Expanding Market for Dietary Supplement Packaging Advanced Packaging Technologies & Innovations Demand

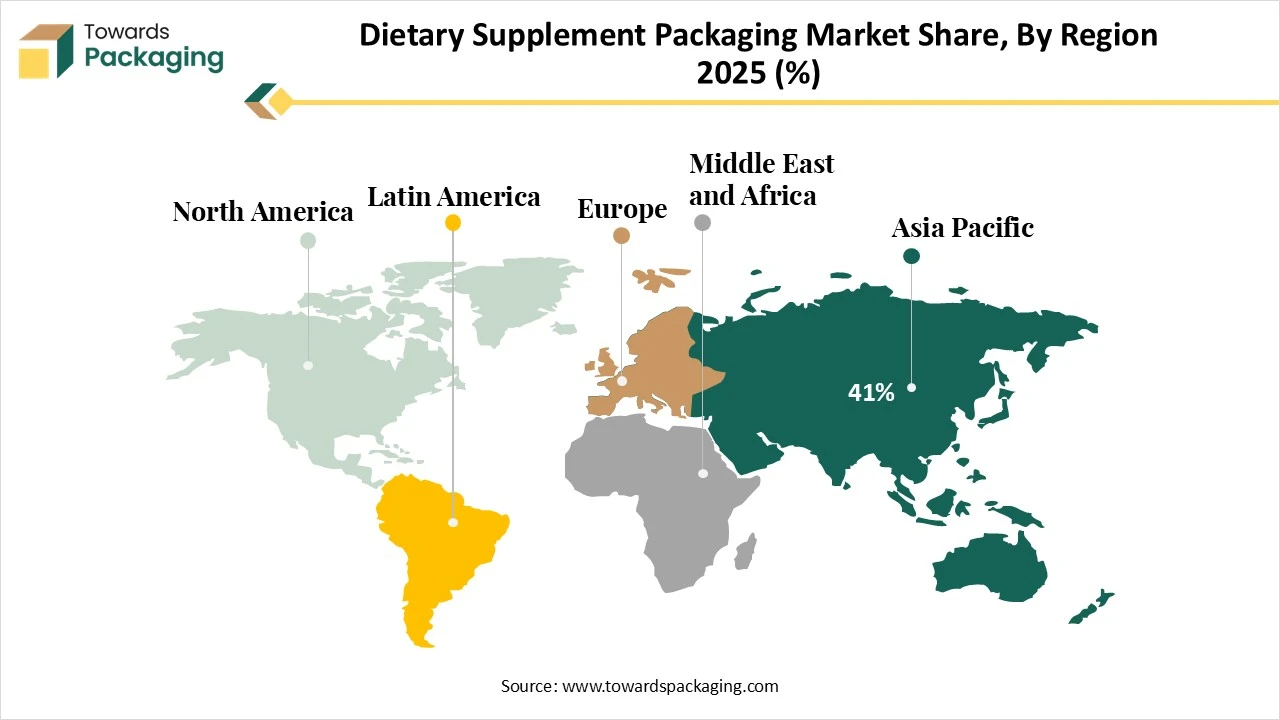

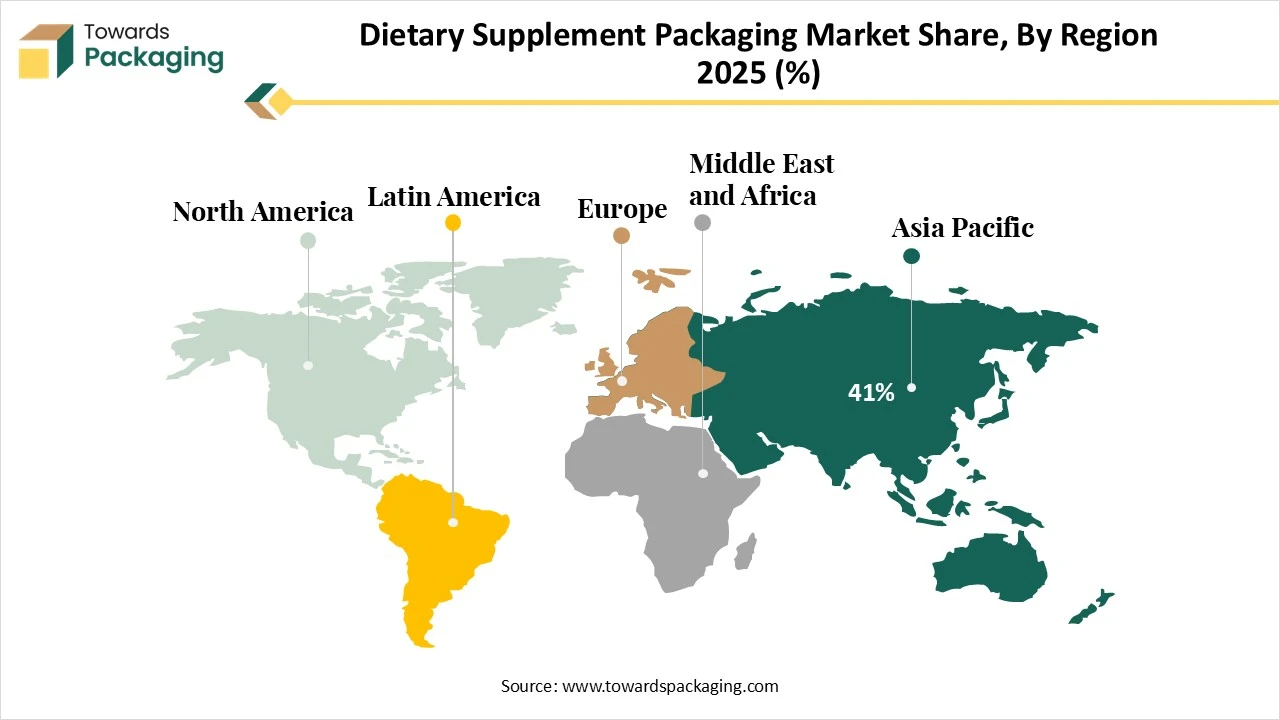

The dietary supplement packaging market provides a full statistical picture of global revenue, market volume, and growth forecasts, covering every segment including material type, product form, and packaging formats. This report includes a complete regional evaluation across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, offering detailed insights into demand patterns and regulatory dynamics. It further analyzes top companies, competitive strategies, manufacturing capabilities, value chain structures, and international trade data, ensuring decision-makers receive a 360-degree view of the industry.

This market is proliferating due to the rising demand for meal replacements, nutrition supplements, and immune boosters raising the packaging market as it must be packed with advanced technology for long-term storage and transportation of the supplements. The dietary supplements packaging market is also rising due to the continuous effort of market players to provide enhanced packaging for safe and longevity products.

Key Insights and Highlights from the Dietary Supplement Packaging Market Analysis

- The dietary supplement packaging market is projected to experience significant revenue growth from 2025 to 2034, driven by increasing demand for nutrition supplements and health products.

- Health-conscious consumers are fueling demand for packaging that ensures product protection, long-term storage, and quality preservation.

- Sustainable, eco-friendly packaging options like biodegradable, recyclable materials are gaining popularity in the dietary supplement packaging industry.

- Child-resistant packaging is in high demand for products containing herbs or other ingredients that may be harmful to children.

- Advanced packaging technologies, including digital, smart, and temperature-sensitive packaging, are becoming essential for supplement preservation.

- Asia Pacific is leading the market with the highest revenue share in 2024, driven by growing demand for nutritional supplements and cost-effective packaging solutions.

- North America is anticipated to grow rapidly due to increased demand for dietary supplements for muscle mass enhancement and convenience in packaging.

- Paper-based packaging is dominating the market due to its eco-friendly nature and growing consumer preference for sustainable products.

- The powder supplement segment is growing rapidly as consumers prefer easy-to-consume, customizable health products.

- Flexible packaging solutions such as bags and pouches are highly favored due to their convenience, portability, and cost-effectiveness.

The dietary supplement packaging market is growing significantly due to rising health concerns and increasing demand for effective, sustainable, and convenient packaging. As people are getting more concerned about their health and wellness there is a huge demand for such supplements that can fulfil their nutrition requirements of the body such as protein powders, vitamin and mineral capsules, and many others. To increase efficiency, preserve quality, and protect from external adverse conditions these products need to be packaged with advanced technology. The incorporation of biodegradable, recyclable, and sustainable packaging ensures the packaging quality along with the environment-friendly packaging of the products. For dietary supplements, child-resistant packaging is also highly in demand mainly in some products that contain herbs and other such ingredients that can harm children.

Market Outlook

Industry Growth Overview: Growth is driven by the expansion of the nutraceutical industry, aging populations, and increasing preventive healthcare trends. The rise of e-commerce and direct-to-consumer supplement brands is further boosting packaging demand.

Sustainability Trends: Manufacturers are adopting recyclable, lightweight, and bio-based packaging materials to reduce environmental impact. Use of PCR plastics, paper-based containers, and refill solutions is gaining traction.

Global Expansion: North America dominates the market due to high supplement consumption, while Asia-Pacific is the fastest-growing region, driven by rising health awareness and disposable incomes. Europe continues to expand with strong regulatory compliance and premium packaging demand.

Key Drivers Fueling Growth in the Dietary Supplement Packaging Market

Growing Demand for Enhanced Protection and Preservation

There is a huge upsurge in the demand for good quality packaging in the dietary supplement packaging market. In current times there is a huge demand growing for such products that are beneficial for health and fulfil the nutritional demand of the customers. As people are becoming health-conscious and fitness freaks their awareness towards the nutritional value of food is also rising significantly. Several supplements such as probiotics, vitamins, and minerals are sensitive to certain external factors like moisture, oxygen, and light that can damage the product quality. Hence, these dietary supplement companies prefer high-protection packaging solutions to provide advanced level protection.

- In October 2024, Berry Global, announced the launch of a range of clarified polypropylene (PP) for healthcare applications. It is developed to deliver high protection and sustainability to healthcare products.

Emerging Trends Shaping the Dietary Supplement Packaging Market

Untapped Market Opportunities in the Dietary Supplement Packaging Industry

Growth of Health and Wellness Products: Dietary Supplement Packaging Market Poised for Expansion

Dietary supplements are rising globally due to the enhancement in awareness among people about the importance of nutrition for their health. The growing education about the health benefits of probiotics, vitamins, amino acids, and minerals also enhances their consumption. According to the report of the National Institute of Health, the prevalence of the consumption of dietary supplements was lower in the majority of social and demographic groups in 2022. Whereas, in 2023, it again increased among females and younger residents. One of the major factors influencing the growth of the packaging market is the growing demand for sustainable packaging products. The majority of brands prefer sustainable packaging options due to the increasing priority for eco-friendly packaging materials.

Regional Insights and Growth Opportunities in the Dietary Supplement Packaging Market

Surging Demand for Nutritional Materials and Supplements: Asian Countries to Lead the Dietary Supplement Packaging Market

Asia Pacific witnessed the highest revenue share for the year 2024 this growth is due to the growing demand among people for nutritious supplements. The accessibility of raw materials, the existence of several processing plants, and low labour charges in the Asia Pacific region. The major market players are continuously focusing on introducing packaging products which can store these products for longer periods and intact the quality of the supplements. The rising demand for such products increases the demand for advanced packaging procedures. In several countries such as India, Japan, China, South Korea, and Thailand this dietary supplement packaging sector is escalating speedily. There are strict rules implemented by the government in the packaging sector resulting in rapid innovation by the market players.

- In September 2022, Centrum, announced the launch of Centrum Multivitamin in India. It is developed in 4 multivitamin variants designed to fulfil the nutrition requirements of people.

Rising Trends in Nutritional Products and Expanding Consumer Base: North America Set for Rapid Growth in the Dietary Supplement Packaging Market

North America is estimated to grow at the fastest rate over the forecast period. The growing trend among people for using dietary supplements to enhance muscle mass has grown the market demand rapidly. With the rising demand for such supplements, the demand for excellent packaging also increases. Such growing demand enhances the production of advanced quality packaging that can satisfy the market demand. Majorly bottles and pouches packaging is preferred by the dietary supplements brand. In countries such as the U.S. and Canada, there is a huge rise in disposable earnings that influences people to work more and result in less time to have meals which ultimately increases the demand for dietary supplements. The major market players such as Arizona Nutritional Supplements (ANS), Amway, Abbott, The Carlyle Group, Herbalife Nutrition, Glanbia, and various others are contributing significantly to the growth of the dietary supplement packaging market.

Why is Europe Considered a Notable Region in the Dietary Supplement Packaging Market?

Europe is expected to grow at a notable rate in the foreseeable future in the dietary supplement packaging market. This is stemming from its large and increasing consumer base, high disposable income, and rising focus on health and wellness. Also, the aging population of the region, together with rising awareness of preventative healthcare, fuels the demand for supplements and, subsequently, specialized packaging. Furthermore, a strong nutraceutical industry, advanced manufacturing capabilities, as well as established infrastructure for recycling in the region contribute to its prominent position in the market.

In-Depth Segmental Insights into the Dietary Supplement Packaging Market

By material type, the paper segment led the dietary supplement packaging market in 2024. This segment is growing significantly due to the rising concern among people about using eco-friendly products. As consumer awareness about environmental impact grows, there is an increasing preference for sustainable and recyclable packaging. Paper-based packaging is seen as an eco-friendly alternative to plastic, which has led to a shift toward paper for dietary supplement packaging. The biodegradable nature of paper aligns with green consumerism, which is becoming a significant trend across various industries, including food and health supplements.

By form, the powder segment led the dietary supplement packaging market in 2024. This segment is in high demand as powder supplements are easy to consume with various health benefits associated with them. One of the major advantages of powdered supplements is the ability to easily adjust serving sizes based on individual needs. This makes them particularly attractive for consumers who want to customize their supplement intake. Packaging for powdered supplements often features measuring scoops or clear serving instructions, making it easier for consumers to control their dosage. As consumers become more health-conscious and focused on personalized nutrition, the demand for powder-based supplements continues to rise.

By product type, the bags and pouches segment led the dietary supplement packaging market in 2024. This segment is growing significantly as these are portable, flexible, and convenient to use in this busy lifestyle of people consuming such supplements. The production of bags and pouches is generally more cost-effective compared to rigid packaging formats such as bottles or containers. Flexible packaging materials like polyethylene (PE), polypropylene (PP), and paper-based pouches are more affordable to produce and require less material. This cost-efficiency benefits both manufacturers and consumers, making bags and pouches an attractive packaging option, especially for larger quantities or bulk packages of dietary supplements.

Segmental Analysis

By Material Type

The glass packaging segment is growing rapidly due to its superior look superior barrier qualities and capacity to shield supplements from contamination and moisture. Glass container adoption is driven by rising demand for high-quality quality pharmaceutical-grade grade clean-label packaging.

By Form

Capsule segment is the fastest growing as consumers prefer capsules for their ease of swallowing, accurate dosing, and better absorption. Rising demand for herbal, protein, and nutraceutical capsules is increasing the need for secure and protective packaging solutions.

By Product Type

The bottles segment is expanding quickly because it is easy to use, reusable, and compatible with various supplement formats. Bottles are perfect for retail and e-commerce distribution because of their strong shelf presence, simple labeling, and tamper-evident features.

By Geography

Germany is a key market for dietary supplements packaging, fueled by the high demand for herbal supplements, vitamins, and minerals. Growing usage of glass and recyclable materials, strict quality standards, and a strong preference for pharmaceutical-grade packaging all contribute to the market's consistent expansion. Additionally, demand is being strengthened by growing consumer confidence in certified and environmentally friendly packaging options.

MEA dietary supplements packaging market is growing gradually because most people are taking nutritional supplements and are more conscious of their health. Increasing pharmacy networks importing branded supplements and raising packaging standards all help to meet demand. Packaging that is safe and protective is becoming more and more necessary as e-commerce becomes more popular.

UAE dominates the dietary supplements packaging market due to vitamins, sports nutrition, and wellness products becoming more popular, and people are becoming more conscious of their health. Demand for premium packaging is being driven by a strong reliance on imported supplements as well as growing pharmacy and retail chains. Furthermore, the demand for robust and tamper-evident packaging solutions is rising due to the expansion of e-commerce sales.

Leading Companies Shaping the Future of the Dietary Supplement Packaging Market

Recent Announcements and Strategic Moves by Leaders in the Dietary Supplement Packaging Market

- In November 2024, Amcor CEO Peter Konieczny acquired Berry Global, intending to become more dominant in consumer and healthcare packaging. The transaction is worth an estimated USD 8.4 billion, based on a price of USD 73.59 per share for Berry’s stock, with the company expecting USD 650 million in benefits by the end of the year, the majority of which are in pre-tax cost synergies.

- In July 2024, Jim Pittas, president and CEO of PMMI expressed, “Pack Expo International 2024 has truly raised the bar for what an industry event can achieve.” According to the CEO and other industry leaders, the packaging industry is observed to gain a boom with such events that offer a space for product expansion.

Key Recent Developments in the Dietary Supplement Packaging Market

- In October 2024, Berry Global launched a range of clarified polypropylene (PP) bottles for healthcare applications. ClariPPil™ bottles offer enhanced sustainability with reduced carbon footprint and improved recyclability vs a PET container solution, together with excellent functionality, product protection, and aesthetics by achieving a RecyClass A certification for its recyclability.

- In November 2023, Kate Farms® launched its first whole food blended meals. Kate Farms Pediatric Blended Meals will introduce the first whole food formulas inspired by meals at home with resealable packaging that directly connects to common tube feeding devices, offering a convenient way to nourish people using feeding tubes by connecting to commonly used tube feeding devices with quick and convenient nutrition.

- In November 2023, Acutia, announced the launch of Acutia Gut Health. It is developed with the combination of L-glutamine, prebiotics, and postbiotics.

- In February 2022, ImpacX, announced the launch of a pilot of its Vitamins.io 2.0 technology, aiming to “revolutionize” both packaging and nutrition. It is developed with smart packaging with a personalized automatic reminder facility for consumers.

Comprehensive Overview of Dietary Supplement Packaging Market Segments

By Material Type

- Paper

- Plastic

- Glass

- Metal

By Form

By Product Type

- Blisters

- Bags & Pouches

- Bottles

- Containers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait