U.S. Pharmaceutical Packaging Market Growth Trends, Regional Insights Segments, Companies & Supply Chain

The U.S. pharmaceutical packaging market is forecasted to expand from USD 56.34 billion in 2026 to USD 106.76 billion by 2035, growing at a CAGR of 7.36% from 2026 to 2035. We cover every major insight including market trends (sustainable materials, smart packaging, biologics growth), segment data (primary packaging 70%, plastic 60%, oral drugs 50%, conventional packaging 55%), and regional trends across NA, EU, APAC, Latin America, and MEA. Our research also includes competitive analysis of major players such as Amcor, Gerresheimer, Schott, BD, West, and Catalent, along with value chain mapping, trade flow statistics, importer–exporter insights, and detailed profiling of manufacturers and suppliers active in the U.S. and global market.

Key Takeaways

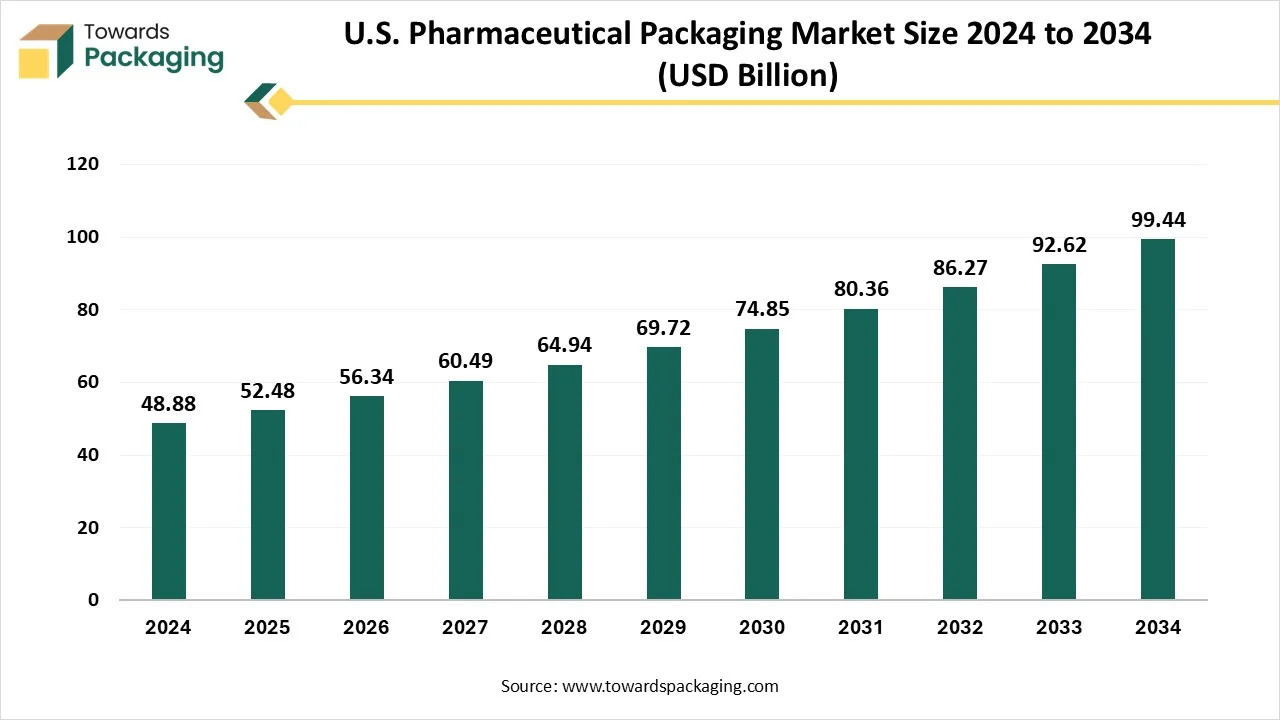

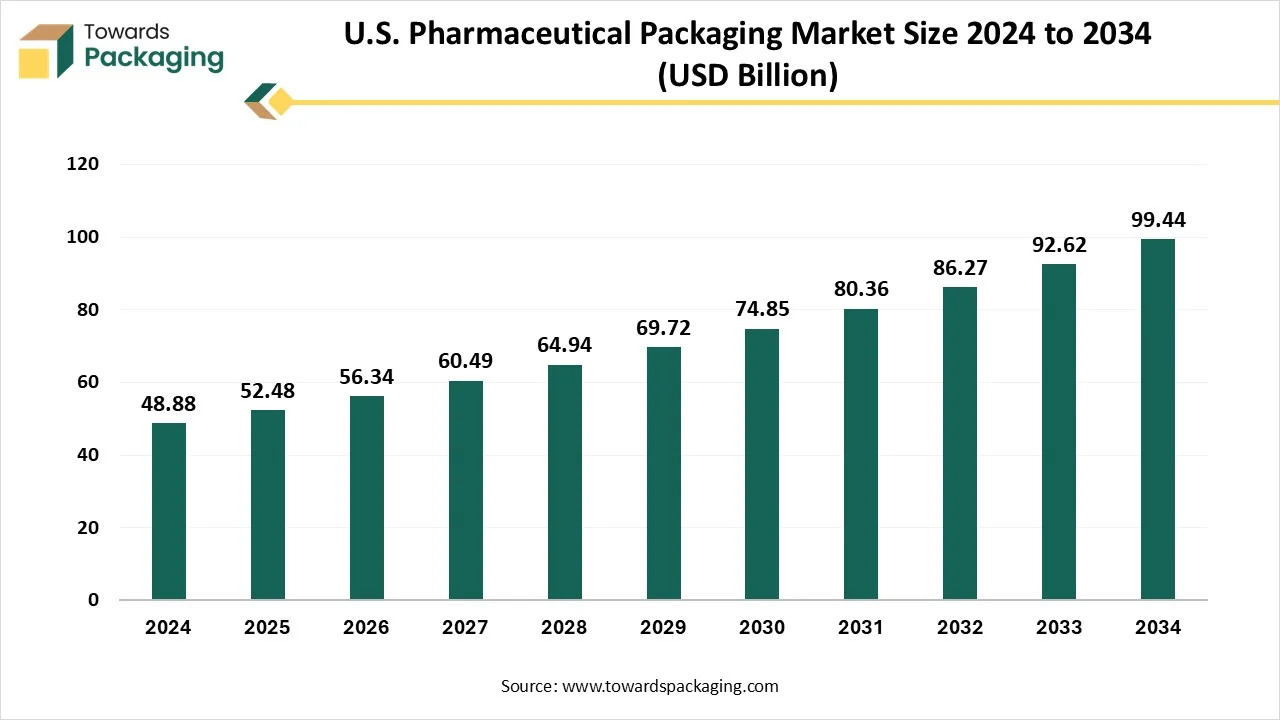

- In terms of revenue, the market is valued at USD 52.48 billion in 2025.

- The market is projected to reach USD 106.76 billion by 2035.

- Rapid growth at a CAGR of 7.36% will be observed in the period between 2025 and 2034.

- By product type, the primary packaging segment accounted for the dominant share in 2024.

- By product type, the syringes & cartridges segment is expected to witness a significant share during the forecast period.

- By material, the plastic segment held a dominant presence in the market in 2024.

- By material, the biodegradable and polymer films segment accounted for considerable growth in the market over the forecast period.

- By drug delivery format, the oral drugs segment held the major market share in 2024.

- By drug delivery format, the injectables segment is projected to grow at a CAGR of between 2025 and 2034.

- By packaging technology, the conventional packaging segment registered its dominance over the market in 2024.

- By packaging technology, the smart packaging (RFID, sensors, temperature monitoring) segment is expected to grow significantly during the forecast period.

- By end use, the pharmaceutical companies segment contributed the biggest market share in 2024.

- By end use, the contract manufacturing organizations (CMOS) segment is expanding at a significant CAGR during the forecast period.

Market Overview

The U.S. pharmaceutical packaging market refers to the industry that develops and supplies packaging solutions specifically designed to protect pharmaceutical products during storage, handling, and transportation while ensuring safety, efficacy, regulatory compliance, and patient convenience. This market includes primary packaging (direct contact with the drug), secondary packaging (external containers/labels), and tertiary packaging (bulk handling).

What are the Key Trends Driving the Growth of the U.S. Pharmaceutical Packaging Market?

- The rising shift in preferences toward recyclable and eco-friendly packaging materials to minimize packaging waste and boost environmental sustainability is expected to boost the market’s revenue during the forecast period.

- The rising focus of pharmaceutical companies on better protection of drugs during transit and storage is expected to accelerate the growth of the U.S. pharmaceutical packaging market.

- The rapid expansion of the e-commerce industry is anticipated to fuel the market’s expansion during the forecast period.

- The rising healthcare expenditure, supportive government framework, rapid technological innovations, rising chronic diseases, and advanced manufacturing processes are significantly contributing to the overall growth of the U.S. pharmaceutical packaging market.

- The rising demand for next-generation biologics and mRNA therapies spurs the demand for advanced multi-barrier packaging solutions are anticipated to fuel the market’s expansion during the forecast period.

- The increasing need for protection of capsules and tablets, ensuring patient safety and convenience, is likely to support the U.S. pharmaceutical packaging market’s revenue during the forecast period.

- The rising emphasis on serialization and anti-counterfeit measures is expected to promote the market’s growth in the coming years.

- The growing demand for child-resistant and tamper-evident features in packaging is projected to support the growth of the U.S. pharmaceutical packaging market.

How is Artificial Intelligence Integration Impacting the Growth of the U.S. Pharmaceutical Packaging Market?

In today's rapidly evolving technological landscape, AI integration holds the potential to reshape the entire landscape of the U.S. pharmaceutical packaging market. The integration of AI technologies in pharmaceutical packaging marks a significant shift towards more efficient, accurate, and innovative packaging practices. Machine Learning algorithms assist vision system experts in identifying and sorting false ejects. In the pharmaceutical packaging, AI integration is paving the way for biodegradable materials and alternatives that can significantly lower greenhouse gas emissions and promote circularity. By harnessing the power of AI algorithms, researchers can develop sustainable packaging materials that reduce wastage, conserve resources, and protect the Earth for future generations.

Market Dynamics

Driver

How is the Increasing Demand for Biopharmaceuticals Impacting the Growth of the Market?

The rising demand for biopharmaceuticals is expected to boost the growth of the U.S. pharmaceutical packaging market during the forecast period. Biopharmaceuticals, which focus on biologics such as monoclonal antibodies, vaccines, gene therapies, and others, require specialized packaging solutions, such as tamper-evident packaging and temperature-controlled packaging to maintain both safety and efficacy. Specialized packaging solutions are increasingly gaining immense popularity in the pharmaceutical industry, with the rise of biopharmaceuticals.

Biologics are sensitive, complex, and require advanced packaging to safeguard therapeutic benefits. Biologics are generally produced in large quantities that are transported in bulk to the fill & finish site. The drug delivery of these bulk drug substances requires efficient and specialized packaging solutions that assist in maintaining the appropriate temperature range during transit. In the production of pharmaceutical goods, complying with stringent guidelines such as current Good Manufacturing Practices, requiring certifications from the FDA is important to ensure the safety and quality of drug substances and medical devices. Single-use bags offer high-quality control and protection for high-value biologics and minimize the risk of contamination.

Restraint

Surge in Raw Material Prices and High Investment

The rising raw material costs and high investment in advanced pharmaceutical packaging technology are anticipated to hinder the market’s growth. The modern technologies, such as serialization and track-and-trace systems, require a high upfront investment. These factors can significantly enhance the production costs and may restrict the market entry for small and medium-sized companies. In addition, rising cases of counterfeit drugs and fake packaging may restrict the expansion of the global U.S. pharmaceutical packaging market.

Opportunity

Increasing Focus on Sustainable and Eco-friendly Pharmaceutical Packaging Solutions

The rising focus on sustainable and eco-friendly packaging solutions is projected to offer lucrative growth opportunities to the growth of the U.S. pharmaceutical packaging market in the coming years. In the pharmaceutical industry, sustainable pharmaceutical packaging focuses on reducing environmental impact throughout the product lifecycle, from production to disposal. This involves using biodegradable, recyclable, or compostable packaging materials to align with the circular economy principles of the country.

Consumers are increasingly preferring to replace conventional packaging materials, such as plastics and polystyrene, which accumulate pollution levels, landfill overflow, and marine debris, posing significant threats to human health and ecosystems. Plastic takes nearly 1000 years to decompose. The adoption of eco-friendly packaging solutions by pharmaceutical companies assists in lowering their carbon footprint and becoming more environmentally conscious. Moreover, the rising regulatory pressure and surge in environmental concerns have encouraged pharma companies to invest in sustainable packaging solutions.

- In March 2025, Green Lab, Southeast Asia's leading eco-packaging manufacturer, announced that it has officially entered the U.S. market. A subsidiary of Frasers & Neave Group, one of Southeast Asia's largest SGX-listed conglomerates, Green Lab now brings its sustainable packaging solutions to North America. (Source: PR Newswire)

Segmental Insights

By Packaging Technology

The conventional packaging segment dominated the market with the largest share in 2024. Conventional pharmaceutical packaging generally involves primary, secondary, and tertiary packaging to safeguard the drugs from contamination, physical damage, and other environmental factors. These packaging ensures secure transport and protects against pharmaceutical products during handling, storage, and facilitates easier logistics for high-volume orders.

On the other hand, the smart packaging (RFID, sensors, temperature monitoring) segment is expected to grow at a significant rate, owing to the increasing need for product authentication, stringent government framework, and rising focus on improving patient safety. Smart packaging ensures the integrity of drugs and reduces the risk of counterfeit drugs reaching the market by ensuring that each package verifies its authenticity. RFID chips assist in tracking the medications throughout the supply chain. Such tools support compliance with serialization requirements like those introduced under the DSCSA.

How is the Primary Packaging Segment Dominating the Market?

The primary packaging segment held a dominant presence in the U.S. pharmaceutical packaging market in 2024. The growth of the segment is mainly driven by the rising demand for biologics, injectable drugs, and personalized medicines. Primary packaging directly holds control over the medication. Primary packaging efficiently protects the drug from contamination and various environmental factors like moisture, oxygen, and light while ensuring accurate dosing and safe handling. These packages comply with the U.S. regulatory requirements for safety and labeling. Labels include crucial information such as expiration, dosage, and product identification to support traceability and minimize errors. There are different types of primary packaging, including bottles, blister packs, vials & ampoules, syringes & cartridges, pouches, and tubes.

The syringes & cartridges sub-segment is growing rapidly, owing to the rising focus on patient safety, increasing need to comply with regulatory guidelines, and increasing demand for biologics requiring specialized storage and handling. In recent years, prefilled syringes and cartridges have gained immense popularity over traditional vials and syringes. Several companies operating in the U.S. are increasingly focusing on developing improved syringe and cartridge designs, particularly those for vaccines, biologics, and other home-based therapies.

How Plastic Segment Dominated the Market in 2024?

Plastics dominated the U.S. pharmaceutical packaging market in 2024. Plastic packaging is widely used in the pharmaceutical industry owing to its durability, versatility, strength, durability, cost-effectiveness, mechanical strength, and stability. Pharmaceutical plastic packaging commonly includes bottles, pill bottles, dispensers, blisters, ampoules, and others. Some specific plastics like PP, PET, and HDPE are preferred for their unique properties, such as barrier protection, strength, versatility, and resistance to chemicals and the environment.

On the other hand, the biodegradable and polymer films segment is expected to grow at a notable rate during the forecast period, owing to the rising environmental and sustainability concerns. The surge in environmental issues and regulatory pressures is compelling pharmaceutical companies to adopt more eco-friendly packaging practices, such as recyclable, biodegradable, and compostable packaging materials, which significantly reduce packaging waste and promote environmental sustainability. Additionally, rapid advancement in material science and pharmaceutical packaging technologies is expected to further boost the market's expansion.

What Makes the Oral Drugs Segment Drive the Market?

The oral drugs segment is expected to dominate the U.S. pharmaceutical packaging market. The growth of the segment is mainly fuelled by the increasing incidence of chronic diseases, a surge in healthcare expenditure, increasing focus on patient compliance and safety, and rising innovation in novel drug packaging systems. In addition, the increasing demand for child-resistant and tamper-evident features in packaging is anticipated to propel the growth of the segment during the forecast period.

On the other hand, the injectables segment is growing at the fastest CAGR owing to the rising prevalence of chronic diseases, surge in aging population, the increasing demand for biologics, and the growing need for safe and convenient packaging solutions. Chronic diseases such as cardiovascular diseases, diabetes, cancer, and immune disorders require long-term treatment, often administered through injectables. Biologics, including antibodies, vaccines, and gene therapies, play a crucial role in treating various chronic disorders, which require specialized packaging solutions that can maintain their stability and efficacy, as well as protection against contamination.

Huge Demand from the Pharmaceutical Companies Supported the Segment’s Dominance

The pharmaceutical companies segment is dominating the market over the U.S. pharmaceutical packaging market in 2024, owing to the rapid expansion of the pharmaceutical industry, coupled with the increasing incidence of chronic diseases. Pharmaceutical companies in the U.S. heavily rely on efficient and specialized pharmaceutical packaging to ensure drug safety and efficacy. Packaging protects drugs from contamination, physical damage, degradation, and other environmental factors such as light, moisture, and oxygen.

On the other hand, the contract manufacturing organizations (CMOS) segment is expected to witness remarkable growth during the forecast period. CMOs are increasingly preferred when pharmaceutical companies plan to outsource drug production to third-party manufacturers. CMOs play a crucial role from drug formulation and production to packaging and distribution for pharmaceutical companies. These specialized services assist pharmaceutical companies in focusing on their core activities and cost optimization.

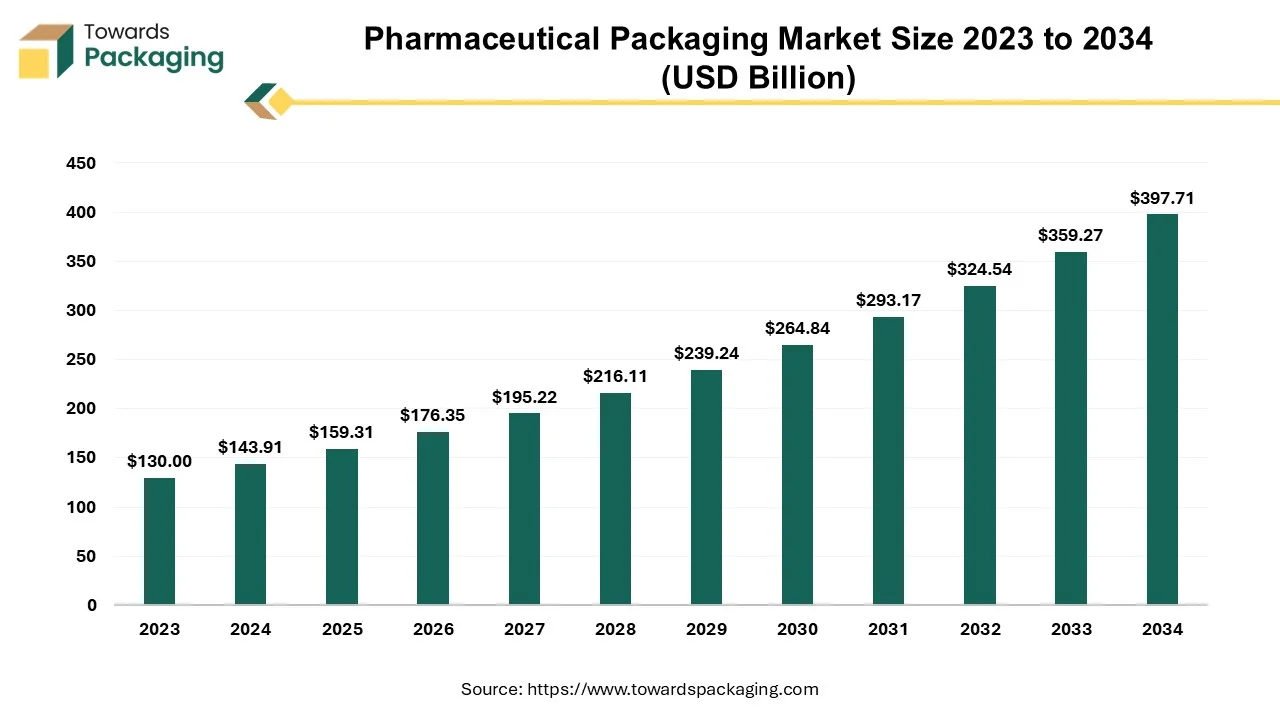

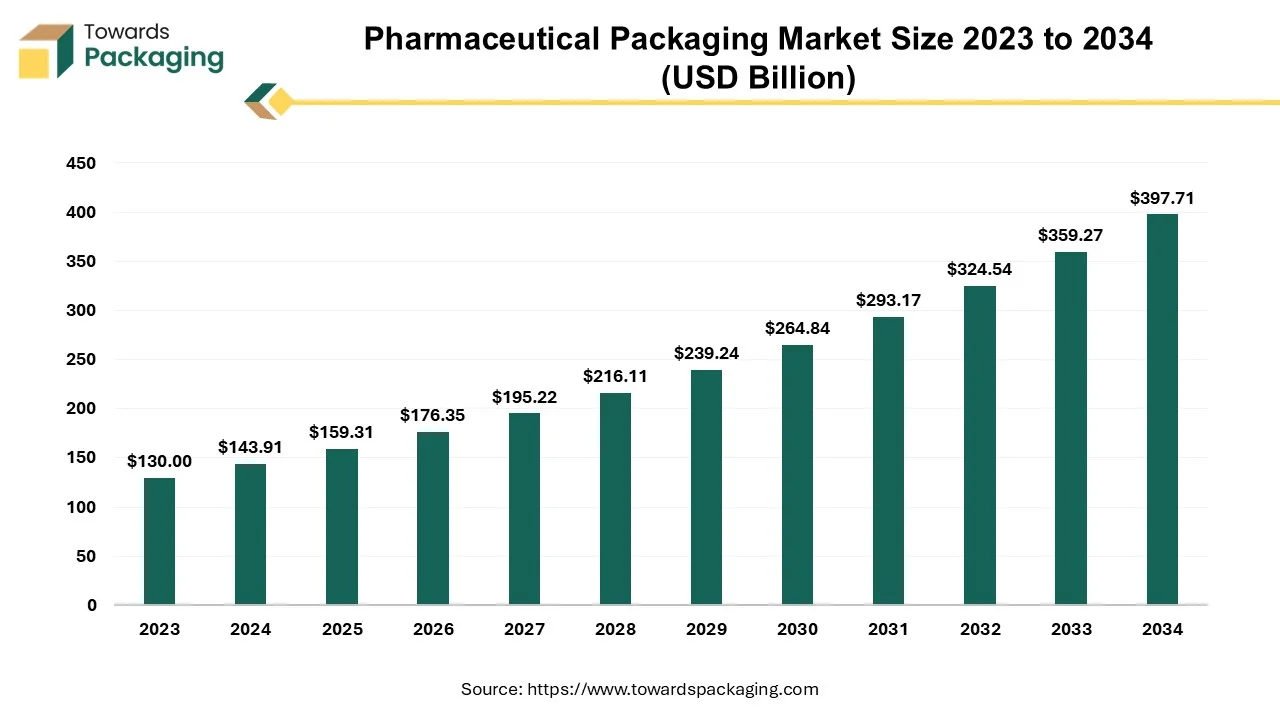

Future of Pharmaceutical Packaging Market

The global pharmaceutical packaging market is forecasted to expand from USD 159.31 billion in 2025 to USD 397.71 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034. The growth is mainly driven by the increasing need for safe and effective drug packaging due to rising demand for medicines worldwide. This is supported by advances in technology and stricter regulations ensuring product quality and patient safety.

A vital part of medicine delivery, pharmaceutical packaging guarantees the efficacy, safety, and integrity of pharmaceutical products for the course of their lifetime. Pharma packaging shields goods against deterioration, contamination, and other outside influences that could jeopardize patient safety and product quality by using specific materials and technology. Packaging acts as a protective barrier against temperature changes, moisture, light, and physical harm.

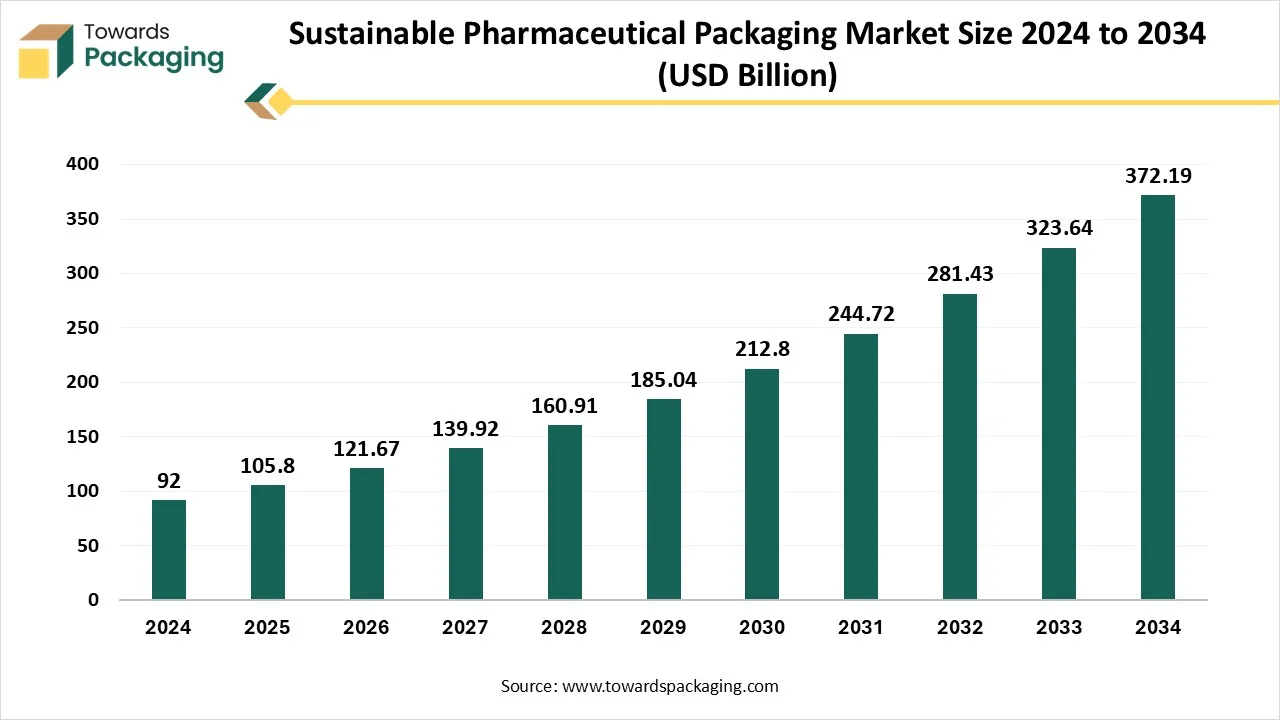

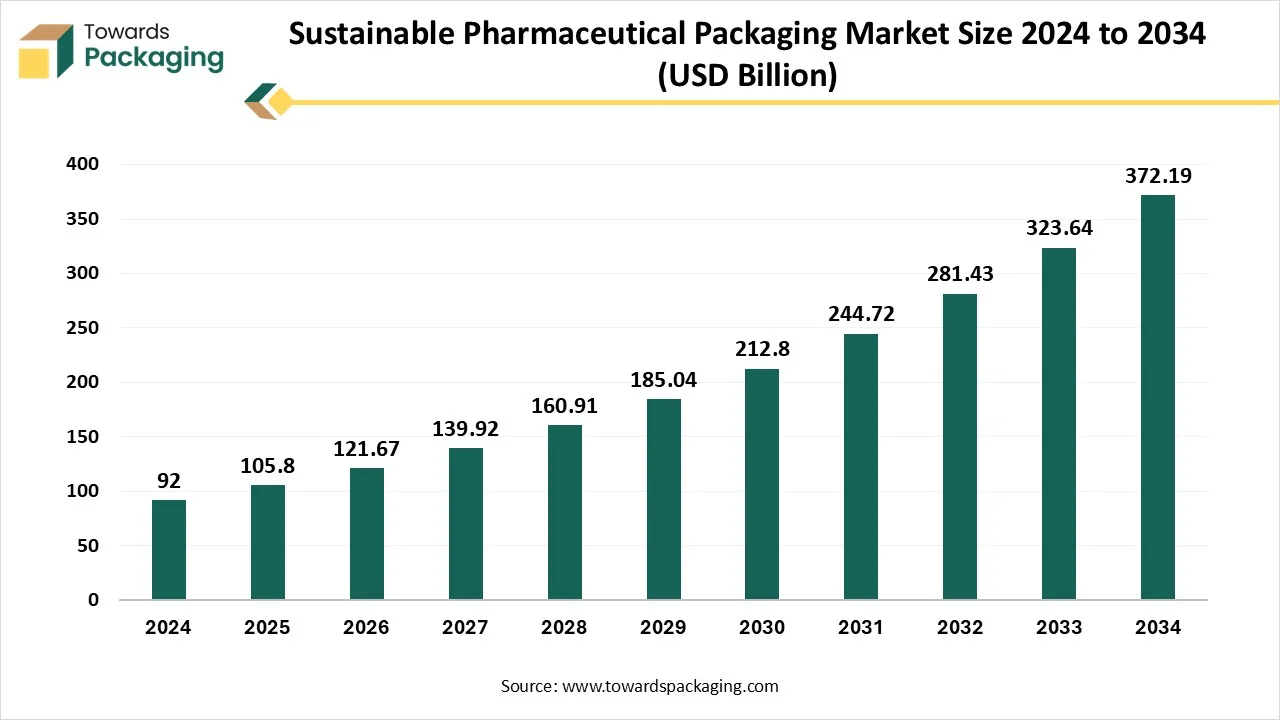

Future of Sustainable Pharmaceutical Packaging Market

The sustainable pharmaceutical packaging market is expected to increase from USD 105.80 billion in 2025 to USD 372.19 billion by 2034, growing at a CAGR of 15% throughout the forecast period from 2025 to 2034. This market proliferates due to the growing necessity for sustainable packaging, as the demand for pharmaceutical products is increasing, and the massive use is creating waste management issues due to non-biodegradable packaging. All these factors are going to show huge growth in the upcoming times in the sustainable pharmaceutical packaging market.

Globally, many chronic diseases are prevalent, and the requirement for health care and pharmaceuticals is increasing rapidly. After COVID-19, thousands of tons of waste were produced. It is a challenging thing to do waste management if the materials are non-biodegradable. Such scenarios have created the necessity to shift to sustainable pharmaceutical packaging.

Top U.S. Pharmaceutical Packaging Market Players

- Amcor plc

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Schott AG

- AptarGroup, Inc.

- Berry Global, Inc.

- Catalent, Inc.

- Becton, Dickinson and Company (BD)

- Nipro Corporation

- SGD Pharma

- Owens-Illinois, Inc.

- WestRock Company

- Sonoco Products Company

- Comar, LLC

- SiO2 Materials Science

- Alpla Inc.

- Tekni-Plex, Inc.

- CCL Industries

- Origin Pharma Packaging

- PCI Pharma Services

The latest Announcement by the Industry leader

- In September 2024, BGS Beta-Gamma-Service, a specialist for more than 40 years in the use of beta and gamma rays for radiation sterilisation for medical devices, pharmaceutical packaging, and biotechnology products, announced its plan to open its first facility in the United States next year. The new 100,000-square-foot plant will offer fully automated E-Beam sterilisation and is in Imperial, PA, near the Pittsburgh International Airport. The facility is expected to be operational in mid-2025 and will operate as BGS US with Leonard Zuba, formerly vice president of sales at Raumedic, as its general manager. (Source: Pharmaceutical Manufacturer)

Recent Development

- In October 2024, Bayer launched a first-of-its-kind in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve. Realized in partnership with pharma packaging specialist Liveo Research, this innovative solution reduces the carbon footprint of this packaging by 38% and marks a stride in environmental stewardship by eliminating the use of polyvinyl chloride (PVC). (Source: Bayer)

- In January 2025, DS Smith launched an innovative temperature-controlled packaging solution for the pharmaceutical industry. The solution is designed to support the sustainability targets of pharmaceutical and biotech businesses, meeting their need to store and transport delicate medicinal products across multiple territories within rigorously controlled temperature environments.(Source: Themanufacturer)

U.S. Pharmaceutical Packaging Market Segmentations

By Product Type

- Primary Packaging

- Bottles

- Blister Packs

- Vials & Ampoules

- Syringes & Cartridges

- Pouches

- Tubes

- Secondary Packaging

- Folding Cartons

- Labels & Inserts

- Shrink Wraps

- Tertiary Packaging

- Corrugated Boxes

- Pallets

- Shipping Containers

By Material

- Plastic

- Glass

- Metal

- Paper & Paperboard

- Aluminum Foil

- Others (Biodegradable, Polymer Films)

By Drug Delivery Format

- Oral Drugs

- Injectables

- Topicals

- Inhalation Drugs

- Transdermal Patches

- Ophthalmic Drugs

By Packaging Technology

- Conventional Packaging

- Smart Packaging (RFID, Sensors, Temperature Monitoring)

- Anti-Counterfeit Packaging

- Sustainable/Eco-Friendly Packaging

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Retail Pharmacies

- Hospitals & Clinics

List of Figures

- U.S. Pharmaceutical Packaging Market Size and Growth: Market Size in 2025 (USD 52.48 billion) and Projected Market Size in 2034 (USD 99.44 billion) with a Growth Rate of 7.36% CAGR (100%).

- By Product Type: Primary Packaging (70%), Secondary Packaging (15%), Tertiary Packaging (15%) (100%).

- By Material: Plastic (60%), Glass (10%), Metal (5%), Paper & Paperboard (10%), Aluminum Foil (5%), Biodegradable & Polymer Films (10%) (100%).

- By Drug Delivery Format: Oral Drugs (50%), Injectables (30%), Topicals (5%), Inhalation Drugs (5%), Transdermal Patches (5%), Ophthalmic Drugs (5%) (100%).

- By Packaging Technology: Conventional Packaging (55%), Smart Packaging (RFID, Sensors, Temperature Monitoring) (20%), Anti-Counterfeit Packaging (10%), Sustainable/Eco-Friendly Packaging (15%) (100%).

- By End Use: Pharmaceutical Companies (60%), Biotechnology Companies (10%), Contract Manufacturing Organizations (CMOs) (15%), Retail Pharmacies (5%), Hospitals & Clinics (10%) (100%).

List of Tables

- U.S. Pharmaceutical Packaging Market Size (2025-2034): Market Size in 2025 (USD 52.48 billion) and Projected Market Size in 2034 (USD 99.44 billion) with a Growth Rate of 7.36% CAGR (100%).

- Market Breakdown by Product Type: Primary Packaging (70%), Secondary Packaging (15%), Tertiary Packaging (15%) (100%).

- Market Breakdown by Material: Plastic (60%), Glass (10%), Metal (5%), Paper & Paperboard (10%), Aluminum Foil (5%), Biodegradable & Polymer Films (10%) (100%).

- Market Breakdown by Drug Delivery Format: Oral Drugs (50%), Injectables (30%), Topicals (5%), Inhalation Drugs (5%), Transdermal Patches (5%), Ophthalmic Drugs (5%) (100%).

- Market Breakdown by Packaging Technology: Conventional Packaging (55%), Smart Packaging (RFID, Sensors, Temperature Monitoring) (20%), Anti-Counterfeit Packaging (10%), Sustainable/Eco-Friendly Packaging (15%) (100%).

- Market Breakdown by End Use: Pharmaceutical Companies (60%), Biotechnology Companies (10%), Contract Manufacturing Organizations (CMOs) (15%), Retail Pharmacies (5%), Hospitals & Clinics (10%) (100%).

Tags

FAQ's

Select User License to Buy

Figures (4)