Aseptic Packaging Market Size, Share, Trends and Forecast Analysis

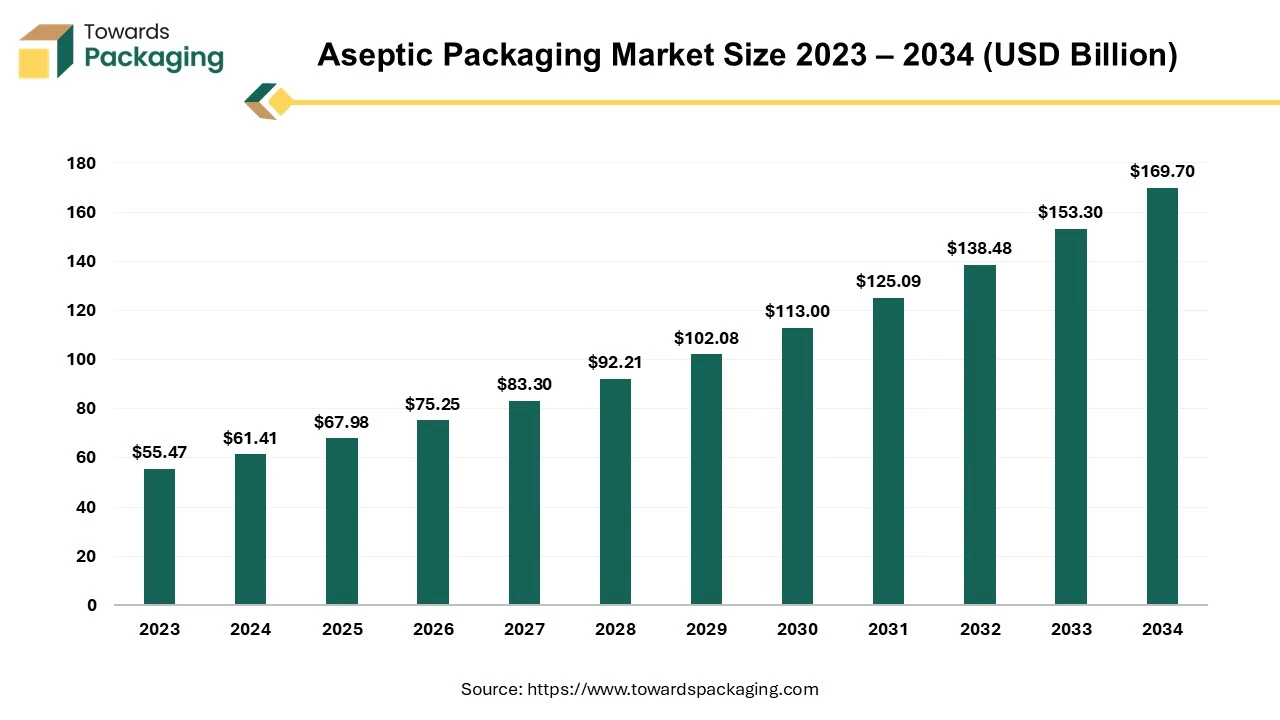

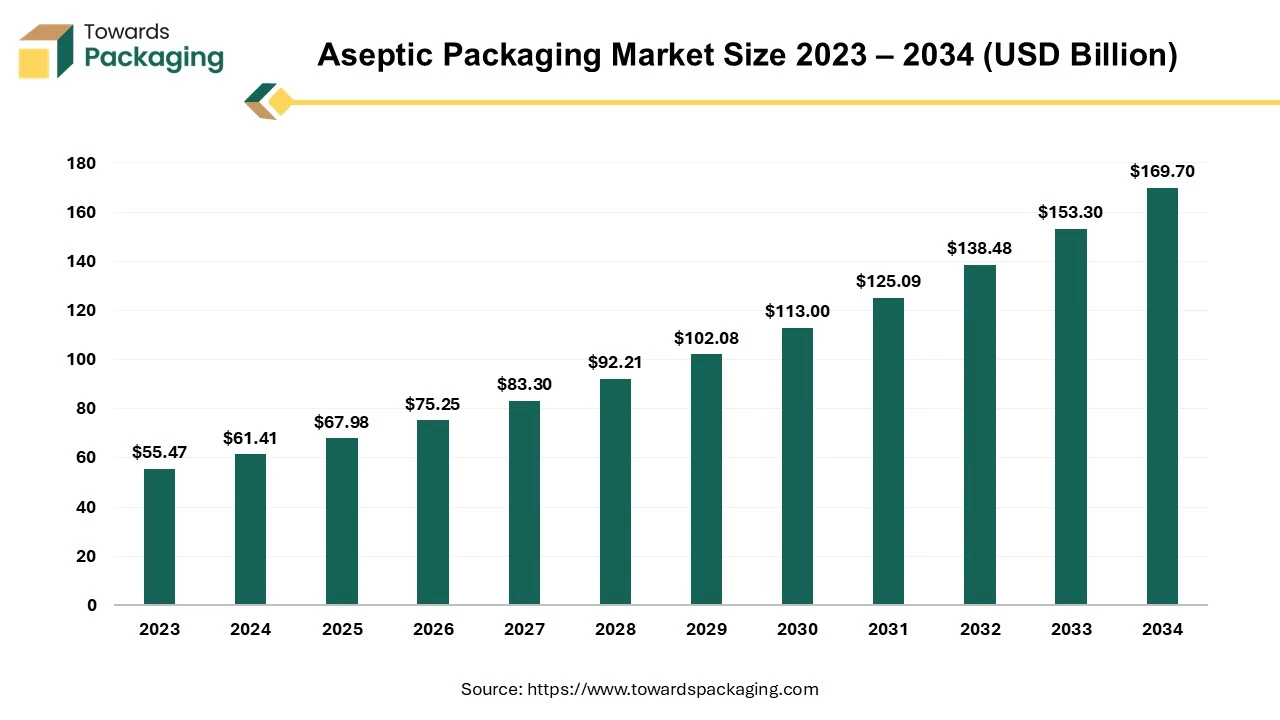

The aseptic packaging market is forecasted to expand from USD 75.25 billion in 2026 to USD 187.87 billion by 2035, growing at a CAGR of 10.7% from 2026 to 2035. Our analysis includes a breakdown of the market size and growth projections, segmentation by end-use sectors (e.g., food & beverage, pharmaceuticals, personal care), and regional breakdown covering APAC, North America, and Europe.

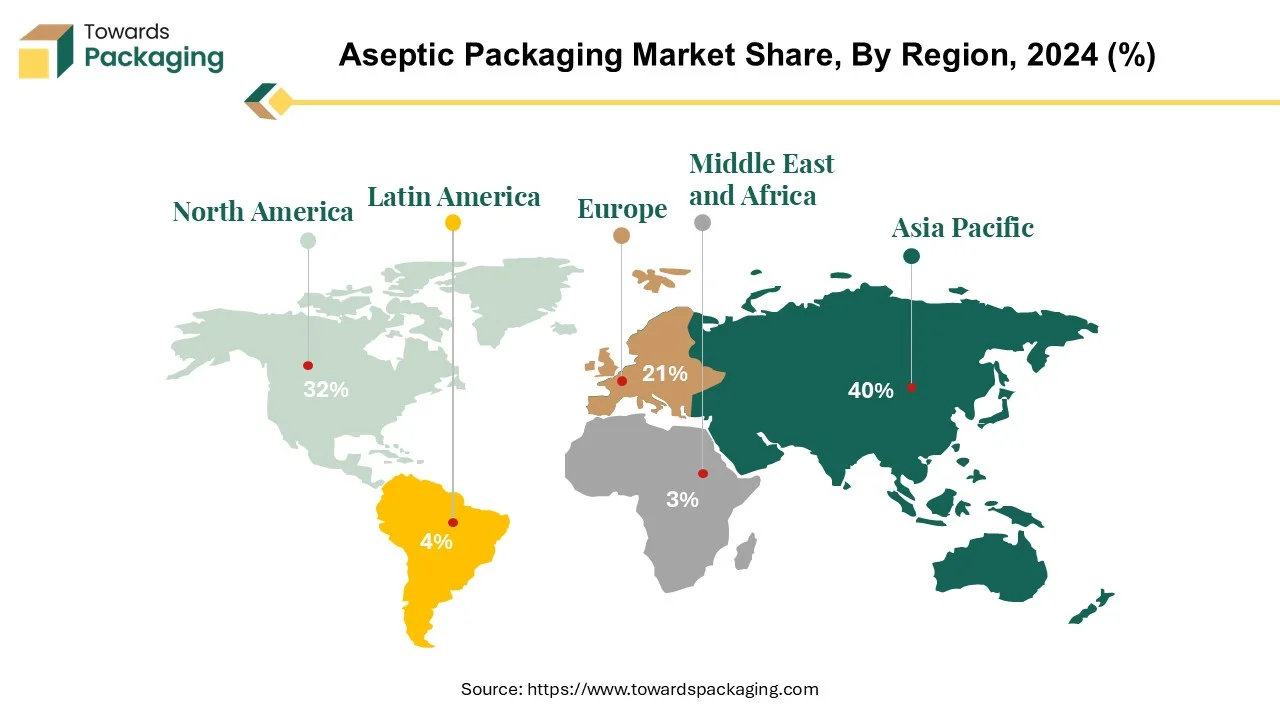

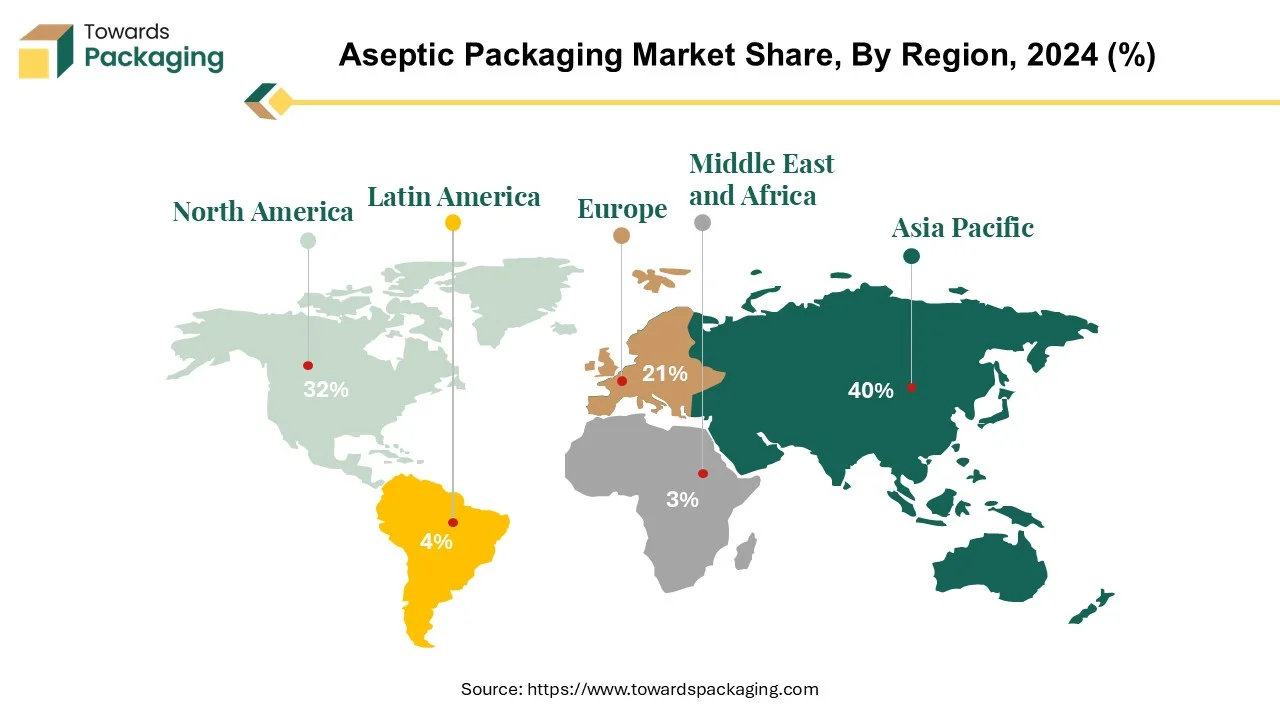

The report offers an exclusive competitive analysis, covering major players, value chain analysis, and strategic insights. Key data points include the regional distribution of market share, growth projections by country, and trends in aseptic packaging solutions such as aseptic beverage cartons and pouches.

Report Highlights: Important Revelations

- Asia-Pacific solidifies its position as a key contributor to the aseptic packaging industry.

- Factors propelling the growth of aseptic packaging in the North American market.

- Aseptic beverage cartons vital packaging solution for long-lasting products.

- Rising food and beverage consumption fuels the demand for aseptic packaging.

Aseptic packaging has become growing in acceptance among producers over the past few decades. This refers to the procedure of placing commercially sterilised goods into sterilised containers that preserve aseptic conditions and securing them hermetically. This approach makes it possible to package shelf-stable goods without additionally requiring for preservatives, assuring that the items can be ingested without refrigeration for up to a year. Aseptic filling is widely used in many industries, notably in the food and healthcare sectors, hence the FDA established rigid regulations for it.

Aseptic packaging offers several benefits, one of which is its capacity to preserve product stability without necessitating refrigeration, hence permitting worldwide distribution without requiring cold storage. This not only lessens the impact on the environment but also improves global accessibility to necessities. Aseptic packaging is a greener option for firms and fits in nicely with sustainability objectives. It drastically lowers plastic waste because the packaging is made mostly of renewable resources and uses about 60% less plastic than traditional solutions. Less energy is also used throughout the production process, which helps with environmental conservation.

Aseptic filling reduces the possibility of product waste while also guaranteeing product safety and freshness. It eases distributors' concerns about product turnover and gives customers the guarantee of freshness for a longer duration by prolonging the shelf life of products and decreasing reliance on preservatives. Aseptic packaging offers advantages including longer shelf life, less environmental impact, and better accessibility to necessary products globally, making it an appealing option for producers looking for efficient, economical, and sustainable packaging ideas.

Key Requirements for Aseptic Packaging Materials

Packaging materials need to meet the following criteria:

- Compatibility: The material must be suitable for the product and meet safety standards to prevent harmful substances from transferring.

- Strength: The packaging must be strong enough to keep the product safe and sterile.

- Sterilization Compatibility: The material should handle sterilization processes without issues.

- Protection: The package should protect the product from oxygen and keep its aroma intact.

Top Benefits of Aseptic Packaging: Longer Shelf Life, Cost Savings, and Eco-Friendliness

Aseptic packaging is becoming increasingly popular among manufacturers. According to The Freedonia Group, the demand for this type of packaging is expected to grow at 6.8% annually, reaching $6.4 billion by 2020. Here’s why:

- Longer Shelf Life: Aseptic packaging extends the shelf life of products by six to 12 months without needing refrigeration. This allows more time for products to be sold and used before they expire.

- Lower Shipping Costs: Aseptic packaging allows products to be stored at room temperature (68-77°F) and is lighter and more compact than traditional packaging. This reduces shipping costs by cutting down on weight and the need for refrigeration.

- No Preservatives Needed: Since aseptic packaging uses sterilization to prevent bacteria, manufacturers don’t need to add preservatives. This means they can use natural ingredients that consumers prefer.

- Eco-Friendly: Aseptic packaging is sustainable, made from renewable resources, and uses about 60% less plastic compared to other packaging options. It also requires less energy to produce.

- Maintains Quality: The advanced aseptic process preserves the taste, smell, and nutritional value of products, ensuring high quality for consumers.

For Instance,

- In October 2023, SIG, an internationally recognised packaging services company, established the foundations for its debut aseptic carton establishment in India, indicating an important development of its position in the country.

Aseptic Packaging Market Trends

- Aseptic packaging technique provides for the sterile packing of products, reducing contamination and prolonging shelf life without the need of refrigeration or preservatives.

- Aseptic packaging ensures the safety and quality of packed items by preserving their nutritional content, flavour, and freshness for an extended duration.

- Aseptic packaging provides ease and portability for on-the-go consumption, meeting the demands of busy lifestyles and consumers seeking convenience foods and beverages.

- Manufacturers are increasingly using sustainable materials and procedures in aseptic packaging to reduce environmental impact while meeting consumer demand for eco-friendly packaging solutions.

Positioning of Asia-Pacific as a Major Player in Aseptic Packaging Industry

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is attributed to the increasing middle-class population, increasing demand for packaged food and beverages and rapid urbanization and industrialization. China, India, Japan and South Korea are fastest growing countries propelling the market growth. Various manufacturers in China produce aseptic bags for the food industry. They offer a wide range of aseptic bags such as Ultra-High Barrier options, High Barrier and Standard Barrier, which expected to increase the market demand in China.

The region comprising Asia-Pacific signifies itself as the key centre for the aseptic packaging market, featuring the largest global presence. Asia is expected to experience the fastest development in this industry, with China and India heading in this field globally. China, in specifically, is anticipated to produce significant improvements, contributing to 28% of the overall market value growth.

Liquid dairy goods are the primary driver of the aseptic packaging sector in China. The Chinese milk products market's commercial scale exceeded 440 billion yuan in 2022, up 4% from the previous year. Based on statistics from China Analytics Consultancy, this market is anticipated to develop at 4.8 %, which will help the aseptic packaging company develop. Aseptic packaging was in great demand in China, which accounted for $4.5 billion, or 56 % from the the Asia-Pacific region region's total demand for the product, based on most recent statistics. With annual average development of more than 19% throughout the last ten years, China's aseptic packaging industry has experienced strong expansion. Several factors are driving this economic trajectory, including the robust growth of the industrial sector, growing personal wages, more consumption, and positive trends in urbanisation.

These components are projected to keep improving China's finished goods demand, which will render aseptic packaging solutions necessary. The increase in Chinese exports towards advanced consumer economies will drive up the need for better packaging, which will increase aseptic packaging consumption in the area. In the aseptic packaging industry, the Asia Pacific area, and China in specific, are positioned as major players with robust development potential driven by economic considerations, urbanization trends, and rising exports.

For Instance,

- In Janaury 2023, Greatview Aseptic Packaging was acquired by Shandong NewJF Technology Packaging Co., Ltd, a prominent aseptic packaging company in China, for 28.22 percent. The deal was finalised.

Growth Drivers for Aseptic Packaging in the North American Market

Aseptic packaging has grown progressively more prevalent in North America, and within the decade that follows, consumer demands for healthy beverages is going to drive this expansion. It is expected that aseptic packaging is going to gain a larger share of the market globally, particularly across North America, since customers continued placing a premium on adopting nutritious choices. Aseptic packaging is American-originated and is increasingly popular since it protects the product's quality and freshness while requiring preservatives. Several aseptic filling and packaging technologies are used in the US for both acidic and low-acid foods to meet the needs of the industry and a wide range of consumer preferences.

The US dairy industry is expected to experience some challenges in 2024, which will affect the value of exports early in the year. Still, greater demand for skimmed products is anticipated in the final quarter of the year due to increased price competition in the United States.

Aseptic packaging's launch in the US opened the door for its subsequent spread throughout North America. As consumers place more focus on adopting health-conscious consuming practices, aseptic packaging is well-positioned to be essential in satisfying evolving customer needs and market expectations in this region.

For Instance,

- In March 2023, Aseptic Solutions USA Ventures, LLC, located in Corona, California, was acquired as an asset by Baldwin Richardson Foods, a renowned maker of customised ingredients for the food and beverage industry.

Latin America

The manufacturing of aseptic packaging in Latin America is expanding due to the growing demand for products with longer shelf lives in the food and beverage industry, particularly in dairy, juices, and ready-to-drink beverages. Local and international packaging companies are investing in high-level aseptic processing technologies and sterile filling machines to meet the region’s growing needs. Countries like Brazil and Mexico are merging as main hubs, supported by a strong beverage industry and growing consumer preference for safe, convenient, and preservative-free packaging. Additionally, sustainability initiatives are encouraging manufacturers to focus on lightweight, recyclable materials, meeting with worldwide packaging trends while catering to the Latin American market.

Middle East and Africa

The production of aseptic packaging in the Middle East and Africa is experiencing steady growth, driven by the growing demand for packaged dairy products, juices, and long-shelf life beverages in the region. Countries like Saudi Arabia, the UAE, and South Africa are becoming important markets, supported by stretching food and beverage industries and changing consumer lifestyles that favor convenience and hygiene. Multinational companies and local converters are investing in current filling technologies and sterile processing units to ensure product safety in hot climates where refrigeration is limited.

Growth Drivers for Aseptic Packaging in the Europe Market

Europe dominated the aseptic packaging market in 2024. The market growth in the region is driven by factors such as rising innovation in packaging technology, increasing presence of packaging companies, increasing focus on sustainability and increasing demand for eco-friendly and sustainable packaging. In addition, to meet the issue of plastic waste, various governments in the region are taking initiatives due to increasing environmental concerns. DS Smith Plc is included in offering plastic, paper and packaging products. With operations across 37 countries, DS Smith offers aseptic packaging for shelf and retail products, which is expected to enhance market growth in Europe.

Aseptic Packaging Market, DRO

Demand:

- The demand for aseptic packaging is being driven by the growing trend towards convenience foods, including ready-to-eat meals, drinks, and dairy products.

Restraint:

- Aseptic packaging may not be appropriate for all products, particularly those with delicate properties or components that are incompatible with sterilization procedures.

Opportunity:

- The increased use of aseptic packaging in developing countries, fueled by urbanization, rising disposable incomes, and changes in consumer preferences creates attractive potential for market growth.

Aseptic Beverage Cartons Essential Packaging for Shelf-Stable Products

In the industry of aseptic packing, cartons are the most popular product. Aseptic beverage cartons, also known as liquid paperboard (LPB) cartons, are essential for distributing shelf-stable dairy and fruit juices for customers across the globe. They are identified by their layered polymer-coated paperboards that include an aluminium foil layer. These cartons are essential to maintaining the longevity and freshness of the food. Hydra pulping is a common method used to recover the paper fibre that make up around 75% of the contents of the carton. The cellulose fibres that are recovered are then used to make building materials like boards and tiles, which makes full use of the carton and reduces waste.

The majority of beverage cartons are gathered via mixed door-to-door groups, offering an array of package alternatives. With the steps of separating and reusing that proceed, each mix presents unique difficulties. Since the incorporation of both paper and PE (polyethylene), beverage containers have a distinct ultraviolet signal; still, certain laminated papers and disposable coffee cups also exhibit comparable signals. When it comes to the material made up of beverage cartons, the usual breakdown is 72.5% fiberboard, 24% polymer, and 3.5% aluminium.

In order to recover valuable resources and reduce environmental damage, this component emphasises the significance of effective recycling methods. In the packaging business, cartons especially aseptic LPB beverage cartons are essential to the distribution of shelf-stable beverages to customers throughout the world. To promote sustainability and lessen environmental impact, efforts must be made to improve recycling procedures and efficiently handle carton waste.

For Instance,

- In November 2023, A paper-based barrier on an aseptic beverage carton has been introduced by Tetra Pak and Lactogal. Tetra Pak has already issued 25 million cartons in Portugal with the intention of launching the packaging on a large scale.

Increasing Demand for Aseptic Packaging Driven by Food and Beverage Consumption

Aseptic packaging is an essential technique for protecting food and drink items by eliminating pathogenic microorganisms from the supply chain. It guarantees a longer shelf life along with the preservation of premium food items. As more consumers choose "natural" (preservative-free) products and liquids that offer extra benefits, a large variety of food and drink items are now aseptically packaged in different shapes and sizes, including cartons, cups, pouches, and bottles. Aseptic packaging involves sterilisation equipment and packaging materials with chemicals like peracetic acid (PAA) or hydrogen peroxide (H2O2) without adding preservatives or creating more heat tolerance to the beverage bottles. The demand for aseptic packaging has increased due to the rise in pre-packaged, ready-to-eat food consumption in many nations across the world as a result of rising disposable income.

The subcategory of aseptic juice drinks experienced a 16.6% increase in dollar sales and a 9.7% increase in unit sales. In contrast, the subcategory of aseptic juices experienced a 16.2% increase in unit sales and a 22.8% increase in dollar sales.

Urbanisation is occurring rapidly; on an annual basis, some 1.4 million people move to cities around the globe, as UN Secretary-General Antonio Guterres has mentioned. A wide range of food products require aseptic packaging, which is being driven by this change in population dynamics and how food is acquired and preferred.

Manufacturers are increasingly embracing sustainable packaging strategies, which is a noticeable trend. As consumers' expectations for sustainable products rise and environmental conservation becomes more widely recognised, companies are placing a higher priority on aseptic packaging and other eco-friendly packaging solutions in order to reduce their carbon footprint. As more people become urbanised, aseptic packaging becomes more important in satisfying customer demands for high-quality, preservative-free food and beverages. These demands are also being driven by a shift towards more sustainable packaging methods and rising disposable income.

For Instance,

- In March 2023, FirstWave Innovations and ProAmpac, a world leader in material science and flexible packaging, have teamed to bring aseptic spouted pouches to market. ProAmpac's capabilities in Rochester, NY, including its highly flexible, low minimum order quantity, will be used in this partnership.

Key Players and Competitive Dynamics in the Aseptic Packaging Market

The competitive landscape of the aseptic packaging market is dominated by established industry giants such as SIG, I. du Pont de Nemours and Company (US), Becton, Dickinson and Company (US), Bemis Company, Inc. (US), Reynolds Group Holdings Limited (New Zealand), Amcor Limited (Australia), Robert Bosch GmbH (Germany), Tetra Laval International S.A. (Switzerland), Greatview Aseptic Packaging Co., Ltd. (China), IMA S.P.A (Italy), and Schott AG (Germany). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

SIG is a top supplier of creative, adaptable, and sustainable packaging. SIG expands its aseptic packaging goods globally and presents its sustainable SIG Terra line.

For Instance,

- In 2023, In SIG released impressive preliminary 2021 statistics for the entire year. Core revenue was €2,047 million, or 6.6%1 more at constant currency than like-for-like revenue.

The best-selling line of carton packages for liquid foods with a long shelf life worldwide is Tetra Brik® Aseptic. It has several alternatives that can help you in your efforts to combat climate change, and it is available in a broad variety of shapes and volumes. Perfect for a variety of products, such as wine, milk, cream, plant-based drinks, tomato-based products, still drinks, and so on.

For Instance,

- In Janaury 2022, Tetra Pak is now the first company in the food and beverage industry to introduce a cap made of certified recycled polymers thanks to a partnership with Elvir, a division of Savencia Fromage & Dairy, a globally recognised milk processor.

Recent Developments

- In May 2025, SIG, an innovative septic carton packaging without the aluminium surface, disclosed the commercial launch of the industry's first: SIG Terra Alu-Free +Complete barrier for the multi-service aseptic cartons. It is based on the success of this innovative packaging material invention in the sector of single-serve cartons, with over 300 million packs sold in China in 2023.

- In January 2025, CR Beverage, which is China’s top bottled water brand, has infused three of Sidel’s complete high-speed aseptic complete lines to align with developed consumer demand for perfect quality, healthier, and eco-friendly materials packaging for the juices, teas, and carbonated drinks.

- In April 2024, a live demonstration of its newly launched aseptic liquid packaging machine, the SPM Aseptica 24000 was organized by Faridabad-based Shubham Flexible Packaging. They have collar-type and multitrack packaging machines in their portfolio.

- In September 2024, Tetra Pak launched the new Tetra Prisma Aseptic 300 Edge beverage carton in collaboration with European juices, nectars and soft drinks markets. The aim behind this launch was to cater to the preference of modern consumers for slimmer and taller packaging.

- In November 2024, MilkyMist, Indian dairy company introduced the ‘world’s first’ long-life probiotic buttermilk in aseptic carton packs in collaboration with AnaBio and SIG.

Aseptic Packaging Market Player

Aseptic Packaging Market Segments

By Product Type

- Cartons

- Pouches

- Bags

- Cans

By End Use

- Food and Beverage

- Pharmaceutical

- Personal Care

- Others

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA