Non-cushioned Mailers Market Size, Regional Breakdown, Segments, Value Chain, Trade Data, and Key Company Profiles

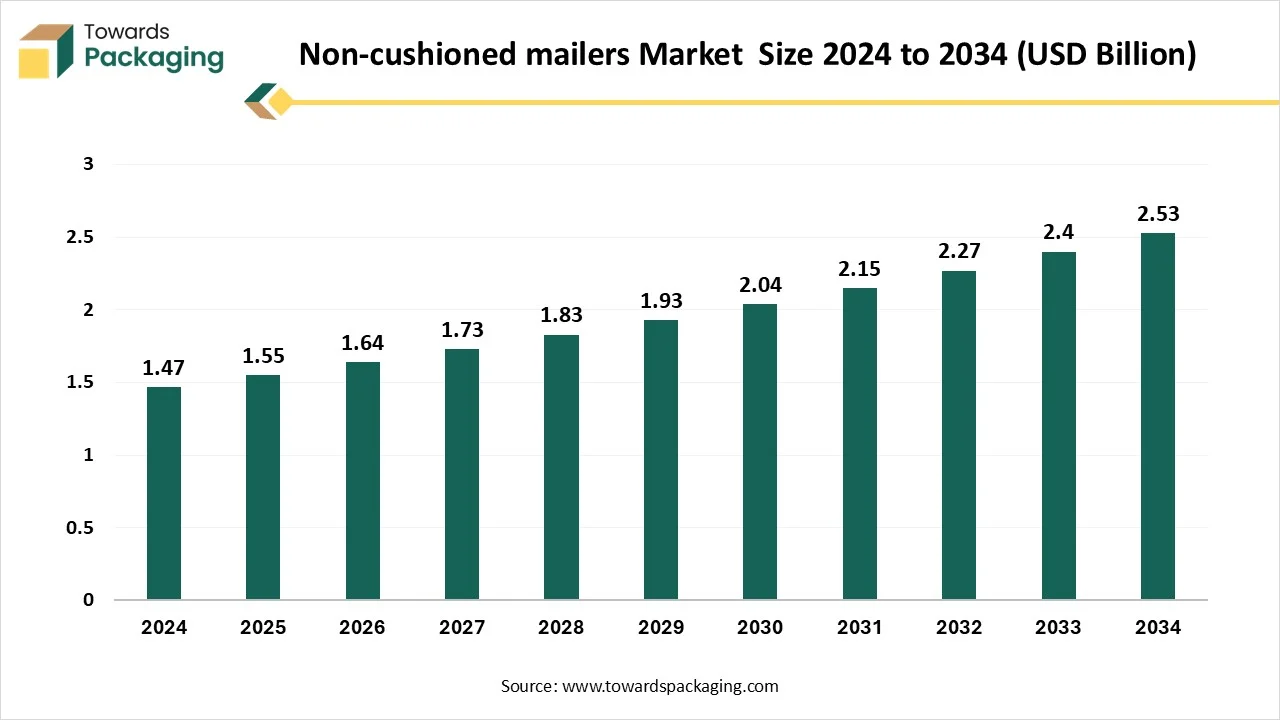

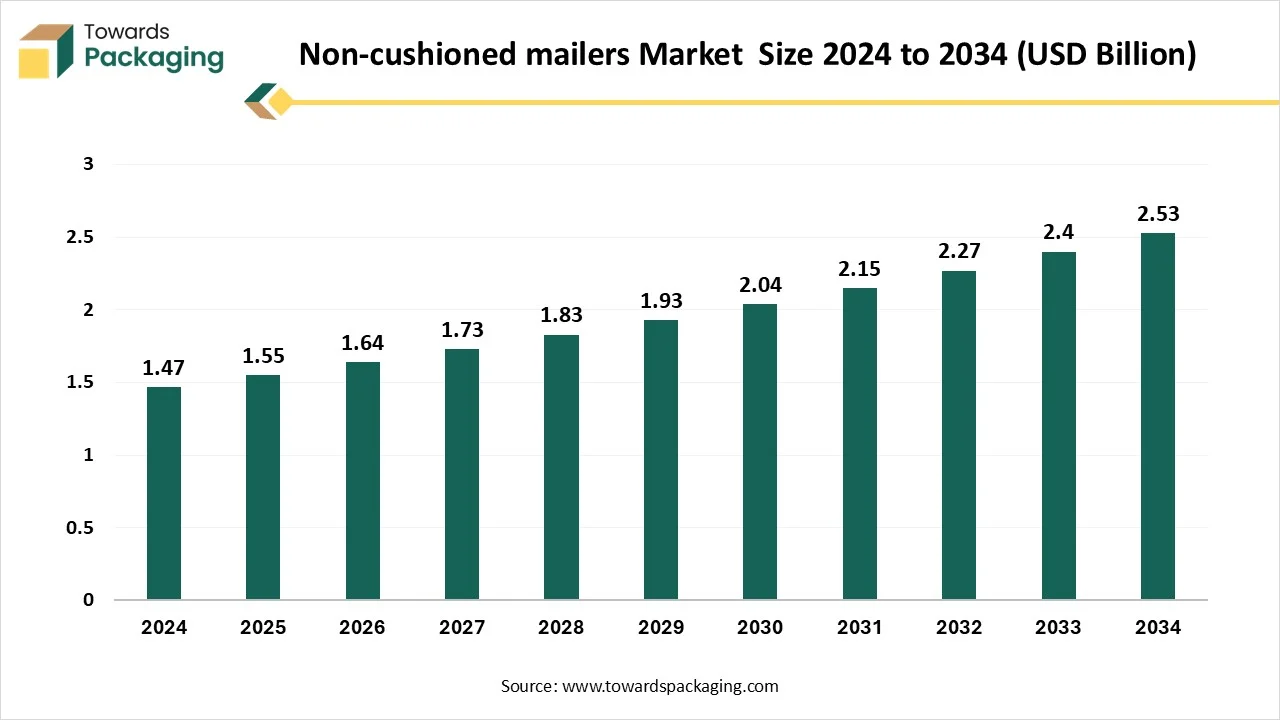

The non-cushioned mailers market is forecasted to expand from USD 1.64 billion in 2026 to USD 2.69 billion by 2035, growing at a CAGR of 5.64% from 2026 to 2035. The study highlights key trends, segment data by material type and end use, and regional performance across North America, Europe, Asia Pacific, Latin America, and MEA. It also includes an in-depth analysis of major companies, trade flows, manufacturer and supplier information, and a full value chain assessment from raw materials to distribution.

Major Key Takeaways of the Non-cushioned Mailers Market

- Asia Pacific dominated the market in 2024.

- Europe is expected to grow at a significant rate in the market during the forecast period.

- By material type, the polyethylene segment dominated the market with the largest share in 2024.

- By end-user, the shipping & logistics industry segment dominated the market with the largest share in 2024.

Market Overview

In the packaging industry, non-cushioned mailers are usually made of materials like paper, paperboard, or plastic film, offering a lightweight and economical shipping option for goods that do not require additional padding or protection during transit. Non-cushioned mailers are lightweight, cost-effective, versatile, and come in various options, ranging from white poly to reinforced kraft. They are most commonly utilised for clothing, soft toys, documents, linens, pet supplies, or lightweight products.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 1.55 Billion |

| Projected Market Size in 2035 |

USD 2.69 Billion |

| CAGR (2025 - 2035) |

5.64% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type, By End Use and By Region |

| Top Key Players |

Pregis, Sealed Air Corporation, 3M Company, Berry Global Inc., Smurfit Kappa Group, WestRock Company. |

What are Major Trends in Non-cushioned Mailers Market in 2025?

- The rising consumer shift towards sustainability is expected to drive the market’s revenue during the forecast period.

- The growing demand for lightweight and cost-effective packaging solutions is anticipated to fuel the market’s expansion during the forecast period.

- The increasing investment in eco-friendly material innovation, along with an increasing focus on reducing carbon footprints, significantly contributes to the overall growth of the non-cushioned mailers market.

- The rising demand from the healthcare and pharmaceutical sectors for secure and reliable shipping of medications and medical supplies is anticipated to accelerate the market’s growth in the coming years.

- The growing demand for quick and reliable solutions to transfer their services from one place to another, particularly in developing and developed countries, supports the growth of the non-cushioned mailers market during the forecast period.

How is Artificial Intelligence Integration Impacting the Growth of the Non-cushioned Mailers Market?

As technology continues to evolve, Artificial intelligence integration is significantly revolutionizing the entire packaging landscape. AI-powered systems assist in streamlining processes to maximize resource efficiency and minimize waste throughout the entire packaging lifecycle. Machine Learning (ML) can effectively detect flaws in packaging materials, minimize material waste, and eliminate the chances of errors. AI can also improve the efficiency of inspection processes in the market, ensuring high-quality, lightweight, and cost-effective products. AI-powered solutions provide predictive maintenance, identifying potential risk, which further assists in reducing maintenance costs and improving equipment uptime.

Market Dynamics

Driver

Expansion of Transportation Industry

The rising demand for non-cushioned mailers in the logistics and transportation industry is expected to boost the growth of the market. In the logistics and transportation industry, non-cushioned mailers is widely used for product protection, reduced product damage, and improved handling efficiencies. Non-cushioned mailers assists in protecting the products from various environmental factors, such as dust, dirt, water, moisture, and other contaminants. UVI stretch film rolls can even protect the load from UV rays. Non-cushioned mailers maximizes the warehouse space while storing the products.

Restraint

Environmental and Regulatory Pressures

The rising environmental concerns related to plastic waste is anticipated to hinder the market's growth. The increasing regulatory pressures on packaging industries are pushing them to adopt sustainable alternatives. In addition, the fluctuation in the price of raw materials polymer-based materials which are widely in the production of stretch films, can adversely impact the profitability of manufacturers. Such factor may hinder the growth of the global non-cushioned mailers market during the forecast period.

Opportunity

Sustainable Packaging Solutions

The rising focus on sustainable and eco-friendly packaging solutions is projected to offer lucrative growth opportunities to the growth of the non-cushioned mailers market in the coming years. Sustainable stretch wraps offer an eco-friendly alternative to traditional plastic stretch films and are specifically designed to be recycled and reused. It assists businesses in reducing their carbon footprint and becoming more environmentally conscious. Moreover, the rising environmental concern has led the sustainable stretch wrap to gain immense popularity, as well as encouraged businesses to invest in eco-friendly packaging solutions such as biodegradable films, recycled stretch wrap, and others. Thus, driving the expansion of the market during the forecast period.

Segmental Analysis

How Polyethylene (PE) Segment Dominated the Market in 2024?

The polyethylene segment held a dominant presence in the non-cushioned mailers market in 2024, owing to its cost-effectiveness, affordability, and versatility. Polyethylene (PE) offers high strength-to-weight ratios, minimizing shipping costs and making handling easier. Polyethylene (PE) stretch wrap can tightly cover the goods, which protects the product and reduces product damage during storage and transit. Polyethylene (PE) stretch wrap can be waterproof and dustproof with high transparency. On the other hand, the Polyvinyl Chloride (PVC) segment is expected to grow at a significant rate. The growth of the segment is attributed to the rapid expansion of the food industry, owing to its high oxygen transmission rate.

Huge Demand from the Shipping & Logistics Industry Supported the Segment’s Dominance

The shipping & logistics industry segment accounted for a significant share of the non-cushioned mailers market in 2024. Stretch wrap is a versatile material used to secure and protect goods as well as keep the load stable during transit and storage. To ensure that the goods arrive safely, stretch wrapping films offer various features to the shipping & logistics Industry, such as multi-directional stretching, load adaptability, and UV resistance. Stretch film plays a crucial role in the shipping and logistics industry. It offers protection, durability, affordability, and versatility, which makes it ideal for businesses of all sizes.

Regional Insights

Asia Pacific: New Manufacturing Technologies to Promote the Dominance

Asia Pacific held the dominant share of the non-cushioned mailers market in 2024. Asia Pacific, especially India and China., have a well-established packaging sector supporting food & beverage, healthcare, and consumer goods industries, all are major users of non-cushioned mailers. The region's high per capita income drives demand for packaged products, especially in e-commerce, retail, and FMCG sectors.

American and European established manufacturers are investing heavily in AI-driven automation in stretch wrapper systems in Asian countries. For instance, In September 2024, Combi Packaging Systems announced the launch of BeeWrap+ Robotic Stretch-Wrapping Technology.

The region’s strong focus on sustainable packaging practices and strict environmental regulations has significantly increased the adoption of sustainable stretch wrap films. Moreover, the rapid growth of e-commerce and the surge in global trade necessitate robust and reliable packaging solutions, contributing to the overall market expansion in the region.

Europe’s Sustainable Initiative to Project Notable Growth

The Europe region is expected to grow at a notable rate in the foreseeable future. The growth of the region is mainly attributed to the growing demand for eco-friendly and biodegradable stretch films, rising integration of automation in packaging processes, and increasing emphasis on improving recyclability. The key players operating in the Europe region have a strong focus on high-performance and sustainable packaging solutions.

- For instance, in December 2023, Mondi, a leading player in packaging and paper, introduced its Advantage StretchWrap, a fully recyclable kraft paper wrapping solution that replaces plastic stretch film and enables a more efficient logistics process, to Sentrex, a European manufacturer of paper bags.

Advantage StretchWrap has 62% lower greenhouse gas (GHG) emissions when compared to virgin plastic stretch film, and 49% lower GHG emissions when compared to plastic film made with 50% recycled content.

European countries such as the Netherlands, Spain, France, Germany, and the UK are leading with robust recycling measures and extended producer responsibilities (EPRs). Policies like the European Union’s Circular Economy Action Plan significantly reduce plastic and encourage companies to invest more in sustainable packaging solutions.

- In addition, the rapid expansion of the e-commerce and retail sectors in the region is anticipated to propel the market’s growth during the forecast period. For instance, according to the International Trade Administration, Europe is experiencing one of the largest retail e-commerce markets globally, with total revenues of USD 631.9 billion in 2023. An annual growth rate of 9.31% for revenues is anticipated to reach a total of USD 902.3 billion in European retail ecommerce sales by 2027.

Non-cushioned Mailers Market Key Players

The Latest Announcement by the Industry Leaders

- In June 2024, Pregis, a Chicago-based protective packaging manufacturer, unveiled that it has advanced the sustainability of its line of EverTec mailers with the introduction of paper certified to the Sustainable Forestry Initiative (SFI) standard. The company stated that choosing SFI assures that the Pregis supply chain supports environmental, social, and governance (ESG) commitments.

Recent Developments

- In August 2024, Pregis, a leading global manufacturer of protective packaging, mailing and bagging, and flexible packaging solutions, has made significant investments in new production lines at its Bethel, Pennsylvania, and Reno, Nevada facilities to increase capacity for its Pregis EverTec mailer portfolio, with a particular focus on the EverTec Non-Cushioned Mailer.

- In September 2024, Mondi, a global leader in sustainable packaging and paper, launches its new recyclable Protective Mailers made entirely of paper. The innovative mailers, developed in collaboration with Amazon, enable e-commerce companies to securely ship goods without the need for plastic bubble wrap, while remaining fully recyclable in conventional paper waste streams. The Protective Mailers are made from Mondi’s strong but lightweight kraft paper and open-flute material, offering a unique combination.

Non-cushioned Mailers Market Segmentations

By Material Type

- Polyethylene

- Kraft Paper

- Metallic Foil

- Polypropylene

- Bubble-lined

- Corrugated

By End Use

- Postal Services

- E-commerce and Retail

- Healthcare and Pharmaceuticals

- Apparel and Fashion

- Food & Beverages

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait