Clarified Polypropylene Bottles Market Growth Forecast, Regional Insights, Value Chain Analysis, Key Players

The Clarified Polypropylene Bottles market covers complete market size projections from 2025 to 2034, driven by the expansion of e-commerce, food and beverage packaging, and personal care demand. This analysis includes detailed segmentation by manufacturing process (injection molding, blow molding, ISBM), applications (cold-fill, hot-fill), and end-use industries. Regional data spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with APAC leading the global share in 2024. The report includes company profiles of Amcor, Berry Global, LyondellBasell, ExxonMobil, Graham Packaging, and others, along with competitive analysis, cost structure insights, trade statistics, supply chain mapping, and manufacturer–supplier ecosystem data.

Key Insights

- Asia Pacific dominated the clarified polypropylene (PP) bottles market in 2024.

- North America is expected to grow at a significant CAGR during the forecast period.

- The European market is growing at a notably.

- By manufacturing process, the injection stretch blow molding (ISBM) segment dominated the market with the largest revenue share in 2024.

- By application, the cold-fill applications segment registered its dominance over the global market in 2024.

- By end-user, in 2024, the food and beverages segment held the largest revenue share.

Market Overview

Clarified polypropylene bottles are known as bottles manufactured from polypropylene plastic that has been clarified to make it more transparent than standard polypropylene. Polypropylene that has been treated with clarifying agents, usually special nucleating agents that improve its optical clarity, making the plastic more see-through or translucent. Clarified polypropylene provides a more glass-like, clear appearance while retaining PP’s toughness.

Key Metrics and Overview

| Metric |

Details |

| Key Market Drivers |

- Rise in e-commerce & personal care

- Lightweight & sustainable packaging

- Advanced molding technologies |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Manufacturing Process, By Application, By End-User Industry and By Region |

| Top Key Players |

Berry Global, Amcor, Plastipak, AG Poly Packs, ExxonMobil, LyondellBasell, Formosa Plastics, Kee Pet Containers, Graham Packaging, Apsara Plastics |

What Are the New Trends in the Clarified Polypropylene (PP) Bottles Market?

Eco-Friendly and Sustainability Innovations

Manufacturers are investing in biodegradable and bio-based PP materials to address environmental concerns and meet regulatory requirements. Advancements in recycling technologies, including chemical and mechanical recycling, are enhancing the efficiency and quality of recycled PP, promoting a circular economy.

Technological Advancements in Manufacturing

Technologies such as injection molding, blow molding, and thermoforming have improved production efficiency and enabled the creation of complex, customized bottle designs. Integration of smart technologies, including QR codes and RFID tagging, is enhancing supply chain transparency, product authentication, and consumer engagement.

Enhanced Functionalities for Specific Applications

Development of antimicrobial coatings and advanced barrier technologies is improving product safety, shelf life, and suitability for pharmaceutical and food packaging. Clarified PP bottles offer a balance of clarity, strength, and lightweight properties, making them ideal for various applications, including personal care and beverages.

How Can AI Improve the Clarified Polypropylene (PP) Bottles Market?

In the clarified polypropylene (PP) bottles market, AI can analyze data from machinery to predict when maintenance is needed, reducing unplanned downtime and increasing operational efficiency. AI algorithms can adjust injection molding or blow molding parameters in real time to optimize material use and cycle times. Machine learning models can minimize energy consumption by optimizing heating and cooling cycles in production. AI-powered vision systems can inspect bottles for defects (e.g., bubbles, inconsistencies in clarity, shape deformities) far more accurately and faster than human inspectors.

Continuous data analysis helps identify quality deviations early, reducing scrap rates and ensuring consistent product performance. AI can fine-tune designs to use less material without compromising strength or transparency, supporting sustainability goals. AI can help sort and classify different grades of PP more accurately, improving the efficiency of recycling processes. AI can analyze market trends, seasonality, and sales data to predict demand and optimize inventory levels. Machine learning models can improve delivery routes and warehousing strategies, reducing transportation costs and emissions.

AI tools can analyze market feedback and trends to help brands develop more appealing bottle designs (e.g., ergonomic, aesthetic, or functional). Generative design algorithms can propose optimal bottle shapes and structures based on strength, transparency, and aesthetic goals. AI can monitor competitor activities, pricing strategies, and new product launches to inform business decisions. AI systems can automatically update databases with changing plastic regulations globally, helping manufacturers stay compliant.

Market Dynamics

Driver

Growth in E-Commerce Sales and Expansion in the Cosmetics and Personal Care Industry

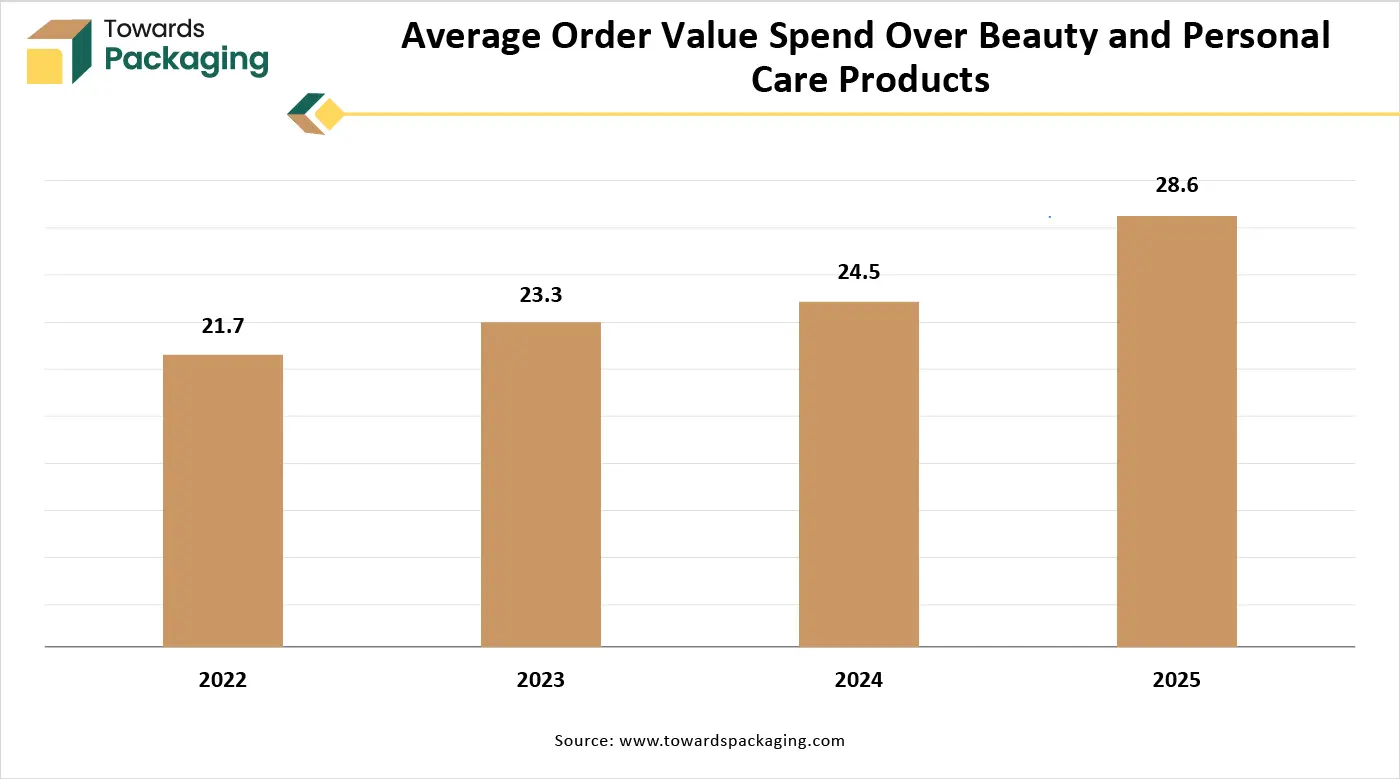

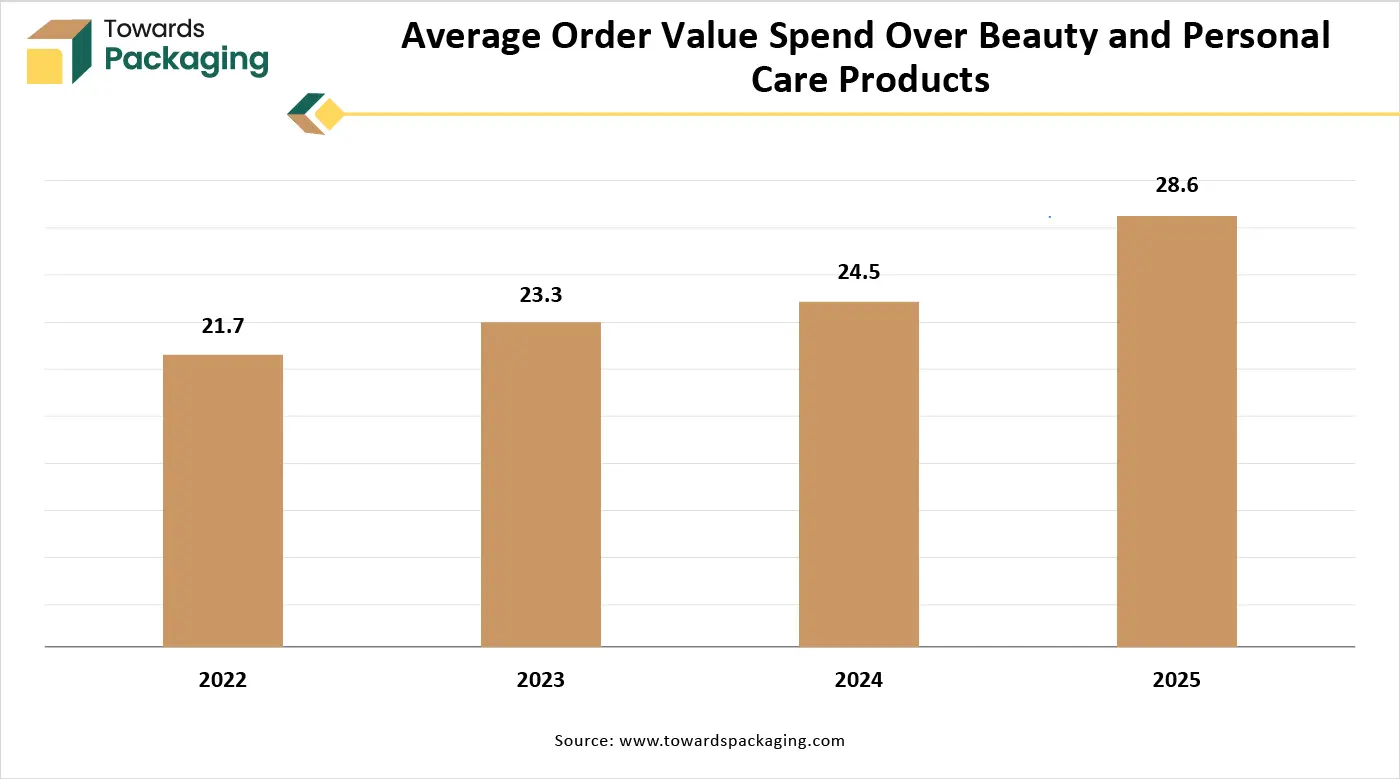

Clarified PP bottles have high moisture barriers and chemical resistance, making them suitable for cosmetics and personal care products packaging. Their clarity and resistance to oils/chemicals make them popular in personal care packaging. Brands leverage the visual clarity of PP bottles for better shelf presence. Clarified polypropylene bottles allow for integrated tamper-proof features, enhancing trust in e-commerce sales.

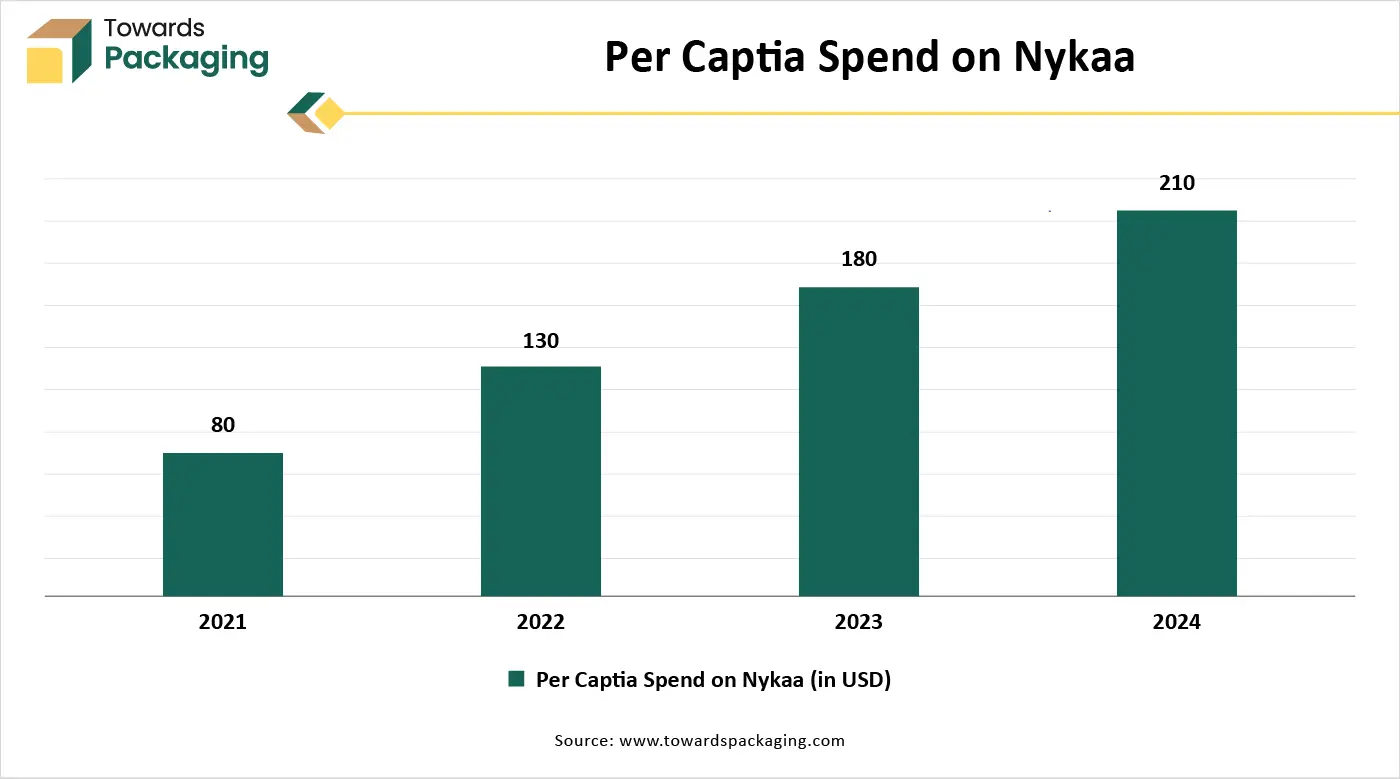

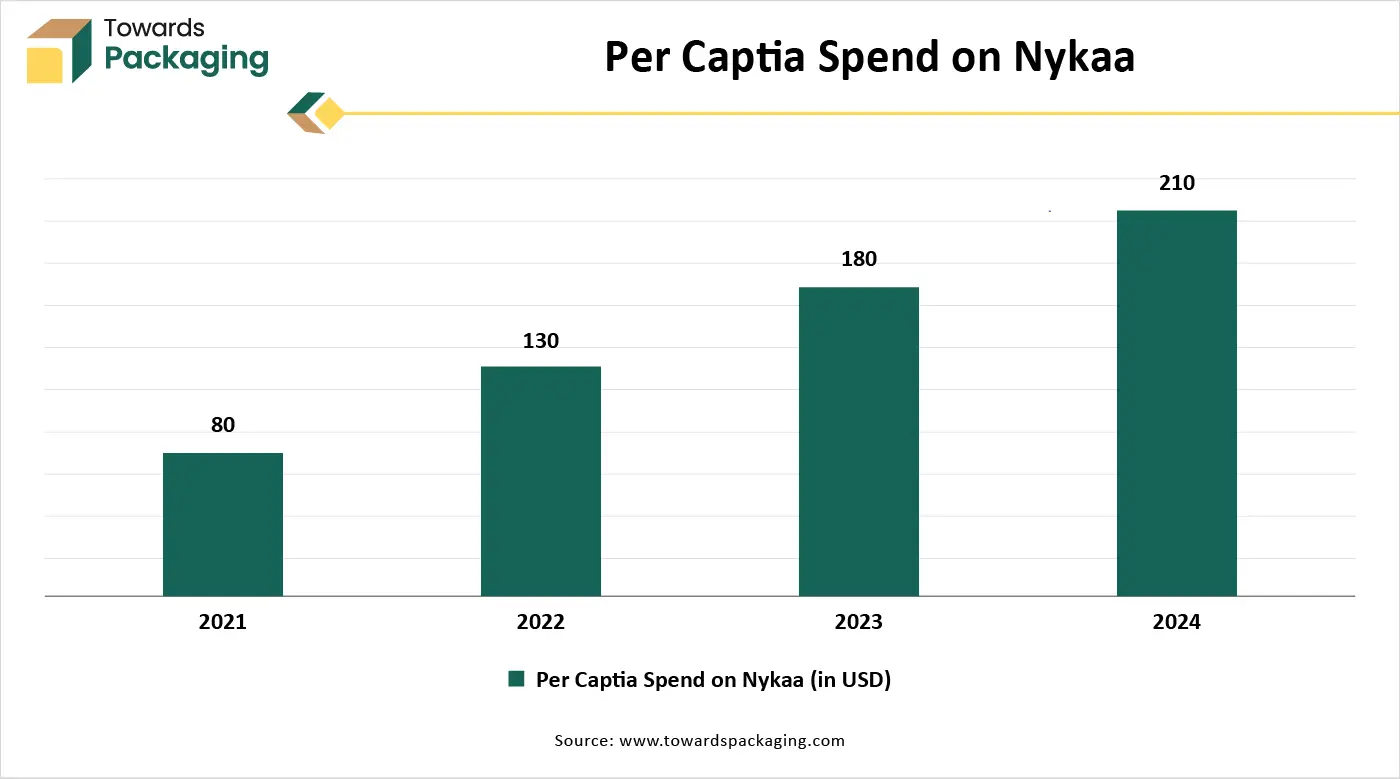

- In February 2025, according to the data published by the ASEAN Cosmetics Association, Inc., estimated that Nykaa reported a 61% increase in consolidated profit after tax for the December quarter, reaching 26.12 crore, while its operating revenue increased by 27%. The parent business of Nykaa, a cosmetics and fashion shop, FSN E-Commerce Ventures, released its Q3 earnings. The online beauty and fashion platform's Q3 profit after tax increased by 61% to 26 crores, while its operating revenue increased 26.7% year over year to 2,267.21 crore from 71,788.80 crore in the same quarter last year.

Restraint

Heat Resistance Limitations and Limited Barrier Properties

The key players operating in the clarified polypropylene (PP) bottles market are facing issues due to heat resistance limitations & limited barrier properties, which are estimated to restrict the growth of the market. Clarified PP has a relatively lower heat resistance compared to some alternatives, making it less suitable for hot-fill applications or products that require sterilization. Clarified PP has inferior gas and moisture barrier properties compared to PET or multilayer packaging, which can be a critical disadvantage for certain food, beverage, or pharmaceutical applications.

Opportunities

Advanced Manufacturing and Automation

Investing in AI, IoT, and automation improves efficiency, quality control, and sustainability, lowering costs and increasing competitiveness. Innovation of thin-wall & lightweight design tech. Using less material while maintaining strength and clarity creates a cost and environmental advantage. For instance, in March 2025, at ProMat 2025, the leading trade show for the packaging and material handling sector, Ranpak Holdings Corp., a global leader in environmentally friendly paper-based packaging automation solutions for e-commerce and industrial supply chains, is poised to make waves. Ranpak is influencing the direction of environmentally friendly packaging and securing its position as one of the top brands in supply chain and manufacturing with three ground-breaking product launches.

Expansion in High-Growth End-Use Industries

Cosmetics and personal care brands are seeking clear, attractive, and chemically resistant bottles—ideal for clarified polypropylene. Growing healthcare needs, especially in aging populations, drive demand for safe, tamper-evident, and transparent bottles for syrups and oral solutions. Clarified PP’s compatibility with hot-fill processes and excellent barrier properties make it a great alternative to glass or PET in juices, sauces, and dairy.

Segmental Insights

Why did the Injection Stretch Blow Molding (ISBM) Segment Dominate the Clarified Polypropylene (PP) Bottles Market in 2024?

The injection stretch blow molding (ISBM) segment held a dominant market presence in 2024 due to its superior clarity and optical properties. ISBM allows for uniform wall distribution and orientation of polymer chains, which enhances transparency, critical for clarified PP bottles. It supports the use of clarifying agents effectively during the process. The biaxial orientation from stretching improves impact resistance, tensile strength, and barrier properties. This makes clarified PP bottles suitable for carbonated drinks, pharmaceuticals, and hot-fill applications.

Injection stretch blow molding enables thinner walls without compromising strength, making bottles lighter and more sustainable. It helps in reducing material usage and shipping costs. It allows for tight control of bottle necks, threads, and shapes—important for tamper-proof caps or custom designs. The injection stretch blow molding is ideal for high-end packaging where aesthetic appeal is crucial. Clarified polypropylene requires precise temperature control and orientation to maintain clarity, which ISBM provides. ISBM offers high-speed production and reduced cycle times, making it cost-effective for large-scale manufacturing.

Cold-Fill Applications Lead the Market

Clarified polypropylene bottles provide excellent clarity, making them visually appealing for cold beverages, juices, dairy products, cosmetics, and personal care. While PP can tolerate high heat (used in hot-fill too), it performs exceptionally well at room and refrigerated temperatures, ideal for cold-fill products. Increasing global consumption of bottled water, juices, smoothies, iced teas, and functional drinks drives demand for cold-fill packaging. Clarified polypropylene bottles are lightweight and recyclable, making them attractive for convenience packaging in cold drinks and personal care.

Cold-fill processes are common in ready-to-drink (RTD) health and wellness products, which prefer clear, lightweight, and non-glass packaging. Cold-fill applications often target retail environments, where visual clarity helps brands showcase their product color, purity, or texture. Clarified PP provides glass-like transparency without the fragility, appealing to both manufacturers and consumers. Cold-fill processes are simpler and cheaper than hot-fill or aseptic filling, requiring less equipment and energy. Clarified polypropylene works well with these systems, offering affordable, mass-producible packaging solutions. The increasing consumer focus on sustainability and safety favours PP over less recyclable or more brittle plastics.

Which End-User Dominated the Clarified Polypropylene (PP) Bottles Market in 2024?

The food and beverages segment registered its dominance over the global clarified polypropylene (PP) bottles market in 2024. Clarification additives are used to improve the transparency of polypropylene, making the bottles look more like glass or PET (polyethylene terephthalate). Consumers associate clear packaging with freshness and cleanliness, especially important for products like juices, sauces, and dairy. Polypropylene is highly resistant to acids, bases, and organic solvents, making it ideal for packaging a wide range of foods and beverages without the risk of leaching or degradation. It doesn’t react with food ingredients, preserving taste and safety.

Clarified PP is lighter than glass or PET, reducing shipping costs and energy usage during transportation. It’s cheaper to produce compared to many other clear plastics, especially with improved processing techniques. Unlike PET, which warps at high temperatures, clarified PP bottles maintain integrity during filling and reheating. Polypropylene is recyclable and gaining popularity in sustainability initiatives. Many clarified Polypropylene products are now being designed with mono-material packaging strategies, improving ease of recycling. Clarified Polypropylene does not absorb or impart flavours or odors, which is vital for maintaining product quality over shelf life.

Regional Insights

What Does Asia Pacific Dominant the Clarified Polypropylene (PP) Bottles Market?

Asia Pacific holds the largest revenue share of the market, owing to the robust manufacturing facilities in the region. Countries like China, India, and Indonesia have massive populations with rising urbanization. The region is witnessing a boom in food delivery, supermarkets, and e-commerce, all of which require high-quality, durable, and clear plastic packaging. This drives high demand for packaged food and beverages, personal care, and household products — all major applications of clarified PP bottles. Clarified PP bottles are preferred due to clarity, chemical resistance, and cost-efficiency. Countries like China, India, Thailand, and Vietnam have extensive plastic and polymer manufacturing industries.

Chinese Market Driven by the Production and Consumption Volumes in the Country

China is the world’s largest producer and consumer of polypropylene, accounting for over 35 million metric tons in 2022. This robust production capacity supports various industries, including packaging, automotive, and construction, fueling the demand for polypropylene bottles. In 2024, China held approximately 36% of the Asia Pacific plastic bottles and containers that were recycled, underscoring its significant role in the region. The country’s strong manufacturing infrastructure and extensive supply chain network contribute to this dominance. Chinese manufacturers are investing in research and development to improve product quality and meet international standards, particularly in food-grade and pharmaceutical packaging. This commitment to innovation enhances the competitiveness of China’s polypropylene bottles in the global market.

North America Boasts Superior Manufacturing and Packaging Technologies

North America, especially the U.S., is home to some of the most advanced plastics manufacturing and packaging technologies. Consumers in North America rely heavily on ready-to-eat meals, microwavable foods, bottled beverages, and portion-controlled packaging. North America is home to major players like Dow, ExxonMobil, Berry Global, Milliken & Company, etc. These companies develop, produce, and distribute clarified PP resins and finished bottles across global supply chains. Consumers in North America seek premium packaging that is visually appealing (clear, glass-like) and functions effectively (microwave-safe, spill-proof).

Which Country Leads the North American Clarified Polypropylene (PP) Bottles Market?

The U.S. dominates the North American market is driven by the robust healthcare and pharmaceutical industries in the country. U.S. companies are increasingly focusing on sustainable packaging solutions. For instance, Berry Global introduced ClariPPil bottles, a recyclable polypropylene alternative to colored PET pill bottles, offering up to 71% lower carbon emissions during production. The U.S. leads in innovation, investing in advanced recycling technologies to promote sustainability. Companies like Procter & Gamble and Coca-Cola use recycled polypropylene to meet consumer demand for eco-friendly products.

Europe’s Government Initiatives to Project Steady Growth in 2024

The European market is expected to grow at a notable rate in the foreseeable future. The regulatory framework of Europe influences the growth of the market in the country. The European Food Safety Authority (EFSA) and other regulatory bodies enforce strict packaging safety standards, encouraging the use of non-toxic, recyclable, and compliant materials like clarified polypropylene. Europe has a large, mature food and beverage industry that demands high-quality, safe, and clear packaging materials—ideal use cases for clarified PP bottles. Europe's advanced pharmaceutical sector requires packaging with high transparency, chemical resistance, and compliance with stringent regulations.

Clarified Polypropylene (PP) Bottles Market Players

- Amcor

- Berry Global

- Plastipak

- AG POLY PACKS PRIVATE LIMITED

- Apsara Plastic Industries

- Pranil Polymers Ltd

- Kee Pet Containers

- Shriram Plastic Industries

- National Bottle House

- Sony Plastics

- Tulsion Pet Industries

- Graham Packaging Co. Inc.

- Midwest Can Company

- Burch Bottle & Packaging

- Feldman Industries

- CS Hyde Company

- LUPOL

- Formosa Plastics Corporation

- Exxon Mobil Corporation

Latest Announcements by Industry Leaders

- Agilyx CEO Ranjeet Bhatia remarked that Agilyx is dedicated to creating a global sourcing platform to support Agilyx ASA’s interests in Cyclyx. Carlos has an unmatched understanding of the cutting-edge recycling sector and is a leader in the profession.Through Agilyx's joint ownership stake, the Agilyx ASA company is bringing together Plastyx and Cyclyx's industry-leading feedstock management skills to create an innovative first mover in this crucial market niche. [Source: PR Newswire]

New Advancements in Clarified Polypropylene (PP) Bottles Industry

- In October 2024, Berry Global introduced a line of healthcare-use clarified polypropylene bottles that provide better product protection and sustainability than conventional colored PET pill bottles. A vast range of items, including vitamins, nutraceuticals, nutritional supplements, cosmetic supplements, and over-the-counter medications, are perfect for ClariPPil bottles. [Source: Pharma Manufacturing News]

- In March 2025, LyondellBasell, a leading global chemical company, announced the introduction of Pro-fax EP649U, a novel polypropylene impact copolymer intended for the rigid packaging sector. Specifically designed for thin-walled injection molding, this novel product is perfect for applications involving food packaging. High flow characteristics and quick crystallization make it possible to produce thin-walled containers with LyondellBasell Pro-fax EP649U in an efficient manner, improving output and product quality. [Source: LyondellBasell]

Global Clarified Polypropylene (PP) Bottles Market Segments

By Manufacturing Process

- Injection Molding

- Blow Molding

- Injection Stretch Blow Molding (ISBM)

By Application

- Cold-Fill Applications

- Hot-Fill Applications

By End-User Industry

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Household Chemicals

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait