France Pharmaceutical Packaging Market Comprehensive Industry Assessment with Market Size, Value Chain Mapping & Global Trade Statistics

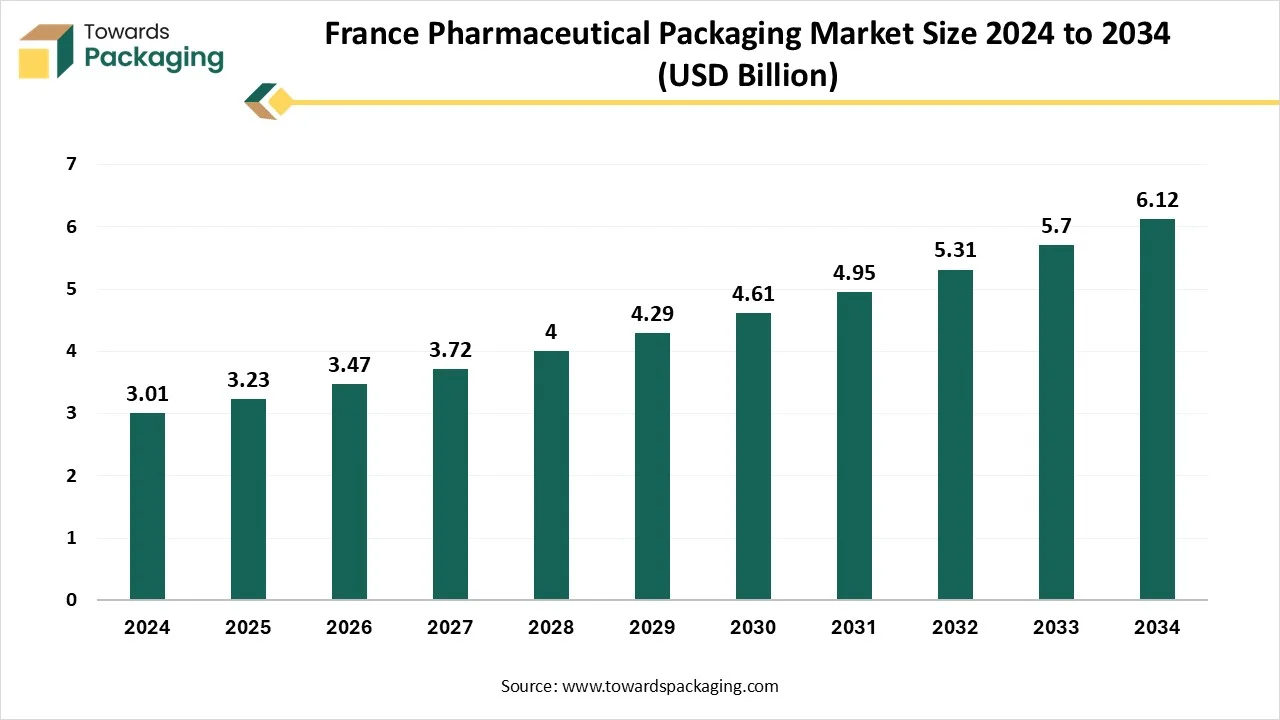

The France pharmaceutical packaging market provides an all-inclusive examination of industry performance, covering market size from USD 3.23 billion in 2025 to USD 6.12 billion by 2034, with all supporting statistical trends such as CAGR, segment shares, regional comparisons, and growth drivers. The report explains packaging types, materials, drug delivery modes, end-use insights, and product-type distribution alongside global regional data (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). It also includes profiles of major companies, competitive dynamics, value chain structure, trade flows, manufacturing footprints, and supplier analysis to give a complete 360-degree market understanding.

Key Takeaways

- In terms of revenue, the market is valued at USD 3.23 billion in 2025.

- The market is projected to reach USD 6.12 billion by 2034.

- Rapid growth at a CAGR of 7.35% will be observed in the period between 2025 and 2034.

- By packaging type, the blister pack segment dominated the market with the largest share in 2024.

- By packaging type, the prefilled syringes and cartridges segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By material, the plastic segment dominated the market in 2024.

- By material, the glass materials segment is expected to grow at the fastest CAGR in the forecast period.

- By drug delivery mode, the oral drugs segment dominated the market with the largest share in 2024.

- By drug delivery mode, the injectable and inhalable drugs segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By product type, the generic drugs segment dominated the market with the largest share in 2024.

- By product type, the biologics segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By end-use, the pharmaceutical manufacturer segment dominated the market in 2024.

- By end-use, the contract packaging organizations (CPO) segment is expected to grow at the fastest CAGR in the forecast period.

France Pharma Packaging: Evolving Landscape

The French pharmaceutical packaging market refers to the industry involved in the design, production, and distribution of packaging materials and solutions specifically for pharmaceutical products. These packaging solutions ensure product safety, stability, and regulatory compliance across prescription drugs, over-the-counter (OTC) medications, and biopharmaceuticals. The regulatory landscape surrounding packaging in France has undergone significant changes in recent years. Three main legislative pieces the AGEC Law, Packaging Law, and European Packaging and Packaging Waste Regulation (PWR) have the goal of controlling waste and fostering a circular economy. This law mandates the phase-out of single-use plastic packaging by 2040 and promotes the use of recyclable and compostable materials. Organizations must contribute financially through the Extended Producer Responsibility (EPR) scheme, effectively placing the responsibility for environmental stewardship on those introducing packaging into the marketplace.

Market Trends: Top Developments in France’s Pharma Packaging

- Personalized Medicine Gains Momentum: France is making a reality with tailored medicine, which utilises genetic and molecular information to make treatments according to the needs of individuals. This strategy is exceptionally changeable in cancer care, where accurate therapies improve survival rates and offer patients new hope.

- Digital Health Integration: France is leading the path in accepting digital health technologies to close healthcare gaps and develop access for all. For example, France’s telemedicine platform ‘Doctolib” has changed healthcare during the Covid-19 pandemic, enabling millions of patients to ask doctors online and easing the burden on hospitals. Digital health in pharmacy and AI-powered tools will change how chronic diseases are controlled, empowering patients to take charge.

- Biopharma Drives Innovation: Biopharmaceuticals are completely changing the healthcare industry in France, serving breakthroughs for complicated diseases, such as autoimmune disorders and rare conditions. These high-level therapies solve medical issues that were once considered untreatable. Take Sweden’s Sobi instance, a top company in orphan drugs that concentrates on rare diseases often disregarded by regular pharma. Their inventions bring hope to the patients and develop lives in which no treatments existed before.

- Sustainability in Pharma: Generating billions of pills yearly includes significant environmental costs, including energy consumption, waste, and carbon emissions. In response to this, France is taking the lead in sustainability in the pharmaceutical industry. This includes utilizing eco-friendly packaging and enabling production facilities with renewable energy, which results in a low carbon footprint.

- Biosimilars are Gaining Traction: Biosimilars are cost-effective alternatives to biologics that help create life-saving treatments more reliably and affordably. In France, companies like Denmark’s Novo Nordisk are leading the way by expanding access to insulin biosimilars, which benefit millions of people with diabetes worldwide.

- Advanced Manufacturing Technologies: France is serving the vision of life by accepting Industry 4.0 technologies in pharmaceutical production. For instance, Sanofi’s continuous production plant in France lowers waste and develops efficiency, showing how advanced technologies change pharma production.

Artificial intelligence is transforming globally, and packaging is no exception. From simplifying design procedures to updating supply chains, AI is driving sustainability, efficiency, and cost-effectiveness. Technology is now mixed directly into packaging material. Smart packaging utilises QR codes, sensors, and NFC tags to make sure medicines are stored correctly and utilised safely. For example, temperature sensors can track whether medicines have been discovered to cause huge heat during transit.

The materials that are utilised to package pharmaceutical products serve excellent protection against air, moisture, and light. Inventions like nanotechnology have led to the development of barrier coverings that expand the shelf life of medicines. These coverings can keep tablets and capsules constant in different climates. 3D Printing is entering pharmaceutical packaging by allowing the creation of tailored patterns. This is specifically useful for clinical trials, in which minute batches of drugs often need tailored solutions. Also, the risk of fake medicines has made safety a top priority. Technologies such as RFID tags, holographic labels, and invisible ink are being utilised to protect counterfeit products. These allow producers and consumers to track medicines at every level.

Market Dynamics

Driver

From Safety to Sustainability: France’s Laws Reshape Pharmaceutical Packaging

France, as a member of the EU, restricts itself to rigid regulations like the EU Classified Medicines Directive (FMD). This demand features lie in sterilization and tamper-evident packaging to ensure drug safety and combat counterfeiting. Regulatory bodies like the Agence Nationale de Sécurité du Médicament et des Produits de Santé (ANSM) in France have imposed strong regulations on packaging to guarantee drug efficacy and quality, too. The legal framework covering pharmaceutical products, including packaging, is complicated and needs specialised expertise to navigate.

France-specific information, such as national registration codes and local prescription and delivery conditions, must be included on the packaging. The growing focus on biologics and inventive drug delivery systems needs specialized packaging solutions. Development in areas like personalized medicine and regenerative medicine also drives the urge for specialised sterile packaging. France is very loyal to the circular economy and has an aim to reduce waste and market sustainable packaging.

Restraint

Strict Labelling Rules Challenge Pharma Packaging in France

Regulatory affairs in France is also responsible for tracking the artwork and text that is on the inner and outer packaging. These must be implemented in the mock-up and must count, in addition to the checked product information, France-specific needs, with a link to drug classifications. List 1 products are non-renewable medicines, except if clearly stated otherwise by the specialist, while List 2 products are renewable, except if it is precisely stated otherwise by the consultant. The label for List 1 products must have a red frame, while List 2 products should have a green frame. France's particular information also has to be added to the packaging for blood-derived medicines.

Opportunity

Digital Health and Sustainability Open New Avenues for French Pharma Packaging

The future of French pharmacy packaging is filled with capability, driven by invention and evolving healthcare trends. Alignment with telemedicine displays a particularly promising avenue, allowing pharmacies to work in tandem with digital health platforms to serve smooth and end-to-end healthcare solutions. This consolidation could be especially effective in rural or underserved regions, where access to healthcare activities is limited. Another main opportunity lies in the stretch of product offerings, specifically in regulatory frameworks to permit the online sale of prescription medications. Such transformations could capably enhance the industry’s scope and user requests. Additionally, sustainability is growing as a main space of focus, with e-pharmacies perfectly positioned to attract eco-friendly consumers by accepting environmentally friendly practices.

Segmental Insights

How did Blister Packs Dominate the French Pharmaceutical Packaging Market?

The French blister packs packaging dominated the market as it protects the medicine from contamination and moisture, ensuring safety even after opening. Specific blister packs enable users to access the needed medicine without accidentally opening required spaces. Cold-sealed blister packaging for pharmaceuticals utilises sustainability, which takes it to another level. By using pressure-only sealing, this innovative strategy reduces heat usage, lowers energy consumption, and minimizes the carbon footprint. The packaging is designed to be eco-friendly and ensures smooth integration into pharmaceutical workflows. Blister packs utilise plastic film pockets that receive their loading material from plastic or aluminum foil.

Prefilled syringes are becoming one of the selected formats for several designs for many injectable medications, along with autoinjectors, on-body devices, and pens, and the fill-finish procedure of these delivery formats ensures the highest sterility and quality standards to protect patient safety. Wearable devices can also develop user experience. Technological growth in delivery devices now enables the focus on mAbs without compromising their safety or efficacy.

How has Plastic Dominated the French Pharmaceutical Packaging Market?

The acid, heat, and alcohol -resistant characteristics of several types of plastics, as well as durable and lightweight elements, make it a safe and easy solution for storing many types of pharmaceutical products. Pharmaceutical containers are generally used in conjunction with the medicines that are carried, which means they cannot be made with anything that could present a risk of toxicity. As an outcome, the plastic material frequently used for these is ensured to be safe for direct contact with medications. Pharma packaging, on the other hand, must also be child-resistant and permanent to avoid accidental ingestion, which makes plastic a highly suitable choice. Most plastics are crafted to resist impact and high temperature without compromising honesty, so they are often selected for these advantageous qualities.

Glass is widely used for packaging in the pharmaceutical industry, from oral liquids and pills to injectable solutions. Its protective and inert qualities make it the preferred choice for many pharmaceutical companies, ensuring that medicines are shielded from oxidation, degradation, and contamination. Glass bottles act as a sturdy barrier against oxygen, moisture, light, and microbial contamination key factors that can cause pharmaceutical ingredient degradation (PID). Sensitive compounds can be oxidized by even small amounts of oxygen or moisture, and light-sensitive formulations may be destabilized by UV exposure. The non-porous nature of glass bottles prevents these elements from passing through, effectively forming a protective shield around the medicine.

How did Oral Drugs Dominate the French Pharmaceutical Packaging Market?

The pharmaceutical sector continues to grow and develop with oral solid dosage (OSD) formulations that remain at the forefront of drug delivery innovation. Manufacturers are heavily focusing on creating modified-release (MR) solid dosage solutions. These formulations can nurture therapeutic blood concentrations for expanded periods, potentially lowering dosing frequency and improving patient adherence. The acceptance of controlled-release and sustained-release technologies is expected to drive market development in the future years. The industry is shifting toward patient-centric formulations, with a rising importance on personalized medicine. This trend is assisted by growth in predictive modelling and artificial intelligence, enabling more accurate dosage and formulation approaches personalised to individual patient demands.

Injectable and inhalable drugs are important for patients who cannot consume oral drugs or need immediate relief. Pharmaceutical organizations specialising in injectable products with a huge range of treatments, from emergency interventions to routine care products like insulin for diabetes and vaccines that prevent diseases. Injectables and inhalables are often chosen over oral medications due to their potential to deliver drugs directly into the bloodstream. , which ensures fast absorption and quicker onset of action. In a complicated situation such as anaphylactic shock, an EpiPen can be lifesaving within seconds. Likewise, injectable antibiotics are an initial defense against many bacterial infections. Their smooth effectiveness can be the difference between death and death, specifically in emergency medical care.

How did Pharmaceutical Manufacturers Dominate the French Pharmaceutical Packaging Market?

Pharmaceutical manufacturers must protect against saturation and prevent migration. Therefore, they need excellent barrier characteristics against external influences like oxygen, light, and water vapor. Moreover, they must prevent the acceptance of the ingredients. Since particular materials cannot align with all needs, barriers are often created from multi-layer plastics-based materials. Packaging that needs to be sterilized to be germ-free also requires heat -and chemical-resistant base materials. To ensure the storage of pharmaceutical ingredients at cryogenic temperatures ( -160 degrees Celsius to -180 degrees Celsius), tailored in specialized temperature-resistant pharmaceutical packaging solutions which are compulsory. Medicines in tablet, powder, or liquid form, as well as creams and ointments, and medical aids like dressing materials, bandages, or plasters have various needs for the barrier properties of the pharmaceutical packaging. Different forms of applications or administrations further decide their shape and design.

Contract packaging organizations (CPOs) play an important role in the healthcare industry, as they serve essential services that are crucial to the success of pharmaceutical and medical product organizations. This counts the assembly of products for packaging, making packaging solutions, and dispensing healthcare products. The role of CPOs proves to be even more crucial, as they have the reliability to help pharmaceutical companies in lowering their negative impact and sustainable packaging solutions, and on the environment. Meeting the dual goals of marketing sustainability and ensuring cost-effectiveness is a main role that CPOs can play in assisting their customers. A balanced strategy makes it compulsory that CPOs should initially target simplifying their manufacturing methods.

How did Generic Drugs Become Popular Pharmaceutical Packaging Market?

Generic drugs have the same active ingredient, in the very same potency, as brand-name drugs. When a medicine is initially made, the pharmaceutical company that explores and promotes it receives a patent on its new drug. The patent generally lasts for 20 years, to give the originating company a chance to recapture its research investment. After the patient expires, a generic version of the drug may become available. Generics are promoted under the drug's chemical, or “generic” name, and align with the same FDA quality and effectiveness standards as the original. Generic medications are particularly proven to work just like their branded equivalent, with the same active ingredient and the same effectiveness, but come at a much lower cost. That’s precisely why it has changed the accessibility of high-quality healthcare to a larger population.

Biologics are a kind of medications that come from organic life. Scientists generate biologics medications by removing organic proteins or genetic materials from cellular lifeforms and, when possible, regenerating them. This means that scientists may have to shut down genes that reproduce the proteins they need. Biologic medications are an example of biotechnology. That’s when researchers use their knowledge to create new products and technology to solve human problems. Biologic drugs often treat challenging diseases that regular human-made drugs can’t successfully treat. Also, biologics are complicated medicines derived from living organisms. Their complex production procedure has regularly limited their availability, initially serving high-income countries.

In terms of biologics, biosimilars have the high capability to generate revenue in the upcoming years. Pharmacists are differently positioned to lead the transformation to biosimilars, specifically in high-impact therapeutic spaces such as immunology and oncology. Furthermore, the biosimilar space is rapidly growing, with many big-profile biologics experiencing patent expirations and latest competitors penetrating the pipeline. Pembrolizumab, dupilumab, risankizumab, and adalimumab each show different stages in the biosimilar life cycle, from current market presence to future potential.

Top Companies in the France Pharmaceutical Packaging Market

- Amcor Plc

- Gerresheimer AG

- Schott AG

- Aptar

- Berry Global Inc.

- West Pharmaceutical Services, Inc.

- SGD Pharma

- Catalent, Inc.

- Bormioli Pharma

- RPC Group (Berry Global)

- Nemera

- Albea Group

- Clariant AG

- Mondi Group

- Nipro Corporation

- WestRock Company

- Stevanato Group

- Constantia Flexibles

- Faubel Pharma Services

- Huhtamaki Group

Industry Leader Announcement

- On 22 January 2024, SGD Pharma, a Global market leader in molded glass primary packaging solutions for the pharmaceutical sector, disclosed the opening of the latest siliconization operation at its state-of-the-art Saint-Quentin Lamotte plant. The company expands its extensive series of in-house services by incorporating its glass siliconization offer, ensuring responsiveness, flexibility in vial sizes, and security of supply. (Source: Biopharma Boardroom)

- On 13 May 2024, the Top pharma company, Pfizer, would invest USD 500 million in France to construct its research and development presence in the country, while AstraZeneca revealed an announcement of USD 388 million for its site at Dunkirk. (Source: Pharmaceutical Manufacturer)

- On 4 March 2025, Aenova, a contract developer and manufacturer for the healthcare and pharmaceutical industry, extended its Bad Sibling site. With a total investment of roughly 20 million euros in the latest production and packaging lines, the site serves as a modern, high-volume infrastructure for the manufacturing of effervescent products and blister packaging. (Source: Contractpharma)

- On 12 February 2025, Axplora, a top leader in API, Small molecule, and ADC manufacturing, is delighted to reveal a landmark of Euro 50 million investment in its Mourenx site in Southwest France, securing its position as a main player in the fight against cardiovascular and metabolic diseases. (Source: Axplora)

Recent Developments

- On 22 January 2025, West Pharmaceutical Services, a top leader in inventive solutions for injectable drug administration, today revealed the introduction of Daikyo PLASCAP Ready-to-use validated 9RUV Closures in a latest nested format available in different configurations at the year’s Pharmapack event in Paris, France. (Source: PR Newswire)

- On 25 February 2025, MM Packaging’s French pharmaceutical packaging site was awarded the EcoVadis Platinum Medal for its sustainability performance, which marks the fifth time these product facilities have achieved this recognition. (Source: Labels and labeling)

- On 19 September 2024, Lonza, a top producer in the pharmaceutical, nutraceutical, and biotech industry, launched its latest facility at the Colmar Site in France. The latest Innovafarm Accelerator will serve as a Center of Excellence for creating and innovating capsule-based production and delivery solutions for pulmonary and oral administration. (Source: Contract Pharma)

- On 28 January 2025, Ampacet, a top masterbatch leader, revealed a ProVital + LaserMark, a profile of masterbatches crafted for high-contrast laser marking using Nd: YAG on medical devices, in vitro diagnostic equipment, and packaging systems. (Source:Med-Techinsights)

Segmentation of the French Pharmaceutical Packaging Market

By Packaging Type

- Primary Packaging

- Blister Packs

- Bottles

- Vials & Ampoules

- Prefilled Syringes & Cartridges

- Pouches

- Tubes

- Secondary Packaging

- Folding Cartons

- Labels

- Shrink Wraps

- Tertiary Packaging

- Corrugated Boxes

- Pallets & Crates

By Material

- Plastic (HDPE, PET, PVC, PP)

- Glass

- Paper & Paperboard

- Aluminium Foil

- Others (Biopolymers, Rubber)

By Drug Delivery Mode

- Oral Drugs

- Injectable Drugs

- Topical/Transdermal Drugs

- Inhalable Drugs

- Ophthalmic & Nasal Drugs

By Product Type

- Branded Drugs

- Generic Drugs

- Biologics

By End-Use

- Pharmaceutical Manufacturing

- Contract Packaging Organizations (CPOs)

- Retail Pharmacies

- Hospitals & Clinics

- Research & Development Centres