Smart Containers Market Industry Report Market Size, Regional Share (North America, Europe, Asia Pacific, Latin America, MEA)

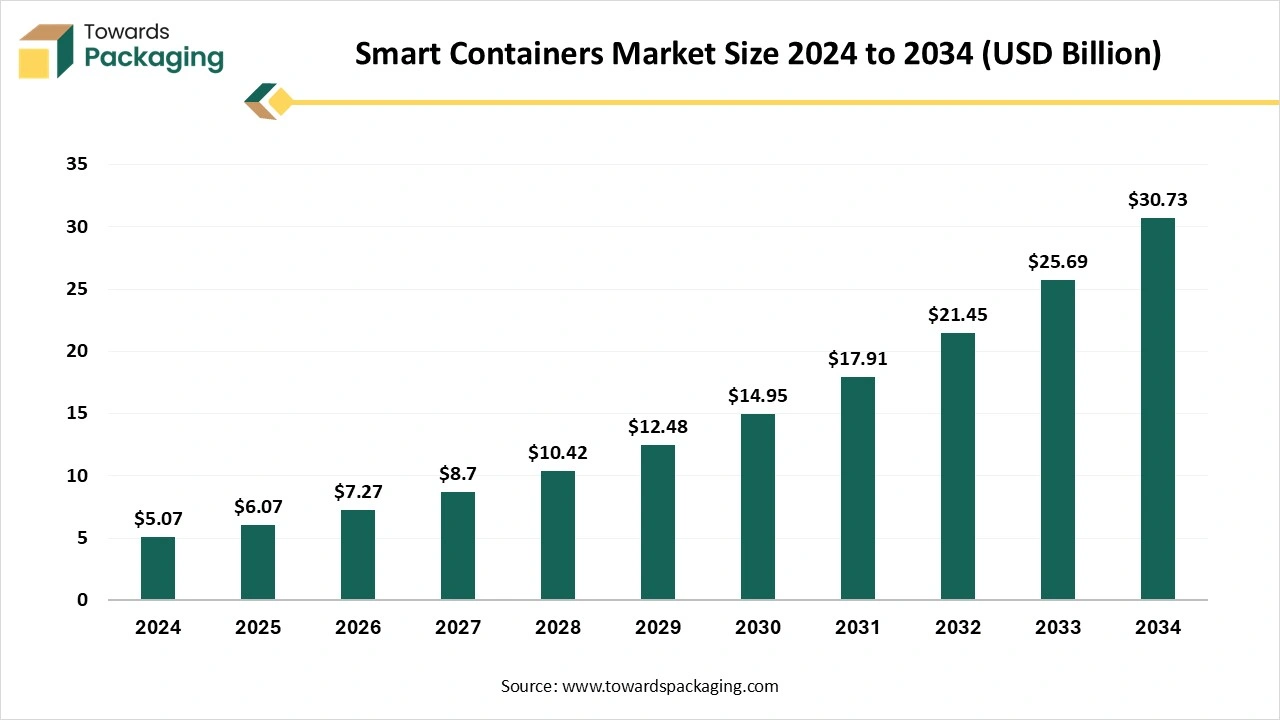

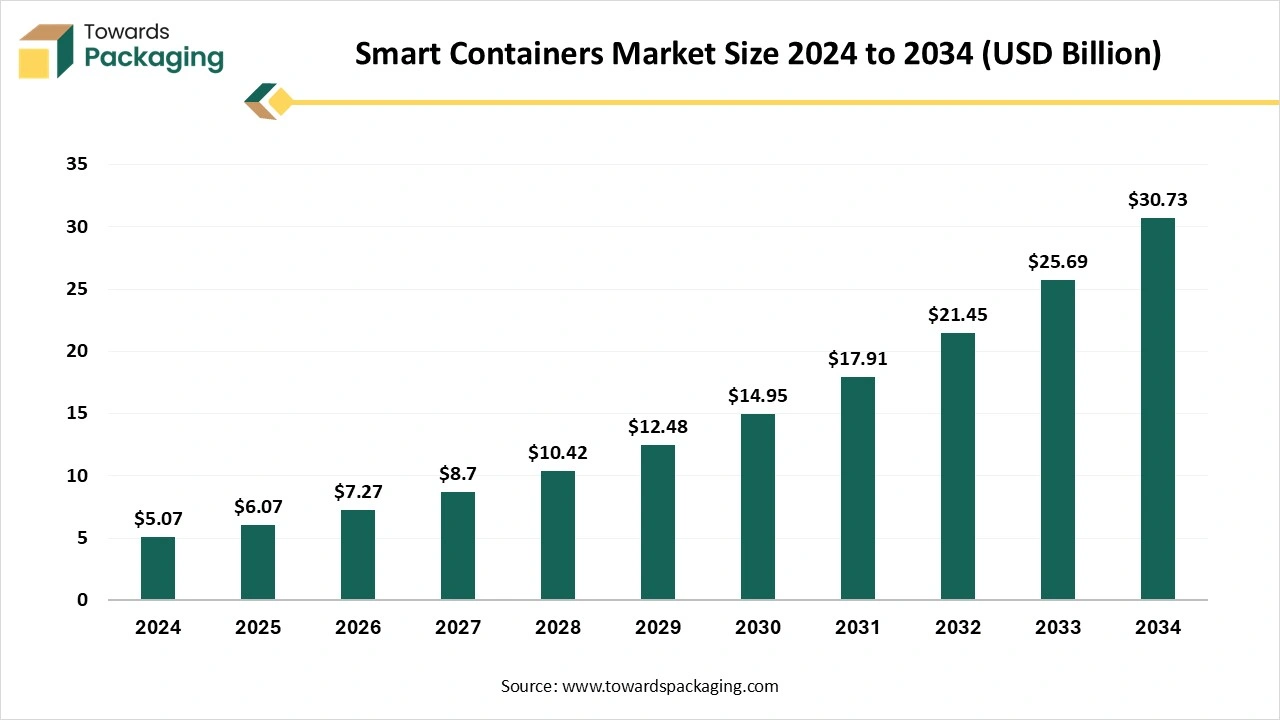

The smart containers market is valued at USD 6.07 billion in 2025 and is projected to reach USD 30.73 billion by 2034, reflecting a strong CAGR of 19.63%. The report delivers complete segmentation statistics hardware dominated the offering segment in 2024 with over 52% share, GPS technology accounted for over 60% usage, and the food & beverage industry led end-use demand with over 29% contribution. Regionally, North America commanded the market in 2024 with 1.10 million units deployed, while Asia Pacific is expected to grow at over 20% CAGR. The study deeply covers the competitive landscape of MSC, Maersk, CMA CGM, COSCO, Hapag-Lloyd, and ONE, coupled with value chain assessment, trade flow mapping, import–export data, and supplier ecosystem structures.

Major Key Insights of the Smart Container Market

- In terms of revenue, the market is valued at USD 6.07 billion in 2025.

- The market is projected to reach USD 30.73 billion by 2034.

- Rapid growth at a CAGR of 19.63% will be observed in the period between 2025 and 2034.

- North America dominated the global market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By offering, the hardware segment held the major revenue share in 2024.

- By offering, the software segment is expected to grow at a considerable CAGR between 2025 and 2034.

- By technology, the GPS segment dominated the market in 2024.

- By technology, the LoRa WAN segment is expanding at a significant CAGR.

- By application, the asset tracking and management segment held the biggest revenue share in 2024.

- By application, the supply chain optimization segment is expected to grow significantly between 2025 and 2034.

- By end use, the food and beverage segment dominated the market in 2024.

- By end use, the pharmaceuticals segment is expected to grow at a significant CAGR over the projected period.

Smart Containers Market: Transparency in Supply Chain Visibility

Smart containers are shipping containers with advanced technologies such as communication devices, sensors, and various other facilities. These are useful in providing real-time information such as temperature, location, humidity, condition of the cargos, and various other aspects. These containers data bring security and efficiency to intermodal transportation. These are of three types: dry storage containers, open side containers, and half-height containers. Growing awareness about cargo security and the necessity to comply with worldwide certification values are influencing the acceptance of progressive container technologies. Businesses are capitalizing on smart resolutions to safeguard their shipments and meet strict security guidelines and quality standards. The importance of supervisory obedience and improved safety events is enhancing the demand for cultured tracking and monitoring systems.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 5.07 Billion |

| Projected Market Size in 2034 |

USD 30.73 Billion |

| CAGR (2025 - 2034) |

19.63% |

| Leading Region |

North America |

| Market Segmentation |

Offering Outlook, Technology Outlook, Application Outlook, End Use Outlook and By Region Covered |

| Top Key Players |

MSC Group, Maersk, CMA CGM, COSCO Shipping Lines, Hapag-Lloyd, Ocean Network Express |

What are the New Trends in the Smart Containers Market?

Growing Demand for Continuous Development

The growing demand for continuous technological development is influencing the growth of this sector, as with the advancement of technology, it becomes easier to get real-time updates of the products.

Growing Demand for Real-time Monitoring Facility

A growing concern for real-time monitoring facilities for enhanced security status, mainly in sectors such as food & beverages and pharmaceuticals. These sectors require extra safety measures due to the high perishable products.

Presence of Predictive Analytics and Artificial Intelligence

The ease due to the presence of predictive analytics to protect products from damaging and artificial intelligence that assures the quality maintenance during shipping has raised the demand for such advancement.

Future Demands

- Rising global trade volumes will drive higher adoption of smart containers to improve shipment visibility and efficiency.

- Strong demand for real-time tracking of temperature, humidity, pressure, and shock will push companies toward IoT-enabled smart containers.

- Growth of cross-border e-commerce will increase demand for automated, trackable containers to manage high-volume shipments.

- The food, pharmaceuticals, and chemicals industries will increasingly require condition-monitoring containers to maintain product integrity.

- Regulatory pressure for safer and transparent supply chains will drive mandatory adoption of smart container technologies.

- Increasing cargo theft and tampering incidents will raise demand for containers with smart locking, geofencing, and intrusion alerts.

- Port digitalization and smart logistics infrastructure worldwide will boost the demand for compatible smart container fleets.

- Companies focusing on carbon-neutral logistics will adopt smart containers to measure emissions and optimize routes.

- The growing need for predictive maintenance will increase demand for containers that can monitor structural health and usage patterns.

- Expansion of cold chain logistics will push the demand for smart refrigerated containers with automated temperature controls.

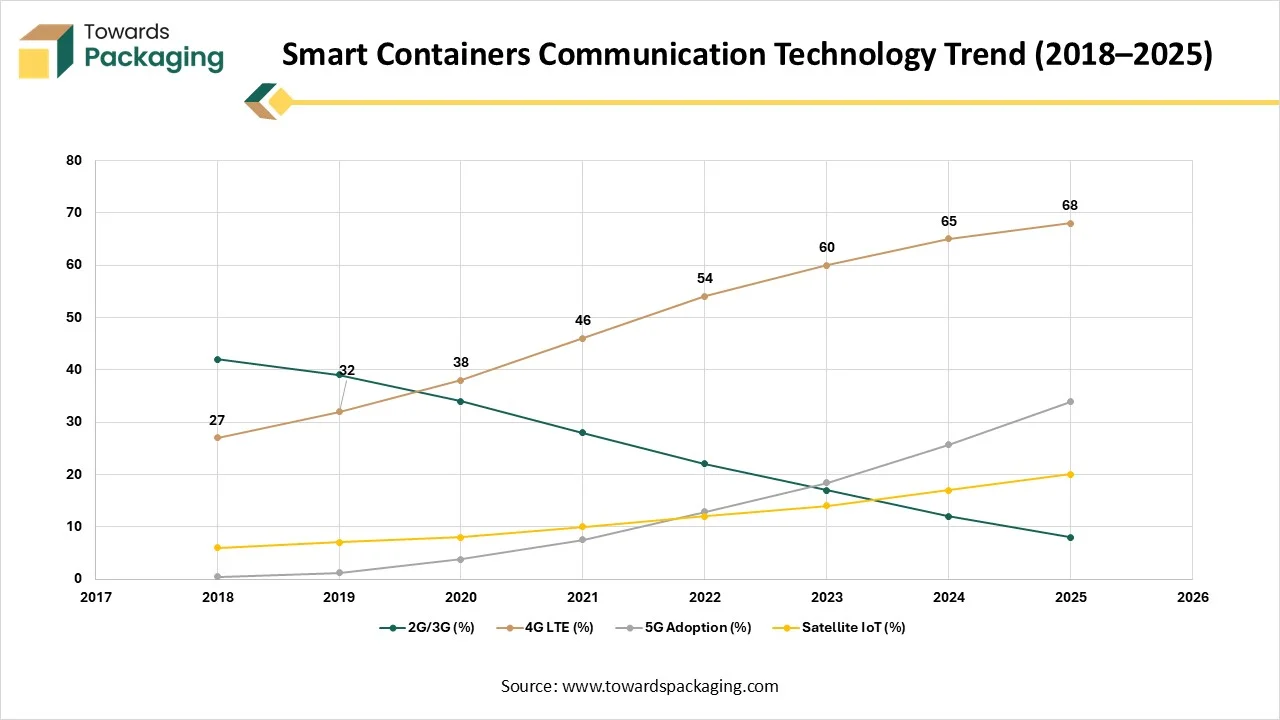

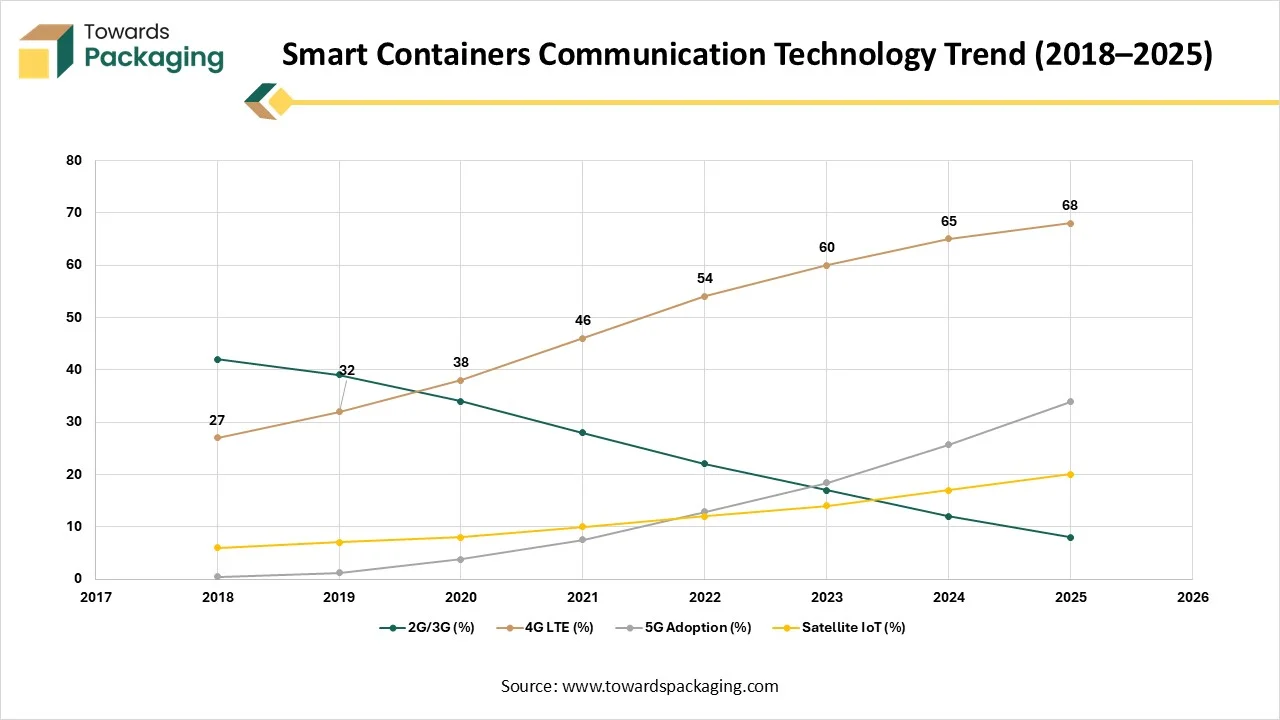

Smart Containers Communication Technology Trend (2018-2025)

| Year |

2G/3G (%) |

4G LTE (%) |

5G Adoption (%) |

Satellite IoT (%) |

| 2018 |

42 |

27 |

0.4 |

6 |

| 2019 |

39 |

32 |

1.2 |

7 |

| 2020 |

34 |

38 |

3.8 |

8 |

| 2021 |

28 |

46 |

7.5 |

10 |

| 2022 |

22 |

54 |

12.9 |

12 |

| 2023 |

17 |

60 |

18.4 |

14 |

| 2024 |

12 |

65 |

25.7 |

17 |

| 2025 |

8 |

68 |

33.9 |

20 |

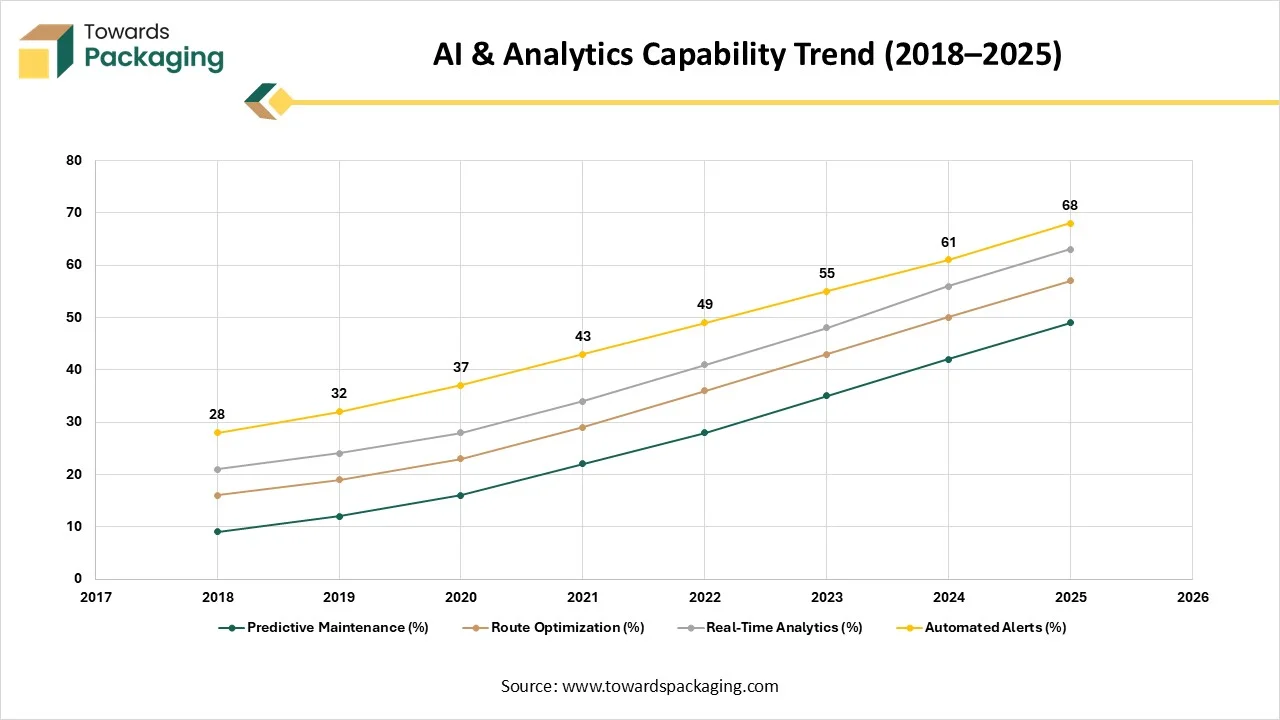

How Can AI Improve the Smart Containers Market?

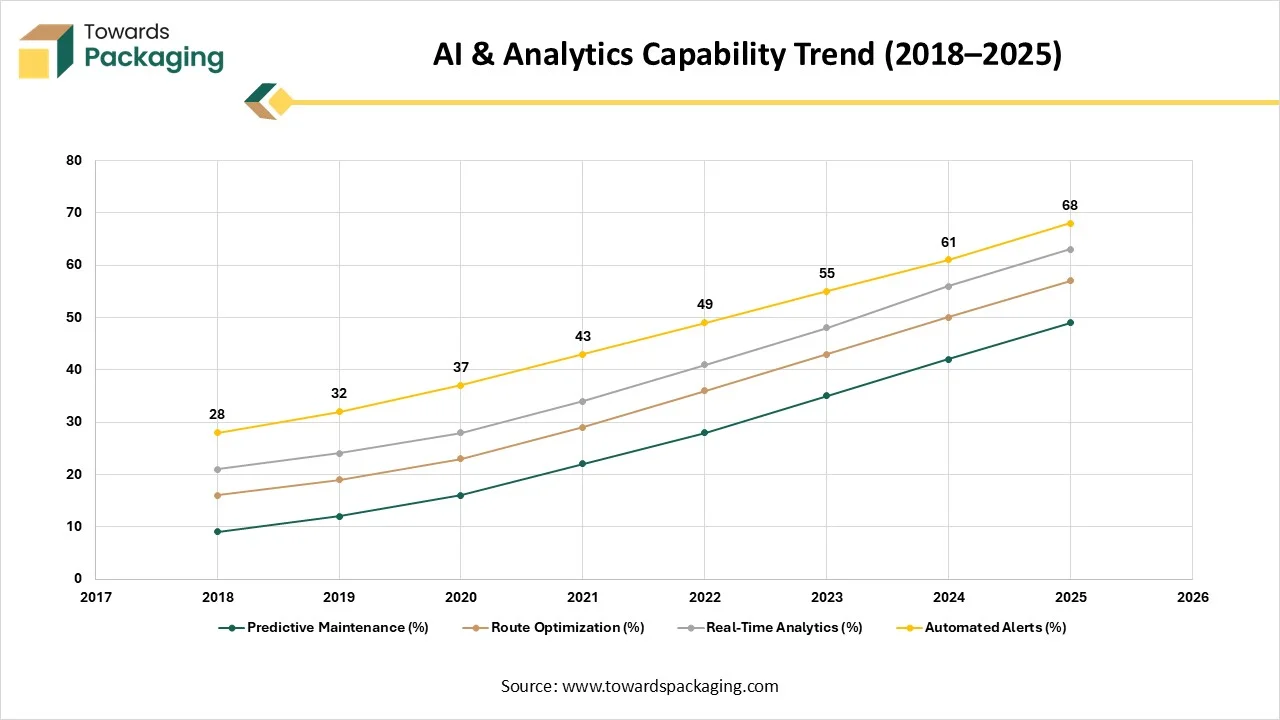

AI & Analytics Capability Trend (2018-2025)

| Year |

Predictive Maintenance (%) |

Route Optimization (%) |

Real-Time Analytics (%) |

Automated Alerts (%) |

| 2018 |

9 |

16 |

21 |

28 |

| 2019 |

12 |

19 |

24 |

32 |

| 2020 |

16 |

23 |

28 |

37 |

| 2021 |

22 |

29 |

34 |

43 |

| 2022 |

28 |

36 |

41 |

49 |

| 2023 |

35 |

43 |

48 |

55 |

| 2024 |

42 |

50 |

56 |

61 |

| 2025 |

49 |

57 |

63 |

68 |

The role of AI in the smart containers market is significant, as it is important for the advancement of the containers. It helps in real-time monitoring of the products packed in the containers and estimates the time to deliver those products. These artificial intelligence tools can easily predict the delivery delays and recognize the inefficiencies present on the routes. It can detect the temperature, which helps to take preventive measures that help to maintain the integrity of the products. With the predictive analytics facility, it becomes easy for market players to analyse all the historical data and make changes according to the current trends. It helps to estimate the delivery of a suitable number of containers at different times. It is also useful in maintaining the equipment and containers to protect them from sudden and major breakdowns. The movement of the containers is easily visible with AI algorithms in the smart containers and also through smart cameras.

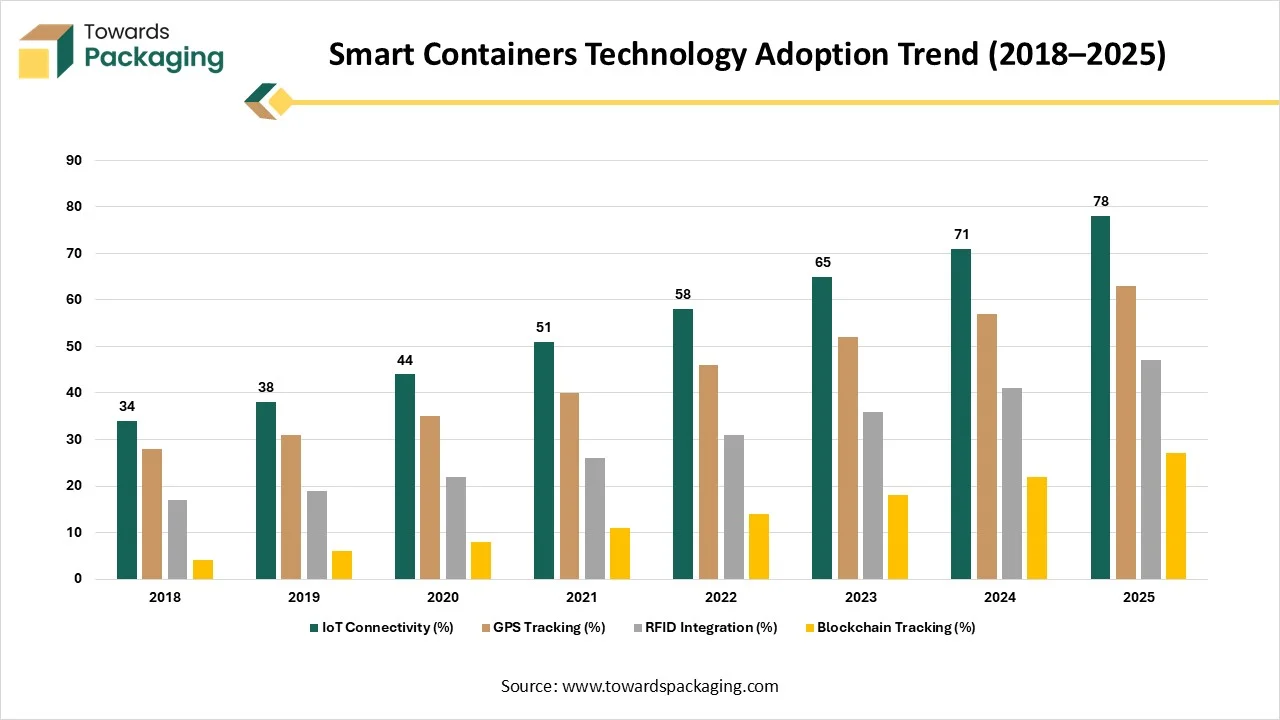

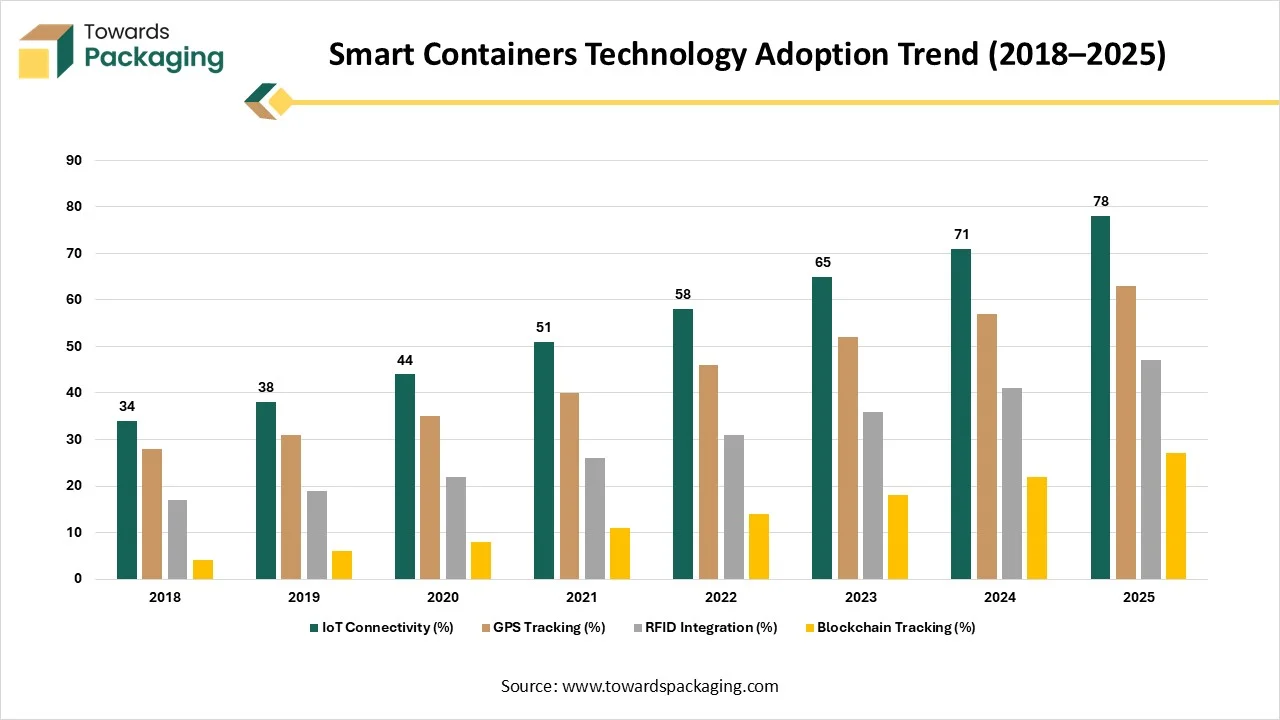

Smart Containers Technology Adoption Trend (2018-2025)

| Year |

IoT Connectivity (%) |

GPS Tracking (%) |

RFID Integration (%) |

Blockchain Tracking (%) |

| 2018 |

34 |

28 |

17 |

4 |

| 2019 |

38 |

31 |

19 |

6 |

| 2020 |

44 |

35 |

22 |

8 |

| 2021 |

51 |

40 |

26 |

11 |

| 2022 |

58 |

46 |

31 |

14 |

| 2023 |

65 |

52 |

36 |

18 |

| 2024 |

71 |

57 |

41 |

22 |

| 2025 |

78 |

63 |

47 |

27 |

Market Dynamics

Driver

Rising concern for real-time monitoring and visibility

The increasing demand for real-time monitoring of the containers to prevent any damage and monitoring the smart containers market efficiently are highly utilized. It helps to provide the appropriate information regarding humidity level, temperature conditions, and the condition of the goods. This makes it possible for companies to improve their supply chain management and the movement of goods in transit. The corporates can easily monitor the situation of perishable products and react actively on time to any matter to avoid loss. By utilizing the real-time data, the market players can enhance the safety of products in transportation, decrease the risk of spoilage and damage and improve inventory levels, and also expand the general functioning efficacy.

The growing acceptance of digitalization and IoT (Internet of Things) in the logistics sector is one of the major drivers of the market. Internet of things equipment and sensors rooted in smart containers allow the gathering and spread of real-time statistics, which can be used to get useful insights into the distribution supply chain. This information can be utilized to improve shipping methods, decrease transportation times, and expand the overall efficacy of logistics processes. Moreover, the incorporation of digital skills such as cloud computing and blockchain is further increasing the abilities and usage of smart containers.

The growing consciousness of ecological sustainability is influencing the demand for more eco-friendly and sustainable shipping choices. These smart containers play an important role in this by allowing the optimization of shipping methods and decreasing fuel consumption. The capacity of smart containers to observe fuel practices and releases allows industries to make informed choices to decrease their ecological impact.

Restraint

Rising charges for the containers

With the advancement of these containers, there is a huge upsurge in the charges of the smart containers, which has become a major hinder in the growth of the market. The primary focus of the major market players is to make these containers available at an affordable price.

Opportunity

Eco-friendly and sustainable packaging options

Due to the growing demand for sustainable and eco-friendly packaging options, the global smart containers market is surging rapidly. The rising consciousness of ecological sustainability is influencing the demand for eco-friendly and more sustainable smart shipping containers. Advancement in the Internet of Things and connectivity show several opportunities for the manufacturer of these containers. Constant advancement in IoT technologies and network expansion are anticipated to meaningfully upsurge smart container abilities.

Advanced connectivity is predictable to allow unified and faster communication between centralized systems and smart containers, and it is expected to improve advanced real-time data and complete performance. These developments can result in smarter and more consistent resolutions, proficient in carrying enhanced-quality data and a quicker response period. The cooperation between progressive IoT abilities and connectivity enhancements is designed to improve the role of smart containers in logistics, introducing opportunities for distribution chain management to be smarter and faster in the future.

Segmental Insights

Hardware Segment Held The Largest Share in 2024

The necessity for physical elements such as RFID tags, sensors, and GPS devices for real-time information and observation of the containers. These are extremely useful in maintaining the integrity of the products by monitoring the humidity level, temperature, and location of the containers. The major components, like humidity and temperature monitors, GPS sensors, and RFID tags, are the most essential for the safe and good quality transit of the high-value and perishable products. On the other hand, the software segment is growing rapidly in the market due to the growing requirement for important data, predictive maintenance abilities, and real-time observation has raised the demand for such facilities through which all the required information can easily be gathered. The incorporation of cloud computing, IoT, and AI permits faster and smarter decision-making to reduce the risk of damage to the products being transported.

Accuracy in Details Influences the GPS Segment

GPS plays an important role in getting the information about the exact locations and tracking the capabilities of the smart containers. Incorporation of such software has improved the level of security in the containers, and also, the process of optimizing the route becomes easy. It enhances the timely delivery and ensures the better condition of the products. LoRA WAN is growing rapidly because of its ability to provide low-power connectivity ideal for Internet of Things applications in logistics. It has high compatibility with varied sensors for monitoring humidity, temperature, and several other conditions that make it an adaptable option for improving efficiency and visibility.

Asset Tracking and Management Segment Held Significant Revenue Share in 2024

The asset tracking and management segment is widely accepted, as there is an urgent requirement for supply chain logistics. It is widely used to understand the condition of the containers. It allows constant monitoring that helps market players to deliver products timely manner and reduce downtime. On the other hand, the supply chain optimization segment is anticipated to grow with the highest CAGR in the market during the studied years. This enhances the efficiency and decreases the charges across logistics operations. By leveraging advanced analytics and real-time data, businesses can reduce operational costs, enhance consumer satisfaction, and improve decision-making procedures.

Maintaining Freshness and Safety in the Food and Beverage Industry

The food and segment is dominating due to the necessary requirement of the containers to maintain the safety and freshness of the food products at the time of transportation. The high-quality protection of food products with advanced technology has raised the adoption of these containers in this sector. The pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This is due to the strict necessities for maintaining and monitoring the quality of the medical products at the time of transportation. It is easy to transport temperature-sensitive chemicals, and a monitoring system enhances the convenience of transporting other heavy diagnostic equipment.

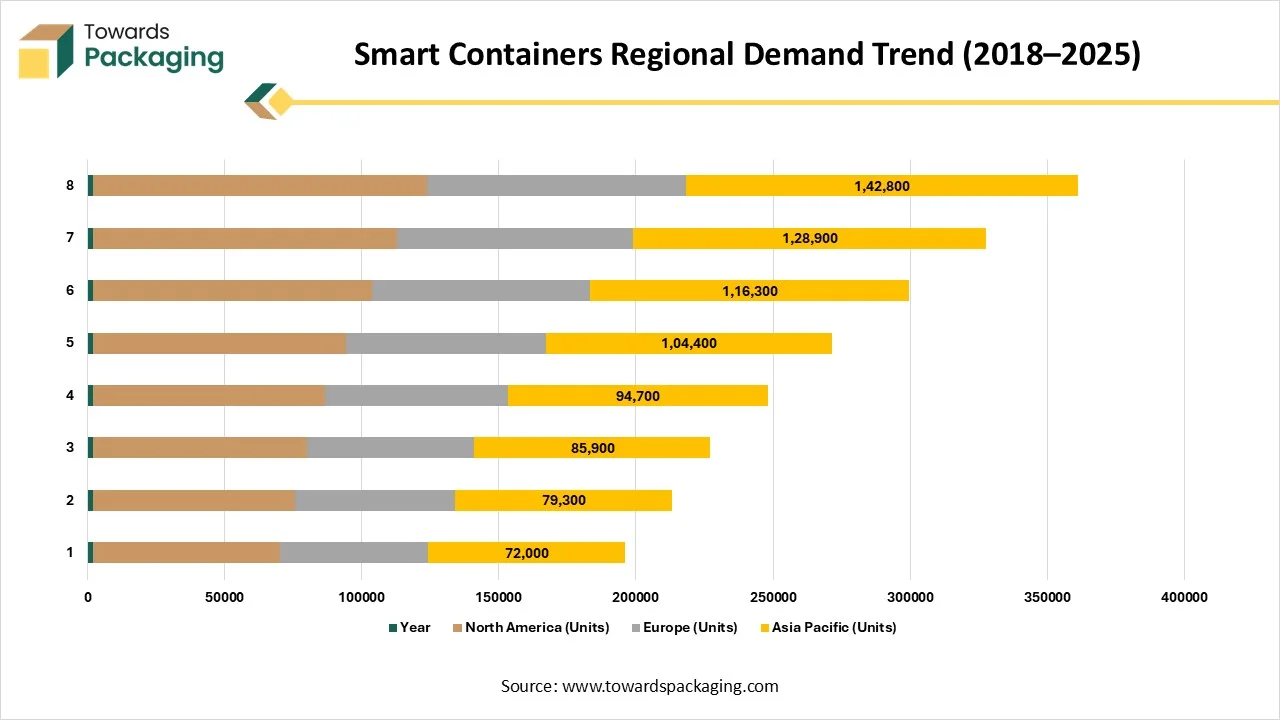

Regional Insights

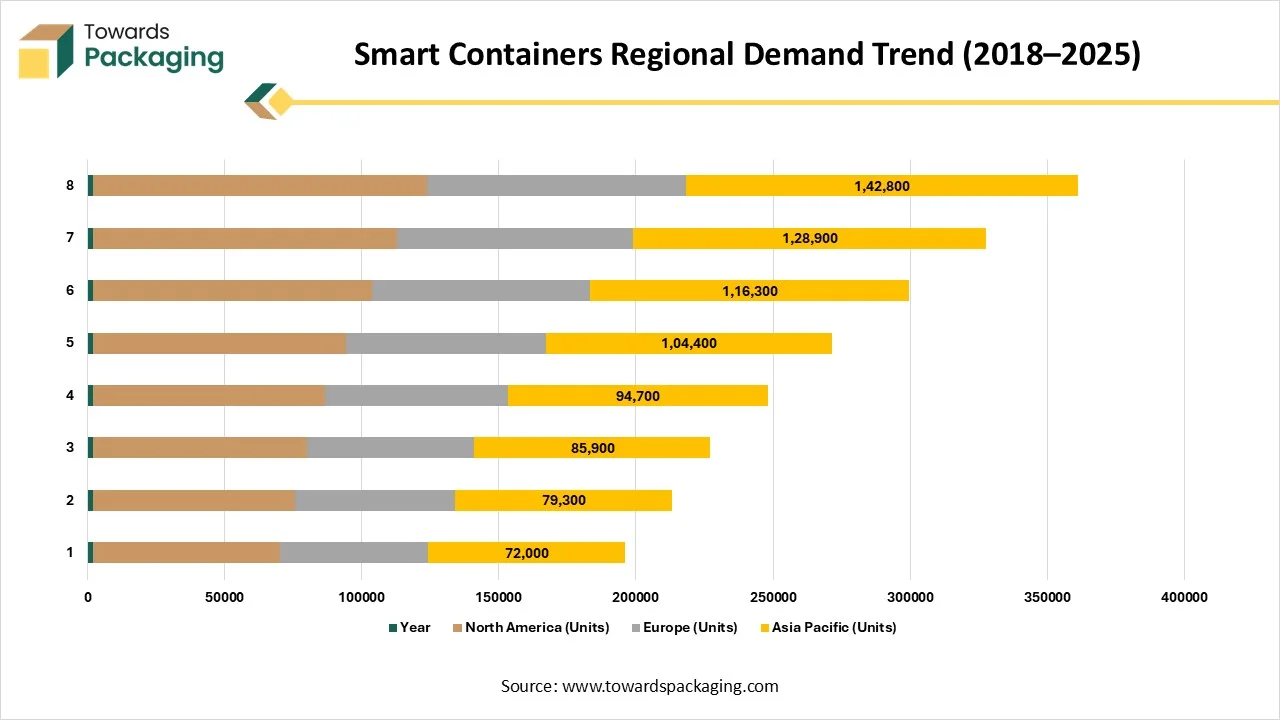

Presence of Advanced Logistics Infrastructure in North America Promotes Dominance

North America held the largest share of the smart containers market in 2024, due to the presence of advanced logistics infrastructure and rapid acceptance of IoT technologies. Countries like North America and Canada are highly focused on increasing the transparency and efficiency of the supply chain. The strict rules of the supervisory body to develop eco-friendly packaging with advanced technology to reduce the risk of damage have influenced this market development.

Smart Containers Regional Demand Trend (2018-2025)

| Year |

North America (Units) |

Europe (Units) |

Asia Pacific (Units) |

| 2018 |

68,000 |

54,000 |

72,000 |

| 2019 |

73,500 |

58,400 |

79,300 |

| 2020 |

77,900 |

61,200 |

85,900 |

| 2021 |

84,600 |

66,800 |

94,700 |

| 2022 |

92,300 |

72,900 |

1,04,400 |

| 2023 |

1,01,800 |

79,600 |

1,16,300 |

| 2024 |

1,10,700 |

86,200 |

1,28,900 |

| 2025 |

1,21,900 |

94,500 |

1,42,800 |

Asia’s Rapidly Growing Industrialization Supports Growth

Asia Pacific is anticipated to grow at the fastest rate in the smart containers market during the forecast period. In countries such as India, China, Japan, South Korea, Thailand, and several others, there is a huge upsurge in the development of industries that influence the transporting business significantly, resulting in huge demand for containers with advanced technology. The rapid industrialization and government initiatives have raised the market to develop exponentially.

Why is the U.S. Smart Containers Market Rapidly Adopting Real-time Tracking Technologies?

In the U.S., the smart containers market will see the fastest-growing demand as real-time tracking and condition monitoring technologies are purchased by logistics firms, retailers, and cold chain operators. Companies will be forced to use containers with sensors, GPS, and temperature control to reduce losses and increase container utilization due to the growth of e-commerce, pharmaceuticals, and high-value goods. Increasing automation in warehouses and ports will hasten adoption even more.

How are Sustainability Rules and Transparency Demands Driving Smart Container Growth in Europe?

In Europe, future demand will be shaped by strict regulations on cargo transparency, sustainability, and supply chain visibility. To increase efficiency, businesses will progressively switch to smart containers that provide CO2 tracking, continuous monitoring, and route optimization. Real-time data from smart containers will be crucial for integrating multimodal transportation systems as European ports rapidly digitize.

What is Fueling Germany's Rising Demand for Enabled Smart Containers?

Germany will drive strong demand for smart containers as industries such as automotive, chemicals, and machinery require more accurate tracking of valuable and sensitive shipments. Logistics players will adopt containers with advanced IoT sensors, automated alerts, and temperature/ humidity monitoring to enhance security and reduce operational delays. Germany's focus on Industry 4.0 will promote smart data-driven container systems.

In India, demand for smart containers will increase as exporters, cold chain operators, and port authorities modernize their supply chains. There will be a significant demand for containers with CPS tracking temperature logs and tamper alerts due to the expansion of pharmaceutical perishable goods and electronics logistics. Adoption will be aided by the government's drive to develop the smart logistics corridors and port digitization.

Why are Exporters in Latin America Increasingly Turning to Smart Containers?

Latin America will see rising demand because more secure and traceable shipping methods are needed for the export of mining, food, and agricultural products. For preserving cargo quality, lowering theft, and enhancing real-time visibility over lengthy and intricate routes, smart containers will be favored. Modernizing infrastructure in important trade hubs will bolster market expansion even more

What Factors are Accelerating the Adoption of Smart Containers in Brazil?

Brazil's smart containers market will grow since the automotive, chemical, and agribusiness sectors need better environmental monitoring and tracking for both domestic and international shipments. IoT-enabled smart containers will minimize spoilage, deter cargo theft, and maximize route efficiency, particularly throughout Brazil's vast geographic area. The digitization of logistics and ports will facilitate growth.

How is MEA Expanding its Trade Network, Driving the Need for the Smart Containers Market?

The MEA will experience increasing demand for smart containers as the region expands its role in global trade and develops major logistics corridors. For long-distance shipments across challenging climates, temperature-sensitive products, and high-value goods, smart containers will be crucial. Adoption will be accelerated by increased investment in free trade zones and smart ports.

Why is the UAE Emerging as a Leading Hub for the Smart Containers Market?

In the UAE, demand will rise sharply as the country strengthens its position as a hub for re-export and international logistics. When handling luxury goods, medications, and perishables, smart containers with sophisticated tracking, condition monitoring, and real-time analytics will be essential. Rapid market expansion will be fueled by the UAE's significant investments in digital supply chain systems and smart port infrastructure.

Smart Containers Market Key Players

- MSC Group

- Maersk

- CMA CGM

- COSCO Shipping Lines

- Hapag-Lloyd

- Ocean Network Express

- Evergreen Marine Corp.

- Hyundai Merchant Marine

- ZIM Integrated Shipping

- Yang Ming Marine Transport Corporation

Latest Announcements by Smart Containers Market Leaders

- In February 2025, the Chief Commercial Officer of ORBCOMM, Christian Allred, expressed, “Future supply chain resilience depends on making smart containers the industry standard, not just for real-time visibility but to protect cargo integrity and increase security.”(Source: Smart Maritime)

New Advancements in the Smart Container Market

- In February 2025, the Smart Container Alliance announced the launch of smart container systems. (Source: Smart Maritime)

- In November 2024, ZIM Integrated Shipping Services Ltd. announced about accelerating of the global deployment of smart containers, advancing visibility and transparency through the integration of Hoopo’s innovative hoopoSense Solar trackers. (Source: ZIM)

Smart Containers Market Segments

Offering Outlook

- Hardware

- Software

- Services

Technology Outlook

- Domestic Intermodal

- International Intermodal

Application Outlook

- Asset Tracking & Management

- Supply Chain Optimization

- Safety and Security

- Others

End Use Outlook

- Food and Beverages

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Others

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait