Polypropylene Disposable Food Containers Market Size, Demand and Trends Analysis

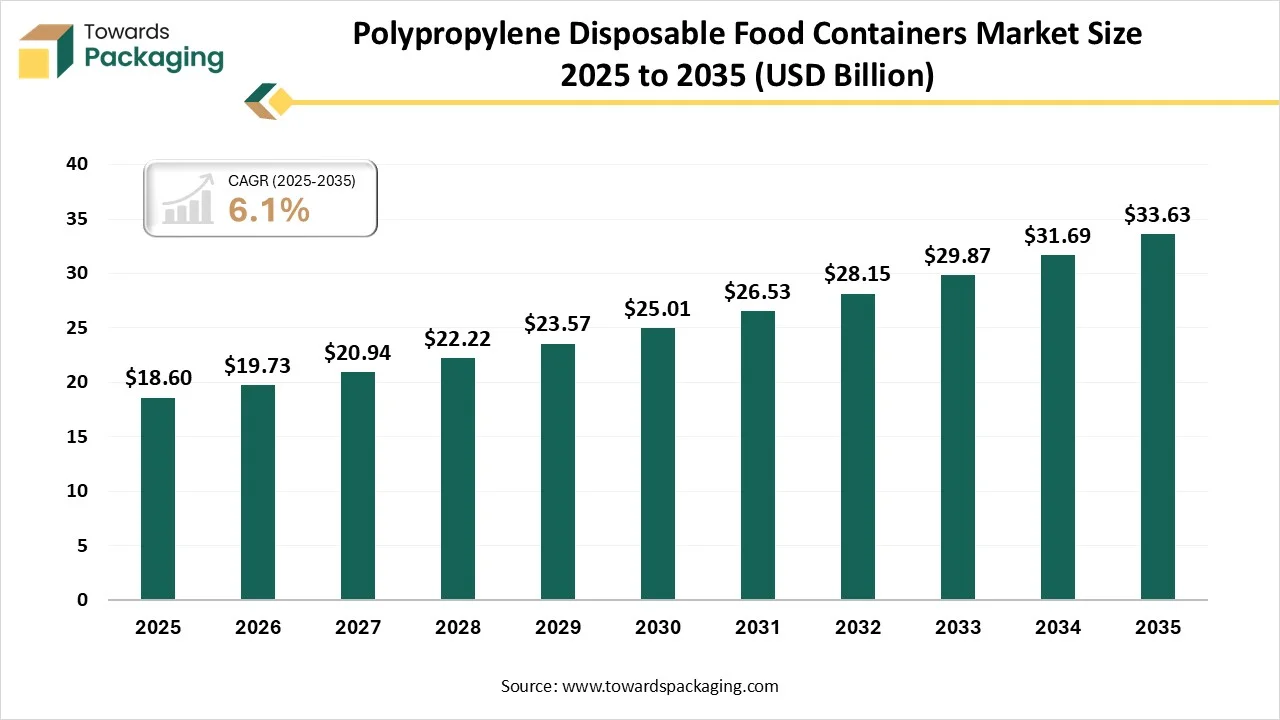

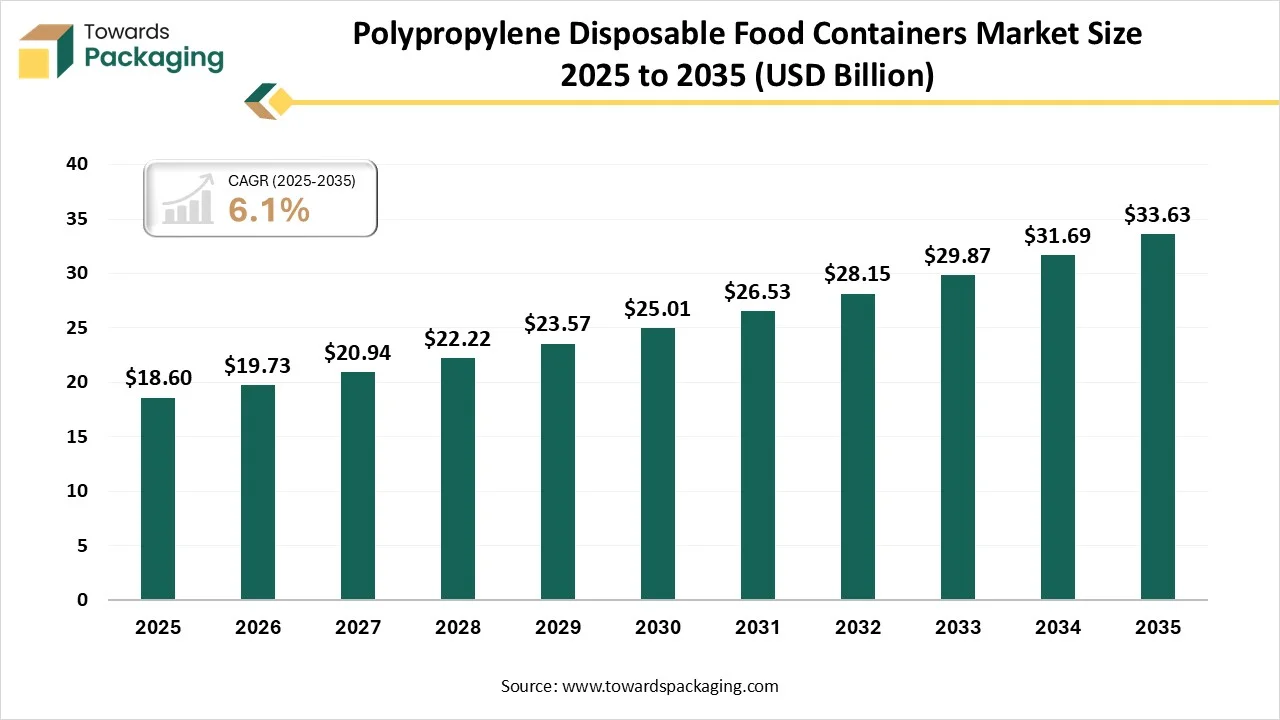

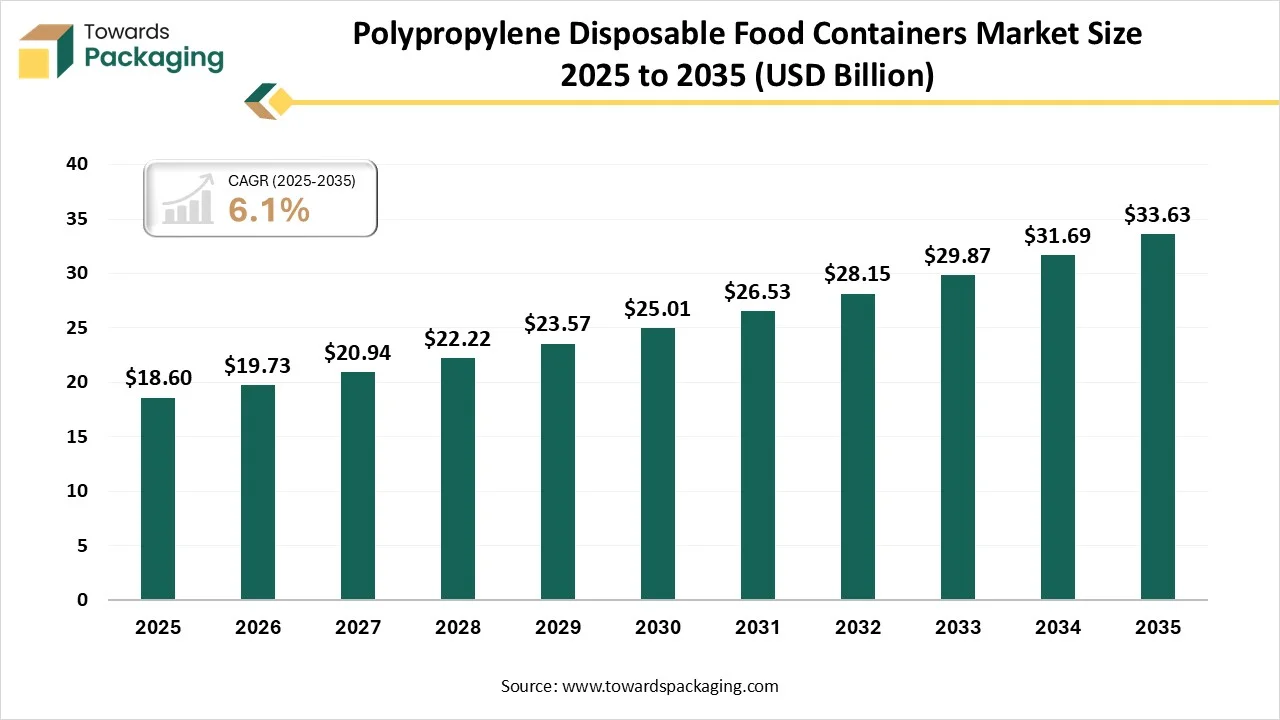

The polypropylene disposable food containers market is forecasted to expand from USD 19.73 billion in 2026 to USD 33.63 billion by 2035, growing at a CAGR of 6.1% from 2026 to 2035. The growth is because PP can firmly stand as a huge series of chemicals, which ensures the food containers' packaging material does not react with the item and maintains its reliability.

Major Key Insights of the Polypropylene Disposable Food Containers Market

- In terms of revenue, the market is valued at USD 18.6 billion in 2025.

- The market is projected to reach USD 33.63 billion by 2035.

- Rapid growth at a CAGR of 6.1% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific dominated the global market by holding the highest market share in 2025.

- By region, North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By product type, the tubes and jars segment dominated the market in 2025.

- By product type, the clamshell containers segment will be growing at a significant CAGR between 2026 and 2035.

- By material type, the polypropylene segment dominated the market in 2025.

- By material type, the bio-based segment will be developing at a main CAGR between 2026 and 2035.

- By shape, the rigid containers segment dominated the market in 2025.

- By shape, the flexible containers segment will be growing at a significant CAGR between 2026 and 2035.

- By end-use, quick service restaurants and food service segments have dominated the market.

- By end-use, food delivery segments will be developing at a main CAGR between 2026 and 2035.

What is the Polypropylene Disposable Food Containers?

Polypropylene disposable food containers are famous, safe, and a perfect option for food packaging because of their heat resistance, durability, and resistance to chemicals. They are easily accessible and available in various sizes and shapes for domestic and commercial usage. They are a food-grade plastic that is being checked by the FDA, which is naturally BPA-Free, ensuring no toxic chemicals are mixed into the food.

Trends in Polypropylene Disposable Food Containers Market

- Smart Packaging: The capability of smart packaging incorporates technology directly into the containers. Hence, temperature indicators, such as updated color if food is being stored at insecure temperatures, develop sensors and lower the risk of foodborne illness.

- Circular Systems: One of the discoverable inventions is the development of complete circular systems for disposable containers. Such systems concentrate on the compostable or recyclable containers, which lowers the landfill waste.

- Acceptance of Changing Consumer Expectations: User expectations are developing, with a growing importance on ethical choices and sustainability, too. This has driven the growth of inventive materials and designs.

- Navigating Evolving Regulations: Along with transforming predictions, regulations are changing the future of disposable food containers. Several regions are banning single-use plastics and marketing the eco-friendly alternatives. Such regulations push businesses to adopt sustainable packaging and invest in inventions, which makes a more sustainable future for the sector.

- Market Growth Overview: The polypropylene disposable food containers industry is expanding as the food sector grows, and the urge for cost-effective, durable, and sustainable packaging continues to develop. These trays analyze such boxes, which serve as a perfect alternative to regular styrofoam and plastic.

- Global Expansion: The global expansion of polypropylene disposable food containers is developing the urge for recyclable and sustainable packaging solutions for developing industrialization and fast urbanization.

- Major Market Players: The major market players in the polypropylene disposable food containers are Drat Container Corporation, Reynolds Group Holdings, Pactiv Evergreen, Huhtamaki Group, and Anchor Packaging, too.

- Startup Ecosystem: The startup ecosystem for the polypropylene disposable food containers has moved from regular high-volume production towards a circularity-as-a-service big-purity recycling, and high-level purity recycling, and lastly advanced material changes.

Technological Developments in the Polypropylene Disposable Food Containers Market

Many materials are developing as front-liners in the sustainable packaging shift. PLA( Polylactic Acid), which comes from sugarcane or corn starch, is a compostable material with the same essence as regular plastic. Bagasse is a byproduct of sugarcane processing, which serves as another compostable and rigid option, specifically opposite to heat. Bamboo is the fastest-growing renewable resource, serving an aesthetically pleasing selection for disposable food containers.

Trade Analysis of Polypropylene Disposable Food Containers Market: Import & Export Statistics

- According to the India export data, India has exported 105 shipments of plastic food containers.

- Such exports were created by 35 Indian exporters to 48 buyers. Most of the plastic food containers export from India destined to Suriname, the United States, and the United Arab Emirates.

- Worldwide, the leading three exporters of plastic food containers are Japan, China, and the United States.

- China has topped the globe in plastic food containers, exporting 31,158 shipments, followed by Japan with 5,304 shipments, and the United States which has taken third position with 4,656 shipments.

Polypropylene Disposable Food Containers Market - Value Chain Analysis

- Package Design and Prototyping: Polypropylene plastic containers are a popular selection for salad packaging because of their perfect durability, clarity, and resistance to grease and moisture. Such containers track salads' freshness and bright colours, which develop their online requests. Such containers are available in different shapes and sizes, enabling space control and customization too.

- Recycling and Waste Management: Plastics are being melted, shredded, and reprocessed into latest pellets, which can be used in food-grade uses if they align with regulatory standards. They are being broken down into their molecular elements and constructed into virgin -quality plastic that ensures high safety and purity.

- Logistics and Distribution: Raw polymers such as (PP, PET, and PS) are being generated from recycled or refinery plastic processors and serve production facilities. Smooth logistical packaging is being used to develop warehouse service as containers are crafted to be stackable to lower the needed footprint and ensure safe handling during transportation.

Segmental Insights

Product Type Insights

Why Clamshell Containers Segment Dominated the Polypropylene Disposable Food Containers Market in 2025?

The tubs and jars segment has dominated the market as they have protective exteriors and lids that prevent the ingredients from possible pollutants from light exposure, users, or the air. They have also highlighted protective barriers like ethylene vinyl alcohol or the aluminate lamination that stores active ingredients from updating the packaging.

The clamshell containers segment is predicted to witness the fastest CAGR during the forecast period. They have protective exteriors and lids that prevent the ingredients from possible pollutants from light exposure, users, or the air. They have also highlighted protective barriers like ethylene vinyl alcohol or the aluminate lamination that stores active ingredients from updating the packaging.

Material Type Insights

How Polypropylene Segment Dominated the Polypropylene Disposable Food Containers Market in 2025?

The polypropylene segment dominated the market in 2025 as disposable plastic food containers are created from food-grade polypropylene, which ensures the food stays fresh and uncontaminated. They deliver a relevant barrier against the external sludges and do not have any pollutant chemicals in the food, even when they are exposed to changing temperatures. This makes them an ideal choice for tracking hygiene standards and food safety, too. They are available in different sizes and shapes, including round and rectangular disposable plastic food containers, which are perfect for various food products.

The bio-based and sustainable alternatives segment is predicted to witness the fastest CAGR during the forecast period. Plant-fiber-based containers are created from agricultural byproducts like sugarcane bagasse, which are fibrous remains after extracting the juice from sugarcane, and bamboo pulp, too. Such materials are big, renewable, and naturally biodegradable too. Hence, sugarcane bagasse is the container that is specifically popular as it is strong, moisture -resistant too, which makes it perfect for hot or cold foods.

Shape Insights

How Rigid Containers Dominated the Polypropylene Disposable Food Containers Market in 2025?

The rigid containers have dominated the market in 2025 as they have plastic bottles, metal cans, glass jars, and other containers that serve perfect protection against physical damage, moisture, and pollutants, too, and assist them to protect and stand strongly, which communicate with the complete procedure of storage and procedure while standing to the regulatory standards. Such rigid packaging is made by utilizing both hot and cold temperature resistance, which allows for temperature updates, resulting in the product being unharmed.

The flexible containers segment is predicted to witness the fastest CAGR during the forecast period. Polypropylene is one of the most commonly used materials in terms of plastic containers with takeaway food boxes and lids, specifically where hot food storage and microwave are needed. It can carry temperatures up to approximately 120 degrees Celsius, which makes it perfect for reheating. Such semi-rigid plastic is lightweight and chemically resistant too, which makes it perfect for soups, sauces, and oily foods.

Application Insights

How have the Quick Service Restaurants and Food-Service Segment Dominated the Polypropylene Disposable Food Containers Market?

The quick service restaurants and food-service segment has dominated the market in 2025, as cafes and restaurants are among the biggest consumers of the disposable food containers. Such containers deliver as disposable packaging for takeout orders, dine-in meals, and food delivery that substitutes regular plastic or styrofoam boxes. Their longevity and the heat opposition make them perfect for soups, hot meals, and desserts. Furthermore, several chains now market their usage of eco-friendly packaging as part of their company’s loyalty to sustainability.

The food delivery segment is predicted to witness the fastest CAGR during the forecast period. Polypropylene plastic storage container solutions for retail businesses and food service across the global and Indian market are committed to serving hygienic, durable, and food-safe plastic containers that align with the growing demands of current food packaging. Such containers are lightweight in nature but crack-opposite, which frequently have leak-proof snap lids or an airtight seal to protect spills during the delivery time.

Regional Insights

How Has Asia Pacific Dominated the Polypropylene Disposable Food Containers Market?

Asia Pacific dominated the polypropylene disposable food containers market in 2025, as the development of this region is initially being driven by the fast urbanization and growing disposable income in the region. The growing popularity of fast food and takeaway services is being linked with a busy lifestyle that has boosted the urge for easy packaging solutions. Furthermore, the stretched foodservice sector, which includes cafes, restaurants, and street vendors, has contributed mainly to the market development.

How is the Polypropylene Disposable Food Containers Market Growing in India?

The polypropylene disposable food containers market in India has witnessed constant development, which is driven by the growing urge for takeout services, convenience foods, and the food delivery stages globally. Industry-particular inventions such as compostable and biodegradable materials, smart packaging solutions, and developed barrier characteristics have mainly materials such as paperboard, PLA (polylactic acid), and recycled plastic to meet with regulatory shifts and user choice for sustainable packaging too.

Why is the Polypropylene Disposable Food Containers Market Developing Rapidly in North America?

North America expects the fastest growth in the market during the forecast period. The fast transformation of the North American disposable food containers serves main issues, which include eco-friendly problems, regulatory constraints, and supply chain complications. AI-driven solutions are developing as important tools to solve such issues -that develop operational efficiency, that allow smarter product design and promote actual-data compliance, which manage huge datasets to grow invention and update manufacturing procedures, and assist predictive demand planning.

Why is Canada using the Polypropylene Disposable Food Containers Market Crucially?

The urge for disposable food containers in Canada continues to develop, which is being driven by the developing food service industry and a developing user choice for convenience. The market is predicted to reach approximately, as the high urbanization rate of 73% and are busy in the “on-the-go’ lifestyles, which have updated the demand for portable, lightweight, and single-use packaging. There is a developed disposable income, and the development of double-income households has led to higher funding for pre-packaged and ready-to-eat meals.

The Polypropylene Disposable Food Containers Market in the region is Growing as in Europe. Regulatory pressure from the EU Packaging and Packaging Waste Regulation (PPWR) is pushing a shift from regular plastics to sustainable alternatives. Plastics in this region are still the biggest segment but experience high bans and taxes on particular items, such as cutlery and plastic plates. There are bagasse, molded fibre, and wood, which are experiencing fast acceptance as ‘plastic-free 'and eco-friendly alternative options.

Germany Polypropylene Disposable Food Containers Market

The German market is crafted by a strong and growing distribution scenario, which is driven by the macroeconomic elements such as user convenience trends, urbanization, and the sustainability regulations too. The growing urge for on-the-go food options urges the development of foodservice and retail channels. E-commerce stages are gaining attention, which assist direct-to-consumer sales and stretch the reach into remote spaces.

Recent Developments

- In October 2025, Milliken & Company has revealed the Millad ClearX™ 9000 which was ready to reveal its operational and sustainability products in the field of medical, food packaging and the home storage applications which is the crucial growth in clearing the technology which is designed to update the aesthetic and performance of the polypropylene.

- In December 2025, Sabert Corporation Europe revealed its latest complete recyclable and compostable foodservice packaging series. It is created from a renewable plant-based resources as the range is free from genuinely added PFAS and fully compliant.

Top Companies in Polypropylene Disposable Food Containers Market

- Dart Container Corporation

- Pactiv Evergreen

- Berry Global Group

- Huhtamaki

- Genpak LLC

- Reynolds Group Holdings

- Amcor

- Sabert Corporation

- Coveris

- Silgan Holdings

- Time Technoplast

Polypropylene Disposable Food Containers Market Segments Covered

By Product Type

- Clamshell Containers

- Tubs & Jars

- Trays & Plates

- Portion Cups

- Cups & Lids

- Takeaway / Foodservice Containers

- Bakery & Deli Containers

By Material Type

- Polypropylene

- PP

- Homopolymer

- Copolymer

- Microwaveable

- Heatresistant

- Other Plastics

- Bio-based / Sustainable Alternatives

- PLA

- Bioplastic

- Compostable

- Biodegradable

- Recyclable

By Shape / Design

- Rigid Containers

- Clamshell

- Tray

- Bowl

- Cup

- Lid

- Flexible Containers

- Film

- Wrap

- Pouch

- Liner

- Bag

By Application / End-Use

- Quick Service Restaurants

- QSR

- Takeaway

- Dinein

- Fastfood

- Retail & Packaged Food

- Readymeal

- Frozen

- Fresh

- Processed

- Institutional Catering

- Hospitals

- Schools

- Corporate

- Cafeterias

- Food Delivery / Takeout

- Delivery

- Aggregators

- Cloudkitchens

- Homeconsumption

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA