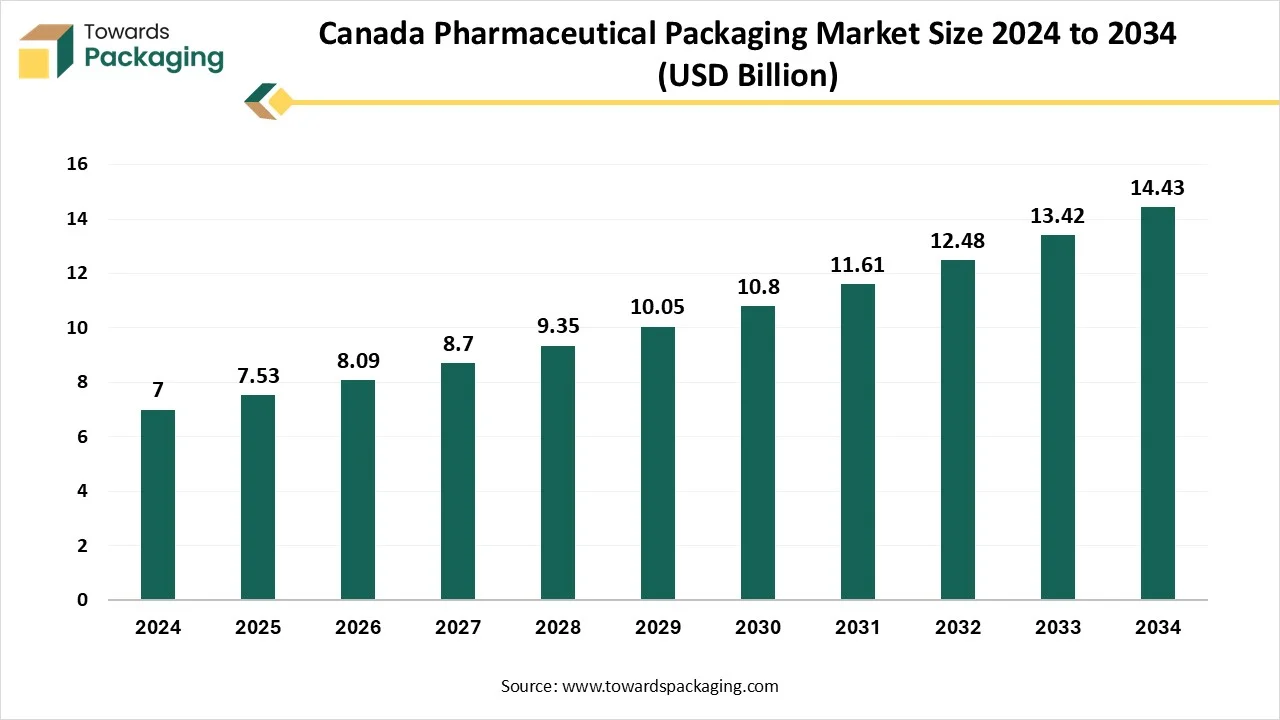

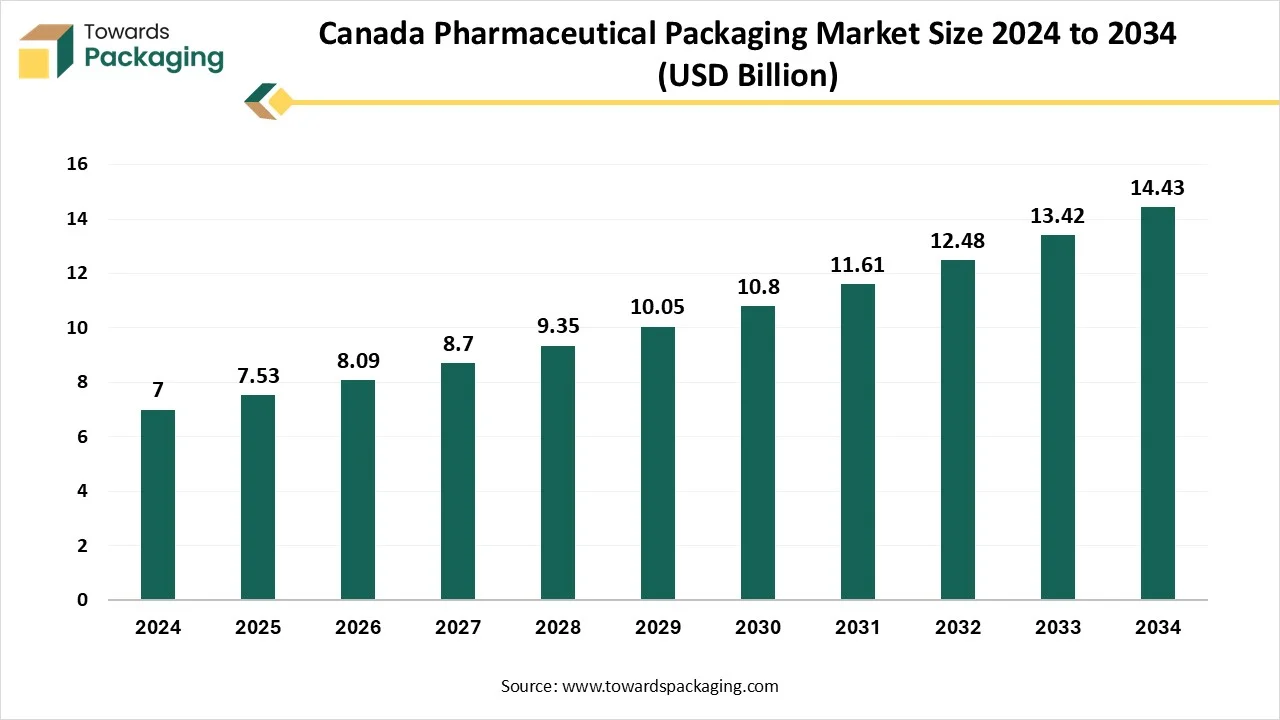

The Canada pharmaceutical packaging market is forecasted to expand from USD 8.01 billion in 2026 to USD 14.73 billion by 2035, growing at a CAGR of 7% from 2026 to 2035. The report outlines detailed segmentation by packaging type, materials, drug categories, route of administration, functionality, and end-use sectors. It also covers regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, providing global context.

The study further evaluates major companies, competitive positioning, manufacturing footprints, trade flows, value chain structures, and supplier dynamics to present a full 360-degree market view.

The Canada pharmaceutical packaging market refers to the industry focused on materials and solutions used for safely enclosing pharmaceutical products during storage, distribution, and usage. Packaging types include blister packs, bottles, vials, ampoules, pouches, and pre-filled syringes, made from plastic, glass, paperboard, and aluminium. Emphasis is placed on tamper-evidence, child resistance, regulatory compliance, and cold-chain capabilities. Growth is driven by increasing drug exports, biologic drugs, an aging population, and rising generic drug penetration.

The rising toward closed-loop structures that arrange recyclability and reusability, influencing the usage of refillable and mono-material packaging solutions.

Packaging formats such as bags, pouches, and wraps are gaining market segment because of their lower resource consumption, convenience, and lighter weight. This is mainly popular in the pet care sector and snack foods.

The increasing trend for active resources that absorb moisture or oxygen, accompanied by indicators for tampering or freshness, is becoming widespread in pharmaceutical and food packaging to preserve security and quality.

The incorporation of AI in the Canada pharmaceutical packaging market plays an important role in the selection of materials that are durable as well as non-reactive. It helps to enhance the reliability of the packages by supporting error-free production of the packages. With the incorporation of advanced technology such as machine learning, robotics, and several others, it has become convenient for manufacturers to avoid surplus production. Such technology prevents the wastage of materials in this market.

Rising E-Commerce Sector

The continuous rise in the e-commerce sector has enhanced research and development in the Canada pharmaceutical packaging market. The exponential development of online shopping has resulted in an increase in demand for protective and secondary packaging. Packaging not only confirms product security during transportation but also serves as a marking device in the unboxing experience. Modern customers are progressively aware of the ecological impact. Brands are answering by accepting biodegradable resources, decreasing plastic content, and including recyclable packaging choices that bring into line with sustainability aims. As inhabitants in developing markets transfer to the direction of urban areas, demand for convenience-absorbed packaged products surges. This change is particularly marked in pharmaceutical, ready-to-eat food, and personal care packaging.

Ecological Issues and Waste Management

Despite progress in sustainability, packaging waste, mainly from single-use plastic remains, is a major worldwide apprehension. Harmonizing presentation with ecological influence is a constant challenge. Variations in the charges of aluminum, petroleum-based polymers, and paper pulp can disturb packaging charges and limits. Producers must manage supply chains professionally to mitigate risks.

Rising Global Consumption Boosting

The rising global consumption has influenced the development opportunities in the Canada pharmaceutical packaging market. The upsurge in the demand for lightweight, innovative, and sustainable packaging solutions is expected to continue growing.

Technological advancements like active packaging, intelligent labels, and digital printing have allowed brands to involve customers while preserving goods' integrity and extending shelf life. Regulatory changes highlighting recyclability, decreased plastic utility, and extended producer responsibility (EPR) are also redesigning how packaging is intended and sourced. In this quickly developing landscape, industries must balance cost-efficacy, aesthetics, functionality, and sustainability.

In Canada, regulatory discussions enable more high-capability drugs that need to be sold in regular pharmacies. If they are implemented, this would create new distribution opportunities, meeting with Canada more appropriately with the U.S model, and allowing broader access to everyday health items in non-pharmacy environments. For the packaging solution deliverables, the limitations are to serve solutions that not only comply but also accept the rising retail designs and user expectations. These moves are relevant across both the user healthcare and prescription drug markets.

The blister packs segment contributed a considerable share of the Canada pharmaceutical packaging market in 2024 due to its convenience, safety, and compliance. The major segments in this are cold-form and thermoformed technologies, which are growing because of their cost-effectiveness and high production speed. Cold-form blister packs are in high demand as they have a high oxygen and moisture barrier. The rising sustainability goal is also pushing this segment to grow exclusively.

The pre-filled syringes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly because of huge market expansion, safety, and convenience. It decreases contamination risk, streamlines administration workflow, and reduces dosing errors.

The plastics segment held a considerable share of the Canada pharmaceutical packaging market in 2024 due to its cost-effectiveness, compatibility, and accessibility. This material is widely used for manufacturing parenteral systems, bottles, and vials. Parenteral vessels are influenced by at-home treatment kits and auto-injection. The huge customization option in this sector has raised the demand for this segment.

The biodegradable & sustainable materials segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This market is fueled due to growing concern for eco-friendly packaging. There is a huge demand for eco-friendly packaging in Canada, which has enhanced the adoption of such materials by the packaging industry.

The generic drugs segment held a considerable share of the Canada pharmaceutical packaging market in 2024 due to cost-competitive production of packaging and government initiatives. The government of this region has influenced people regarding cost-efficient generic drugs, which has increased its demand. The rising demand for such drugs has raised the demand for high-quality packaging that can help in the storage of the products for a longer period. The growing influence of generic medicines has raised the demand for the packaging of the products.

The biologics & biosimilars segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing demand for small-molecule drugs has influenced the demand for this segment. Producers are accepting different formats of packaging with several delivery options has influenced innovation in this market.

The oral segment held a considerable share of the Canada pharmaceutical packaging market in 2024 due to the rising recommendations for oral medicines. The rising patient reliability and effectiveness of the medicine have raised the demand for this market. This segment dominates because of its long shelf life, extension of its utilization, and ease of administration. Inventions are also enhancing in formats such as fast-dissolving buccal systems and oral thin films.

The injectable segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This rapid development is influenced by increasing demand from clinics looking for safe, hospitals, regulatory complaints, and biotech firms. Major drivers comprise the biologic therapies, requiring sterile barriers, improved patient security, and smart packaging.

The tamper-evident packaging segment dominated the Canada pharmaceutical packaging market in 2024 due to the growing demand for safe pharmaceutical packaging. This technology confirms both prevention from interfering and acquiescence with supervisory orders. This segment provides customer trust, proven security, regulatory alignment, and dose accuracy. The rising penetration of the e-commerce sector has influenced the development of tamper-evident packaging.

The temperature-controlled packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is highly influenced by vaccines, biologics, and other temperature-sensitive therapeutics. This development stems from the increasing requirement to save drug integrity at the time of transportation and storage.

The pharmaceutical manufacturers segment held a considerable share of the Canada pharmaceutical packaging solutions market in 2024 due to streamlined supply chains and regulatory rules. The continuous demand for innovation in this sector has raised the demand for this segment to meet the shifting demand of the consumers. The increasing investment by major market players in the research and development process has raised the influence of this market.

The home healthcare providers segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to the rising influence of at-home treatments and telemedicine facilities. There has been a huge upsurge in the demand for secondary packaging has raised the demand for home healthcare providers. Rising telemedicine facilities and online delivery systems of medicines are progressively boosting the growth of the segment.

Pharmaceutical producers in Canada directly assist several advanced-level jobs, from engineers to scientists to manufacturing workers, logistics professionals, and regulatory experts, too. These are not only perfect-paying positions but also careers that invest in the growth and delivery of life-saving treatments for Canadians. Canadian drug producer constantly invests in the explosion and growth of technologies. This investment assists in developing productivity and reveals future economic development.

Producing itself remains an important part of Canada’s economic infrastructure. Pharmaceutical manufacturing facilities assist regional economies across the region. Canada lowers its dependency on foreign supply chains and expands their domestic potential.

Ontario held the largest share of the Canada pharmaceutical packaging market in 2024, due to strategic infrastructure and specialized firms. The rising demand for customized blister packs, bottles, pouches, and several other packaging essentials for personalized treatment plans has influenced the development of this market. The continuous collaboration of the major market players present in this region has raised the demand for highly innovative pharmaceutical packaging.

British Columbia is estimated to grow at the fastest rate in the Canada pharmaceutical packaging market during the forecast period. This is because of the rising manufacturing base. It comprises blister packaging, encapsulation, bottles, coatings, and sachets. The regulatory customer pressure combines with green packaging invention in primary as well as secondary pharmaceutical packaging.

By Packaging Type

By Material Type

By Drug Type

By Functionality

By End-Use

By Province/Region

March 2026

March 2026

March 2026

March 2026