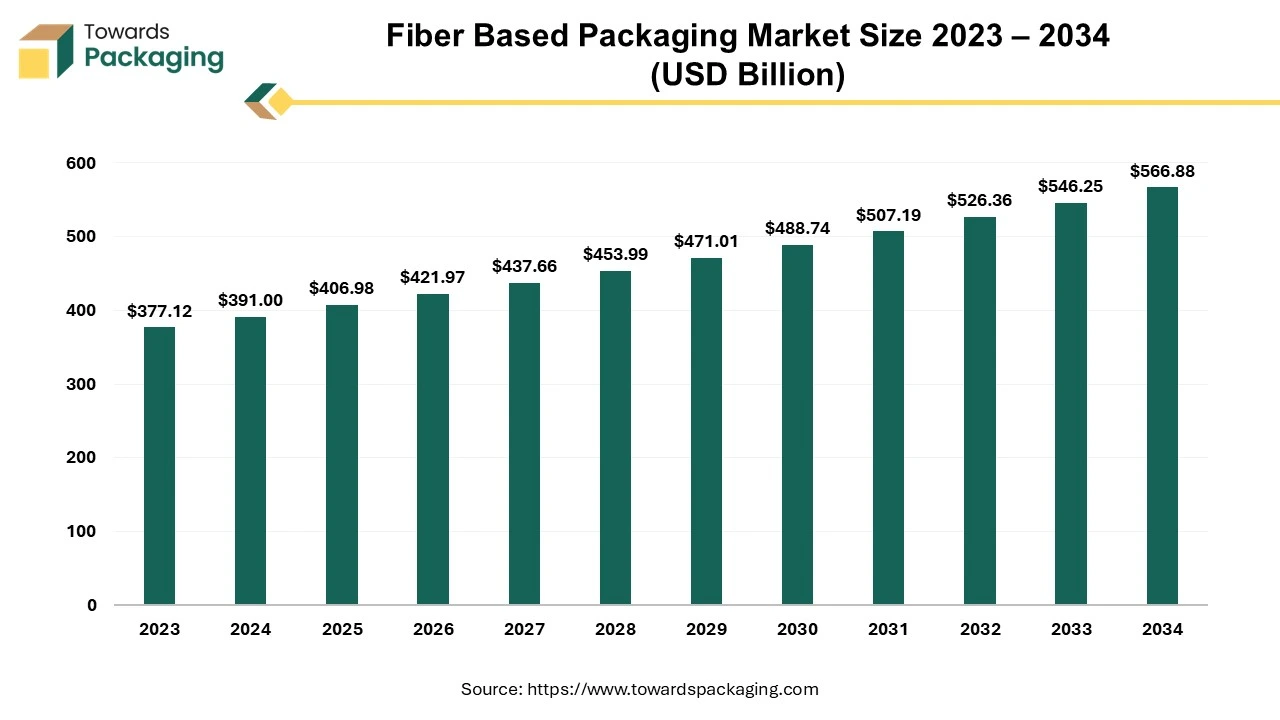

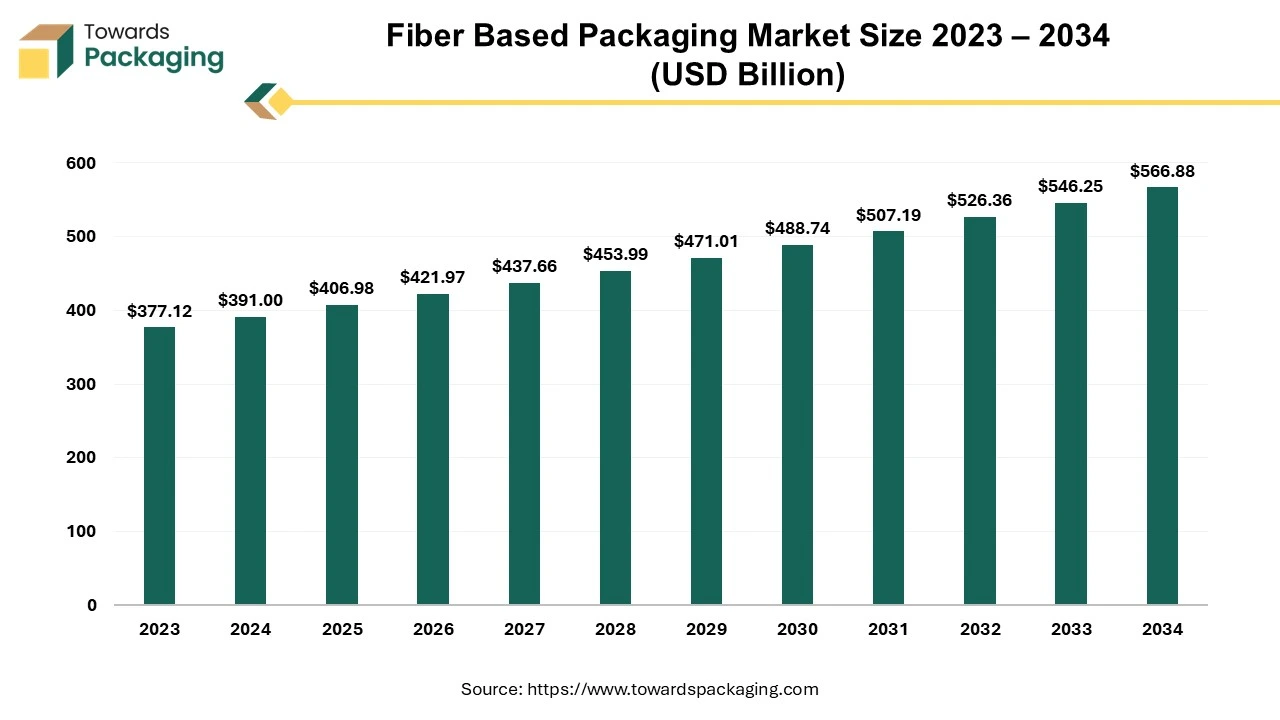

The fiber-based packaging market is forecasted to expand from USD 421.69 billion in 2026 to USD 592.45 billion by 2035, growing at a CAGR of 3.85% from 2026 to 2035. Market demand is rising due to the shift toward sustainable packaging, with corrugated materials holding the largest share in 2024, accounting for a significant portion of global consumption.

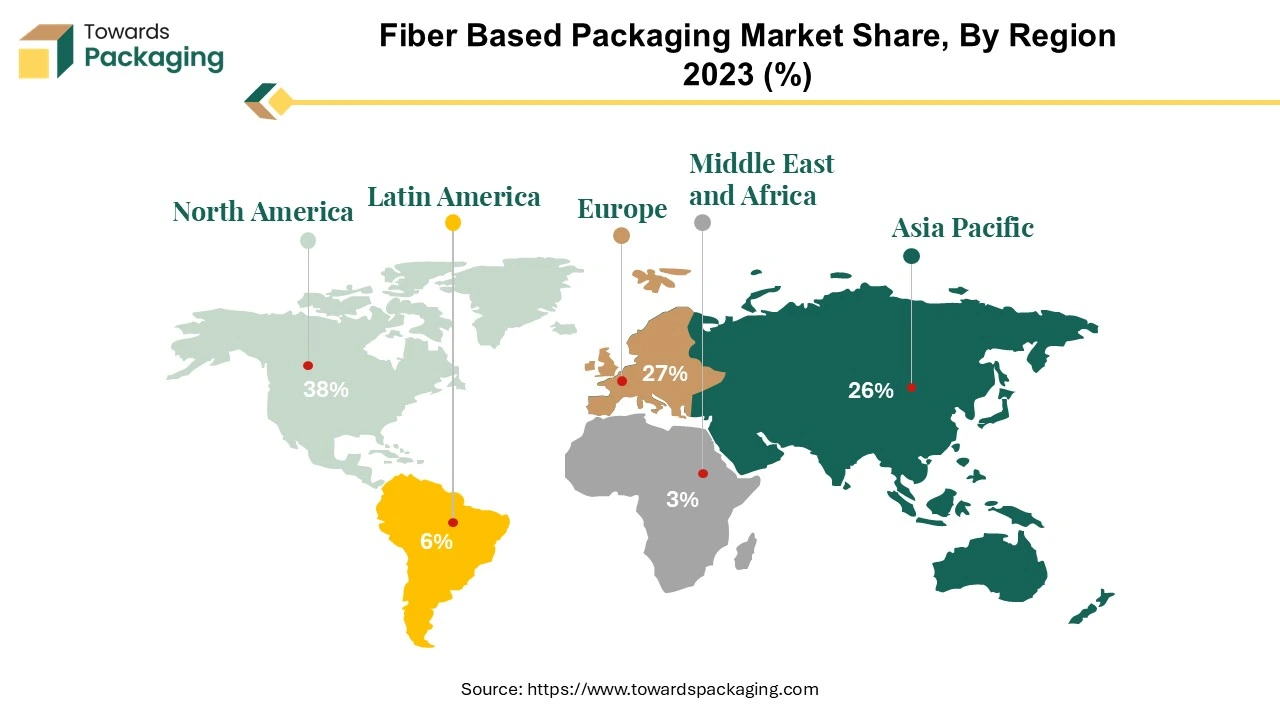

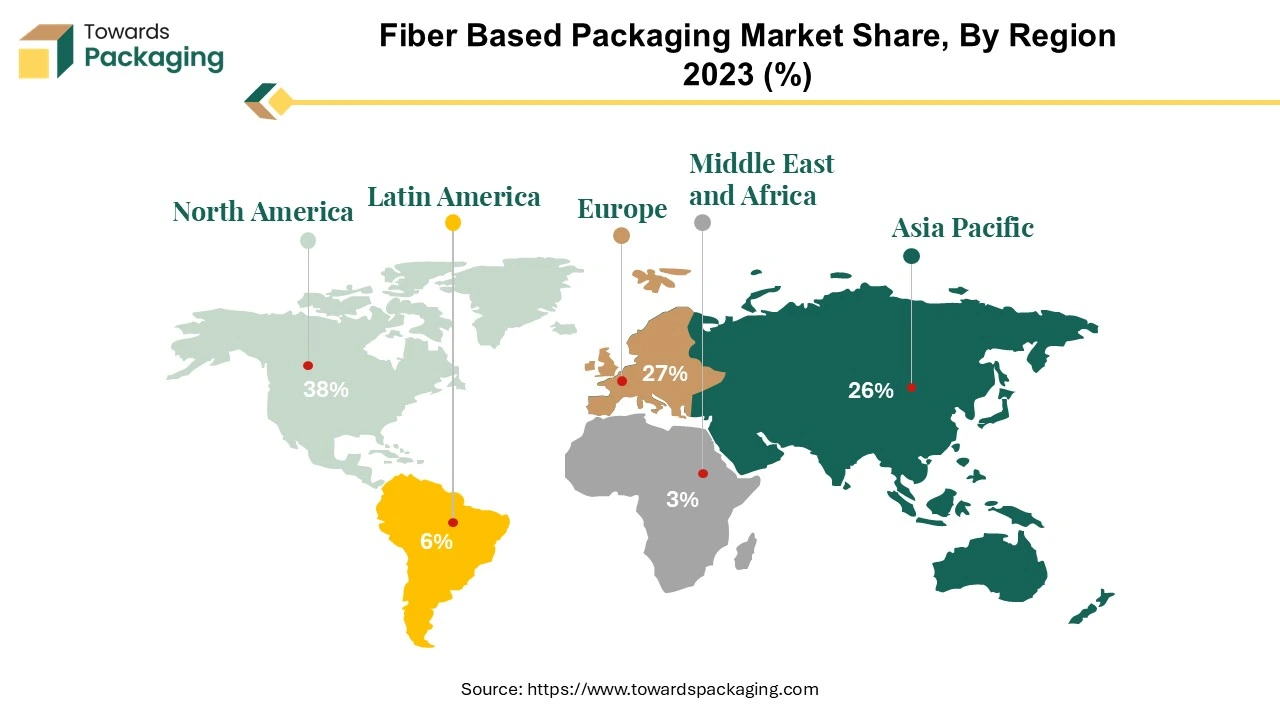

Regionally, North America led the market in 2024 with a dominant share, driven by large players such as International Paper and WestRock, while Asia Pacific is forecasted to grow at the fastest rate through 2034, supported by e-commerce growth of 9.8% YoY in China (H1 2024). Europe continues to expand due to regulatory pressures like the PPWR and SUPD, influencing packaging manufacturers.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing fiber-based packaging which is estimated to drive the global fiber-based packaging market over the forecast period.

Packaging made from natural virgin fiber, such as cardboard, paper, and other plant-based materials, usually derived from agricultural waste or wood pulp is referred as fiber-based packaging. The fiber-based packaging is more sustainable than synthetic or plastic alternatives. Paper and other fiber-based materials are derived from renewable resources, such as trees and agricultural waste. Unlike plastic, which can take hundreds of years to break down, fiber-based packaging materials decompose relatively quickly when exposed to natural elements, reducing their environmental impact. Many fiber-based materials, especially paper and cardboard, are highly recyclable. Paper could be reused multiple times, which minimizes waste and the need for new raw materials. Increasingly, consumers are seeking eco-friendly alternatives to plastic. Fiber-based packaging is seen as a more sustainable choice, which can enhance a brand's appeal to environmentally conscious customers.

Due to the rising global warming and environmental crisis consumers are shifting towards sustainable packaging. With growing environmental concerns, consumers are increasingly preferring brands that offer sustainable packaging. Fiber-based packaging, being biodegradable and recyclable, is seen as a eco-friendlier alternative to plastic and other non-renewable materials.

Governments worldwide has introduced stricter regulations against single-use plastics, encouraging industries to adopt fiber-based packaging. For instance, the European Union and several U.S. states have implemented plastic banned or restrictions, which are driving the demand for alternative materials like paper, cardboard, and molded fiber.

The fiber-based materials such as paper and cardboard have limitations when it comes to oxygen, grease and moisture resistance. To overcome these limitations, innovations in bio-based barrier coatings (e.g., starches, plant-based waxes, or polymers) are gaining momentum, upgrading the shelf-life and functionality of fiber-based packaging for food and beverage products. Fiber-based packaging is also evolving to meet the requirements of the modern marketplace. This includes the integration of smart packaging technologies (e.g., QR codes, NFC tags) that enhance the consumer experience or provide supply chain tracking.

Rising Focus on Recycled Content: Rising emphasis on sustainability is shifting companies to utilize recycled paper and recycled fiber in their packaging. Brands are aiming to incorporate post-consumer recycled (PCR) content to minimize waste and develop a more circular packaging economy.

Closed-Loop Recycling: Companies are also developing systems that allow fiber-based packaging to be recycled back into the production loop, improving the material’s sustainability and minimizing the demand for virgin fiber. This push towards a closed-loop system is being supported by recycling innovations and consumer participation. Shift from Plastics to Paper: Many food and beverage brands are switching from plastic to paper or molded fiber packaging.

AI can significantly improve the fiber-based packaging industry in several key areas, enhancing sustainability, innovation and efficiency. AI can help in developing more efficient packaging designs, minimizing material waste and improving strength-to-weight ratios. Machine learning algorithms can analyze patterns in material utilization and suggest ways to reduce unnecessary bulk while maintaining structural integrity.

In aim to reduce plastic waste and promote circular economies governments worldwide are implementing stricter regulations. Initiatives like plastic bans, extended producer responsibility (EPR) programs, and recycling mandates are incentivizing companies to invest in recyclable, sustainable, or compostable fiber-based packaging solutions. Consumers are becoming more conscious of their environmental impact and increasingly favour brands that utilize compostable recyclable or sustainable packaging. The increasing demand for packaging that minimizes waste and promotes sustainability is pushing businesses to adopt fiber-based alternatives over plastics, which are often seen as environmentally harmful.

The conference is set to discuss important issues that the industry is now facing: How can companies adjust to changing rules? How may plastic-free substitutes be created without compromising their usability and capacity to be recycled? In the rapidly evolving landscape, what part will fiber-based packaging play? As new package sustainability standards are established by the EU's package and Packaging Waste Regulation (PPWR) and Single-Use Plastics Directive (SUPD), manufacturers are under increased pressure.

Manufacturers and brands are under tremendous pressure to innovate as a result of the EU's Packaging and Packaging Waste Regulation (PPWR) and Single-Use Plastics Directive (SUPD), which establish new guidelines for packaging sustainability. In order to help delegates, keep ahead of the curve and take action toward greener packaging practices, the Functional Fiber-Based Materials & Packaging 2024 conference was intended to offer useful solutions, legislative updates, and technological breakthroughs.

The key players operating in the market are facing issue due to availability of alternative substitutes and disruption in supply chain, which may restrict the growth of the fiber-based packaging market in the near future. While fiber-based packaging is biodegradable and sustainable, it may not offer the same level of strength, durability, or barrier protection as plastic. This can be a limitation for certain products, particularly those that require moisture or air resistance (e.g., fresh foods, electronics). The supply of raw materials for fiber-based packaging, like recycled paper or virgin pulp, can be affected by fluctuations in availability and cost. Additionally, the processing of these materials often requires specialized machinery and infrastructure, which can limit production scalability.

Fiber-based packaging can be more expensive to produce compared to traditional plastic or other materials. The cost of raw materials like paper pulp, and the more complex manufacturing processes involved, can make fiber-based options less competitive, especially in price-sensitive markets. Other environmentally friendly materials, such as biodegradable plastics (e.g., PLA) or plant-based polymers, may offer some of the benefits of fiber-based packaging, creating competition in the sustainable packaging market.

Large corporations and retailers are setting sustainability targets that include reducing their reliance on plastic packaging. This has led to a shift toward more sustainable packaging alternatives like fiber-based solutions. The key players operating in the market are focused on research & development of advanced technology for the introduction of the new fiber-based products, which is estimated to create lucrative opportunity for the growth of the fiber-based packaging market in the near future.

According to statistics from Statista Market Insights and Marketer, the demand for different fiber-based packaging solutions is expected to increase by 5–10% per year due to the ongoing expansion of global e-commerce, for instance. Therefore, it is necessary to create high-quality, scalable packaging that is simple to recycle and drastically lowers carbon emissions. VTT technical research centre forecasts a significant transition from conventional plastic-based non-woven items to cellulose-based ones, such as napkins and wipes.

Corrugated segment held a dominant presence in the fiber-based packaging market in 2024. Corrugated material is widely used for making fiber-based packaging due to several key advantages that make it ideal for packaging applications.

Corrugated fiberboard is strong and provides excellent protection for products during shipping and handling. The structure of corrugated material, with its fluted inner layer sandwiched between two flat liners, offers superior resistance to pressure, crushing, and impact, ensuring that products remain safe and intact.

Despite its strength, corrugated packaging is relatively lightweight compared to other materials like plastic or metal. This makes it cost-effective for shipping and reduces transportation costs. Corrugated packaging is manufactured primarily from renewable materials (wood pulp or recycled paper), and it is recyclable and biodegradable. This aligns with the growing demand for environmentally friendly and sustainable packaging solutions.

The recycle fiber segment registered its dominance over the global fiber-based packaging market in 2024. By utilizing recycled fiber significantly minimizes the demand for virgin wood pulp, conserving natural resources, preserving forests, and reducing environmental impact. It helps lower carbon emissions associated with the production of new paper and fiber materials, making recycled fiber a more sustainable option for packaging.

The production of recycled fiber typically utilizes less energy compared to innovating fiber from virgin wood pulp. This results in a minimization in overall energy consumption, which is beneficial both environmentally and economically.

The corrugated boxes segment led the global fiber-based packaging market.

These factors attribute for application of the corrugated box in usage of secondary packaging.

The food & beverages segment dominated the fiber-based packaging market globally. Fabric packaging is often developed to be reusable, which makes it an attractive option for consumers who prioritize sustainability. Bags, pouches, and wraps made from fabric can be utilized multiple times for storage or carrying, minimizing the requirement for single-use packaging. This durability extends the value of the packaging for both manufacturers and consumers.

Fabric packaging provides a unique aesthetic that stands out from traditional packaging materials. It can be custom-designed with colors, prints, and logos, offering excellent branding opportunities. High-end food and beverage products, like artisanal coffees, gourmet teas, and premium wines, often utilizes fabric packaging to convey a sense of craftsmanship, luxury, and environmental consciousness.

North America region held a significant share of the fiber-based packaging market in 2024. North America region has a strong presence in the fiber-based packaging due to presence of major key players like International Paper, Westrock, Amcor plc., and Berry Global among others. Environmental concerns about plastic waste and pollution have significantly increased in North America. As consumers and businesses alike become more eco-conscious, there is a growing preference for sustainable packaging solutions.

North American governments, particularly in the U.S. and Canada, have implemented increasingly stringent regulations around waste management and packaging sustainability. Policies such as bans on single-use plastics and requirements for recyclability in packaging have pushed businesses and industries to adopt alternative materials like fiber-based packaging. Additionally, tax incentives, extended producer responsibility (EPR) schemes, and other environmental regulations are encouraging the shift toward more sustainable packaging solutions.

Asia Pacific region is anticipated to grow at the fastest rate in the fiber-based packaging market during the forecast period. Environmental awareness is on the rise across the APAC region, with increasing concerns about plastic pollution, especially in countries like China and India. Governments and consumers are pushing for sustainable solutions, and many APAC nations have started implementing stricter environmental regulations, promoting the use of recyclable, biodegradable, and eco-friendly materials.

Asia Pacific has seen rapid growth in e-commerce, with countries like China and India experiencing explosive online retail expansion. This shift has significantly increased demand for packaging solutions, including fiber-based packaging, which is commonly used in e-commerce shipments for its cost-effectiveness and protective qualities. The rise of online shopping, along with the growth of online food delivery services, has accelerated the need for sustainable and versatile packaging options in the region.

According to VTT Vice President of Biomaterial Processing and Products Atte Virtanen, it was states that with the support of over 50 industry partners, to initiate new project for sustainable packaging solutions which is a crucial step towards more competitive and sustainable fiber-based goods and has the potential to have a significant impact. The idea of one-on-one commercial projects with businesses and packaging industries that spur innovation in the manufacturing of energy-efficient paper boards was the aim of the project.

VTT's mission is to bridge the gap between science, technology, business, and people in order to create a sustainable future.

The sustainability program will create a new, cutting-edge open-access pilot line in Jyväskylä, Finland, and has a budget of about 20 million euros (US$ 21 million) up till 2028. The goal of the cooperative study is to create and evaluate sustainable, economically feasible substitutes for non-woven textiles, hygiene products, and fiber packaging.

By Material Type

By Material Source

By Product Type

By End-user

By Region

February 2026

February 2026

February 2026

February 2026