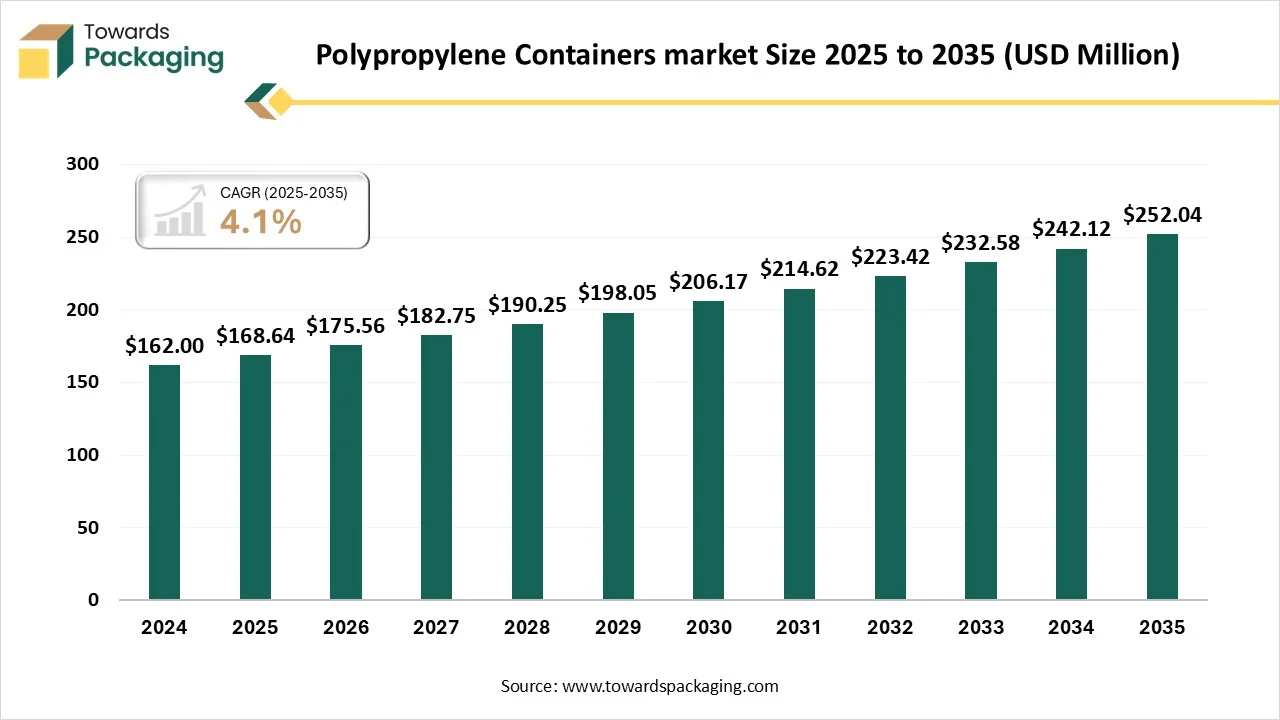

The polypropylene containers market is projected to reach USD 252.04 million by 2035, growing from USD 175.56 million in 2026, at a CAGR of 4.1% during the forecast period from 2026 to 2035. The market growth is driven by increasing demand for safe and sustainable packaging solutions, rising adoption of polypropylene over other materials due to cost-effectiveness, and regulatory support promoting hygienic and robust packaging standards.

The polypropylene containers market encompasses the production, distribution, and commercialization of containers made from polypropylene (PP), a thermoplastic polymer known for its high chemical resistance, durability, and lightweight properties. These containers are widely used across pharmaceutical, food & beverage, personal care, and chemical industries for storage, transportation, and packaging purposes. Polypropylene containers offer advantages such as moisture resistance, heat tolerance, and recyclability, making them suitable for both bulk and retail applications.

AI solves one of the plastics sector’s biggest analysis and sustainability challenges. High-level AI systems develop recycling effectiveness by precisely classifying plastic types and categorizing them, lowering the pollutants and increasing the volume of plastics adequately recycled. By developing the recycling quality and rates, AI assists a circular economy, which helps reduce the sector’s environmental impact.

Furthermore, AI promotes augmented product lifecycle management, which allows organizations to accurately manage plastic usage, easily predict when the materials should be managed, repurposed, and recycled, and create logical decisions about their material lifecycle methods. This proactive method lessens waste and markets sustainable manufacturing practices.

As per the global data, the world has officially imported 32,680 shipments of the Polypropylene Container during the period June 2024 to May 2025. Such imports were supplied by 3,264 exporters to 3,936 overall buyers, which has marked a development rate of -0% as compared to the previous twelve months.

The globe has imported many of its Polypropylene Containers from China, India, and Uzbekistan.

Worldwide, the leading three importers of the Polypropylene containers are the United States, Russia, and Brazil. Russia has topped the globe in terms of Polypropylene containers, with 15,792 shipments, followed by the United States with 9,937 shipments, and Brazil, which took the third position with 6,288 shipments.

The polypropylene raw material is the basis from which a huge range of items are produced. This raw material is generally available in granular or pellet form, from which it can be melted and molded into different shapes. The quality of the polypropylene raw material is complicated, which directly affects the characteristics of the outcome product, such as flexibility, strength, and chemical resistance too.

Polypropylene is generated through polypropylene polymerization, where propylene gas molecules are connected together by using a catalyst system under managed temperature and pressure. This complicated procedure makes a multifaceted plastic powder or a pellet which can be shaped into a huge range of outcome products for consumer and industrial uses.

The creative collapsible pattern of polypropylene containers displays a game-changing solution, which allows effective space usage during return shipments and storage, too. This flexibility results in main reductions in the storage space demand and lessens the carbon emissions linked with transportation.

The rigid containers segment has dominated the market with a 40% share in 2025 as they are strong, injection-molded containers that are utilised to package products like cakes, cookies, and other baked goods. They are manufactured from PCR, PIR, plant-based, and compostable materials; such containers offer remarkable durability and protection. They are ideal for products that need a stackable and secure container for transport and storage. Their rigid design assists in the prevention of crushing, to make sure the products inside remain whole, bakeries, delis, and other food service uses, as such containers serve an eco-friendly and long-lasting solution for fresh food products.

The flexible containers segment is expected to experience the fastest CAGR during the forecast period. This kind of packaging is a pattern of flexible packaging created from the laminated films like PE, PET, or PP, which is crafted in order to protect the products while storing the weight and material usage low. It counts designs like flat pouches, stand-up pouches, sachets, and spouted editions, and each can be filled, locked, and tailored to match various products. As the material design is very flexible instead of rigid, such packs are convenient to store, affordable to the supply chain, and deliver strong barrier performance for liquids, food supplements, and household goods.

The bulk containers segment has dominated the market with a 45% share in 2025 as a huge series of containers are easily available for food storage and industrial and commercial uses, with selections changing in shapes, sizes, and lid types. Such containers are being valued for their light weight, durability, and chemical resistance. The commercial and industrial options accessible are wholesale durable 100% Native PP Industrial plastic containers, which are strong, crafted for heavy applications in garages and warehouses, with a load capacity of 50kg.

The retail and consumer containers segment is expected to experience the fastest CAGR during the forecast period. Polypropylene is heavily resistant to impact, moisture, and chemicals, which protects the products from damage and pollutants throughout the supply chain and on the shelf, too. It is being checked by the regulatory bodies like the FDA, PP, which is a non-toxic and BPA-free material that does not screen toxic chemicals into contents, which makes it a safe selection for fragile products like medicine and food.

The food and beverages segment has dominated the market with a 35% share in 2025, as polypropylene containers enable food to be well-maintained in perfect condition for a long time. As the material serves as a safe protection against the external factors, whether they are physical and biological ( antimicrobial characteristics barrier against pathogens and aging of food and chemicals, which is opposite to product spoilage and climatic factors). They have limitless uses in the food sector and can be useful for every type of beverage and solid foods.

The personal care & cosmetics segment is expected to experience the fastest CAGR during the forecast period. Both industry urges high standards for packaging quality, specifically related to user safety. Polypropylene material aligns with such standards because of its chemical inertia, which showcases that it does not react with the cosmetic ingredients even during the long-term period. Furthermore, polypropylene plastic is free of toxic chemicals like phthalates or BPA, which makes it an absolute safety for users. It is convenient for printability and moldability, which enables cosmetic brands to make different and attention-grabbing packaging designs that develop product value.

The standard polypropylene segment has dominated the market with a 50% share in 2025 because it is widely used for the low-cost thermoplastic polymer, which is well-known for its perfect balance of chemical resistance, mechanical strength, and light weight too. It is reliable material utilised across different sectors for both flexible and rigid uses. On the other hand, polypropylene as a material has a relatively high melting point (around 160 degrees Celsius to 170 degrees Celsius for homopolymers which enables it to be utilized in hot-fill uses and microwavable containers.

The copolymer polypropylene segment is expected to experience the fastest CAGR during the forecast period. It is an adaptable and durable plastic material, which is a thermoplastic polymer implemented in a wide range of applications. Such material is made by polymerizing propylene with ethylene or butene monomers. The outcome is a material that is more flexible and stronger than homopolymer polypropylene. It is perfectly known for its precise chemical composition and lower melting point, which makes it convenient to produce and perfect for different sectors.

The direct sales to manufacturers segment has dominated the market in 2025 with a 50% share, as direct sales of these containers are accessible from various manufacturers, distributors, and wholesalers that align with both individual users and B2B, with the assistance of different online and direct channels. The crucial attributes while purchasing the polypropylene containers are shape, color, capacity, lid type ( airtight, screw cap ), and the reusability of durable and disposable products.

The online/ digital platforms segment is expected to experience the fastest CAGR during the forecast period. The polypropylene containers are widely sold via digital platforms that encourage their lightweight, durable, and food-safe characteristics. A huge variety of items that are available on main e-commerce sites and tailored for B2B stages, which range from small food storage to heavy industrial containers. The sector is progressively accepting digital solutions. This counts on mixing the IoT sensors and the RFID tags into the packaging for real-time tracking of ingredients.

North America region held the largest share in the market in 2025 with a 35% share, as the urge for the same is developing constantly, which is driven by the packaging sector and the move towards sustainable and lightweight materials. The North American market is a main segment of the worldwide market and is predicted to continue its demand. The growth in on-the-go consumption designs and the development of the e-commerce business have developed the urge for lightweight, durable, and often resealable containers, which ensure product safety during transportation.

The Canadian plastic containers industry is meant for sustained development, which is driven by the growing urge for easy packaging, the development of sustainable materials, and the expansion of the end-use sectors. As producers continue to fund research and development, accept sustainable practices, and push rising technologies, the plastic container industry will remain an important element of the global packaging sector. By matching with user choice and solving environmental issues, the sector is perfectly positioned to thrive in the future period.

The demand for polypropylene containers in the Asia Pacific is strong and growing as sustainability pressures are heavily shaping the import-export methods, with strict eco-friendly regulations that have a move towards environmentally friendly materials and sustainable packaging solutions that can encourage trade tariffs and the compliance cost. Investment appetite in high production technologies, which includes smart logistics and automation, will further sustain the region’s potential to align with growing worldwide demand for high-quality PP container liners, particularly in industries like agriculture, chemicals, and industrial goods.

The polypropylene container sector in India is experiencing a major transformation as organizations invest in technology, infrastructure, and measures. As a rising economy, India is operating towards self-dependence in petrochemicals, which reduces the imports of the main section of its polypropylene needs and demands, initially from South Korea, the UAE, and Saudi Arabia. Hence, latest funding in manufacturing potential, upgrading in manufacturing capacity, and government initiatives have a goal to fill the urge for the supply gap.

Sustainability and recycling are the main elements that define the European industry. EU regulations like Single-Use Plastics Directive and the Circular Economy Action Plan, which makes a compulsion for high recycling rates and the application of post-consumer recycled content. This has led to a crucial shift towards mono-material PP solutions, which are convenient to recycle.

Technological inventions are updating the plastic production scenario in Germany. Organizations such as Versalis SpA, Berry Global Inc., and Crown Holdings Inc. are driving this update with their main market proximity and cutting-edge strategies. The sector is experiencing developments in terms of plastic production technology, which includes developed processing techniques and the growth of the latest materials. These inventions are not only developing the product quality but also improving smoothness and lowering the environmental impact.

The polypropylene containers market in the Middle East & Africa (MEA) region, driven by the packaging industry, specifically for food and beverages, is a main driver for the MEA market. The automation sector is also a main end-user, which uses polypropylene for machine parts because of its lightweight and power nature. Furthermore, the construction sector is using a PP in the infrastructure projects that include sector development.

Pharmaceutical and Healthcare packaging is the fastest-developing segment, with PP containers being famous for their resistance to breakage and chemical stability. Polypropylene was the biggest raw material for the plastic containers. Also, strict environmental regulations, which include a national ban on single-use plastics from the year 2025, include corporate sustainability aims that are developing the move towards bio-based and recyclable alternatives.

In South America, the polypropylene containers Market is growing constantly as this region is a main importer of PP material and witnesses main competition from the cost-competitive exports from North America, the Middle East, and Asia, which leads to pressured local margins. There is a growing trend towards developing bio-based PP (particularly in Brazil by using sugarcane ethanol ) and funding in high-level recycling technologies to assist a circular economy and align with the regulatory urges.

Brazil’s big user market and the growing middle class are boosting the urge for pre-packaged and convenient food and the personal care items that use the PP containers. Secondly, there is a growing trend towards sustainability that increases the urge for bio-based and recycled PP selections. Main players like Braskem and Shell are included in the projects to develop the circular ingredient for PP manufacturing. Inventions like lightweight materials for the packaging and developed procedure techniques are developing the product for efficiency and performance too.

By Product Type

By Deployment Type / Packaging Format

By Application

By Technology / Material Type

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026