Plastic Free Packaging Market Size and Regional Production Analysis

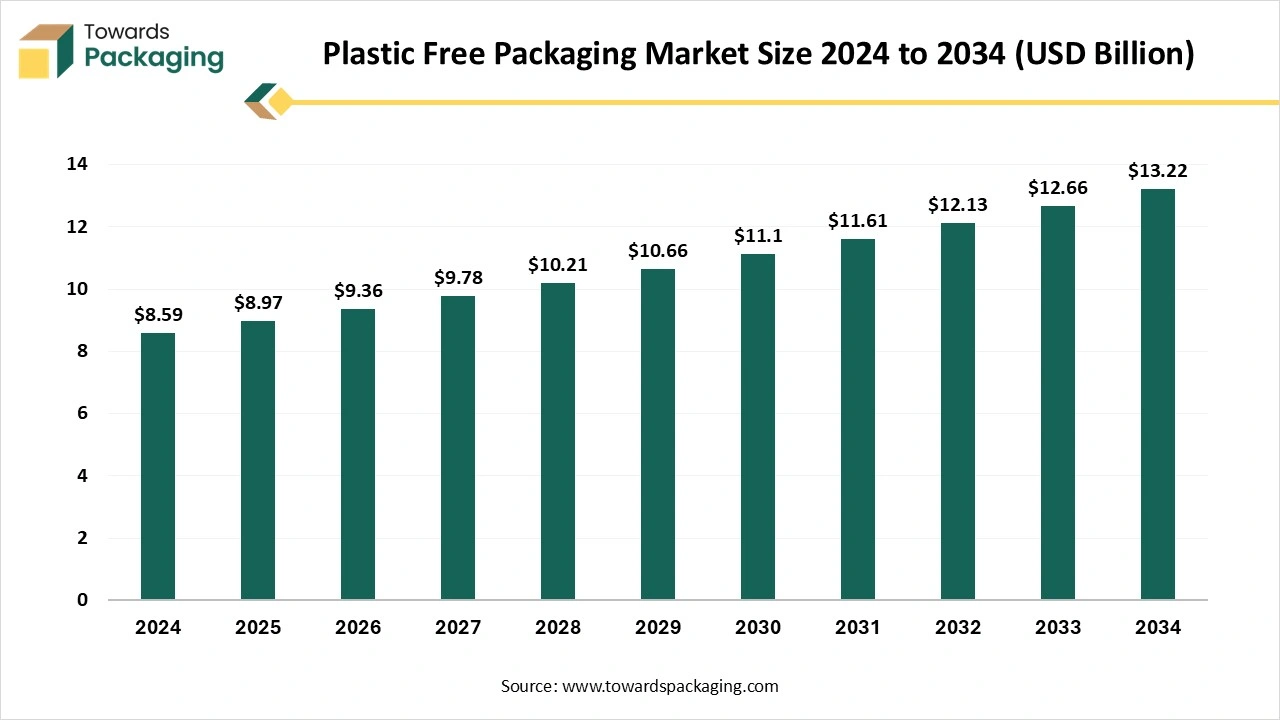

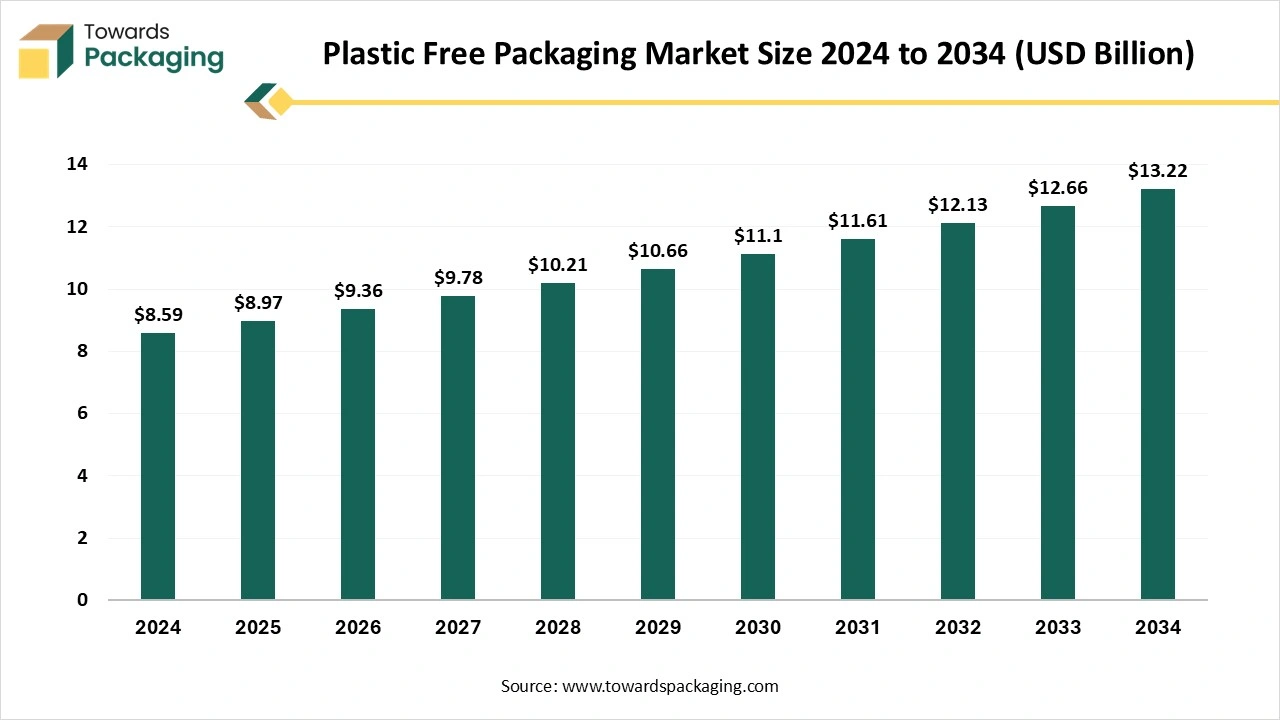

The plastic-free packaging market is forecasted to expand from USD 9.36 billion in 2026 to USD 13.79 billion by 2035, growing at a CAGR of 4.4% from 2026 to 2035. This analysis includes detailed segmentation by packaging type, materials, and end-user industries, along with extensive regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

It also examines emerging trends such as nano-cellulose packaging, algae-based plastics, and AI-driven optimization, while offering competitive profiling of companies like Mondi, Amcor, WestRock, Smurfit Kappa, and Huhtamaki. The report further covers trade flows, supplier networks, manufacturing capacity, and value chain structure, giving a holistic view of market dynamics.

Key Takeaways

- In terms of revenue, the market is valued at USD 8.97 billion in 2025.

- The market is projected to reach USD 13.22 billion by 2034.

- Rapid growth at a CAGR of 4.4% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the plastic-free packaging market in 2024.

- North America is expected to host the fastest-growing market in the coming years.

- By packaging type, the rigid packaging segment dominated the market in 2024.

- By packaging type, the flexible packaging segment is expected to grow rapidly during the forecast period.

- By material, the paper packaging segment led the global market in 2024.

- By material, the glass packaging segment is predicted to grow rapidly.

- By end-user, the food and beverages segment dominated the market in 2024.

- By end-user, the pharmaceutical packaging segment is growing rapidly.

Plastic-Free Packaging Market Overview: The Rise of Plastic-Free Packaging

Plastic-free packaging simply means utilizing alteration materials like cardboard or paper to package products instead of plastic, which is totally safe for the environment. The crucial reason why organizations are moving towards plastic-free packaging is that it is recyclable and regenerative. With the growth in recycling establishments in many countries globally, it is easier than before for organizations to recycle their waste products.

Plastic-free packaging is considerable for the environment. It is made of recycled material and is fully disposable at the end. No further waste is made during the production procedure, and less plastic gives rise to ends up in landfills and oceans, where it pollutes the ecosystem and harms wildlife too. Heavy retailers are also shifting towards sustainability as they target the “Target Zero“ program that assists users in choosing products with environmental advantages, and on the other hand, Walmart's “Built for Better” and Amazon’s “Climate Pledge Friendly” initiative do the same.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2025 | USD 8.97 Billion |

| Projected Market Size in 2035 | USD 13.79 Billion |

| CAGR (2025 - 2035) | 4.4% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Type, By Material, By End-User Industry and By Region |

| Top Key Players | Mondi, Amcor PLC, WestRock Company, Sealed Air Corporation, Smurfit Kappa, Huhtamaki OYJ, Tetra Pak International S.A. |

Plastic-Free Packaging Market Trends

- Nano-cellulose is derived from plant fibers and possesses great power, biodegradability, and lightweight characteristics, too. Its heavy surface area and different mechanical properties make it perfect for making flexible, strong, and translucent films for product packaging. Its fence elements can be developed to guard against gases and moisture, which extends the shelf life of packaged goods.

- Plant proteins are being incorporated into biodegradable films and coatings. This equipment is not only biodegradable but also edible and biocompatible, which makes it perfect for food packaging and medical uses. These protein films can be created to have different properties like strength, flexibility, and waterproofing that make them evergreen for various types of packaging.

- Algae-based plastics are rising as a sustainable alternative to regular plastics. It comes from algae biomass, as these are biodegradable materials and have a smaller carbon footprint than petroleum-based plastics. Algae-based plastics are perfect where packaging demands are durable and flexible, too.

- Active and smart packaging techniques are being incorporated into biodegradable packaging solutions to grow their functionality. Active packaging includes integrating substances that communicate with the contained product to expand its shelf life or improve its quality.

AI Integration in the Plastic Free Packaging Market

Artificial Intelligence is in the middle of this move, which changes how packaging is crafted, made, and served. -AI is assisting businesses that lower packaging waste, ship products, and reduce costs more effectively. As it accepts this aim, it also slows down linked warehousing, freight, and labor prices. While several companies solve EPR regulations by moving to eco-friendly materials, the most specific outcome that pops up from lowering overall packaging volume.

Tech -machinery systems created using AI can do this using machine learning to examine shipping demand like weight, fragility, and product dimensions. The system then decides the specific packaging size needed for shipping and automatically lowers and arranges a box to it. With actual time data, organizations can ship products in the minimal possible container without compromising protection. AI-powered packaging serves a rigid return on investment (ROI) by reducing material costs, minimizing freight expenses, and updating warehouse space, as businesses can gain specific general savings.

Plastic-Free Packaging Market Dynamics

Driver

Driving the shift: How awareness and legislation drive sustainable packaging

The force for sustainable packaging has gained attention in recent years because of intensified awareness of environmental issues like waste and pollution. Businesses and users are under similar pressure to directly solve the effects that regular conventional packaging material can have on the surroundings, specifically plastics. This roaring awareness and outcome lifestyle transformations have paved the way for a rising shift in user selection towards plastic sustainability and products that diligently minimize harm and conceivable effects on the planet. The latest legislations play a crucial role in vigorously growing the acceptance of sustainable packaging. As environmental issues rise, government regulations are becoming stricter to moderate the effects of packaging material, specifically plastics. For instance, to this,

The “Break Free From Plastic Pollution” bill is a featured piece of legislation that moves the shift towards sustainable packaging predominant to this bill is the description of extended producer responsibility (EPR) and this stereotype carries producers and manufacturers accountable for the complete lifecycle of their products, from the primary stage to last.

Restraint

Challenges concerning cost, durability, and decomposition issues

Producing plastic-free packaging totally depends on natural raw materials, which leads to the high cost of generating green packaging alternatives. The manufacturing procedure also adds disbursement rather than the price of creating regular plastic. Due to this, the cost of making plastic-free packaging runs approximately 20-30% greater than needed to produce regular petroleum-based packaging plastics.

Opportunity

Empowering EPR

Consumers play an important role in the EPR programs due to growing awareness and education. Digital platforms, mobile apps, and social media campaigns will be utilized to engage users in terms of recycling leadership and push responsible disposal of plastic packaging. The highlighted engagement will encourage the success of EPR programs and contribute to the overall economy. Technological growth will constantly improve the efficiency and effectiveness of plastic recycling. Inventions such as high-level filtering technologies, decentralized recycling systems, and chemical recycling will increase the potential to recycle a wide range of plastic materials.

The future of EPR for plastic packaging will include huge partnerships between stakeholders. Businesses, governments, NGOs, and users will collaborate to grow and implement efficient EPR solutions. These partnerships will result in groundbreaking best practices and a more sustainable and circular economy for plastic packaging.

Segmental Insights

By Packaging Type

Rigid packaging dominated the plastic-free packaging market in 2024

The industry for rigid packaging totally concentrates on sustainability because of supportive consumer and governmental urge to lessen its ecological impact. Novel materials having the aim at enhancing rigid packaging sustainability, usability, and performance are overwhelming in the industry. A rising number of companies are utilizing rigid packaging as a branding strategy to make their products unique and grow consumer engagement. Rigid packaging is a selected option in several industries due to its versatility and adaptability, and its application is expected to constantly improve as a result of changing consumer choices and technology growth. The food and beverage industry is a crucial user of rigid packaging, despite it is also used in the packaging of medications, domestic goods, and personal care products.

Flexible packaging is expected to be the fastest-growing type in the plastic-free packaging market. It is created from plastic and/or paper-based materials and has different uses, specifically, in food, such as crisps and biscuits. Paper-based flexible packaging can be a complicated sandwich of substrates, frequently with a paper outer layer with a thinner plastic inner liner. Flexible packaging also protects the product while utilizing less plastic. Inventions are being made in confectionery, biscuits, and snacks, and also pet food industry.

By Material

Paper packaging dominated the plastic-free packaging market in 2024

The paper packaging sector is magnificently versatile and extremely effective, whether we are utilizing it for shipping, storage, retail displays, or even around the house. For several brands, packaging isn’t just a holder -it's part of the product, and the way it looks eco-friendly matters a lot. Paper as a material is incredibly acceptable and can be updated in many ways to adjust its flexibility and power for the extremely challenging demands. Paper packaging perfectly aligns with the circular economy model. The initial component, wood fiber, is a natural, renewable, and sustainable resource. This kind of packaging is readily assembled and recycled, which allocates this precious fibre to be reused regularly.

Glass packaging is predicted to be the fastest-growing type in the plastic-free packaging market. Health-conscious consumers are choosing non-plastic alternatives. It is becoming coherent that packaging does not just carry food in it but is linked with what is filled inside. Glass is the perfect packaging material as it does not have a connection with materials like microplastics. Glass completely is created from natural four ingredients like soda ash, sand, limestone, and recycled glass which are absolutely safe and simple as consumers are aware of the material.

By End-User Industry

Food and beverages dominated the plastic-free packaging market in 2024

By understanding the importance of sustainable solutions, several cafes, restaurants, and fast-food centers are transforming to eco-friendly preferences. Sustainable products like sugarcane food containers, compostable straws, and bamboo cutlery are gaining attention as they serve the same characteristics without the environmental toll. Apart from straws and cutlery, Food and beverage companies are discovering the latest forms of packaging. Recycled paper, plant-based packaging, and recycled containers are now widely utilized to lessen the plastic footprint of food delivery and takeout services.

Pharmaceutical packaging is the fastest-growing end-user industry in the plastic-free packaging market. One of the most effective trends in sustainable pharmaceutical packaging is the usage of biodegradable and compostable materials. This kind of material is crafted to rank naturally over a period of time, which impacts the environment in the minimal way possible. Some organizations are creating packaging made from plant-based and renewable sources like sugarcane. Corn and cellulose. These bioplastics serve many of the advantages of regular plastic, such as moisture resistance and durability, but with the added benefit of being compostable and biodegradable.

Regional Insights

Asia-Pacific Dominated the Market in 2024

The Asia Pacific has the biggest focus of megacities worldwide, with 28 cities that expand 10 million. High population reinforces pressure on resources, overall environmental sustainability, and waste management systems. The fast urbanization associated with this population growth has noticeably spiked consumption levels, specifically in the demand for single-use packaging, especially flexible plastics. In this industry, multi-layer plastic-free packaging is crucial for expanding shelf life with its exceptional barrier characteristics against moisture, oxygen, and contaminants. They specifically reduce food waste in areas with low effective distribution systems and lessen reliability on cold chain logistics by sustaining food quality without constant refrigeration.

The paper industry in India is experiencing a major shift as businesses transform away from plastic-based packaging solutions. This fashion is due to rising environmental awareness among users and the rigorous regulations implemented by the government on single-use plastics. Indian organizations are at the front line for this change. They are creating inventive paper packaging solutions that meet the demand for plastic, which adds paper bags and boxes to standard packaging for cosmetics and electronics. For instance, to this,

Energizer Holdings, which is the world’s largest producer and distributor of single-use batteries, has revealed the introduction of 100 % recyclable plastic-free packaging for its range of Energizer batteries.

North America Expected to be the Fastest-Growing Region

U.S users have made their selection firm and clear that ranked compostable packaging as the most sustainable packaging material. This choice crosses other eco-friendly options like plant-based material,paper-based cartons, and totally recyclable plastic bottles and containers. The rigid industry demand for plastic-free packaging is forcing companies to update and align with consumer demand and expectations, which further grows the move towards sustainable packaging solutions.

Canada’s greening government is reinforcing action inside the federal government and guiding practical steps to track the usage and disposal of plastics within its own operations. It is operating towards eliminating the unwanted use of single-use plastic in government operations, events, and meetings, and buying more sustainable plastic products that can be repurposed, repaired, and reused. For instance, to this,

- On 20 June 2024, Amazon disclosed its first U.S. automated fulfillment center in Ohio to defeat plastic delivery packaging, including the change from plastic air pillows to paper fillers.

Latin America

In Latin America, the demand for plastic-free packaging is gaining attention, fueled by growing environmental awareness, stricter government regulations on single-use plastics, and rising user preference for sustainable products. Countries like Chile, Mexico, and Colombia have introduced bans or restrictions on certain plastic items, prompting food, beverage, and retail brands to shift towards paper-based, compostable, and plant-based packaging alternatives. E-commerce expansion and the booming food delivery sector are also driving the need for eco-friendly, durable solutions that maintain product safety without depending on traditional plastic.

Middle East and Africa

In the Middle East and Africa, the urge for plastic-free packaging is steadily rising, driven by growing environmental issues, government-led initiatives to curb plastic pollution, and the growing influence of global sustainability trends. Countries like the United Arba Emirates, Saudi Arabia, and South Africa have implemented bans or restrictions on particular single-use plastics, encouraging industries to adopt paper-based, biodegradable, and compostable alternatives. The regions' expanding food, beverage, and personal care sectors, along with the fast growth of e-commerce, are creating new opportunities for eco-friendly packaging solutions that balance sustainability and durability in hot and humid climates.f

Plastic Free Packaging Market Key Players

- Mondi

- Amcor PLC

- WestRock Company

- Sealed Air Corporation

- Smurfit Kappa

- Huhtamaki OYJ

- Tetra Pak International S.A.

Latest Announcements by Market Leaders

- On 11 February 2025, Rottneros Packaging AB, a leader in thermoformed pulp packaging, revealed that it will launch its NATURE series of sustainable food packaging trays at Packaging Innovations and Empack 2025, as it is making from 130 years of high-quality pulp production within the Rottneros Group.

- On 4 September 2024, Google eliminated plastic from consumer electronics packaging by the current year with the latest, paper-centric design that gives importance to accessibility and minimizes waste.

Recent Developments

- In July 2025, Terrasafe, a North Carolina-based materials invention company, revealed its acquisition of Dissolves, a dissolvable film packaging startup. The company merger paves the way for two plastic-free products to market, which are water-soluble laundry detergent sheets and edible pod packaging, that are currently available for pre-order.

- On 27 May 2025, Oroville Flexible Packaging, A RE: CIRCLE solution company and top in flexible plastics and packaging solutions for foodservice and retail customers, revealed the official launch of “Oroflex,” which is a sustainable flexible plastic, recycling, and packaging system.

- On 26 May 2025, Cafe-restaurant chain Starbucks revealed new to-go cups as paperboard cups for hot drinks, which substitute the regular polyethylene barrier layer with mineral-based coating that is easily available in 10 different European countries, like France, Germany, and Switzerland.

- On 23 May 2025, PPG Industries revealed PPG EnviroLuxe Plus powder coatings, an inventive solution including up to 18% post-industrial recycled plastic (rPET) and produced without per- and polyfluoroalkyl substances. This latest product line shows a specific growth in sustainable coating packaging for plastics and industrial coating sensors.

- On 9 May 2025, Zomato, India’s food ordering and delivery platform, in partnership with Startup India, the Department for Promotion of Industry and Internal Trade, Government of India, wrapped up the second edition of the Zomato Plastic-free Future Packathon, held at Bharat Manadam in Delhi.

- In January 2025, Energizer Holdings, which is the world's largest producer and distributor of primary batteries, revealed the launch of 1005 recyclable plastic-free packaging for its Energizer batteries. The latest paper-based packaging serves a sleek, eco-friendly design that makes shopping, the storage experience, and opening simple.

- In August 2024, Google stated that it has aligned with its goal for 2025 to make all the packaging for its latest launch hardware, including Fitbit, Pixel, and Nest Devices, without plastic, as per the announcement today. It fixed the aim long back in 2020, when 94% of its packaging was already plastic-free.

Plastic-Free Packaging Market Segments

By Packaging Type

- Rigid packaging

- Flexible packaging

- Hybrid packaging

By Material

- Paper

- Glass

- Metal

- Aluminum Foil

- Others

By End-User Industry

- Food and Beverages

- Pharmaceutical

- Consumer Goods

- Electrical and Electronics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Tags

FAQ's

Select User License to Buy

Figures (2)