North America High-Barrier Packaging Films Market Outloook, Segmentation Value Chain, Manufacturers & Trade Data Report

The North America high-barrier packaging films market is forecasted to expand from USD 13.68 billion in 2026 to USD 47.97 billion by 2035, growing at a CAGR of 14.96% from 2026 to 2035. It includes extensive regional insights covering North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, along with a deep competitive analysis of leading companies such as Amcor, Berry Global, Sealed Air, and others.

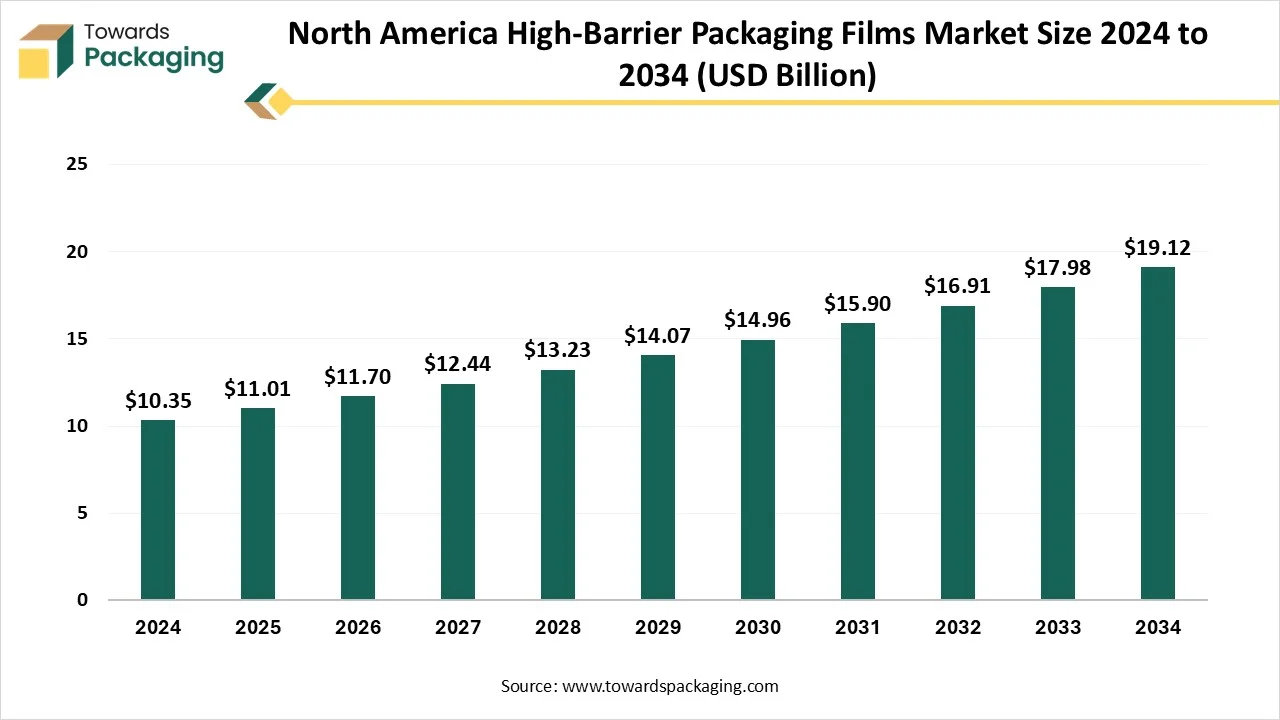

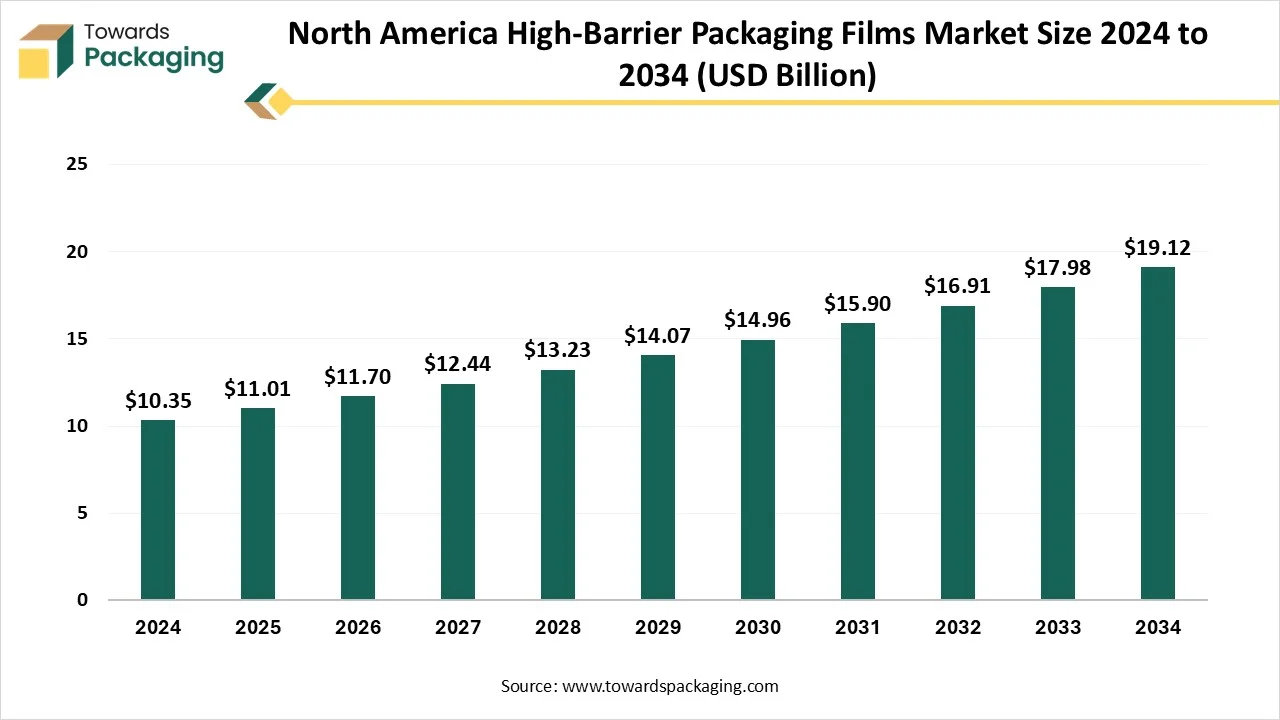

The study also integrates value chain analysis, trade flow data, manufacturing landscapes, supplier mapping, technological advancements, and all statistical market figures including CAGR (14.96%), revenue forecasts (USD 11.01 bn in 2025 to USD 19.12 bn in 2034), and segment-level dominance and growth metrics.

Key Takeaways

- The market is predicted to grow at a CAGR of 14.96% from 2026 to 2035.

- By material type, the polyethylene (PE) segment held the major market share in 2024.

- By material type, the polypropylene (PP) segment is projected to grow at a fastest CAGR between 2025 and 2034.

- By product type, the bags and pouches segment contributed the biggest North America high-barrier packaging films market in 2024.

- By product type, the wrapping films segment is expanding at a fastest CAGR between 2025 and 2034.

- By type, the metallized films segment dominated the market in 2024.

- By type, inorganic oxide coating Films are expected to grow at a fastest CAGR over the projected period.

- By end-user, the food segment dominated the market in 2024.

- By end-user, pharmaceuticals are predicted to grow at a fastest CAGR over the forecast period.

Market Overview

High barrier packaging films point to materials that are crafted to serve superior protection against external factors like moisture, oxygen, and light. By making a rigid barrier, this kind of packaging ensures expanding shelf life, product integrity, and storage quality. Sectors like pharmaceuticals and food heavily depend on packaging to track the freshness of food and the efficacy of pharmaceuticals. This packaging solution is included to align with sustainability demands, environmentally friendly solutions, and to integrate advanced protection.

The solution capabilities are in the plastics fabrication technology, which includes lamination, co-extrusion, and metallization technology. When such polymers are covered to create a composite material, the producer may build film food packaging or medical device packaging that has custom protection against specific environmental forces.

| Segment |

Key Materials |

Application |

Barrier Focus |

Growth Driver |

| Pharma |

PVDC , Alu-Laminates and Nylon |

Tablets, Injectable s, Medical systems |

Biological and Chemical protection |

Stringent Compliance |

| Food |

EVOH, PA,PET,PE |

Ready Meals, Diary and Meat |

Moisture and Oxygen |

Worldwide shelf life extension |

| Nutraceuticals |

Laminated Films, Coated Paper |

Powders and Capsules |

UV, Moisture and Light |

Functional Supplement Growth |

North America High-Barrier Packaging Films Market Trends

- Extended Shelf Life: High barrier films discovery to moisture and oxygen, tracking the integrity of the products and preventing spoilage over time. This reduced the demand for regular substitutions, investing in cost efficiency and a perfect customer experience.

- Environmental protection: By restricting external contaminants such as pollutants, dust, and micro-organisms, high barrier packaging assists in tracking cleanliness and safety, by lowering the dependency on chemical preservatives and expanding the product's natural shelf life.

- Freshness Maintenance: High barrier films make sure that food products like crisps, snacks, coffee, and similar items that are delicate to environmental protection keep their taste, aroma, and texture for extended periods. By protecting these products from oxygen and moisture, the packaging makes sure that users delight in high-quality products as intended, even after prolonged storage and transportation.

- Advanced barrier coating and food-safety surface science: Barrier inventions have transformed from single-solution lacquers to multifunctional thin films that serve anti-corrosion, oxygen scavenging, and flavour-neutral interfaces simultaneously. Growth in inorganic and organic hybrid coatings and nanolayered barriers expands the shelf life for brittle beverages and lowers the demand for thicker metal substrates.

- High-Performance Barrier Packaging and Anti-counterfeiting Measures: Protecting product honesty is important. Among the different packaging materials exists a selection of high-level protective elements that protect items against external factors, thus developing their preservation state and expanding their usable timeframes.

AI Integration in the North America High-Barrier Packaging Films Market

The materials utilised to package food and pharmaceutical products must provide perfect protection against air, moisture, and light. Inventions like nanotechnology have led to the development of barrier coatings that expand the shelf life of medicines. These coverings can keep capsules and tablets constant in changing environments. The growth of fake medicines has made safety a top issue. Technologies like RFID tags, holographic labels, and invisible inks are being utilised to prevent counterfeit products.

This enables producers and users to track food and medicines at every stage. Apart from these, packaging lines are now becoming intelligent and faster with robotics and automation. Machines can fill, label, seal, and examine products with high accuracy. This lowers errors and fast-tracks manufacturing.

- In July 2025, Nestle's research and development department had officially partnered with IBM Research to make current tools that have the strength of Artificial Intelligence and deep technology to deliver innovative inventions to life. This kind of research collaboration has paved the way for the development of generative AI that can examine novel high-barrier packaging solutions.

Market Dynamics

Market Driver

Growth of Foundations

The three foundations of user experience in terms of packaged food which is hygienic sanitation, freshness, and appearance. High barrier protection films are the main ones. These kinds of films regulate the penetration of moisture, oxygen, and even UV and other substances. Since the biological stability and chemical properties of packaged food are completely dependent on the characteristics of the obstacle linked with plastic packaging for a long period.

Whether it is meat, cheese, snacks, or ready-to-eat meals, expanding the shelf life by utilising the plastic films is normal. Goods that have to be refrigerated and eaten quickly are now having large assignments, or are available globally through extensive distribution, with high-barrier plastic films. The Oxygen transmission rates (OTR) and Water Vapour Transmission Rates are also crucial elements that define the effectiveness of these films.

Market Restraint

Layers Limit The Development

High-level barrier materials like PVDC, EVOH, or aluminium layers are expensive, making films costlier than standard packaging. Multilayer film production needs specialized extrusion and lamination technology, which increases operational complexity and limits small-scale production. Several high-barrier films are made of multiple polymer layers or polymer-metal combinations that are difficult to classify during recycling, leading to sustainability issues. Increasing worldwide regulations around single-use plastics and non-recyclable packaging put pressure on manufacturers to seek eco-friendly barrier alterations. Also, the sector witnesses pressure from alternative barrier solutions like bio-based coatings, metalized films, and sustainable mono-materials, encouraging invention and cost-control.

Market Opportunity

Tight Packaging Films Matter

The packaging design technique should ensure recyclability from the beginning. These factors include the kind of material, how they are manufactured, and how it can be used again. Polyethylene (PE) is an evergreen plastic that has been accepted for several types of packaging and processing while also allowing mono-material designs that are capable of being recycled and can invest in high-quality recyclate for further usage. Circular designs not only apply to the latest packaging designs but should also be utilised to recheck and develop upon current packaging designs. For instance, a conventional laminate structure that uses coatings and metallized layers to serve the compulsory protection of the urging barrier uses.

Oxygen Permeability (PO₂) of Coated Films at Different RH Levels

"Units: cm³·mm/m²·day·bar - Values not explicitly provided in the text are marked N/A."

| Film Type |

PO₂ at 10% RH |

PO₂ at 50% RH |

PO₂ at 85% RH |

Notes |

| Biofilm/m-PVOH (10 µm layer) |

~0.10–0.17* |

~0.10–0.17* |

3.94 |

PO₂ reduced 42–66% vs. 5 µm coating; stable up to 50% RH |

| Biofilm/m-PVOH/PLA |

~0.10–0.17* |

~0.10–0.17* |

4.02 |

PLA becomes saturated at 85% RH |

| Biofilm/m-PVOH/PLA + 5% wax |

N/A |

N/A |

3.42 (15% lower than 4.02) |

Wax reduces oxygen permeation |

| Biofilm/m-PVOH/PLA + 10% wax |

N/A |

N/A |

3.14 (22% lower than 4.02) |

Higher wax = stronger barrier |

| Reference (Apicella et al. 2022, 5 µm coating) |

0.22–0.30 |

0.22–0.30 |

N/A |

Baseline for comparison |

Transparency (TR%) of Biofilm and Multilayer Films

| Film Type |

UVC Transmittance (200–280 nm) |

UVB Transmittance (280–320 nm) |

UVA Transmittance (320–400 nm) |

TR% at 800 nm |

Notes |

| Neat Biofilm |

0% |

0% |

Low (<10%) |

9.60% |

Baseline substrate |

| Biofilm/m-PVOH |

0% |

0% |

Low (<10%) |

17.00% |

Transparency increases with m-PVOH layer |

| Biofilm/m-PVOH/PLA (0% wax) |

0% |

0% |

Low (<10%) |

17.10% |

Similar to m-PVOH-only; PLA transparent |

| Biofilm/m-PVOH/PLA + 5% wax |

0% |

0% |

Low (<10%) |

<17% (reduced) |

Wax lowers transparency |

| Biofilm/m-PVOH/PLA + 10% wax |

0% |

0% |

Low (<10%) |

<<17% (strong reduction) |

Higher wax = lower transparency |

Segmental Insights

Material Type Insights

How Did Polyethylene Segment Dominate The North America High-Barrier Packaging Films Market In 2024?

Polyethylene (PE) segment has dominated the market in 2024 as it has gained main attention for its potential to keep products safe, fresh, and protected from surrounding elements. These packaging solutions are perfect for preserving the quality of sensitive products like poultry, meat, sauces, and dairy, thanks to their perfect sealing potential. The high-barrier characteristics make them unique in stretching shelf life and preventing contamination, making them a selected choice for several producers. The usage of polyethylene (PE) has been at the forefront of this invention, serving unmatched reliability and high-barrier properties. This acceptability makes polyethylene flow wrap packaging stand out, especially for products that demand flexibility and temperature resistance.

The polypropylene segment is expected to grow fastest in the market during the forecast period. One of the engaging aspects of polypropylene (PP) is the classification of grades available for this polymer, each with its different behaviours and characteristics. While this may primarily look confusing, the advantages lie in the ability to tailor the complete information to align with the particular demands of the food packaging solutions. While making a packaging solution for extended shelf-life applications or shelf-stable products, the demand for effective moisture barrier uses and effective oxygen barrier is complicated. Polypropylene material includes innate moisture barrier elements with a Moisture Vapour Transmission Rate (MVTR), which is an assessment of gaseous H2O passage through a barrier of 0.5g (g-mil.100 in 2/24 hr).

Product Type Insights

How Did The Bags And Pouches Segment Dominate The North America High-Barrier Packaging Films Market In 2024?

Bags and pouches segment have dominated the market in 2024 as several layers of barrier film make the foundation of bags and pouches. These layers are overlaid to make a remarkable, rigid, and reliable pattern and material. This film has barrier properties that make it puncture-resistant and protect products from moisture, odors, UV rays, and gases. This type of packaging is specifically famous for retail packaging because it is sturdy and flexible. High barrier pouches and bags are the product of the urgent demand to have packaging guaranteed to preserve and protect products.

The wrapping films segment is expected to be the fastest growing in the market during the Predicted Period. Wrapping films in high barrier packaging are specialized flexible films designed to tightly wrap around products while offering superior protection against moisture, oxygen, UV light, and other external factors that can compromise product quality. These films are prevalently made using high-level multilayer structures, including materials such as PVDC, EVOH, metalized layers, or PET, that serve excellent barrier properties while maintaining strength and flexibility. However, due to their complicated material composition, these films may pose recycling limitations, driving producers to discover recyclable mono-material alterations and bio-based barrier solutions.

Type Insights

How Did The Metallized Films Segment Dominate The North America High-Barrier Packaging Films Market In 2024?

Metallized films segment dominated the market in 2024, as it is the most standard flexible packaging, and are high-barrier metallized films. They are a shiny shield for high protection. Engineers thoroughly make these films with small metal coverings to make the barrier rigid without making it heavier. Oxide coating and plasma make them more moisture-resistant, air-resistant, small-resistant, and light. High barrier films protect countless goods throughout various sectors. These films protect food items from moisture and oxygen while protecting taste, freshness, and fragrance in different worlds of snacks and food. Manufacturers shift these films into protective Cocoons, which help track chocolate richness, chip crunch, and spice flavour with sustained brightness.

The inorganic oxide coating films segment is expected to be the fastest-growing in the market during the forecast period. Inorganic oxide coating films in high barrier packaging are advanced materials designed to serve exceptional protection against gas and moisture transmission while maintaining transparency and flexibility. These films are typically coated with ultra-thin layers of inorganic oxides like aluminium oxide(Al2O3) or silicon oxide (SiOx) using processes like vacuum deposition or plasma-enhanced chemical vapor deposition. The coatings create a sense, glass-like barrier which significantly reduces water vapour permeability and oxygen and water vapor too.

End-User Insights

How Did The Food Industry Segment Dominate The End-User Sector In The North America High-Barrier Packaging Films Market In 2024?

The food sector segment dominated the market in 2024 as High-barrier flexible packaging has been a game changer in the food packaging for several reasons, including its potential for resource and lower shipping costs, and expanding the shelf life of products. Latest growth in the high barrier flexible packaging is encouraging the invention even further by serving strong protection against light, oxygen, and moisture. These packaging solutions serve extra protection, especially for sensitive foods like dairy, meat, and fresh produce. By tracking the best surroundings inside the packaging, these materials serve to protect the nutritional quality and freshness of food for a longer time. This lowers food waste, which is the main issue for users and businesses. For instance, vacuum-sealed bags are a famous example of high-barrier packaging films, as these bags are prevalently used in the food sector for packaging products like meat, coffee, and cheese. The vacuum-sealing procedure prevents air from entering the packaging, which assists in preventing spoilage and oxidation.

The pharmaceutical segment is expected to be the fastest-growing in the North America high-barrier packaging films market during the forecast period. Barrier packaging is an important element in the pharmaceutical sector, ensuring the efficacy, safety, and shelf life of medications. With up to 90% of active pharmaceutical ingredients(API) fragile to oxygen or moisture, barrier packaging plays a crucial role in protecting drugs from external elements like contaminants, light, and surrounding conditions. While regular barrier solutions protect the potency of medications and avoid degradation, the pharmaceutical sector is under growing pressure to align with strict sustainability goals. This includes lowering environmental effects through the usage of eco-friendly materials, lowering waste, and marketing circularity -all while clinging to strong regulatory standards.

- In June 2025, Honeywell declared that Evertis, a leading generator of film for the packaging industry, has selected Aclar Film, which is to be used by the Evercare Pharmaceutical brand. Evertis choosing the Aclar Film will have assistance in life-saving medicines as they urge for secure packaging while helping the sector's efforts to shift towards recyclable solutions.

Top Companies in North America High-Barrier Packaging Films Market

Latest Announcements By Industry Leaders

- In February 2025, Evertis, which is a Top company in PET multilayer film supplier for the food sector, has today revealed the plans to construct its latest leading-edge production plant in Columbia, United States. With a total investment of USD 100 million, a current facility is scheduled to be operational in Q2 2026, with its initial commercial sales to users experienced last year.

New Advancements in North America High-Barrier Packaging Films Market

- In December 2024, American Packaging Corporation, a top company in flexible packaging solutions, revealed another extension of APC's RE Sustainable Packaging Profile, with the addition of the latest high-performance, paper-based packaging technologies, which are targeted for curbside recyclability while serving perfect product protection levels that expand shelf life, track product freshness, and protect flavour.

- In 2025, Novolex and Pactiv Evergreen revealed a perfect agreement to integrate, making a top producer in beverage, food, and specialty packaging. Pactiv Evergreen shareholders will receive USD18.00 per share in cash, valuing the transactions at USD 6.7Million.

North America High-Barrier Packaging Films Market Segments

By Material

- Polyethylene (Dominated)

- Polypropylene (Fastest-growing)

- BOPET (Biaxially Oriented Polyethylene Terephthalate)

- Polyvinyl Chloride

By Product Type

- Bags & Pouches (Dominated)

- Wrapping Films (Fastest-growing)

- Trays Lidding Films

- Blister Packs

- Others

By Type (Coating/Film Structure)

- Metallized Films (Dominated)

- Inorganic Oxide Coating Films (Fastest-growing)

- Clear Films

- Organic Coating Films

- Others

By End-User/Application

- Food (Dominated)

- Pharmaceuticals (Fastest-growing)

- Beverages

- Personal Care & Cosmetics

- Others