The smart packaging for retail & e-commerce market covers an in-depth analysis of global market size, annual growth rates, and future value projections supported by complete statistical datasets. This report examines emerging trends, technology innovations, and segment-wise performance across components, packaging formats, and applications. It includes detailed regional insights for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with production, consumption, import–export, trade flows, and supply chain structures.

The study also maps leading manufacturers, suppliers, and top companies, offering competitive benchmarking, market share, and value chain analysis from raw materials to end-user industries.

Smart packaging refers to packaging systems embedded with advanced technologies like sensors, RFID, NFC, and QR codes to monitor, communicate, and enhance product functionality. In the retail & e-commerce market, smart packaging improves product tracking, authenticity verification, and consumer engagement. It supports sustainability through recyclable materials and optimized designs. Brands use it to ensure secure deliveries, create interactive unboxing experiences, and gain supply chain insights. As online shopping grows, smart packaging plays a key role in improving efficiency, transparency, and customer satisfaction.

AI integration significantly enhances smart packaging in the retail & e-commerce market by enabling data-driven, personalized, and efficient packaging solutions. Through AI-powered analytics, companies can track consumer behaviour, predict demand patterns, and optimize inventory management, leading to reduced waste and faster fulfillment. AI also enables dynamic QR codes or AR features on packaging, creating interactive, personalized shopping experiences that boost customer engagement and brand loyalty. In logistics, AI supports real-time monitoring of package conditions such as temperature, humidity, or tampering ensuring product integrity during transit.

AI streamlines packaging design and production by recommending materials that balance sustainability, protection, and cost-effectiveness. With machine learning algorithms, brands can optimize box sizes, reduce empty space, and cut carbon emissions. AI also strengthens anti-counterfeiting measures by verifying authenticity through digital markers and blockchain integration. Altogether, AI transforms smart packaging into a powerful tool for sustainability, traceability, personalization, and operational efficiency in the fast-paced retail and e-commerce landscape.

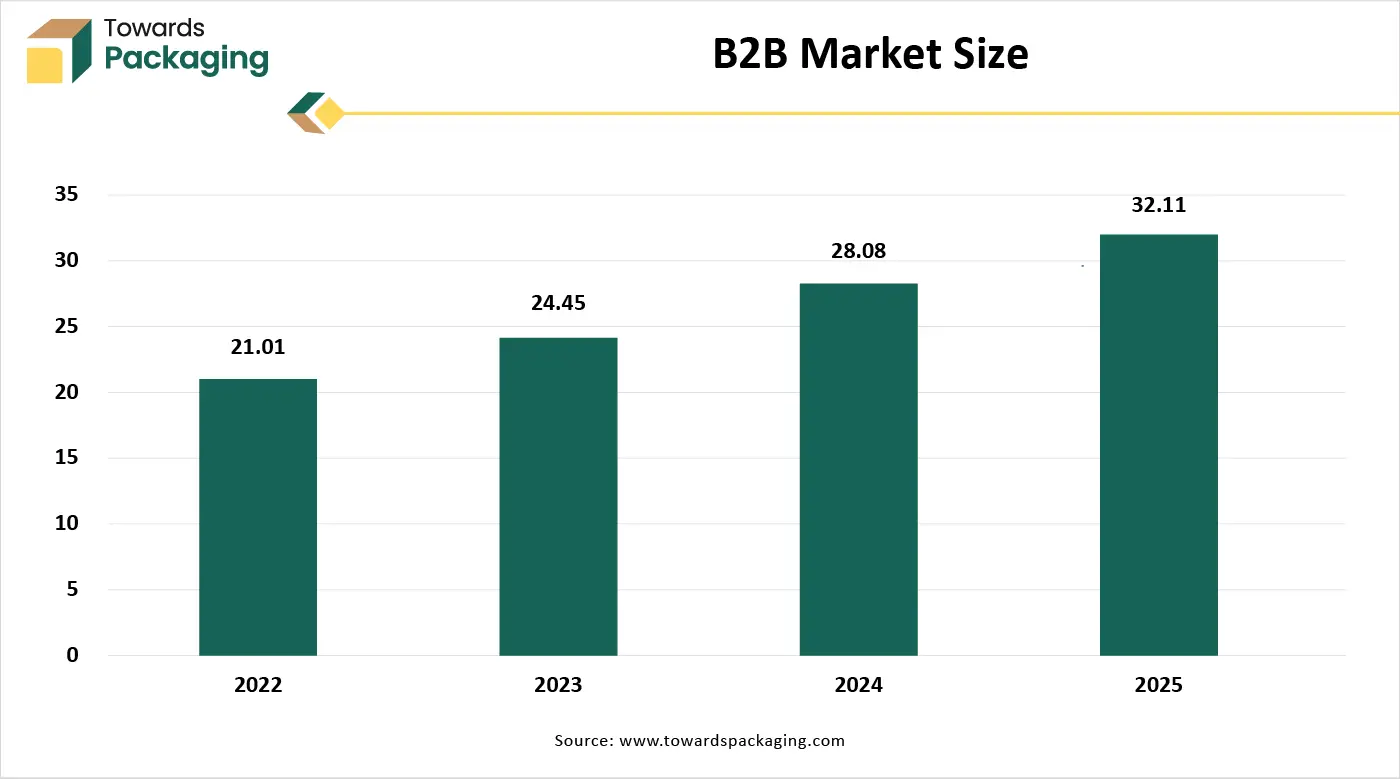

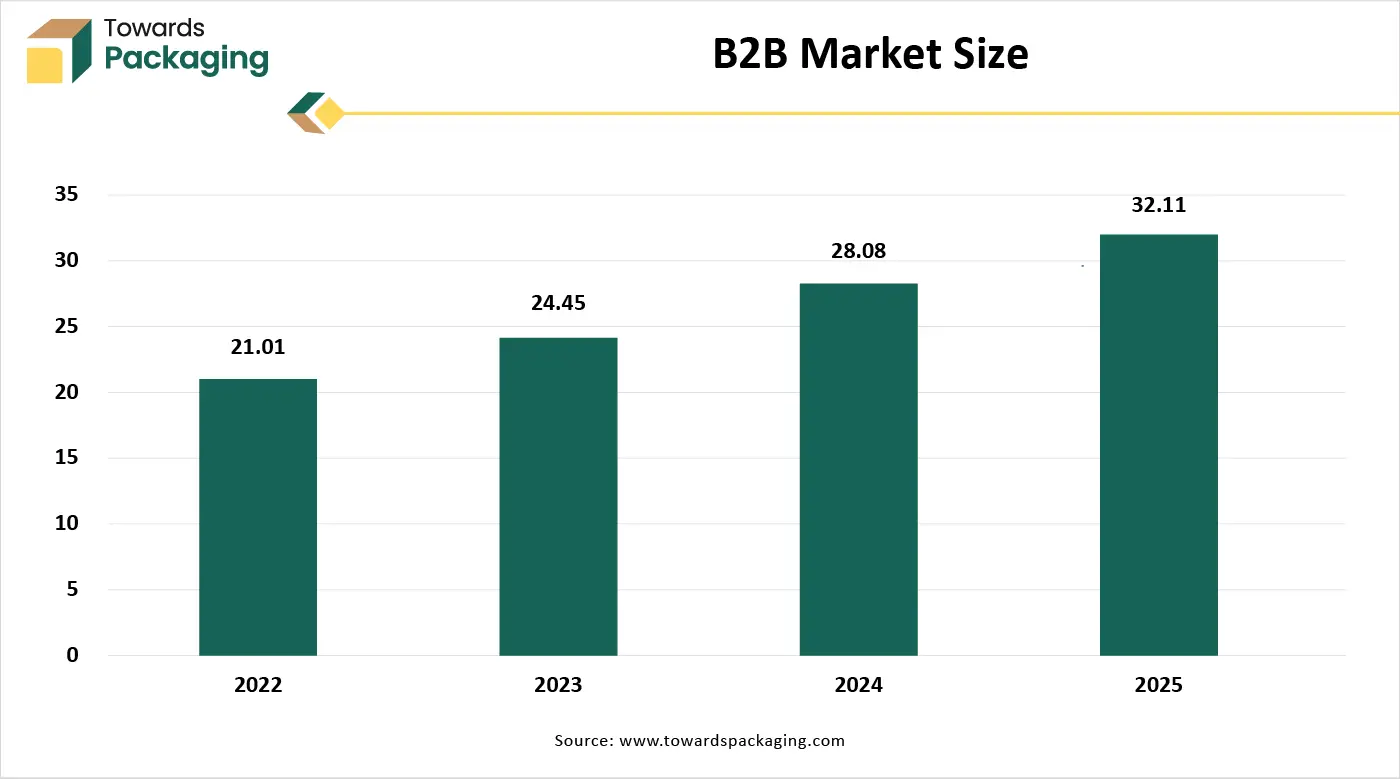

Growth in Retail & E-commerce Sales

With the global rise in online shopping, there is a growing need for packaging that ensures product safety, traceability, and engaging unboxing experiences. As online orders surge, brands require advanced packaging solutions like RFID, QR codes, and NFC for real-time tracking, inventory management, and efficient supply chain operations. E-commerce orders go through complex delivery chains. Smart packaging with condition monitoring (temperature, shock, humidity sensors) helps ensure products remain undamaged and safe, improving customer satisfaction.

Smart packaging enables personalized experiences such as scannable codes for product information, interactive unboxing, or promotional content, enhancing customer engagement and brand loyalty. With increased online product sales, especially in pharmaceuticals and luxury goods, smart packaging helps verify authenticity using unique identifiers, ensuring trust and compliance. Smart packaging can facilitate easier returns by integrating systems that track return status, validate contents, and provide quick re-processing, which is essential in the e-commerce model.

Regulatory Uncertainty & Complex Integration

The key players operating in the market are facing issues due to regulatory uncertainty & complex integration, which is estimated to restrict the growth of the market. Smart packaging technologies such as RFID, sensors, and printed electronics can significantly increase packaging costs, making them less accessible for small to medium businesses. Incorporating smart technologies into existing supply chains and packaging systems requires technical expertise and infrastructure upgrades, which can be challenging and time-consuming. Smart packaging often collects and transmits user data, raising privacy and security concerns among consumers and regulators. Varying global regulations regarding smart packaging technologies can hinder widespread implementation and innovation.

The QR code and RFID tags segment dominates the market due to their cost-effectiveness, ease of integration, and versatility across product categories. QR codes enable interactive consumer experiences, such as accessing product details, promotions, and authentication with a simple smartphone scan. RFID tags offer real-time tracking, efficient inventory management, and enhanced supply chain visibility. These technologies support both customer engagement and operational efficiency, making them widely adopted by retailers and e-commerce players seeking smart, scalable packaging solutions.

Mobile apps integrated and NFC are gaining popularity due to rising smartphone penetration and consumer demand for personalized, interactive experiences. NFC technology enables one-tap access to product information, loyalty programs, and digital content, enhancing brand engagement. Mobile app integration allows brands to collect valuable consumer insights, deliver real-time updates, and enable secure authentication. As consumers seek seamless, tech-driven interactions, this segment rapidly expands, especially in premium and tech-savvy product categories.

The connected packaging segment dominates the market due to its ability to enhance consumer engagement, product authentication, and supply chain transparency. Technologies like QR codes, NFC, and RFID allow real-time tracking, interactive experiences, and personalized marketing, boosting brand loyalty. This segment also helps combat counterfeiting and improves inventory management. The growing use of smartphones and internet access further drives adoption, making connected packaging a preferred choice for retailers and e-commerce platforms aiming for smarter customer interaction.

Sensor-based packaging is growing rapidly due to its ability to monitor real-time conditions such as temperature, humidity, and freshness. This is especially valuable for perishable and sensitive goods like food, pharmaceuticals, and cosmetics. Rising consumer demand for product safety and quality assurance, along with stricter regulatory compliance, drives its adoption. Additionally, sensor-based packaging reduces spoilage and enhances supply chain visibility, making it a crucial solution for modern retail logistics.

The food and beverage segment dominates the smart packaging for retail & e-commerce market due to the high demand for freshness, safety, and traceability in consumable goods. Smart packaging solutions like QR codes, sensors, and RFID tags enable real-time monitoring of temperature, expiration dates, and product authenticity, ensuring quality during transit and storage. Growing consumer awareness about food safety, coupled with regulatory requirements, further drives adoption. Additionally, brands leverage smart packaging to offer interactive experiences, such as nutritional information and promotions, enhancing consumer engagement. The rapid growth of online grocery shopping also fuels the segment’s dominance in the market.

Pharmaceutical and luxury goods are using smart packaging solutions due to rising concerns over product authenticity, safety, and traceability. For pharmaceuticals, smart packaging ensures compliance, monitors storage conditions, and prevents counterfeiting. In luxury goods, technologies like NFC and QR codes offer product verification and exclusive digital experiences, enhancing brand value and consumer trust. Increasing e-commerce sales of high-value and sensitive items further accelerate the adoption of smart packaging in these segments.

The FMCG and retail chains segment dominates the smart packaging for retail & e-commerce market due to high product turnover, large-scale operations, and the need for efficient inventory and supply chain management. These businesses benefit from technologies like RFID, QR codes, and connected packaging to streamline logistics, reduce shrinkage, and enhance product visibility. Additionally, smart packaging enables personalized marketing and consumer engagement at scale, helping brands stand out in competitive markets. The growing emphasis on digitalization and customer experience further supports the widespread adoption of smart packaging in this segment.

E-commerce and DTC (direct-to-consumer) brands are growing in the market due to increasing online shopping trends and the need for enhanced customer engagement. These brands use smart packaging technologies like QR codes, NFC, and mobile app integration to deliver interactive, personalized experiences and build stronger brand loyalty. Smart packaging also enables real-time tracking, authenticity verification, and data collection, helping DTC brands optimize logistics and better understand consumer behaviour in a competitive digital environment.

The boxes and labels segment dominates the packaging format category in the smart packaging for retail & e-commerce market due to its widespread use, versatility, and ease of integration with smart technologies like QR codes, RFID tags, and printed sensors. Boxes serve as the primary packaging for shipping and displaying products, especially in e-commerce, while labels provide a convenient platform for interactive features and essential product information. This format supports cost-effective branding, real-time tracking, and consumer engagement without major changes to existing packaging lines. Its compatibility across industries, from FMCG to electronics, further reinforces its dominance in the smart packaging landscape.

Smart pouches and seals are gaining popularity due to their flexibility, lightweight nature, and ability to integrate advanced features like time-temperature indicators, freshness sensors, and tamper-evident seals. They offer enhanced convenience for both consumers and retailers, especially for products in the food, personal care, and pharmaceutical sectors. These formats support extended shelf life, improved safety, and easy product authentication. Additionally, the rising demand for sustainable and space-efficient packaging solutions in e-commerce drives their rapid adoption, making them ideal for direct-to-consumer deliveries and modern retail logistics.

North America dominates the smart packaging market for retail and e-commerce due to its advanced technological infrastructure, strong presence of leading packaging and retail companies, and high consumer adoption of innovative solutions. The region benefits from significant investments in R&D, enabling rapid integration of smart technologies like RFID, IoT, and AI into packaging systems. Additionally, growing demand for personalized, sustainable, and tamper-proof packaging solutions fuels innovation. Regulatory support for smart labeling and traceability, combined with a highly developed e-commerce ecosystem, further boosts market growth.

U. S. Market Trends

The U.S. leads the smart packaging market in North America, driven by a strong e-commerce sector, widespread digital adoption, and the presence of major retail and packaging companies like Amazon, Walmart, and 3 M. High consumer demand for connected and sustainable packaging, along with government regulations promoting food and drug traceability, encourages rapid adoption of RFID, NFC, and IoT-enabled packaging. The U.S. also has a robust innovation ecosystem and invests heavily in AI and smart logistics solutions, further supporting market dominance.

Canada Market Trends

Canada is witnessing steady growth in the smart packaging sector due to increasing awareness of sustainable practices and growing demand for high-tech packaging in retail and healthcare. The Canadian government supports digital transformation and sustainable innovation, which is encouraging retailers and packaging companies to integrate intelligent features like QR codes and smart sensors. Though smaller in scale compared to the U.S., Canada's high e-commerce penetration and sustainability goals position it as a key emerging market.

Asia Pacific is experiencing rapid growth in the smart packaging market for retail and e-commerce due to rising urbanization, a booming e-commerce sector, and increasing smartphone and internet penetration. Countries like China, India, Japan, and South Korea are witnessing strong consumer demand for convenient, safe, and interactive packaging solutions. Government initiatives promoting digitalization and smart manufacturing, along with growing investments in advanced technologies like IoT, RFID, and AI, are accelerating adoption. Additionally, heightened awareness of product authenticity, sustainability concerns, and the need for supply chain transparency further drives market expansion across the region.

China Market Trends

China leads the Asia Pacific smart packaging market due to its massive e-commerce volume, advanced logistics infrastructure, and strong government support for digital technologies. Major players like Alibaba and JD.com heavily invest in smart packaging solutions, such as QR codes, NFC tags, and tamper-evident features to enhance traceability and customer experience. Rapid advancements in AI and IoT also drive innovation in the packaging sector, especially for high-volume retail and export goods.

India Market Trends

India is emerging as a high-growth market due to its expanding middle class, increasing online shopping, and growing demand for product safety and transparency. Initiatives like “Digital India” and rising smartphone penetration support the adoption of QR code-based interactive packaging. Additionally, Indian retailers are beginning to explore smart labels and tracking technologies to reduce counterfeiting and improve supply chain efficiency.

Japan Market Trends

Japan has a well-established retail infrastructure and a strong focus on technological innovation, making it a key market for high-end smart packaging. Japanese consumers demand high-quality, tamper-proof, and informative packaging, especially in electronics, cosmetics, and food products. The country also emphasizes sustainable and minimalistic smart packaging designs, integrating automation and IoT for logistics and inventory management.

Europe is witnessing notable growth in the smart packaging market for retail and e-commerce due to strong regulatory support, rising environmental awareness, and a highly developed retail infrastructure. The European Union’s Green Deal and Circular Economy Action Plan are pushing retailers and packaging companies to adopt sustainable and technologically advanced solutions. Consumers in the region demand eco-friendly, traceable, and interactive packaging, driving the use of QR codes, RFID, NFC, and smart sensors for product authentication, condition monitoring, and enhanced user engagement.

Countries like Germany, France, and the UK are leading innovation in packaging automation and digitalization, while Eastern European nations are emerging markets with growing e-commerce activity. The rise of omnichannel retail and the need for secure, tamper-evident packaging are also key drivers. Additionally, increased investments in R&D and cross-industry collaborations between tech firms and packaging manufacturers are accelerating the integration of AI, IoT, and data analytics in smart packaging across Europe.

By Technology Type

By Component

By Packaging Format

By Application

By End-User Industry

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026