High Barrier Foil Pouches Market Size, Share, Trends and Forecast Analysis

The high barrier foil pouches market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. The worldwide packaging sector, valued for its capacity to extend shelf life and prevent sensitive products from external aspects. This market is anticipated to raise because of the growing demand for suitability and sustainable packing options. Major trends comprising a change in the direction of recyclability and sustainability, technological progressions in film resources, growing demand for suitability and transportability, and development in evolving economies.

Major Key Insights of the High Barrier Foil Pouches Market

- By region, Asia Pacific dominated the global market by holding highest market share in 2025.

- By region, Europe is expected to grow at a fastest CAGR from 2026 to 2035.

- By material type, the plastic-based multilayer pouches (PE, PP, PET, EVOH, PA, etc.) segment contributed the biggest market share in 2025.

- By material type, the aluminum foil pouches / foillaminate pouches segment will be expanding at a fastest CAGR in between 2026 and 2035.

- By pouches/ product type, the standup pouches (doypacks, zipper pouches, retort pouches, etc.) segment contributed the biggest market share in 2025.

- By pouches/ product type, the spouted pouches / Flat pouches / Three or Fourside seal pouches segment will be expanding at a fastest CAGR in between 2026 and 2035.

- By application / end use industry, the food & beverages segment contributed the biggest market share in 2025.

- By application / end use industry, the pharmaceutical & healthcare packaging segment will be expanding at a fastest CAGR in between 2026 and 2035.

- By barrier type / functionality, the standard moisture & oxygen barrier pouches segment contributed the biggest market share in 2025.

- By barrier type / functionality, the high-performance barrier pouches (moisture, oxygen, light, aroma, UV protection) segment will be expanding at a fastest CAGR in between 2026 and 2035.

- By distribution channel, the traditional retail / grocery / brickandmortar supply chain segment contributed the biggest market share in 2025.

- By distribution channel, the ecommerce / direct-toconsumer / online grocery & subscription retail segment will be expanding at a fastest CAGR in between 2026 and 2035.

What is High Barrier Foil Pouches?

High barrier foil pouches are multi-layered flexible bags which are produced with an aluminum foil core that provides excellent protection against light, moisture, oxygen, and contaminants, enhancing product shelf life by generating an impermeable barrier, suitable for sensitive goods such as foods, coffee, electronics, and chemicals needing vacuum or improved atmosphere packaging.

High Barrier Foil Pouches Market Trends

- Market Growth Overview: High barrier foil pouches market is expanding due to rising demand for flexible packaging, product protection, busy lifestyle, product innovation, and rapid urbanization. The increasing demand for versatile and convenient packaging has evolved the growth of this market.

- Major Market Players: High barrier foil pouches market includes Bemic Company Inc., Amcor Plc, Dura Pack Inc., Berry Global Inc., Mondi Group, Clifton Packaging Group, and many other.

- Startup Ecosystem: The startup industries play an important role in developing sustainable, recyclable, and smart packaging options. The integration of advanced technology has enhanced the demand for this market.

Technological transformation in the high barrier foil pouches market plays a significant role in its expansion. Enhanced technology such as integration of RFID tags, QR codes, and sensor has raised the demand for monitoring freshness, authenticity, and traceability. Innovations are emphasized on attaining foil-like barrier presentation utilizing thinner or alternate resources. These technological changes allow the market to stable the necessity for strong product defence with growing customer and supervisory demands for intelligent and sustainable packaging choices.

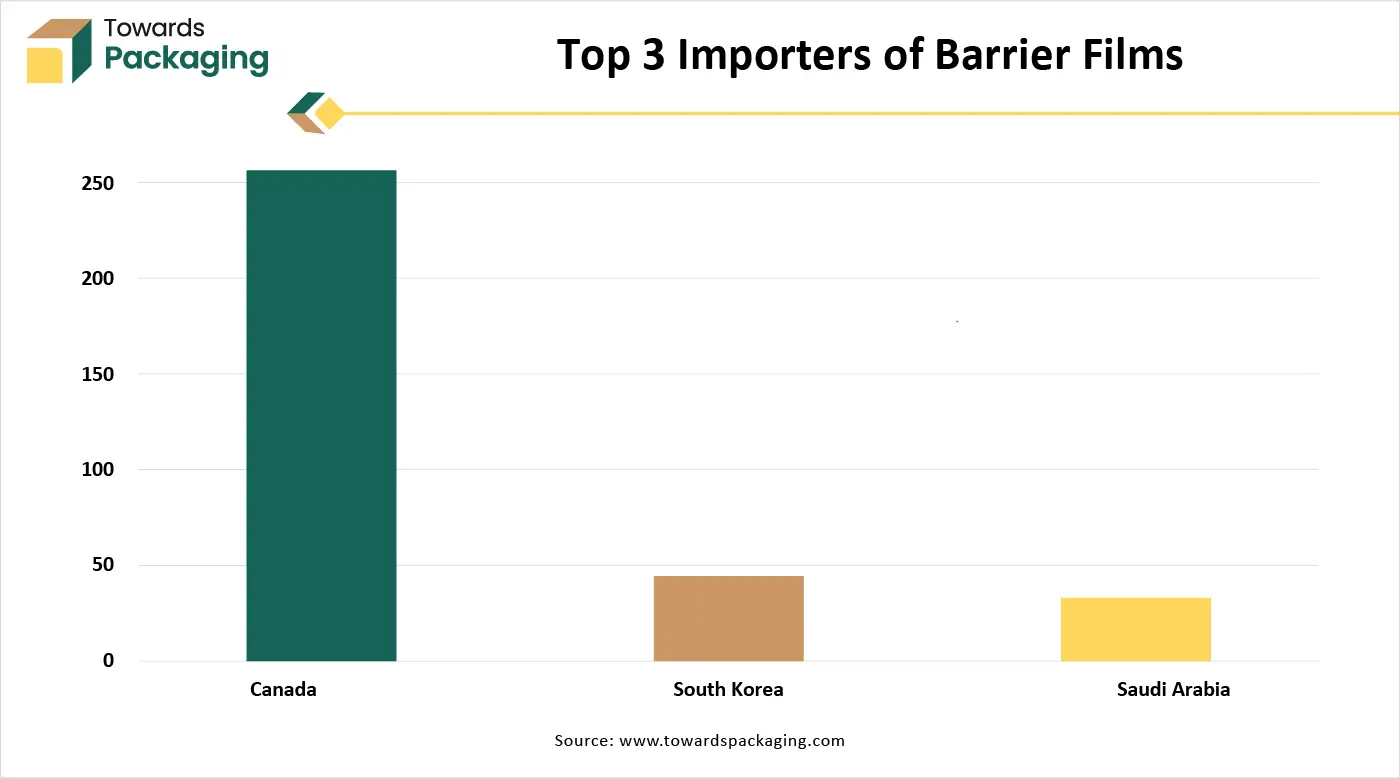

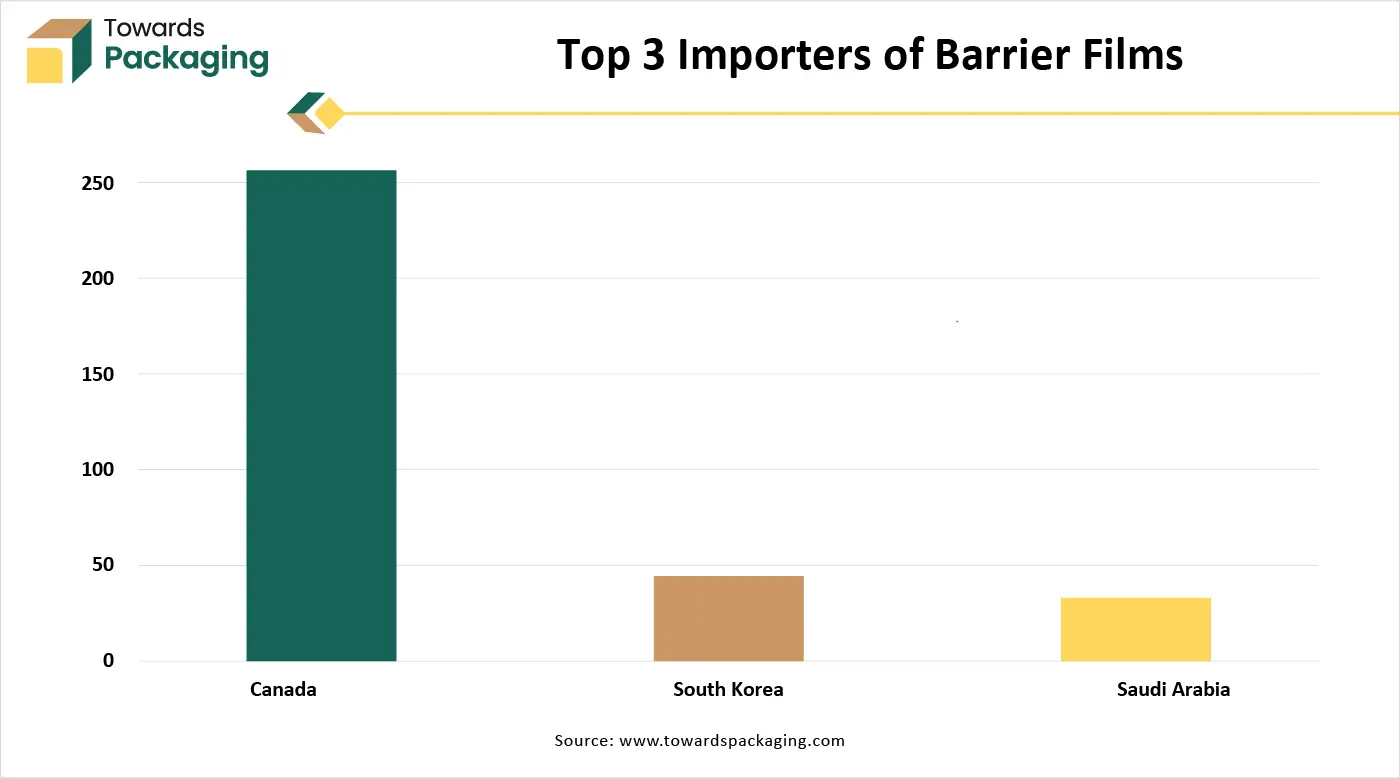

Trade Analysis of High Barrier Foil Pouches Market: Import & Export Statistics

- China: It is the top-most exporter of Barrier Foil worldwide with 193 shipments.

- United States: It is the second top exporter of Barrier Foil which is estimated to be of 50 shipments.

- Taiwan: It is the third top most exporter of Barrier Foil with 29 shipments worldwide.

High Barrier Foil Pouches Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are aluminum foil, polyester, polyethylene (PE), and polyamide.

- Key Players: Hindalco Industries Ltd, RUSAL

Component Manufacturing

The component manufacturing in this market comprises plastic film, aluminum foil, high barrier additives, fitments, and closures.

- Key Players: Hindalco Industries Ltd, Pactiv Evergreen Inc.

Logistics and Distribution

This segment ensures supply-chain authentication and safety of the products.

- Key Players: Pouch Factory, Trishakti Polymers

Material Type Insights

Why Plastic-based multilayer pouches (PE, PP, PET, EVOH, PA, etc.) Segment Dominated the High Barrier Foil Pouches Market In 2025?

The plastic-based multilayer pouches (PE, PP, PET, EVOH, PA, etc.) segment dominated the market with highest share in 2025 due to its excellent moisture barrier properties, flexibility, and cost-effectiveness. It is influenced by customer demand for growing e-commerce sector, convenience as well as lightweight packaging, and packaging that enhance shelf life for fragile products. This segment is highly influenced by technological inventions in resource science and an emphasis on developing efficient, yet sustainable as well as cost-operative, packaging options. It allows transparent packaging which provide convenience to consumers to get information regarding packaged product quality as well as quantity.

The aluminum foil pouches / foillaminate pouches segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to their excellent protective properties. It provides protection against moisture, light, bacteria, and oxygen to the packaged products. Such properties help in extending the shelf life of packaged products and protecting their integrity and shelf life. This segment is growing significantly due to increasing consumption of ready-to-consume food products. Rapid urbanization, shifting customer lifestyles, and the extension of the e-commerce sector has majorly influenced the development of this segment.

Pouch/ Product Type Insights

Why StandUp Pouches (Doypacks, Zipper Pouches, Retort Pouches, Etc.) Segment Dominated The High Barrier Foil Pouches Market In 2025?

The standup pouches (doypacks, zipper pouches, retort pouches, etc.) segment dominated the market with highest share in 2025 due to rising consumer convenience and superior protection of products. The major factors influencing the growth of this sector are strong customer preference and various functional advantages. These pouches are lightweight that decreases transportation charges and reduce their carbon footprint in comparison with rigid packaging. It can resist huge temperature for sterilization process and are leading pouch type.

The spouted pouches / flat pouches / three or fourside seal pouches segment is expected to grow at the fastest CAGR during the forecast period. This segment is influenced by increasing demand for convenient packaging, product defence, and environment-friendly substitutes. The primary factors enhancing the demand for this segment is convenience, environment-friendly substitute, and spill protection. It is widely preferred due to its durability and shifting demand towards recyclable packaging.

The specialty pouches (retort, resealable, multilayer barrier pouches) is the fastest-growing in the market, as it comprises superior protection against air, light, and moisture. This segment is designed for high-temperature sterilization and killing bacteria. Excellent barrier properties decrease food waste and permit for broader distribution. Continuous change in the direction lightweight, compact, and possibly recyclable mono-material pouches.

Application / End-Use Industry Type Insights

Why Food & Beverages Dominated the High Barrier Foil Pouches Market In 2025?

The food & beverages segment dominated the market with highest share in 2025. Rapid urbanization and busy customer lifestyles have enhanced reliability on ready-to-consume and on-the-go food options. Innovations in this segment are emphasizing on new resources and patterns to improve functionality and sustainability. The continuous extension of online food delivery facilities and e-commerce has influenced the demand for protective and durable packaging that can resist extended transport. Presence of high barrier foil pouches safeguard products from several external factors such as contaminants, moisture, oxygen, and light, protecting nutritional value, flavor, and aroma for longer period.

The pharmaceutical & healthcare packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to enhanced demand for patient safety and drug stability. This market offers superior protection, avoiding degradation of delicate drugs, well-known for their forte and extended shelf-life. The rapid shift from old-style metal and glass cans to cost-effective, lightweight, and compact pouches. Important for sterile medical equipment, pharmaceuticals, and surgical kits, confirming pollution-free packing. Improved peel ability, resealable structures, and child-resistant patterns have pushed this market to grow.

The personal care & cosmetics is the fastest-growing in the market. The major driver is the requirement for enhanced barrier shield against ecological aspects to outspread shelf life and protect product integrity and efficacy. Brands are highly focusing towards advanced and aesthetically attractive packaging to attract customers, and pouches provide superior surface area for vivacious branding and visually attractive on retail shelves.

Barrier Type / Functionality Type Insights

Why Standard moisture & oxygen barrier pouches Dominated the High Barrier Foil Pouches Market In 2025?

The standard moisture & oxygen barrier pouches segment dominated the market with highest share in 2025 due to protection, convenience, and sustainability. The major influencer is the requirement for high barrier defence against ecological aspects to enlarge shelf life and protect product integrity and efficiency. Pouches can provide a higher cost-operative substitute to old-style rigid packaging arrangements like cans and bottles in some usages. The superior barrier possessions of foil guard sensitive preparations from UV light, moisture, and oxygen, which can reduce active elements.

The high-performance barrier pouches (moisture, oxygen, light, aroma, UV protection) segment is expected to grow at the fastest CAGR during the forecast period of. This segment is growing due to technological advancement, recyclability and less production charges. This segment is majorly influenced by the requirement for prolonged shelf life and goods integrity in delicate applications such as electronics, food, and pharmaceuticals. The major factor is the requirement to defence sensitive goods from several ecological factors to outspread shelf life and decrease waste. Flexible and resealable pouch setups provide customer convenience and these are cost-operative packaging solution.

Distribution / Retail Channel Type Insights

Why Traditional retail / Grocery / Brickandmortar supply chain Dominated the High Barrier Foil Pouches Market In 2025?

The traditional retail / Grocery / Brickandmortar supply chain segment dominated the market with highest share in 2025 due to its enhanced product visibility property. It is influenced by the growing demand for packing that can endure the rigors of e-commerce transport. This segment has resulted in the inventions in pouch patterns, like improved durability structures. It is driving the growth and acceptance of bio-based and recyclable high-barrier foil pouches in the supply chain, as producers respond to ecological apprehensions and guidelines.

The ecommerce / direct-toconsumer / online grocery & subscription retail segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to need for enhanced protection during transportation of products. It is important for preserving product quality and outspreading shelf life for fragile and delicate products such as cosmetics, food, and supplements. It offers superior surfaces for excellent-definition printing, attractive finishes, and exclusive patterns, supporting brands to stand out in this competitive market.

Regional Insights

How Asia Pacific is Dominating in the High Barrier Foil Pouches Market?

Asia Pacific held the largest share in the high barrier foil pouches market in 2025, due to presence of huge consumer base, retail modernization, cost-efficient production, sustainability drive, and growing pharmaceutical sector. High scale production capacity has influenced the innovation process in this market. Strict government guidelines have also inclined consumers towards adoption of such packaging. Increasing demand for appealing and durable packaging, with high barrier foil pouches is suitable for ready-to-consume and on-the-go items. Rising inclination towards environment-friendly as well as recyclable barrier packaging options.

Why High Barrier Foil Pouches Market is Dominating in China?

Rising demand for product preservation, strict food safety guidelines, changing lifestyle, and domestic production potential has enhanced the demand for market in China. With increasing urbanization and busy consumer lifestyles, there is a significant demand for on-the-go and ready-to-eat (RTE) meals. It provides an excellent balance of presentation, suitability, and cost-efficacy, positioning effortlessly with the rapid financial development of the country. Producers have profit from high-speed, effectual manufacturing lines that backing mass making.

Why High Barrier Foil Pouches Market is Growing Rapidly in Europe?

Europe expects the fastest growth in the market during the forecast period. Extended shelf-life and convenience have enhanced the demand for the market. The expansion of the e-commerce, food and beverage, and pharmaceutical sectors needs dependable, high-presentation packaging for secure transport and storing. High barrier foil pouches are lightweight and need less storing space associated to old-style rigid packing, causing to charge savings in logistics and transport. The necessity for packing that balances practical presentation and customer suitability with growing ecological accountability and supervisory compliance.

How High Barrier Foil Pouches Market is Expanding in Germany?

Growing customer demand for portable as well as convenient packaging has boosted the development of the market in Germany. It has encouraged advanced, sustainable packing options. These are important for safe blister packs and several other medical equipment packaging. These progressions enhance product security, supply chain clarity, and decrease waste. The extension of online shopping is boosting demand for cost-effective, durable, and lightweight packaging choices that can resist the inflexibilities of transportation while confirming product security.

North American market for high-barrier foil pouches is strong and growing rapidly. The growth of the market is driven by flexible packaging for ready-to-eat foods, snacks, beverages and pharmaceuticals. Consumers and manufacturers in the U.S. and Canada increasingly prefer light, flexible pouches that protect contents from oxygen, moisture, and light key for extending shelf life and preserving freshness.

The United States market for high-barrier foil (and film) pouches and packaging is robust and growing. Drivers include growing consumer preference for ready-to-eat, on-the-go, or shelf-stable food and beverage items; expansion of e-commerce and home delivery; increased demand for pet food, healthcare/pharma packaging, and convenience in packaging; along with rising emphasis on lightweight, flexible and increasingly more sustainable packaging formats.

The market for high-barrier foil pouches in the Middle East & Africa (MEA) region is expanding steadily. Much of this demand is driven by the food and beverage sector accounting for a majority share as rising urbanization, growing disposable incomes, and shifting lifestyles increase consumption of packaged, processed, ready-to-eat foods and snacks.

The UAE market including high-barrier pouches and films is substantial and growing steadily. Growth is being driven by increasing demand for ready-to-eat and convenience foods, export-oriented “halal-certified” packaging, rising health-care/pharma product packaging, and regulatory pushes toward recyclable, mono-material barrier films under sustainability rules.

The South America market including the HighBarrier Foil Pouches is growing steadily. Drivers include rising consumption of processed and convenience foods, expansion of e-commerce (driving demand for easy-to-transport packaging), growth in pet-food and premium snack segments, and growing demand from pharmaceuticals and medical packaging.

Brazil expects the significant growth in the market. Demand is driven by strong growth in flexible packaging including pouches catering to the country’s booming food, beverage, pharmaceuticals, and personal-care sectors. Wider trends such as rising urbanization, growth in ready-to-eat and portion-pack foods, the expansion of e-commerce, and demand for moisture- and oxygen-resistant barrier packaging are boosting pouch and flexible-packaging adoption across Brazil

Recent Developments

- In December 2025, DQ PACK announced the launch excellent-quality, custom-planned coffee bean food packing bags. These solutions provide to the developing requirements of the field coffee market globally, joining both aesthetic appeal and functionality.

- In May 2024, Uflex announced the launch of ‘B-UUB-M' Outstanding Barrier Metallized BOPP Film custom-made for packing cookies, chips, dry fruits, beverages, snacks, biscuits, and other chocolate and confectionery items.

Top Companies in the High Barrier Foil Pouches Market

- Platinum Polymers Pvt Ltd.: It is the producer and supplier of barrier foil pouches in India.

- QED Kares Packers Pvt. Ltd.: It specializes in aluminum foil pouches with high barrier properties.

- J K Pouching: It is an emerging manufacturer of various high-barrier pouches, including foil and EVOH.

- Protective Packaging Ltd.: It focuses on high-presentation, corrosion-prevention packaging, including barrier foil bags.

- Ted Pack: It offers 3-4 layers foil bags for coffee, tea, etc., with custom printing.

- Others: Amcor Plc., Sri Vallabh Enterprises, Mondi Group, Fres-co System, Berry Global, Flair Flexible Packaging, Constantia Flexibles, and Uflex.

High Barrier Foil Pouches Market Segments Covered

By Material Type

- Plastic-based multilayer pouches (PE, PP, PET, EVOH, PA, etc.)

- Aluminum foil pouches / foillaminate pouches

- Other emerging materials (e.g. recyclable paper-based barrier laminates)

By Pouch / Product Type

- Standup pouches (doypacks, zipper pouches, retort pouches, etc.)

- Spouted pouches / Flat pouches / Three or Fourside seal pouches

- Specialty pouches (retort, resealable, multilayer barrier pouches)

By Application / EndUse Industry

- Food & Beverages

- Pharmaceutical & Healthcare Packaging

- Pet food / Pet nutrition

- Personal care & cosmetics

- Industrial / Specialty products (chemicals, homecare, dehydrated goods, etc.)

By Barrier Type / Functionality

- Standard moisture & oxygen barrier pouches

- High-performance barrier pouches (moisture, oxygen, light, aroma, UV protection)

By Distribution / Retail Channel

Traditional retail / Grocery / Brickandmortar supply chain

Ecommerce / Direct-toConsumer / Online Grocery & Subscription retail

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA