The North America flexible plastic packaging market is anticipated to grow from USD 67.25 billion in 2026 to USD 124.68 billion by 2035, with a compound annual growth rate (CAGR) of 7.1% during the forecast period from 2026 to 2035. Plastic packaging is rapidly developing in North America because of the development of the urge for eco-friendly and high-performance packaging. Recycling initiatives and technologies like the circular economy are becoming more famous.

The flexible plastic packaging industry is the worldwide sector for non-rigid containers created from films, plastic, and foils, which are utilized to market, protect, and distribute products. This sector counts products like bags, pouches, and wraps, which are being driven by the food and beverages, personal care, and pharmaceutical sectors because of the packaging’s customizable, lightweight, and evergreen nature too.

Also, a standard machine generally utilizes plastic films such as polypropylene, polyethylene, and polystyrene, and others to make durable and versatile storage solutions for beverages, food, and pharmaceuticals, too. Instances of some items kept in flexible plastic packaging, which can be searched in your home, include a re-sealable bag of granola and a squeezable pouch of toothpaste, too.

Flexible plastic packaging is witnessing well-searched updates, which are driven by sustainability goals, moving consumer expectations, and technological developments, too. Artificial Intelligence plays an increasingly crucial role in the flexible packaging sector. Machine learning is being utilized to update material usage, develop operational efficiency, and reduce waste, too. The AI-oriented predictive maintenance is lowering machine downtime, whereas smart packaging generated by AI is developing security and traceability too, specifically in sensitive industries like food safety and pharmaceuticals.

Worldwide, the leading three importers of United States Flexible Plastic packaging are Brazil and Colombia. Colombia has topped the globe in United States Flexible Plastic Packaging, importing 125 shipments, which is being followed by Brazil with 4 shipments.

The globe has imported many of the United States' Flexible Plastic Packaging from Germany, the United States, and the United Kingdom.

As per the global data, the world has officially imported 113 shipments of United States Flexible Plastic Packaging during the period December 2023 to November 2024. These imports were made by 41 exporters to 37 buyers overall, which marks a growth rate as compared to the leading twelve months.

Raw Material Sourcing: One of the main future trends in terms of sourcing of plastic raw materials for production is the move towards environmentally friendly and sustainable options. With the developing awareness of the effect of plastic pollution on the environment, users are urging more environmentally friendly products. Manufacturers are now seeking paths to reduce their carbon footprint and lower the environmental impact of their operations by sourcing the raw materials from sustainable sources.

Key Players: Amcor plc, Constantia Flexibles, and Berry Global Inc

Component Manufacturing: Raw plastic resins are integrated with the additives and then processed and melted, frequently with the assistance of extrusion to make a single or multilayer film. The film is being printed with the graphics and text by using procedures such as gravure printing or flexographic printing. This can occur on the surface or an interior layer before the lamination for protection.

Key Players: Flex Pak Services, Mondi, and Huhtamaki

Logistics and Distribution: Technological developments have led to the latest flexible packaging materials being revealed to the market, resulting in smarter packaging solutions. Flexible packaging -specifically packaging films that not only serve a developed consumer experience but also smooth the supply chain, resulting in production schedules and improved costs.

Key Players: Sealed Air, Transcontinental Inc., and Sonoco Products Company

The plastics segment dominated the market in 2025 because flexible plastic packaging includes pieces, films, bags, wraps, and other materials that can bend or conform to the shape of their contents without the loss of integrity. Like their strong equivalent generated by other producers, such materials are versatile, lightweight, and highly tailored. Their potential is to serve extremely perfect characteristics while lowering the material consumption, which makes them perfect for industries that range from food and beverage to personal care to pharmaceuticals.

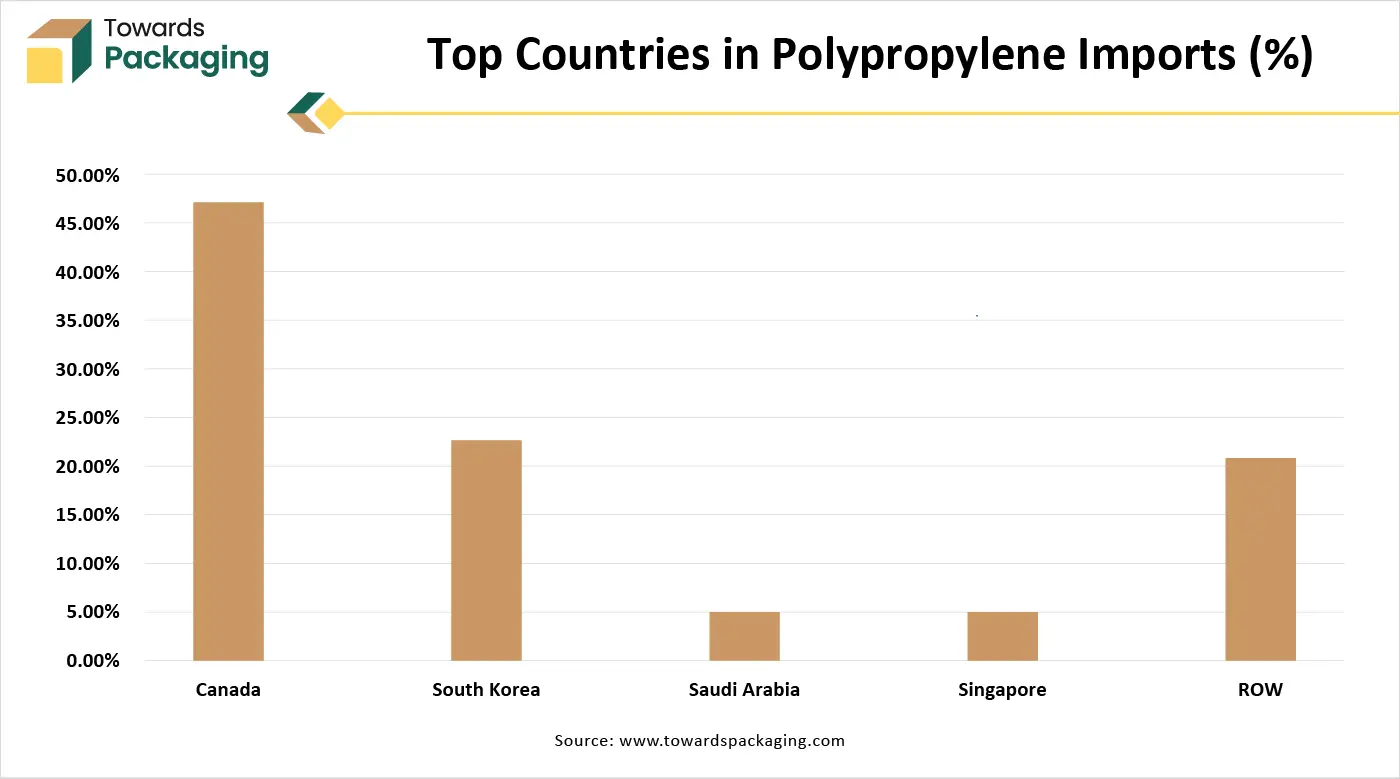

The polypropylene segment is expected to experience the fastest CAGR during the forecast period. Many types of polypropylenes are utilized in flexible packaging, which includes biaxially oriented polypropylene (BOPP) and cast polypropylene (CPP). BOPP is well known for its strength and clarity, which makes it ideal for the packaging of snacks and confectionery, too, while the CPP serves perfect heat sealability, which makes it ideal for pouches and laminates. As the urge for flexible packaging continues to develop, producers heavily select polypropylene for its equilibrium of sustainability, cost-effectiveness, and performance, too.

The pouches segment has dominated the market in 2025 as it is a flexible and lightweight packaging that is extremely acceptable and is utilized in the packaging of drinks, medicines, personal care, and foodstuffs products. Rigid packages like cans, bottles, boxes, and pouches are flexible enough to be molded, sealed, and shaped to your product. Stand-up pouches are used in coffee, snacks, liquid goods, and pet treats, too, which are simple to keep and have an accurate shelf appearance. Flat pouches are perfectly known as single-use or pillow pouches, which are lighter in weight, and spout pouches have a spout to make accessible resealing and pouring, which is ideal for baby food, cleaning supplies, and juice too.

Films & wraps / flexible films segment are predicted to experience the fastest CAGR during the forecast period. Flexible packaging films, initially made of plastic, develop product adaptability and protection. These films search overall uses that range from the food sector to electronics, pharmaceuticals, and household goods. Different types of plastic films are present, such as PE, PP, PVC, BOPP, and BOPET, among others. Every kind of offer is different in terms of advantages and features that portray particular uses within flexible packaging.

The food and beverages segment has dominated the market in 2025 because in this sector, in which product aesthetics and freshness are necessary, flexible packaging serves the perfect combination of both worlds. It creates products that are convenient, safer, and reliable for users, while being convenient and economical to align with environmental standards. Inventive packaging designs like resealable and easy-peel options, which enriched the convenience of using the packaged foods and beverages.

With an instance of this,

Pharmaceutical & medical packaging is expected to witness the fastest CAGR during the forecast period. One of the largest barriers to medical packaging is to withstand a sterilization procedure, which is a compulsion in healthcare. Flexible packaging, its polyethylene pattern gives a different breathability, which is perfect for the procedure of avoiding ETO into the packaging. Additionally, prescription medications such as antihypertensives and antibiotics are prevalently packed in blister packs as they provide protection against tampering, which can be personalized to include characteristics like push-through openings and perforated lines for convenient opening.

For instance, to this

In August 2025, Aptar Pharma revealed a major development in sustainable pharmaceutical packaging with its Freepod nasal spray pump, which is currently manufactured with a huge balance of bio-based resins.

The United States held the largest share in the market in 2025, as it is witnessing transformative development, which is due to rising user choice, technological developments in materials, sustainability accreditation, and the production procedure. Main embracement has driven the developing urge for durable, lightweight, and tamper-evident packaging solutions in personal care, pharmaceuticals, and food and beverages, too.

For instance, to this

Mexico expects the fastest growth in the market during the forecast period, because this region is classified by rigid market development, which has driven the urge for e-commerce, food and beverages, and the pharmaceuticals industry, while likely experiencing developing pressure to accept the recyclable and sustainable solutions because of user and regulatory demands. The food and beverage sector is the biggest consumer of flexible packaging in Mexico, which uses it heavily for products such as processed meats, dairy, snacks, and ready-to-eat meals to expand the shelf life and lower the transportation costs.

By Material Type

By Product / Format Type

By End‑Use Industry / Application

January 2026

January 2026

January 2026

January 2026