South Korea Cosmetic Packaging Market Growth Trends, Segment Analysis Trade Dynamics

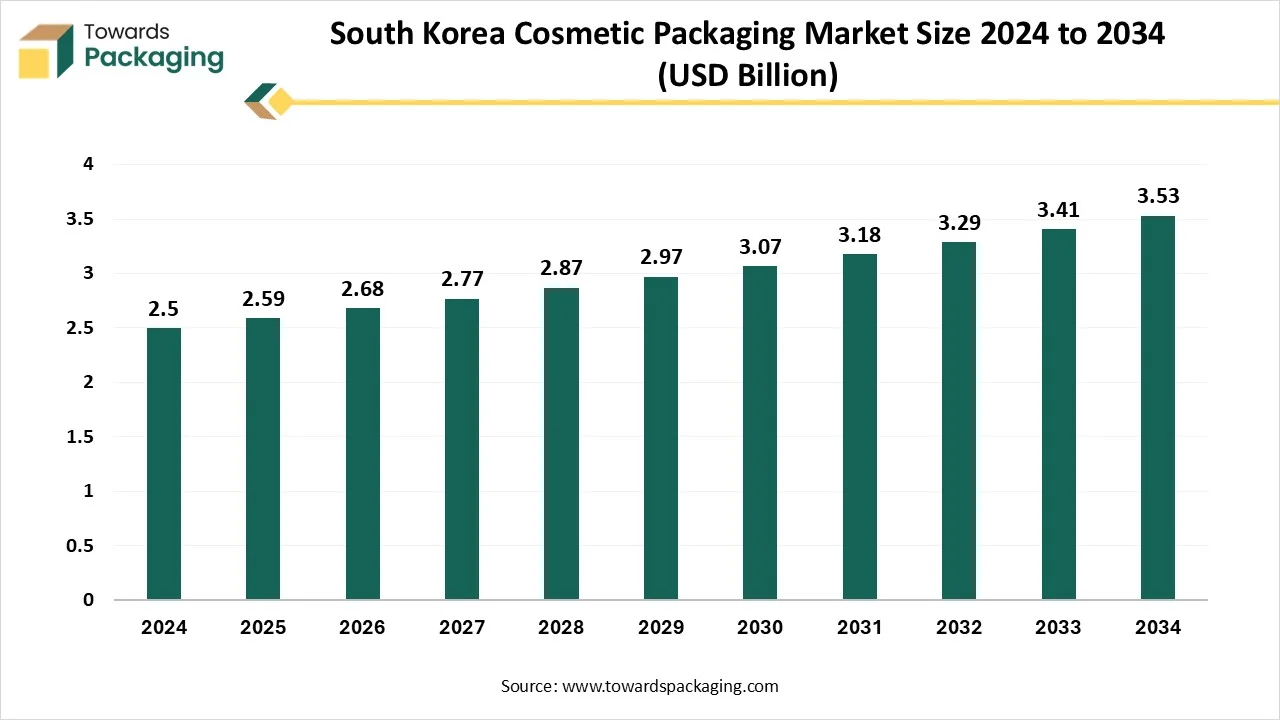

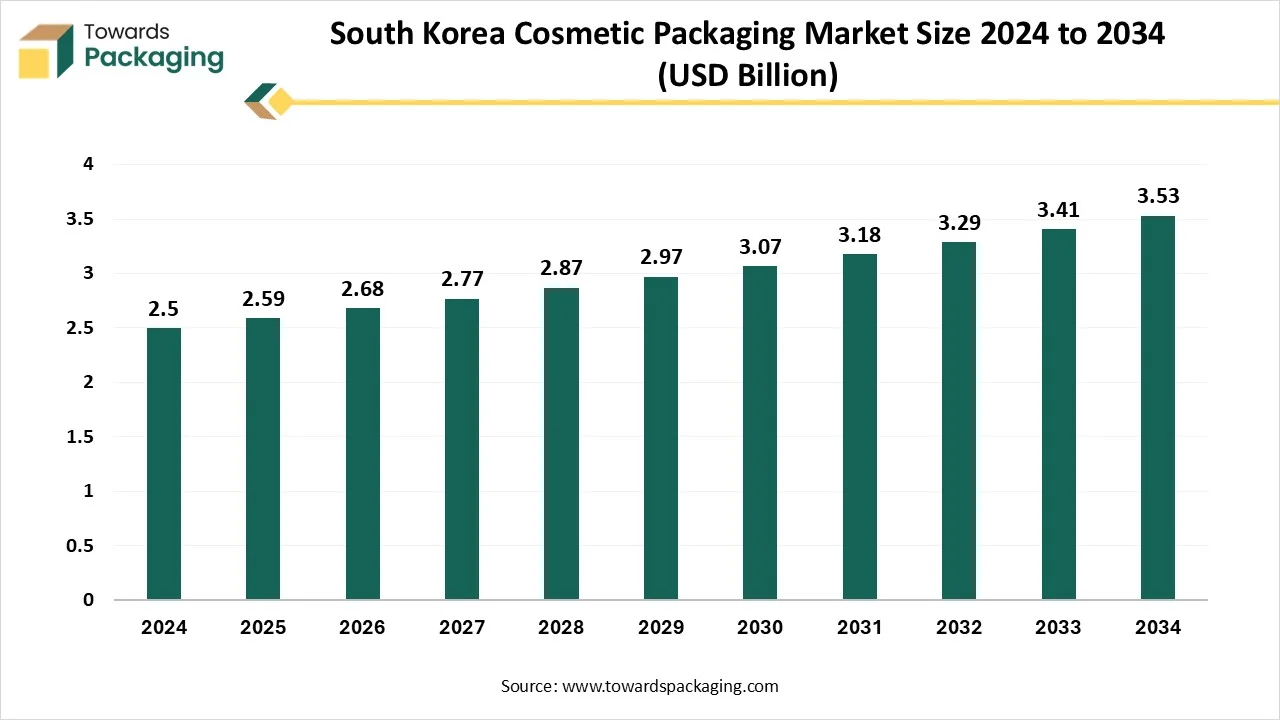

The South Korea cosmetic packaging market is forecasted to expand from USD 2.68 billion in 2026 to USD 3.65 billion by 2035, growing at a CAGR of 3.5% from 2026 to 2035. This report provides full quantitative coverage of market size, historical data, and detailed forecasts by material (with plastics such as PET and PP leading in 2024 and sustainable/bio-based materials growing the fastest), by product (bottles dominating in 2024 and airless tubes expanding at the highest CAGR), by packaging functionality (primary packaging leading and refillable formats growing fastest), by technology (standard injection molding dominating and airless packaging rising most rapidly), by application (skincare leading and cosmeceuticals/dermatologicals growing the fastest), and by end-user type (mass-market brands dominating and indie & D2C brands expanding quickest).

In addition, the study benchmarks South Korea’s positioning against North America, Europe, APAC, Latin America, and the Middle East & Africa using regional demand, trade flows, and import–export statistics. The report also delivers company profiles and competitive analysis of key players such as Yonwoo, Kolmar Korea Packaging, Samhwa Plastic, Amorepacific and LG H&H packaging units, along with value chain mapping, OEM/ODM ecosystem analysis, trade data, and detailed manufacturer and supplier databases to support strategic sourcing and market entry decisions.

Key Insights

- In terms of revenue, the market is valued at USD 2.59 billion in 2025.

- The market is projected to reach USD 3.65 billion by 2035.

- Rapid growth at a CAGR of 3.5% will be observed in the period between 2025 and 2034.

- By material type, the plastic (PET, PP) segment dominated the market with the largest share in 2024.

- By material type, the sustainable/bio-based Materials segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By product type, the bottles segment dominated the market in 2024.

- By product type, the airless Tubes segment is expected to grow at the fastest CAGR in the forecast period.

- By packaging functionality, the primary packaging segment dominated the market in 2024.

- By packaging functionality, the refillable packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By packaging technology, the standard injection segment dominated the market with the largest share in 2024.

- By packaging technology, the airless packaging segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By application, the skincare segment dominated the market with the largest share in 2024.

- By application, the cosmeceuticals / dermatologicals segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By end-user type, the mass-market brands segment dominated the market in 2024.

- By end-user type, the indie & D2C brands segment is expected to grow at the fastest CAGR in the forecast period.

Market Overview

Cosmetic packaging refers to the containers, wrappers, and overall design used to encase and protect cosmetic products such as creams, lotions, lipsticks, perfumes, foundations, and other beauty-related items. It includes both primary packaging (directly holding the product, like bottles, jars, tubes) and secondary packaging (outer boxes or labels). Cosmetic packaging is essential not only for preserving the quality and hygiene of the product but also for attracting consumers through aesthetics, branding, and functionality. Innovative materials, eco-friendliness, ease of use, and visual appeal play key roles in cosmetic packaging design and production.

A rising preference for sustainable and recyclable packaging is encouraging manufacturers to adopt eco-friendly materials like biodegradable plastics, glass, and refillable containers. Companies are also focusing on compact, travel-friendly packaging designs to align with consumer convenience. Additionally, the popularity of e-commerce is influencing the development of tamper-proof, lightweight, and protective packaging suitable for long-distance delivery. The market benefits from strong domestic R&D capabilities, government support for sustainability, and an agile manufacturing sector that quickly adapts to global packaging trends and consumer demands.

What are the New Trends in the South Korea Cosmetic Packaging Market?

Sustainable and Eco-Friendly Packaging

- There is a strong movement toward using biodegradable, recyclable, and refillable packaging materials such as glass, paper-based containers, and bioplastics. Consumers are increasingly prioritizing brands with low environmental impact.

Minimalist and Aesthetic Designs

- Simple, clean, and modern packaging with soft pastel colors and elegant typography is gaining popularity. Korean consumers value visual appeal, making design a powerful marketing tool.

Refillable and Reusable Solutions

- Many Korean brands are introducing refill stations and reusable containers to reduce plastic waste and enhance customer loyalty. This aligns with the country’s eco-conscious consumer base.

Smart and Functional Packaging

- Integration of QR codes, NFC tags, and smart seals is on the rise, enabling product authentication, customer interaction, and usage tracking through smartphones.

Compact and Travel-Friendly Formats

- With a busy lifestyle and travel-savvy consumers, compact packaging such as stick formats, sachets, and mini-containers is increasingly in demand.

Customizable and Personalized Packaging

- Some brands are offering packaging that allows personalization with names, messages, or artwork to enhance emotional engagement and gifting appeal.

E-Commerce-Oriented Packaging

- Packaging optimized for shipping lightweight, durable, and tamper-evident products is a growing trend due to the boom in online beauty sales.

Airless and Hygienic Packaging

- Packaging that prevents contamination and enhances shelf life, such as airless pumps and sealed droppers, is gaining traction for skincare products.

How Can AI Improve the South Korea Cosmetic Packaging Industry?

AI integration can significantly enhance the South Korea cosmetic packaging industry by streamlining production, improving design, and personalizing consumer experiences. In manufacturing, AI-driven automation enables faster, more precise packaging processes, reducing waste and ensuring consistent quality. Machine learning algorithms can analyze consumer behaviour and trends to help brands create packaging that aligns with market preferences, such as preferred colors, materials, or formats. AI also assists in product customization by allowing real-time design adjustments and on-demand printing, which is especially valuable in South Korea’s trend-sensitive beauty market.

In logistics and quality control, AI-enabled systems detect defects and optimize inventory management, ensuring timely distribution with minimal errors. For sustainability, AI tools can simulate the environmental impact of different packaging materials, guiding brands toward greener alternatives. Furthermore, AI enhances e-commerce packaging by predicting shipping stresses and suggesting more protective yet efficient designs. Smart packaging solutions using AI, such as QR codes linked to virtual skincare guides or product authentication, create interactive consumer experiences, building brand trust and engagement.

Market Dynamics

Driver

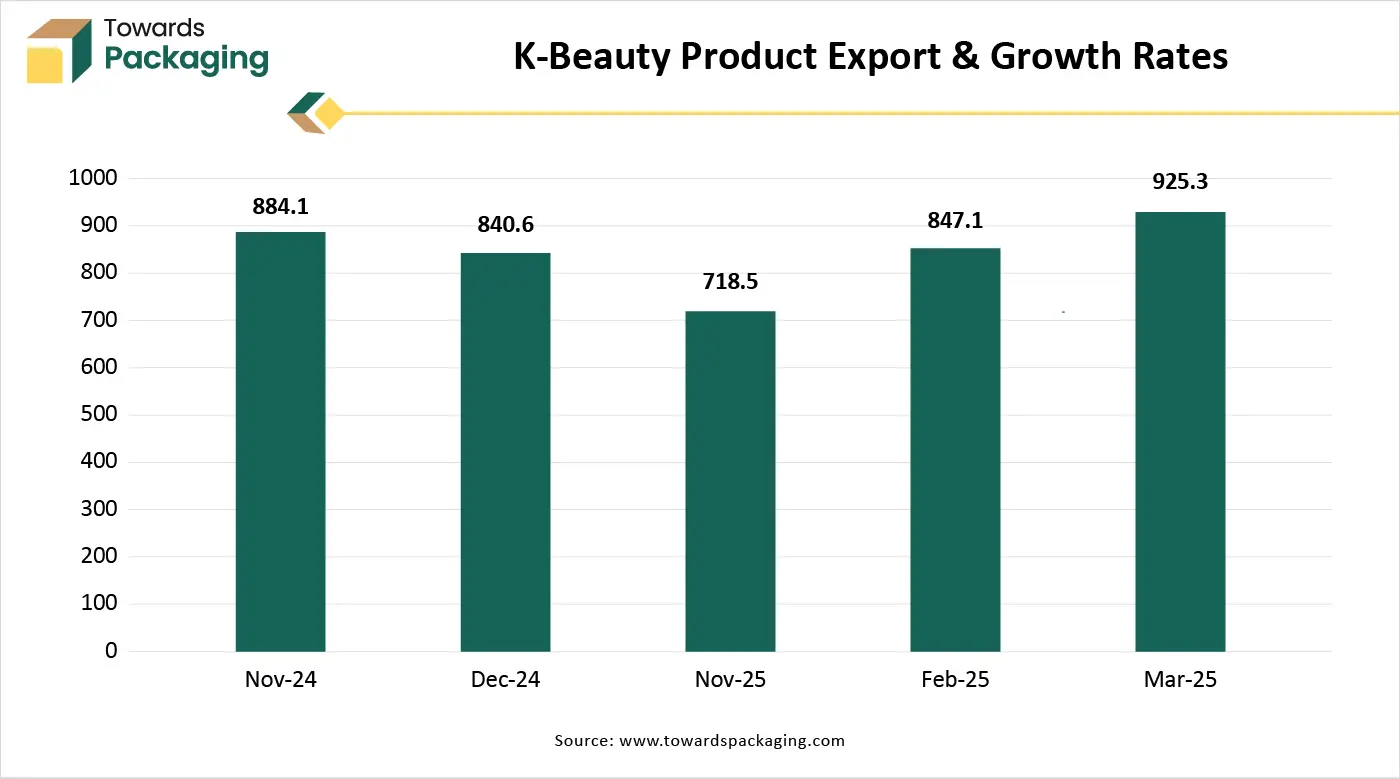

Increased Global Popularity of K-Beauty

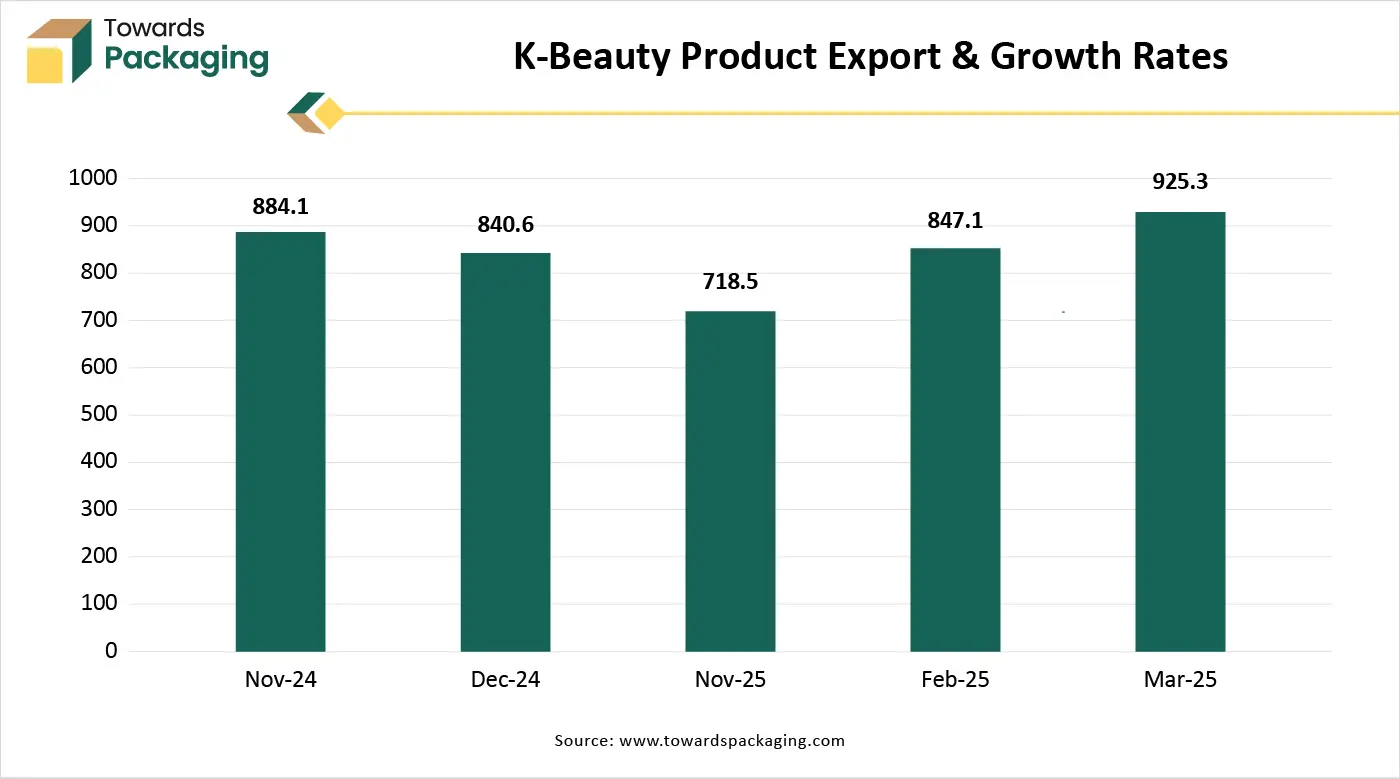

The export of K-beauty products to international markets necessitates attractive, durable, and compliant packaging, driving innovation and growth in the packaging sector. South Korea is a global leader in beauty innovations, particularly in skincare, which fuels continuous demand for high-quality, functional, and visually appealing cosmetic packaging. Growing environmental consciousness among consumers is pushing brands to adopt eco-friendly, biodegradable, and recyclable packaging, opening new opportunities for material innovation.

South Korean consumers prioritize product appearance and packaging as a reflection of quality and brand value. This emphasis on visual appeal propels investment in creative and premium packaging designs. The rise of online beauty retail increases the demand for protective, lightweight, and tamper-proof packaging suited for long-distance delivery. The market for K-beauty is expanding rapidly on a global scale due to increasing interest in its distinctive skincare concepts and cutting-edge products. Brands like Anua, Biodance, and Skin1004 are becoming more popular in this “second wave” of K-beauty, which is characterized by an emphasis on natural ingredients, multi-step procedures, and distinctive formulations.

- According to data from the Korea Customs Service, skincare exports to the U.S. increased from USD231.9 million in 2020 to USD815.1 million in 2024, a more than threefold increase. Over the same time period, color cosmetics exports to the US market more than quadrupled, rising from USD124 million to USD267.8 million.

Restraint

Strict Environmental Regulations & Supply Chain Disruptions

While sustainability is a driver, evolving government regulations around plastic usage, recyclability, and waste management can pose compliance challenges and require significant investment in R&D and infrastructure. Fluctuations in the availability and prices of raw materials, such as bioplastics or glass, can disrupt manufacturing timelines and impact profit margins, especially during global crises. Not all cosmetic brands, especially domestic startups and SMEs, are fully aware or capable of implementing advanced packaging technologies or sustainable practices. The cosmetic packaging sector is highly competitive with both local and international players. This leads to pricing pressure and limits profit margins, particularly for generic or non-branded packaging manufacturers.

What are the Opportunities for the Growth of the South Korea Cosmetic Packaging Market?

Sustainable Packaging Innovation

- As environmental awareness continues to rise, there’s a growing opportunity for packaging companies to develop and supply biodegradable, recyclable, and refillable packaging. Brands that innovate with eco-friendly materials can gain strong market traction.

Smart and Connected Packaging

- Integration of technologies such as QR codes, NFC, and augmented reality in cosmetic packaging can create interactive user experiences, offering both engagement and product authentication a unique selling point in digital-savvy South Korea.

Personalized and Custom Packaging

- As consumers seek more personalized products, there's an opportunity for packaging manufacturers to offer bespoke, on-demand printing and customization services, enhancing brand differentiation.

Premium and Luxury Segment Expansion

- South Korea’s rising middle class and demand for premium beauty products create an opening for upscale, high-end cosmetic packaging solutions that emphasize sophistication and exclusivity.

Segmental Insights

Why does the Plastic Segment Dominate the South Korea Cosmetic Packaging Market?

Plastic remains the dominant material type segment in the South Korea cosmetic packaging market due to its cost-effectiveness, versatility, and adaptability to consumer and brand needs. It is more affordable than alternatives like glass or metal, making it ideal for large-scale production across both premium and mass-market cosmetics. Its flexibility allows manufacturers to mold it into a wide range of shapes and designs, such as pumps, tubes, jars, and compacts formats that are highly preferred in the Korean beauty sector. Plastic is also lightweight and durable, reducing shipping costs and making it more convenient for e-commerce packaging, which is rapidly growing in South Korea.

Several types of plastics offer excellent barrier properties, helping protect cosmetic products from moisture, UV light, and contamination, thereby extending product shelf life. Plastic packaging is compatible with advanced features such as airless dispensers and tamper-evident designs, which enhance functionality and appeal. Moreover, ongoing innovations in recyclable and bio-based plastics are helping the industry meet sustainability goals without compromising on performance, ensuring plastic retains its dominant position despite rising environmental concerns.

Increasing Consumer Awareness of Environmental Issues Promotes the Fastest Growth of Sustainable or Bio-based Materials

The sustainable or bio-based materials segment is emerging as the fastest-growing segment in the South Korea cosmetic packaging market due to increasing consumer awareness of environmental issues and the demand for eco-friendly alternatives. South Korean consumers, particularly younger demographics, are placing greater importance on sustainability, prompting brands to adopt biodegradable, recyclable, or compostable packaging made from materials like sugarcane, cornstarch, bamboo, and paper. Additionally, government regulations and policies aimed at reducing plastic waste are encouraging companies to shift toward greener packaging solutions.

The global image of South Korea as a leader in innovation and ethical consumerism also drives cosmetic brands to showcase their commitment to environmental responsibility through sustainable packaging choices. Technological advancements in material science have made bio-based packaging more functional, aesthetically pleasing, and compatible with product safety standards. Furthermore, the rise in premium and niche beauty brands that emphasize clean and green branding has further boosted demand for sustainable materials. As environmental consciousness continues to shape purchasing behaviour, the sustainable and bio-based materials segment is set to experience accelerated growth in South Korea's dynamic cosmetic packaging landscape.

Which Product Type Dominated the South Korea Cosmetic Packaging Market in 2024?

Bottles dominate the South Korea cosmetic packaging market because they are highly versatile, accommodating liquid and semi-liquid products like toners, serums, cleansers, and lotions. Their varied materials, plastic, glass, or aluminum, offer barrier protection, durability, and visual appeal, aligning with both functional and premium branding needs. Bottles also support innovative features such as airless pumps, dropper caps, and refill systems, enhancing user convenience and hygiene. Moreover, their compatibility with e-commerce, being lightweight, leak-resistant, and travel-friendly, makes them the preferred choice for both manufacturers and consumers.

Airless Tube Segment to Grow at Fastest Rate

The airless tube segment is the fastest-growing in the South Korea cosmetic packaging market due to its superior ability to preserve the integrity of sensitive skincare formulations. These tubes prevent air exposure, which protects products from oxidation and contamination, extending shelf life, an essential feature for natural and high-performance cosmetics. South Korea’s advanced skincare industry favours airless packaging for serums, creams, and lotions that require precision and hygiene. Consumers also appreciate the controlled dispensing and minimal product waste. With the rise of clean beauty and preservative-free formulas, demand for airless tubes continues to surge among both brands and consumers.

Which Packaging Functionality Dominated the South Korea Cosmetic Packaging Market in 2024?

The primary segment dominates the South Korea cosmetic packaging market due to its direct role in preserving product integrity, hygiene, and usability. It includes containers like bottles, jars, tubes, and pumps that hold the actual cosmetic product, making it essential for protecting against contamination and extending shelf life. South Korean consumers highly value clean, functional, and aesthetically pleasing packaging, making primary packaging a critical branding tool. Additionally, innovations like airless pumps and sustainable materials are being integrated into primary packaging, further enhancing its market dominance.

Refillable Packaging Segment Projected to Grow Fastest in 2024

The refillable segment is rapidly gaining traction in South Korea’s cosmetic packaging market due to growing consumer demand for sustainability and waste reduction. By enabling consumers to reuse durable outer containers such as glass jars, metal compacts, or high-quality plastic bottles, refillable systems significantly reduce single-use packaging waste. South Korean brands are responding with sleek, modular designs that make refilling both convenient and aesthetically appealing, reinforcing brand loyalty. Governments and retailers are also promoting refill stations and eco-friendly initiatives, boosting adoption. Additionally, refillable packaging often offers cost savings over time, making it attractive to both eco-conscious and budget-savvy consumers.

Which Application Dominates the South Korea Cosmetic Packaging Market?

The skincare segment is the dominant segment in the South Korea cosmetic packaging market due to the country’s strong cultural emphasis on skincare as part of daily self-care routines. South Korea is globally recognized for its advanced skincare industry, which includes products like cleansers, toners, essences, serums, moisturizers, and sunscreens. These products require diverse and specialized packaging formats such as pumps, airless tubes, droppers, and jars that protect sensitive formulations and enhance user convenience. Additionally, consumers’ preference for multi-step skincare regimens leads to higher product volumes and increased packaging demand. Continuous product innovation and premium branding further support the dominance of skincare packaging in the market.

Cosmeceuticals / Dermatologicals Segment Shown Rapid Growth

The cosmeceuticals or dermatological segment is the fastest-growing application segment in the South Korea cosmetic packaging market due to rising consumer interest in science-backed, functional skincare products. As more people seek treatments for issues like acne, aging, sensitivity, and pigmentation, demand for dermatologist-formulated products with active ingredients has surged. These formulations often require advanced, protective packaging such as airless pumps, opaque containers, and tamper-proof seals to preserve efficacy and hygiene.

Additionally, South Korea's emphasis on innovation and clinical skincare trends drives continuous product development, further boosting packaging needs. The segment also benefits from increased trust in medical-grade beauty products and a growing health-conscious consumer base.

Why does the Standard Injection Segment Dominate the South Korea Cosmetic Packaging Market?

The standard injection segment dominates the South Korea cosmetic packaging market due to its precision, efficiency, and ability to produce complex, high-quality packaging components. This technology is widely used to manufacture plastic containers, caps, and closures that meet the demands of South Korea’s innovative and visually driven cosmetic industry. It allows for mass production with consistent shapes and intricate details, which is ideal for the country’s diverse range of skincare and makeup products. Additionally, injection molding supports customization, rapid prototyping, and compatibility with sustainable materials, making it a preferred choice for brands focused on both functionality and design excellence.

Airless Packaging Segment to Grow at Fastest Rate

The airless segment is rapidly outperforming others in South Korea’s cosmetic packaging market due to its effective protection of sensitive skincare formulations from oxidation and contamination. By preventing air exposure, airless systems such as pumps, bottles, and tubes help maintain product efficacy and extend shelf life, which is vital for high-performance serums, creams, and dermatological treatments. The trend is supported by sustainability mandates encouraging refillable and recyclable airless solutions, along with consumer preferences for hygienic, portable, and elegant packaging. Additionally, South Korea’s booming pharmaceutical and K-beauty industries are driving demand for precision-dispensing and sterile packaging formats, further fueling growth.

Which End-User Dominated the South Korea Cosmetic Packaging Market in 2024?

The mass-market brand segment dominates South Korea’s cosmetic packaging landscape due to its extensive reach, affordable price points, and high-volume sales. Over 50% of the beauty market is made up of mass brands, driven by accessible distribution channels such as Olive Young and online platforms, which prioritize practical yet visually appealing packaging. These brands demand cost-effective packaging solutions like plastic bottles and tubes that deliver on functionality and branding without high production costs. Their fast product turnover, propelled by trend-driven consumer behaviour and influencer marketing, further reinforces the need for scalable packaging. Consequently, mass-market brands remain the dominant end‑user segment in South Korea’s cosmetic packaging market.

Indie and D2C Brand Segment to grow at the Fastest Rate

The indie and D2C brand segment is the fastest-growing end-user type in South Korea’s cosmetic packaging market due to several intertwined factors. First, a surge of small, agile indie brands, nearly 28,000 registered in 2024, up from 15,700 in 2019, is fueling demand. Backed by a robust OEM/ODM infrastructure, these brands can rapidly bring to market innovative formulations and packaging with minimal upfront investment.

Additionally, indie labels strongly emphasize unique storytelling, eco-conscious values, and social‑media‑friendly design. Custom molds, playful visuals, and sustainable materials help them go viral. This approach, combining speed, creativity, personalization, and green messaging, resonates deeply with Gen Z and millennial consumers seeking novel experiences, positioning indie and D2C brands as the fastest-growing and most dynamic segment in cosmetic packaging.

Regional Insights

The South Korea cosmetic packaging market is witnessing significant growth driven by the country’s dynamic beauty and skincare industry, which is globally renowned for innovation and quality. The demand for attractive, functional, and sustainable packaging solutions is on the rise as South Korean consumers place high value on aesthetics, hygiene, and environmental consciousness. Technological advancements in packaging materials and smart packaging features are further enhancing product appeal and shelf life. The growing popularity of K-beauty globally has also led to increased exports, driving the need for durable and visually compelling packaging.

Top South Korea Cosmetic Packaging Market Key Players

- Yonwoo Co., Ltd.

- Kolmar Korea Packaging

- Taesung Industrial Co., Ltd.

- Cosmopak Korea

- CTK Cosmetics

- Amorepacific Packaging R&D Division

- LG Household & Health Care Packaging Unit

- LAPACK Co., Ltd.

- YONWOO PIONEER

- Jinwoong Industrial Co., Ltd.

- Samhwa Plastic Co., Ltd.

- Airlesspack Korea

- Samhwa Metal Co., Ltd.

- Soonkang Co., Ltd.

- Shinhwa Pack

- Hana Pack

- Daihan C&C

- Dreampack Co., Ltd.

- SEMO Cosmetic Packaging

- Wooil Industrial Co., Ltd.

Latest Announcements by Industry Leaders

- On July 04, 2025, Kim GeunMo, director of Dongsung Chemical’s Bioplastics Division, stated that their company is focused on creating a sustainable packaging ecosystem in Korea, with a focus on the Bioplastic Complex, which debuted in Ulsan in 2024 and is the country’s only bioplastics innovation hub.

New Advancements in the Market

- In January 2025, Grabity Hair Care, a brand innovated by Polyphenol Factory headquartered in Yangpyeong-dong, Seoul, revealed the introduction of the South Korean haircare range packed within eco-friendly packaging. The eco-friendly packaging made from coconut shells for all Grabity goods minimizes the use of plastic and demonstrates the company’s commitment to environmental responsibility.

- In July 2025, Dongsung Chemical and Cosmax jointly brought Korea's bio-based hot melt adhesive containing biodegradable bioplastic PHA to the market. The two businesses collaborated over the last two years to create the glue, which is being utilized in cosmetic packaging. This combines functionality and sustainability, which is a major advancement.

South Korea Cosmetic Packaging Market Segments

By Material Type

- Plastic

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Acrylic

- Others (e.g., SAN, ABS)

- Glass

- Amber Glass

- Frosted Glass

- Clear Glass

- Metal

- Aluminum

- Tin

- Other alloys

- Paper & Paperboard

- Kraft Paper

- Bleached Board

- Corrugated Paperboard

- Others (Bamboo, etc.)

By Product Type

- Bottles

- Dropper Bottles

- Pump Bottles

- Spray Bottles

- Jars

- Cream Jars

- Gel Jars

- Balm Containers

- Tubes

- Squeeze Tubes

- Airless Tubes

- Pumps & Dispensers

- Sticks

- Lip balm sticks

- Deodorant sticks

- Compacts & Palettes

- Droppers & Pipettes

- Pouches & Sachets

- Roll-ons

- Caps & Closures

By Application

- Skincare

- Creams

- Serums

- Lotions

- Masks

- Haircare

- Shampoos

- Conditioners

- Hair Oils

- Makeup

- Foundation

- Lipsticks

- Eyeshadows

- Compacts

- Fragrance

- Perfume Bottles

- Sample Sprays

- Personal Care

- Deodorants

- Hand Wash

- Oral Care

- Cosmeceuticals / Dermatologicals

By Packaging Functionality

- Primary Packaging

- Secondary Packaging

By Packaging Technology

- Standard Injection Molding

- Airless Packaging

- Sustainable / Recyclable Packaging

- Refillable / Reusable Packaging

- Smart Packaging

- Custom & Decorative Packaging

By End-User Type

- Premium / Luxury Brands

- Mass-market Brands

- Indie & D2C Brands

- OEM / ODM Manufacturers

Tags

FAQ's

Select User License to Buy

Figures (3)