Glass Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

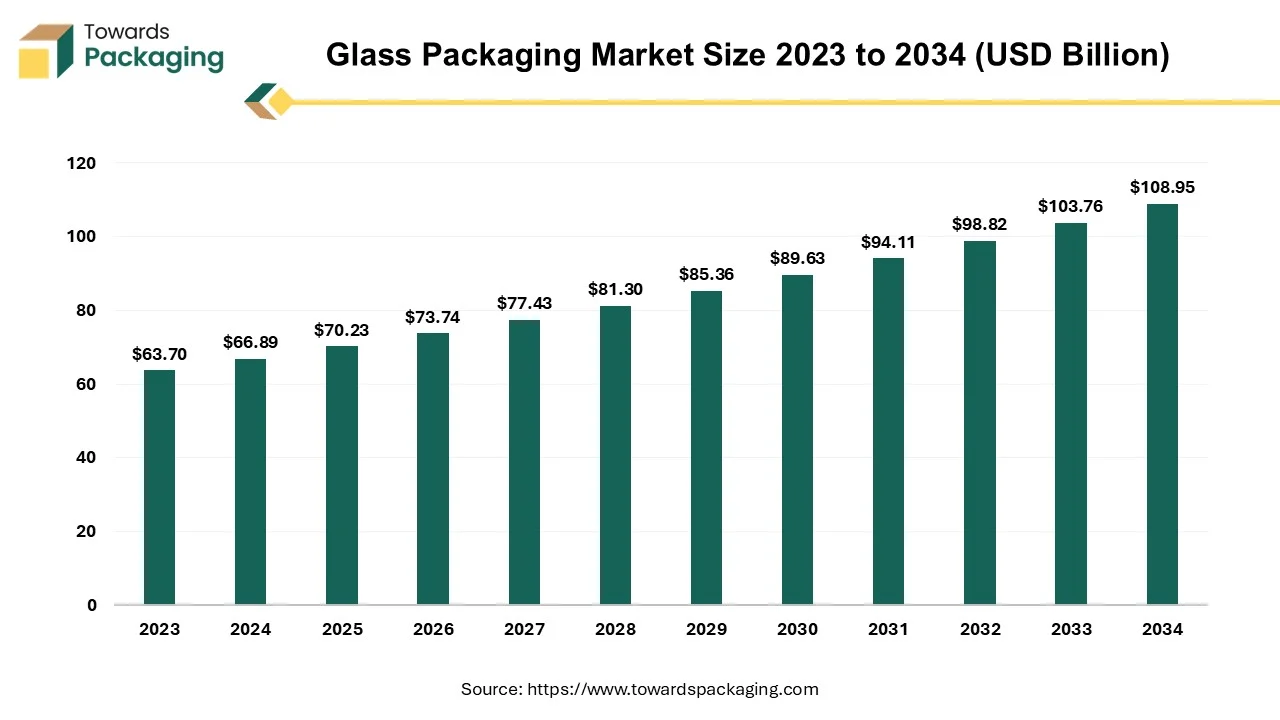

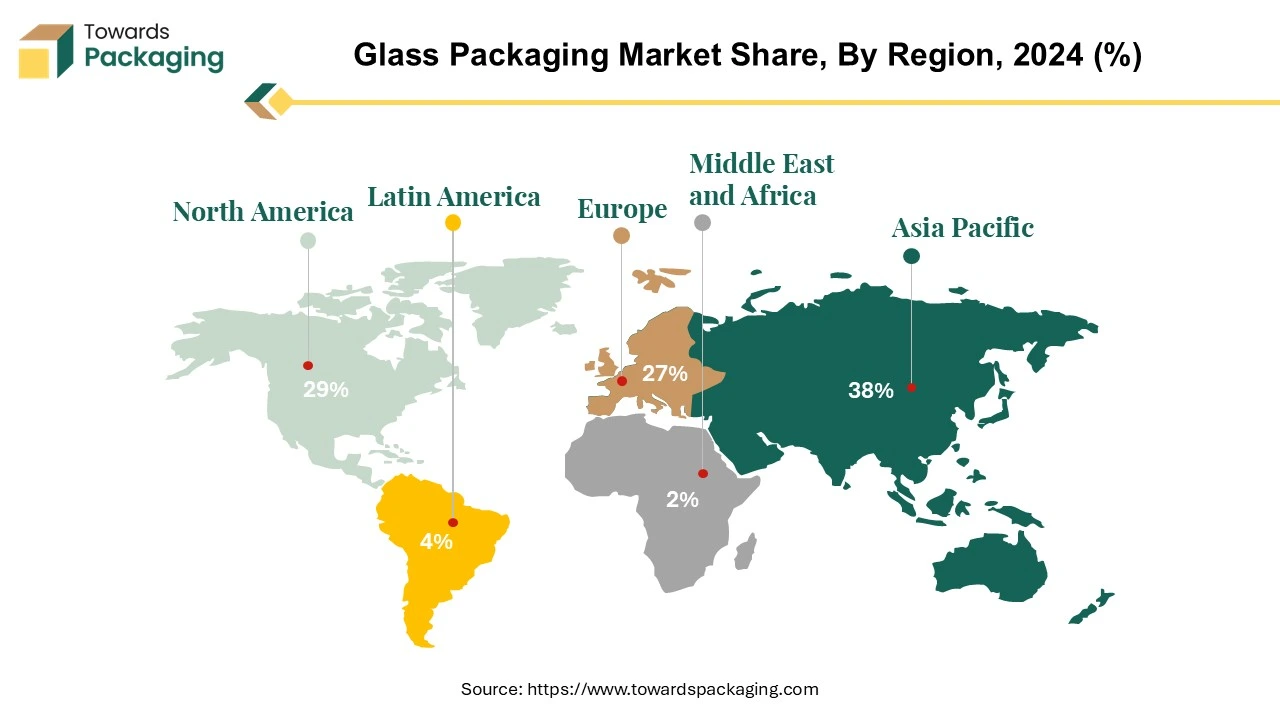

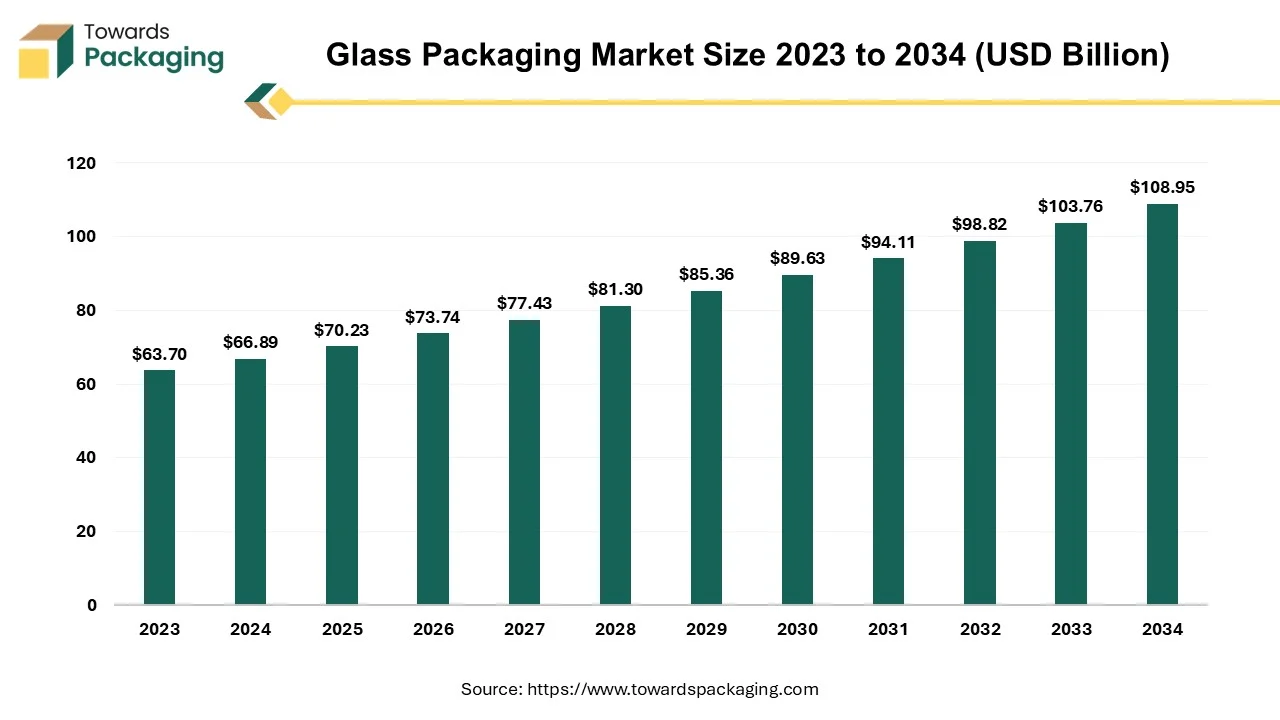

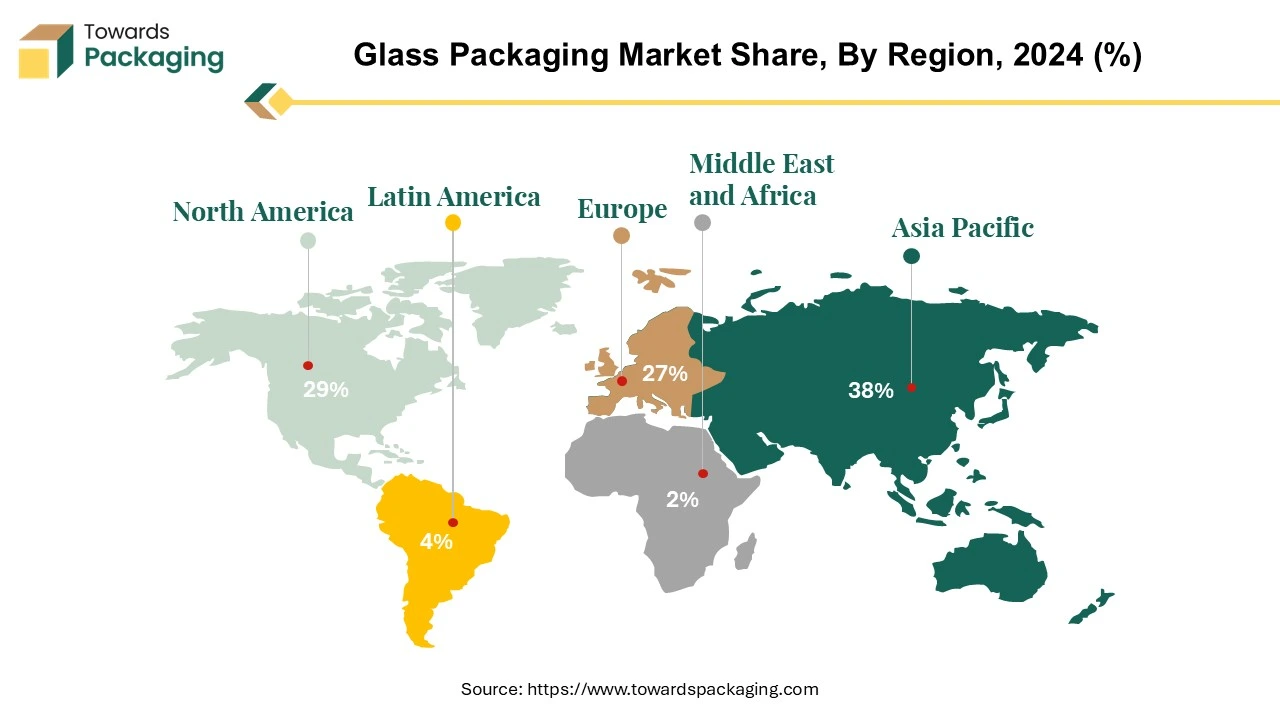

The glass packaging market is forecasted to expand from USD 73.75 billion in 2026 to USD 114.40 billion by 2035, growing at a CAGR of 5% from 2026 to 2035. The market is segmented by material, including soda-lime glass, borosilicate, and de-alkalized soda-lime glass. By product, the vials segment holds the largest market share, while the beverage industry continues to be the dominant application. Geographically, Asia Pacific led the market in 2024, followed by North America and Europe. The market is shaped by major players like Piramal Glass Pvt. Ltd., Owens-Illinois Inc., and Gerresheimer AG, who dominate the competitive landscape.

Major Key Insights of the Glass Packaging Market

- Asia Pacific dominated the glass packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the soda-lime glass segment dominated the market with the largest share in 2024.

- By product, the vials segment registered its dominance over the global glass packaging market in 2024.

- By application, the beverages segment dominated the glass packaging market in 2024.

Glass Packaging Market: Non-reactive Packaging

Glass packaging has been used for centuries due to its durability, chemical stability, and premium appeal. It remains a popular choice for industries like food & beverages, pharmaceuticals, cosmetics, and premium seafood packaging. The glass packaging provides a 100% barrier against oxygen, moisture, and external contaminants, ensuring a longer shelf life. Protects sensitive contents like seafood, dairy, and medicines from spoilage. Often used for high-end products due to its luxurious look and feel. Glass packaging can be coloured, embossed, or customized for branding purposes.

Market Trends

- Eco-Friendly and Sustainability Packaging: A significant shift towards reducing plastic waste has led brands to adopt glass packaging as an eco-friendly alternative. Companies like Lidl have initiated programs to reduce plastic usage by 20% by 2025, encouraging consumers to choose products in glass containers. In Scotland, traditional glass milk bottles are resurging as eco-conscious consumers opt for sustainable options over plastic.

- Lightweight and Innovative Designs: Advancements in glass manufacturing have resulted in lighter and more durable packaging solutions. For instance, Johnnie Walker introduced the world's lightest glass whisky bottle, weighing 180 grams, reducing carbon emissions associated with production and transportation.

- Recyclable Glass Packaging: British Glass and the UK container manufacturers collaborated with WRAP (Waste and Resources Action Programme) to establish a methodology for determining the recycled content of glass containers. This approach is in line with ISO 14021 Environmental labels and declarations, which pertains to self-declared environmental claims (Type Il environmental labelling). Under this method, the following materials can be counted toward recycled content: calumite (a waste material from iron production used in glass production); waste plate (flint) glass from glazing and automotive; and glass packaging waste from bottles and jars from recycling collections (UK and imports). The recycled content statistic reported by British Glass and its members does not include glass from internal process losses (such as test runs or rejects), even though it will be returned to the furnace whenever feasible (unless requested and properly labelled as such).

- This is to guarantee that recycled content: demonstrates authentic utilization of waste products and the circular economy It is not inflated by changes in the manufacturing process; it corresponds with a decrease in the usage of virgin raw materials. The availability of appropriate cullet varies daily, hence it is impossible to provide recycled glass content for individual products. Over the course of a calendar year, the UK's national recycled glass content figures are determined.

- Glass Reinvented: Glass, which is an evergreen material, is being reimagined. Lightweight glass-made containers lower energy consumption during transportation and production without compromising durability. Furthermore, implementing recycled glass specifically minimizes the environmental footprint of glass packaging.

- Biodegradable and Compostable Materials: Plant-based materials like corn starch and sugarcane are gaining attention in non-alcoholic packaging. These materials naturally decompose, which reduces waste and environmental effects.

- Advanced Recycling Technologies: Chemical recycling inventions are breaking down plastics into reusable monomers that solve challenges with hard-to-recycle materials. This technology's goal is to close the loop in the glass packaging lifecycle.

- Carbon-Neutral Packaging: Receiving carbon neutrality across the packaging lifecycle is gaining attention.

- Minimalist Design: The "less is more" strategy to glass packaging removes unwanted components, which reduces material use and simplifies the recycling process.

- Zero-Waste Packaging: Circular Systems like edible packaging and fully compostable packaging are gaining attention. These inventions' goal is to eliminate waste completely from glass packaging.

How Can AI Improve the Glass Packaging Industry?

AI-driven automation can streamline glass production by optimizing temperature, pressure, and speed in molding, reducing energy consumption. Predictive maintenance uses AI to analyze equipment performance and anticipate failures, reducing downtime and repair costs. Computer vision and machine learning can detect defects (cracks, bubbles, irregularities) faster and more accurately than manual inspection. AI can improve consistency in production by automatically adjusting processes based on real-time quality assessments. AI-integrated QR codes and NFC technology provide consumers with real-time product information, sustainability details, and recycling instructions.

AI-powered computer vision can detect defects such as cracks, bubbles, or irregularities in glass bottles and containers with greater accuracy than human inspection. Machine learning algorithms can continuously improve defect detection by analyzing past data and predicting manufacturing issues. AI can analyze sensor data to predict equipment failures before they happen, reducing downtime. AI-driven systems can adjust temperature, pressure, and speed in glass molding to optimize quality while minimizing energy consumption. AI-driven demand forecasting can help manufacturers produce the right amount of glass packaging, reducing overproduction and waste. Automated logistics management can optimize delivery routes and warehouse stocking, cutting costs and emissions.

Driver

Growth in Pharmaceutical & Healthcare Sectors

Glass is chemically inert, making it ideal for storing medicines, vaccines, and injectable drugs. The expansion of biotechnology and specialty drugs is increasing the demand for borosilicate glass vials and ampoules. The pharmaceutical industry relies heavily on glass vials, ampoules, and syringes for storing vaccines, injectable drugs, and biologics. The growth of biopharmaceuticals, gene therapies, and specialty drugs increases the need for high-quality borosilicate glass that resists chemical interactions. Biologics and biosimilars require packaging that prevents contamination, and glass is preferred due to its inert properties and ability to maintain drug stability.

As personalized medicine and advanced therapies grow, customized glass packaging solutions will be in higher demand. Rising healthcare spending in developing countries (India, China, Brazil) is increasing the production of pharmaceuticals, fueling demand for glass packaging. The aging population worldwide is driving demand for injectables, IV solutions, and ophthalmic products, all of which rely on glass packaging. The expansion of the pharmaceutical and healthcare industries is directly boosting the demand for glass packaging, especially for vials, ampoules, and high-quality containers used in medicine storage.

According to the data published by the Indian Pharmaceutical Association, in 2025, it has been estimated that according to an investigation by ETMutual Funds, mutual funds focused on pharmaceutical and healthcare have provided the highest average return in 2024 (January 1, 2024 to December 3, 2024), at about 38.05%.

Restraint

Fragility & Handling Issues & Competition from Alternative Packaging Materials

The key players operating in the market are facing issue due to fragility of glass material and competition from alternative packaging materials which has estimated to restrict the growth of the glass packaging market. Glass production requires extremely high temperatures, leading to higher energy consumption and costs, especially with rising fuel prices. Some segments prefer plastic pouches, cartons, or metal cans due to cost-efficiency and convenience.

Glass is more fragile than plastic or metal, leading to higher breakage risks during transport and storage. Although glass is sustainable, its manufacturing process emits significant CO₂, making it less eco-friendly compared to some alternatives. Consumers often prefer lightweight and shatterproof packaging, making plastic or aluminum more appealing for on-the-go products. Advances in biodegradable plastics and compostable packaging present competition to glass.

Market Opportunity

Sustainability & Environmental Regulations

Growing concerns about plastic waste and pollution are pushing brands to switch to glass, which is 100% recyclable and reusable. Government policies & regulations: Many countries are introducing plastic bans and recycling mandates, encouraging industries to adopt glass packaging. Circular economy initiatives: Glass can be recycled endlessly without losing quality, aligning with sustainability goals of major corporations.

Manufacturers are developing lightweight glass to reduce transportation costs and carbon emissions. Smart glass packaging (e.g., NFC-enabled bottles, QR codes) is gaining traction, offering enhanced customer engagement and traceability. For instance, in 2023, SGD Pharma, pharmaceutical company revealed the expansion of the beauty and cosmetics range with the launch of the Nova - a lightweight glass bottle.

Soda-Lime Glass Segment Led the Market in 2024

The soda-lime glass segment held a dominant presence in the glass packaging market in 2024. Soda-lime glass is cheaper to manufacture compared to other types like borosilicate glass, making it the preferred choice for mass production. Transparent and color-customizable of soda-lime glass making it ideal for packaging and display. Soda-lime glass has low melting point (compared to borosilicate glass) makes it easier to mold and shape.

Vials Segment to Show Significant Growth in the Upcoming Period

The vials segment accounted for a significant share of the glass packaging market in 2024. Glass is extensively used for manufacturing vials due to its unique properties that ensure the safety, stability, and effectiveness of stored substances. As glass has chemical inertness & non-reactivity. Glass does not react with drugs, vaccines, or chemicals preventing contamination. The glass material offers thermal resistance can withstand high-temperature sterilization processes (autoclaving). The glass material is suitable for cryogenic storage and transport of temperature-sensitive drugs.

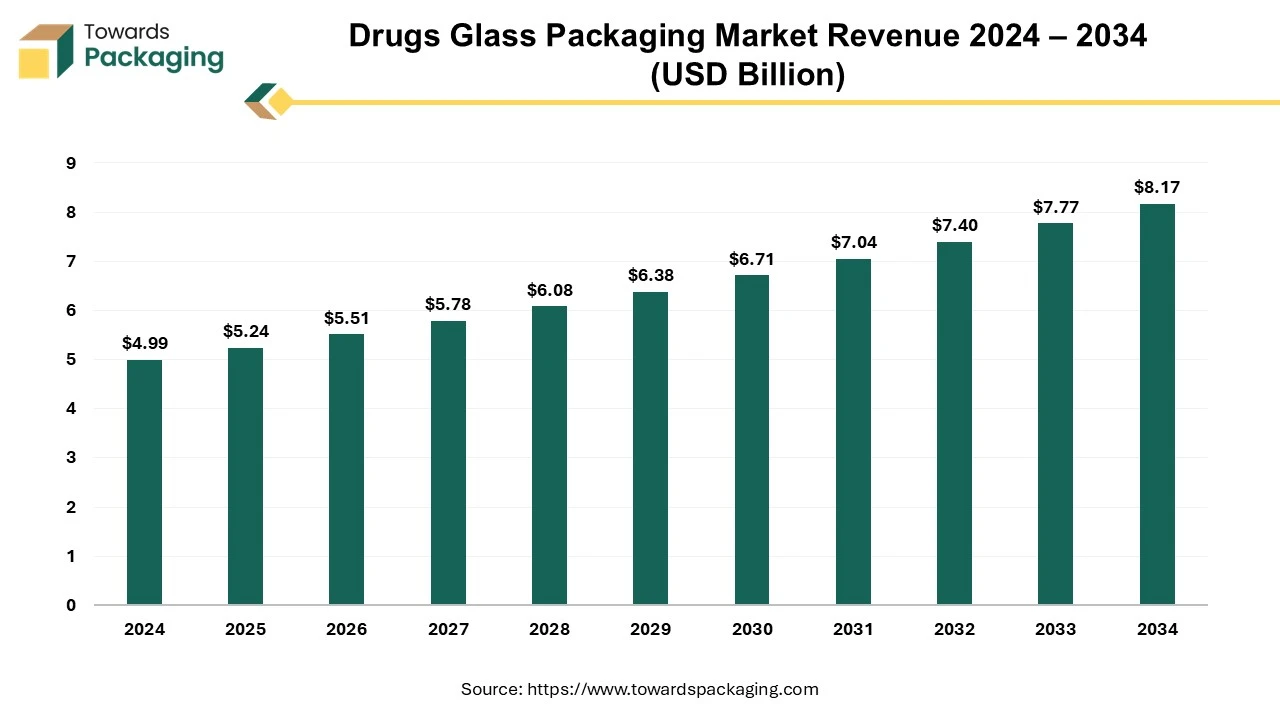

Drugs Glass Packaging Market Research Insight: Industry Insights, Trends and Forecast

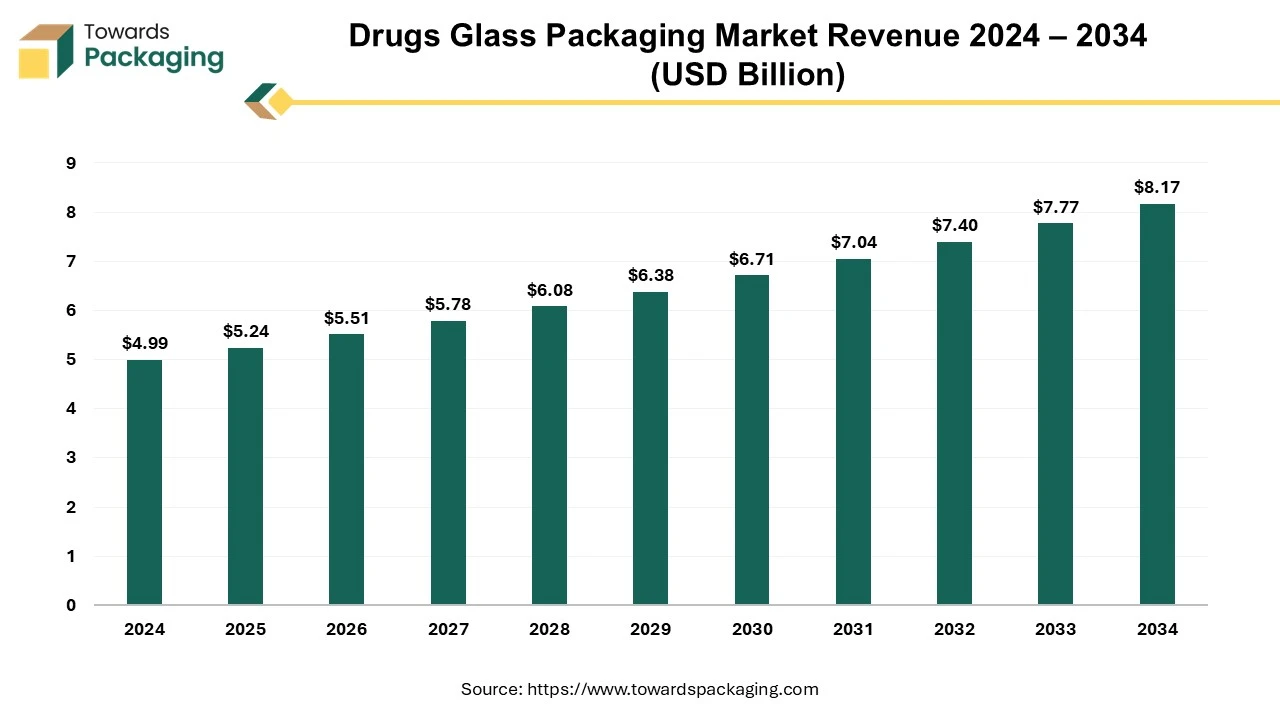

The drugs glass packaging market is expected to increase from USD 5.51 billion in 2025 to USD 8.17 billion by 2034, growing at a CAGR of 5.05% throughout the forecast period from 2025 to 2034.

The market is proliferating due to the increasing pharmaceutical industries due to continuous research and funding. These drugs need safe contamination-free packaging which can also enhance the shelf life of the products. This eco-friendly, safe and sustainable packaging demand in several industries significantly drives the drugs glass packaging market.

The drugs glass packaging market is an important industry in the healthcare packaging sector. This deals with sustainable packaging and transporting medicinal glass packaging to several areas. This market is generally driven by the rising trend of eco-friendly packaging and reliable glass packaging demand among consumers which should also be convenient. The drugs glass packaging industry manufactures different types of glass bottles with various requirements such as shapes, sizes, quality, locking systems, and many others

Expansion of Food & Beverages Industry to Support Dominance

The food & beverages segment registered its dominance over the global glass packaging market in 2024. As companies expand, they introduce more products requiring glass packaging (e.g., sauces, juices, dairy products, alcoholic drinks). Increasing consumer preference for premium and organic foods boosts glass usage due to its perceived purity and safety. The wine, beer, and spirits industry relies heavily on glass bottles for preserving taste and quality. Expanding breweries and distilleries increase the demand for customized and sustainable glass bottles.

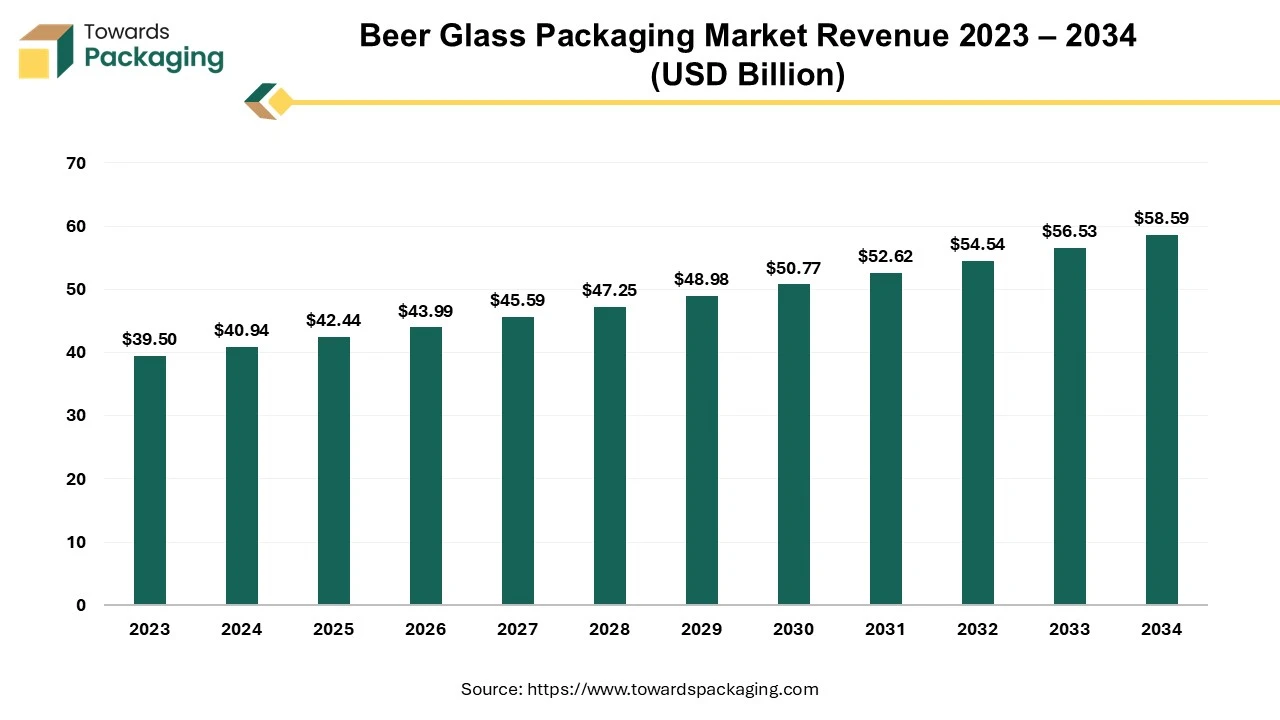

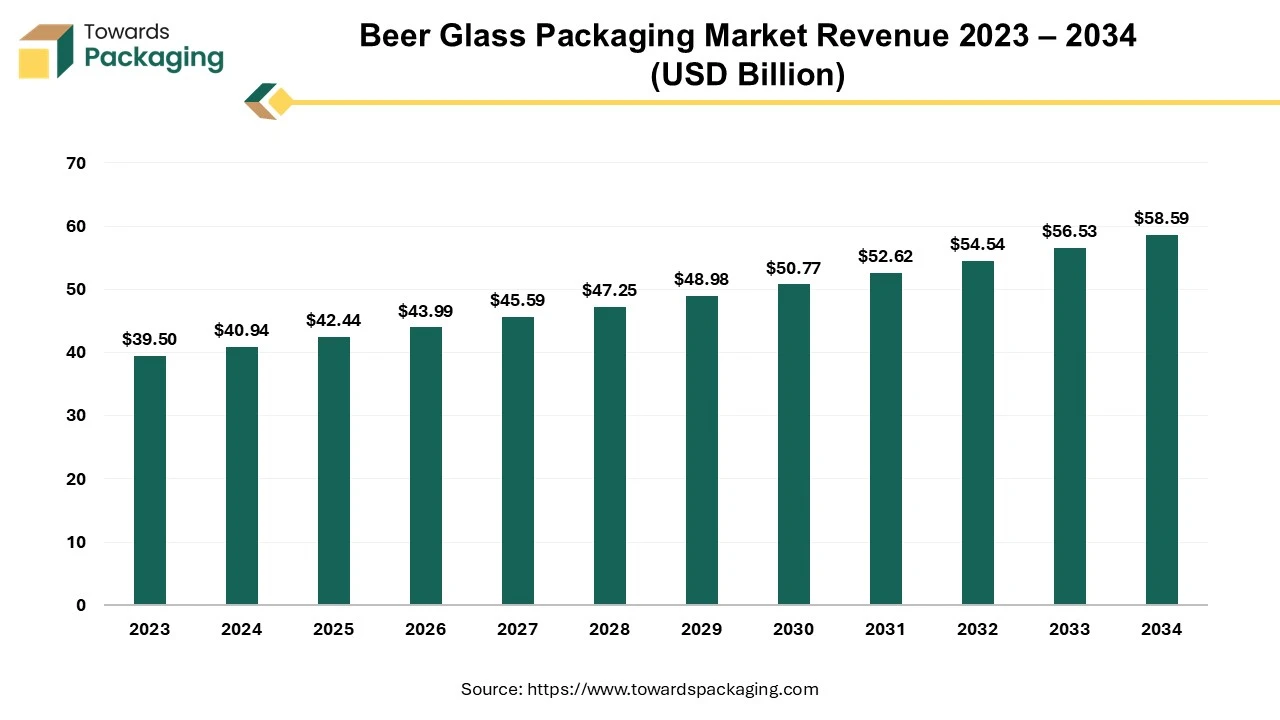

Growth of Beer Glass Packaging Market

The beer glass packaging market is set to grow from USD 42.44 billion in 2025 to USD 58.59 billion by 2034, with an expected CAGR of 3.65% over the forecast period from 2025 to 2034.

The market is proliferating due to the increasing demand for alcoholic beverages in celebrations. Consumers' demand for eco-friendly packaging is pushing the beer glass packaging market.

The beer glass packaging market is an important industry in the packaging sector. This deals with sustainable packaging and transporting beer bottles to several areas. This market is generally driven by the rising trend of premium-looking bottle demand among consumers which should also be convenient to use. The beer glass packaging industry deals with manufacturing different types of bottles with a variety of shapes, sizes, colors, locking systems, and many others. This industry manufactures different quality glass bottles with a variety of designs which makes it different from one brand to another. These bottles are of different types according to their weight as well. As there is a huge demand for lightweight glass bottles the growth factor of this industry is exponential.

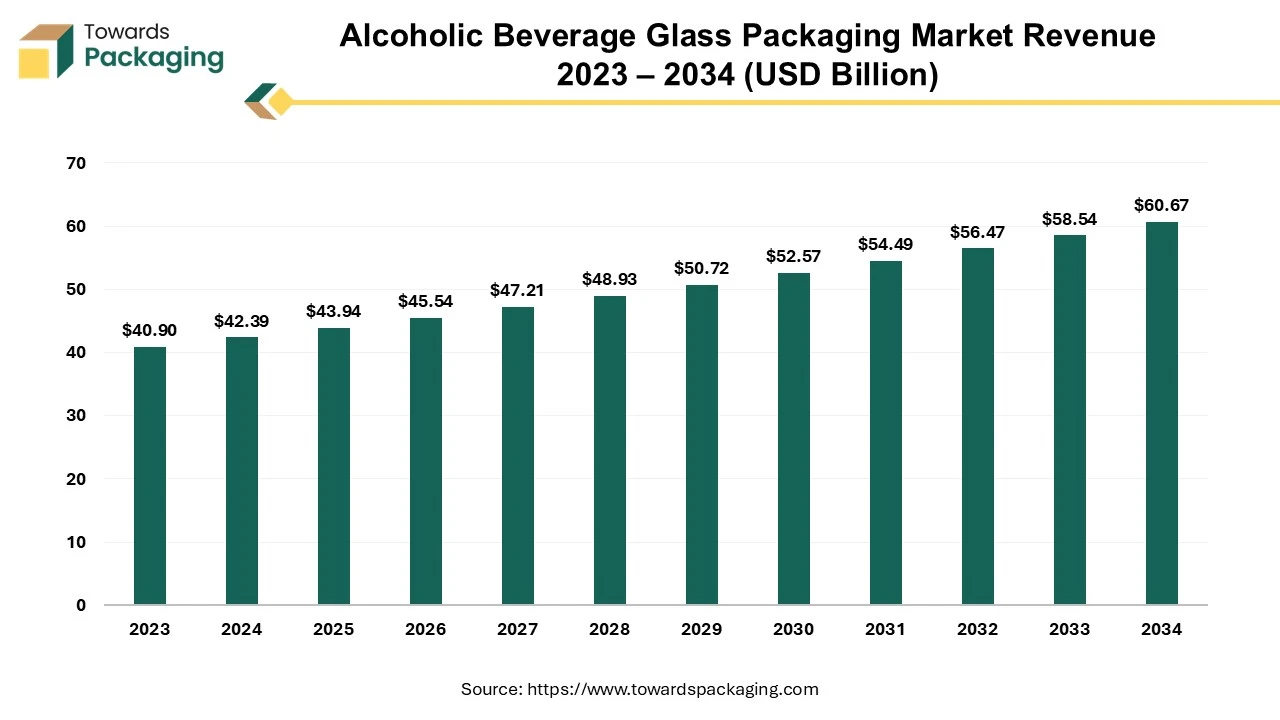

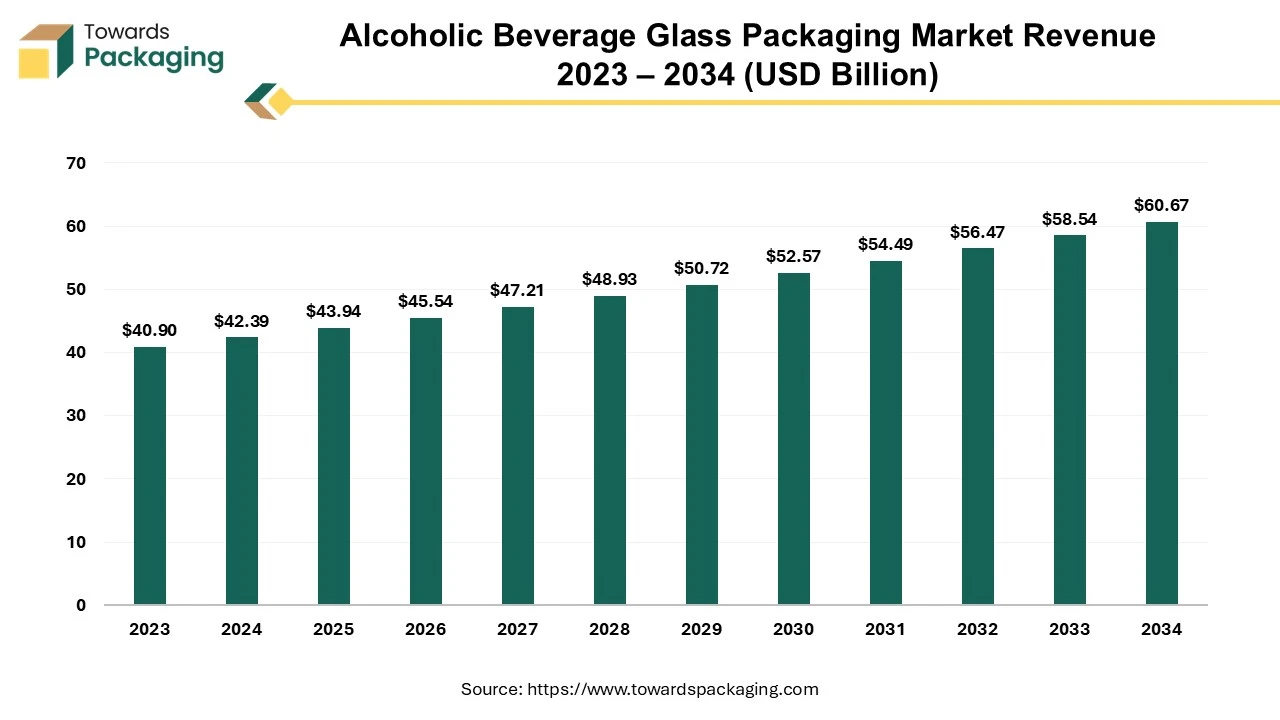

Growth of Alcoholic Beverage Glass Packaging Market

The alcoholic beverage glass packaging market is expected to increase from USD 43.94 billion in 2025 to USD 60.67 billion by 2034, growing at a CAGR of 3.65% throughout the forecast period from 2025 to 2034.

The market is proliferating due to the increasing consumption of alcoholic beverages by people for celebrations, high disposable earnings, societal demand, and many other factors. Consumers' continuous demand for eco-friendly packaging is pushing the alcoholic beverage glass packaging market.

Asia Pacific region dominated the global glass packaging market in 2024. This increase is explained by the growing need for environmentally friendly and sustainable packaging options because glass is a 100% recyclable material that has a smaller environmental impact. Furthermore, the expansion of the food, beverage, and pharmaceutical sectors in the area is increasing demand for long-lasting, safe, and high-quality glass packaging. Further encouraging market expansion are cutting-edge technology and packaging designs that improve the visual attractiveness of glass items.

India Glass Packaging Market Trends

The demand for glass packaging in India has increased due to shifting lifestyles, increased disposable incomes, and growing westernization, especially in the food and beverage and alcoholic beverage sectors. Additionally, as glass is the ideal material for products like ampoules, dropper bottles, and high-end cosmetic containers, the expanding healthcare and cosmetics industries have helped to fuel the need for glass packaging.

North America’s Developed Industrial Sector to Support Growth

North America region is anticipated to grow at the fastest rate in the glass packaging market during the forecast period. North America region has a high consumption of alcoholic beverages, especially beer, wine, and spirits, which are often packaged in glass bottles due to their premium appeal and ability to preserve taste. Increasing awareness about environmental sustainability has led to a preference for glass, as it is 100% recyclable and reusable without losing quality. The pharmaceutical and personal care industries in North America rely on glass packaging for its chemical resistance, safety, and aesthetic appeal.

U.S. Glass Packaging Market Trends

The U.S. glass packaging market is anticipated to increase significantly during the over the forecast years. The market is being driven in large part by the growing demand for eco-friendly and sustainable packaging options as a result of consumers' increased environmental consciousness. Due to glass's inert and non-reactive qualities, the pharmaceutical industry is seeing an increase in demand for glass packaging, which is fueling market expansion. It is anticipated that the need for glass packaging will be fueled by the aging of the American population and the concurrent growth of the pharmaceutical sector.

The U.S. glass packaging market is set to grow from USD 9 billion in 2025 to USD 12.8 billion by 2034, with an expected CAGR of 4% over the forecast period from 2025 to 2034. Increasing customer consciousness regarding sustainability and health has boosted the demand for glass packaging, particularly in the food and beverage industry.

Technological progressions, such as lightweighting and improved design competencies, are driving the U.S. glass packaging market development. The Midwest U.S. is dominating due to the increasing demand for eco-friendly and sustainable packaging results.

Canada Glass Packaging Market Trends

The market for glass packaging in Canada is anticipated to expand considerably as a result of rising beer consumption. Glass bottles are widely used to protect beer's contents from UV light exposure. Glass bottles and containers are also in high demand due to the growing popularity of cosmetics and fragrance goods, especially high-end and luxury brands. A competitive advantage for the expansion prospects of the sector is also provided by Canada's position as a major exporter of glass and glassware.

Europe Region Projects Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The EU has implemented stringent policies to reduce plastic waste and promote circular economy practices, driving demand for glass as a sustainable packaging solution. Europe has one of the highest glass recycling rates globally, with countries like Germany, France, and the Netherlands leading in glass collection and reuse. This supports cost-effective and sustainable glass production. European consumers are highly conscious of sustainability, leading to a growing preference for glass over plastic, especially in food, beverages, and cosmetics.

The increasing consumption of wine, beer, and premium spirits, particularly in countries like Italy, France, and Spain, is driving the demand for glass bottles. European manufacturers are investing in advanced technologies to produce lightweight yet durable glass bottles, reducing costs and carbon emissions while maintaining strength and aesthetics. European governments and packaging companies are working together to enhance glass recycling infrastructure and encourage glass usage through incentives and funding programs.

Global Glass Packaging Market Top Players

- Piramal Glass Pvt. Ltd.

- Owens-Illinois Inc.

- WestPack LLC

- Gerresheimer AG

- Hindustan National Glass & Industries Ltd.

- Ardagh Group

- HEINZ-GLAS GmbH & Co. KGaA

- Agrado Sa

- SGD SA (SGD Pharma)

- AAPL Solutions Pvt. Ltd.

- Crestani Srl

- Schott Kaisha Pvt. Ltd.

- AGI Glaspac (HSIL Ltd.)

- Borosil Glass Works Ltd. (Klasspack Pvt. Ltd)

- Haldyn Glass Limited (HGL)

- Sunrise Glass Industries Private Limited

- Ajanta Bottle Pvt. Ltd.

- G.M Overseas

- Empire Industries Limited- Vitrum Glass

- Consol Speciality Glass Limited

Latest Announcements by Glass Packaging Industry Leaders

- Thaddeus Lubbers, Director, Sales-Beer and Beverage at Ardagh, presented alongside Glass Packaging Institute (GP) President Scott DeFife at CBC's "Sustainability Solutions in Glass Packaging for Brewers" panel session in April 2024. One of the top glass suppliers to the American beer market, Ardagh has been making inventive glass bottles in the United States for over 125 years. Two new Boston Round bottles were added to Ardagh's expanding line of American-made bottles. AGP-North America's BOBTM website (BuyOurBottles) offers the new 16 oz (473 ml) Boston Round glass beverage bottles in amber (brown) and flint (clear) glass.

New Advancements in Glass Packaging Industry

- In October 2024, Berry Global, packaging solutions providing company introduced a line of healthcare-use clarified polypropylene (PP) bottles that provide better product protection and sustainability than conventional colored PET pill bottles. Numerous goods, such as vitamins, nutraceuticals, nutritional supplements, cosmetic supplements, and over-the-counter medications, are perfect for Clarippil bottles.

- On 7 October 2024, Lumson, which is top in luxury airless solutions in the airless packaging world, revealed XTAG, a 15 and 30ml glass bottle having an airless refill system that utilizes pouch technology. This product shows the latest approach to consumption, which respects the people, planet, and process. (Source: Cosmetics Business)

- In November 2024, The Ardagh Group's operating company, Ardagh Glass Packaging-North America (AGP-North America), added two new 12-ounce glass bottles to its Peak bottle line. AGP-North America's BOB website (BuyOurBottles) now offers the new 12 oz Emerald Peak in green glass and the new 12 oz Amber Peak in brown glass, which complement the current 12 oz Clear Peak bottle in flint (clear) glass. The Twist-off bottles from the Peak line are developed and produced in the United States using premium glass.

- On 17 July 2024, Ardagh Glass Packaging North America, a business unit of Ardagh Group, strengthened its American-made bottles with the launch of the latest series of craft beverage bottles. The latest series of 12 oz glass bottles is available in three colors: flint, emerald green, and amber. (Source: Food Techbiz)

Global Glass Packaging Market Segments

By Material

- Soda Lime Glass

- Borosilicate

- De-alkalized Soda Lime Glass

By Product

- Vials

- Bottles

- Jars & Containers

- Ampoules

- Cartridges & Syringes

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait