Uncoated Recycled Paperboard Market Trends, Growth and Market Size Analysis

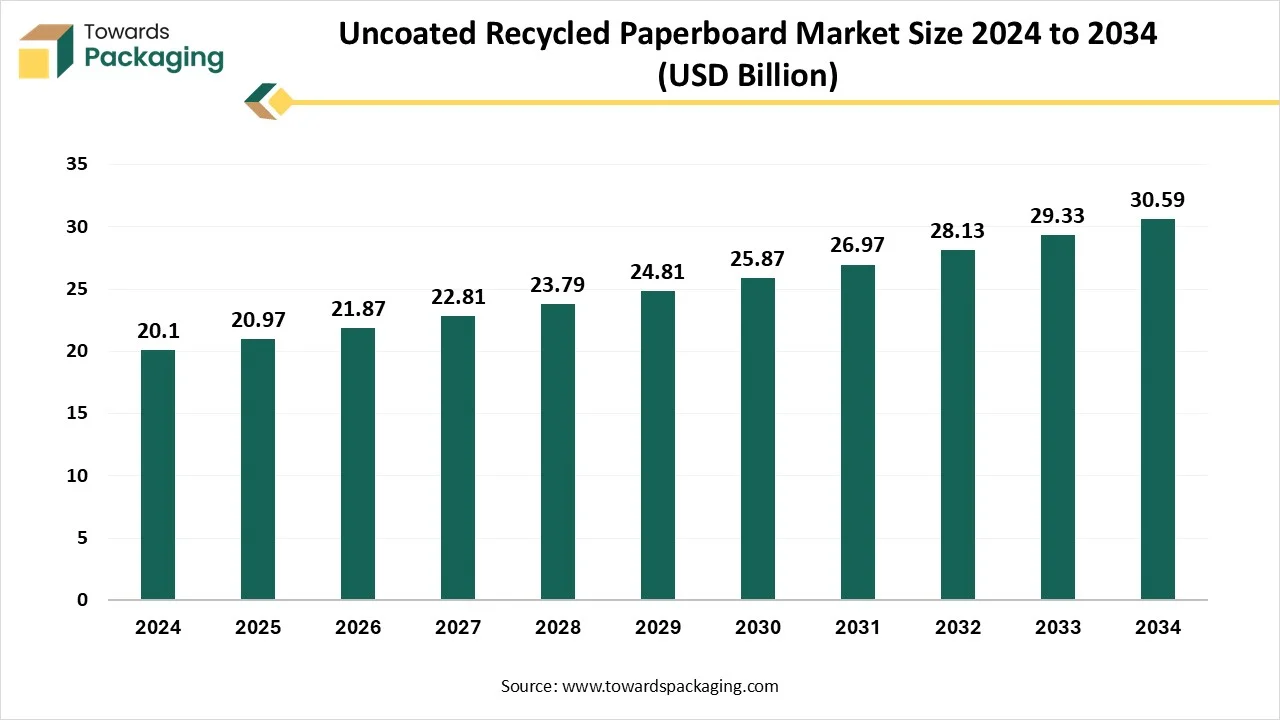

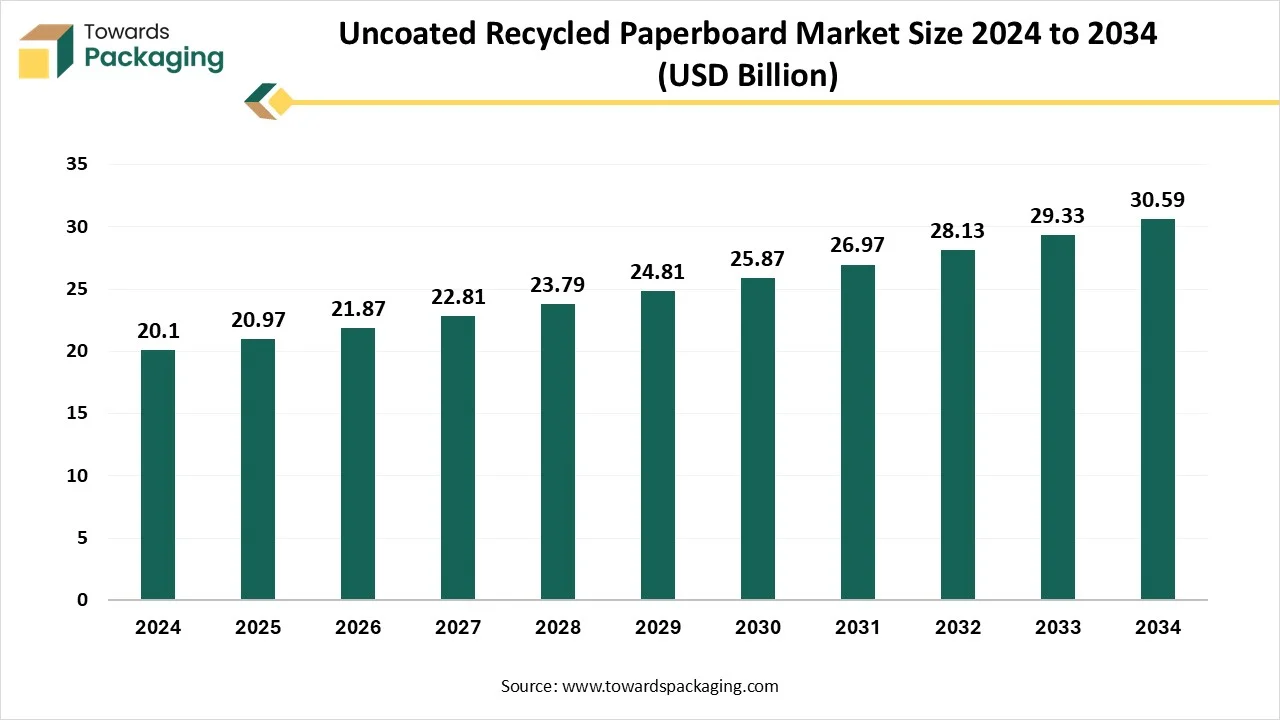

The uncoated recycled paperboard market is forecasted to expand from USD 21.87 billion in 2026 to USD 31.94 billion by 2035, growing at a CAGR of 4.3% from 2026 to 2035. The development can be credited to the growing acceptance of e-commerce and digital facilities, increasing ecological consciousness among customers for environment-friendly goods, and a rise in demand from food packaging firms. The rapid growth in the e-commerce industry has influenced the demand for uncoated recycled paperboard as it is an ecological packaging option and an alternative to the packaging industry.

Key Insights

- In terms of revenue, the market is valued at USD 20.97 billion in 2025.

- The market is projected to reach USD 31.94 billion by 2035.

- Rapid growth at a CAGR of 4.3% will be observed in the period between 2025 and 2034.

- North America dominated the global market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By thickness, the medium weight (0.20 mm - 0.30 mm) segment held a major revenue share in 2024.

- By thickness, the lightweight (below 0.20 mm) segment is expected to grow at a significant CAGR between 2025 and 2034.

- By application, the food and beverages segment contributed the biggest revenue share in 2024.

- By application, the cosmetics and personal care products segment will expand at a significant CAGR between 2025 and 2034.

- By end user, the consumer goods segment dominated the market in 2024.

- By end user, the healthcare segment will grow at a significant CAGR between 2025 and 2035.

Uncoated Recycled Paperboard Market: Need for Eco-Friendly Packaging

The uncoated recycled paperboard market is experiencing significant development due to the rising demand for sustainable packaging choices. These are generated from recycled fibre, which makes it an environment-friendly substitute for virgin paperboard. As customers and corporates rapidly give preference to sustainable products, this is pushing the development of the uncoated recycled paperboard market majorly in sectors such as food and beverages, cosmetics and personal care, electronics, and several others.

The extension of the e-commerce sector has influenced the demand for the requirement of lightweight and durable packaging resources. Uncoated recycled paperboards are well-known for their recyclability properties and strength and making them a suitable option for packaging resolutions in this sector. Corporations are progressively concentrating on evolving high-quality recycled paperboard goods that fulfill the developing requirements of customers and trades. The competitive changing aspects are driven by factors such as the increasing demand for environment-friendly packaging solutions, supervisory compliance, and technological developments.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 20.96 Billion |

| Projected Market Size in 2035 |

USD 31.94 Billion |

| CAGR (2026 - 2035) |

4.3% |

| Leading Region |

North America |

| Market Segmentation |

By Thickness, By Application, By End Use and By Region |

| Top Key Players |

JK Paper Limited, International Paper Co, Spento Papers India LLP, Nippon Paper Industries, Delta Paper Mills Ltd |

What are the New Trends in the Uncoated Recycled Paperboard Market?

- Rising Shift towards Circular Economy

Corporations are progressively concentrating on designing goods that can be effortlessly recycled, thus contributing to a more sustainable packaging network. This change not only aligns with customer choices but also improves brand status and reliability.

- Innovation in the Design of Product

Uncoated recycled paperboard provides flexibility in designing, permitting brands to generate unique packing that seems different in the market. This trend is mainly related to the consumer goods segment, where packaging is crucial in attracting clients. As brands capitalize on advanced designs, the demand for uncoated recycled paperboard is anticipated to increase.

- Demand for Lightweight Packaging

Lightweight packaging is a rising trend in the packaging sector, designed to decrease material utilization and reduce ecological impact. In the uncoated recycled paperboard market, lightweight creativity is influencing companies to create thinner, yet sturdy, paperboard choices.

How Can AI Improve the Uncoated Recycled Paperboard Market?

In the uncoated recycled paperboard sector, AI plays an important role in checking the quality of the uncoated recycled paperboard used for the packaging of a wide range of products. The evolving demand of consumers towards developing the quality of the paperboards and customization in shape and size has raised the incorporation of artificial intelligence in this sector. Major companies are collaborating to enhance the services and fulfill the requirements of the market.

Future Trends in Uncoated Recycled Paperboard

- The future of the uncoated recycled paperboard industry looks significant, with expected growth driven by consumer choice and regulatory landscapes. Growing emphasis will encourage sectors to innovate eco-friendly packaging options, stretching paperboard’s uses.

- Technological growth is likely to develop product quality, including developed durability, printability, and barrier properties against contaminants and moisture, too. Developments in rising markets, along with growth in the e-commerce and retail sectors.

- Furthermore, collaborations between producers and end-users can lead to personalized paperboard solutions tailored to particular needs.

- The growth in e-commerce has boosted demand for lightweight and durable packaging, which can withstand shipping stresses. Furthermore, rigid government regulations and policies whose goal is to reduce plastic waste have propelled producers to shift toward paperboard alternatives.

- Rising urbanization and disposable income levels are contributing to growth, further stimulating growth. Together, these drivers' current investments and research are making paperboard a chosen material for packaging across different sectors and geographical regions.

- Many factors are driving growth in the paperboard material. Growing consumer awareness about environmental sustainability is a main catalyst, encouraging businesses to accept recyclable and biodegradable packaging solutions.

Future Demand Surge: What’s Powering the Recycled Paperboard Boom?

| Future Demand Factor |

Detail |

Market Impact |

| Shift to Sustainable Packaging |

Companies are replacing plastics with recyclable paperboard to meet sustainability and ESG goals. |

Strong rise in URB use for cartons, boxes, sleeves, and consumer packaging. |

| Growth of E-commerce |

More online shopping increases the need for protective and secondary packaging. |

Higher URB demand for inserts, partitions, and shipping-related applications. |

| FMCG & Food Sector Adoption |

Brands prefer eco-friendly, low-cost packaging for food, cosmetics, and household goods. |

Wider usage of URB in trays, sleeves, folding cartons, and multipacks. |

| Regulatory Push for Recycling |

Plastic bans and circular economy policies support recycled fiber packaging. |

Expansion of URB production capacity and improved wastepaper recovery. |

| Advances in Recycling Technology |

Mills are upgrading systems to produce stronger, better-quality recycled board. |

Enables URB to penetrate more applications and reduce reliance on virgin fiber. |

Market Outlook

- Industry Growth Overview: Due to the growing environmentally friendly packaging in the food, FMCG, and industrial sectors, the market for uncoated recycled paperboard is expanding steadily. It is favored for carton sleeves and protective packaging due to its strength and affordability. Availability is still supported by increases in recycling capacity.

- Sustainability Trends: Converters are moving toward 100% recycled, chlorine-free free and low chemical paperboard grades due to a strong sustainability momentum. Water-based adhesives, lightweighting, and lower carbon footprints are important developments. Recyclable paperboard is progressively taking the place of plastic-based formats.

- Global Expansion: Global expansion is driven by growth in e-commerce, consumer goods, and export packaging across APAC, Europe, and the Americas. Manufacturers are upgrading mills and adding new recycled lines to meet rising demand. International brands are shifting procurement toward certified recycled paperboard suppliers.

Market Dynamics

Driver

Rising Demand for Sustainability and Cost-effectiveness

The worldwide push in the direction of sustainability is a major driver for the uncoated recycled paperboard market. Administrations and governments globally are implementing strict guidelines to decrease plastic waste and promote recycling. This supervisory situation encourages trades to accept recycled resources, comprising URB, as a share of their packaging resolutions. The growing customer fondness for sustainable goods further strengthens this trend, as more people are eager to pay a premium for environment-friendly packaging choices. This market provides a cost-effective substitute for traditional packaging resources. The manufacture of recycled paperboard characteristically incurs lower raw resources charges in comparison with virgin paperboard, as it uses post-consumer waste.

Restraint

Rising Quality Issues During the Manufacturing Process

Despite the rising demand for uncoated recycled paperboard, there are issues associated with the awareness of quality among customers and producers. Some shareholders may view recycled resources as inferior to virgin resources, mainly in terms of strength and availability. Producers must capitalize on compliance procedures, which can increase effective charges and improve impression effectiveness.

Opportunity

Rising Investment in Recycling Infrastructure

Governments and remote units are capitalizing on recycling infrastructure to improve the efficacy of waste management arrangements. The recycling partnership informs that funds in recycling plans can significantly increase the recovery charges of recyclable resources. This trend is expected to progress the accessibility of high-quality recycled fibre, thus supporting the development of the uncoated recycled paperboard market. Improved recycling infrastructure not only increases the source of raw resources but also raises a circular economy, where wastage is decreased, and materials are reused.

Segmental Insights

Why Did Medium Weight (0.20 mm - 0.30 mm) Segment Dominate the Uncoated Recycled Paperboard Market in 2024?

The medium weight (0.20 mm - 0.30 mm) segment holds a dominant presence over the uncoated recycled paperboard market in 2024 due to the balance between strength as well as light weight. The rising e-commerce trend has influenced the lightweight packaging market, which enhances the demand for medium-weight uncoated recycled paperboard packaging of the products. This type of packaging is extensively used in electronics, consumer goods, and cosmetic sectors. The growing demand for flexible packaging materials has raised the demand for such packaging, with this thickness essential to maintain the quality of the product.

The lightweight (Below 0.20 mm) segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The growing online delivery system has raised the demand for lightweight packaging materials that are eco-friendly as well.

Why Does the Food and Beverages Segment Dominated the Uncoated Recycled Paperboard Market?

The food and beverages segment holds a considerable share of the uncoated recycled paperboard market in 2024 due to the growing demand for extending the shelf life of food and beverages. The rising storage of food products has raised the concern for enhanced level packaging, which has led to an increase in the demand for the uncoated recycled paperboard market. The major food and beverage companies started using such packaging due to the rising concern of consumers towards biodegradable and compostable packaging. This helps the market players to enhance their brand value and attract a huge number of consumers.

The cosmetic and personal care segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. There is a wide usage of cosmetic and personal care products, which compels market players to develop packaging that can last for a longer period. These packages help brands attract huge customers due to the rising concern for eco-friendly product packaging.

Why Does the Consumer Goods Segment Dominate the Market?

The consumer goods segment leads the uncoated recycled paperboard market due to the growing concern towards eco-friendly packaging of the products. There are several government initiatives which has raised awareness about the adverse effects of packaging on the environment, and have aware people to use packaging that has less or no adverse impact on the environment.

The healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The rising healthcare infrastructure and continuous innovation in this field have raised the demand for packaging to protect the products from damage due to any external factors. The growing demand to enhance the storage period of the products has raised the consumption of uncoated recycled packaging.

Regional Insights

Presence of Recycling Infrastructures in North America Promotes Dominance

North America held the largest share of the uncoated recycled paperboard market in 2024, due to the presence of recycling infrastructures. Moreover, the growing customer demand for environment-friendly packaging solutions is influencing manufacturers in this region to accept uncoated recycled paperboard in their product deliveries. The status of this region deceits in its capacity to set trends in sustainability and drive the worldwide market dynamics.

U.S. Uncoated Recycled Paperboard Market Trends

The U.S. uncoated recycled paperboard market is growing steadily as companies adopt fiber-based, environmentally friendly packaging. Wider URB adoption is being driven by strong demand from the food e-commerce and household product sectors, as well as stringent sustainability goals. The U.S. has a stable wastepaper supply and an established recycling ecosystem. The U.S. keeps using cutting-edge recycling technologies to boost board performance and increase production capacity.

Asia Pacific’s Rising Ecological Awareness Supports Growth

Asia Pacific is estimated to grow at the fastest rate in the uncoated recycled paperboard market during the forecast period. This is rising due to the growing awareness regarding the ecological issues among people in this region. The growing adoption of sustainable products has raised the demand for this market in countries such as India, Japan, China, and several others.

India Uncoated Recycled Paperboard Market Trends

In India, the uncoated recycled paperboard market is rising rapidly due to the expansion of FMCG e-commerce and the growing pressure to use less plastic packaging. Although issues like low wastepaper recovery and reliance on imports still exist, URB is preferred due to its affordability and recyclability. Nonetheless, government backing for eco-friendly packaging and enhanced recycling programs is accelerating market expansion in a number of significant industries.

Europe Paper & Paperboard - Adjusted Statistical Data Table (2022)

(Values in million tonnes)

| Category |

Adjusted 2022 Value (million tonnes) |

Approx. Change |

| Total Production |

95.1 |

Slight decline |

| Apparent Consumption |

90.3 |

Nearly stable |

Production by Grade

| Grade / Sub-category |

Adjusted 2022 Production |

Adjustment |

| Graphic Grades (Total) |

24 |

Slightly lower |

| – Uncoated Woodfree Paper |

7.3 |

−0.1 |

| – Coated Paper |

8.2 |

−0.1 |

| – Newsprint |

4 |

−0.1 |

| Sanitary & Household Papers |

8.2 |

0.1 |

| Packaging Materials (Total) |

55.4 |

−0.4 |

| – Case Materials |

33.8 |

−0.2 |

| – Cartonboard |

11.8 |

0.1 |

Apparent Consumption by Grade

| Grade / Sub-category |

Adjusted 2022 Consumption |

Adjustment |

| Graphic Grades (Total) |

22 |

Slightly lower |

| – Uncoated Woodfree |

7.1 |

0.1 |

| – Coated Papers |

6.7 |

−0.1 |

| – Newsprint |

4.3 |

0.1 |

| Sanitary & Household Papers |

8.2 |

0.1 |

| Packaging Materials (Total) |

52.5 |

0.3 |

| – Cartonboard |

9.5 |

0.1 |

| – Case Materials |

33.8 |

0.1 |

Trade - Packaging Papers

| Trade Flow |

Adjusted 2022 Value |

Adjustment |

| Exports |

35.8 |

−0.3 |

| Imports |

32.7 |

0.2 |

Europe’s paper and paperboard market still reflects a year of pressure from high energy costs and expensive raw materials. Overall production shows a moderate decline, mainly driven by weaker output in graphic grades and case materials. Sanitary papers and cartonboard remain more resilient, showing slight growth.

Consumption remains relatively stable, with packaging materials holding up better than graphic papers. Trade patterns highlight a mild reduction in exports and a small uptick in imports, reflecting tighter fibre availability and shifting supply chains.

Top Companies in Uncoated Recycled Paperboard Market

Latest Announcements by the Uncoated Recycled Paperboard Market

- In May 2025, President and CEO Ole Rosgaard expressed, “Closing this facility was not an easy decision, especially knowing the effect it has on our team members, their families, and the surrounding community. I want to sincerely thank our Los Angeles colleagues for their hard work and commitment over the years. As we move forward, our focus is on providing meaningful support, including severance benefits and career transition resources, to help them through this change.” (Source: Packaging Dive)

New Advancements in the Market

- On 26 March 2024, Grief, a top leader in industrial packaging solutions and services, revealed that it has completed its previously announced acquisition of Ipackchem Group SAS. (Source: GlobeNewswire)

- On 10 March 2025, Sonoco Products Company revealed a USD 70 per ton price increase for all grades of uncoated recycled paperboard in Canada and the United States, effective from 10 April 2025, because of growing input costs and market conditions too. (Source: Nasdaq)

- In September 2024, Koehler Paper announced the launch of a new high‐quality product range made for tea packaging, offering the perfect solution to the high demand for organic tea and sustainable packaging alternatives on the tea market. (Source: Packaging Strategies)

Uncoated Recycled Paperboard Market Segments

By Thickness

- Medium weight (0.20 mm - 0.30 mm)

- Lightweight (Below 0.20 mm)

By Application

- E-Commerce

- Consumer Goods and Electronics

- Industrial and Heavy-Duty

- Others

By End Use

- Consumer Goods

- Retail

- Manufacturing

- Healthcare

- Education

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait