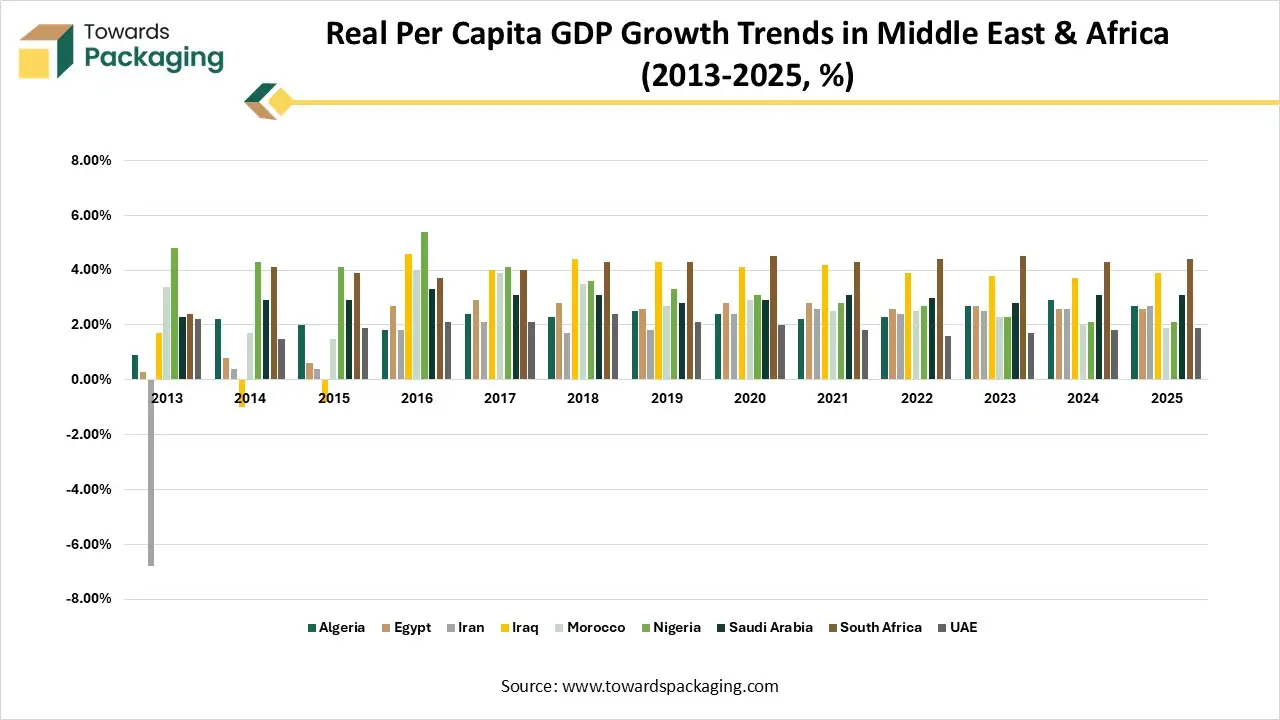

Real Per Capita GDP Growth Trends in Middle East & Africa (2013–2025, %)

| Country |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| Algeria |

0.90% |

2.20% |

2.00% |

1.80% |

2.40% |

2.30% |

2.50% |

2.40% |

2.20% |

2.30% |

2.70% |

2.90% |

2.70% |

| Egypt |

0.30% |

0.80% |

0.60% |

2.70% |

2.90% |

2.80% |

2.60% |

2.80% |

2.80% |

2.60% |

2.70% |

2.60% |

2.60% |

| Iran |

-6.80% |

0.40% |

0.40% |

1.80% |

2.10% |

1.70% |

1.80% |

2.40% |

2.60% |

2.40% |

2.50% |

2.60% |

2.70% |

| Iraq |

1.70% |

-1.00% |

-0.80% |

4.60% |

4.00% |

4.40% |

4.30% |

4.10% |

4.20% |

3.90% |

3.80% |

3.70% |

3.90% |

| Morocco |

3.40% |

1.70% |

1.50% |

4.00% |

3.90% |

3.50% |

2.70% |

2.90% |

2.50% |

2.50% |

2.30% |

2.00% |

1.90% |

| Nigeria |

4.80% |

4.30% |

4.10% |

5.40% |

4.10% |

3.60% |

3.30% |

3.10% |

2.80% |

2.70% |

2.30% |

2.10% |

2.10% |

| Saudi Arabia |

2.30% |

2.90% |

2.90% |

3.30% |

3.10% |

3.10% |

2.80% |

2.90% |

3.10% |

3.00% |

2.80% |

3.10% |

3.10% |

| South Africa |

2.40% |

4.10% |

3.90% |

3.70% |

4.00% |

4.30% |

4.30% |

4.50% |

4.30% |

4.40% |

4.50% |

4.30% |

4.40% |

| UAE |

2.20% |

1.50% |

1.90% |

2.10% |

2.10% |

2.40% |

2.10% |

2.00% |

1.80% |

1.60% |

1.70% |

1.80% |

1.90% |

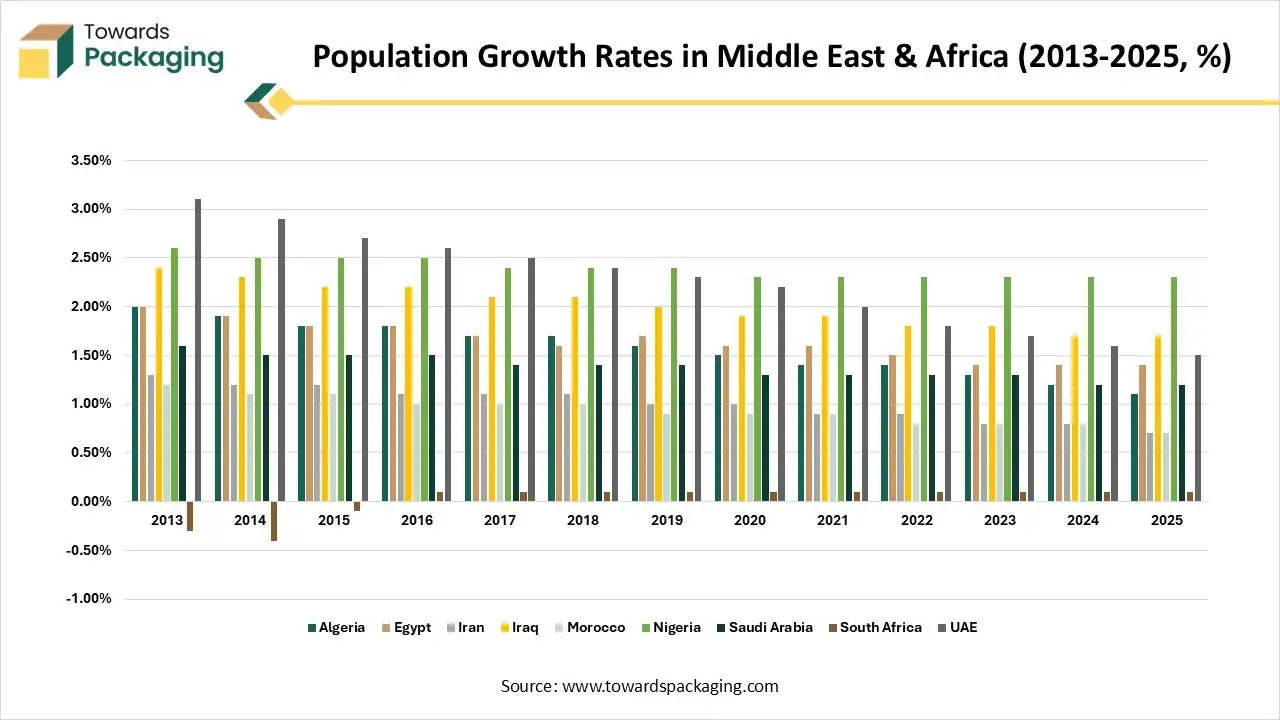

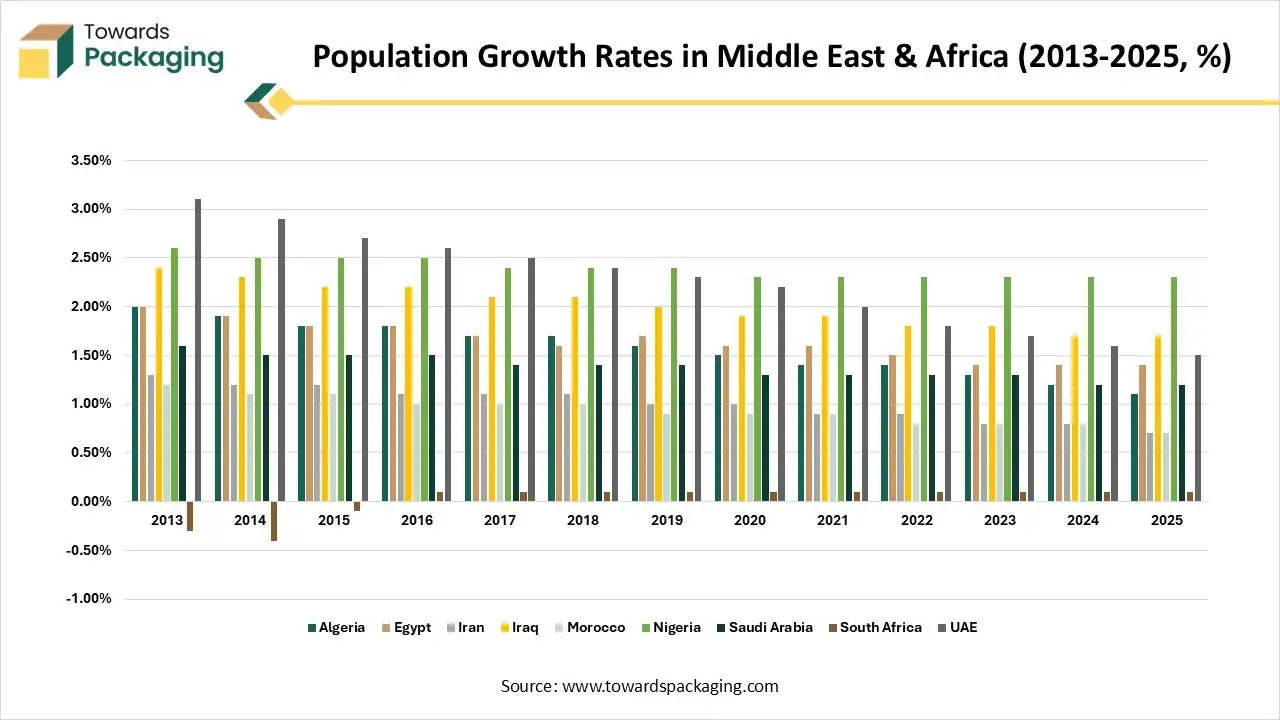

Population Growth Rates in Middle East & Africa (2013–2025, %)

The table shows population growth patterns across key Middle East and African countries from 2013 to 2025. High-growth markets like Nigeria, Iraq, and the UAE maintain strong demographic momentum, although UAE’s rate gradually slows as its economy matures. Meanwhile, countries such as Iran, Morocco, and Algeria exhibit a steady decline in growth rates due to falling birth rates and demographic transitions. South Africa remains comparatively stagnant, reflecting low fertility and migration patterns. Overall, the region displays a move toward slower but stabilizing population expansion.

Flexible Plastic Packaging Market, DRO

Demand:

- Flexible plastic packaging extends the shelf life and freshness of packaged items by providing effective protection against the moisture, light, air, and contaminants.

Restraint:

- Flexible plastic packaging is being condemned for promoting plastic waste and environmental degradation, despite its convenience and use.

Opportunity:

- Potential prospects for closed-loop recycling systems and package recovery programmes as the economy shifts to a circular one.

Innovative Applications of Polyethylene in Flexible Plastic Packaging

Polyethylene material leading in the flexible packaging market and hold largest share in the packaging market. An innovative material that is widely used in the flexible plastic packaging market is polyethylene, particularly low-density polyethylene (LDPE). LDPE's flexible, lightweight and softness appreciated. For applications where rigidity, high temperature obstructions, and structural strength are not the main concerns, this material's low temperature flexibility, toughness, and corrosion resistance make it perfect. Because of its advantageous qualities, including strong chemical and impact resistance, ease of fabrication and shaping, and cost-effectiveness, LDPE is used in orthotics and prosthetics.

The versatile and reasonably priced flexible PVC is a material that is frequently utilised in plastic extrusions. Flexible PVC comes in several grades and colours, including clear alternatives, and can be found in a wide variety of softness and hardness degrees, including semi-rigid forms. Its versatility and affordability make it a preferred option for a wide range of applications in various industries.

In February 2023, exports showed an apparent downturn, even though plastic films and sheets are widely used across a range of industries. The decline was ascribed to a decline in sales of films and sheets with self-adhesive, rigid and flexible propylene polymer sheets, flexible polyethylene terephthalate sheets and films, metallized sheets and films, and laminated sheets and films. Because of the slowdown in global demand and huge levels of inventory, Indian manufacturers also saw a decline in production in tandem with the export decline.

For Instance,

- In June 2023, LyondellBasell and AFA Nord, two agricultural film recyclers, have launched a 50:50 joint venture to improve the recycling of waste from post-commercial flexible secondary packaging. The joint company aims to produce high-grade recycled plastic from discarded linearly low-density polyethylene (LLDPE) and low-density polyethylene (LDPE) components.

Growing Trend of Flexible Pouches in Flexible Plastic Packaging

Flexible spouted pouches are becoming a growing trend in the flexible plastic packaging sector due to their low environmental effect and support for refilling choices. These pouches utilise 90% less plastic than typical HDPE bottles, which means that their carbon footprint is reduced by 65% and their packaging weight is reduced by 90%. This corresponds with the increasing inclination towards reusable packaging options, especially for consumables like detergents, soap, and cleaners. Brands encourage a circular economy and lessen waste by providing refill pouches, which allow customers to reuse their current bottles and containers.

Refill pouches and other flexible plastic packaging are appealing because they fit neatly in customers' recycling containers. Refill models' enhanced sustainability appeals to buyers who care about the environment, many of whom value conservation above all else and are prepared to pay extra for eco-friendly packaging.

The growing cost-of-living problem throughout Europe is driving up demand for refill pouches as consumers look for less expensive options. Because of this, companies are switching from bulky HDPE bottles to flexible packaging alternatives like spouted pouches or adding refill pouches to complement their current bottles.

Brand owners are emphasising distinctive materials and pouch shapes in order to stand out in the market. They are also implementing cutting-edge resealing technologies that provide easy access to the contents while prolonging shelf life. In order to draw in customers looking for economical, environmentally friendly packaging options, firms use this strategic differentiator.

For Instance,

- In June 2023, the globally recognised CCL Industries Inc. declared that it has finalised an agreement to purchase Pouch Partners AG, Switzerland, a business that is under the ownership of the Capri-Sun Group, a Swiss corporation.

Food and Beverage Leading Consumers of Flexible Plastic Packaging

Food and beverage largest end users of flexible plastic packaging. Flexible packaging such as pouches, bags, films and wrappers, which is required for the safe and hygienic transportation of agricultural good and food products. It prolongs product life, reduces food waste, and protects goods from harm. Recycling plastic packaging that is flexible poses an immense challenge. It increases the shelf life of products, helps to reduce food waste and protects products from insects and others.

India ranks as one of the largest generators of agricultural products and food in the globe. India has the largest farming economy, with 3.5% growth predicted in 2022–2023. India is a major producer of pulses, dairy products, wheat, rice, and other food grains.

Food and drink products make up around two thirds of all packaging, and they use about 90% of all flexible packaging. Flexpack's growth into new product categories is being driven by its advantages. Setting this in perspective, flexible packaging presently accounts for roughly 19% of the US market and 39% of the worldwide packaging business. The benefits and versatility of flexible plastic packaging continue to promote its significance as the worldwide packaging market approaches $1 trillion yearly, especially in the food and beverage sector.

For Instance,

- In June 2021, Redi-Bag, an established manufacturer of polyethylene flexible plastic packaging, was purchased by Soteria Flexibles. Soteria Flexible was able to penetrate the seafood and product packing markets because to the acquisition.

The Dynamics of the Supply Chain in the Flexible Plastic Packaging Market

The supply chain in the flexible plastic packaging market is a complex, multi-tiered system that ensures the efficient production and distribution of packaging solutions. It starts with the procurement of raw materials such as polyethylene, polypropylene, and other polymers. Suppliers of these materials play a critical role in providing high-quality inputs that meet the specific requirements of flexible packaging.

These raw materials are transported to manufacturing facilities where they are processed into various forms of flexible packaging, including films, pouches, and laminates. Production involves advanced technologies like extrusion and co-extrusion, which are closely monitored to ensure product quality and consistency.

After production, the packaging products move through a network of distributors and wholesalers who manage logistics to deliver the finished goods to various end-users. This segment includes food and beverage companies, pharmaceuticals, personal care, and other industries that rely on flexible packaging for product protection and consumer convenience.

Efficient supply chain management in this market involves coordinating material supply, optimizing production schedules, and ensuring timely distribution. Employing technologies for real-time tracking, inventory management, and demand forecasting helps in addressing market fluctuations and maintaining a smooth flow from production to end-use.

Key Players and Competitive Dynamics in the Flexible Plastic Packaging Market

The competitive landscape of the flexible plastic packaging market is dominated by established industry giants such as Sealed Air Corporation, FlexCollect, Mondi Group, Berry Global Group, Amcor Ltd., Constantia Flexibles Group GmbH, DS Smith Plc, Bemis Company, Oyj Huhtamäki, Sonoco Products Company, Inc, AR Packaging Group AB. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcors offers creative, eye-catching, and environmentally friendly flexible packaging options to make companies stand out and better while also protecting the environment. Apart from its reduced ecological footprint, lightweight packaging presents noteworthy advantages in terms of logistics. However, not every pouch is equally prepared to satisfy the needs of e-commerce supply chains (particularly with regard to liquid-containing pouches). By making your flexible packaging more e-commerce-friendly, you can prevent product damage and protect your brand's reputation.

For Instance,

- Recycling-ready mono-PE and mono-PP versions of Amcor's AmPrima® flexible packaging solution is offered.

FlexCollect will contribute to the development of a thorough understanding of the most effective ways to maximise recovery and recycling by integrating flexible plastic packaging into currently available household collection services, spanning various regions and demographics.

For Instance,

- In May 2022, with funding from UK Research and Innovation (UKRI), FlexCollect the largest collaborative project in the UK—launched today to facilitate the collection and recycling of flexible plastic packaging.

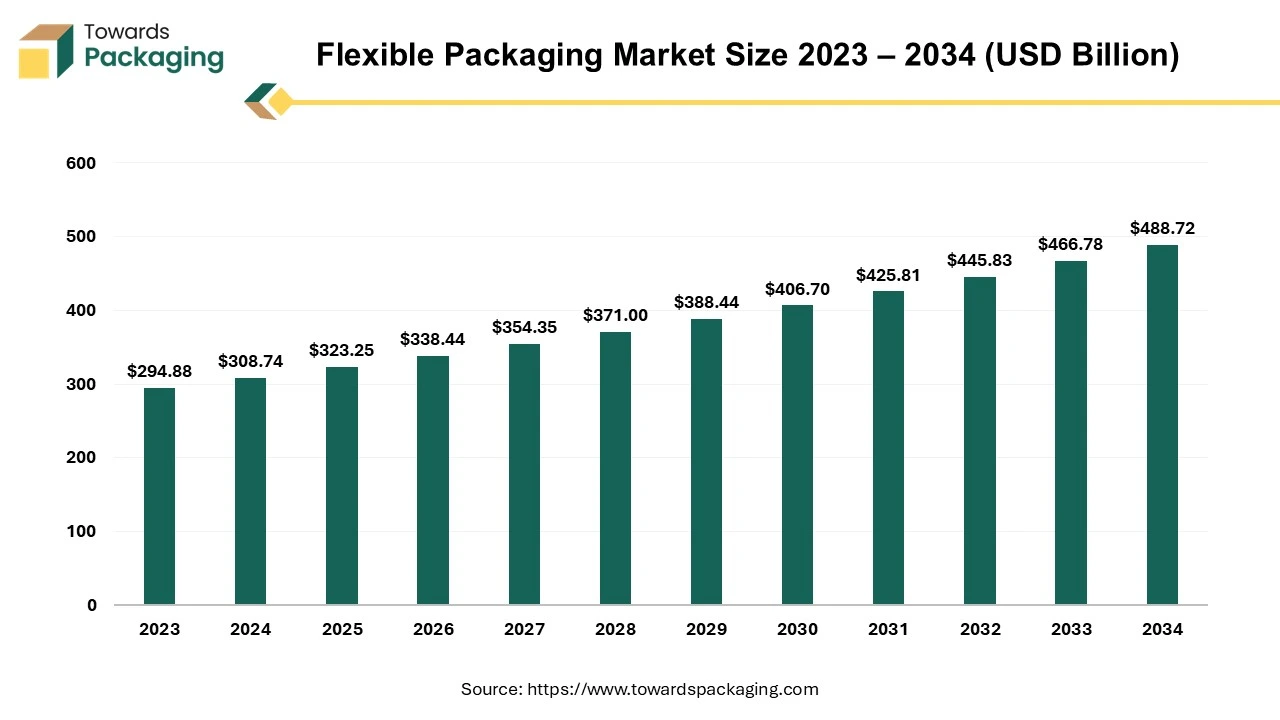

Future of Flexible Packaging Market

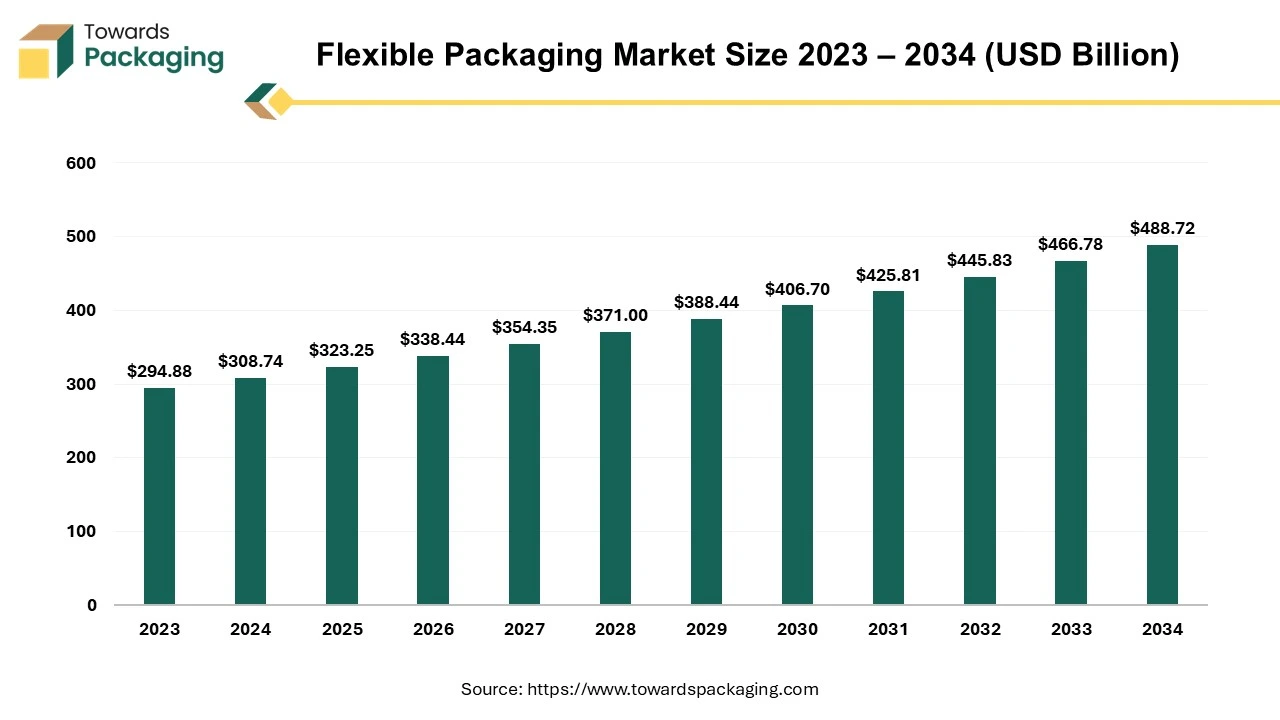

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

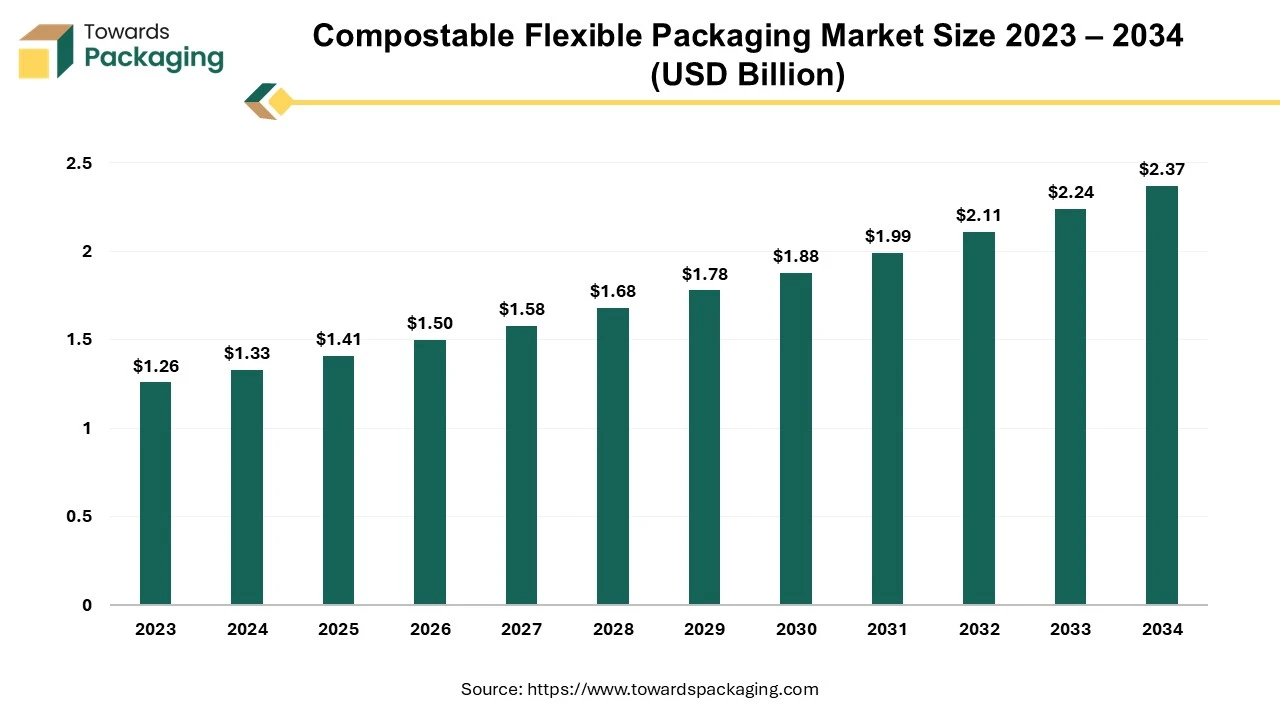

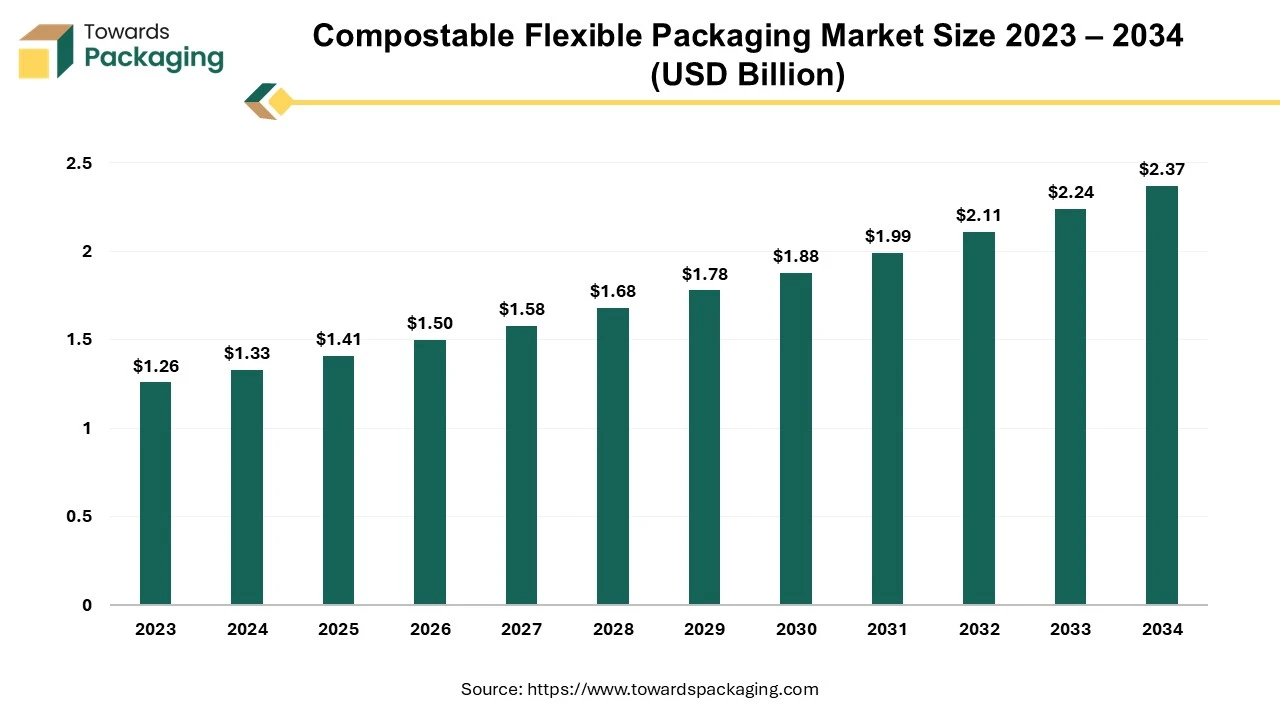

Future of Compostable Flexible Packaging Market

The compostable flexible packaging market is expected to increase from USD 1.41 billion in 2025 to USD 2.37 billion by 2034, growing at a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

Compostable flexible packaging is generated from various recycled and plant-based components, such as wood pulp and potato starch, making it an environmentally beneficial choice. Unlike some non-compostable rivals, natural components in compostable flexible packaging do not emit harmful pollutants when disposed of, helping to create healthier soil. An evolution in compostable flexible packaging has led to bioplastic, a plant-based alternative with qualities similar to less sustainable equivalents. Bioplastic, suitable for applications such as smoothie cups and fruit juices, is economically compostable because it is made from renewable sources and is also recyclable and reusable. It is well known that flexible packaging has reductions in each of these areas.

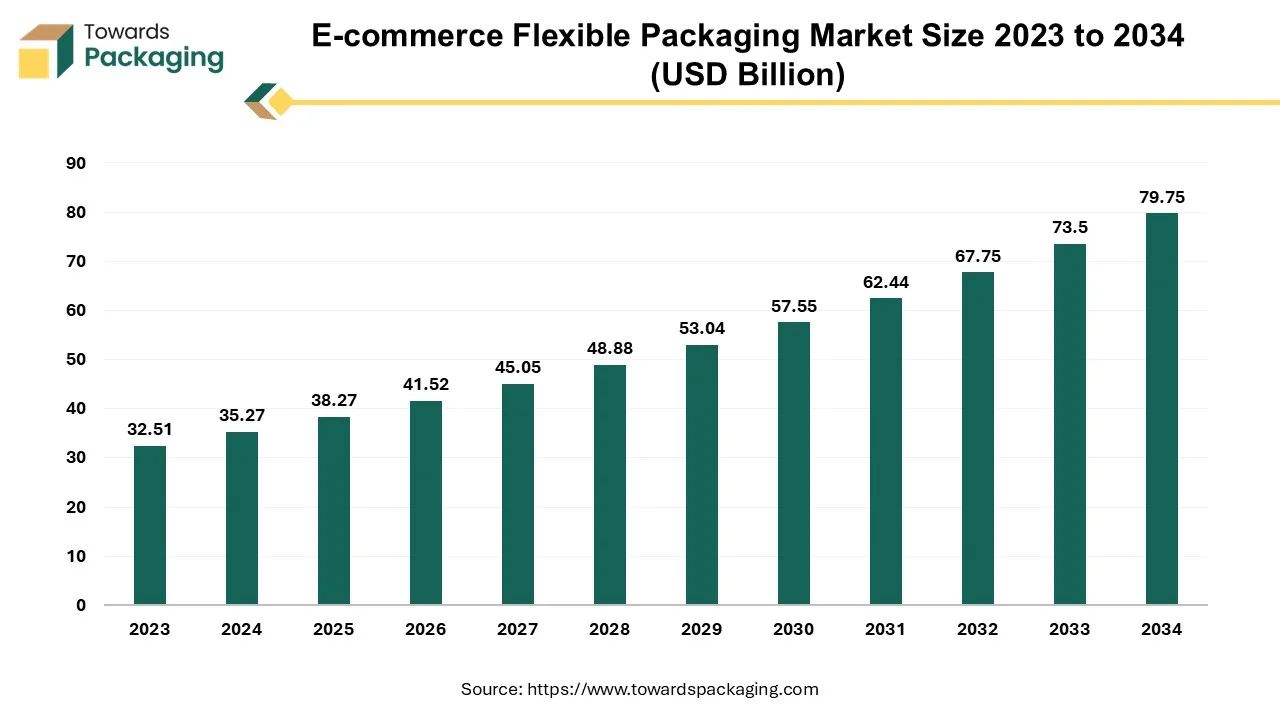

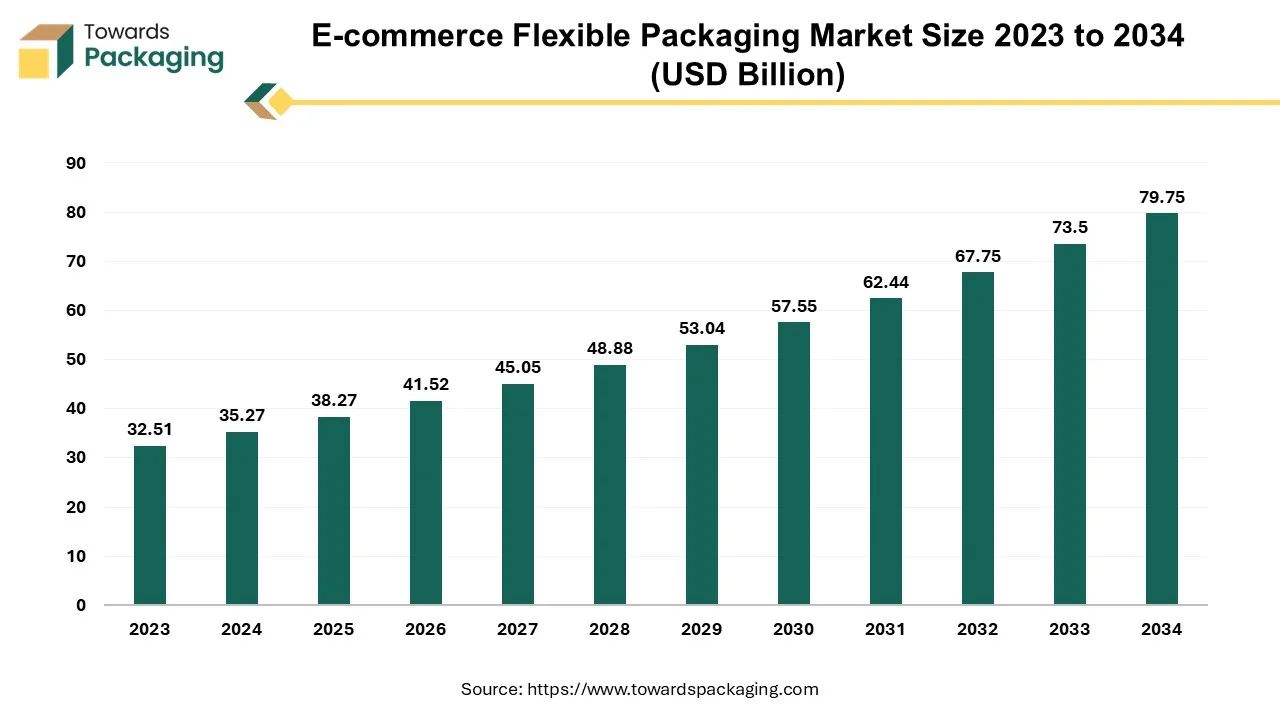

Future of E-Commerce Flexible Packaging Market

The e-commerce flexible packaging market is anticipated to grow from USD 41.52 billion in 2025 to USD 79.75 billion by 2034, with a compound annual growth rate (CAGR) of 8.50% during the forecast period from 2025 to 2034.

Flexible packaging is the rapidly growing sector of the global packaging industry and is one of the best solutions for the e-commerce applications. By using flexible packaging, retailers may accomplish e-commerce shipping that is affordable, effective, and lightweight. Flexible packaging typically uses less energy during production and transportation, produces less product waste, which lowers greenhouse gas emissions, and uses less landfill space. This is because flexible packaging makes it possible to use resources efficiently and hence widely adopted by the e-commerce sector. Thus, the e-commerce flexible packaging market is anticipated to witness significant growth during the forecast period.

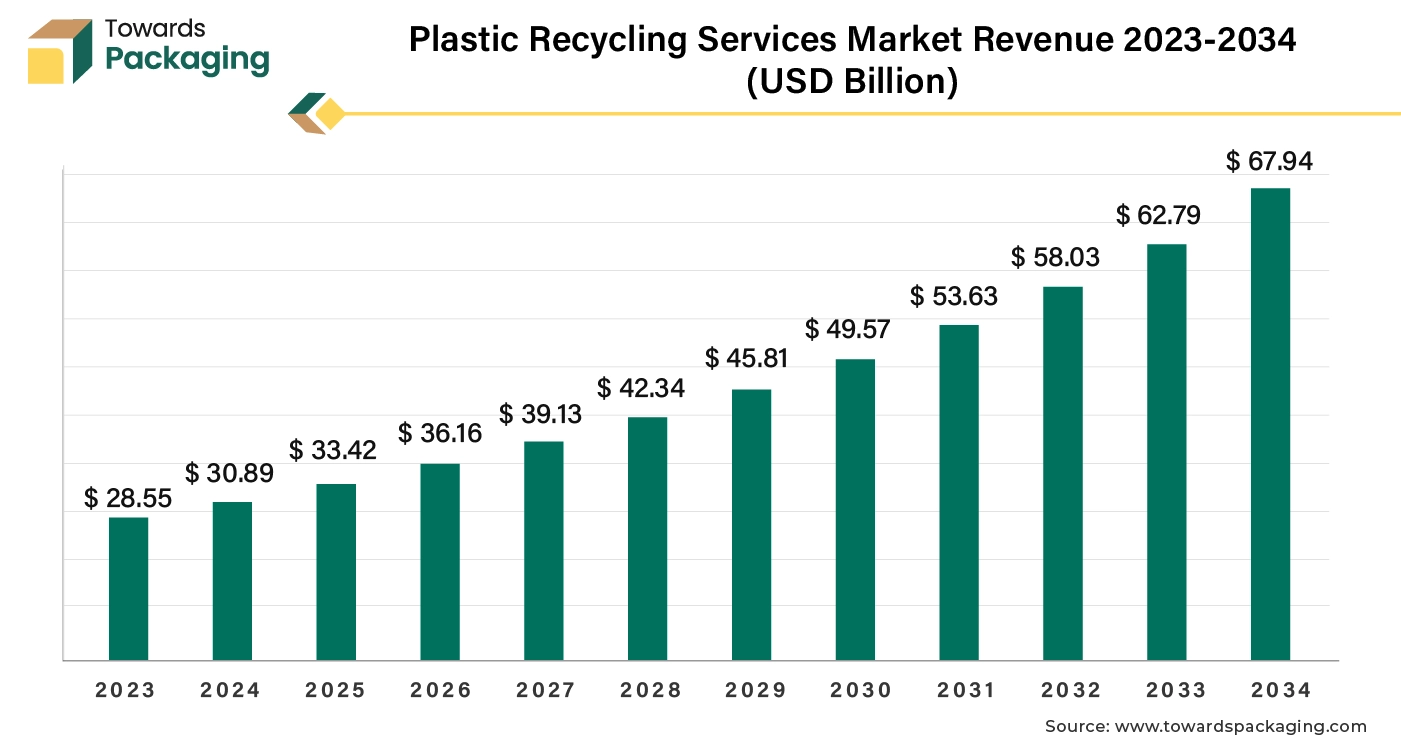

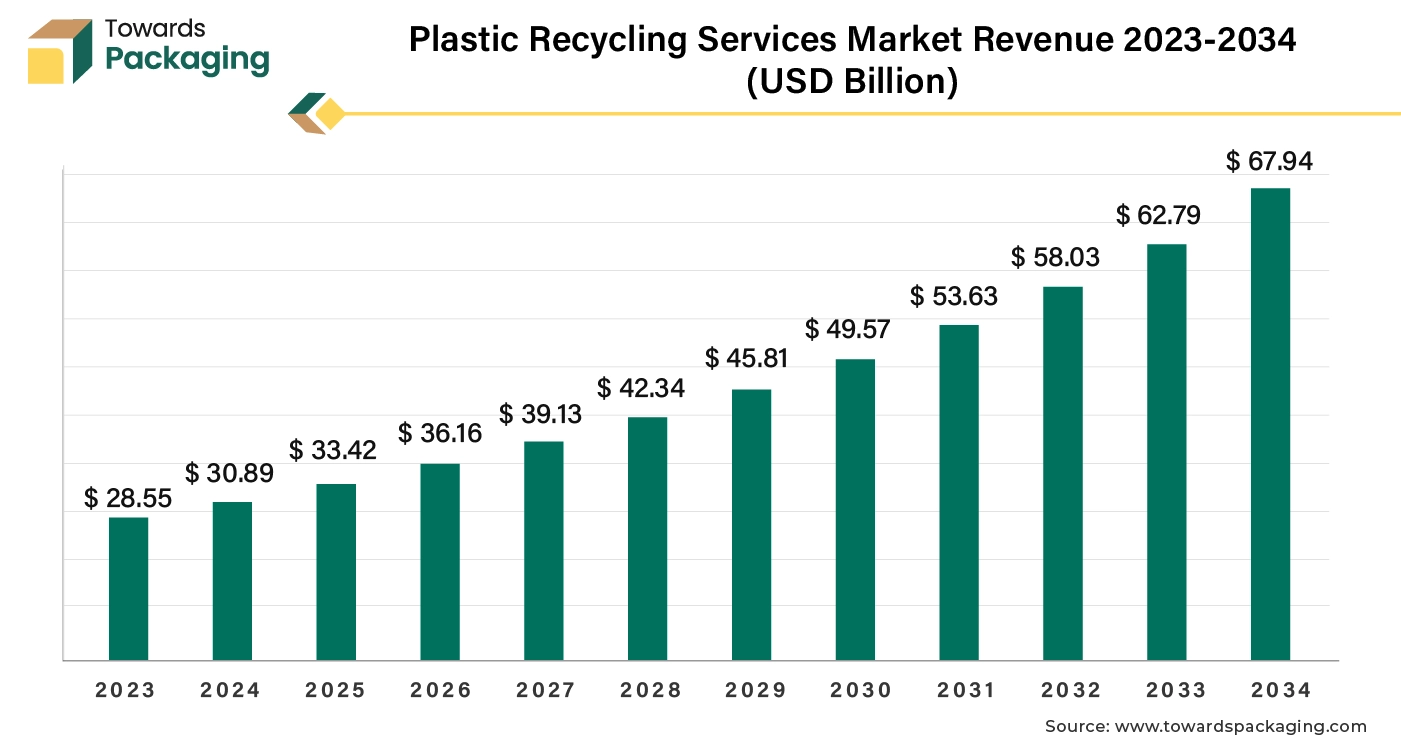

Future of Plastic Recycling Services Market

The global plastic recycling services market size reached US$ 30.89 billion in 2024 and is projected to hit around US$ 67.94 billion by 2034, expanding at a CAGR of 8.20% during the forecast period from 2025 to 2034. The rising demand for sustainable practices as well as growing awareness about the eco-friendly options amongst consumers is expected to surge the demand for plastic recycling services market.

Growth in the circular economy emphasizes recycling as a way to reduce waste and conserve resources. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for plastic recycling which is estimated to drive the global plastic recycling services market over the forecast period.

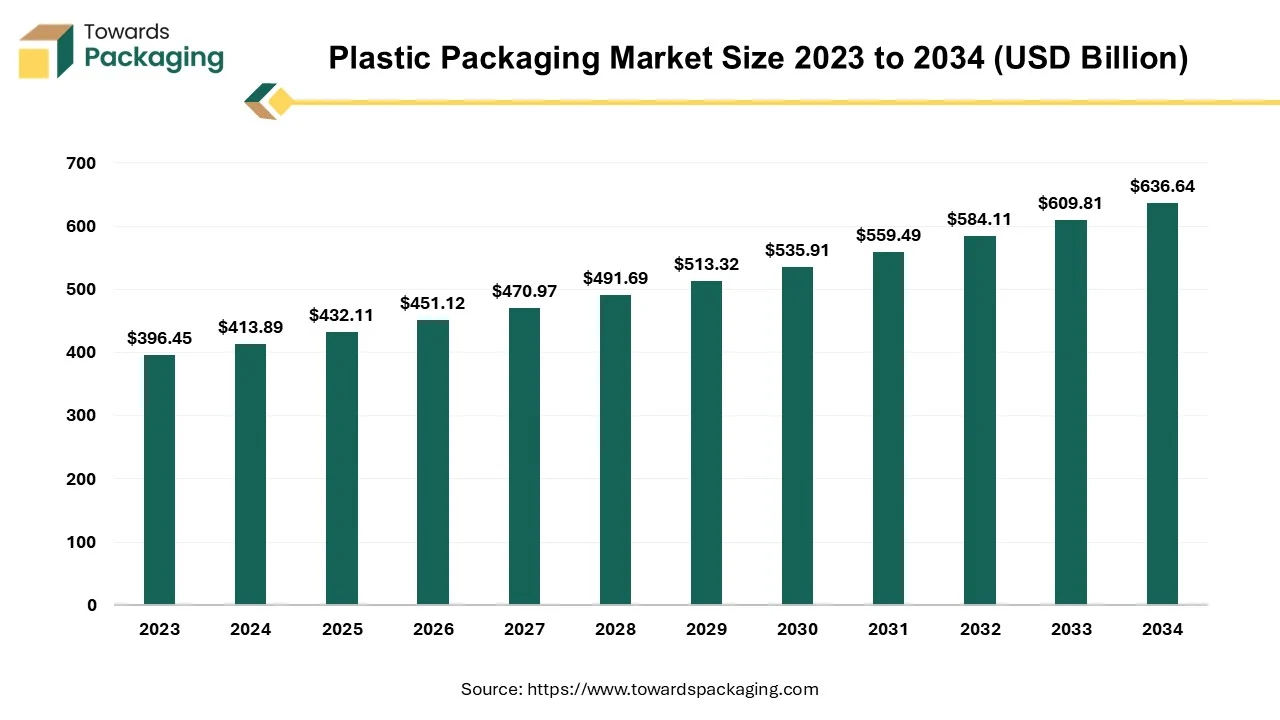

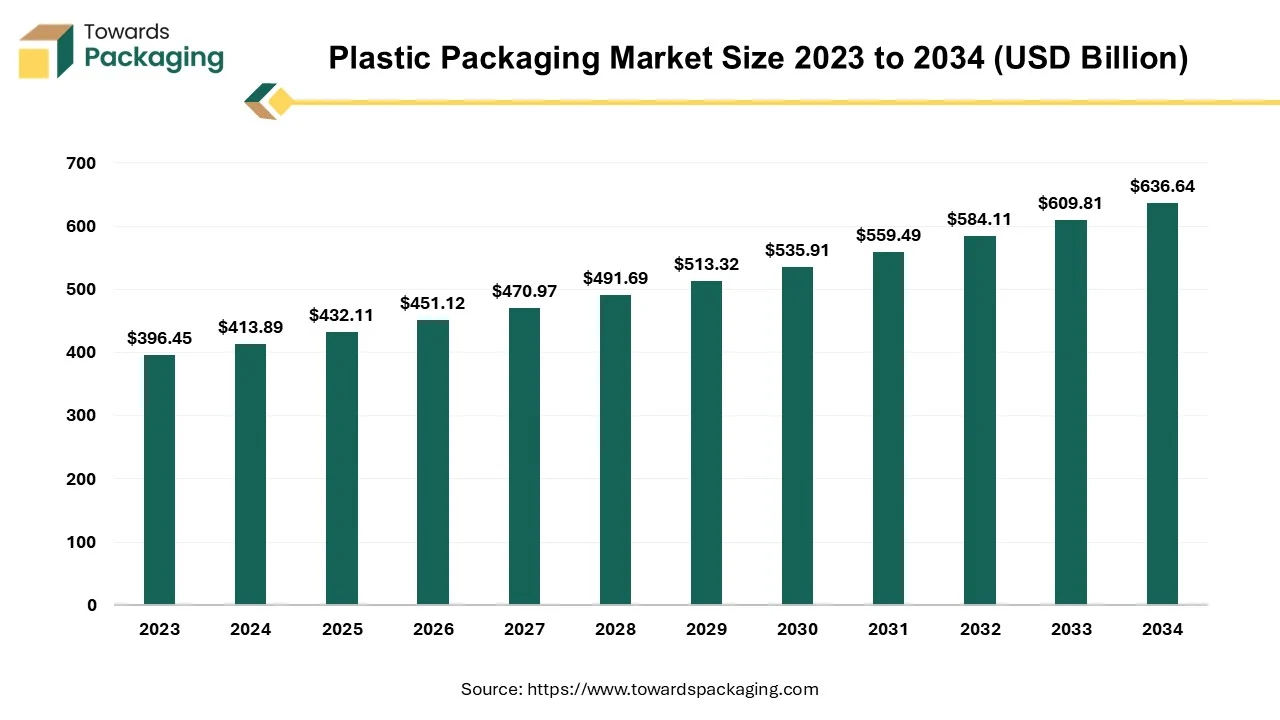

Future of Plastic Packaging Market

The plastic packaging market is projected to reach USD 636.64 billion by 2034, growing from USD 432.11 billion in 2025, at a CAGR of 4.4% during the forecast period from 2025 to 2034. The surge in online shopping, urbanization, and demand for convenient, safe, and long-shelf-life products has significantly increased the need for efficient and protective packaging solutions. The rising adoption of sustainable practices, technological innovations, and expanding food and beverage consumption globally are further fueling this market expansion.

The utilization of various semi-synthetic or synthetic materials to enclose, protect, transport, and display products is known as plastic packaging. The plastic packaging is extensively utilized for packaging materials worldwide, due to its versatility, durability, and cost-effectiveness. The common plastics utilized in packaging have been mentioned here as follows: polyethylene, polyethylene terephthalate, polystyrene, polyvinyl chloride, and bioplastics among others.

New Advancements in Flexible Plastic Packaging Industry

- In May 2025, Oroville Flexible Packaging launched “Oroflex,” a sustainable flexible packaging and recycling system offering customized domestic manufacturing and transparent audit trails to help retail and foodservice clients achieve efficiency and sustainability goals.

- In November 2024, Amcor and Mespack jointly developed a recycle-ready 2L stand-up pouch, specifically designed for home care products such as cleaners, soaps, and laundry detergents. This collaboration combines Mespack’s packaging machinery with Amcor’s advanced materials to address the technical challenges of scaling up larger flexible packaging formats using recyclable materials.

- In July 2024, Mondi launched FlexiBag Reinforced, a recyclable mono-PE-based pre-made bag with enhanced mechanical strength, expanding its sustainable packaging portfolio.

- In May 2025, award-winning snack brand Burts announced new crisp packaging made from 55% recycled plastic. Rolling out from June 2025, the eco-friendly packs will cover popular 40g and 150g flavors and feature a green flash highlighting the recycled content.

- In March 2025, Borealis announces Borcycle M CWT120CL, a recycled linear low density polyethylene (rLLDPE) grade intended for flexible packaging applications other than food that contains 85% post-consumer recycled material. Developed in collaboration with Ecoplast, a Borealis Group member, this recently released grade is intended for critical uses that call for exceptional toughness-stiffness balance, low gel content, and great stretchability. The rLLDPE grade is a noteworthy technological accomplishment that demonstrates Borealis' EverMinds dedication to promoting circularity via innovation.

- In October 2024, samples of the recycled BOPP film that TOPPAN, RM Tohcello, and Mitsui Chemicals have produced will be available. The film waste was collected, de-inked, and repurposed into pellets. This project, which intends to introduce the material by 2025 and encourages horizontal recycling of flexible packaging film, is in line with Japan's 2025 target for reusable/recyclable plastics.

- In March 2025, Ahlstrom, a world pioneer in fiber-based specialty materials, introduces LamiBak Flex, the newest high-performance base paper in its LamiBak™* line. Building on the established popularity of the original LamiBak product line, LamiBak Flex was created especially for flexible packaging. This introduction demonstrates Ahlstrom's dedication to offering cutting-edge solutions that meet the expanding demand for high-barrier, sustainable, and safe packaging materials.

Value Chain Analysis

- Raw Materials & Polymer Production: The chain starts with polymers like PE, PP, PET, PVC, and advanced resins supplied by global chemical companies. Additives, stabilizers, and colorants are incorporated to achieve strength, clarity, and barrier performance. Suppliers also develop food-grade and pharma-grade materials to meet strict regulations. The availability and pricing of raw materials strongly influence market competitiveness.

- Conversion, printing & Packaging Manufacturing: Plastics are processed through film blowing, molding, extrusion, thermoforming, and injection techniques to create bottles, caps, pouches, trays, and films. Manufacturers increasingly integrate digital printing, high-speed sealing, and barrier layering. Automation and robotics are improving production efficiency and precision. The shift toward mono-material and recyclable structures is redefining manufacturing steps.

- Distribution, Reuse, Recycling & End of Life: Finished packaging moves the FMCG, food, pharma, and retail industries through global supply networks. Reverse logistics and reuse models are slowly emerging for select categories. End-of-life management includes mechanical recycling, chemical recycling, and PCR integration into new packaging. Governments and brands are partnering to enhance collection systems and strengthen circular economy infrastructure.

Flexible Plastic Packaging Market Player

Flexible Plastic Packaging Market Segments

By Material

- Polyethylene

- PVC

- Polypropylene

- Polystyrene

- Others

By Packaging Type

- Pouches

- Bags

- Sachets

- Films

- Wraps

- Containers

By End Use

- Food and Beverage

- Pharmaceutical

- Personal care & Cosmetics

- Industrial

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA