Fast-Food Containers Market Size, Growth, Demand and Production Forecast

The fast-food containers market is expected to grow from USD 66.59 billion in 2026 to USD 110.69 billion by 2035, with a CAGR of 5.65% throughout the forecast period from 2026 to 2035. The rising fast-food industry, and rising convenience among consumers, availability of on-the-go food products has influenced the growth of the market. Huge demand for customization of fast-food packages has pushed this market to grow exponentially. With the increasing food delivery platforms and online orders of food products has pushed innovation in this market for efficient delivery of food products. This market is dominating in the Asia Pacific region due to the growing urbanization and fast-food culture among consumers.

Major Key Insights of the Fast-Food Containers Market

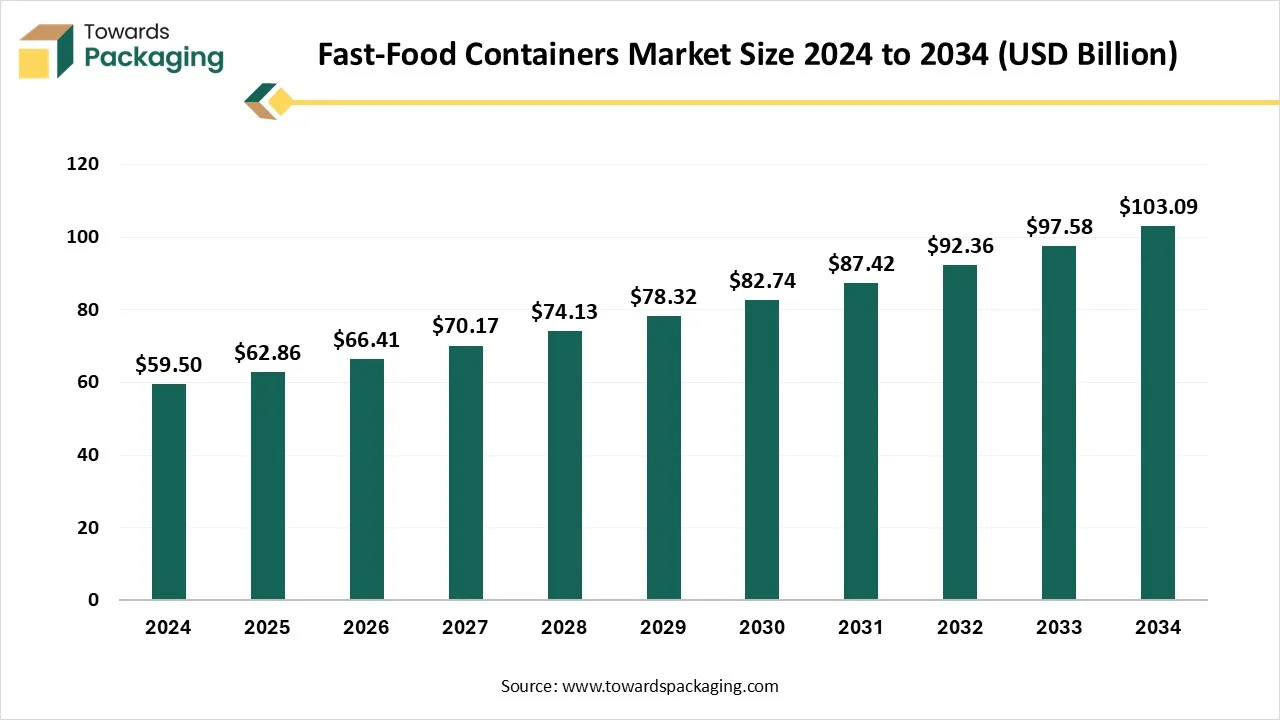

- In terms of revenue, the market is valued at USD 62.86 billion in 2025.

- The market is projected to reach USD 103.09 billion by 2034.

- Rapid growth at a CAGR of 5.65% will be observed in the period between 2025 and 2034.

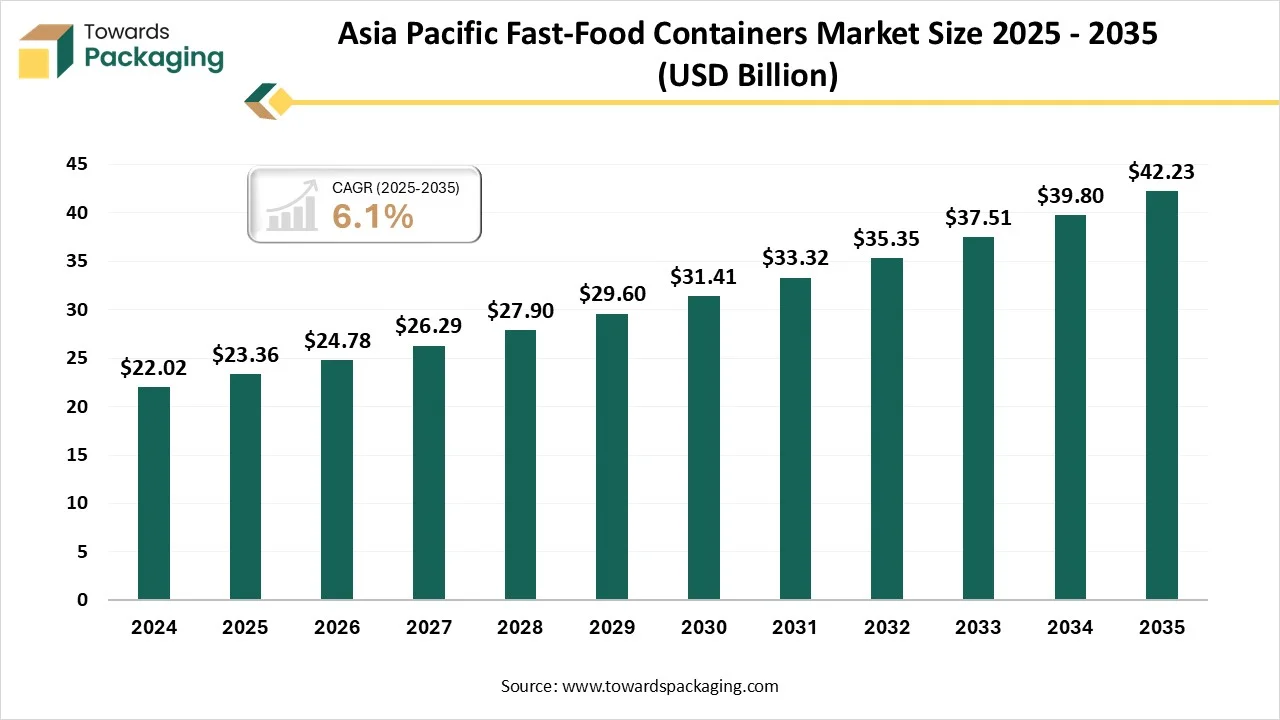

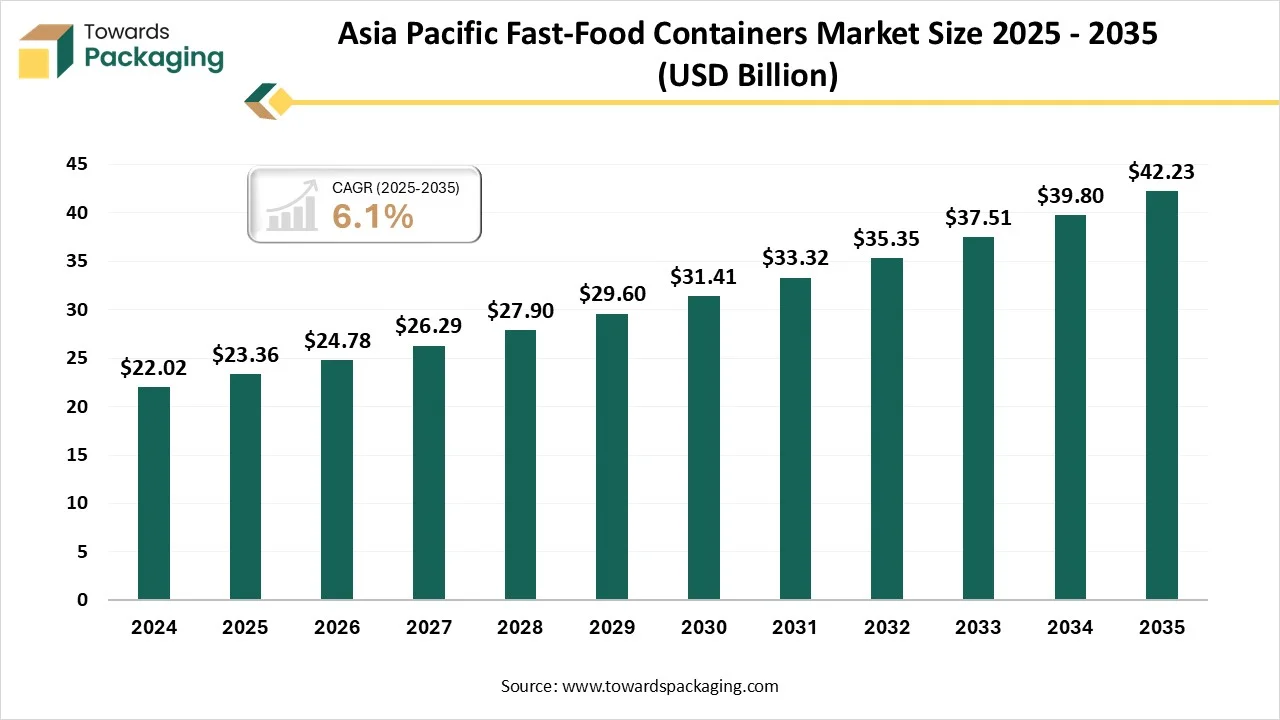

- By region, Asia Pacific dominated the global market by holding highest market share in 2024.

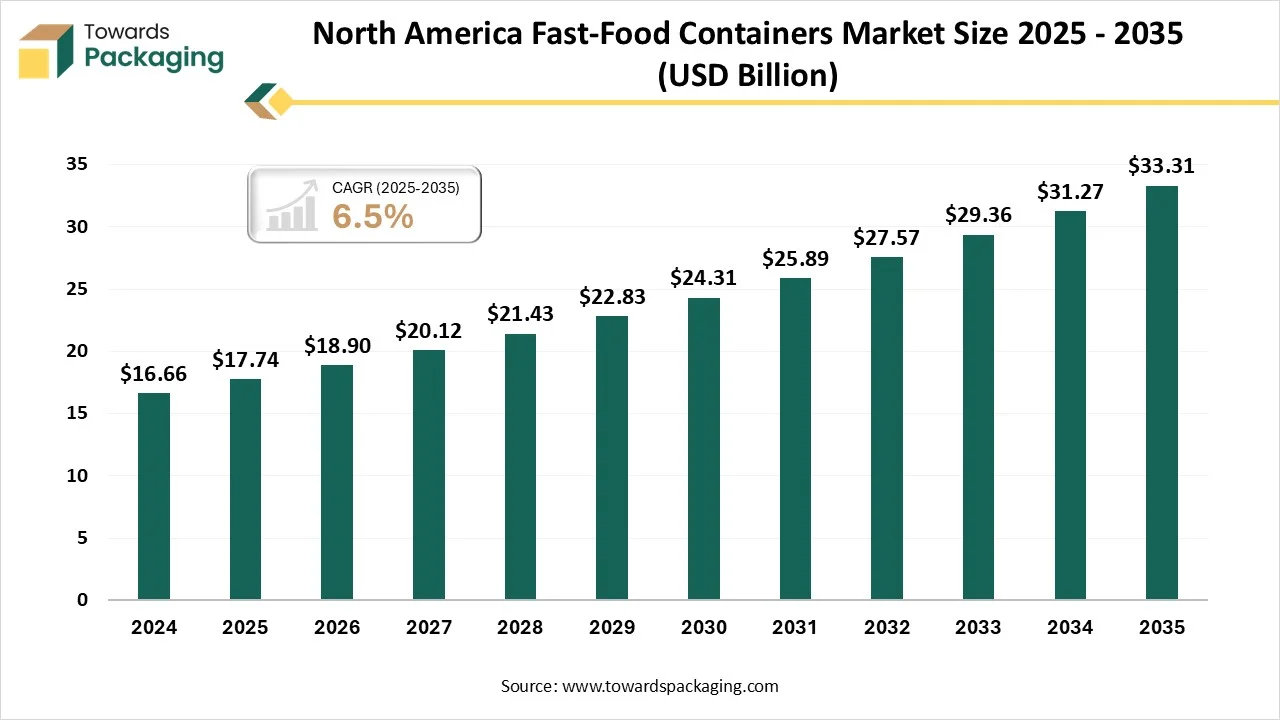

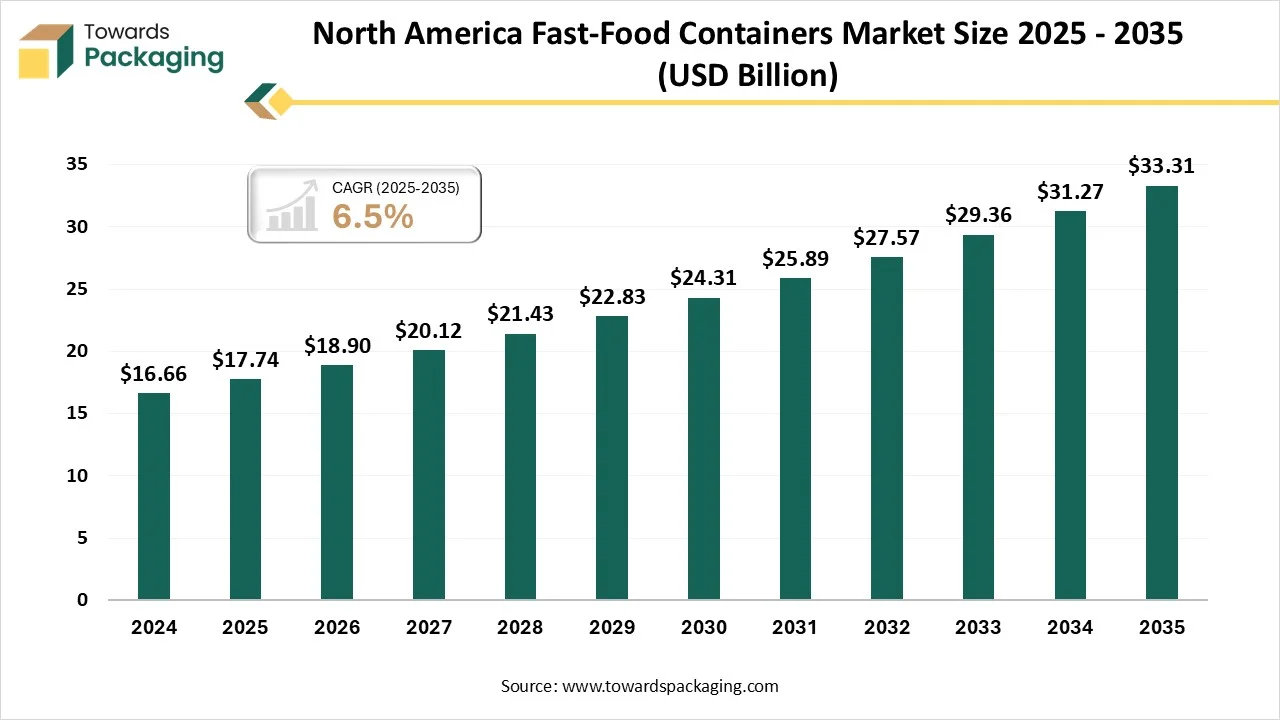

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By material, the paper & paperboard segment contributed the biggest market share in 2024.

- By material, the plastic segment will be expanding at a significant CAGR in between 2025 and 2034.

- By product type, the clamshells & boxes segment contributed the biggest market share of in 2024.

- By product type, the cups & lids segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By end-user, the quick-service restaurants (QSRs) segment contributed the biggest market share of in 2024.

- By end-user, the food delivery & takeaway services segment is expanding at a significant CAGR in between 2025 and 2034.

- By distribution channel, the direct sales (to QSRs and Chains) segment dominated the market with the share of in 2024.

- By distribution channel, the online retail/marketplace segment will be expanding at a significant CAGR in between 2025 and 2034.

Market Overview

The fast-food containers refers to the industry focused on manufacturing, distributing, and utilizing packaging solutions designed specifically for the quick-service and fast-food industry. These containers include boxes, trays, clamshells, cups, bowls, wraps, and lids, made from diverse materials such as paper & paperboard, plastic, foam, aluminum, and biodegradable alternatives. They play a crucial role in food safety, convenience, portion control, and brand visibility, while also addressing growing concerns over sustainability, recyclability, and government regulations on single-use packaging.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 62.86 Billion |

| Projected Market Size in 2034 |

USD 103.09 Billion |

| CAGR (2025 - 2034) |

5.65% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Product Type, By End-User, By Distribution Channel and By Region |

| Top Key Players |

Tier 1: Amcor plc, Berry Global, Smurfit WestRock, Huhtamaki, WestRock, International Paper, Graphic Packaging, Sealed Air, Ball, Crown

Tier 2: Pactiv Evergreen, Dart Container, Genpak, Sabert, Eco-Products, BioPak, Detmold, Hinojosa, Jindal Poly, DS Smith

Tier 3: Anchor Packaging, GreenGood, Karat, FASTFOODPAK, SubSafe, Noissue, MVI ECOPACK, Guangzhou Jianxin, Hi tray, Rearun Plastic

|

What are New Trends in the Fast-Food Containers Market?

Changing Supervisory Guidelines

- A worldwide change in the direction of circular economy has influenced the demand for innovation and supervisory changes.

Innovation in Technology and Designs

- Continuous innovation in the technology and designs of the fast-food containers has raised its demand on fast-food sector.

Growing Trend for Eco-friendly Packaging

How Can AI Improve the Fast-Food Containers Market?

The integration of AI technology in the fast-food containers market plays an important role in optimizing the recyclability potential of the containers. Generative AI is used in minimalizing the utilization of materials for manufacturing the containers. Artificial intelligence helps in optimizing the route for delivery of fast-food which result in low consumption of fuel. It upgrades recycling process of the containers which promote eco-friendly packaging and boost the expansion of the market.

Market Dynamics

Market Driver

Rising Concern for Sustainable Packaging

The rising concern for sustainable packaging has driven the innovation in the fast-food containers market. The growing awareness among consumers and strict regulatory guidelines enhanced the acceptance of environment-friendly packaging. The increase in urbanization and busy existences has fuelled the demand for suitable, on-the-go food choices, influencing the requirement for effectual and practical packing resolutions that protect food quality throughout transportation. The quick development of fast-food outlets in emerging regions, influenced by altering eating patterns and growing disposable profits, has resulted in amplified demand for localized and advanced packaging resolutions.

Market Challenges And Restraints

Strict Ecological Guidelines

Strict ecological guidelines in the packaging industry have hindered the expansion of the fast-food containers market. The demand for biodegradable eco-friendly packaging has raised the charges of such containers which decrease its adoption. Lack of recycling services hinder the efficacy of sustainable containers solutions, restraining their acceptance and affecting the complete market development.

Market Opportunity

Increasing Collaborations and Technological Development

Increasing collaboration and technological development in the packaging sector has raised the opportunities for growth of the fast-food containers market. To upsurge efficiency and cut expenditures, trades are focusing on using smart technologies and automation. Meanwhile, collaborations among food outlets and packaging manufacturers are nurturing original and customized resolutions that provide to the exclusive needs of consumers. The fast-food containers industry will endure to grow because of this dynamic ecology, which offers probabilities for extension and invention across characteristics and product groups.

Material Type Insights

Why Paper & Paperboard Segment Dominated the Fast-Food Containers Market In 2024?

The paper & paperboard segment dominated the fast-food containers market in 2024 due to strict guidelines and sustainability option. This segment offers an eco-friendly substitute in the fast-food containers sector which boost the demand of it. The growing demand for fast-food delivery and takeout facilities has speed up the acceptance of such containers made up of paper & paperboard in QSR chains, restaurants, and cafes looking for enhancement of brand sustainability and also confirming cost affordability. The extension of moulded fibre technology, presenting water and grease resistance films, enlarged sturdiness, and improved insulation possessions, has supported market demand, confirming excellent food protection and temperature retaining for both hot and cold food.

The plastic segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its cost-efficiency and protective packaging. Plastic containers have appeared as a most widespread choices to report the heavy demand for saleable food items as they provide enhanced strength, cost efficacy, and food protection abilities, and have observed noteworthy uptake transversely fast-food vents, delivery facilities, and ready-to-eat food products. These are the durable and versatile solution available for manufacturing containers to enhance the demand of the consumers.

Product Type Insights

Why Clamshells & Boxes Segment Dominated the Fast-Food Containers Market In 2024?

The clamshells & boxes segment held the largest share in the market in 2024 due to grease-proof and protective packaging of food products. The growing culture of take-out services and delivery platforms has raised advancement in this segment. Meanwhile old-style box packing, clamshells provide one-piece creation, tamper resistant, and improved food performance, leading to the elevation dining involvement for customers getting delivery and takeout services. Constant innovation of the materials has evolved the expansion of the market.

The cups & lids segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to increasing demand for convenience and sustainability. The growing trend for reusable and disposable containers has influenced the demand for such cups & lids. Huge customization option available in this segment has pushed the market to grow rapidly.

End-User Insights

Why Quick-Service Restaurants (QSRs) Segment Dominated the Fast-Food Containers Market In 2024?

The quick-service restaurants (QSRs) segment held the largest share of the market in 2024 due to the consumption of large volume containers. Rapid shift towards urban areas, presence of huge food delivery services, and busy lifestyle has influenced the demand for these containers. Increasing urban population with fast lifestyle has raised the demand for such service. The rising trend for digital ordering of the fast-food and presence of several delivery platforms has pushed the advancement of this segment. The worldwide food delivery platforms which is an extension of this service model upsurge the innovation in this market.

The food delivery & takeaway services segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to presence of several online food delivery platforms. Rapid growth in urbanization and convenience provided by several online delivery platforms such as DoorDash and Uber Eats has raised the demand for containers packaging. Changing lifestyle of people due to high number of working populations has boosted the market to grow significantly.

Distribution Channel Insights

Why Direct Sales (to QSRs and Chains) Segment Dominated the Fast-Food Containers Market In 2024?

The direct sales (to QSRs and Chains) segment held the largest share of the market in 2024 due to strategic partnership. It has huge demand for high quality production of containers to maintain continuous supply chain. High demand for customization of the containers with a wide range of food items availability has raised the demand for this segment. The bulk supply becomes cost-effective option for fast-food suppliers which enhance this segment to promote this market.

The online retail/marketplace segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to increasing e-commerce sector in the fast-food industry. The increasing smartphone utilization has raised online ordering of food items and enhance the demand for packaging containers. Changing lifestyle of people has raised the demand for online orders of fast-food products with enhanced packaging to maintain its taste and quality.

Regional Insights

Expansion of Middle-Class Population in Asia-Pacific Promote Dominance

Asia Pacific held the largest share of the market in 2024, due to expansion of middle-class population. The rising demand of the consumers for convenience and ready-to-eat food options has pushed the market to grow rapidly. In countries like India, China, Japan, and several others fast-food industry is growing significantly which has influenced the demand for containers packaging. Increasing online delivery facilities has boosted the packaging market for safe transportation of food products.

Huge Demand for Ready-to-Eat Food Promote the Fast-Food Containers Market in China

Huge demand for ready-to-eat food products has raised the expansion of the market in China. Presence of several production companies has introduced innovation in this field which has influenced this market to grow rapidly. Increasing disposable earning is one of the major factors behind the expansion of this market in China.

North America’s Expanded Online Food Delivery Facilities Enhance Market Demand

North America expects the significant growth in the fast-food containers market during the forecast period. Presence of major food delivery platforms has enhanced the demand for high-quality packaging to maintain the freshness of food products. Changing lifestyle of people has changed the demand for this market with increasing online orders for food products. There is a huge demand for lightweight and leak-proof resources for manufacturing of containers packaging.

Fast-Food Containers Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are paperboard, aluminum, glass, and paper has boosted the demand.

- Key Players: WestRock, Huhtamaki Oyj

Component Manufacturing

The major focus of the market players is to develop eco-friendly and high-volume containers by utilizing paperboard, paper, and aluminum.

- Key Players: Amcor Plc, Mondi Group

Logistics and Distribution

This segment is focusing on quick and efficient delivery with sustainable packaging of the fast-food products.

- Key Players: DHL Group, XPO Logistics

Top Companies in the Fast-Food Containers Market

Tier 1

- Amcor plc

- Berry Global Inc.

- Smurfit WestRock

- Huhtamaki Oyj

- WestRock Company

- International Paper Company

- Graphic Packaging International

- Sealed Air Corporation

- Crown Holdings

- Ball Corporation

Tier 2

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Genpak LLC

- Sabert Corporation

- Eco-Products, Inc.

- BioPak

- Detmold Group

- Hinojosa Packaging Group

Tier 3

Latest Announcements by Industry Leaders

- In April 2025, ABB Robotics introduced new restaurant concept in collaboration with BurgerBots. It is to upsurge the experience of the fast-food culture in future. President of ABB Robotics Division, Marc Segura, expressed, “The food industry is changing constantly, and our enhanced technology has upgraded reliability, consistency, and reliability.”

Recent Developments

- In January 2023, Mongabay declared about the launch of seaweed-based packages for wrapping food products in it. It is an algae and marine plant available in the water bodies help in solving the plastic packaging issues.

Fast-Food Containers Market Segments

By Material

- Paper & Paperboard

- Plastic

- Foam

- Aluminum

- Biodegradable/Compostable Materials

By Product Type

- Clamshells & Boxes

- Cups & Lids

- Bowls & Trays

- Wraps & Bags

- Others (Cutlery, Plates, Portion Packs)

By End-User

- Quick-Service Restaurants (QSRs)

- Cafés & Coffee Shops

- Food Delivery & Takeaway Services

- Street Vendors & Small Food Outlets

- Others (Catering, Institutional Buyers)

By Distribution Channel

- Direct Sales (to QSRs and Chains)

- Distributors & Wholesalers

- Online Retail/Marketplace

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait