Recycled Aluminum Packaging Market Size, Share, Trends, and Growth Forecast

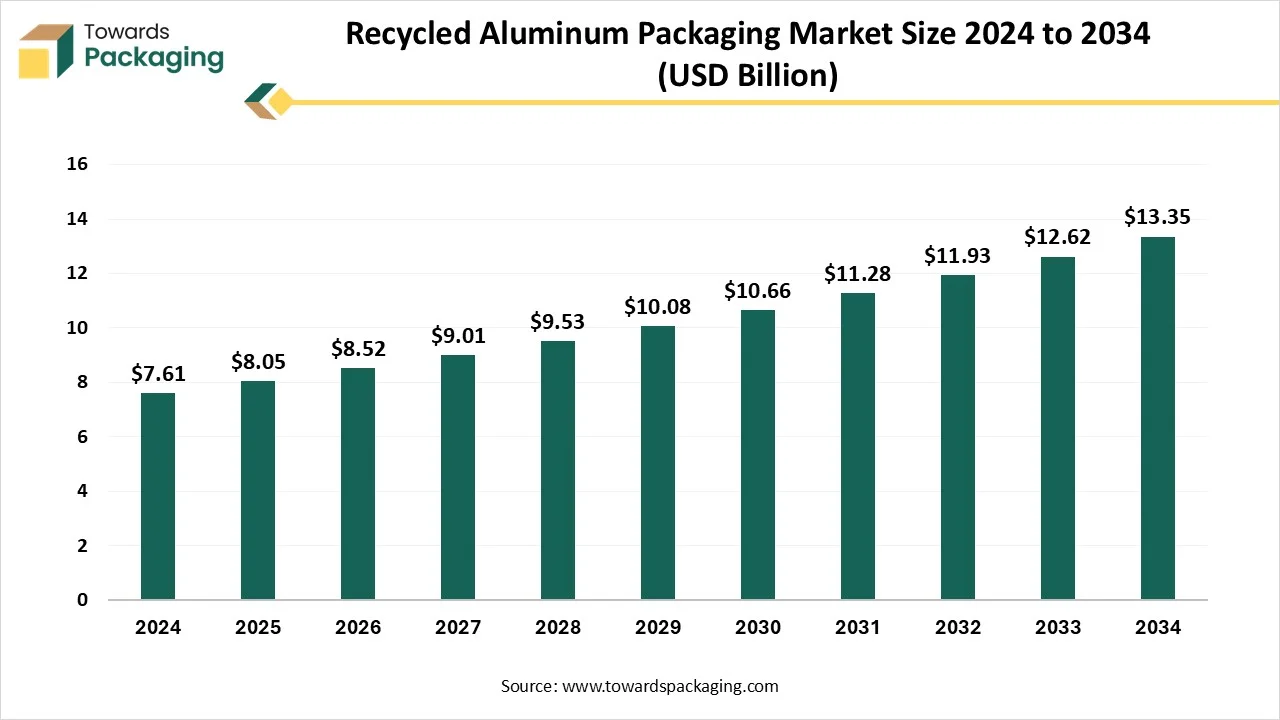

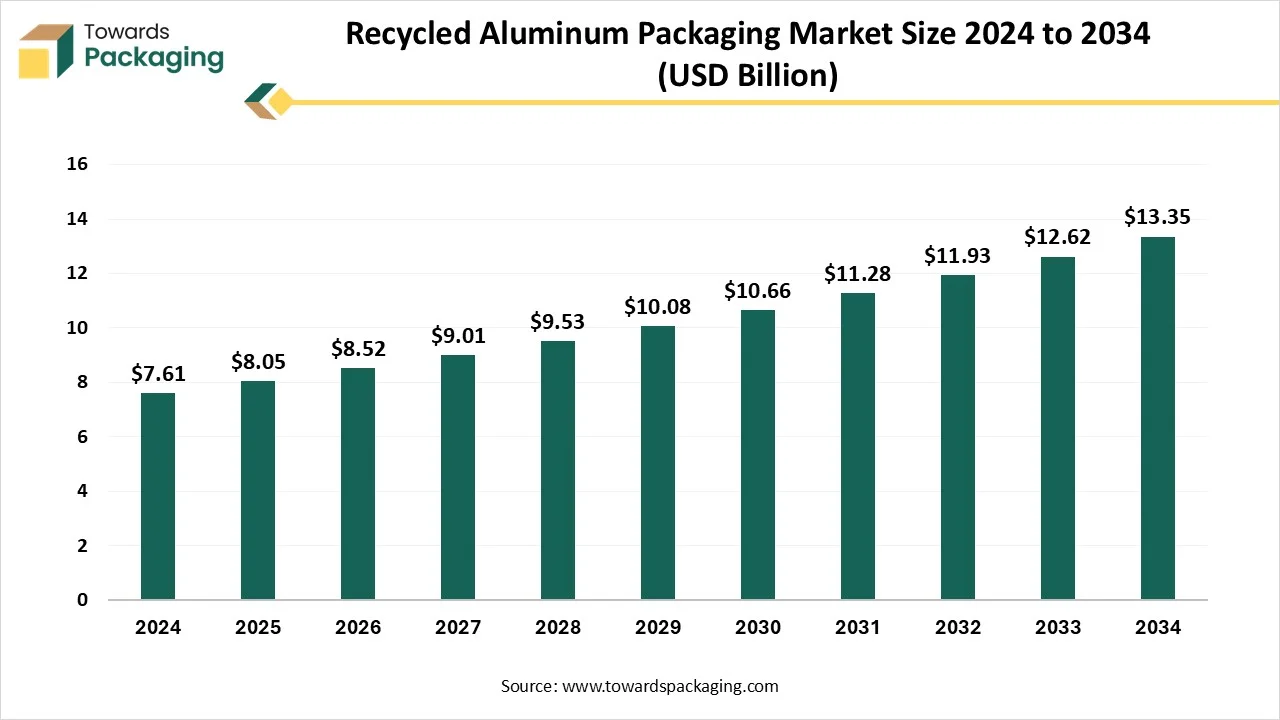

The recycled aluminium packaging market is projected to grow from USD 8.05 billion in 2025 to USD 14.12 billion by 2035, at a CAGR of 5.78%, and our report covers every aspect including detailed market size evaluation, segment-wise performance analysis, and regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It also provides competitive landscape mapping, company profiles, manufacturing and supplier intelligence, trade flow data, and complete value chain assessment for informed decision-making.

Key Takeaways

- In terms of revenue, the market is valued at USD 8.05 billion in 2025.

- The market is projected to reach USD 13.35 billion by 2035.

- Rapid growth at a CAGR of 5.78% will be observed in the period between 2026 and 2035.

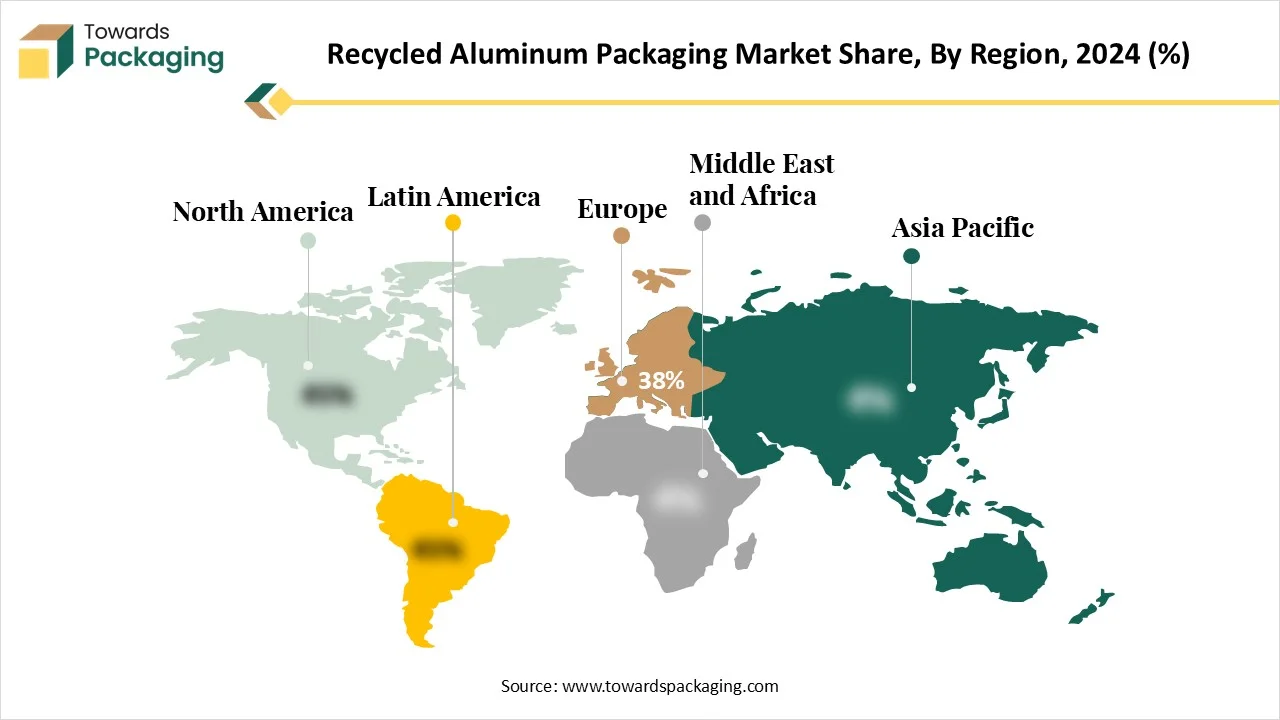

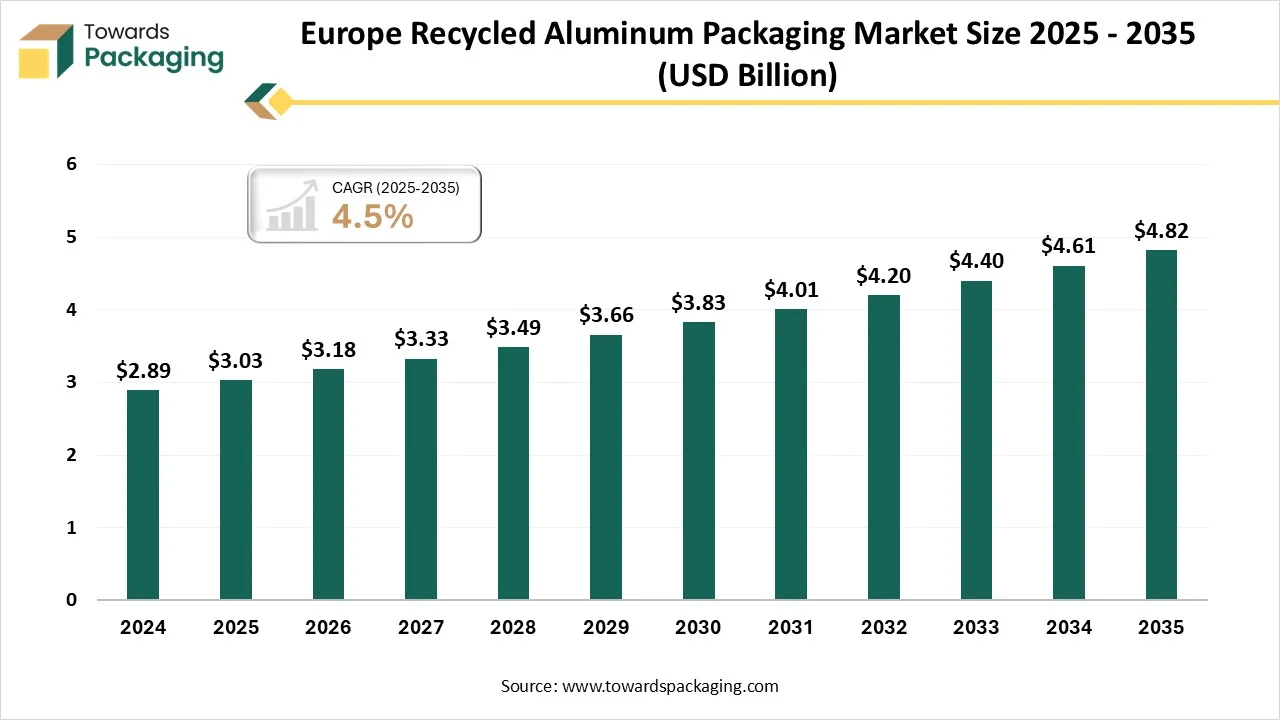

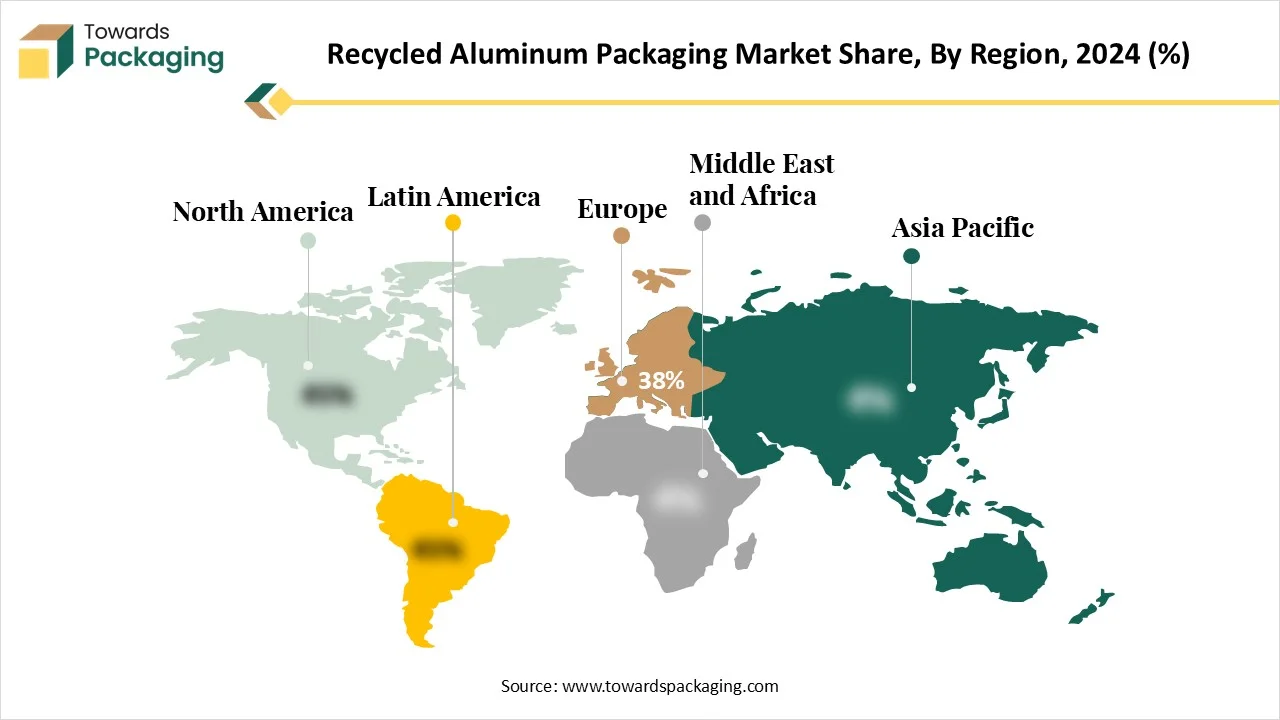

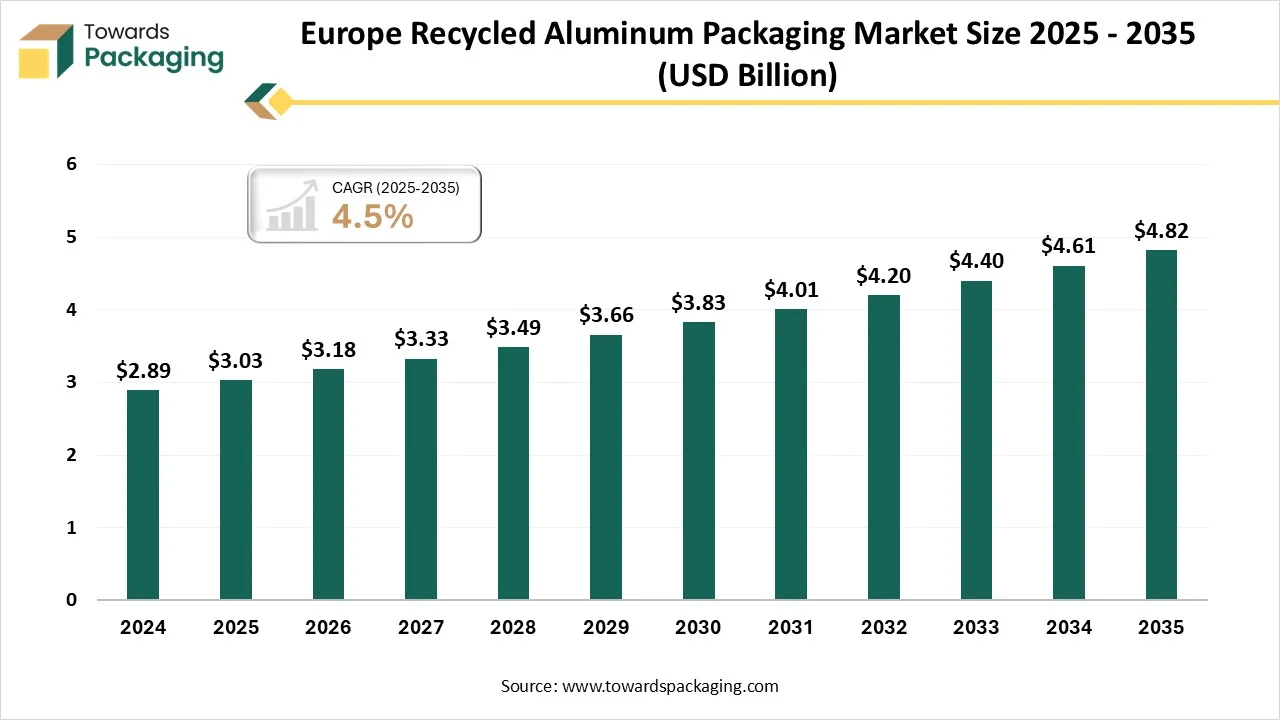

- Europe dominated the global market with the largest revenue share of 38% in 2024.

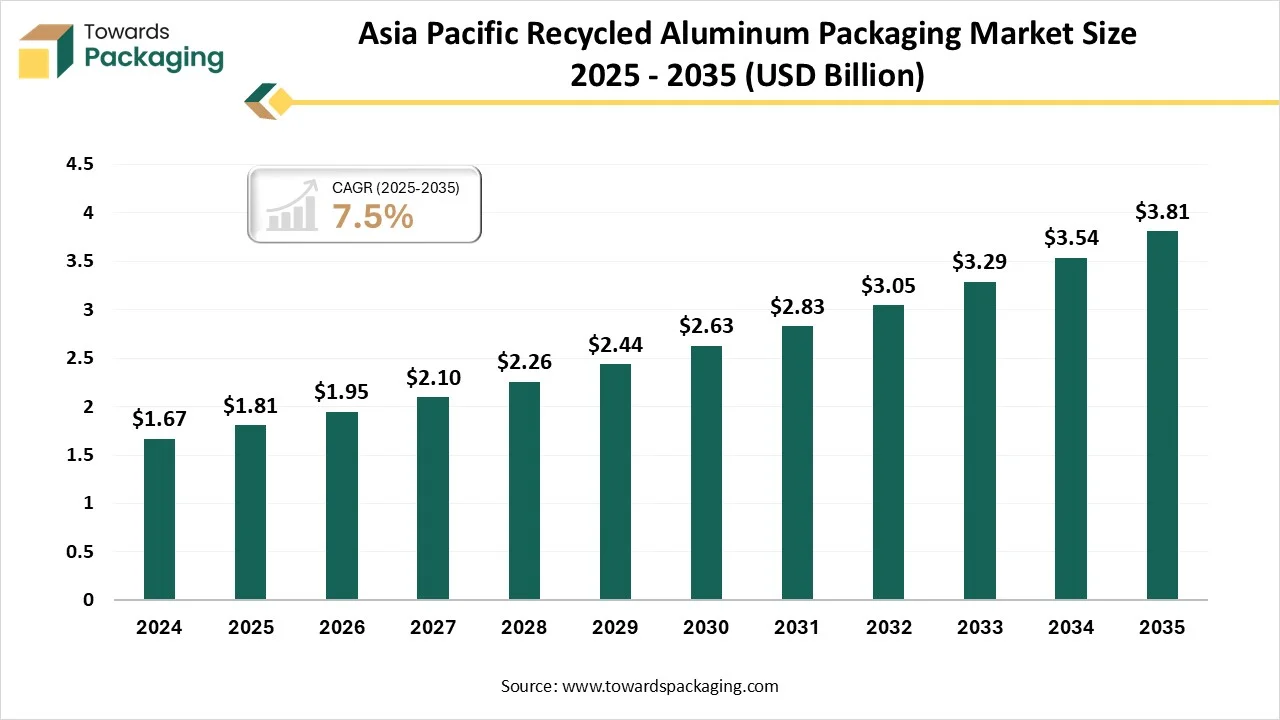

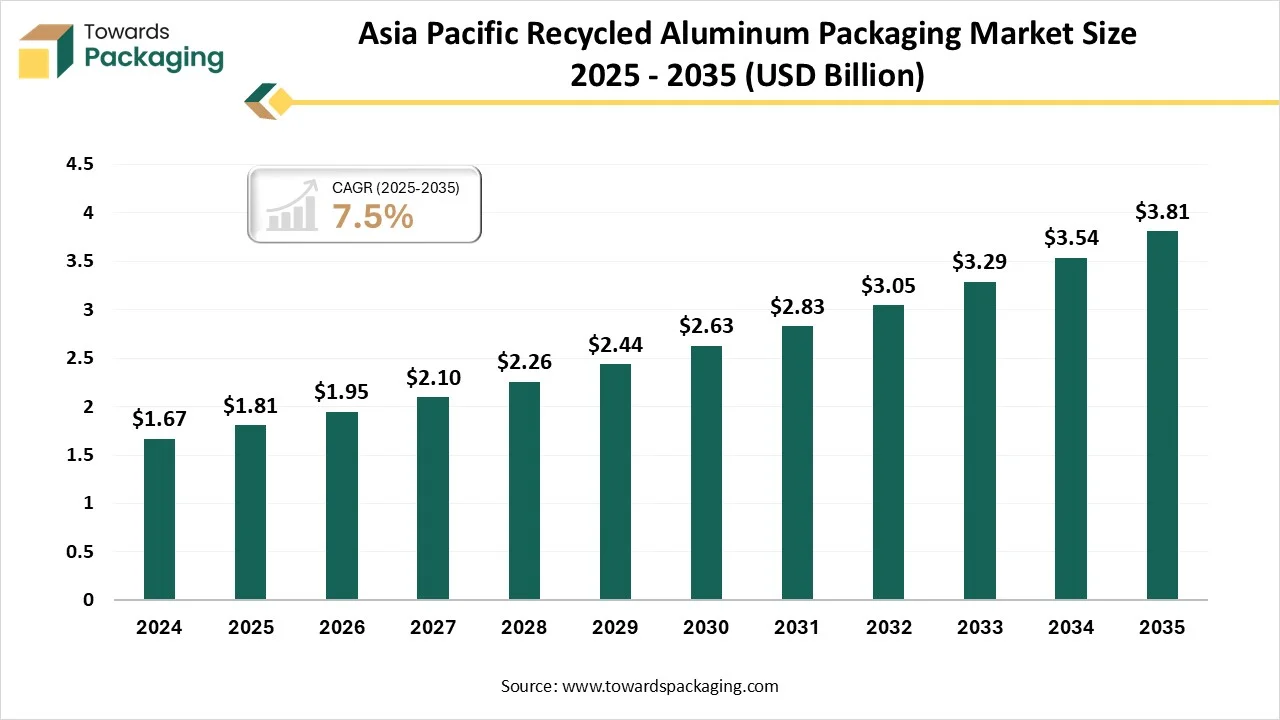

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the beverage cans segment contributed the biggest revenue share of 45% in 2024.

- By packaging type, the tubes and bottles segment will expand at a significant CAGR between 2025 and 2034.

- By application, the food and beverage segment contributed 58% revenue share in 2024.

- By application, the pharmaceutical and cosmetic packaging segment is expected to grow rapidly in the coming years.

- By recycling source, the post-consumer recycled segment dominated with the 63% recycled aluminium packaging market share in 2024.

- By recycling source, the post-industrial recycled segment is expected to grow significantly over the studied period.

- By packaging format, rigid packaging dominated the market by a 52% share in 2024.

- By packaging format, the flexible foil packaging segment is expected to rise significantly over the upcoming years.

- By end-use industry, food and beverage dominated the market by a 60% share in 2024.

- By end-use industry, the cosmetics and personal care segment is predicted to grow significantly over the period.

Market Overview: Advantages it offers

The Recycled Aluminum Packaging Market focuses on the use of secondary (recycled) aluminum to manufacture various types of packaging products such as cans, foils, trays, tubes, and bottles. Recycled aluminum offers nearly the same physical and chemical properties as primary aluminum while consuming up to 95% less energy during production. It is favored for its infinite recyclability, lightweight, corrosion resistance, and low environmental footprint.

Aluminum is one of the most recyclable materials on Earth. Just like any other material, aluminum can be recycled several times without losing its original properties. Recycled aluminum is manufactured by melting down used aluminum products, such as window frames, beverage cans, facades, doors, and even automobile parts, and repurposing them into the latest forms.

Recycled Aluminium Packaging Market Trends

- Superior barrier properties: Aluminium is dense to three of the most destructive agents in air, nature-light, and moisture. So, when food and beverages are stored in aluminium packaging, they remain fresh for a longer time than in plastic containers (as plastics permit light).

- Greater Recyclability: Aluminum recycling takes a very small percentage of the energy needed for manufacturing the same amount of raw material. So, aluminum suppliers can supply recycled aluminum for packaging without consuming or wasting much energy. Aluminum packaging leads to a 97% shrinkage in greenhouse gas emissions as compared to the manufacturing of virgin aluminum raw materials.

- Food grade safety: Food and beverages inside food grade aluminum packaging stay secure to consume, just like in plastic packaging, in which microplastics continuously extract from food materials. Hence, in aluminum packaging, extremely acidic food or highly salty (like pickles, highly acidic lime juice, etc) should be avoided as they can react with aluminum and bring about the element to seep into food.

- Lightweight Packaging Solutions: Recycled aluminum packaging is gaining attention as a lightweight and eco-friendly solution in different industries, especially in food and beverage. It significantly lowers transportation costs and carbon emissions, making it perfect for sustainable logistics. Despite being lightweight, aluminium offers excellent barrier properties in protecting contents from light, air, moisture, and oxygen.

- Regulatory pressure and climate goals: Aluminum packaging is heavily influenced by the regulatory framework and overall climate goals. Governments and environmental companies are reinforcing strict regulations around emissions, sustainable sourcing, and recyclability. The global aluminium industry is experiencing an important transformation as environmental sustainability has become a focus of policy and industrial approach.

- Economic resilience: Aluminum‘s recyclability is unmatched. Nearly 75% of all aluminium ever generated is still in use today, underscoring its longevity and circular potential. But beyond its limitless recyclability, aluminum's role in the circular economy expands far deeper and better. Generating aluminum from recycled foil and material needs 95% less energy than primary aluminium manufacturing and results in only 5% of the linked carbon emissions.

AI Integration in Recycled Aluminium Packaging Market

Artificial Intelligence is more than just an industry jargon. In metal recycling, it shows a paradigm transformation. Instead of just depending on chemical composition or density. AI-powered systems explain visual patterns and structural indications. Like manual sorters utilise their eyes, the CLARITY AI system uses similar optical features, which are quick and more constant. These systems utilise high-quality visible light cameras integrated with deep learning algorithms trained on thousands of real-world samples. The outcome is a machine that can classify materials depending on subtle differences in shape, texture, surface properties, and contour, even without any color differences. Sheet metal, cast aluminium, and extrusion profiles may all appear grey to the naked eye. But AI can still optimize small differences like reflectivity, surface smoothness, manufacturing marks, and edge geometry.

Aluminum is essential in microchip manufacturing due to its extraordinary electrical properties and thermal conductivity. These elements make aluminium perfect for maintaining staple operations in high-performance computing and dispersing heat in the surroundings. Furthermore, its corrosion resistance and lightweight nature make it a selected choice for packaging and other components in microchips.

Market Dynamics

Market Driver

Aluminium Cans Are The Main Character

The growing consumption of cans is heavily due to the growing demand for beverage packaging. Sector experts point to several factors that drive this trend. Primary is growing user demand for single-serving, portable drinks. As per the research, organizations built up global production capacity following the pandemic, given the demand for at-home beverages. At-home drinking became less, hence, after the COVID-19 Lockdown ended, users returned to restaurants and bars. In reverse, beverage makers are now shifting to aluminum as a marketing effort to sell their drinks to users.

Market Restraint

Sorting And Collection Is The Challenge

One of the primary challenges in aluminum recycling is pollution. Aluminium products often have impurities and are integrated with other materials, which can complicate the recycling procedure. For example, aluminum cans can have coatings or labels that must be removed before recycling. Contaminated scrap can reduce the quality of the recycled metal, making it less useful for high-quality uses. Effective sorting and collection of aluminum waste are important for successful recycling. Hence, insufficient infrastructure and incompetent waste management systems can lead to aluminium waste, resulting in landfills. Furthermore, mixed recycling bins can result in aluminum being toxic with other materials, further complicating the recycling procedure.

Market Opportunity

Growing Awareness Regarding Environment

The demand for aluminum recycling is increasing due to growing awareness of environmental problems and the benefits of recycling. The benefits of aluminum recycling expand beyond energy savings. Recycling aluminium assists the environment by lowering the demand to mine and process new raw materials. It promotes a circular economy by making sure that aluminum products can be constantly reused, thus lowering landfill waste and reducing resource decrease. Recycling aluminum lowers the need for raw material extraction, minimizes environmental effects, and energy usage. The aluminum recycling procedure assists in protecting resources and lowering greenhouse gas emissions, meeting the global sustainability goals. Recycling aluminum utilises only 5% of the energy required to make new aluminum, but it still has similar properties to the original metal. In fact, aluminum can be recycled over and over again without losing any of its quality.

Segmental Insights

Packaging Type Insights

How Did The Beverage Can Segment Dominate The Recycled Aluminium Packaging Market in 2024?

Beverage cans segment dominated the market in 2024, as aluminium cans in Beverage serve a different blend of characteristics that make them perfect for a variety of soft drinks, energy drinks, beer, mineral water, cocktails, and even dairy-based beverages. Their potential to chill quickly, protect carbonation, and block light and oxygen makes them perfect for other designs from a product quality standpoint. But it's environmental advantages that set them apart in the current sustainability-driven world. Aluminum is 100% recyclable and can be processed again endlessly without any limitation or degradation in quality. For users, Aluminum cans in beverages offer durability, convenience, and aesthetic appeal. For brands, they serve as an excellent canvas for labelling, printing, and branding, crucial for visibility in crowded retail spaces.

Tubes and bottles segment expects the fastest growth in the recycled aluminium packaging market during the forecast period. The personal care and cosmetics industry is heavily focused on sustainability, with packaging playing a crucial role in shaping the brand's surrounding reputation. Every refill of the aluminum bottle, a pump allegedly saves up to 21.9 g of plastic, lowering plastic waste by 56.7% as compared to standard 13.5 oz plastic bottles. For instance, a well-known brand, Uni, which serves a closed-loop system utilising a reusable aluminium dispenser and refills created from 100 % recycled aluminum, is available for body wash, shampoo, and personal care products. These instances accurately showcase how aluminum not only aligns with product protection demands and hygiene but also visibly assists a brand's green loyalty. , an increasingly resolute factor in the worldwide personal care products.

Application Insights

How Did The Food And Beverage Segment Dominate The Recycled Aluminium Packaging Market In 2024?

The food and beverage segment dominate the market in 2024. Aluminum cans are mainly lighter and serve as a more streamlined packaging solution. This not only lowers the travelling costs but also lessens carbon emissions, meeting with global efforts to lower environmental effects. For food and beverage companies, the reduced weight results in savings in logistics, as well as carrying and storage costs. This factor also enables more effective storage and assembling, assisting retailers in saving valuable shelf space. Lighter packaging also looks to online businesses seeking to update shipping costs, as the lighter cans decrease overall parcel weight.

Pharmaceutical and cosmetic packaging segment expects the fastest growth in the recycled aluminium packaging market during the forecast period. Aluminum packaging is gaining attention in the pharmaceutical industry due to rising environmental issues and sustainability goals. With aluminium being 100% recyclable without losing quality, pharma companies are increasingly focusing on recycling aluminium foils, blister packs and tubes used in packaging. Cosmetic aluminum bottles are heavily reusable and recyclable, making them a perfect sustainable choice which assists in reducing waste. These bottles protect our cosmetics from light, oxygen and air and expand their shelf life and ensure product safety. The slim design of aluminium bottles develops the aesthetic look of products, serving them a luxury look which users appreciate.

Recycling Source Insights

How Did The Post-Consumer Recycled Segment Dominate The Recycled Aluminium Packaging Market in 2024?

The post-consumer recycled segment dominate the market in 2024. Post-consumer recycled content (PCR) is the usual term for materials created from recycled products that have already been utilised by users. These products may include paper, aluminum, cardboard boxes, plastic bottles, and more. The urge for post-consumer recycled content is heavy for a reason. These materials serve a crucial role for packaging producers seeking to implement eco-friendly initiatives that do not mainly change their production or distribution procedures. The main advantage of post-consumer recycled is a lesser environmental impact. PCR reduces energy usage by at least 79% as compared to manufacturing regular packaging materials.

Post-industrial recycled segment expects the fastest growth in the recycled aluminium packaging market during the forecast period. Post-Industrial recycled fits every demand, processing, and recycling route. Aluminum packaging needs to be classified from other packaging materials when designed for material recycling. A rising number of sorting facilities are filled with eddy current separators that serve as an overall means of classification of the aluminum fraction. Multi-material packaging systems can have tinplate, plastics, beverage cartons, and paper packaging, rather than aluminum packaging, eg, beverage cartons. Different systems have been made to take out aluminum from complicated packaging systems, like mechanical pyrolysis, separation, and repulping.

How Did The Rigid Packaging Segment Dominate The Recycled Aluminium Packaging Market In 2024?

Rigid packaging segment dominated the market in 2024; Rigid packaging is perfect at serving durable security throughout the supply chain so that products come to the customer in a similar condition as they leave the factory. This is a crucial protective packaging quality for sensitive items such as electronics and glass containers, as their chances of being damaged during transit or storage are lowered. Avoiding product loss and fewer product returns are perfect for the bottom line and strengthen user trust. It also provides more than protection; it serves different advantages as an evergreen medium for branding. Classifying a product in such a busy market can be difficult, but with the potential to craft tailored shapes and finishes, organisations can stand out from the shelf.

Flexible foil packaging segment expects the fastest growth in the recycled aluminium packaging market during the forecast period. One of the main reasons that aluminium flexible foil is selected for flexible packaging is its accurate barrier characteristics. It makes a shield that efficiently barricades oxygen, light, and moisture, which can all negatively affect product quality. Light discovery, for example, can result in photodegradation in confidential items like cosmetics and food, changing their flavor, colour, and nutritional value. Alike, oxygen exposure outcomes in products to oxidize or spoil, resulting in degradation, especially in food products that contain oils and fats. By avoiding these elements from reaching the product, aluminum foils assist in making sure a longer shelf life and managing freshness.

End-Use Industry Insights

How Did The Food And Beverage Industry Segment Dominate The Recycled Aluminium Packaging Market in 2024?

The food and beverage industry segment dominated the market in 2024. Recycled aluminium is a prevalent material utilised for food packaging due to its versatility. One of its main benefits is its potential to behave as an effective barrier, preventing food from exposure to air and light and tracking the quality. Also, aluminium packaging is conveniently recyclable and can be personalised to meet particular user demand in terms of patterns and size. These elements make aluminium a perfect choice for food packaging in various settings. There are different additional advantages of utilising aluminum for food and beverage packaging. Colourful packaging of aluminum boxes and cans frequently sells perfectly, as users generally choose a particular product because they are enticed by its design and packaging.

Cosmetics and personal care segment expects the fastest growth in the recycled aluminium packaging market during the forecast period. The beauty industry is progressively shifting to aluminum packaging for most of the packaging in the cosmetic sector. This trend is due to aluminum packaging's different mixture of functionality, aesthetic appeal, and environmental advantages. As users and brands alike became more eco-friendly aware, the urge for a sustainable packaging solution has never grown. Aluminum packaging delivers numerous benefits, making it a popular choice for packaging raw materials utilised in the cosmetic industry. The growth of aluminium tubes in the personal care sector exists in their eco-sustainable profile. The choice for end consumers for green packaging is a fact that cosmetic organizations use packaging which can be quickly recognised as 'green' as it's good for the environment.

Regional Insights

How Did Europe Dominate The Recycled Aluminium Packaging Market?

Europe dominated market in 2024. The aluminum recycling is one of the most successful sectors in green policy: the complete recycling rate for just aluminium beverage cans in the European Union, United Kingdom, Norway, Switzerland, and Iceland was 74.6% in the year 2025, having a record of 580,000 tonnes. Furthermore, recycling aluminium requires 95% less energy than the manufacturing of raw material, leading to a significant reduction in CO2 emissions. The environmental advantages are precise by expanding the life cycle of Aluminum with the assistance of recycling. The field reduces resource removal and assists an honest circular economy.

Asia Pacific expects the fastest growth in the recycled aluminium packaging market during the forecast period The packaging sector in India is quickly expanding, and in terms of aluminium packaging, it is also developing. It plays an important role in the packaging of pharmaceutical and food products. Variations in the aluminum packaging have a direct effect on the packaging sector. On the other hand, China makes the most use of aluminium than any other country in the world. Hence, regulatory pressures and emission decrease efforts have led to a major role in aluminium manufacturing potential. Due to this, aluminum prices in China have grown due to a developed supply chain. This move showcases a main opportunity for establishing an aluminum recycling business in India.

Top Companies in the Recycled Aluminium Packaging Market

Industry Leader Announcement In The Industry

- In June 2025, Meadow revealed a collaboration with aluminium solutions provider Novelis, as it became one of the company's supply chain partners, whose goal is to increase the recycled materials utilised in Meadow's pre-fill solution.

- In April 2025, Saint James Iced Tea, the fastest rising iced tea brand in the United States, revealed a major packaging growth at the start of this month. The brand revealed 100% recyclable aluminium bottles, apart from its past tetra packaging. This emphasizes sustainable manufacturing, while continuing to serve the luxury organic iced tea, which defines its leadership in the department.

Recent Developments

- In December 2024, Ball Corporation, a top provider of sustainable aluminum packaging for personal care, beverages, and home products, revealed its partnership with Dabur India, one of the most iconic and long-term consumer goods organizations established over 135 years ago for the launch of Real Bites in the recyclable aluminum cans in Indian Market.

- In June 2025, TUBEX disclosed the world's first applicator tube created completely from a single piece of recycled aluminum, designed for use with beauty products in the lip and eye areas.

Segmentation of the Recycled Aluminium Packaging Market

By Packaging Type

- Cans

- Foil Wraps

- Household & Catering Foil

- Pharmaceutical Blister Foil

- Tubes

- Bottles

- Trays

- Caps & Closures

By Application

- Food & Beverage Packaging

- Carbonated Drinks, Energy Drinks

- Canned Foods (Vegetables, Soups, Ready Meals)

- Frozen Meals

- Pharmaceutical Packaging

- Blister Packs

- Sachet Wraps

- Cosmetic & Personal Care Packaging

- Deodorant Sticks

- Lotion Bottles

- Toothpaste Tubes

- Household Product Packaging

- Pet Food Packaging

- Industrial Chemicals (limited use)

By Recycling Source

- Post-Consumer Recycled (PCR) Aluminum

- Post-Industrial Recycled (PIR) Aluminum

By Packaging Format

- Rigid Packaging

- Semi-Rigid Packaging

- Flexible Foil Packaging

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Household Products

- Pet Food

- Industrial Chemicals

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japa

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait