U.S Cosmetic Packaging Market Size, Trends, Share and Growth Analysis

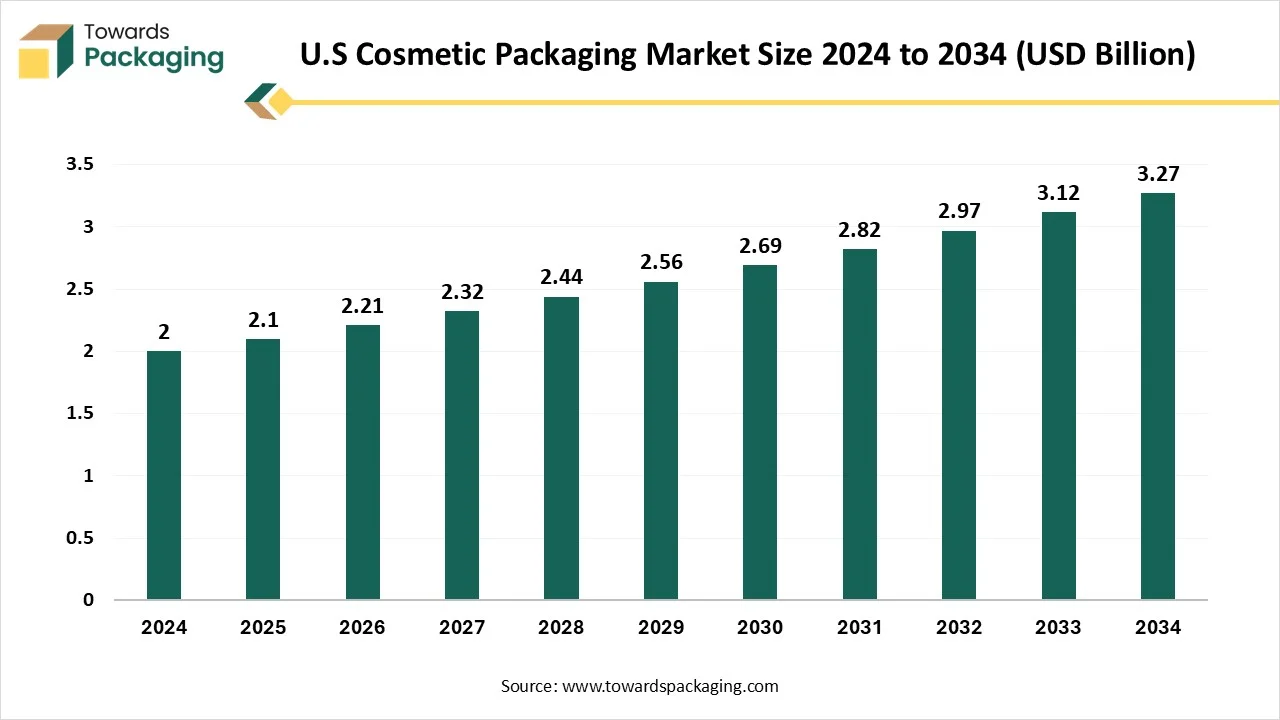

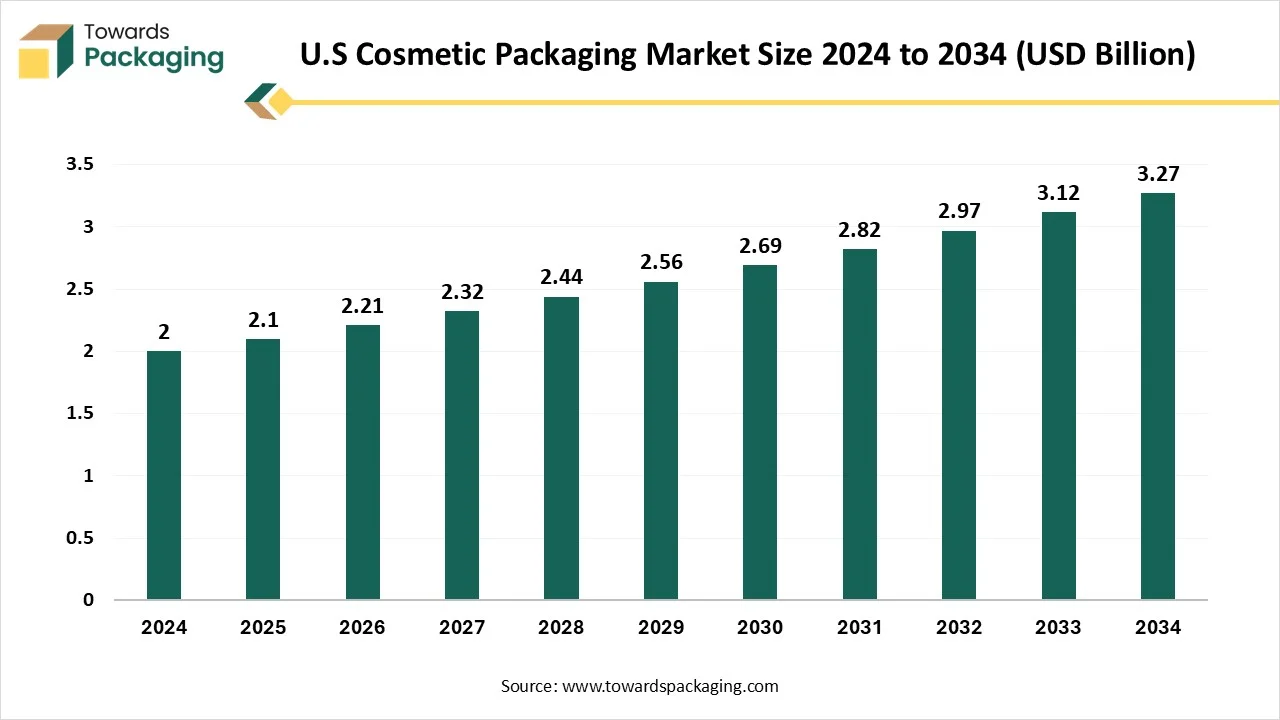

The U.S cosmetic packaging market is forecasted to expand from USD 2.21 billion in 2026 to USD 3.44 billion by 2035, growing at a CAGR of 5.05% from 2026 to 2035. Growing disposable incomes and increasing consumer spending on personal care and premium products. Also, rising consumer awareness and the urge for aesthetically pleasing and functional packaging. California had the largest revenue share in 2024, but the South (Florida and Texas) was the area with the fastest rate of growth. The most popular packing style was bottles and jars, although tubes are predicted to grow significantly.

The majority of packaging was made of plastic, but biodegradable and sustainable materials will become more popular. The category of skincare goods is dominated by color cosmetics, which are expected to grow quickly. The most popular application types were creams and gels, although liquids are expected to rise significantly in the future. The primary sales channels were salons and offline stores, but in the upcoming years, it is anticipated that the internet and direct-to-consumer platforms will grow considerably.

Key Takeaways

- In terms of revenue, the market is valued at USD 2.1 billion in 2025.

- The market is projected to reach USD 3.44 billion by 2035.

- Rapid growth at a CAGR of 5.05% will be observed in the period between 2025 and 2034.

- West (California) dominated the U.S cosmetic packaging market with the largest revenue share in 2024.

- The South (Texas, Florida) is the fastest-growing region in the market.

- By packaging type, the bottles and jars segment contributed the biggest revenue share in 2024.

- By packaging type, the tubes segment will expand at a significant CAGR between 2025 and 2034.

- By material type, the plastic (PET, PP) segment contributed revenue share in 2024.

- By material type, the sustainable and biodegradable segment will expand at a significant CAGR between 2025 and 2034.

- By product category, the skincare segment contributed the largest revenue share in 2024.

- By product category, the color cosmetics segment will expand at a significant CAGR between 2025 and 2034.

- By application format, the cream/gel segment dominated the market with the largest share in the year 2024.

- By application format, the liquid segment is expected to grow significantly over the studied period.

- By distribution channel, the offline (retail, salon) segment contributed the biggest revenue share in 2024.

- By distribution channel, the online (DTC and E-commerce) segment will expand at a significant CAGR between 2025 and 2034.

Market Overview

The U.S. cosmetic packaging market refers to the industry focused on designing, manufacturing, and distributing packaging solutions used for cosmetic and personal care products. This includes primary and secondary packaging such as bottles, jars, tubes, pouches, compacts, and aerosol containers. These packaging formats serve critical functions such as product protection, ease of use, aesthetic appeal, and brand identity. With rising consumer demand for eco-friendly, premium, and functional packaging, the U.S. market is evolving across segments like skin care, hair care, fragrances, and colour cosmetics.

Technologies Developed in Smart Packaging in Cosmetics

- Near Field Communication: It is used by brands like L’Oréal. The NFC tags enable users to simply tap their phone on an item to allow sync routines, loyalty programs, and ingredient breakdowns, too. It is convenient to mix and user-friendly, the NFC is becoming a baseline smart characteristic in the beauty packaging.

- Radio Frequency Identification: Coty and Shiseido use RFID to track the inventory and ensure product authenticity across the global supply chains. It serves an actual-time visibility from the warehouse to the vanity shelf, which is important for luxury skincare and cosmetics.

- QR codes with Analytics: Apart from linking to product Info, the QR codes now assist brands in analyzing the user behavior.Organisations such as the Ordinary use QR codes for usage guides and recycling information, and in order to manage which content consumers engage with the most.

- Augmented Reality: Kylie Cosmetics has an innovative AR virtuality try, which led users to try makeup shades directly through the packaging. This lowers the returns, improves the conversions, and adds a perfect factor to the revealing experience.

- AI-powered skincare interfaces: Brands are discovering the packaging -mixed AI that serves a skincare routine depending on the live user data -right from the skin tone to daily weather. A serum bottle that accepts your regimen, relying on your skin's updating demands.

- Printed Electronics: The flexible circuits printed directly onto the packaging allow smart labels, usage trackers, and animated messages without the bulky chips. This jas transformed for slim and high-design cosmetics packaging.

What are the New Trends in the U.S Cosmetic Packaging Market?

- Colorful, User-Friendly and On-Trend: Vitamasque, a K-beauty-inspired brand that starts with sheet masks, has recently grown into a full skincare series. The affordable and reliable count toners, serums, cleansers, and moisturizers, too. The eco-friendly packaging solutions include 30% PCR, and the line’s airless containers maintain the potency of the current ingredients.

- Classic Dopper Packs and New Designs: Classic dropper packaging is famous for skincare serums, and Virospack offers various options. Liquid serums and oils are dispensed from droppers, which serve accurate dosage, controlled, and ensure consumers use the correct amount without wastage. Skincare products need the package and product to be accurately synced.

- Airless Glass: Several types of skincare products need airless packaging, especially retinol formulas. Goop Beauty, Gwyneth Paltrow's brand, currently revealed the 3x retinol regenerative serum. Its invention lies in the fact of a clean formula. This formula integrates three various retinoids with a complication that soothes and assists the skin’s barrier, without interference with the retinol’s efficacy.

- An Innovative, Eco-Friendly Pump: Credo, a retailer that changed the clean beauty scene, debuted its Credo Skincare collection. The line counts the moisturizers and cleansers in recyclable glass bottles. Upcycled vetiver root extract is the line’s star ingredient, and a local co-operative in Hlati ethically invests in.

- Tubes Offer Convenience and Precision: Tubes are frequently lightweight and easy to carry in a purse. Pair a tube with a dispensing tube, pump, or nozzle, and the package can accommodate different types of skincare formulas. Naturium, a brand that defines high-performance skincare should be and can be clinically -effective skin, reliable and affordable, chose a tube for its skincare -meets -makeup-launch.

- Elevating Aluminum with Decoration: Aluminum may not be the first material that comes to mind when you think of packaging, but ABA Packaging’s Warford says many brands are selecting its Envases line for a variety of unexpected product types. And the correct decoration can elevate the appearance of an aluminium bottle.

AI Integration in the U.S Cosmetic Packaging Market

Artificial intelligence is increasingly adopted in manufacturing to refine production processes, minimize waste, and maintain product quality. For example, AI-powered machines monitor production lines in real-time, notifying operators of any deviations that might compromise product quality. AI algorithms analyze data from manufacturing outputs to identify ways to enhance efficiency and reduce waste. In the cosmetic and skincare sectors, sustainability concerns are prompting the use of AI to cut waste and optimize packaging design. These algorithms can scrutinize packaging options to find opportunities for reduction such as decreasing plastic usage and suggest improvements based on consumer feedback. This integration of AI helps drive both quality and sustainability goals.

Market Dynamics

Driver

Innovation, sustainability trends, and customer preferences all influence the U.S. cosmetic packaging business. One of the main causes is the growing desire for high-end, customized cosmetics, which feeds the demand for packaging that is both aesthetically pleasing and useful. Packaging is a vital strategy for brand differentiation since consumers are increasingly associating attractive packaging with product quality and brand value. Additionally, manufacturers are encouraged to invest in creative and beautiful packaging that improves the unboxing experience and digital appeal due to the increased popularity of e-commerce and social media-driven beauty trends.

Restraint

FDA and other labeling requirements must be met by cosmetic packaging. It can be difficult and time-consuming to ensure compliance with evolving requirements on ingredient transparency and environmental claims (such as "biodegradable" or "recyclable"). The United States still lacks uniform and effective recycling programs throughout the states, despite increased awareness. Complicated packaging styles, such as laminated tubes or mixed-material pumps, are frequently not recyclable, which contributes to environmental waste. Consumers of today expect sustainability, style, and utility all at once.

Opportunity

The market for cosmetic packaging in the United States is full of new opportunities driven by smart technology, customisation, and sustainability. It is anticipated that brands will make greater investments in refillable and reusable packaging systems that reduce waste and foster customer loyalty. As rules tighten and consumers emphasize eco-friendly items, biodegradable materials such as compostable films, foam made from mushrooms, and recycled plastics will become more popular. Brands will be able to affordably offer limited-edition designs and customized package experiences because of digital printing and customization. Using augmented reality, NFC chips, and QR codes, smart packaging will allow consumers to interact with brands, convey brand stories, and verify products using their cellphones.

Segmental Insights

How Bottles and Jars dominated the Packaging Type in the U.S Cosmetic Packaging Industry?

Particularly for skincare, haircare, and high-end cosmetics, bottles, and jars continue to be the mainstay of American cosmetic packaging. Their excellent shelf appeal, ease of usage, and variety are the main reasons for their popularity. Glass jars convey luxury and sustainability, drawing in eco-aware customers, while plastic bottles provide portable, break-resistant alternatives perfect for mass-market and portable formats. Airless pump bottles are being used by brands more and more to prolong product shelf life by shielding formulas from contamination and oxidation. Additionally, as consumer preferences for sustainable packaging and regulatory pressure increase, there is an increasing need for recyclable, refillable, and PCR (post-consumer recycled) plastic bottles and jars.

In the American cosmetics market, tubes are a very common packaging shape, especially for items like cleansers, lotions, creams, and foundations. They are convenient for personal use and on-the-go because of their squeezable, hygienic design, which permits controlled dispensing and minimal product waste. Tubes are preferred by brands because of their affordability, lightweight construction, and broad design freedom, which enable tamper-evident seals, unique finishes, and brilliant printing. As companies react to sustainability objectives and consumer demand for eco-friendly solutions without compromising functionality or aesthetics, recent trends demonstrate a substantial development in recyclable mono-material tubes, bio-based polymers, and refillable designs.

How did Plastic (PET, PP) dominate the Material type in the U.S. Cosmetic Packaging Industry?

Plastic has long dominated the cosmetic packaging business in the United States due to its cost-effectiveness, lightweight nature, and versatility when compared to metal and glass. It enables producers to create a variety of shapes with superior barrier qualities to shield formulas from deterioration and contamination, such as bottles, jars, pumps, tubes, and caps. Innovative forms, vivid colors, and upscale finishes are also supported by plastic packaging, which makes brands stand out on store shelves. Additionally, plastic is strong and resistant to breaking, which appeals to both customer convenience and e-commerce shipping requirements. While sustainability concerns are driving interest in recycled and bio-based plastics, conventional plastic still holds the largest share due to its scalability, affordability, and design flexibility across mass-market and premium cosmetic segments.

As companies react to consumer demand for eco-friendly alternatives to traditional plastics, sustainable and biodegradable materials are becoming more popular in U.S. cosmetic packaging. Jars, tubes, and cartons are increasingly being made from materials such as recycled PET (rPET), bioplastics made from sugarcane, molded pulp, paperboard, and biodegradable films. These materials promote the objectives of the circular economy, lessen landfill waste, and reduce carbon footprints. Additionally, businesses are spending money on refillable formats and monomaterial packaging to prolong product lifecycles and simplify recycling. Despite the fact that usage is increasing, there are still difficulties in striking a balance between sustainability and performance standards like barrier protection, durability, and aesthetics, which are crucial for maintaining product quality and brand appeal.

How did Skincare Dominate the Product Category Segment in the U.S Cosmetic Packaging Market?

With booming categories like serums, moisturizers, sunscreens, and anti-aging therapies, skincare is the largest and most dynamic market driving demand for cosmetic packaging in the United States. Customers anticipate packaging that blends high-end design, practicality, and hygienic features, such as airless pumps, droppers, and squeeze tubes that shield formulations from oxidation and contamination. In order to appeal to environmentally conscious consumers, firms are increasingly using recyclable glass jars, PCR (post-consumer recycled) plastics, and refillable containers. Sustainability is also a top priority. Skincare packaging is also impacted by the growth of e-commerce, which is driving demand for lightweight, leak-proof formats and protective secondary packaging to guarantee product delivery and preserve a posh unpacking experience.

In the U.S. market, color cosmetics, including lipsticks, foundations, eyeshadows, and mascaras, continue to be a major source of packaging innovation. Sleek, striking designs and practical formats that stand out in stores and on social media are becoming top priorities for brands. Compact palettes with magnetic closures, twist-up sticks, and custom-printed tubes that improve visual appeal and brand storytelling are popular trends. Customers' need for portability and sustainability is also driving up demand for recyclable materials, refillable compacts, and tiny sizes. Furthermore, to guarantee accurate application and maintain product integrity over time, color cosmetic packaging frequently incorporates cutting-edge applicators and airtight sealing.

How did the Cream and Gel dominate the Application in the U.S Cosmetic Packaging Market?

Because of their extensive use in skincare, haircare, and specialist treatments, creams, and gels have taken the lead in the U.S. cosmetic packaging industry. Their appeal stems from consumers' need for lightweight, hydrating, and tailored compositions that produce noticeable effects. This need encourages the development of squeezable tubes, airless pump bottles, and jars, which are made to improve user convenience and preserve product stability. Clear or frosted containers let businesses highlight enticing textures, while airless systems are preferred for protecting delicate active substances and avoiding contamination. Because of its adaptability, creams and gels are now a top priority for companies looking to create high-end, useful, and environmentally friendly packaging that appeals to both mass and luxury consumers.

Since liquid formulations are frequently used in foundations, serums, cleansers, toners, and hair treatments, they have emerged as a major growth driver in the U.S. cosmetic packaging market. The need for dropper bottles, pump dispensers, and sprayers has increased as a result of consumers' preference for liquid products due to their ease of use, quick absorption, and accurate dosing. In addition to enhancing control and hygiene, these packaging styles aid in shielding formulations from contamination and oxidation. Additionally, in order to improve shelf appeal and support sustainability objectives, manufacturers are using more and more streamlined, high-end designs made of recyclable materials. Liquids are becoming more and more popular as skincare and cosmetics procedures get more complex.

How did the Offline (retail and salon) Dominate the Distribution Channel?

Because they provide real, in-person product experiences that internet buying cannot match, offline retail and salon channels have continued to dominate the U.S. cosmetic packaging market. Specialty beauty shops, department stores, and salon retailers have consistent foot traffic because consumers frequently like to see, touch, and test products like skincare creams, cosmetics, and hair treatments before making a purchase. Additionally, salons are reputable establishments where expert advice shapes consumer choices and strengthens brand and package loyalty. Brick-and-mortar and salon settings are crucial distribution channels for cosmetic manufacturers aiming to reach both mainstream and luxury markets because of their eye-catching displays, high-end packaging designs, and special in-store promotions, which further boost offline sales.

The demand for packaging that is optimized for shipping, unboxing, and brand storytelling is being driven by online DTC and e-commerce platforms, which are drastically changing the cosmetic packaging market in the United States. Brands are investing in strong, tamper-evident, and eye-catching packaging that protects items throughout transit and creates a memorable at-home experience as customers increasingly purchase on beauty platforms, Amazon, and brand websites. Growth is also being fueled by influencer partnerships, subscription boxes, and customized package elements like limited-edition designs and unique labeling. E-commerce is one of the fastest-growing industry sectors due to the ease of online buying and social media marketing, which has forced firms to reconsider packaging in order to satisfy logistics, sustainability, and customer interaction requirements.

By Region

How did the West (California) Dominate the U.S. Cosmetic Packaging Market?

California, which is home to important centers of the beauty industry, including Los Angeles and San Francisco, has become the focal point of the American cosmetic packaging business. Beauty companies, contract manufacturers, and packaging suppliers are heavily concentrated in the state, fostering a vibrant ecosystem that encourages innovation and quick time to market. California's strong clean beauty and independent brand movements have increased demand for eco-friendly, recyclable, and simple packaging options, and the state's close proximity to IT firms and design firms has sped up the adoption of smart packaging and high-end design trends. The West leads the country in cosmetic packaging because of its vast consumer base, strong e-commerce infrastructure, and cultural leadership in beauty trends.

South (Texas, Florida) is Growing Rapidly

Florida and Texas have emerged as significant development engines for the cosmetic packaging sector in the South. Strong population growth, extensive retail networks, and thriving multicultural consumer bases in both states fuel demand for a wide range of beauty items and customized packaging styles. Texas facilitates the effective manufacture and distribution of packaging materials due to its growing manufacturing and logistics capacities. Brands have been prompted to create bilingual labeling and regionally tailored designs by Florida's status as a gateway to Latin America. The South is becoming a more competitive region in the U.S. cosmetic packaging market as a result of these states' combined efforts to increase investments in premium packaging to service luxury and independent beauty businesses, as well as more affordable plastic and flexible packaging.

Cosmetic Packaging Market Trends, Challenges & Strategic Recommendations

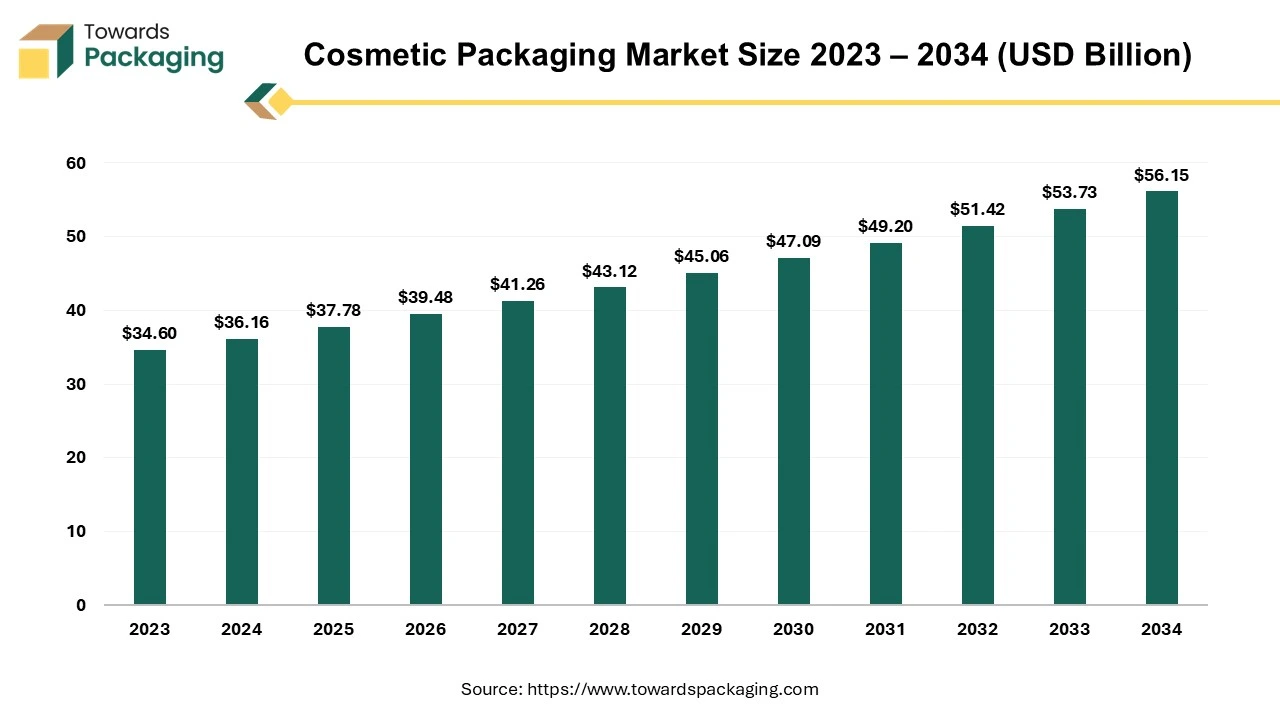

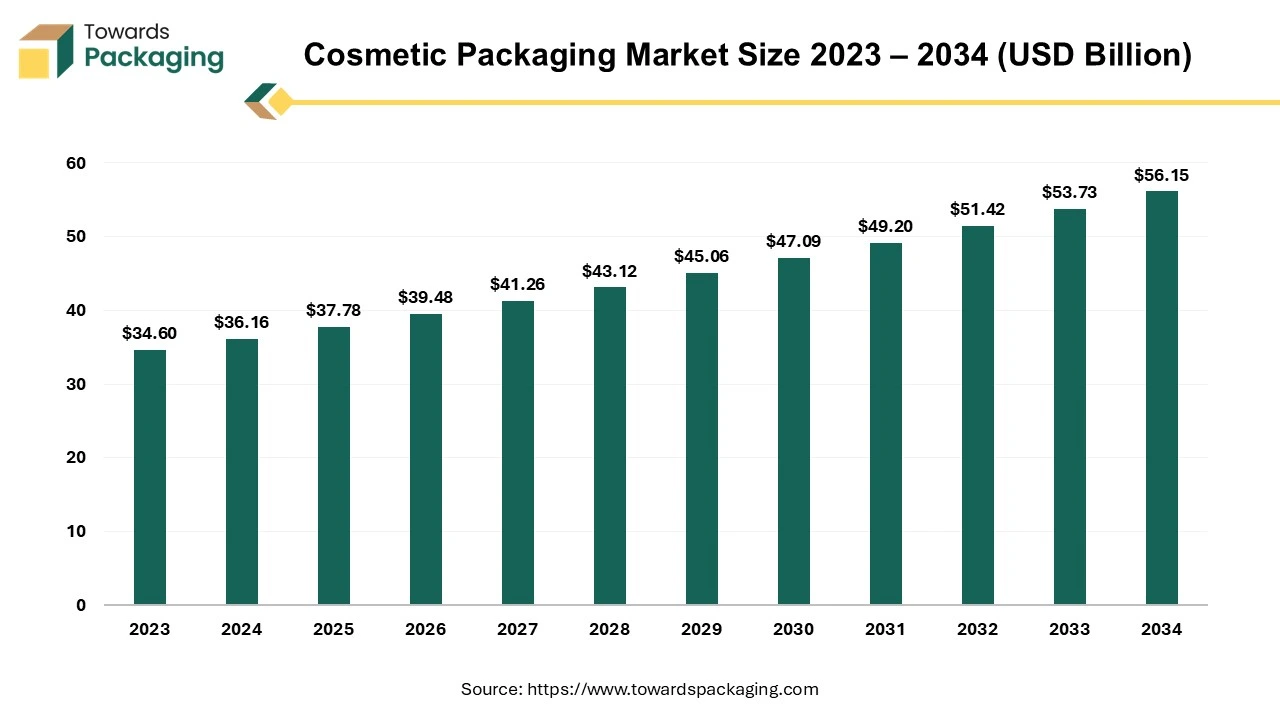

The cosmetic packaging market is poised for significant growth, with a market size of US$ 36.16 Billion in 2024 and a projected CAGR of 4.5%, reaching US$ 56.15 Billion by 2034. This report provides a comprehensive analysis of the global cosmetic packaging industry, focusing on key market segments, regional insights (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa), and competitive dynamics. The rising consumer focus on sustainability and eco-friendly products is driving innovation in packaging materials and designs. Additionally, the rapid expansion of online shopping and increasing disposable incomes in emerging markets are boosting demand.

Major Key Insights of the Cosmetic Packaging Market:

- Asia Pacific dominated the cosmetic packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By type, the bottles segment dominated the market with the largest share in 2024.

- By application, the skin care segment registered its dominance over the global cosmetic packaging market in 2024.

- By material, paper-based segment is expected to grow at significant rate during the forecast period.

- By capacity, the 100 ml – 150 ml segment dominated the cosmetic packaging market in 2024.

Plastic Cosmetic Packaging Market Size, Share, Trends and Forecast Analysis

The plastic cosmetic packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising demand for cost-effective, sustainable, and durability in the cosmetic packaging sector has influenced the demand for the market. Increasing usage of cosmetic products has influenced brands to design innovative packaging for the packaging of products that can enhance its shelf-life as well as provide convenience to the consumers.

Major Key Insights of the Plastic Cosmetic Packaging Market

- By region, Asia Pacific dominated the global market by holding highest market share of 30% in 2024.

- By region, Middle East & Africa is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the bottles segment contributed the biggest market share of 35% in 2024.

- By packaging type, the tubes segment will be expanding at a significant CAGR in between 2025 and 2034.

- By material type, the polypropylene (PP) segment contributed the biggest market share of 30% in 2024.

Top Companies in the U.S Cosmetic Packaging Market

- Amcor plc

- AptarGroup Inc.

- Berry Global Inc.

- Gerresheimer AG

- Silgan Holdings Inc.

- Albéa Group

- WestRock Company

- HCT Group

- Quadpack

- Huhtamaki Oyj

- RPC M&H Plastics

- World Wide Packaging LLC

- WWP Beauty

- Cosmopak USA

- DS Smith Plc

- FusionPKG

- Lumson S.p.A.

- Graham Packaging

- Heinz-Glas USA

- International Cosmetic Suppliers Ltd.

Industry Leader Announcement

- On 16 January 2025, IBM and L'Oréal, the world’s largest beauty company, revealed a collaboration to leverage IBM’s generative artificial intelligence (GenAI) technology and expertise to reveal new insights in cosmetic formulation data, facilitating L'Oréal's usage of sustainable raw materials for energy and material waste reductions.

- On 1 October 2024, Estee Lauder Corporation (ELC) revealed three changes in the North America leadership team to fulfill its next phase of growth. Mark Loomis, has left the beauty giant’s Group President, North America will be retiring at the end of the fiscal year 2025.

Recent Developments

- In November 2025, All Over Spray is a luxury aerosol packaging that serves an ultra-continuous and powerful mist with 360-degree dispensing that serves an immersive and luxurious fragrance experience. This perfect-performing valve technology ensures neutral diffusion and the actual dosage with every actuation, too.

- In November 2025, MGA Entertainment disclosed Mini Glam, which is a clean and age-perfect beauty line for kids which are newly available at Target. The series includes a lip lotion,shimmer cosmetics, and glaosses priced at USD 7.99.

- On 5 May 2025, Chanel disclosed its fragrance and Beauty Products on Nykaa, which is India’s leading beauty and lifestyle platform in the digital-first consumer tech company.

- On 21 October 2024, Victoria Beckham’s beauty brand will reveal a US-based pop-up to market its fourth fragrance launch. The three-room “dreamlike” activation at the High Line in New York displays how Victoria Beckham Beauty 21:50 Reverie Fragrance came to be.

- On 3 December 2024, the latest Korean beauty skincare brand, Asno, which protects animals in the Arctic and Antarctica. This brand joins hands with the K-Beauty market, taking advantage of rising consumer interest in the K-Wave.

- On 8 July 2025, Hairstory disclosed the colorful new look in a refillable bottle. The ‘Beer Bottle” houses the brand’s main product, New Wash, and has lots of sustainable characteristics.

Segmentation of the U.S. Cosmetic Packaging Market

By Packaging Type

- Bottles & Jars

- Tubes

- Pumps & Dispensers

- Compacts & Cases

- Pouches & Sachets

- Droppers

- Roll-ons

- Aerosol Cans

- Palettes

By Material Type

- Plastic

- Glass

- Metal

- Paperboard & Cardboard

- Sustainable/Biodegradable Materials

By Product Category

- Skin Care

- Hair Care

- Color Cosmetics

- Fragrances

- Bath & Body

- Men’s Grooming

By Application Format

- Liquid

- Cream/Gel

- Solid

- Powder

- Aerosol

By Region

- West (California, Washington)

- South (Texas, Florida)

- Midwest (Illinois, Ohio)

- Northeast (New York, Massachusetts)

Tags

FAQ's

Select User License to Buy

Figures (3)