Asia Pacific Plastic Packaging Market Size, Share, Trends and Forecast Analysis

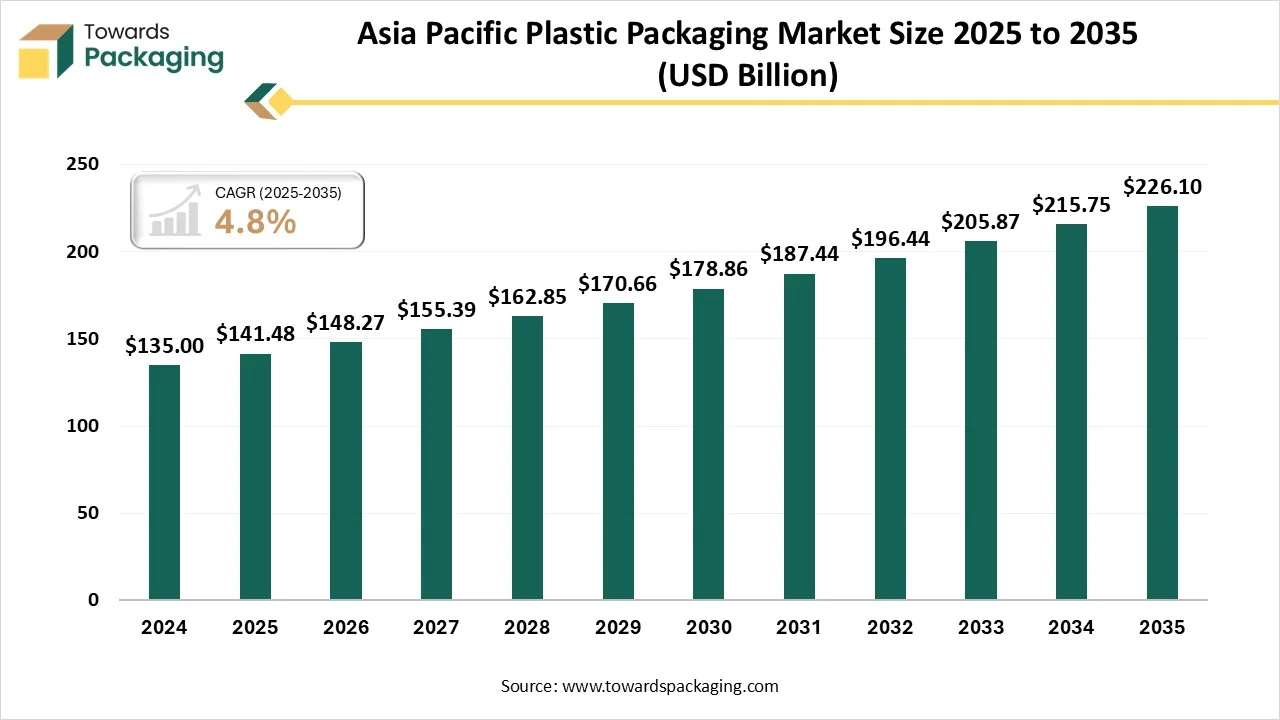

The Asia Pacific plastic packaging market is projected to grow from USD 148.27 billion in 2026 to USD 226.1 billion by 2035, registering a CAGR of 4.8% during 2026–2035. Our report provides in-depth coverage of market size, growth trends, and segment-wise data by material type, product type, application, and end-use industry. It delivers detailed regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with comprehensive company profiling, competitive landscape assessment, value chain evaluation, and trade flow analysis.

The study also includes manufacturers and suppliers data, production capacities, import-export statistics, and insights into sustainability trends, technological advancements, and evolving consumer preferences driving the market.

Major Key Insights of the Asia Pacific Plastic Packaging Market

- In terms of revenue, the market is valued at USD 148.27 billion in 2026.

- The market is projected to reach USD 226.1 billion by 2035.

- Rapid growth at a CAGR of 4.8% will be observed in the period between 2026 to 2035.

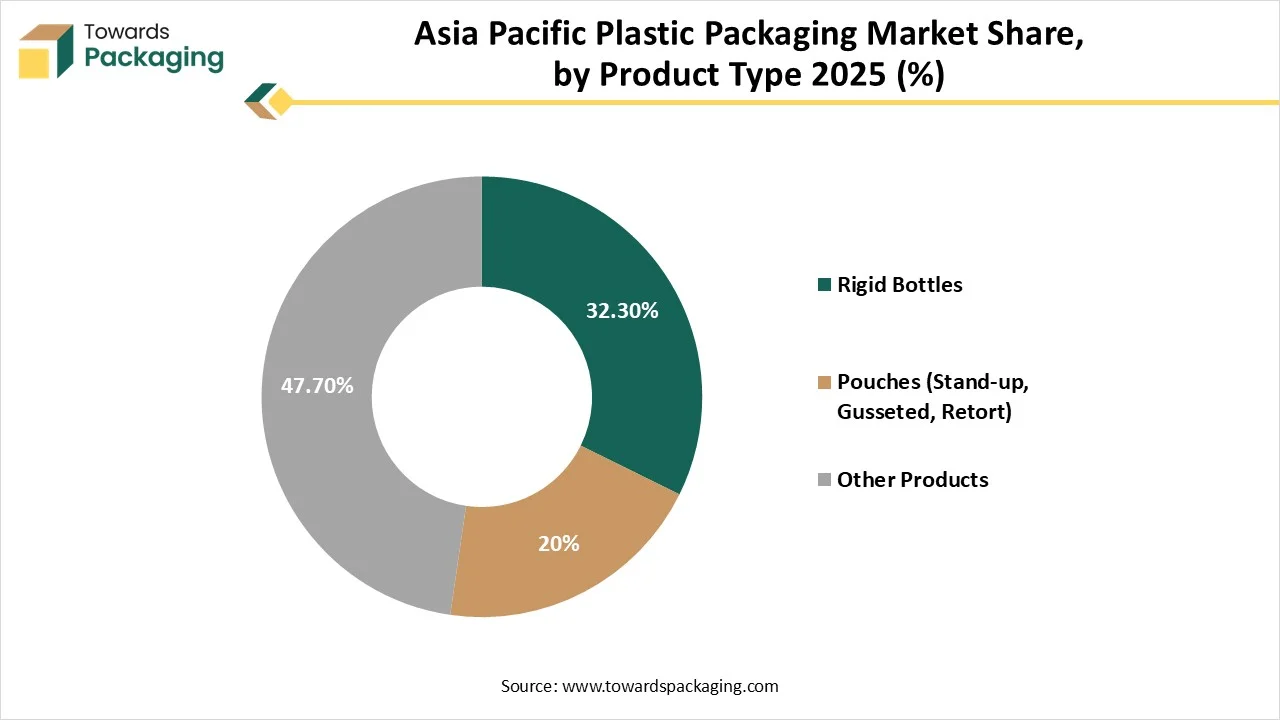

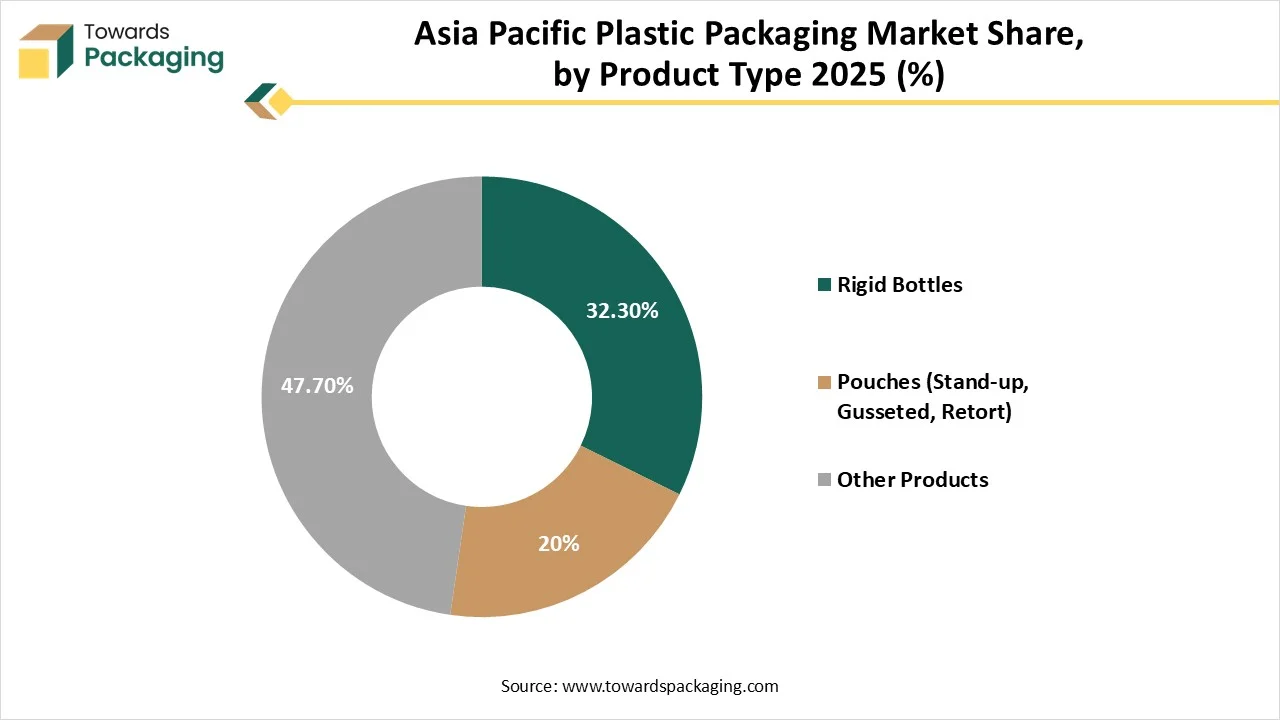

- By product type, the rigid bottles segment contributed the biggest market share of 32.3% in 2024.

- By product type, the pouches (stand-up, gusseted, retort) segment will be expanding at a significant CAGR in between 2026 to 2035.

- By material type, the polyethylene (HDPE, LDPE, LLDPE) segment contributed the biggest market share of 34.7% in 2024.

- By material type, the bioplastics / Bio-PET / Bio-PE segment will be expanding at a significant CAGR in between 2026 to 2035.

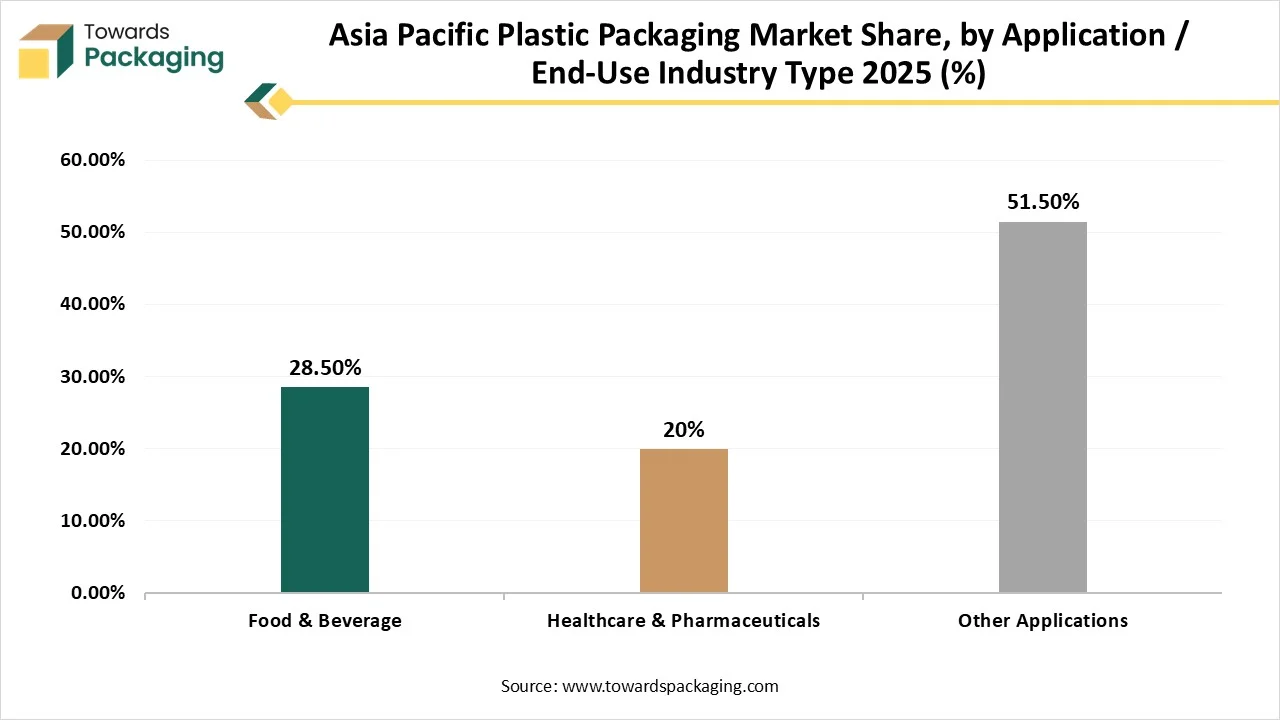

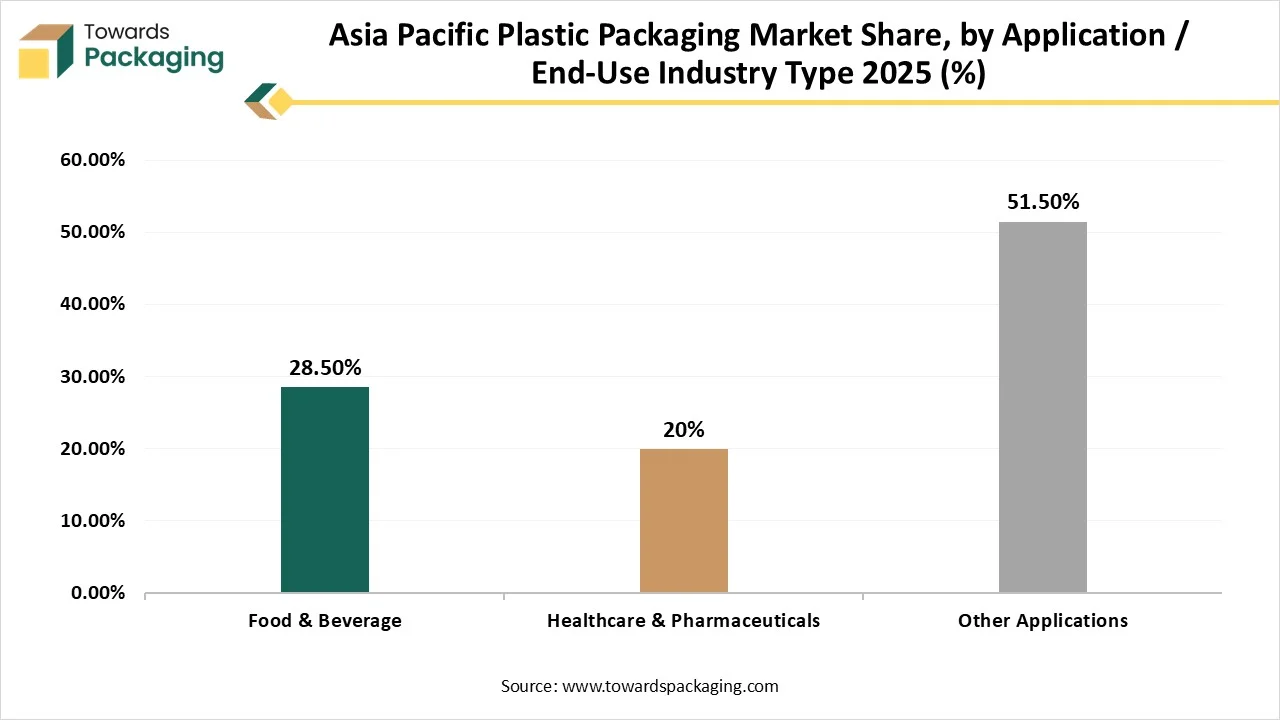

- By application/ end use industry, the food & beverage segment contributed the biggest market share of 28.5% in 2024.

- By application/ end use industry, the healthcare & pharmaceuticals segment will be expanding at a significant CAGR in between 2026 to 2035.

- By packaging type, the rigid segment contributed the biggest market share of 68.5% in 2024.

- By packaging type, the flexible segment will be expanding at a significant CAGR in between 2026 to 2035.

What is Asia Pacific Plastic Packaging?

Asia Pacific plastic packaging refers production and sale of polymer-based containers, films, bottles, trays, closures and multilayer laminates used to protect, transport and present food, beverages, personal care, pharmaceutical, industrial and e-commerce products. It covers rigid and flexible formats, barrier and recyclable structures, and conversion technologies (blow/fill/seal, extrusion, thermoforming, injection molding). Demand is driven by convenience, lightweighting, extended shelf life and e-commerce; sustainability and circular-economy innovations (PCR, mono-materials, recyclable films) increasingly shape product design and investment.

Asia Pacific Plastic Packaging Market Trends

- Market Growth Overview: Asia Pacific plastic packaging market is expanding due to growth is influenced by rising disposable earning, lifestyle shifts, the extension of e-commerce, and the increasing demand for cost-effectual and lightweight packing choices. Invention is emphasized on growing more environment-friendly technologies and showing gaps in recycling organization.

- Global Expansion: Regions such as China, India, Japan, New Zealand, Australia, and South Korea are witnessing the rapid growth of economy and population, booming e-commerce sector, enhancing food & beverages sector, increasing logistics and supply chain requirement, and various other.

- Major Market Players: Asia Pacific plastic packaging market includes Huhtamaki Oyj, Amcor Plc, Mondi Plc, Berry Global Inc., Sealed Air Corporation, Sonoco Products Company, and many other.

- Startup Ecosystem: The startup industries play an important role in developing sustainability process, e-commerce sector, flexible packaging, and advanced manufacturing.

Major Transformation in Technology of the Asia Pacific Plastic Packaging Market

Technological transformation in the Asia Pacific plastic packaging market plays a significant role in its expansion. The integration of AI technology has influenced the advancement in the resources, enhancement in recycling process, and creating eco-friendly designs. This process is undergoing noteworthy development because of its capacity to generate precise, thin-wall usages for luxury food and healthcare items. The increasing incorporation of robotics in the packaging industry has reduced labour charges and made packaging process cost-effective.

Trade Analysis of Asia Pacific Plastic Packaging Market: Import & Export Statistics

- China: It is the top most exporter of the world’s top-most plastic packaging material exporter with 48,036 shipments.

- Japan: It is one of the leading exporter of plastic packaging materials in Asia Pacific region with 9,404 shipments.

- South Korea: This region is predicted to export around 3,193 shipments of plastic packaging materials across the world.

Asia Pacific Plastic Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP).

- Key Players: LyondellBasell, Sabic

Component Manufacturing

The component manufacturing in this market comprises resins, polyethylene, blisters, and trays.

- Key Players: ALPLA Werke Alwin Lehner GmbH & Co KG, Toyo Seikan Group Holdings Ltd.

Logistics and Distribution

This segment is growing focus on expansion retail substructure, and production capabilities.

- Key Players: Nippon Express Holdings, Kerry Logistics Network

Product Type Insights

Why Rigid Bottles Segment Dominated the Asia Pacific Plastic Packaging Market In 2024?

The rigid bottles segment dominated the market with highest share in 2024 due to strong demand for safe packaging. Its manufacturing process includes a huge variety of resin type such as polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP). This segment is highly in-demand due to rising food & beverages industry, pharmaceuticals, personal care and toiletries, and industrial market. A main process utilized in the manufacturing of rigid plastic packaging. A noteworthy customer of rigid bottles for goods like mouthwash and cosmetics.

The pouches (stand-up, gusseted, retort) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to changing lifestyle and rapid urbanization. It is majorly influenced by rising demand for packed foods, increasing disposable earnings, and the change in the direction of sustainable, convenient, and lightweight packaging options. It offers prolonged volume and steadiness for items such as pet food, coffee, and industrial products. It is manufactured to endure high-temperature handing out for shelf-steady food products, providing a substitute to old-style glass jars and metal cans.

The jars & containers is the fastest-growing in the market, as it comprises durability, product visibility, and cost-effectiveness in the packaging sector. The rising trend for such as sustainability are affecting development and growth. The increasing demand for preservation of food products has raised the demand for this segment in the food & beverages sector. The strength and visibility properties of this segment has enhanced its demand in luxurious packaging.

Material Type Insights

| Material Type Segments | Market Share 2025 (%) |

| Polyethylene (HDPE, LDPE, LLDPE) | 34.70% |

| Bioplastics / Bio-PET / Bio-PE | 25% |

| Other Materials | 40.30% |

Why Polyethylene (HDPE, LDPE, LLDPE) Segment Dominated the Asia Pacific Plastic Packaging Market In 2024?

The polyethylene (HDPE, LDPE, LLDPE) segment dominated the market with highest share in 2024 due to rapid urbanization and industrialization. HDPE offers huge tensile strength, chemical inertness, and effective resistance. These are extensively utilized for rigid drums, containers, and bottles where strength and durability are important. LDPE packaging is flexible, lightweight, and resistant to influence and moisture. It is mainly utilized for flexible packaging, comprising bags, films, and few containers. It is influenced by the development of e-commerce, which depend on strong and safe packaging options.

The Bioplastics / Bio-PET / Bio-PE segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to feedstock availability and government initiatives. These are utilized in both rigid as well as flexible packaging, like films, bottles, jars, and cups, and seamlessly incorporated into present recycling streams. These planned to be compostable or biodegradable, providing a diverse end-of-life option than old-style plastics. Strict Government guidelines in countries like China, India, Japan, South Korea, and several others encourage the usage of biodegradable substitutes.

The polyethylene terephthalate (PET) is the fastest-growing in the market, as it comprises enhance shelf-life packaging and government initiatives. Growing demand for packed food & beverages because of increasing disposable earnings and tiring lifestyles. The development of online retail influences demand for this material convenient and protective packaging qualities for shipping. Initiatives encouraging recycling and the usage of recycled PET (rPET) are generating a strong industry for sustainable options.

Application / End-Use Type Insights

Why Food & Beverage Segment Dominated the Asia Pacific Plastic Packaging Market In 2024?

The food & beverage segment dominated the market with highest share in 2024 due to rising e-commerce sector, convenience, and growing middle class population. A wide range of food products such as bakery and confectionery, dairy, frozen and fresh food, confectionery and snacks, seafood and meat packaging influence the development of this market. The rapid growth in the alcohol market has influenced the bottled packaging with protection. These is a need for safe storage from air, moisture, and light without degrading the quality of food products has raised the adoption of this market.

The healthcare & pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to huge demand for storage and transportation. The increasing drug delivery portals has raised the demand for such packaging for safe transportation. Increasing emphasis on protective transportation and management of medicines for injectable, transdermal routes, and oral. It is influenced by increasing government programs and pet ownership for animal health.

The personal care & cosmetics is the fastest-growing in the market, as it comprises bottles, jars, tubes, pouches, and many other. It also includes development in refillable and sustainable packaging, influenced by customer consciousness and e-commerce sector. There is a robust influence for sustainable packing, comprising the usage of recyclable plastics as well as refillable choices, to decrease ecological influence. Amplified customer consciousness regarding personal dressing and appearance is a major aspect influencing the complete market's extension.

Packaging Type Insights

| Packaging Type Segments | Market Share 2025 (%) |

| Rigid | 68.50% |

| Flexible | 20% |

| Other Types | 11.50% |

Why Rigid Packaging Segment Dominated the Asia Pacific Plastic Packaging Market In 2024?

The rigid packaging segment dominated the market with highest share in 2024 due to increasing demand for strong packaging for protective storage as well as transportation. It is highly preferred for the packaging of fragile products. Rising e-commerce sector has influenced the demand for rigid packaging of the products. It includes packaging such as bottles, jars, trays, tubes, caps & closures. Increasing shift towards urban areas has influenced the demand for rigid packaging profoundly.

The flexible packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its versatility and huge customization options. It comprises pouches, stretch films, shrink films, liners, wraps & film rolls for packaging of a wide range of products. The rapid growth in travelling due to presence of working individual the demand for such packaging is growing. The increasing need of small batch packaging of products has raised the demand for this segment.

Country Insights

How China is Dominating in the Asia Pacific Plastic Packaging Market?

China held the largest share in the Asia Pacific plastic packaging market in 2024, due to presence of huge manufacturing hub and customer base. This region is important in the acceptance of new technologies, comprising robotics, smart packing, and sustainable resources, which allows effectual innovation and production. Advance recycling technology for plastic packaging waste has raised the demand for this market. Huge demand for packaged products due to changing lifestyle of the consumers has evolved this market to grow rapidly. The rapid growth of pharmaceutical, food & beverage, cosmetic, and electronics sector has fuelled the demand for this market.

Why Asia Pacific Plastic Packaging Market is Growing Rapidly in India?

Rising disposable earning and increasing consumption of packaged products have enhanced the demand for the market. The rapid extension of the e-commerce sector directly influences the requirement for varied, strong, and visually attractive packaging option to help online purchases. It is frequently more cost-operative and provides a mixture of advantages such as durable, lightweight, and offering a good shelf-life for packaged products. The increasing demand for long-lasting and convenient packaging, and also rising emphasis on innovative and sustainable packaging option facilitate suggestively to the expansion of the market.

Recent Developments

- In October 2025, Henkel announced the launch of packaging RecycLab in Shanghai to improve packaging recyclability and appraise adhesive solution. The aim is to enhance company’s potential and favour evolution to a circular economy.

- In July 2025, WIMBÉE which is a packaging company of France collaborated with Koehler Paper to introduce completely recyclable cardboard cap for aerosols for the first time. It is a customized substitute of old-style plastic closure.

Top Companies in the Asia Pacific Plastic Packaging Market

- Amcor plc: It offers plastic, packaging film, metal, and glass packaging for industries including food, beverage, medical, and pharmaceuticals.

- Berry Global: It offers a wide range of plastic packaging products to various sectors.

- Sealed Air Corporation: It offers a variety of packaging solutions, including those for the food, pharmaceutical, and personal care industries.

- Mondi Group: It provides a wide range of packaging, with an emphasis on paper-based and flexible solutions.

- Huhtamaki Oyj: It offers a diverse range of packaging, including solutions for food service, food and beverage, and other consumer goods.

- Others: Sonoco Products Company, Silgan Holdings, ALPLA, Plastipak Packaging, Constantia Flexibles, CCL Industries, Winpak Ltd, Coveris, Uflex Ltd, and RPC/Superfos (Berry Global Group)

Asia Pacific Plastic Packaging Market Segments Covered

By Product Type

- Rigid Bottles

- Jars & Containers

- Trays & Clamshells

- Cups & Tubs

- Drums & IBCs

- Flexible Films & Wraps

- Pouches (Stand-up, Gusseted, Retort)

- Sachets

- Bags (Shopping Bags, Industrial Bags)

By Material Type

- Polyethylene (HDPE, LDPE, LLDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- EVOH

- Polyamide (Nylon)

- Bioplastics / Bio-PET / Bio-PE

- PCR Plastics (Post-Consumer Recycled)

By Application / End-Use

- Food & Beverage - Dominated

- Personal Care & Cosmetics

- Home Care & Household

- Healthcare & Pharmaceuticals - Fastest

- Industrial & Chemical

- Agriculture

- E-commerce & Retail

- Automotive Components Packaging

By Packaging Type

- Rigid

- Bottles

- Jars

- Trays

- Tubs

- Caps & Closures

- Flexible

- Pouches

- Wraps & Film Rolls

- Liners

- Shrink Films

- Stretch Films

Tags

FAQ's

Select User License to Buy

Figures (4)