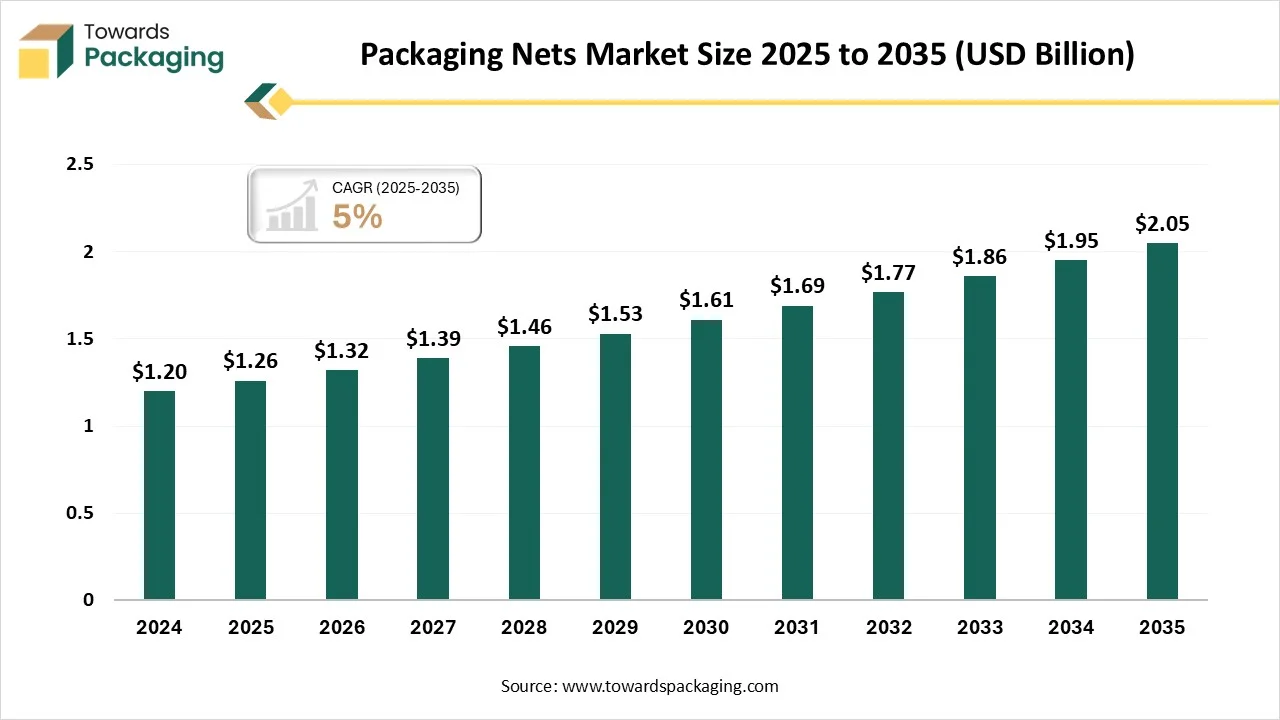

The packaging nets market is forecasted to expand from USD 1.32 billion in 2026 to USD 2.05 billion by 2035, growing at a CAGR of 5% from 2026 to 2035. There is a huge demand for packaging nets is growing suggestively owing to extension of the meat and seafood industry and the development of e-commerce. Growing ecological worries are boosting industries to accept more environment-friendly choices. This has resulted in enhanced innovation in compostable, recyclable, and biodegradable nets.

The packaging nets involves mesh-based flexible packaging materials used for protecting, storing, and transporting products like fruits, vegetables, shellfish, firewood, and industrial goods. These nets are typically made from polyethylene (PE), polypropylene (PP), or other polymers. The market is driven by growing demand for sustainable, lightweight, and breathable packaging solutions. Increasing adoption in agriculture and food industries, along with innovations in recyclable and compostable net materials, supports market expansion, particularly across Europe and Asia-Pacific regions.

| Metric | Details |

| Market Size in 2025 | USD 1.32 Billion |

| Projected Market Size in 2035 | USD 2.05 Billion |

| CAGR (2025 - 2035) | 5% |

| Leading Region | North America |

| Market Segmentation | By Material, By Packaging Type, By Application and By End-Use Industry |

| Top Key Players | LC Packaging International BV, NorPlex, Intermas, Giró Group, MAAR, SWM, Starlinger Group, Lenzing, NNZ Group, Extraco NV, LenoPack Industries, Norplex Inc., Tenax Corporation, SWM International, Industrial Netting Inc |

The growing demand for smart packaging with RFID and NFC, IoT integration, and digital watermark has influenced innovation process in the production technology of the packaging nets market. Advancement in the manufacturing technology with 3D-printed technology has boost the growth of this market. Nanomaterials are utilized to generate packaging which enhance shelf life, displays food condition, and can self-repair.

For instance, Satya Group develop agricultural nets named under category Agro Net which ensures strength, durability, and UV resistance. It utilized progressive machinery and advanced technology to grow consistent goods that endure harsh weather situations and offer constant crop protection.

The major raw materials utilized in this market are high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and polypropylene (PP).

The component manufacturing in this market comprises additives, labels, tags, sealing and cutting machines.

This segment comprises distribution of raw materials with less shipping charges.

The polyethylene (PE) segment dominated the market with highest share in 2024 due to its chemical and moisture resistance properties, and its durability. It offers protective shield to moisture, tearing, and chemicals which makes it suitable for safeguarding and defensive a wide range of products at the time of transportation and storage. It is comparatively low-cost to produce, offering to its extensive utilization across several industries.

The polypropylene (PP) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its superior properties, recyclability, and versatility. These are extensively utilized because of their excellent tensile strength, superior chemical resistance, flexibility, and durability. It is a recyclable resource, positioning with rising worldwide sustainability trends and guidelines endorsing a circular economy. These are cost proficient, and recyclable materials and these properties makes polypropylene the increasing preference for packaging nets.

The extruded nets segment dominated the market with highest share in 2024 due to versatility, cost-effectiveness, and durability. It is driven by its efficacy of their production process and their capacity to offer breathability and visibility to the products. These are lightweight, cost-operative, and their engineering process permits for robust, even mesh buildings. These are formed by forcing liquefied plastic over a die, which generates a constant mesh.

The raschel nets segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its customization option, breathability, and durability. These are manufactured by compelling molten plastic over a die, generating an unchanging mesh. Their extensive utilization across several applications, comprising shellfish, fruits, vegetables, and industrial goods, influences their top most market situation.

The tubular nets are the fastest-growing in the market, as it comprises automatic and semi-automatic packaging technology. These are appropriate for an extensive variety of products, comprising confectionery, fruits, vegetables, and nuts, it can be modified in various size and color. These are easy-going and it can be offered on rolls, creating them easy to manage and utilize in several clipping machines.

The fruits & vegetables segment dominated the market with highest share in 2024 due to its protective, breathable, and lightweight nature. This segment plays an important role in maintaining the freshness of the products at the time of transportation and storage, with requests for a huge variety of products such as soft fruits, citrus fruits, and onions. The rising trend for pre-packaged and ready-to-eat fresh foods also pays to this supremacy. These nets are perfect for defending delicate products such as soft fruits from bruising and crushing at the time of handling and transportation.

The seafood segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to large-scale commercial fishing operation which require protective storage. The increasing consumption of sea food due to its nutritive properties and rising health awareness. Huge production demand safe storage of the products which enhance the demand for this market.

The firewood is the fastest-growing in the market, as it comprises biodegradable and sustainable packaging. There is an increasing demand for environment-friendly choices, comprising bags which are made up from natural fibers such as jute or cotton, or produced from biodegradable or recycled plastics. The firewood packaging machine is observing development, representing a shift in the direction of more effectual, automated packing solutions for steady handling and sizing.

The food & beverages segment dominated the market with highest share in 2024 due to increasing demand for bottled or packaged products. This packaging ensures ventilation and protects from damage to the products from several external factors. It is driven by rising worldwide consumption and the requirement for tamper-proof and sterile packaging. The increasing customer demand, the requirement for advanced and sustainable packing, and strict guidelines on food security.

The agriculture segment expects the fastest growth during the forecast period. This segment is growing due to increasing utilization of nets for the protection of crops. It is driven by the requirement to guard crops from harsh weather, pests, and birds while enlightening yield superiority. These nets help control sunlight and moisture, generating an exact atmosphere that helps in healthy plant development.

The industrial is the fastest-growing in the market, as it comprises cost-effective and light weight packaging solution. These are reliable for the protection of huge quantity of products. The demand for enhancing shelf life of several products and protection from adverse condition these nets are widely accepted.

North America held the largest share in the packaging nets market in 2024, due to increasing demand for freshly produced food products. Bulk transportation and packaging with maintained freshness and integrity have influenced the growth of this market. The rising demand for freshly produced products, like vegetables and fruits, influences the requirement for packaging nets to preserve them fresh through transportation. Producers are emphasizing on generating packaging that enhances pattern for lightweight resources and decreased packaging mechanisms, further contributory to the development of packaging nets.

Rising concern towards sustainable packaging production has evolved the demand for packaging nets in the U.S. There is a robust customer preference and rising supervisory pressure in the U.S. to decrease one-time use plastic waste. The U.S. has an important market for fresh seafood, fruits, and vegetables, influenced by health-aware customer preferences. The thriving in online grocery shop and home delivery facilities needs packaging, which is protective, lightweight, and durable at the time of transit. Their flexibility to unevenly shaped objects made them an adaptable packing solution across diverse sectors.

Rising urbanization and industrialization has raised the demand for the market. The increasing agriculture industry, with high quantity of vegetables and fruits exports, generates a high demand for breathable and defensive packing. Moreover, increasing disposable earnings and an increasing customer base are fuelling demand across food and consumer goods businesses. The extension of current retail transversely the region, attached with a rising customer base, is growing the demand for packed products and progressive packaging resolutions.

Increasing e-commerce sector has boosted the development process in the market in China. It emphasizes on sustainability and reviewed plastic ban are boosting companies to invent and accept recyclable and biodegradable packaging nets. This is generating new occasions for companies that can offer environment-friendly substitutes. These utilize less raw materials yet provide superior protection which attract a wide range of consumers towards this market.

The major factors influencing the growth of market are strict government guidelines, rising ecological concern, and expansion of e-commerce sector. There is an increasing customer preference for freshly produced vegetables, seafood, and fruits, which need enhanced packaging solutions that provide suitable airflow and prevention to enhance shelf life and protect from spoilage. Packaging nets are suitable for this purpose, providing a balance of visibility, breathability, and protection. It provides an effective and safe way to transport unpreserved and unevenly shaped product, fulfilling the exact demands of online trade logistics.

There is a strong demand for sustainable packaging in Germany which fuelled the development of the market. Some major benefits of these nets are it provide breathability and material efficacy. It offers functional benefits, mainly in the food market, which is responsible for high market share of the usage of packaging net. Customers can easily observe the product without opening the packing, which helps in value examination and builds reliability.

The major factors influencing the growth of the market in Middle East & Africa is increasing demand for the consumption of freshly produced products. There is an increasing consumer fondness for high-quality fresh vegetables, fruits, and various other perishable products in the region. These packaging nets are important in shielding these products at the time of shipping, reducing damage, and preserving freshness by offering essential airflow, which influences their demand in the agricultural sectors. These are utilized to safeguard product quality during shipping through some challenging logistics ways.

Presence of huge food & beverages industry in Dubai there is a huge demand for enhanced quality packaging net for safe transportation of products. It helps in maintaining the quality and make transportation cost-efficient. The major manufacturers are investing profoundly for innovation in this market. It boosts the production of eco-friendly packaging net and expands its adoption.

The packaging nets market in Latin America is experiencing steady growth. Key markets include Brazil, Mexico, and Argentina, driven by expanding agricultural exports, particularly fresh produce and seafood, which require breathable, protective packaging. Synthetic nets dominate the region due to durability and cost-effectiveness. Market growth is supported by increasing demand from food and non-food industries, improved logistics, and export activities.

Mexico seen a significant growth in the market. This growth is primarily driven by the dominant synthetic material segment, which holds the largest share and is expected to expand fastest during this period. Key supporting factors include Mexico’s expanding agricultural exports and foodprocessing packaging demand, alongside increasing industrial activity and logistics needs.

By Material

By Packaging Type

By Application

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026