U.S. Glass Packaging Market Size, Share, Trends, and Growth Forecast

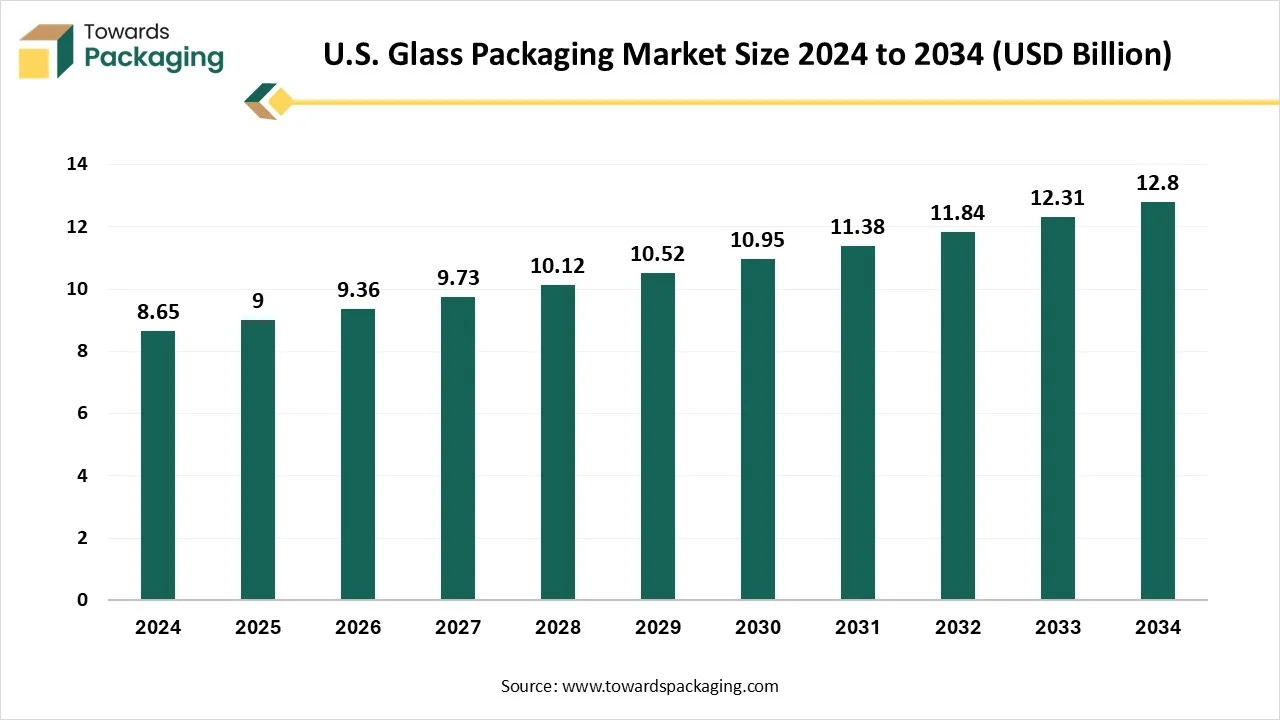

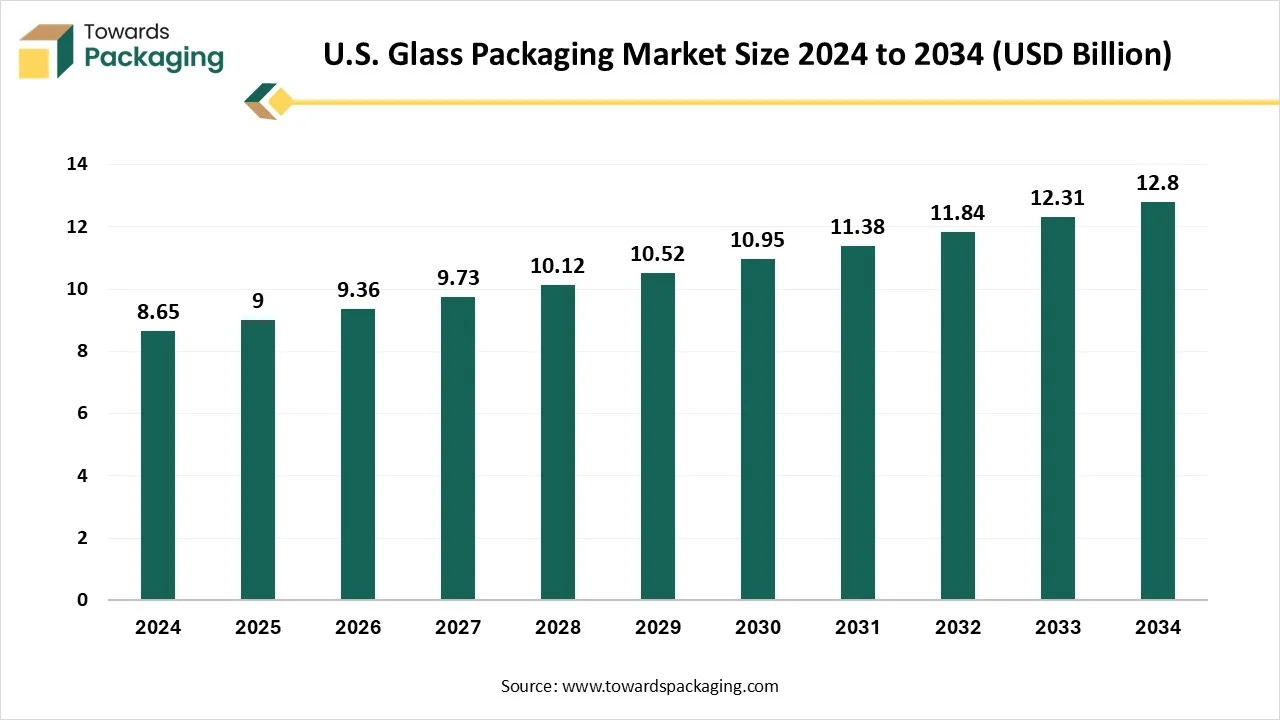

The U.S. glass packaging market is projected to increase from USD 9 billion in 2025 to USD 12.8 billion by 2034, reflecting a CAGR of 4% during the 2025–2034 forecast period. Growing consumer focus on sustainability and health is significantly strengthening the demand for glass packaging, especially within the food and beverage sector. Advancements in technology, including lightweighting and enhanced design capabilities, are further supporting market expansion. The Midwest U.S. continues to lead the market, driven by rising demand for eco-friendly and sustainable packaging solutions.

Key Insights

- In terms of revenue, the market is valued at USD 9 billion in 2025.

- The market is projected to reach USD 12.8 billion by 2034.

- Rapid growth at a CAGR of 4% will be observed in the period between 2025 and 2034.

- The Midwest U.S. dominated the global market by holding more than 30% of the market share in 2024.

- The Midwest U.S. dominated the global market with the largest share in 2024.

- The West U.S. is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the bottles segment contributed the biggest market share of 68% in 2024.

- By product type, the vials & ampoules (pharma) segment is expected to expand at a significant CAGR between 2025 and 2034.

- By glass type, the type III (Soda Lime) segment contributed the biggest market share of 72% in 2024.

- By glass type, the type I (Borosilicate) segment will be expanding at a significant CAGR between 2025 and 2034.

- By capacity, the 500 ml - 1 liter segment contributed the biggest market share of 40% in 2024.

- By capacity, the < 50 m segment is expanding at a significant CAGR between 2025 and 2034.

- By color, the clear (flint) segment contributed the biggest market share of 60% in 2024.

- By color, the amber segment will be expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverages segment held the major market share of 75% in 2024.

- By end-use industry, the cosmetics & personal care segment is projected to grow at a CAGR between 2025 and 2034.

- By distribution channel, the direct sales (B2B) segment contributed the biggest market share of 70% in 2024.

- By distribution channel, the online (bulk platforms + cosmetic startups) segment will be expanding at a significant CAGR between 2025 and 2034.

Market Overview

The U.S. glass packaging market refers to the production and sale of glass containers used to package products across a range of industries, including food & beverages, pharmaceuticals, cosmetics & personal care, and household chemicals. Glass packaging is valued for its recyclability, chemical inertness, barrier properties, and premium brand perception.

Future Demands in U.S. Glass Packaging Market

- The market is growing due to demand for beverages (wine, beer) and pharmaceutical products.

- Glass is valued for purity, recyclability, and premium appeal.

- Premiumization trends in craft beverages and organic products boost demand.

- Recycled content usage reduces environmental impact and supports sustainable branding.

- Growth in cosmetics and specialty food sectors further contributes to demand.

- Lightweight and durable glass bottles reduce transportation costs and carbon footprint.

- Consumers increasingly prefer glass as a fully recyclable, sustainable alternative to plastics.

- Expansion in the functional food & beverage segment drives glass demand for nutrient-rich beverages and health products.

- The trend toward artisanal and small-batch products increases premium glass bottle usage.

- Technological advancements in glass manufacturing enhance container strength and thermal shock resistance, supporting faster filling lines and safer transportation.

- Increased focus on single-serve and smaller-format glass containers to cater to changing consumption habits and on-the-go lifestyles, particularly for premium soft drinks and energy shots.

Emerging Technologies in U.S. Glass Packaging Market

| Technology |

Description |

What Is Required |

| Lightweight glass bottles |

Same strength as traditional bottles but significantly lighter for lower transport costs and emissions. |

Advanced forming equipment, strength-optimization design, quality control systems to ensure durability. |

| High-quality recycled cullet |

Improved cleaning and sorting technologies allow higher recycled content without compromising clarity or safety. |

Investment in upgraded sorting/cleaning machines and partnerships with high-volume recycling facilities. |

| Smart QR/NFC labels |

Interactive labels offering recycling, reuse, and brand-engagement features. |

Digital integration platforms, label-printing tech with embedded chips/codes, and consumer-facing apps or portals. |

| Recyclable decorative coatings |

Premium aesthetic coatings that do not interfere with glass recyclability. |

Access to environmentally compliant coating materials and updated application systems that maintain recyclability. |

| Hybrid glass composition |

New glass blends that melt at lower temperatures to reduce energy consumption. |

R&D capabilities, furnace recalibration or modification, and material testing to ensure regulatory compliance. |

| Automated inspection using AI |

High-speed AI vision systems detect defects and enhance production efficiency. |

AI-powered imaging hardware, training datasets, integration with production lines, and skilled technicians to manage systems. |

Sustainability and Compliance

- The U.S glass packaging industry emphasizes higher recycled glass usage, energy efficient production and closed loop recycling systems to reduce emissions and conserve natural resources.

- Local environmental laws, EPA regulations, and Glass Packaging Institute (GPI) standards all serve as guidelines for compliance.

- These precautions guarantee that glass packaging is both environmentally friendly and safe for consumers.

- Companies that adopt these strategies can also maximize production efficiency and lower operating costs by conserving energy and establishing themselves as leaders in sustainability within the food and beverage packaging industries.

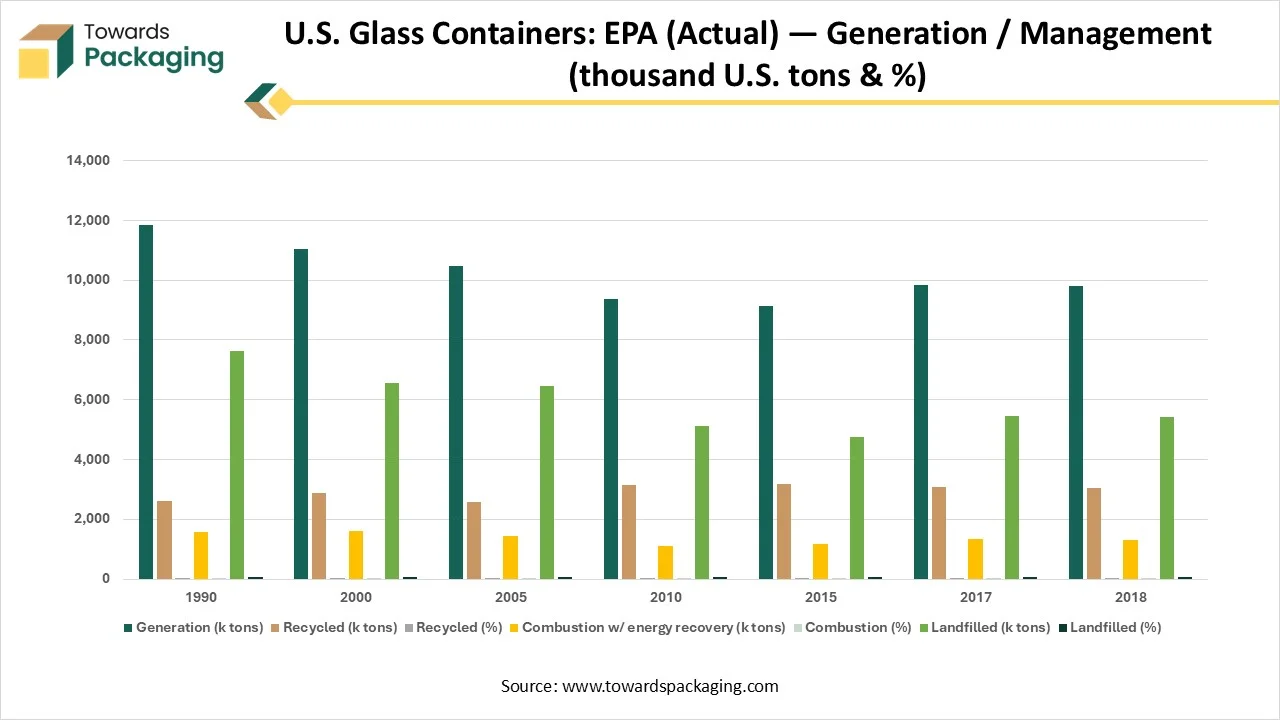

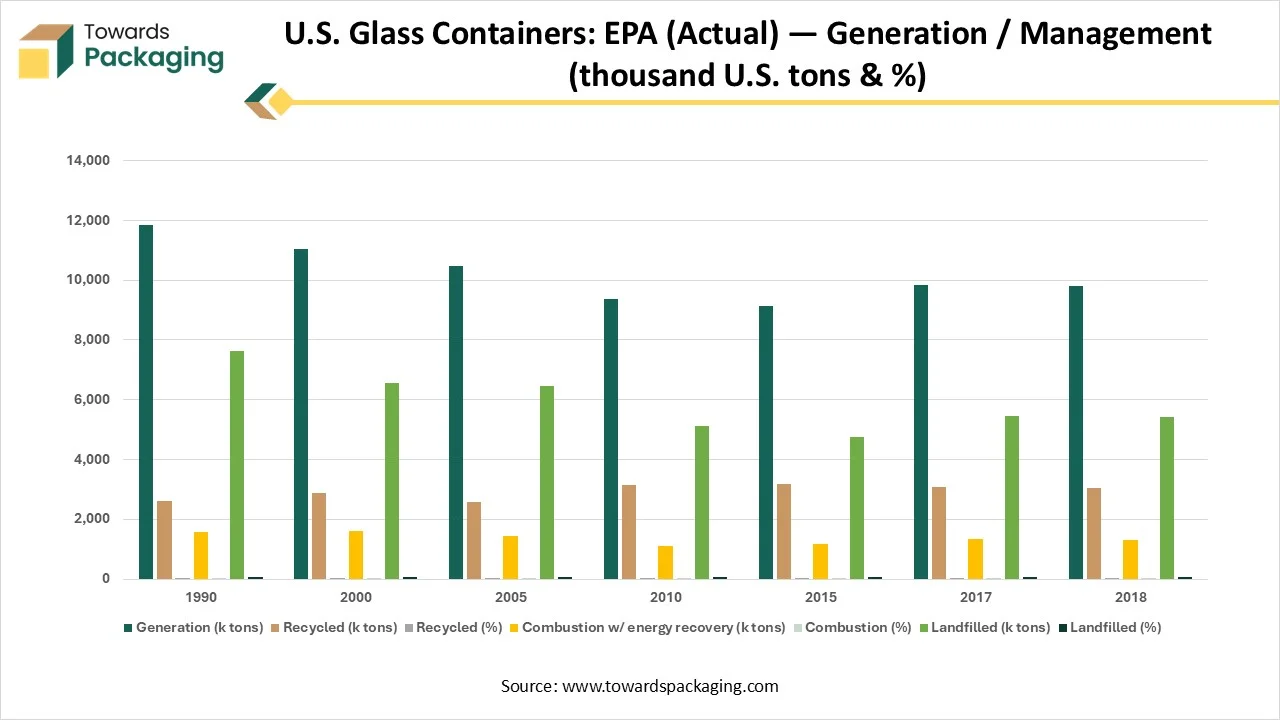

U.S. Glass Containers: EPA (Actual) Generation / Management (thousand U.S. tons & %)

| Year |

Generation (k tons) |

Recycled (k tons) |

Recycled (%) |

Combustion w/ energy recovery (k tons) |

Combustion (%) |

Landfilled (k tons) |

Landfilled (%) |

| 1990 |

11,830 |

2,620 |

22.1 |

1,570 |

13.3 |

7,640 |

64.6 |

| 2000 |

11,040 |

2,880 |

26.1 |

1,590 |

14.4 |

6,570 |

59.5 |

| 2005 |

10,460 |

2,590 |

24.8 |

1,430 |

13.7 |

6,440 |

61.6 |

| 2010 |

9,360 |

3,130 |

33.4 |

1,110 |

11.9 |

5,120 |

54.7 |

| 2015 |

9,120 |

3,190 |

35 |

1,170 |

12.8 |

4,760 |

52.2 |

| 2017 |

9,850 |

3,070 |

31.2 |

1,330 |

13.5 |

5,450 |

55.3 |

| 2018 |

9,790 |

3,060 |

31.3 |

1,310 |

13.4 |

5,420 |

55.4 |

What are the New Trends in the U.S. Glass Packaging Market?

Rising Demand for Safe & Healthy Packaging

- Increasing customer demand for healthier and safer packaging is supporting glass packaging in different groups.

Acceptance for Alternative Forms

- The growing adoption of alternative forms of packaging, such as metal, plastic, wood, and paper, is distressing the industry’s development. The increasing progression in the packing technology has improved innovation in this market and increased its demand.

Eco-friendly Packaging Demand

How Can AI Improve the U.S. Glass Packaging Market?

The incorporation of AI in the U.S. glass packaging market plays an important role in the production of error-free packaging of the products. It is utilized for the optimization of resources for the production of high-quality packaging. Incorporation of advanced technology has enhanced customization options in the packaging industry. It also helps reduce the wastage of materials by analysing the demand of the market. Due to the utilization of advanced technology and assurance of material quality, it enhances the reliability of the brands in this market.

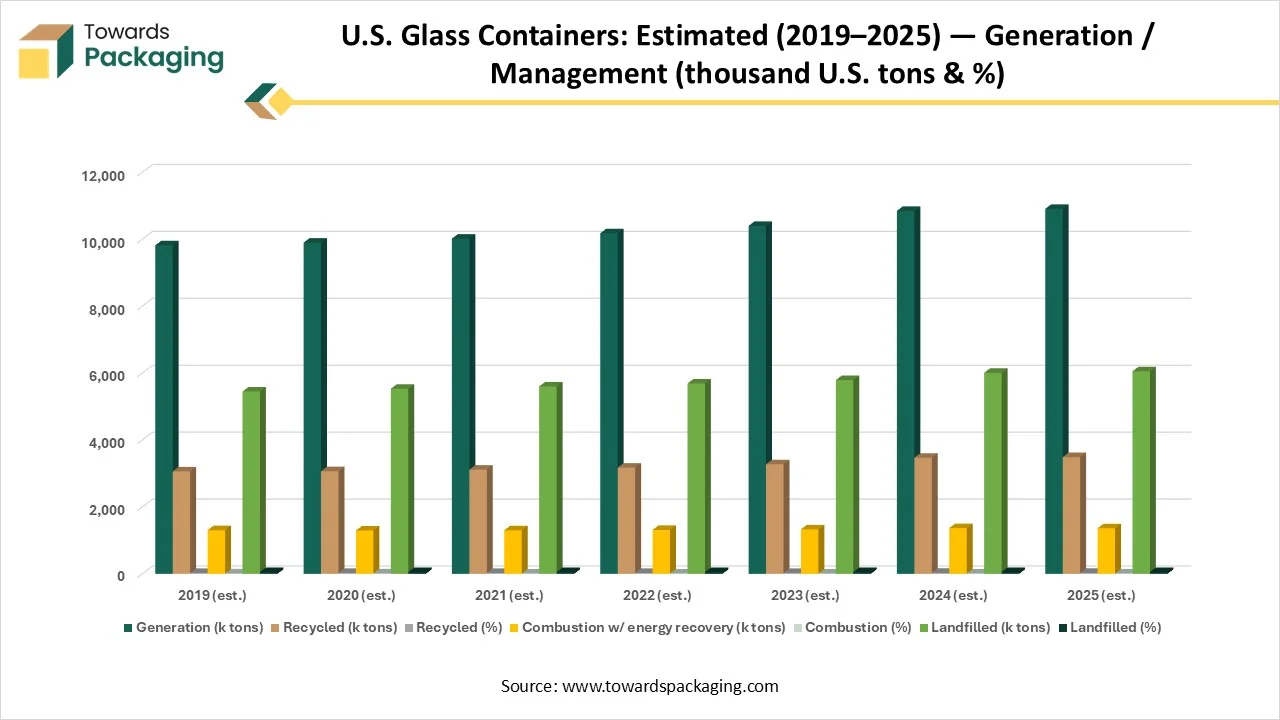

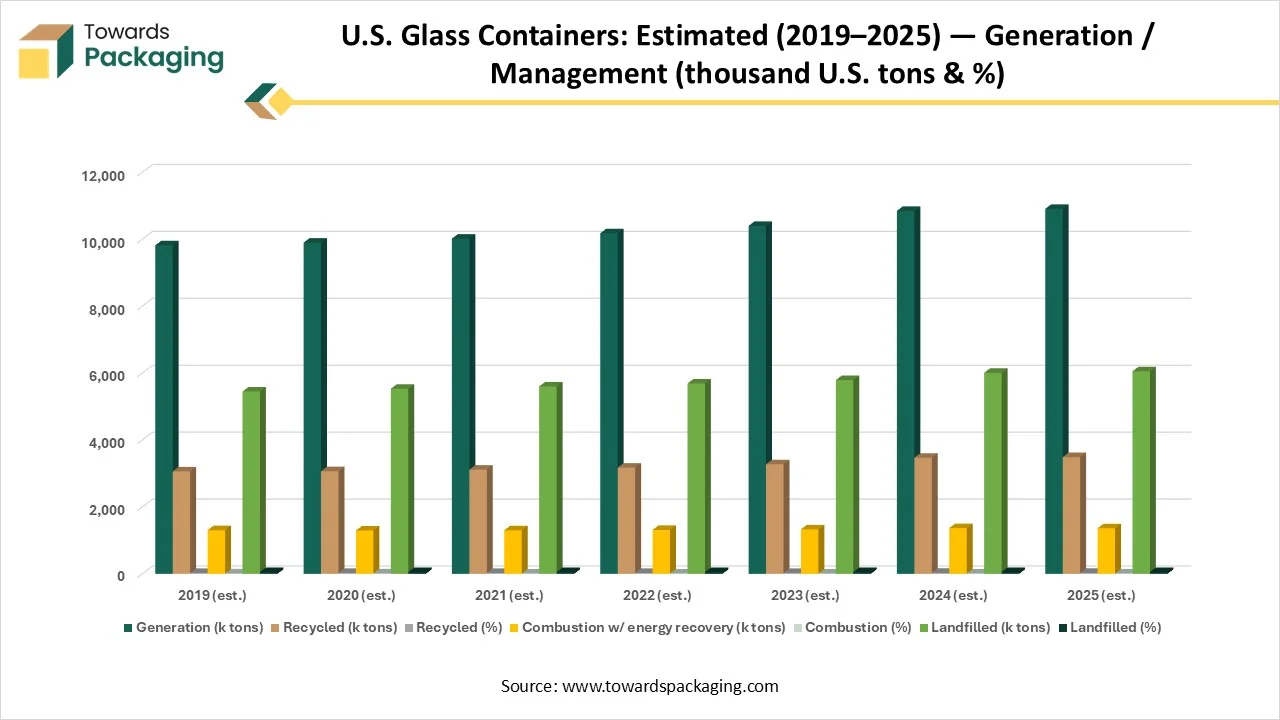

U.S. Glass Containers: Estimated (2019-2025) Generation / Management (thousand U.S. tons & %)

| Year |

Generation (k tons) |

Recycled (k tons) |

Recycled (%) |

Combustion w/ energy recovery (k tons) |

Combustion (%) |

Landfilled (k tons) |

Landfilled (%) |

| 2019 (est.) |

9,820 |

3,063.80 |

31.2 |

1,306.10 |

13.3 |

5,450.10 |

55.5 |

| 2020 (est.) |

9,900 |

3,069.00 |

31 |

1,296.90 |

13.1 |

5,534.10 |

55.9 |

| 2021 (est.) |

10,020 |

3,116.20 |

31.1 |

1,302.60 |

13 |

5,601.20 |

55.9 |

| 2022 (est.) |

10,180 |

3,176.20 |

31.2 |

1,313.20 |

12.9 |

5,690.60 |

55.9 |

| 2023 (est.) |

10,400 |

3,276.00 |

31.5 |

1,331.20 |

12.8 |

5,792.80 |

55.7 |

| 2024 (est.) |

10,850 |

3,472.00 |

32 |

1,367.10 |

12.6 |

6,010.90 |

55.4 |

| 2025 (est.) |

10,910 |

3,491.20 |

32 |

1,363.80 |

12.5 |

6,055.00 |

55.5 |

Market Dynamics

Drivers

Rising Demand for Sustainable Packaging Solutions

The continuous demand for sustainable packaging solutions in several industries has driven the development of the U.S. glass packaging market. Sustainable packing resolutions are getting prominent as customers and brands order environment-friendly choices. This has resulted in amplified demand for glass packaging because of its recyclability and capability to preserve product freshness. Moreover, premiumization is a rising trend in the industry, with customers showing a preference for superior-quality, aesthetically attractive glass packaging for stuff such as luxury cosmetics and craft beverages. The surge in e-commerce has also congested the glass packaging market, influencing the demand for advanced packaging solutions that ensure the safe & secure transportation of goods.

Restraints

Logistical and Transportation Issues

The logistical issues and transportation charges can influence the marketplace, particularly for the glass packaging sector, which is more fragile as compared to other resources. Meeting strong supervisory needs and preserving quality values also pose challenges for glass packaging producers. Moreover, customers ' preferences for accessibility and practicality over old-style glass packaging hinder market development. To remain competitive, market players present in the U.S. glass packaging market need to invent, capitalize on sustainable choices, streamline processes, and acclimatize to altering market dynamics efficiently.

Opportunity

Rising Innovation for Eco-friendly Packaging

Rising innovation for the development of eco-friendly packaging has boosted several opportunities in the U.S. glass packaging market. With the rising consciousness of ecological matters, customers are choosing glass packing as a biodegradable and reusable choice compared to plastic. This factor is influencing the demand for glass vessels in several businesses such as cosmetics, food & beverage, and pharmaceuticals. Moreover, progressions in glass engineering technology are enhancing the strength and pattern flexibility of glass packages, making it a favored option for premium goods. Capitalizing on glass packages, businesses or producers in the U.S. can be a lucrative opportunity as the industry continues to expand and evolve to fulfill the sustainability demands of both customers and regulatory bodies.

Glass in MSW Generation & Management (Selected Years, ’000 U.S. tons)

| Year |

Generation (glass containers & packaging) |

Recycled (glass) |

Recycled rate (%) |

Combustion w/ energy recovery |

Landfilled (glass) |

| 1990 |

11,830 |

2,620 |

~22.1% |

1,570 |

7,640 (EPA) |

| 2000 |

11,040 |

2,880 |

~26.1% |

1,590 |

6,570 (EPA) |

| 2005 |

10,460 |

2,590 |

~24.8% |

1,430 |

6,440 (EPA) |

| 2010 |

9,360 |

3,130 |

~33.4% |

1,110 |

5,120 (EPA) |

| 2015 |

9,120 |

3,190 |

~35.0% |

1,170 |

4,760 (EPA) |

| 2018 |

9,790 |

3,060 |

~31.3% |

1,310 |

5,420 (EPA) |

Segmental Insights

Why Bottles Segment Dominated the U.S. Glass Packaging Market in 2024?

The bottles segment contributed a considerable share of the U.S. glass packaging market in 2024 due to the rising demand for a wide variety of beverages. The increasing number of beverages available in the market and the rising party culture have influenced the demand for glass packaging. Glass has the ability to preserve taste and help in offering a premium appeal. These are non-reactive and recyclable packaging, which is highly preferred by customers. The rising innovation for lightweight glass technology has influenced the growth of this segment.

The vials & ampoules (pharma) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising concern for the safe delivery of vaccines, injectable drugs, and biologics has influenced the demand for this segment. This segment is growing significantly due to its protection capacity against moisture and oxygen, and chemical inertness. The market is growing also due to compatibility and reliability.

Why Type III (Soda Lime) Segment Dominates the U.S. Glass Packaging Market in 2024?

The type III (soda lime) segment is expected to have a considerable share of the U.S. glass packaging market in 2024 due to its superior performance, low charges, and ease of production. These are reliable as it has high barrier properties and compatibility with an automated manufacturing facility. The growing demand for packaging with a premium and attractive look has enhanced the demand for this sector. Technological enhancements such as precision molding, lightweighting, and energy-efficient furnaces have raised the demand for this sector.

The type I (Borosilicate) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising demand for strong soda lime packaging has influenced the demand for this segment. The rising demand for high-end cosmetics, injectables, biologics, and vaccines has influenced the growth of the type I (borosilicate) segment.

Why 500 ml - 1 litre Segment Dominated the U.S. Glass Packaging Market in 2024?

The 500 ml - 1 litre segment is expected to have a considerable share of the U.S. glass packaging market in 2024 due to its shareable and convenient formats. This type of container is widely used for the packaging of products such as wine, beer, juices, water, craft spirits, and soft drinks. Progressions in ultralight glass technology, together with automatic filling outlines, have enhanced shipping efficacy and decreased charges. The growing demand for convenient packaging has influenced this segment to grow rapidly.

The < 50 ml segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising demand for compact products that are easy to carry while travelling has raised the demand for this segment. In industries such as cosmetics, has a huge demand for such small packages for trial and to use as a travel kit.

Why Clear (Flint) Segment Dominate the U.S. Glass Packaging Market in 2024?

The clear (flint) segment is expected to dominant over the U.S. glass packaging market in 2024 due to its versatility, transparency, and purity. These are majorly utilized for the packaging of alcohol & spirits to show the purity of the liquid. This segment is also growing rapidly due to the pharmaceutical sector. It is highly preferred because of its chemical stability and inertness. The rising trend for premium packaging has influenced the development of this segment.

The amber segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its unique capacity to protect products from harmful UV radiation. It is widely used for the packaging of products such as nutraceuticals, craft beer, supplements, and wine.

Why the Food & Beverages Segment Dominated the U.S. Glass Packaging Market in 2024?

The food & beverages segment is expected to have a considerable share of the U.S. glass packaging market in 2024 due to growing customer demand for sustainability and health-aware packaging resolutions. It also conserves food & beverages for an extended time and avoids pollution. This type of packaging is neutral reacting, and recycling reprocess nature, which enhances the demand for such material in this sector.

The cosmetics & personal care segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Cosmetic containers include vials & ampoules, bottles, jars, palettes, among others, which are utilized for the packing of nail-care, skincare, haircare, and make-up goods. Cosmetic ampules are accessible in glass containers for premium cosmetic packing. Glass containers, comprising jars and bottles, are extensively utilized in the U.S. because of the several dispensing choices, including spray nozzles, jet and drop inserts, pump heads, and frothing caps.

Why Direct Sales (B2B) Segment Dominated the U.S. Glass Packaging Market in 2024?

The direct sales (B2B) segment is expected to have a considerable share of the U.S. glass packaging market in 2024 due to the convenience among customers and brands. Direct sales help in reducing the charges and make this packaging affordable for all categories. This segment is majorly influenced by contract-based or high-volume production of the packages. The growing demand for customized packaging has led to the development of the market.

The online (bulk platforms + cosmetic startups) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Due to the advancement in the packaging industry, this segment is growing rapidly. Continuous launch of new products in the cosmetic market requires unique packaging to attract a huge number of consumers to this market.

Regional Insights

Well-Established Industries in Glass Packaging, Midwest U.S., Promote Dominance

The Midwest U.S. region held the largest share of the U.S. glass packaging market in 2024, due to the presence of well-established industries in this region. The presence of major market players influenced collaboration and investment for research and development work in this industry. This results in the innovation of packaging technology, which raises the demand for the glass packaging industry. With the advancement in packaging technology, the production of superior quality packaging increases the reliability of several industries.

West U.S.’s Rising Ecological Concerns Support Growth

The West U.S. region is estimated to grow at the fastest rate in the U.S. glass packaging market during the forecast period. The market demand is rising in this region due to increasing ecological concerns and escalating eco-friendly alternatives for packaging. Strict government guidelines towards the packaging industry have influenced the production of eco-friendly packaging for products. The increasing demand for packaging that can be recycled and reused is boosting the development of this market.

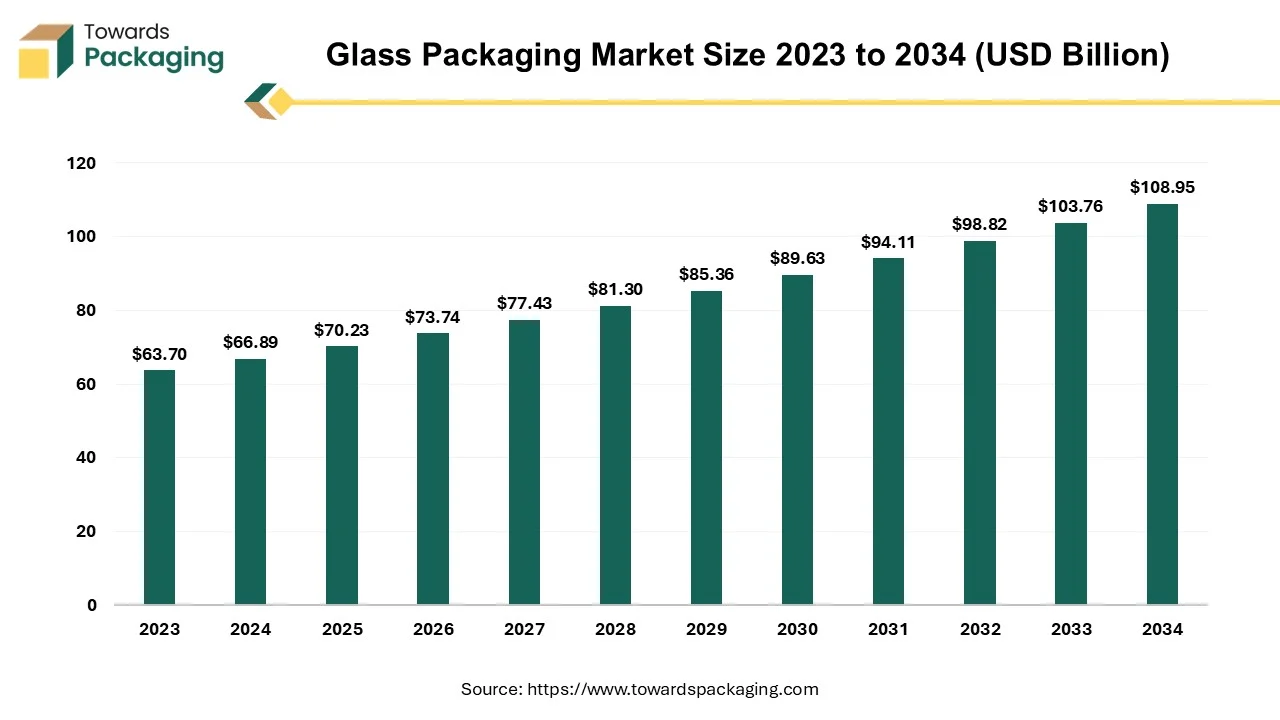

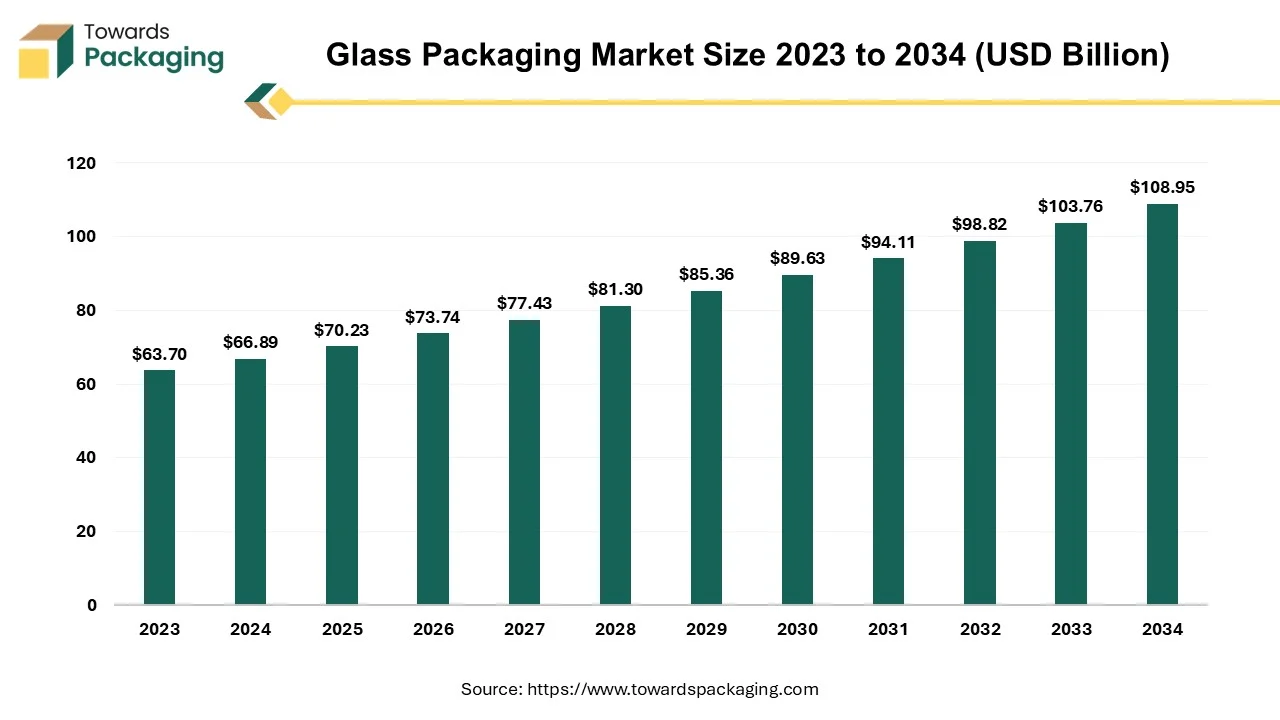

Future of Glass Packaging Market

The glass packaging market is projected to reach USD 108.95 billion by 2034, growing from USD 70.23 billion in 2025, at a CAGR of 5% during the forecast period from 2025 to 2034. Increasing consumer demand for sustainable and premium packaging drives companies to adopt durable, recyclable materials that ensure product safety and enhance brand appeal. Additionally, advancements in manufacturing and rising healthcare and beverage industries boost the need for high-quality, specialized containers.

Glass packaging has been used for centuries due to its durability, chemical stability, and premium appeal. It remains a popular choice for industries like food & beverages, pharmaceuticals, cosmetics, and premium seafood packaging. The glass packaging provides a 100% barrier against oxygen, moisture, and external contaminants, ensuring a longer shelf life. Protects sensitive contents like seafood, dairy, and medicines from spoilage. Often used for high-end products due to its luxurious look and feel. Glass packaging can be coloured, embossed, or customized for branding purposes.

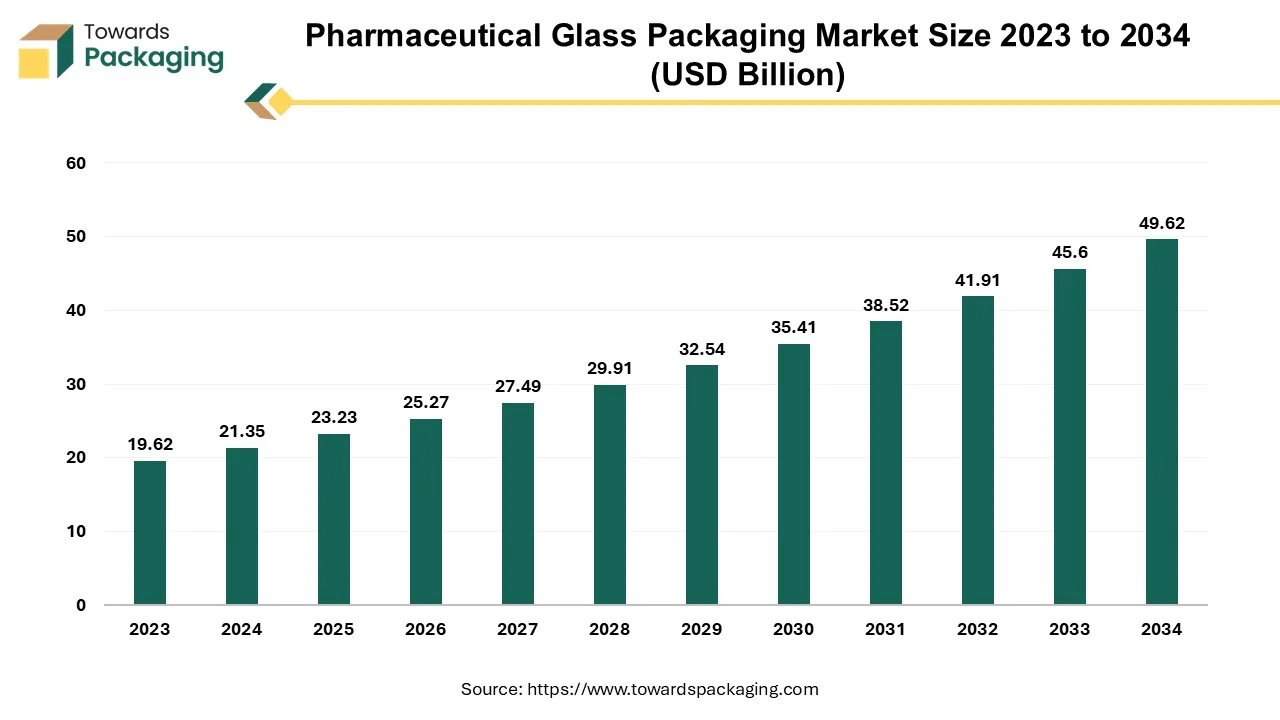

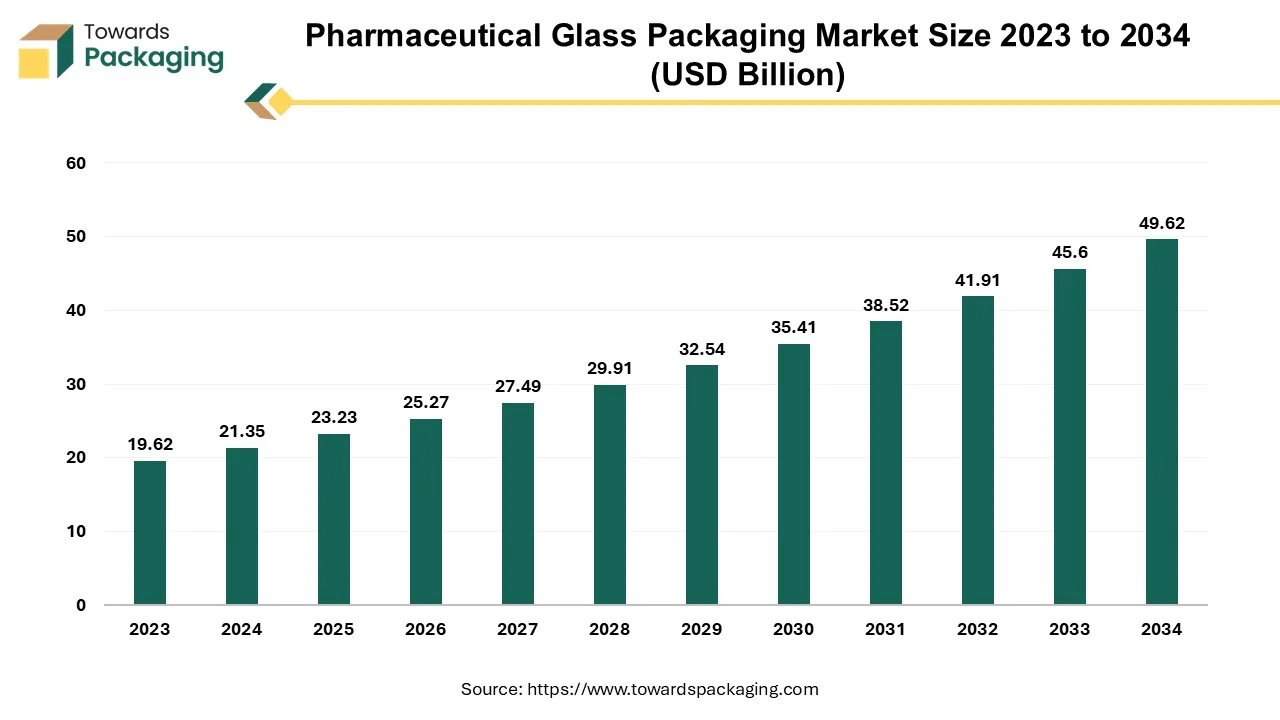

Future of Pharmaceutical Glass Packaging Market

The pharmaceutical glass packaging market is anticipated to grow from USD 23.23 billion in 2025 to USD 49.62 billion by 2034, with a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2025 to 2034.

Glass has long been the main material used in the pharmaceutical packaging industry because of its remarkable qualities. Glass is a great material to store drugs in solid, liquid, injectable, or reconstitution form because of its chemical stability and inertness. The medications' purity and integrity are guaranteed to last due to its non-reactive nature, even in the presence of other compounds or chemicals. Glass also has a strong resilience to temperature changes, which is important in the pharmaceutical industry because pharmaceutical items frequently need certain storage conditions. This resilience is especially useful for preserving the integrity of the packaging during procedures like sterilisation, freezing, or freeze-drying.

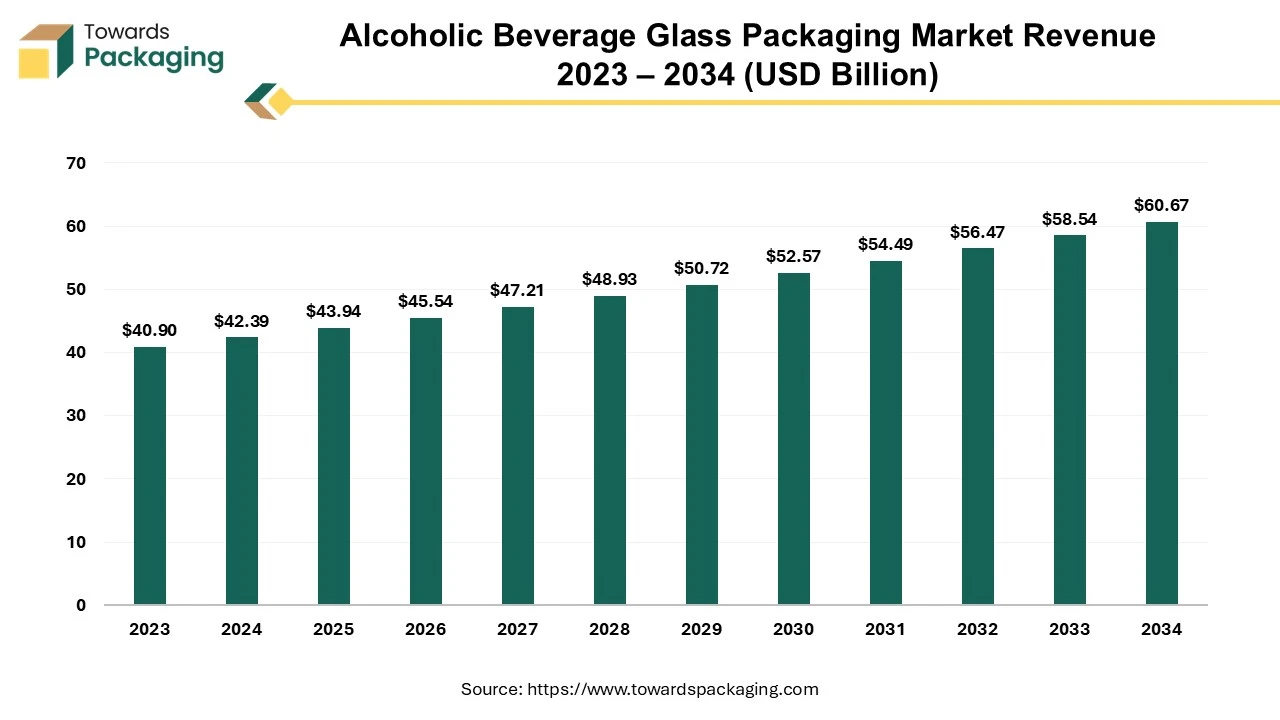

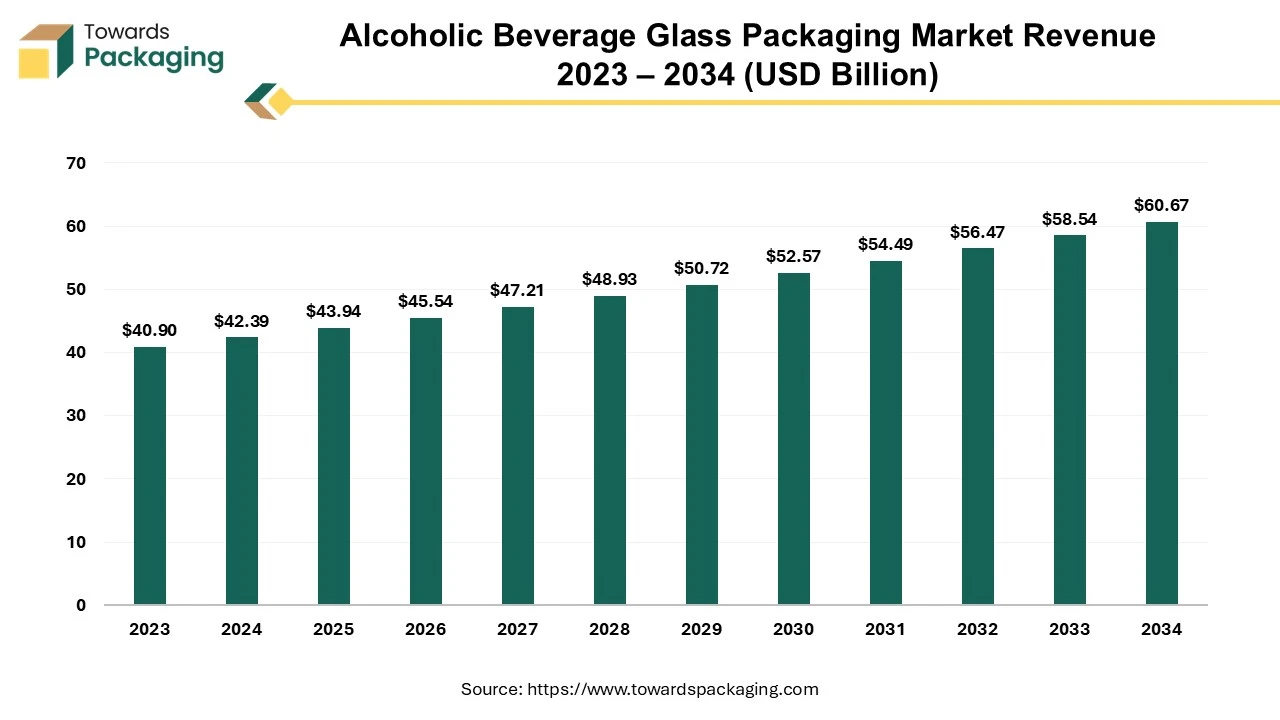

Future of Alcoholic Beverage Glass Packaging Market

The alcoholic beverage glass packaging market is expected to increase from USD 43.94 billion in 2025 to USD 60.67 billion by 2034, growing at a CAGR of 3.65% throughout the forecast period from 2025 to 2034.

The market is proliferating due to the increasing consumption of alcoholic beverages by people for celebrations, high disposable earnings, societal demand, and many other factors. Consumers' continuous demand for eco-friendly packaging is pushing the alcoholic beverage glass packaging market.

Top Companies in the U.S. Glass Packaging Market

Latest Announcements by Industry Leaders

- In July 2024, AGP-North America beer & beverage vice-president Rashmi Markan said: “Ardagh Glass Packaging continues to focus on developing its portfolio of American-made glass bottles to offer craft beverage producers increased flexibility for packaging their products. The new, 12oz craft beverage series of bottles complements a wide variety of craft beverages, offering brand differentiation with a trusted, sustainable glass bottle that fully protects the flavour of the beverage.”(Source: Packaging Gateway)

New Advancements in the Market

- In July 2024, Ardagh launches new craft beverage glass bottles in the US. The new series of bottles is designed and produced in the US from 100% recyclable glass.(Source: Packaging Gateway)

- In February 2025, Olay launched Olay Super Cream with SPF 30 the brand’s first-ever moisturizer in a glass jar.(Source: Beauty Packaging)

U.S. Glass Packaging Market Segments

By Product Type

- Bottles

- Beer Bottles

- Wine Bottles

- Spirits Bottles

- Water Bottles

- Non-Alcoholic Beverage Bottles

- Jars

- Food Jars (Jam, Honey, etc.)

- Cosmetic Jars

- Pharmaceutical Jars

- Vials & Ampoules

- Others

- Candle Jars

- Decorative Glass Packaging

By Glass Type

- Type I (Borosilicate Glass)

- Type II (Treated Soda Lime Glass)

- Type III (Soda Lime Glass

- Amber Glass

- Flint (Clear) Glass

- Green Glass

By End-Use Industry

- Food & Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Food

- Sauces

- Condiments

- Jams & Spreads

- Pickles

- Baby Food

- Pharmaceuticals

- Oral Syrups

- Injectable Vials

- Vitamin Containers

- Cosmetics & Personal Care

- Perfumes

- Creams & Lotions

- Serums & Oils

- Household & Industrial Chemicals

- Cleaners

- Fragrances

- Others

- Candle & Décor

By Capacity

- < 50 ml

- 50-200 ml

- 200-500 ml

- 500 ml - 1 liter

- 1 liter

By Color

- Clear (Flint)

- Amber

- Green

- Blue

- Others (Decorative)

By Distribution Channel

- Direct Sales (B2B)

- Distributors / Wholesalers

- Online (Bulk platforms & marketplaces)

By Region

- Northeast U.S.

- Midwest U.S.

- South U.S.

- West U.S.