Beverage Packaging Machine Market Overview: Market Size, Segments, Regional Demand, Competitive Benchmarking & Supply Chain Data

The beverage packaging machine market is forecasted to expand from USD 12.07 billion in 2026 to USD 21.34 billion by 2035, growing at a CAGR of 6.53% from 2026 to 2035. Regionally, North America leads in 2024, while Europe is forecast to grow fastest, with Asia-Pacific showing strong momentum due to rising RTD beverage consumption. The study includes full competitive analysis of major companies such as Krones, KHS, Sidel, GEA, Coesia, Barry-Wehmiller, along with value chain mapping, trade flow insights, and manufacturer–supplier relationships across NA, EU, APAC, LA & MEA.

Key Takeaways

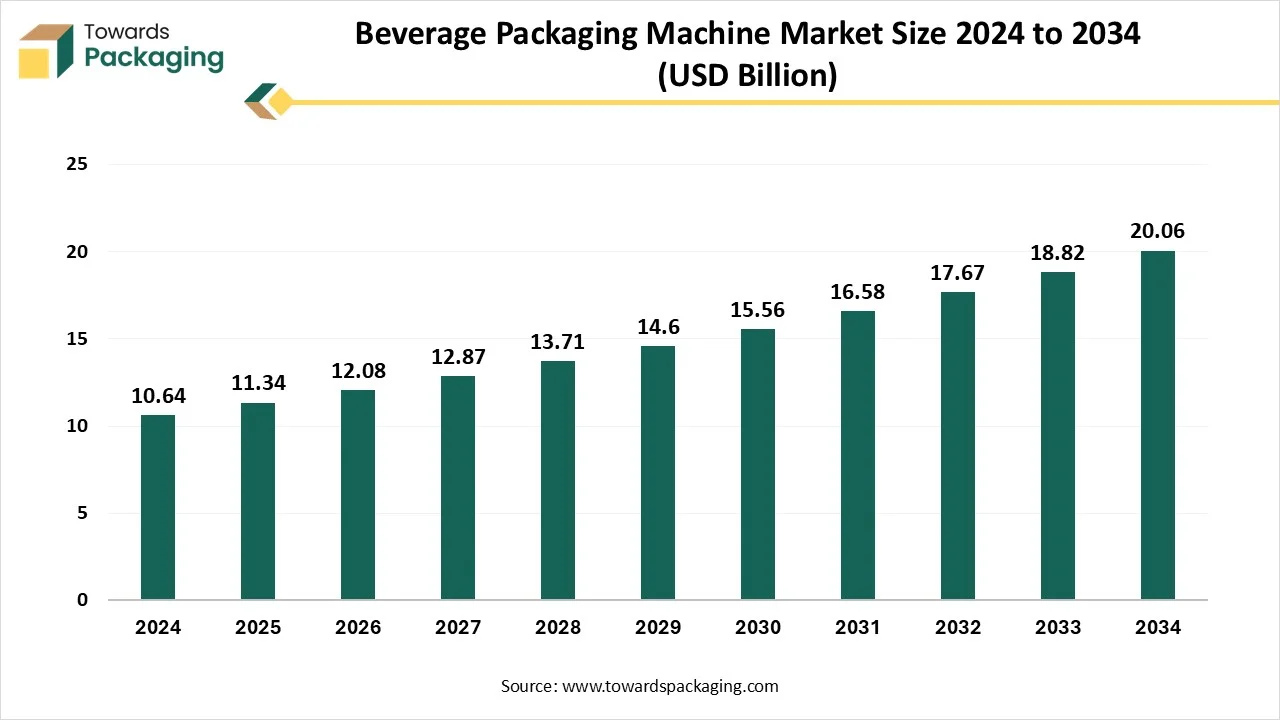

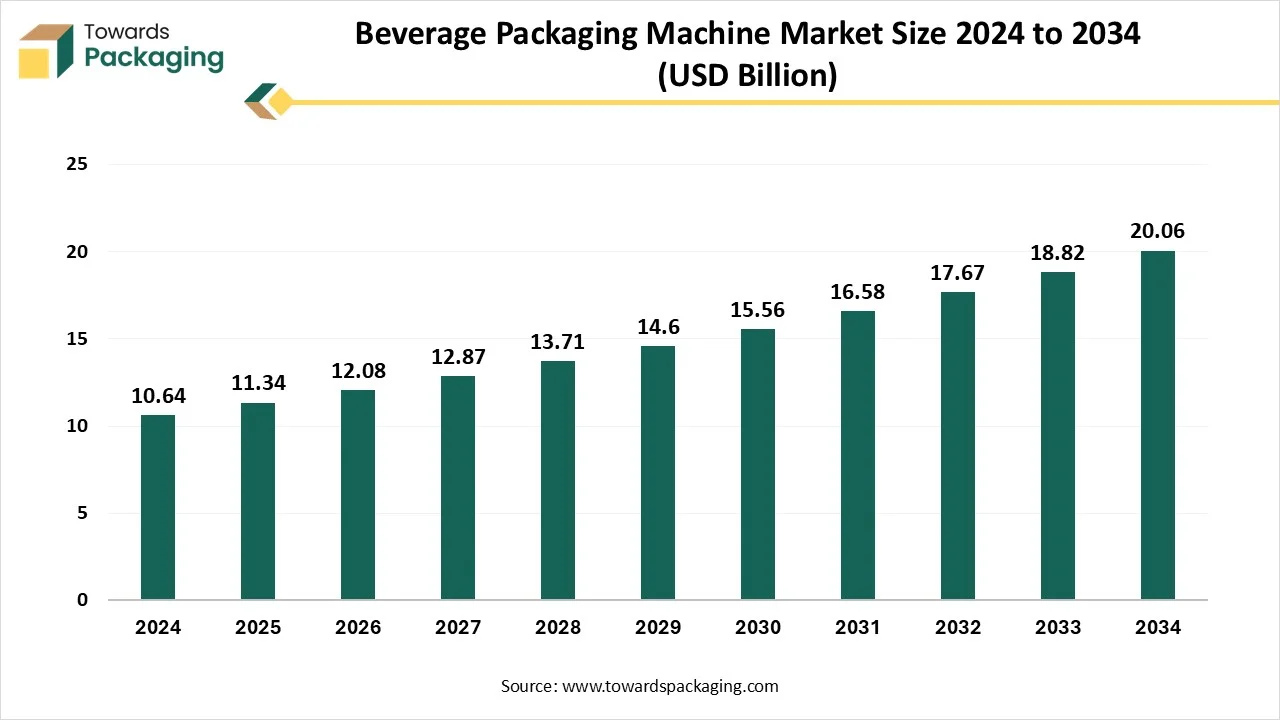

- In terms of revenue, the market is valued at USD 11.34 billion in 2025.

- The market is projected to reach USD 20.06 billion by 2034.

- Rapid growth at a CAGR of 6.53% will be observed in the period between 2025 and 2034.

- North America led the market with the highest revenue share in 2024.

- Europe is expected to grow at the highest CAGR during the forecast period.

- By machine type, the filling and capping machine segment dominated the market in 2024.

- By automation level, the fully automatic segment held the largest revenue share in 2024.

- By distribution channel, in 2024, the direct sales segment led the global market.

- By distribution channel, the indirect sales are expected to grow at the fastest CAGR.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 11.33 Billion |

| Projected Market Size in 2035 |

USD 21.34 Billion |

| CAGR (2025 - 2035) |

6.53% |

| Leading Region |

North America |

| Market Segmentation |

By Machine Type, By Automation Level, By Beverage Type, By Packaging Format, By Packaging Material, By Distribution Channel, By Region |

| Top Key Players |

Barry-Wehmiller Companies, Coesia, Douglas Machine, GEA Group, Jacob White Packaging Ltd. |

Market Overview

A beverage packaging machine is equipment that is designed to automate the process of packaging various types of beverages. These machines offer various functionalities, from capping and filling to labeling and sealing, within a production line. There are some crucial components of beverage packaging machines, including bottle feeder, filling system, capping and sealing mechanism, labeling unit, date and batch coding, packaging line conveyors, and others. Beverage packaging machines find various applications across various industries, such as soft drinks and carbonated beverages, juices and flavored waters, bottled water, energy drinks, and functional beverages. Beverage packaging machines improve production efficiency, reduce human error, and ensure a hygienic packaging process.

What are the Emerging Trends in the Beverage Packaging Machine Market?

- The ongoing research related to sustainable materials and production methods is anticipated to propel the beverage packaging machine market during the forecast period.

- The surging investment in advanced beverages manufacturing infrastructure is expected to boost the market’s growth during the forecast period.

- The increasing use of eco-friendly biodegradable materials to minimize their carbon footprint, bolstering the market’s growth in the coming years.

- The increasing consumer demand for alcoholic and non-alcoholic packaged beverages, along with the growing population, is expected to fuel the market’s expansion in the coming years.

How is AI Contributing to the Beverage Packaging Machine Market?

Artificial intelligence (AI) integration prevents downtime by predicting maintenance needs and assists in saving costs by avoiding breakdowns. AI can improve the defect detection of beverage packaging machines, enhancing quality and efficiency while minimizing costs. The integration of AI & ML, real-time monitoring systems, and smart labels is reshaping the way beverages are produced, packaged, and delivered. AI algorithms can analyze large amounts of data from production lines. This analysis assists in identifying patterns, predicting equipment failures, and optimizing workflows. Therefore, the integration of the Internet of Things and AI is rapidly revolutionizing the packaging automation in beverage packaging machines as these technologies streamline operations and enhance efficiency.

Market Dynamics

Driver

Growing demand for ready-to-drink beverages

The rising consumer demand for ready-to-drink beverages is expected to drive the growth of the beverage packaging machine market during the forecast period. Beverage packaging machines play a crucial role in the beverage industry, optimizing production processes and products. To automate the numerous tasks, beverage packaging machines can significantly enhance production efficiency, eliminate human intervention, and ensure a hygienic and consistent packaging process for ready-to-drink beverages. These machines cater to ready-to-drink beverages containing various ingredients, maintaining their potency and quality. With their cutting-edge features and versatility, these machines are the driving force behind the rapid evolution of the beverage packaging landscape.

Restraint

High initial capital investment

The high initial capital investment is expected to hamper the market's growth. High capital is necessary for the maintenance and operation of advanced machinery, which often discourages smaller and medium-sized manufacturers from adopting such equipment due to budget constraints. Such factors are likely to limit the expansion of the global beverage packaging machine market during the forecast period.

Opportunity

Increasing focus on sustainability and eco-friendly packaging

The growing focus on sustainability and eco-friendly packaging is projected to offer lucrative opportunities to the beverage packaging machine market during the forecast period. The shift towards eco-friendly beverage packaging machines represents a major step toward sustainable packaging solutions. Regulatory bodies and consumers are increasingly inclined towards eco-friendly packaging solutions, which include recycled materials, biodegradable plastics, and innovative designs that minimize wastage. Over the years, businesses increasingly recognize their environmental responsibilities, which has led to the adoption of these innovative technologies. The manufacturers of beverage packaging machines are heavily investing in technology that allows for sustainable and eco-friendly materials. Thus, bolstering the market’s growth in the coming years

Segmental Insights

By Machine Type

In 2024, the filling and capping machine segment led the beverage packaging machines market due to the growing global production of bottled and canned beverages and the increasing emphasis on achieving efficient, high-quality production and manufacturing processes. These machines play a crucial role in the accurate and consistent filling of beverages in containers as cans, bottles, or cartons, and then followed by the capping, which ensures the safety, hygiene, and maintains the quality of the product.

By Automation Level

The fully automatic segment led the beverage packaging machines market due to the increasing adoption of fully automatic machines and growing awareness of their numerous benefits. Due to the benefits in operational cost, efficiency, and scaling in fully automatic mode, particularly in assembly-type machine production, is likely to accelerate the segment’s growth. These automatic machines can run throughout the day and night with little or no human intervention. On the other hand, the labelling and coding machine segment is expected to witness a significant share during the forecast period owing to the rising production of alcoholic beverages, non-alcoholic beverages, and dairy beverages. Additionally, stringent regulatory requirements for accurate product information. Several regulatory bodies and Governments around the world are implementing stringent guidelines to ensure consumer safety and product traceability.

By Distribution Channel

Direct sales represented the largest share, driven by an increase in direct sales of beverage packaging machines. Direct sales allow manufacturers to take control over the entire sales process, which further assists in providing personalized support and strengthening customer relationships. On the other hand, the indirect sales are expected to grow at the fastest rate, owing to the surge in sales of indirect sales of beverage packaging machines. These indirect sales of beverage packaging machines include the selling of these machines through intermediaries to the end or final customer.

Regional Insights

North America Leads with a Well-Established F&B Infrastructure

North America has the presence of a well-established beverage industry. The growth of the region is attributed to the rising demand for ready-to-drink beverages, growing focus on eco-friendly packaging, and rising companies' expenses towards R&D to create newer packaging technologies that are more energy efficient. In addition, rapid technological innovation in packaging solutions that cater to evolving consumer preferences is anticipated to propel the region’s growth.

The beverage packaging machines market in North America is majorly dominated by the United States, owing to its diverse beverage production industry, increasing investments in automation and sustainability initiatives, and rising adoption of advanced technologies. The country has a strong presence of key beverage manufacturers such as PepsiCo, Coca-Cola, and Dr Pepper Snapple Group, which raises the need for these firms to invest in advanced beverage packaging machines.

Rapid Growth in the European Market

The European market is shifting rapidly towards sustainability and eco-friendly materials due to various Government compliances and increased end consumer demand for sustainable packaging. Countries like Germany, Italy, the UK, and Spain are the major contributors to the market. Several manufacturers are increasingly adopting new technologies, including advanced automation, AI systems, and robotics, to minimize costs and enhance production efficiency. Additionally, rising partnership and collaboration between machinery manufacturers and beverage companies boost innovation to reduce environmental impact and enhance efficiency within production processes.

Asia Pacific

The Asian beverage industry is ever-developing and changing. Driven by fast urbanisation, changing consumer choices, and a growing demand for health-conscious and ready-to-drink beverages, the region has become one of the most highlighted and large-potential hubs in the global beverage industry. As brands compete to serve, consistency and invention are at scale; the cornerstone of their success lies in reliable and effective packaging solutions. Also, with the constant awakening of health awareness among asian countries, the urge for beverages is significantly moving towards functionality and health. Sugar-free, low-sugar, and low-calorie products are famous, such as sugar-free carbonated beverages and low-sugar juice beverages, and the industry share continues to rise.

Latin America

In Latin America, sales of soft drinks were 115 billion liters in 2024. As per the research, use in the region is predicted to grow by a further 12 % to 128 billion litres by 2028. Also, the consumption of carbonated drinks will rise to 9% to 69 billion litres by the year 2028. The development rate is 14% and for juices, it is 135% by the year 2028. So generally, carbonated soft drinks are a crucial driver of industry trends in the Latin American Market. This region is home to 3 to 6 of the biggest markets in the world for the retail sale of carbonated soft drinks (Argentina, Mexico, and Brazil).

Beverage Packaging Machine Market Key Players

- Barry-Wehmiller Companies

- Coesia

- Douglas Machine

- GEA Group

- Jacob White Packaging Ltd.

- KHS Group

- Krones AG

- ProMach

- Sealed Air Corporation

- Serac Group

- Sidel Group

Latest Announcements by Market Leaders

- In November 2024, Sidel announced the launch of an innovative bottle washer for the beverage industry. With beverage bottlers requiring a solution that reduces production costs while improving their environmental footprint, Sidel has launched its new bottle washer, which combines chemical and ultrasound technology for the highest performance.

New Advancements

- On 6 August 2025, Pittston Co-Packers revealed the launch of its first high–volume beverage producer facility, which is serving complete service co-packing solutions. The latest 403,000 sqft facility aligns with the demand of current national beverage brands with end-to-end manufacturing capabilities.

- In November 2024, SIG, a leading packaging solutions provider, announced the expansion of its SIG Neo filling machine portfolio, featuring the world's fastest and most flexible aseptic carton filling machine for multi-serve formats. With the surge in high output and flexibility, TCO-improved and sustainable options, the SIG Neo technology platform offers groundbreaking solutions.

- In August 2024, beverage can manufacturers are set to advantage from Akzonobel’s thirst for invention following the launch of new performance internal coating technology which is free of all bisphenols, styrene, formaldehyde and PFAS as the company’s Packaging coating business has created Accelshield 300, an interior spray coating for beverage cans that goes well beyond technologies in the sector.

- In July 2024, Eliter Packaging Machinery introduced its latest model of automatic sleeving machine for multipacks and with a maximum speed of 80 wraps per minute. The multipack sleeving machine is designed to apply a cardboard sleeve around a variety of packaging containers organised in multipack and cluster packaging formats.

Beverage Packaging Machine Market Segments

By Machine Type

- Filling and Capping Machine

- Labeling and Coding Machine

- Palletizing and Depalletizing Machine

- Conveying and Handling Machine

- Cleaning and Sterilizing Machine

- Wrapping and Bundling Machine

- Others (Inspection, Checkweighing, etc.)

By Automation Level

- Manual Machines

- Semi-Automatic Machines

- Fully Automatic Machines

By Beverage Type

- Alcoholic Beverages

- Non-alcoholic Beverages

- Dairy Beverages

By Packaging Format

- Bottles

- Cans

- Cartons

- Containers

- Others (Pouches, etc.)

By Packaging Material

- Glass

- Metal

- Paperboard

- Plastic

- Others (Biodegradable material, etc.)

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)