The fossil-based plastics market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. This report provides detailed insights into market trends, segmentation by polymer types such as polyethylene (PE), polypropylene (PP), PVC, PET, and polystyrene (PS), and applications across packaging, automotive, electronics, construction, and healthcare. Regional analysis covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Key players including ExxonMobil Chemical, Dow/DuPont, SABIC, and LyondellBasell Industries are profiled with market share, products, and recent strategic developments. The study also highlights value chain analysis, trade dynamics, and manufacturing trends globally.

Fossil-based plastics are synthetic polymers that are generally derived from fossil fuels such as petroleum and natural gas. Fossil-based plastics are most commonly used across various industries owing to their durability, versatility, cost-effectiveness, and long-lasting attributes. Fossil-based plastics such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and polystyrene (PS) are widely used in various applications such as plastic bags, plastic bottles, packaging, automotive parts, and others.

| Metric | Details |

| Key Drivers | - High demand for plastic bags and bottles - Growth in e-commerce and packaging - AI integration improving production and efficiency |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type (Polymer), By Application and By Region |

| Top Key Players | ExxonMobil Chemical, Dow/DuPont (Dow Inc.), SABIC, LyondellBasell Industries |

As AI technology continues to evolve, the integration of artificial intelligence holds significant potential to reshape the landscape of the fossil-based plastics market, improving the quality of materials and reducing waste. AI integration assists in minimizing wastage, enabling predictive maintenance, improving machine uptime, optimizing production processes, and developing materials with certain properties. By harnessing the power of Artificial Intelligence (AI) and Machine Learning (ML) technologies, companies operating in the plastic industry can effectively innovate and improve the efficiency of their operations through rapid automation and advanced data analysis.

Rising Demand for Plastic Bags and Bottles

The growing demand for consumer demand for plastic bags and bottles is expected to boost the market’s revenue during the forecast period. Plastic bags are widely used for shopping for groceries, apparel, cosmetics, and many other products. Plastic bags are quicker to open and pack, much cheaper than paper bags, and they take up less space than paper bags. Plastic bottles are widely used for storing liquids like beverages, water, and various other liquid products. In bottles, fossil-based plastics assist in creating a tight seal, preventing leaks or damage, and maintaining the quality of the contents. These factors are propelling the market’s growth during the forecast period.

Rising Environmental Concern

The increasing environmental concern related to plastic waste is anticipated to hinder the market's growth. Plastics are non-biodegradable and non-renewable materials. Fossil-based plastics linger in the environment for centuries, break down into microplastics, and result in polluting natural habitats. A fossil-based plastics come from fossil fuels, a source that the world is trying to move away from, shifting towards eco-friendly options. Bio-based products are rapidly gaining immense popularity as a sustainable choice among eco-conscious individuals, as they are made from renewable sources. In addition, the stringent environmental regulations regarding the usage of fossil-based plastic may hinder the growth of the global fossil-based plastics market during the forecast period.

How is the Increasing Demand from the Packaging Industry Impacting the Market Expansion?

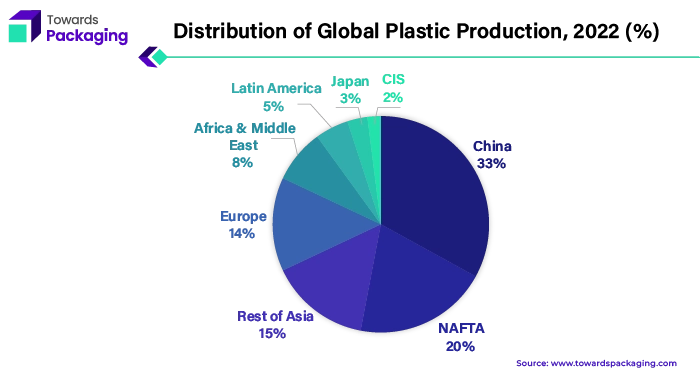

The growing demand from the packaging industry is projected to offer lucrative growth opportunities to the fossil-based plastics market in the coming years. Packaging is one of the major applications of plastic materials worldwide, making up a significant share of total global plastics production. Over the years, plastic has revolutionised the packaging sector by extending the shelf life of fresh food, ensuring safety and freshness to maintain the integrity of goods, and contributing to lighter and safer shipping. Almost 36% of all plastics produced are used in packaging, including single-use plastic products for food and beverage containers. Plastic is considered an ideal packaging material owing to its various attributes such as durability, flexibility, strength, low cost, lightweight, and protective properties. Thus, driving the market’s growth.

The polyethylene (PE) segment dominated the market with the largest share in 2024, owing to its excellent combination of properties makes it an ideal material for diverse applications across industries. Polyethylene (PE) has widespread usage, which includes packaging bottles, containers, construction pipes, automotive components, and electronics wire and cable insulation.

On the other hand, the polypropylene (PP) segment is growing at the fastest CAGR, owing to its rising use in packaging material and automotive parts. The growth of the segment is mainly driven by its strength, cost-effectiveness, ease of use, lightweight, ease of mass production, and adaptability in various industries. Polypropylene has an excellent resistance to moisture and chemicals and which often makes it an ideal choice for the packaging of various products from multiple industries.

The packaging industry segment is expected to experience rapid growth over the global fossil-based plastics market in 2024, owing to the increasing consumer spending on packaged food and beverages. In the packaging industry, numerous manufacturers extensively prefer plastic material to lower production costs while protecting the item against contamination, ensuring product freshness, and maintaining integrity. Moreover, the rapid expansion of e-commerce platforms enables manufacturers to cater to a broader range of customers. Such factors are anticipated to propel the market’s expansion in the coming years.

On the other hand, the electronics segment is expected to grow at a significant rate. The fastest growth of the segment is mainly driven by the rapid expansion of the electronics industry globally, which has significantly increased the adoption of plastics as it offers various benefits. Plastics are extensively used in the electronics industry as it has invaluable properties such as lightweight, durability, economy, electrical insulation, easy design, heat insulation, and others that make them an ideal material option. Plastics are most commonly used in switches, connectors, wire and cable coating, and others.

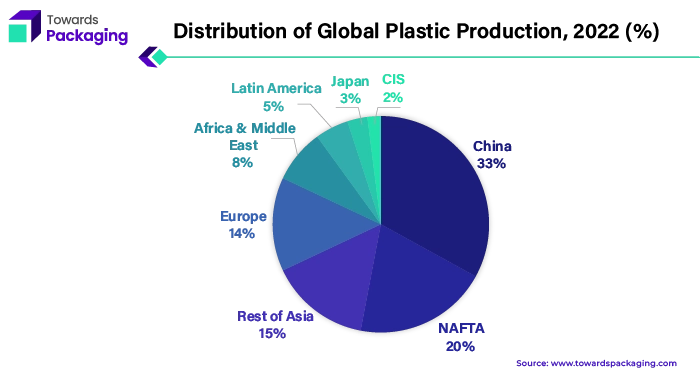

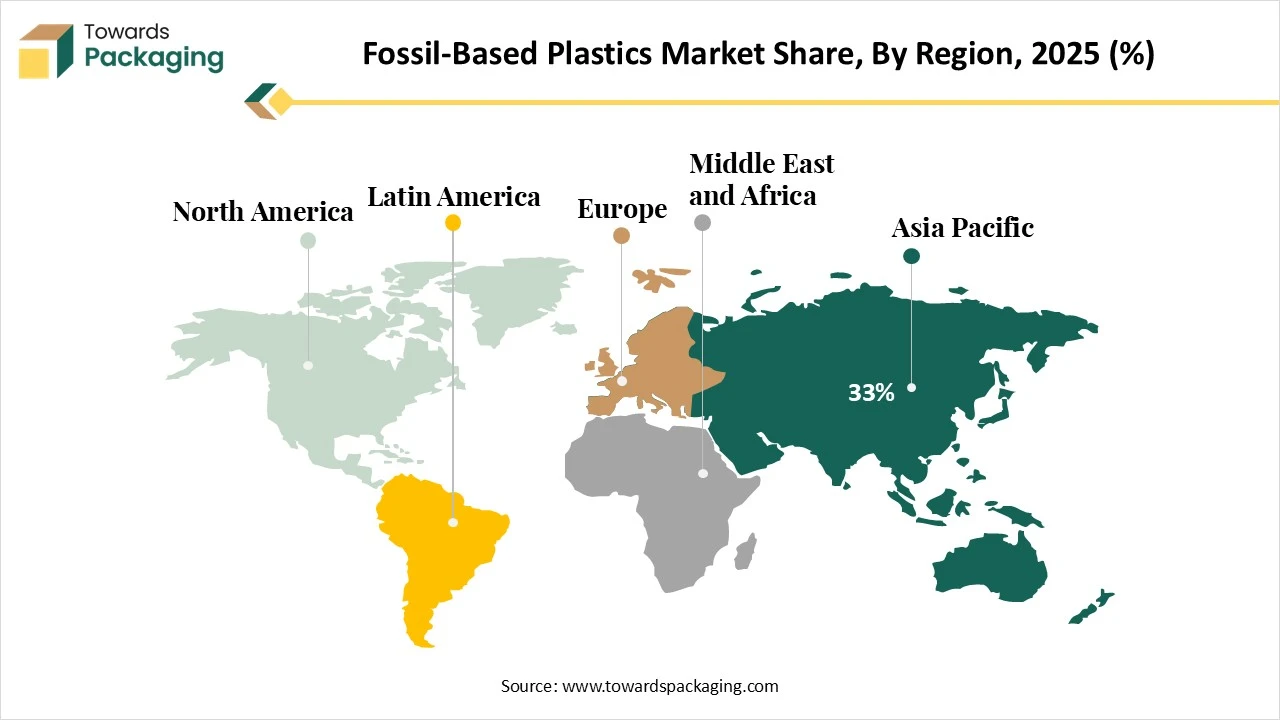

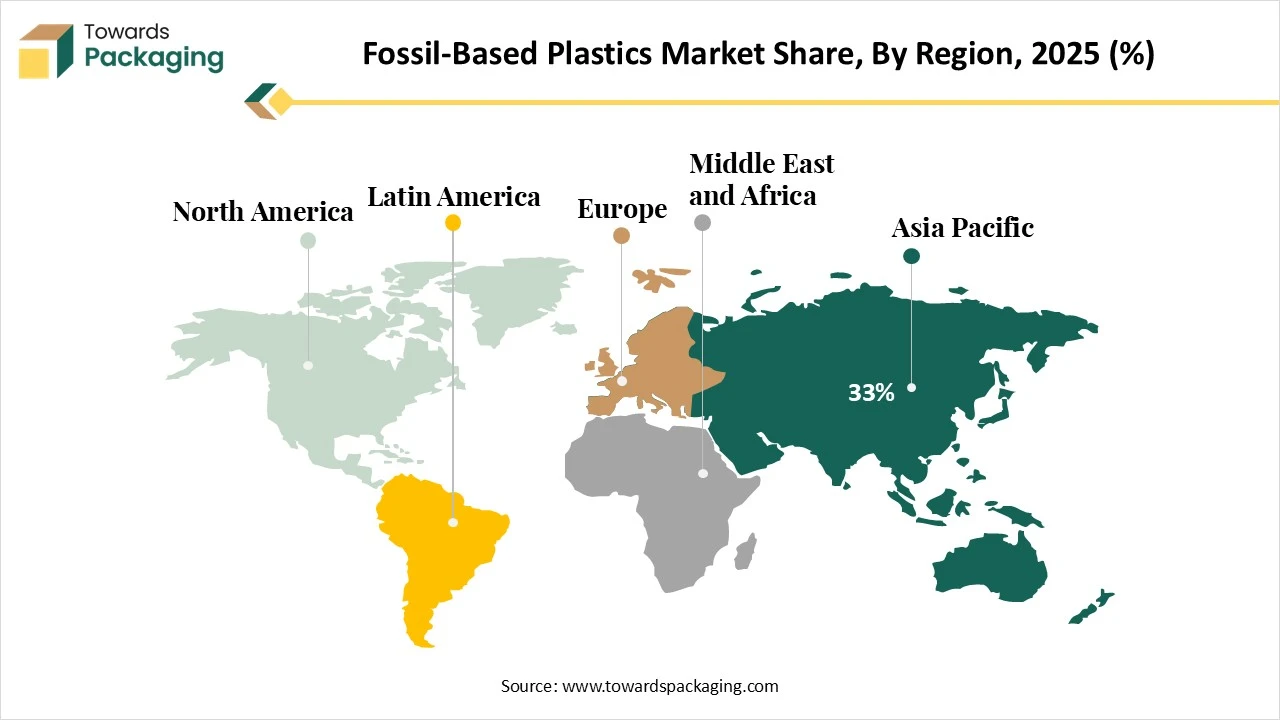

Asia Pacific is experiencing rapid growth during the forecast period is attributed to the presence of prominent market players, improving economic conditions, rapid urbanization, a rise in disposable income, growing consumer demand for safety and hygiene plastic packaging products, and increasing adoption of plastic processing technologies. Additionally, fossil-based plastics are most extensively utilized in the Asia Pacific region across various industries such as packaging, automotive, construction, electronics, healthcare, and others, owing to their low cost, versatility, ease of manufacture, durability, lightweight, and strength. The availability of raw materials and cheap labour in countries such as China and India is expected to boost the regional market’s growth during the forecast period.

China and India have a strong presence in the plastic industry to meet the evolving consumer demand, as well as to reduce imports. India is one of the largest producers and manufacturers of plastics. India exports plastic to more than 200 countries in the world. India largely exports plastic and related products to the UK, France, Bangladesh, Turkey, Nepal, UAE, USA, Germany, Italy, and other countries. Furthermore, numerous initiatives of the government, including Make in India and Skill India, are anticipated to accelerate the growth of the region in the coming years.

On the other hand, North America is expected to grow at a significant rate in the market during the forecast period, owing to the rising consumer preferences for lightweight and convenience packaging, a surge in disposable income, expansion of the e-commerce sector, and growing consumer demand for packaged food and beverages. The North American region represents considerable potential for the fossil-based plastics market, owing to the presence of well-established industries such as food and beverages, automotive, cosmetics and personal care, household cleaning products, electronics, packaging, and construction. Furthermore, the rapid technological advancements in manufacturing, such as 3D printing or additive manufacturing, to enhance the efficiency in the production process and customization options for fossil-based plastics support the market’s expansion in the region.

By Type (Polymer)

By Application

By Region

February 2026

February 2026

February 2026

February 2026