Germany Flexible Packaging Market Growth, Innovations and Market Size Forecast

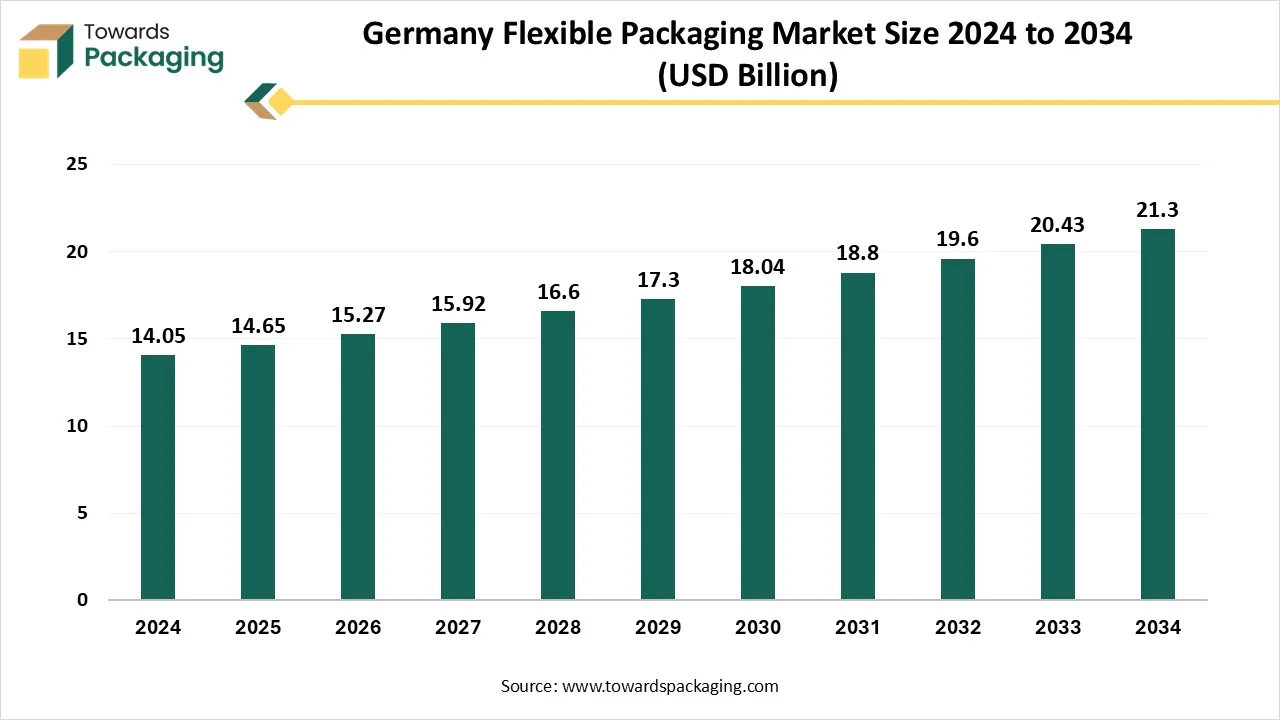

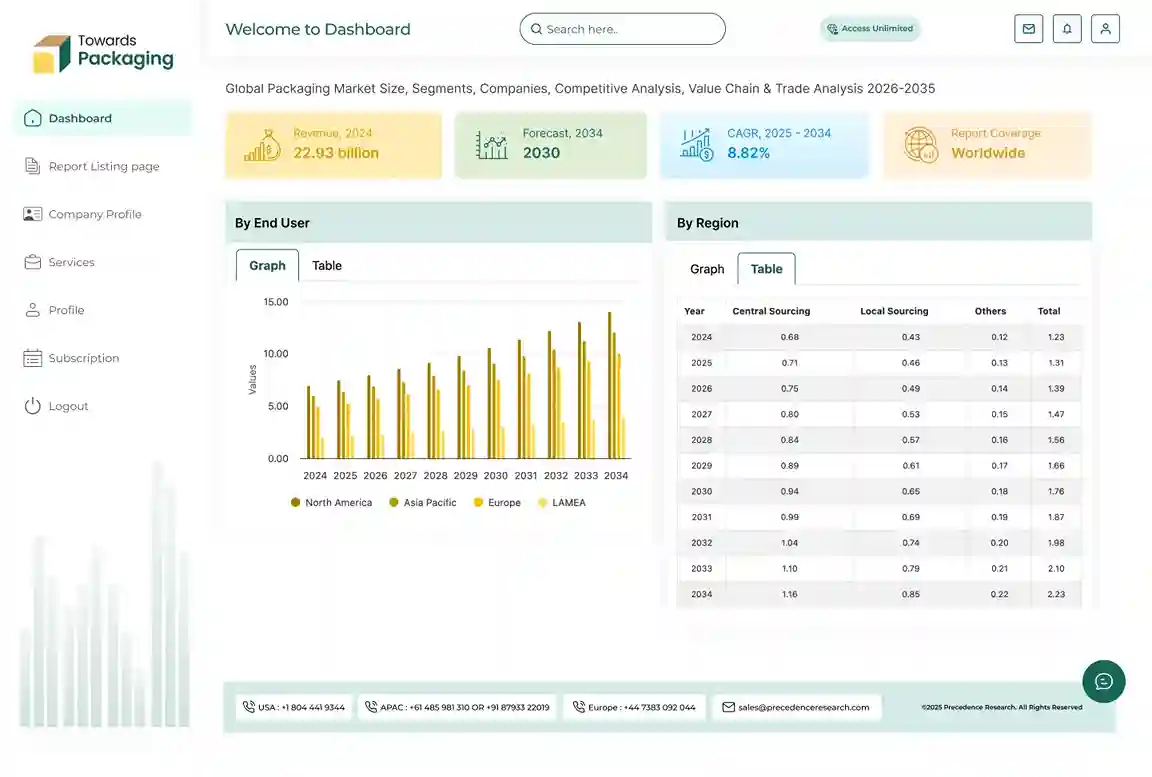

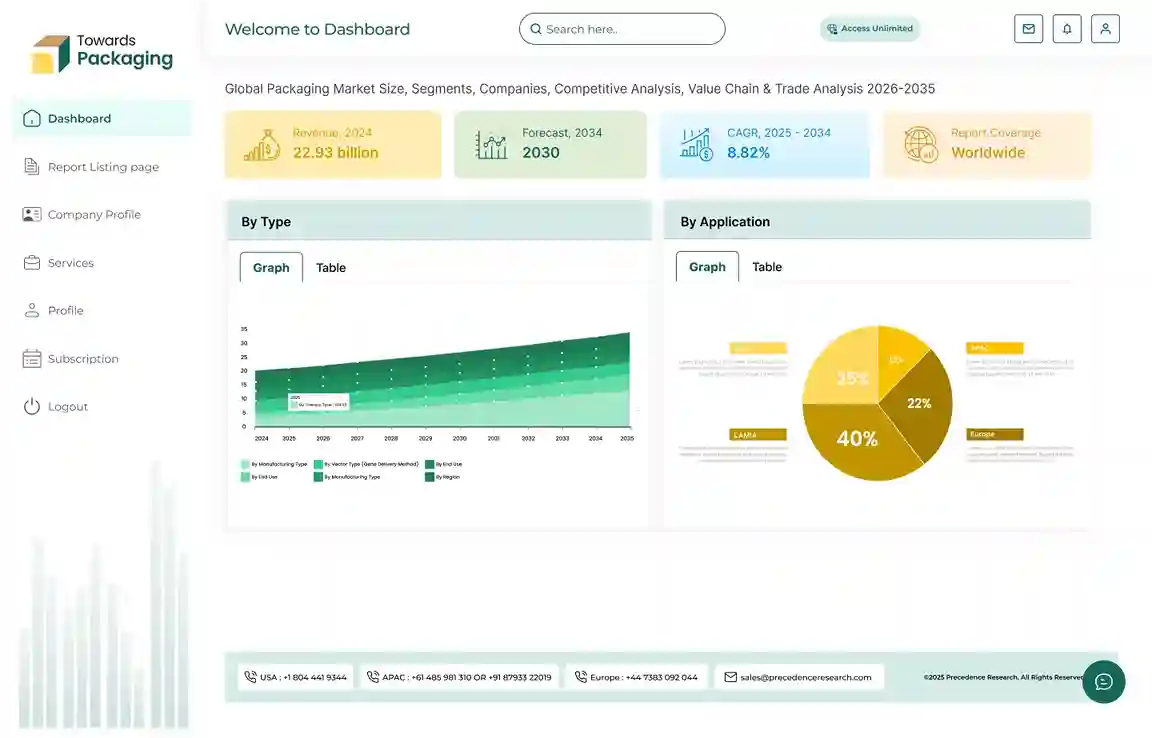

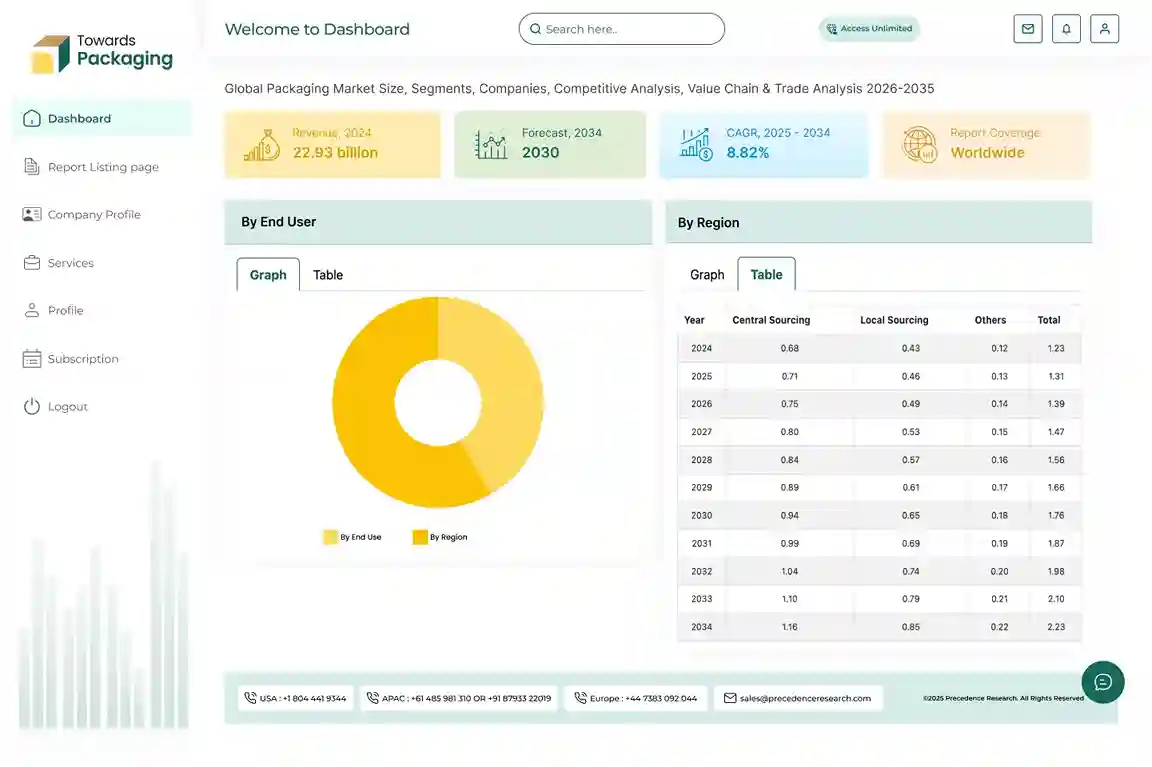

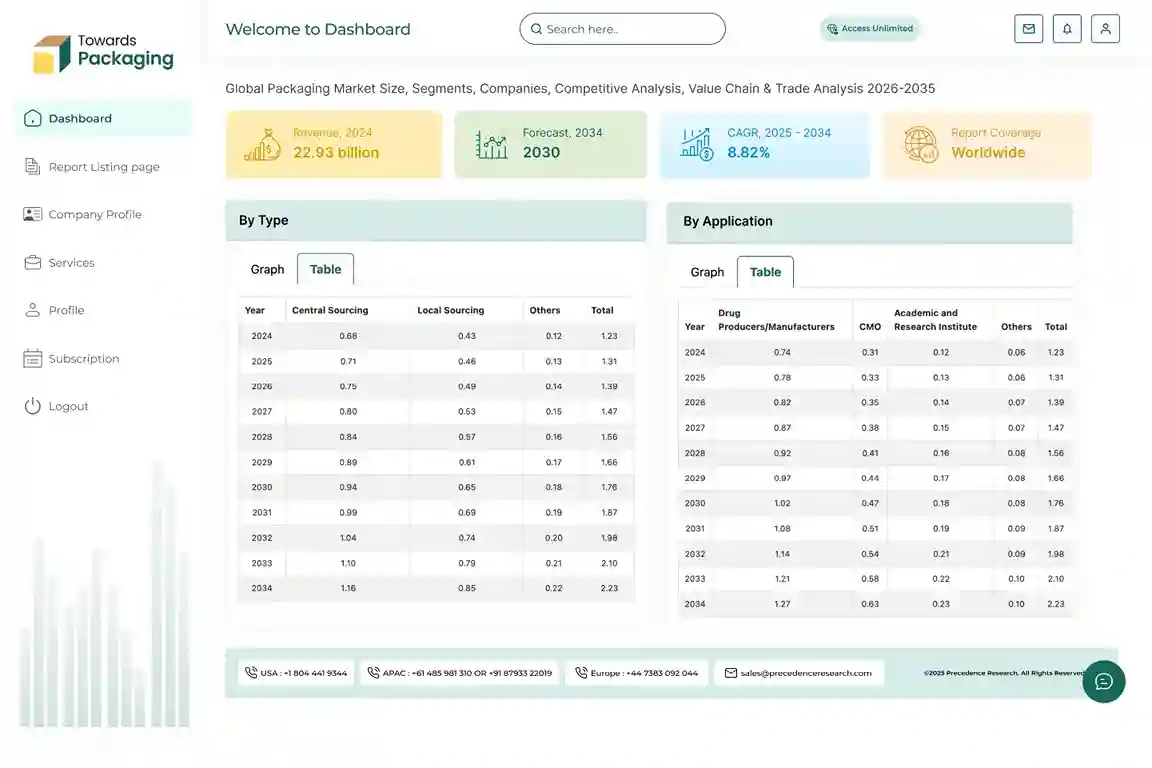

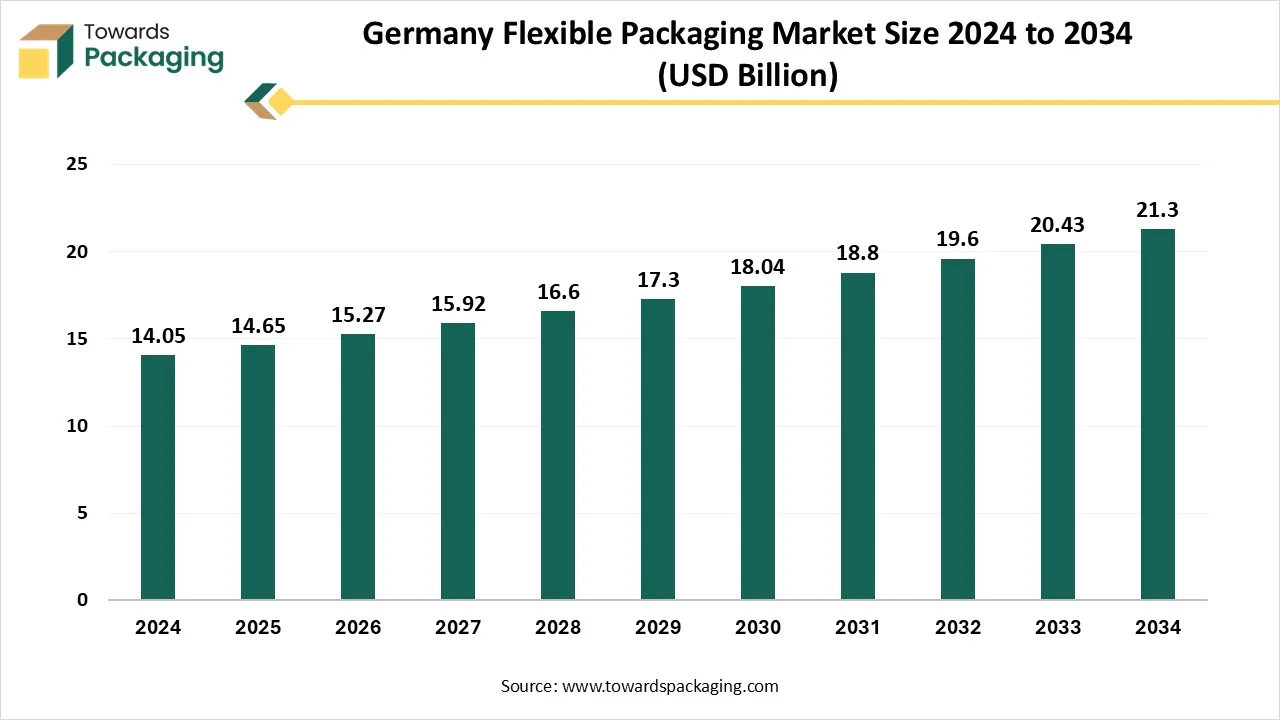

The Germany flexible packaging market is forecasted to expand from USD 15.27 billion in 2026 to USD 22.21 billion by 2035, growing at a CAGR of 4.25% from 2026 to 2035. The Germany Flexible Packaging Market refers to the industry engaged in the production and distribution of packaging materials that are non-rigid in nature, such as pouches, bags, wraps, and films.

These materials offer advantages like lightweight properties, extended shelf life, cost efficiency, and sustainability. Widely used across food & beverages, pharmaceuticals, cosmetics, personal care, and industrial applications, the German market emphasizes eco-conscious solutions driven by strict environmental regulations and high consumer awareness around recyclability and circular packaging models.

Key Insights

- In terms of revenue, the market is valued at USD 14.65 billion in 2025.

- The market is projected to reach USD 22.21 billion by 2035.

- Rapid growth at a CAGR of 4.25% will be observed in the period between 2025 and 2034.

- By packaging type, the stand-up pouches segment dominated the market with the largest share in 2024.

- By packaging type, the sachets segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By material type, the plastic films (PE, PET) segment dominated the market in 2024.

- By material type, the bioplastics & compostable materials segment is expected to grow at the fastest CAGR in the forecast period.

- By technology, the flexographic printing segment dominated the market with the largest share in 2024.

- By technology, the digital printing segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By application, the food & beverages segment dominated the market in 2024.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use, the FMCG segment dominated the market with the largest share in 2024.

- By end-use, the e-commerce & retail packaging segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

What is Meant by Flexible Packaging?

Flexible packaging refers to packaging made from materials that are easily bendable and can change shape when filled or handled. These materials typically include plastic films, paper, foil, or combinations of these, and are used to produce items like pouches, bags, wraps, and sachets. This type of packaging is known for being lightweight, durable, cost-effective, and easy to mold or seal, making it highly efficient for transportation and storage. Flexible packaging is widely used across various industries such as food and beverages (e.g., snack bags and juice pouches), personal care (e.g., shampoo sachets), pharmaceuticals (e.g., blister packs and medical pouches), and household products (e.g., detergent refills). Its popularity stems from its ability to extend shelf life, reduce material usage, and offer convenience for both manufacturers and consumers.

What are the Key Trends Transforming the Flexible Packaging Market?

Sustainability & Circular Economy

Brands are switching to mono‑material structures (e.g., mono‑PE or mono‑PP films) for easier recycling, instead of complex laminated systems. Adoption of compostable and bio‑based films, like PLA/PHA, is rising, though limited industrial composting infrastructure remains an obstacle. Carbon‑neutral packaging and carbon‑impact labeling are gaining traction, helping brands align with ESG and regulatory targets. Businesses are developing take‑back and reuse systems, as well as molecular recycling to upcycle multilayer packages into raw materials. Real‑world innovations like Dow’s INNATE TF 220 recyclable polymer for BOPE films highlight progress toward fully recyclable flexible packaging.

Smart & Interactive Packaging

QR codes, NFC, blockchain, and RFID are enabling traceability, supply‑chain transparency, product authentication, and interactive consumer experiences. Intelligent active packaging, like oxygen or temperature sensors and antimicrobial layers, is improving food safety and shelf life. Breakthrough battery‑free, stretchable, autonomous smart packaging prototypes now support real‑time sensing and controlled release of freshness‑preserving agents.

Customization, Digital & Printing Innovation

Digital printing is reshaping the industry, enabling vibrant short-run designs, personalization, versioning, and flexible branding campaigns. Brands are offering personalized packaging, such as names or messages on flexible pouches, to boost engagement and loyalty.

Convenience, Portability & E‑Commerce Adaptation

Stand‑up pouches, resealable bags, easy‑tear and spout formats, designed for portability and portion control, are surging in popularity among urban and on‑the‑go consumers. Flexible packaging is ideally suited for e‑commerce and direct‑to‑consumer shipping: lightweight, durable, customizable, tamper‑evident, and reducing transport costs.

Regulatory Compliance, Industry Consolidation & Investment

New rules like the EU Green Deal, Packaging Waste Regulation, Plastic Packaging Tax, and EPR mandates are pushing companies to adapt materials and disclose recyclability, recycled content, and carbon footprints. Mergers and acquisitions (M&A) activity is accelerating as larger firms acquire technology‑driven players (smart packaging, digital print, sustainable adhesives) to expand capabilities. Investors increasingly back startups focused on sustainable materials, smart packaging systems, and automation or smart manufacturing.

How Can AI Improve the Germany Flexible Packaging Industry?

AI integration is revolutionizing the German flexible packaging industry by driving improvements in efficiency, sustainability, quality control, and customization. Through smart automation and predictive maintenance, AI optimizes packaging lines by enabling real-time error detection and reducing downtime, which enhances productivity in Germany's highly automated manufacturing sector. In supply chain management, AI forecasts demand patterns and manages inventory more efficiently, ensuring smoother operations in the country’s export-driven economy. AI also plays a critical role in sustainable material optimization by simulating eco-friendly blends and thinner film gauges, aligning with Germany's commitment to green packaging and compliance with EU regulations.

AI enables the development of smart packaging with integrated sensors, QR codes, or NFC tags that support real-time tracking, anti-counterfeiting, and personalized consumer interaction key advantages for Germany’s pharmaceutical, food, and industrial sectors. In quality control, AI-powered vision systems detect defects in packaging materials at high speeds, maintaining the country’s stringent quality standards. AI also enhances customization through digital printing optimization by analyzing consumer trends and enabling personalized packaging, which is particularly valuable for Germany’s premium food and cosmetic markets. Additionally, AI improves energy and resource efficiency during production, supporting Germany’s environmental goals and its pathway to Net Zero by 2045.

Market Dynamics

Driver

Rising Demand for Sustainable Packaging & Stringent Environmental Regulations, and EU Policies

Strong consumer preference for recyclable, biodegradable, and compostable materials due to environmental awareness. Compliance with laws such as Extended Producer Responsibility (EPR) and the EU Green Deal drives the adoption of flexible and recyclable packaging. For instance, in February 2025, Strict guidelines for companies putting packaged goods on the German market are established by the German Packaging Act (VerpackG), which enforces environmental standards for waste reduction and recycling. Since January 1, 2019, VerpackG has implemented Extended Producer Responsibility (EP), which mandates that businesses register their packaging, take part in recycling programs, and reach predetermined recycling goals.

Restraint

Recycling Infrastructure Challenges & Complex Supply Chain Regulations

The key players operating in the market are facing issues due to recycling infrastructure challenges & complex supply chain regulations. Germany has stringent packaging waste and recyclability laws. Non-compliance or inability to adapt to evolving regulations can limit product innovation and market entry. Biodegradable and recyclable materials are often more expensive than conventional plastics, increasing production costs for manufacturers. Limited availability of advanced recycling systems for multi-layer and composite flexible packaging materials hinders circular economy efforts. Despite the shift toward sustainability, flexible packaging, especially plastic-based, still faces criticism for its environmental impact, affecting public perception.

For certain high-end, protective, or premium applications, rigid packaging is still preferred, limiting flexible packaging's reach. The German market is influenced by both EU-wide and national compliance standards, which can create additional complexity and cost for manufacturers. Integrating new automation, smart technologies, or switching to mono-material films requires high capital investment, which can be a barrier for small and medium-sized players. Germany's mature market leads to intense competition and margin pressure among existing flexible packaging suppliers.

What are the Opportunities for Growth of the Germany Flexible Packaging Market?

Growth in Food, Pharma, and Personal Care Industries

- Increased consumption of packaged goods, convenience foods, and pharmaceutical products requires high-performance packaging.

Advanced Manufacturing Infrastructure

- Germany's strong industrial base supports efficient, high-precision, and automated flexible packaging production.

Innovation in Packaging Design and Functionality

- Demand for resealable, easy-to-use, portion-controlled, and smart packaging formats.

Cost-Effectiveness and Material Efficiency

- Flexible packaging uses less raw material than rigid packaging, reducing costs and waste.

Increased Focus on Product Shelf-Life and Safety

- Flexible packaging provides excellent barrier protection for food and pharma products, extending freshness and safety.

Digitalization and Smart Packaging Trends

- Integration of QR codes, sensors, and tracking technologies to meet consumer expectations and regulatory requirements.

Growing Export Opportunities

- As a major exporter, Germany’s flexible packaging supports global supply chains needing lightweight, durable, and efficient solutions.

Segmental Insights

Which Packaging Type Dominated the Germany Flexible Packaging Market in 2024?

The stand-up pouches segment is dominant in the German flexible packaging market due to a combination of consumer convenience, sustainability, and cost-efficiency. These pouches are lightweight, portable, and easy to store, aligning well with the lifestyle of modern German consumers who prioritize functionality and minimalism. They offer excellent barrier properties that preserve freshness, making them ideal for food, beverages, and personal care products. Stand-up pouches also use less material compared to rigid packaging, reducing waste and transportation costs an important factor in eco-conscious Germany. Furthermore, their compatibility with resealable features and customizable printing supports branding and extended shelf appeal. As sustainability regulations tighten, their recyclability and lower carbon footprint make them a preferred choice across various industries.

The sachet packaging segment is the fastest-growing in the German flexible packaging market due to its strong alignment with modern consumer needs and industry trends. Sachets offer convenience, portability, and precise dosing, making them ideal for on-the-go lifestyles and single-use applications in food, personal care, and automotive sectors. Their low material and production costs enable manufacturers to offer affordable, small-quantity products, appealing to value-conscious consumers. Sachets also provide excellent barrier properties, preserving product quality and extending shelf life, particularly important in food and pharmaceutical packaging. The growing use of sachets in cosmetics, for sampling and travel-size formats, and in automotive applications for pre-measured fluids is further driving demand. Additionally, advancements in recyclable and biodegradable sachet materials align with Germany’s strict environmental regulations and sustainability goals. The use of automated vertical form fill seal (VFFS) machines also supports efficient and flexible sachet production, contributing to their rapid market expansion.

Which Material Type Dominated the Germany Flexible Packaging Market?

The plastic films segment (particularly PE and PET) is dominant in the flexible packaging market due to a combination of performance, cost-efficiency, and versatility. Polyethylene (PE) and polyethylene terephthalate (PET) offer excellent barrier properties, ensuring protection against moisture, oxygen, and contaminants, making them ideal for packaging food, beverages, pharmaceuticals, and personal care products. These films are lightweight, flexible, and durable, which helps reduce shipping and handling costs. Their ease of printing and sealing supports attractive designs and brand visibility, while compatibility with automated machinery ensures high-speed production. Additionally, the widespread recyclability of mono-material PE and PET films, along with growing innovations in sustainable grades, reinforces their use in meeting environmental standards. These attributes make PE and PET films a preferred and dominant material type in the global flexible packaging industry.

The bioplastics and compostable materials segment is the fastest-growing material type within the German flexible packaging market, propelled by a compelling mix of regulatory support, consumer demand, and innovation-driven cost parity. Germany’s regulatory environment strongly favours bioplastic adoption laws like the updated Packaging Act (“Verpackungsgesetz”) incentivize renewable and recycled packaging, while EU directives phase out fossil‑based plastics in key applications. Rising environmental awareness among consumers and brands drives rapid demand growth for packaging with lower carbon footprints and compostable credentials, especially for food, cosmetics, and personal care sectors. Technological advances have made bioplastics such as PLA, PHA, bio‑PE, and starch blends more affordable and performance‑competitive, with improved barrier and mechanical properties suited to flexible packaging formats. Germany’s leadership in R&D, with active collaboration between universities, research institutes, and packaging firms, accelerates the development of high-functionality biodegradable films and compostable laminates.

Why does the Flexographic Printing Technology Segment Dominate the Germany Flexible Packaging market?

The flexographic printing technology segment has emerged as the dominant method in Germany’s flexible packaging market due to its unmatched speed, cost-efficiency, and adaptability. German converters benefit from high-speed flexo presses that support rapid production and fast turnaround on both short and long runs, reducing downtime and per-unit costs. Its ability to print on a wide range of substrates, from plastic films and aluminum foil to paper and multilayer laminates, makes it ideal for food, pharmaceuticals, and consumer goods packaging markets in Germany. The technology also aligns with Germany’s strict sustainability regulations: it supports water-based and UV-curable low-VOC inks, minimizes material waste, and is compatible with recyclable substrates. Furthermore, German packaging firms are investing in advanced automation, hybrid presses, inline inspection, and digital workflows, leveraging Industry 4.0 to boost quality and consistency while meeting branding and regulatory expectations.

The digital printing segment is the fastest-growing printing technology in the flexible packaging market, thanks to its remarkable flexibility, speed, and sustainability. By eliminating plate-making, digital printing enables rapid onboarding and swift product turnaround, ideal for short runs, seasonal SKUs, and promotional packaging. Brands can easily customize or personalize packaging on demand, enhancing consumer engagement and brand differentiation. It also reduces material waste, ink usage, and energy consumption, aligning with eco-conscious manufacturing goals. With vivid graphics and variable-data capabilities, digital printing offers premium quality at lower volumes, making it a strategic choice in modern flexible packaging production.

Which Application Dominated the Germany Flexible Packaging Market in 2024?

The food and beverages segment is the dominant application in the German flexible packaging market due to high consumer demand for packaged and ready-to-eat products, driven by fast-paced lifestyles and urbanization. Flexible packaging offers excellent barrier properties, extended shelf life, and convenience features like resealability and portability, ideal for snacks, dairy, meats, and beverages. Germany’s strong food processing industry and emphasis on hygiene, sustainability, and branding further support the widespread adoption of flexible packaging in this sector.

The pharmaceutical application segment is the fastest-growing within Germany’s flexible packaging market, driven by rising demand for sterile, unit-dose, and tamper-evident solutions in biopharmaceuticals, vaccines, and personalized medications. High-barrier formats such as blisters and specialty pouches protect pharmaceutical products from moisture, light, and contamination, while enabling precise dosing and regulatory compliance. Adoption of child‑resistant, serialized, and smart packaging like RFID-enabled or tamper-evident labels addresses stringent EU safety and traceability mandates. Growth in e‑commerce pharmacy channels further spurs demand for durable, secure, flexible packaging formats in home delivery scenarios.

Why does the FMCG Segment Dominate the Germany Flexible Packaging market?

The FMCG (Fast-Moving Consumer Goods) segment is the dominant end-use in Germany’s flexible packaging market because it aligns perfectly with evolving consumer and industry needs. High demand for packaged foods, snacks, ready meals, beverages, and personal care products drives volume. Flexible packaging provides excellent barrier protection, extends shelf life, and supports convenience formats like resealable pouches ideal for Germany’s urban, on-the-go population. Its lightweight and cost-efficient nature makes supply, storage, and retail logistics more efficient while enabling attractive branding and sustainable options popular among eco-conscious consumers.

The e‑commerce and retail packaging segment is the fastest-growing end-use in Germany’s flexible packaging market due to a surge in online shopping, which now accounts for around €100 billion annually and continues to expand rapidly. Flexible formats are favoured by e‑retailers because they are lightweight, cost-effective, and protective, minimizing shipping damage and reducing logistics costs. At the same time, strong environmental regulation and consumer demand in Germany are driving the adoption of recyclable and biodegradable materials in e‑commerce packaging. Together, these trends are fueling the rapid growth of flexible packaging in online retail channels.

Regional Insights

The German flexible packaging market is experiencing steady growth, driven by rising demand for sustainable, lightweight, and efficient packaging solutions across the food, pharmaceutical, and personal care industries. With a strong manufacturing base, advanced automation, and increasing consumer preference for eco-friendly materials, Germany leads in innovation and quality. South Germany, especially Bavaria and Baden-Württemberg, plays a dominant role due to its industrial strength, research capabilities, and export-oriented economy, making the region a key hub for flexible packaging development and production.

South Germany Market Trends

South Germany, particularly the states of Bavaria and Baden-Württemberg, dominates the German flexible packaging market due to a combination of strong industrial, technological, and logistical advantages. These regions host a robust manufacturing base, including automotive, electronics, and engineering sectors, which require advanced and customized flexible packaging solutions. The presence of major packaging and printing companies further enhances the region’s production capacity and market influence. Additionally, Bavaria and Baden-Württemberg are among Germany’s top exporting states, increasing the demand for efficient and protective packaging to support global supply chains. The regions also benefit from their proximity to key consumer goods manufacturers in food, beverage, pharmaceuticals, and personal care industries, all major users of flexible packaging. An efficient transport and logistics infrastructure enables smooth distribution across Germany and neighbouring countries.

East Germany Market Trends

The flexible packaging market in East Germany is gradually expanding, supported by ongoing industrial development, investment in manufacturing infrastructure, and growing demand from regional food processing, agriculture, and pharmaceutical sectors. While it is less dominant compared to South and West Germany, East Germany benefits from lower operational costs, skilled labor, and increasing government support for regional innovation and sustainability. The region is also witnessing a rise in small and mid-sized packaging firms adopting recyclable materials and automation, contributing to the broader shift toward eco-friendly and efficient packaging solutions across the country.

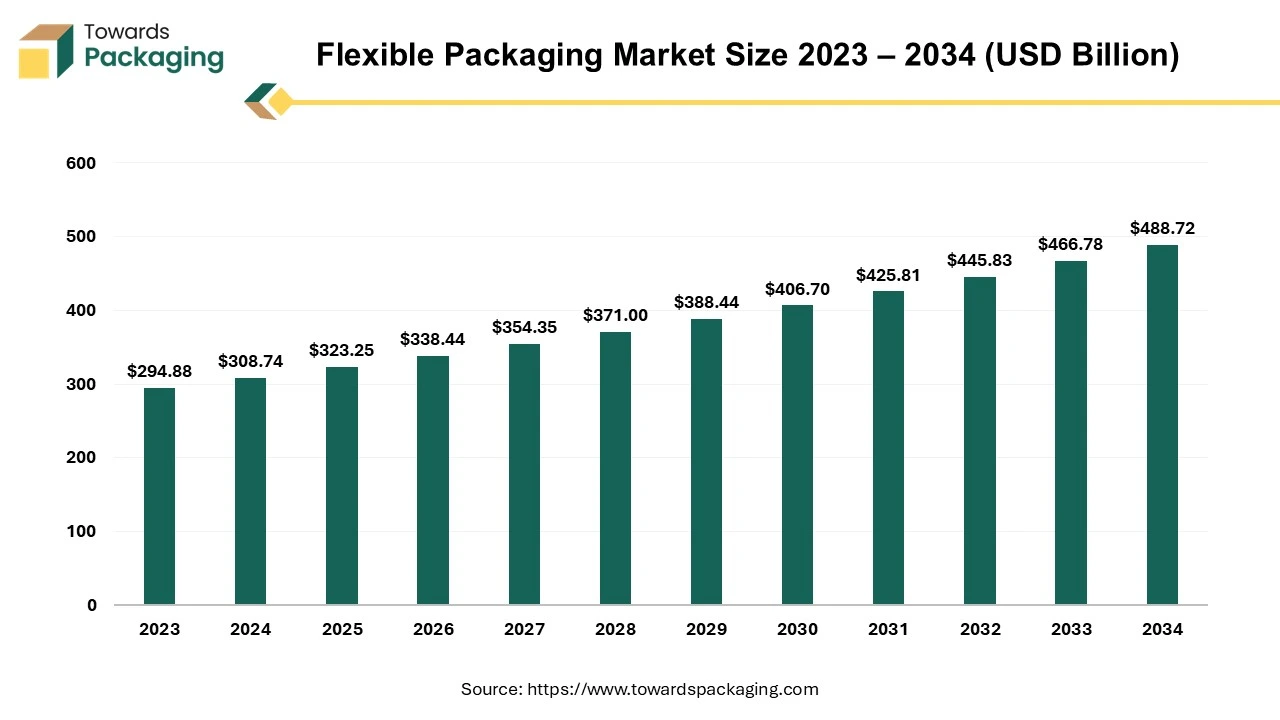

Flexible Packaging Market

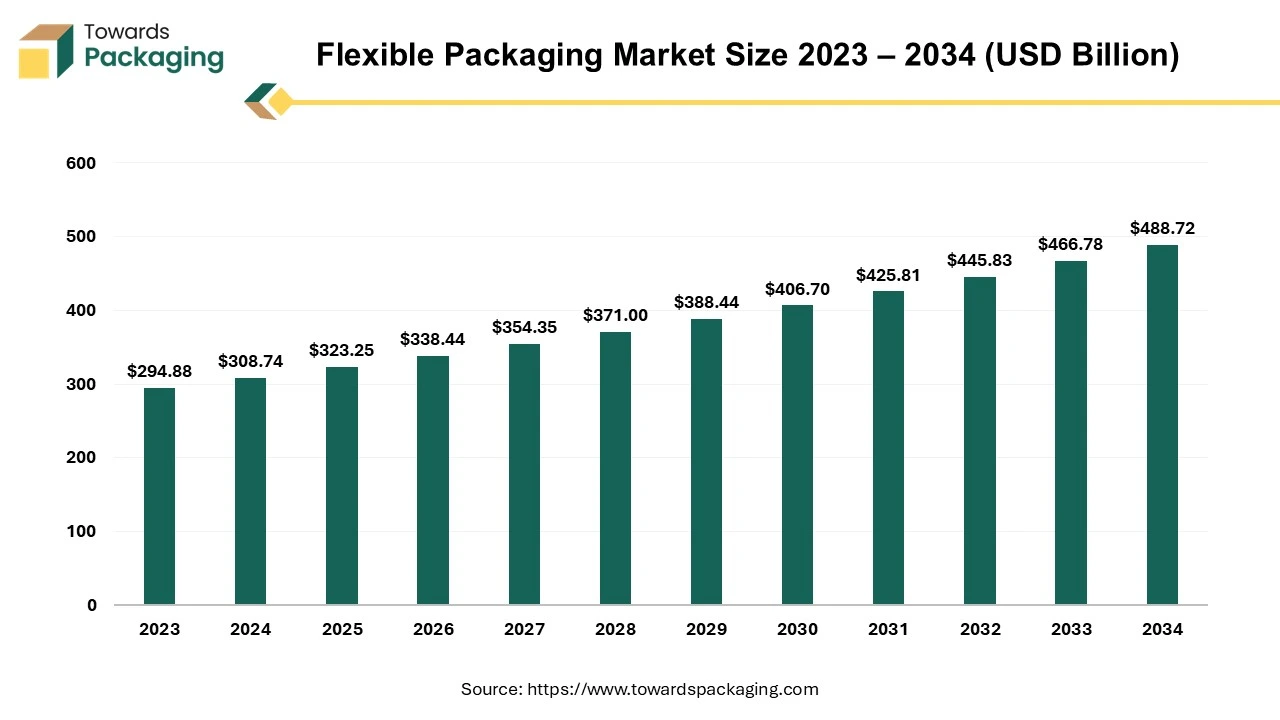

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Top Germany Flexible Packaging Market Players

- Amcor Flexibles

- Mondi Group

- Constantia Flexibles

- Huhtamaki

- Berry Global

- Coveris Group

- Sonoco Products Company

- Schur Flexibles

- Sealed Air

- Clondalkin Group

- Wipak Group

- Südpack Verpackungen

- Aluflexpack AG

- All4Labels Group

- RKW Group

- Walki Group

- RPC bpi Group

- Flextrus AB

- Bemis Company (Amcor)

- Printpack

Latest Announcements by Industry Leaders

- In November 2024, Thomas Ott, CEO of Flexible Packaging, Mondi plc, a packaging company, announced the opening of a new innovation hub for developing sustainable flexible packaging solutions. (Source: Pulpapernews)

New Advancements in the Market

- In January 2025, Sihl Germany expanded their knowledge and creative packaging solutions to Great Britain and the Republic of Ireland by establishing a strategic agreement with Polypouch UK Ltd. The cooperation was formally acknowledged with the gift of a partner trophy during an exciting meeting with Sam Frankel, the sales director, and Stephen Frankel, the owner and CEO of Polypouch UK.

Germany Flexible Packaging Market Segments

By Packaging Type

- Stand-Up Pouches

- Flat Pouches

- Rollstock

- Bags & Sacks

- Sachets

- Wraps

- Lidding Films

- Blister Packs

- Stick Packs

- Vacuum Bags

By Material Type

- Plastic (PE, PP, PET, PVC)

- Paper & Paperboard

- Aluminum Foil

- Bioplastics & Compostable Materials

- Multilayer Barrier Films

By Technology

- Flexographic Printing

- Rotogravure Printing

- Digital Printing

- Offset Printing

- Cold Seal & Heat Seal Technologies

By Application

- Food & Beverages

- Snacks & Confectionery

- Dairy Products

- Beverages (Juices, Energy Drinks)

- Ready-to-Eat Meals

- Pharmaceuticals

- Personal Care & Cosmetics

- Household & Industrial Chemicals

- Pet Food

By End-Use Industry

- FMCG

- Healthcare & Pharma

- Retail & E-commerce

- Agriculture

- Automotive & Industrial

By Distribution Channel

- B2B Supply

- Supermarkets & Hypermarkets

- Online/E-commerce

- Specialized Packaging Retailers

By Region

- North (Hamburg, Bremen)

- South (Bavaria, Baden-Württemberg)

- West (NRW, Hesse)

- East (Berlin, Saxony)

Tags

FAQ's

Select User License to Buy

Figures (3)