The liquid packaging board market provides a complete view of global market size, growing from USD 44.71 billion in 2026 to USD 86.07 billion by 2035 at a 7.55% CAGR. This report covers segment-level insights including SBS leading with 61.1% share, cartons dominating with 52.5%, and dairy applications holding 46.8% along with regional data showing Europe at 37.6% share and APAC growing fastest at 8.5% CAGR. It includes value chain analysis, trade flows, top exporters (U.S., India, Brazil), import–export patterns, and competitive intelligence on leading market players such as Stora Enso, WestRock, Billerud, Nippon Paper, and Tetra Pak.

Major Key Insights of the Liquid Packaging Board Market

- By region, Europe dominated the global market by holding the highest market share of 37.6% in 2024.

- By region, Asia Pacific is expected to grow at an 8.5% CAGR from 2025 to 2034.

- By grade, the solid bleached sulfate board (SBS) segment contributed the biggest market share of 61.1% in 2024.

- By grade, the coated unbleached kraft board (CUK) segment will be expanding at a significant CAGR of 7.2% between 2025 and 2034.

- By packaging type, the cartons segment accounted for the largest market share of 52.5% in 2024.

- By packaging type, the pouches segment will be expanding at a significant CAGR of 7.8% between 2025 and 2034.

- By application, the dairy products segment accounted for the largest market share of 46.8% in 2024.

- By application, the juices & beverages segment will be expanding at a significant CAGR between 2025 and 2034.

Key Technological Shifts

- Adoption of recyclable, fiber-based barrier coatings to replace traditional PE layers and improve sustainability.

- Shift toward bio-based or dispersion coatings that reduce reliance on fossil-based plastics.

- Development of foil-free barrier systems, replacing aluminum layers with advanced fiber barriers.

- Engineering lightweight, multi-layer structures that reduce material usage without compromising performance.

- Use of high-strength pulp formulations to enhance stiffness, durability, and liquid resistance.

- Integration of smart features for traceability, authentication, and recycling efficiency.

- Advancements in digital printing technologies enable customization, rapid prototyping, and regional campaigns.

Future Demands

- Strong demand for low-plastic recyclable and environmentally friendly liquid packaging to replace conventional plastic bottles will be fueled by growing consumer and governmental pressure.

- Brands will increasingly require aseptic and long-life cartons that can keep beverages fresh without refrigeration, especially dairy juices and plant-based drinks.

- There will be rising demand for portable single-serve and easy-to-use formats such as small cartons, resealable tops, and convenient shapes to support on-the-go consumption.

- The growth of online grocery delivery will create demand for lightweight, damage-resistant, and leak-proof cartons that can survive shipping and handling.

What are Liquid Packaging Boards?

Liquid packaging boards are multi-layer paperboards designed to safely package and preserve liquids such as milk, juice, soups, and other beverages. It is made from high-quality bleached chemical pulp with polyethylene or aluminum coatings to provide barrier protection against moisture, oxygen, and light. Known for durability, stiffness, and printability, liquid packaging board supports aseptic and sustainable packaging solutions. Increasing demand for recyclable and renewable fiber-based materials is driving growth in food and beverage packaging applications.

Liquid Packaging Board Market Outlook

- Market Growth Overview: The liquid packaging board market is expanding due to rising customer preferences, technological inventions, sustainability, and increasing beverage varieties in the market. The rising consumption of beverages such as juices, sodas, water, and others is driving rapid growth in this market.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, the Middle East & Africa are witnessing e-commerce growth, technological innovation, rising food & beverages industry, product preservation, customer convenience, ecological concern, and sustainability.

- Major Market Players: The liquid packaging board market includes SIG Combibloc, Elopak AS, Nippon Paper Industries, Mondi Group, WestRock Company, Smurfit Kappa Group Inc., Stora Enso Oyj, and various others.

- Startup Ecosystem: The startup industries play an important role in developing sustainable, advanced barrier technologies, convenient, and smart packaging technology.

The enhancement of productivity and increased production efficiency have driven technological advancement in the liquid packaging board market. Progressive engineering procedures make the creation of liquid packaging boards more effective and cost-effective. Technology is being developed to produce boards with a smaller carbon footprint and to help develop recyclable and renewable resources to replace plastic. Inventions are also emphasizing the enhancement of recycling procedures for these complex resources to close resource cycles. Techniques now comprise three-layer coverings with useful fillers to fill fibre gaps, advance surface density, and improve water barrier and operational stability.

Trade Analysis of Liquid Packaging Board Market: Import & Export Statistics

Trade in liquid packaging boards sits at the intersection of pulp & paper commodity flows and food-packaging value chains.

- What’s actually traded (product forms & HS proxies)

- Rolls and reels of liquid packaging board for converters.

- Pre-cut/finished blanks (less common cross-border; usually produced near converters).

Coated/laminated specialty board with barrier layers (PE, EVOH, PLA coatings) and functional seals.

HS proxies in trade datasets commonly sit under coated/uncoated paper & paperboard headings, with some specialty items reported under food-grade/packaging sub-codes.

Top exporter origins (who supplies the world)

- United States: It is considered the topmost exporter of Liquid Packaging Board with 13,620 shipments.

- India: It stands in the second position as an exporter of Liquid Packaging Board worldwide with 50 shipments.

- Brazil: It is the third top-most exporter of the Liquid Packaging Board with 9 shipments.

- Top importers/demand centres (where boards are consumed)

- Asia (China, India, Southeast Asia): Large converting and filling capacity for juices and dairy; many import specialist board grades until local high-spec mills scale up.

- Africa & Middle East: Growing demand for ambient beverage packaging; many countries import board or pre-formed blanks from European and Asian suppliers.

- North America & Europe: Big converting capacity but still import specialty board or components for niche packaging needs. Latin America imports for markets lacking local high-spec board capacity.

Typical trade flows & logistics patterns

- Rolls to Converters: Roll shipments (FCL or flat racks) to aseptic and carton converters near filling plants. Converters often prefer local or regional supply to minimise transit damage and maintain lot continuity.

- Regional hubs: The Netherlands and Antwerp often function as EU distribution/consolidation hubs for board and packaging materials; Singapore and Dubai play similar roles in APAC/MENA routing.

- Project shipments: New filling plants import specialist board grades or pre-formed blanks as part of CAPEX project deliveries; these are high-value, low-volume shipments compared with commodity paper.

Liquid Packaging Board Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are paper pulp, plastic coatings, and aluminum foil.

- Key Players: LyondellBasell, Dow Chemical Company

Component Manufacturing

The component manufacturing in this market comprises Paperboard, printing ply, polyethylene (PE).

- Key Players: Stora Enso Oyj, WestRock Company

Logistics and Distribution

This segment is involving a network of manufacturers, distributors, and end-users.

- Key Players: CEVA Logistics, Gati Ltd.

Grade Insights

Why Did the Solid Bleached Sulfate Board (SBS) Segment Dominate the Liquid Packaging Board Market In 2024?

The solid bleached sulfate board (SBS) segment dominated the market, accounting for a 61.1% share in 2024, due to its strength and excellent printability. The smooth, white board’s surface is ideal for high-quality printing, enabling vibrant graphics and complete branding on beverage containers and cartons. It is recognized for its excellent stiffness and strength, which are important for a liquid package that requires withstanding filling, transportation, and handling without distorting. Coated grades of board can offer high-level moisture resistance, an important need for containing liquids and protecting them from the environment.

The coated unbleached kraft board (CUK) segment is expected to grow at a 7.2% CAGR during the forecast period of 2025 to 2034. This segment is growing due to its high strength and durability. It is produced from virgin kraft pulp, unbleached, and has an organic brown color that demands to sustainability-emphasized branding. The coated surface provides a barrier against grease and moisture, which is important for packaged liquids and frozen food products. It is generally used for beverage carriers, frozen food cartons, and other applications that require wet-strength properties.

The uncoated kraft board is the fastest-growing in the liquid packaging board market, as it offers strength and superior barrier properties. It is primarily influenced by demand for natural-looking, sustainable, and environmentally friendly packaging choices. These are recognized for excellent tensile strength, superior folding endurance, and resistance to tearing, and are packed, which confirms the packaging remains integral during filling, shipping, and storage of weighty liquids.

Packaging Type Insights

Why Did the Cartons Segment Dominate the Liquid Packaging Board Market In 2024?

The cartons segment dominated the market, accounting for a 52.2% share in 2024, driven by bulk transportation and storage. A wide variety of cartons is used for a wide range of goods, such as juice and milk, providing advantages such as specialized designs, extended shelf life, and resealable features. The main applications for this segment include liquid juices, dairy products, and non-carbonated beverages. The cartons are patterned for both short-term and long-term shelf life, with extended cartons containing an aluminum layer to shield against oxygen and light.

The pouches segment is expected to grow at a 7.8% CAGR during the forecast period of 2025 to 2034. This segment is growing due to its portability, convenience, and lightweight design. These are gaining market share by providing a cost-effective, lightweight, and convenient alternative to outdated rigid packaging setups such as cartons, plastic bottles, and glass. Major drivers include rising customer demand for lightweight, convenient, and portable packaging that reduces transportation costs and storage space requirements. The rise of e-commerce favors pouches because of their compactness, durability, and lightweight nature, which reduces shipping costs and the risk of damage or leakage during transportation.

The cups segment is the fastest-growing in the liquid packaging board market, as it comprises single-use cups and containers. It protects liquid penetration, preserves product quality, and confirms functionality. It is coated or lined with barrier resources. Concerns about sustainability and the single-use plastic ban are boosting demand for environmentally friendly cup materials and coatings. The rise of cafe chains and quick service restaurants (QSRs) is a major influencer for this segment.

Application Insights

Why Dairy Products Segment Dominated the Liquid Packaging Board Market In 2024?

The dairy products segment dominated the market with a 46.8% share in 2024 due to its capacity to absorb moisture. It has excellent barrier properties against oxygen, light, and several other pollutants while transporting. These packages also provide strength for long-term storage of the products. It comprises a huge variety of products, like cream, flavored milk, liquid milk, yogurt, and various other value-added dairy-based beverages. The growth of this segment is influenced by rising customer demand for plant-based substitutes and dairy products across several countries, varying lifestyles, and the need for safe, convenient, and sustainable packaging.

The juices & beverages segment is expected to grow at a 7.4% CAGR during the forecast period of 2025 to 2034. This segment is growing due to its leak-proof and protective properties. It offers crucial protection and sealability for juices and several other beverages. It supports maintaining the integrity and safety of the goods inside. It is a recyclable resource, which brings into line with growing customer and supervisory demand for sustainable packing. Excellent moisture resistance protects against leaks, which is important for liquid goods.

The alcoholic beverages segment is the fastest-growing in the liquid packaging board market, driven by brand appeal and premiumization. A growing trend in the alcoholic beverage sector is driving demand for premium, high-quality packaging that enhances brand image. The drive for ecologically friendly packaging is influencing demand for easily recyclable materials such as glass and paper-based options.

Regional Insights

How is Europe Dominating the Liquid Packaging Board Market?

Europe held a 37.6% share of the liquid packaging board market in 2024, driven by increasing demand for recyclability and renewability in packaging. Customers are increasingly aware of environmental issues and are choosing sustainable packaging, driving demand for this packaging and positioning it as a more environmentally friendly alternative to plastic. These are more eager to recompense for extremely recyclable goods and look for on-pack data highlighting the environmentally friendly content of the packaging. These consumers are highly eager to buy highly recyclable goods and to seek on-pack data that highlights the packaging's environmental friendliness.

Why Liquid Packaging Board Market is Dominating in Germany?

Advanced, innovative manufacturing infrastructure has driven demand for liquid packaging board in Germany. It has a strong production base and robust technological proficiency, enabling the production of high-quality, advanced liquid packaging boards. These customers are increasingly seeking environmentally responsible choices, and liquid packaging boards are seen as a sustainable option. Major corporations are at the forefront of emerging packaging technologies, comprising sustainable and functional materials that fulfil developing customer requirements for products such as plant-based and practical beverages.

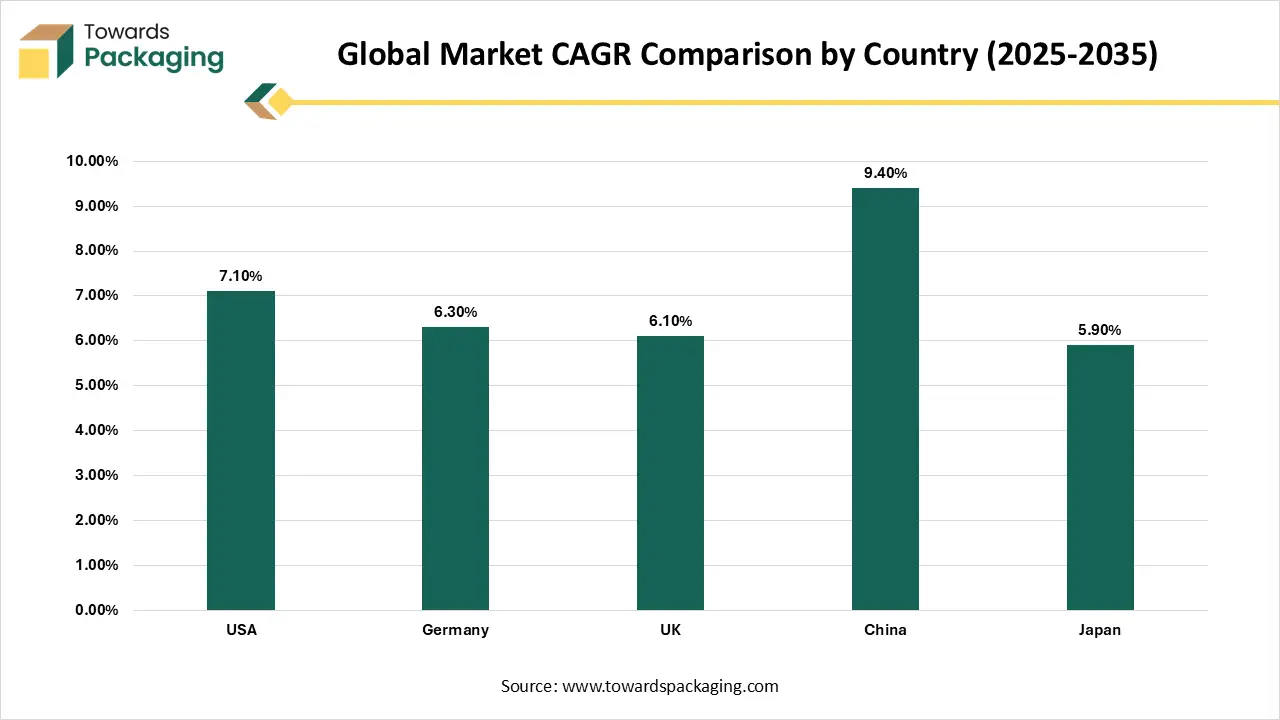

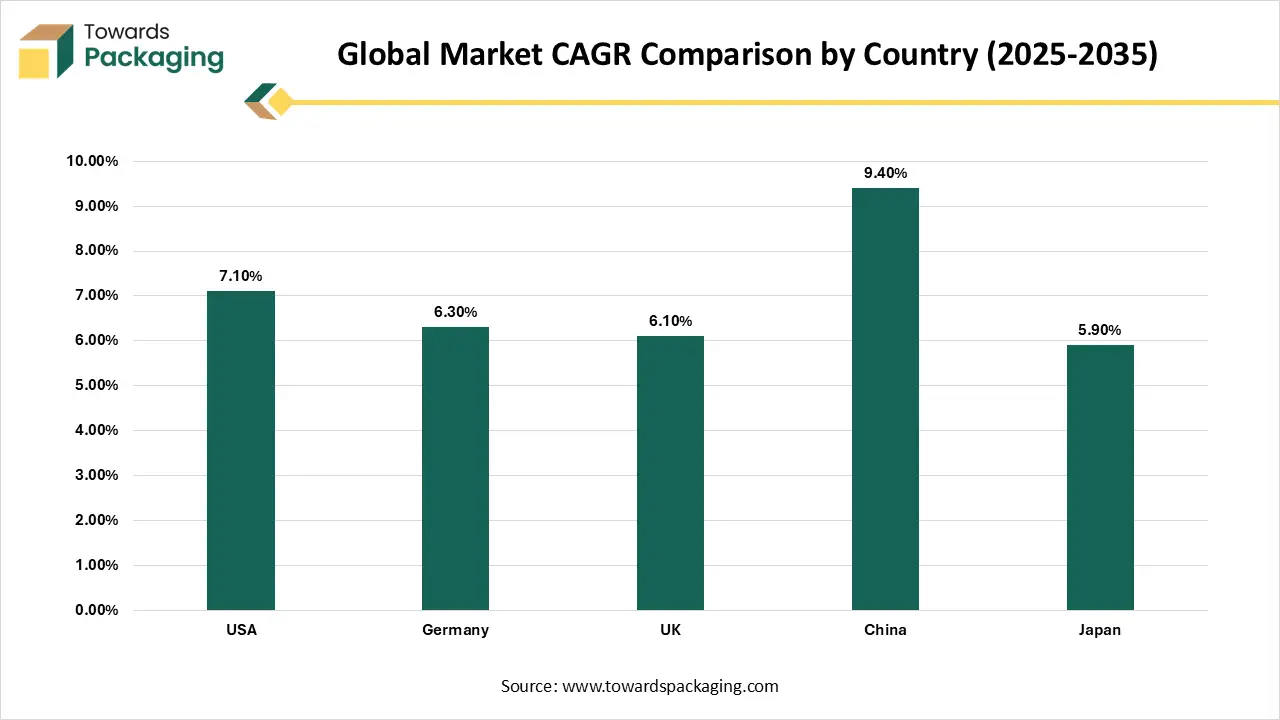

Global Market CAGR Comparison by Country

| Country |

CAGR (2025-2035) |

| USA |

7.10% |

| Germany |

6.30% |

| UK |

6.10% |

| China |

9.40% |

| Japan |

5.90% |

Why Liquid Packaging Board Market Growing Rapidly in the Asia Pacific?

The rising middle-class population and urbanization have increased demand for liquid packaging board. Fast urbanization in countries such as China, India, and others has resulted in a larger population in areas with higher disposable incomes and a growing demand for packaged products. There is a significant surge in demand for packaged dairy products, drinks, and other foods, driven by changing lifestyles and rising consumer awareness of product convenience and safety.

How Liquid Packaging Board Market Expanding in China?

The demographic and economic shifts have accelerated development in the liquid packaging board market in China. Inventions in aseptic coating and processing technologies have extended the shelf life of goods packaged in boards, broadening their applications and expanding their use cases. The two major advantages of water-based inks and new barrier technologies make the packing more suitable and functional for sensitive items. The rapid development of e-commerce and modern trade channels across China requires effective, durable packaging solutions for supply. Liquid packaging board fulfils these requirements by being eco-friendly, lightweight, and easy to transport, making it a perfect fit for current logistics demands.

India’s Imports of Corrugated Paper & Paperboard Boxes (HS 48191010) Country-wise Summary (Apr 2018-Mar 2019)

| Country |

Unit |

Mar 2019 Qty |

Mar 2019 Value (INR) |

Apr 2018–Mar 2019 Qty |

Apr 2018–Mar 2019 Value (INR) |

| China P RP |

KGS |

326,950 |

58,912,400 |

4,602,480 |

787,954,000 |

| Hong Kong |

KGS |

17,420 |

5,028,600 |

544,880 |

191,684,300 |

| Sri Lanka DSR |

KGS |

125,360 |

18,742,900 |

897,540 |

167,014,600 |

| Vietnam |

KGS |

19,510 |

3,846,200 |

924,120 |

139,998,700 |

| South Africa |

KGS |

240,380 |

23,812,900 |

1,093,980 |

110,936,200 |

| Israel |

KGS |

1,430 |

55,672,900 |

2,260 |

55,813,900 |

| U Arab Emirates |

KGS |

35,980 |

1,886,700 |

300,920 |

45,148,900 |

| USA |

KGS |

670 |

803,900 |

141,320 |

39,257,800 |

| Germany |

KGS |

8,860 |

2,104,300 |

153,240 |

36,942,900 |

| Korea RP |

KGS |

1,710 |

1,014,900 |

125,900 |

19,742,300 |

| Sweden |

KGS |

1,630 |

1,575,900 |

19,820 |

16,402,800 |

Which Factor is Responsible for the Notable Growth of the Liquid Packaging Board Market in North America?

The major factors influencing the growth of the liquid packaging board market are customer environmental consciousness, stringent regulations, extended shelf life, product protection, technological advancements, convenience, and the e-commerce sector. Customers are increasingly seeking packaging that is biodegradable, recyclable, and made from renewable resources. This consciousness has enabled food & beverage brands to evolve from traditional glass and plastic containers to cartons made from other materials.

Why is the U.S. Utilizing these Packaging Significantly?

The rising consumer convenience initiatives and changing lifestyle in the U.S. which fuelled the development of the liquid packaging board market. The rising demand for ready-to-consume beverages, driven by on-the-go and busy lifestyles, is making portable, lightweight packaging options like cartons increasingly popular. This comprises products such as nutritional shakes, juices, and coffee drinks. Increasing consumer consciousness has driven significant shifts towards environmentally friendly packaging choices. Liquid packaging board is frequently produced from renewable materials like paper and is recyclable, aligning with both customer preferences and the growing regulatory focus on sustainability.

Value Chain Analysis

- Raw Material Sourcing: Packaging companies source fibers and polymers with a stronger focus on cost stability, supply reliability, and sustainability. Many are shifting to certified, recycled, and renewable materials to meet regulations and consumer expectations.

- Logistics and Distribution: Efficient logistics use tracking systems, automation, and optimized routes to move and store packaged goods quickly and affordably. Suppliers are being forced to use greener, more intelligent delivery networks as e-commerce grows.

- Recycling and Waste Management: Recycling efforts aim to recover valuable materials and reduce landfill waste through better collection, sorting, and reuse. Companies are adopting circular design and EPR models to meet sustainability goals and extract new value from waste streams.

Top Companies in the Liquid Packaging Board Market

- Stora Enso Oyj – Stora Enso is one of the world’s leading providers of renewable packaging materials, offering liquid packaging board designed for aseptic and chilled beverage cartons. The company focuses on fiber-based, recyclable solutions that reduce plastic dependency in food and drink packaging.

- Billerud AB – Billerud produces high-performance liquid packaging board known for its strength, printability, and barrier properties. Its sustainable packaging materials are used in milk, juice, and liquid food cartons, emphasizing renewable and recyclable paperboard innovation.

- Mondi Group – Mondi manufactures fiber-based packaging materials, including coated and uncoated liquid packaging boards. The company integrates advanced barrier technologies for extended shelf life while promoting environmentally friendly packaging solutions.

- WestRock Company – WestRock provides liquid packaging board and coated paperboard solutions for beverage cartons and dairy packaging. Its focus lies in innovation and recyclability, offering lightweight, durable, and food-safe materials.

- Nippon Paper Industries Co., Ltd. – Nippon Paper develops liquid packaging board with high resistance to moisture and oxygen. Its products are widely used in the beverage and food sectors, featuring advanced coatings for sustainability and performance.

- Smurfit Kappa Group – Smurfit Kappa produces sustainable, fiber-based liquid packaging solutions for non-carbonated beverages and dairy products. The company focuses on renewable raw materials and circular economy practices in paperboard manufacturing.

- International Paper Company – International Paper supplies coated paperboard grades used in liquid food and beverage cartons. The company’s innovations aim to improve recyclability and reduce environmental impact through sustainable forestry and material sourcing.

- Evergreen Packaging LLC (Pactiv Evergreen) – Evergreen Packaging manufactures paper-based liquid packaging board used in milk, juice, and plant-based beverage cartons. The company emphasizes renewable fiber sourcing and barrier coating innovations for recyclable packaging.

- Metsä Board Corporation – Metsä Board produces lightweight, premium paperboard materials designed for liquid packaging applications. Its focus on sustainability includes fully traceable Nordic wood fibers and recyclable, food-safe coatings.

- Georgia-Pacific LLC – Georgia-Pacific offers liquid packaging board and coated paper products for food and beverage packaging. The company’s materials combine durability, print quality, and environmental responsibility.

- Elopak ASA – Elopak is a major provider of packaging systems and liquid packaging board-based cartons for beverages. Its Pure-Pak® line uses renewable materials and aims for full circularity through recyclable, bio-based packaging solutions.

- Tetra Pak International S.A. – Tetra Pak is the global leader in aseptic liquid food packaging systems, using high-quality liquid packaging board as a core material. The company focuses on fully recyclable, low-carbon solutions for beverages and liquid foods.

- Greatview Aseptic Packaging Co., Ltd. – Greatview manufactures aseptic packaging board and cartons for the liquid dairy and beverage industries. The company emphasizes efficiency, affordability, and compatibility with existing filling systems.

- UPM-Kymmene Oyj – UPM produces liquid packaging board and barrier-coated paper materials derived from sustainably managed forests. Its innovations focus on renewable packaging solutions that replace fossil-based materials.

- Klabin S.A. – Klabin, based in Brazil, manufactures liquid packaging board with strong barrier and sealing properties. The company is recognized for its vertically integrated, sustainable production model and expanding footprint in beverage packaging markets.

Recent Developments

- In September 2025, Berglandmilch introduced its dairy product in Austria using SIG Terra MidiBlock Alu free+ full barrier cartons, marking another adoption of aluminum-free full barrier packaging in Europe.

- In November 2025, Oji Holdings declared strategies to begin a liquid packaging carton manufacturing facility in Dong Nai Province, southern Vietnam, as part of its wider extension plan in Southeast Asia.

- In May 2025, Elopak declared a new paperboard choice envisioned for fresh liquids within chilled supply systems. This inventiveness underlines the company’s commitment to sustainability and the decrease of greenhouse gas releases in its product variety.

Liquid Packaging Board Market Segments

By Grade

- Coated Unbleached Kraft Board (CUK)

- Solid Bleached Sulfate Board (SBS)

- Uncoated Kraft Board

By Packaging Type

- Cartons

- Pouches

- Cups

- Cans

- Others (Trays, Bottles)

By Application

- Dairy Products

- Juices & Beverages

- Liquid Food (Soups, Sauces, etc.)

- Alcoholic Beverages

- Others (Pharmaceutical, Household Liquids)

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA