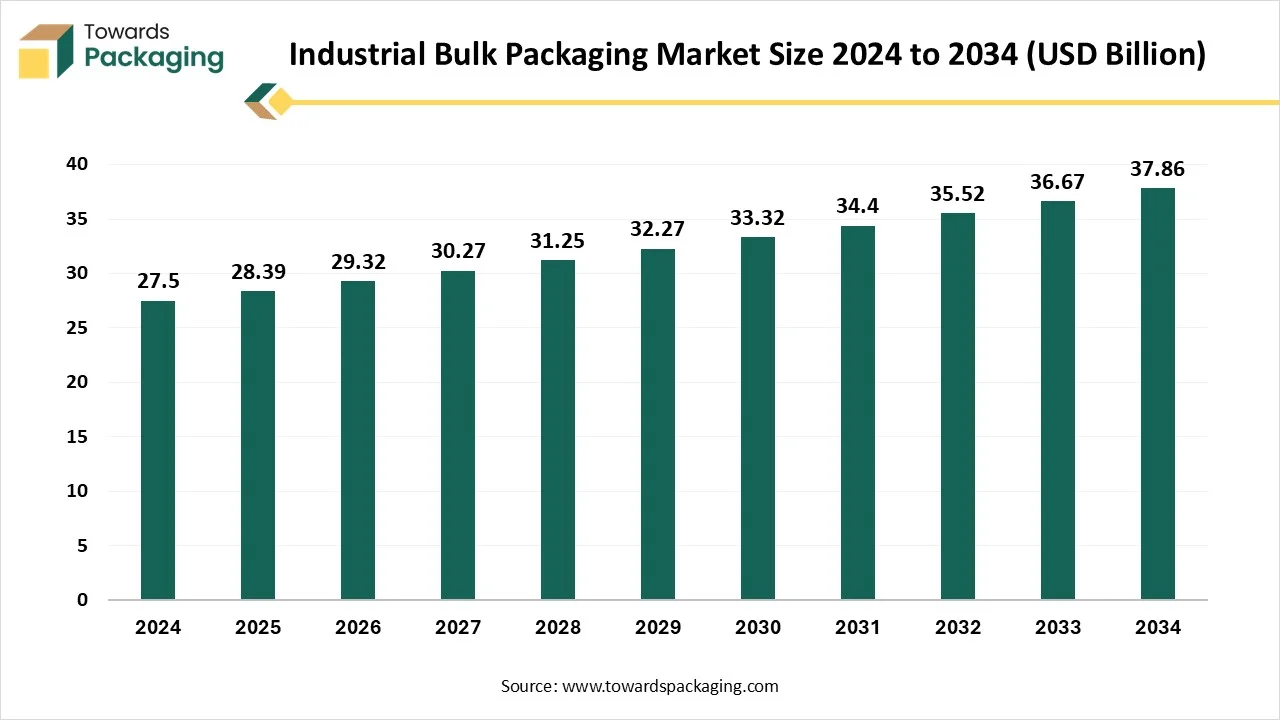

The industrial bulk packaging market is forecasted to expand from USD 29.32 billion in 2026 to USD 39.10 billion by 2035, growing at a CAGR of 3.25% from 2026 to 2035. The report provides a detailed analysis of packaging types (drums dominant, flexitanks fastest-growing, IBCs, tote tanks, tank trucks), materials (plastic dominant, metal, HDPE, stainless steel, aluminum), oil types (hydraulic oil 2024 dominant, transformer oil growing), and end-use industries (chemicals & petrochemicals 2024 major share, pharmaceuticals growing, automotive, industrial machinery).

Regional coverage includes Asia Pacific leading, Europe growing, North America, Latin America, and MEA, along with top manufacturers Greif, Mauser Packaging Solutions, SCHÜTZ, Time Technoplast, Snyder Industries, SIA Flexitanks, value chain analysis, global trade flows, and annual production statistics (Asia Pacific 3,880M units, Europe 2,330M, North America 2,040M, LATAM 820M, MEA 620M).

Industrial bulk oil packaging refers to the packaging solutions used to store, transport, and dispense large volumes of oil, such as engine oils, lubricants, base oils, hydraulic oils, and transformer oils for B2B use (manufacturers, OEMs, heavy equipment users, etc.)

| Metric | Details |

| Market Size in 2025 | USD 28.39 Billion |

| Projected Market Size in 2035 | USD 39.10 Billion |

| CAGR (2026 - 2035) | 3.25% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Type, By Material, By Oil Type, By End-Use Industry and By Region |

| Top Key Players | Greif, Inc., Mauser Packaging Solutions, SCHÜTZ GmbH and Co. KGaA, Balmer Lawrie and Co. Ltd., Time Technoplast Ltd., Snyder Industries, SIA Flexitanks Ltd. |

| Indicator | Statistical Value |

| Global industrial goods shipped annually | 78 trillion kg |

| Share shipped in bulk packaging formats | 46% |

| Industrial bulk-packaged goods volume | 35.9 trillion kg |

| Bulk packaging units produced annually | 9.2 to 9.8 billion units |

| Core bulk packaging formats | Drums, IBCs, FIBCs, sacks, pails |

As technology continues to evolve, AI integration holds great potential to revolutionize the industrial bulk packaging market by enhancing sustainability, efficiency, and accuracy. AI is reshaping how industrial bulk packaging processes are designed, executed, and optimized, which leads to increased cost savings, reduced waste, and improved overall quality control. AI not only meets the evolving consumer demands but also lowers the environmental footprint. AI-driven vision systems are significantly assisting in scrutinizing the packaging for defects. The use of machine learning (ML) algorithms detects imperfections and improves the quality of packaged goods. Therefore, AI-powered systems can predict maintenance needs and optimize production, leading to a reduction in waste and an increase in overall productivity.

How is the Rising Globalization and Industrialization Impacting the Market’s Growth?

The rising globalization and industrialization are expected to boost the growth of the industrial bulk packaging market during the forecast period. The rising globalization and industrialization have led to an increased need for efficient and secure packaging solutions that can handle large volumes of products across various industries. Several businesses operating in industries such as food and beverage, chemical, oil and gas, and pharmaceutical industries are widely adopting industrial bulk packaging to protect high-volume goods while handling, storing, and transportation, and also focus on aligning with evolving environmental regulations. Thus, driving the market’s growth during the forecast period.

Limited Recycling Capacity

The limited recycling capacity associated with advanced technologies is anticipated to hamper the market's growth. Several countries, particularly middle and lower-income countries, have very limited recycling capacity, which increases the regulatory pressure to adopt environmentally friendly bulk packaging solutions. Moreover, the industrial bulk packaging requires a long cleaning validation time. Such factors are likely to limit the expansion of the global Industrial bulk packaging market.

Growing Focus on Sustainability and Rapid Technological Innovation

The surge in environmental concerns and the implementation of stringent regulations are promoting the increasing use of eco-friendly packaging materials and designs. Several prominent companies are increasingly investing in R&D to develop sustainable, lightweight, and intelligent packaging solutions. Additionally, the rapid technological innovation in materials science and packaging technologies improves safety, efficiency, and sustainability. The advancements in packaging technology, including the development of intermediate bulk containers (IBCs) and several other innovative solutions, improve the versatility, safety, and efficiency of industrial bulk packaging. Therefore, the rising shift towards recyclable bulk packaging significantly reduces their carbon footprint and contributes to a circular economy.

| Region | Annual Production (Million Units) |

| Asia-Pacific | 3,880 |

| Europe | 2,330 |

| North America | 2,040 |

| Latin America | 820 |

| Middle East & Africa | 620 |

The plastic segment held the majority of the market share in 2024. Plastic packaging is widely used owing to its durability, strength, lightweight, cost-effectiveness, ease of mass production, and adaptability across various industries. Its lightweight and affordability nature assists in lowering the transportation costs and enhances handling efficiency, which plays a vital role in industrial bulk packaging. Numerous organizations widely prefer plastic packaging to reduce production costs while protecting against contamination or unfavourable environment, and maintaining the integrity of the product throughout the supply chain. Moreover, the rapid advancements in plastic manufacturing technologies and the increasing focus on improving the material’s strength and sustainability significantly enhance the production of eco-friendly plastic packaging.

The hydraulic oil segment registered its dominance over the global Industrial bulk packaging market in 2024. The rapid globalization and industrialization in emerging economies, along with the rise in oil consumption, are expected to create substantial demand for safe transportation and storage of hydraulic oils, driving the growth of the segment during the forecast period. Hydraulic oil is most widely used in several industrial applications due to its large number of benefits, such as powering the forks that lift heavy goods.

On the other hand, the transformer oil is expected to witness remarkable growth during the forecast period. This packaging plays a crucial role in storing and distributing transformer oil. Transformer oil is commonly supplied in steel drums or barrels. Transformer oil is widely used for insulation and cooling in electrical transformers. Industrial bulk packaging ensures safe storage and transport, and prevents oil spills as well as protects from contamination and moisture. Thus, bolstering the segment’s growth.

The drums segment is expected to dominate the market with the largest share in 2024. Drums make the packaging the most secure, safe, durable, and reliable, which makes them an ideal choice for storing and transporting a wide range of industrial goods, such as oils, chemicals, oils, food and beverage products, and others. Drums offer robust protection against contamination and damage to products, ensuring the safe handling of both non-hazardous and hazardous materials. They are widely available in various sizes with different materials, such as plastic, steel, metal, and fiber, which enhances their appeal across various industries. Moreover, the ease of handling and their reusability and recyclability attributes assist in promoting the circular economy.

On the other hand, flexitanks are anticipated to grow at the fastest CAGR, owing to their versatility, cost-effectiveness, and efficiency to safely and securely transport liquids, minimizing the risk of leaks and contamination. Flexitanks are specifically designed for transporting non-hazardous bulk liquids, including industrial chemicals, food-grade products, and other bulk liquids. Flexitanks are flexible and large containers widely used to transport liquids in standard shipping containers. In the food and beverage industries, flexitanks are most often used to transport liquids like edible oils, wine, fruit juices, and other food-grade products. Such factors are propelling the segment’s growth during the forecast period.

The chemicals and petrochemicals segment held a dominant presence in the industrial bulk packaging market in 2024, owing to the increasing demand for efficient and safe transportation of chemical and petrochemical products. Chemicals and petrochemical industries increasingly require industrial bulk packaging solutions to ensure the safety of products, prevent oil spills or contamination, and comply with stringent regulatory standards. Intermediate bulk containers, drums, and other bulk packaging solutions are gaining immense popularity for handling hazardous and non-hazardous chemicals, providing robust protection during storage and transportation.

On the other hand, the pharmaceuticals and healthcare segment is expected to grow at a notable rate. The growth of the segment is mainly driven by the rising need for reliable and secure packaging solutions to store and transport pharmaceutical products. The stringent regulatory requirements implemented by various governments and regulatory bodies ensure the maintenance of product integrity during handling, storing, and transportation. Thus, driving the market’s growth in the coming years.

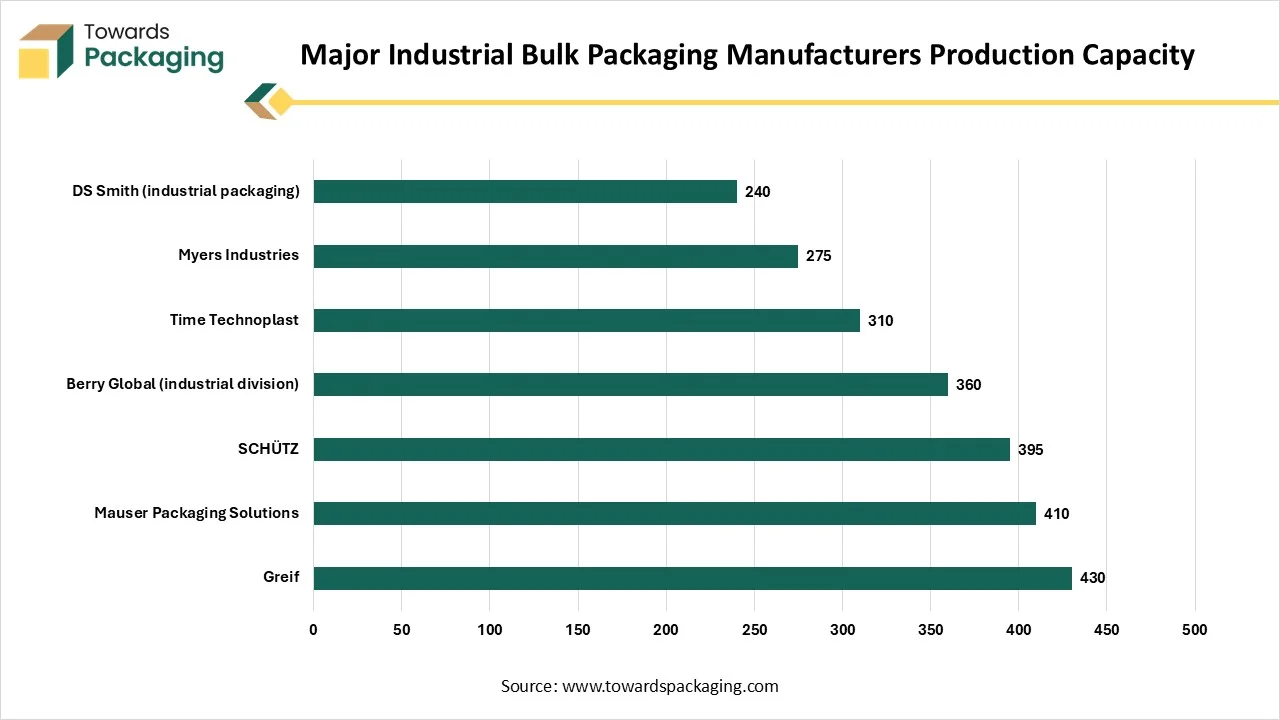

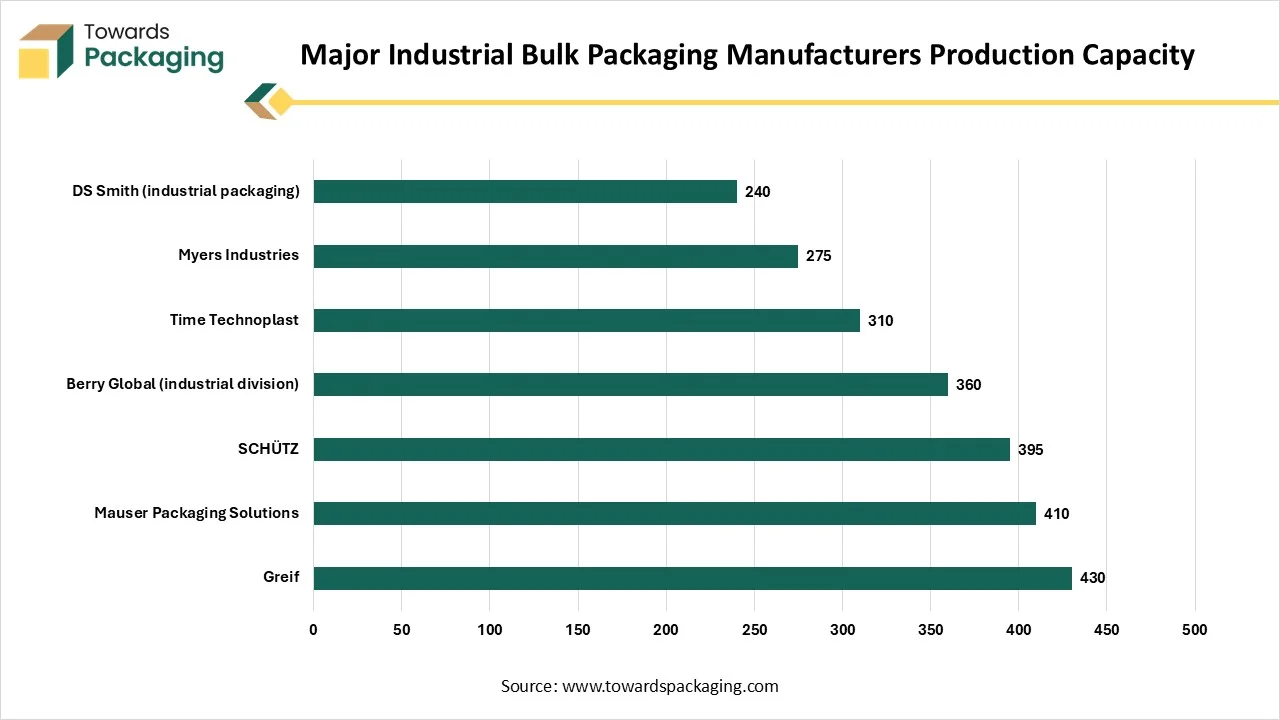

| Manufacturer | Headquarters | Annual Capacity (Million Units) |

| Greif | United States | 430 |

| Mauser Packaging Solutions | Luxembourg | 410 |

| SCHÜTZ | Germany | 395 |

| Berry Global (industrial division) | United States | 360 |

| Time Technoplast | India | 310 |

| Myers Industries | United States | 275 |

| DS Smith (industrial packaging) | United Kingdom | 240 |

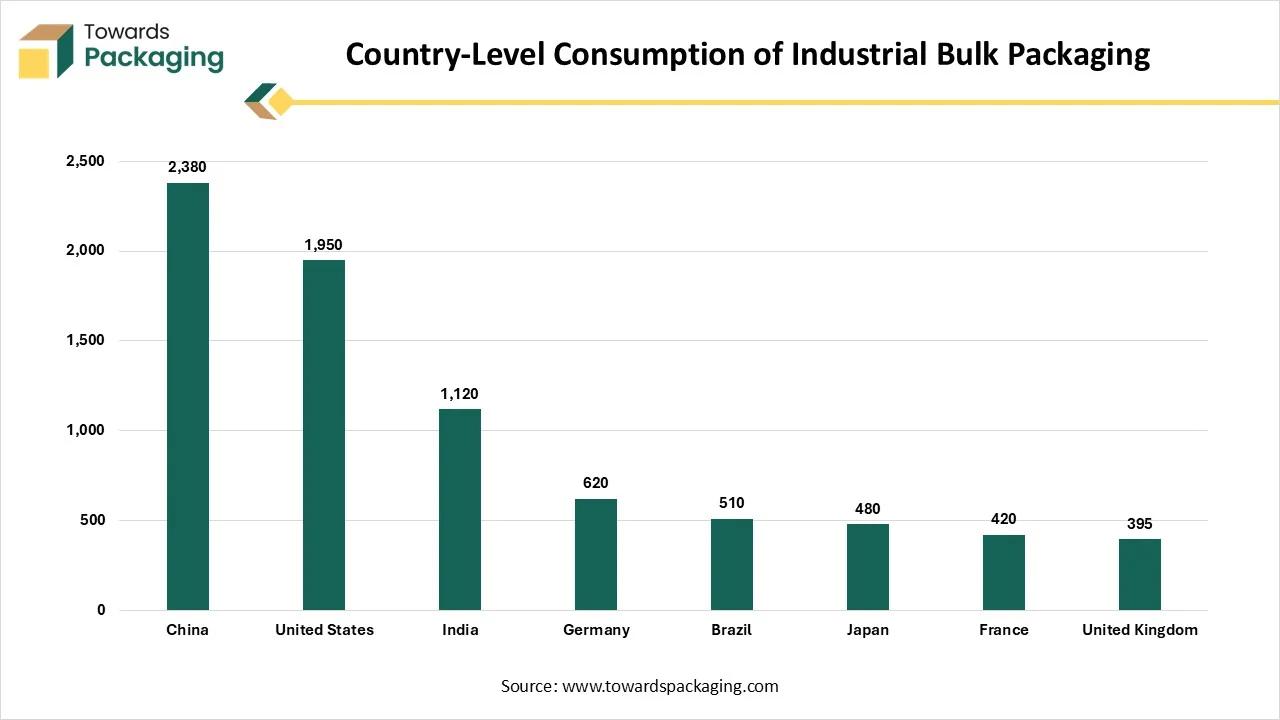

Asia Pacific held the dominant share of the Industrial bulk packaging market in 2024. Asia Pacific has a strong presence of well-established food and beverage, oil and gas, pharmaceuticals, and chemical industries, all are major users of Industrial bulk packaging solutions. The rapid urbanization and industrialization in countries such as China, India, South Korea, Vietnam, and Japan have significantly increased the demand for durable and efficient packaging solutions. Additionally, the rising demand from the pharmaceutical sector is expanding rapidly, fuelled by the increasing healthcare needs and surging investments to advance healthcare infrastructure by governments and key market players, necessitating reliable bulk packaging. Furthermore, the expanded manufacturing capabilities, rising focus on advancing in packaging technology, and the government's favourable policies encourage the utilization of eco-friendly packaging materials and designs to lower the carbon footprint and boost environmental sustainability. These factors are expected to propel the market’s growth in the Asia Pacific region during the forecast period.

On the other hand, Europe is expected to grow at a significant rate in the market during the forecast period. The growth of the region is attributed to the growing demand for efficient and reliable packaging solutions, the growing popularity of bio-based plastics, and rising innovation in materials science and packaging technologies. Government in the region increasingly encourages the use of sustainable packaging practices, which has led to an increasing focus of businesses on reusable and eco-friendly packaging to reduce waste and promote circular economy principles. The rising integration of smart packaging technologies such as printed sensors, NFC tags, Radio Frequency Identification (RFID), and other advanced technologies enables real-time tracking and inventory management. The surge in cross-border trade and rising industrial activities has significantly influenced the market’s revenue in the European region. In addition, the rising demand from pharmaceuticals, food and beverages, petrochemicals, and others is anticipated to fuel the regional market’s growth during the forecast period.

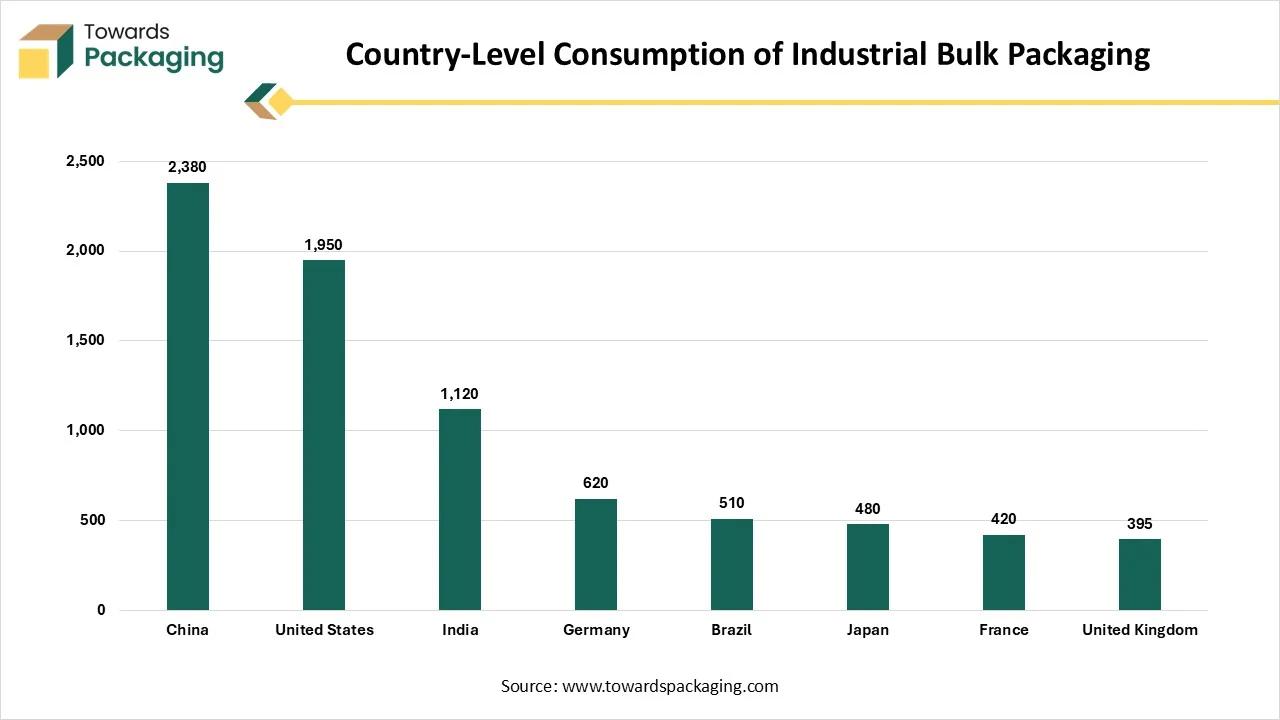

| Country | Annual Consumption (Million Units) |

| China | 2,380 |

| United States | 1,950 |

| India | 1,120 |

| Germany | 620 |

| Brazil | 510 |

| Japan | 480 |

| France | 420 |

| United Kingdom | 395 |

By Packaging Type

By Material

By Oil Type

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026