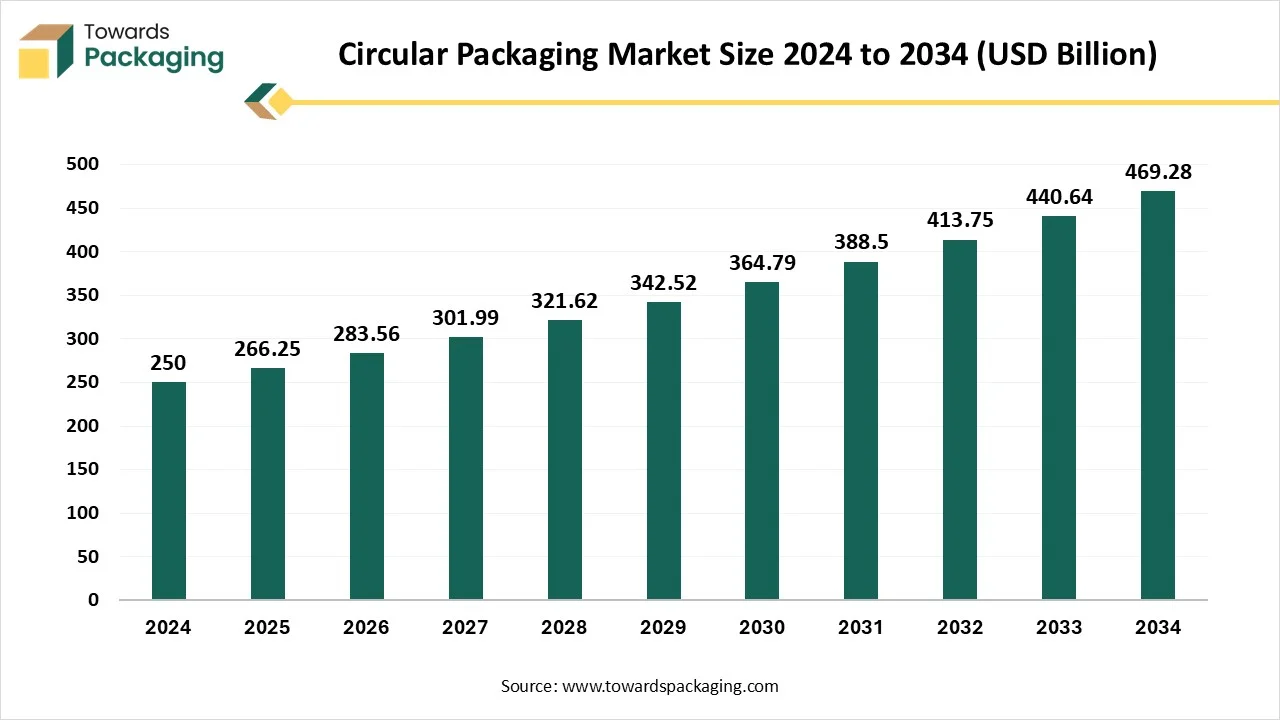

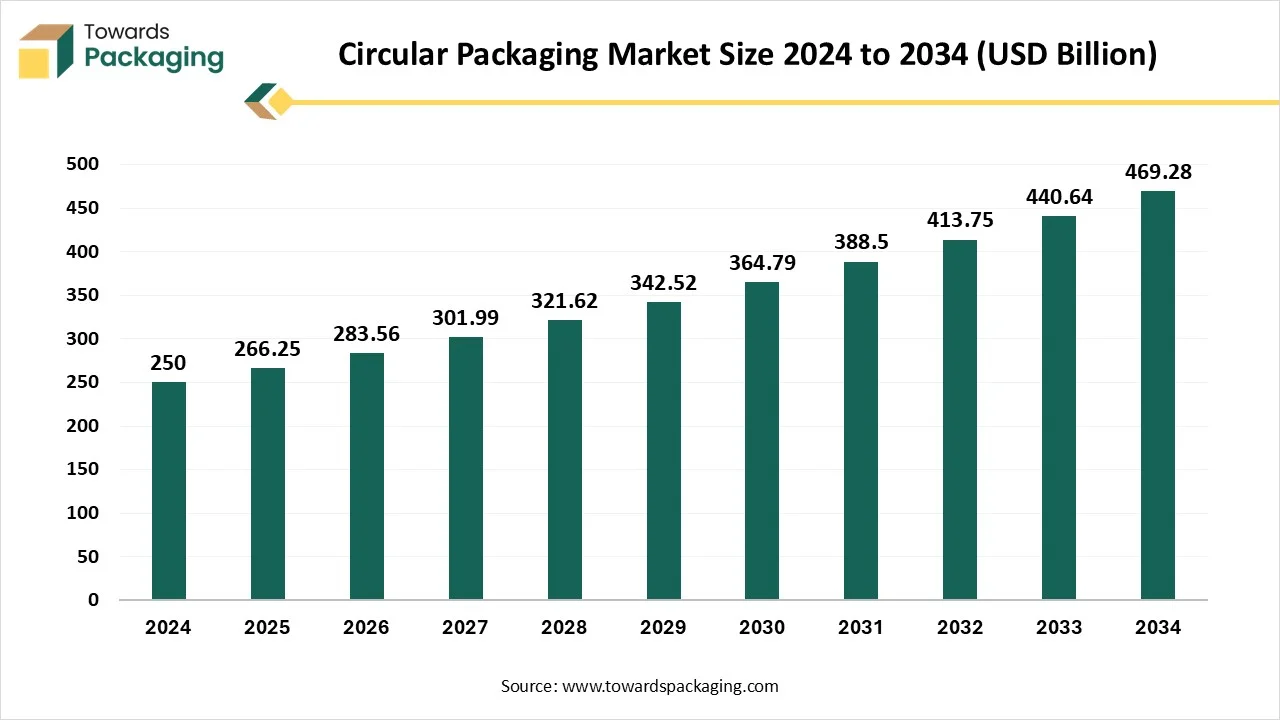

The circular packaging market is forecasted to expand from USD 283.56 billion in 2026 to USD 499.79 billion by 2035, growing at a CAGR of 6.5% from 2026 to 2035. This report provides a comprehensive analysis of market trends, key segments by material type, packaging format, function, end-use industries, and lifecycle models.

It covers regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting growth opportunities, regulatory impact, and sustainability initiatives. The study also profiles top companies including Amcor plc, Tetra Pak, Smurfit Kappa, and Berry Global, along with competitive strategies, value chain dynamics, and global trade data.

A sustainable strategy, circular packaging aims to reduce waste by extending the useful life of packaging materials through reuse, recycling, and regeneration. By establishing a closed-loop system, this technique guarantees that packaging materials either safely disintegrate without endangering the environment or return to the system as reused resources. An essential component of the circular economy is compostable packaging. It actively restores natural ecosystems by turning waste into nutrient-rich soil. Circular packaging offers quantifiable advantages to companies prepared to bolster their sustainability efforts, including substantial environmental impact alignment with Extended Produces Responsibility (EPR) regulations, and a clear route to sustainability objectives.

AI integration is transforming the circular packaging market by enhancing efficiency, traceability, and sustainability throughout the packaging lifecycle. In recycling, AI-powered sorting systems can accurately identify and separate materials, increasing the purity of recovered resources and enabling effective upcycling. In packaging design, AI helps optimize materials for recyclability, reduce waste, and eliminate unnecessary components. AI also enables end-to-end traceability using IoT devices like RFID and QR codes, allowing companies to track packaging from production to disposal or reuse. Additionally, AI-driven demand forecasting and inventory management reduce overproduction and material waste. By analyzing consumer behaviour, AI helps brands develop more effective reuse or return programs. In recycling and packaging facilities, predictive maintenance supported by AI ensures consistent equipment performance. Altogether, AI is a critical enabler of smart, scalable, and circular packaging systems that support sustainability goals and improve operational outcomes.

Environmental Regulations and Plastic Bans

Governments across the globe are enforcing strict packaging waste laws, such as bans on single-use plastics, mandatory recycling targets, and Extended Producer Responsibility (EPR) schemes. These regulations push companies to adopt recyclable, reusable, and compostable packaging.

Lack of Recycling Infrastructure & Performance Limitations

The growth of the circular packaging market is restricted by several challenges, including high initial costs of innovation, limited recycling infrastructure, and a lack of standardized regulations. Complex supply chain requirements and inadequate reverse logistics further hinder adoption. Consumer resistance due to low awareness or convenience issues adds to the problem. Additionally, some circular materials lack durability or performance for specific applications. Regulatory inconsistencies and weak data systems for tracking and traceability also pose significant barriers to implementing effective circular packaging solutions at scale.

Refill stations, returnable containers, and reuse models in grocery, beauty, and e-commerce are gaining traction, opening new revenue streams and reducing waste.

Advancements in bio-based materials, smart packaging (e.g., RFID, QR), AI-powered recycling, and mono-material flexible films are enabling scalable circular solutions across sectors like food, e-commerce, and personal care.

The recycled materials segment is dominant in the circular packaging market due to its widespread availability, cost-effectiveness, and ability to reduce environmental impact. These materials—such as recycled paper, plastic, metal, and glass are supported by well-established collection and processing systems, making them easier to scale across industries. Recycled materials help reduce dependence on virgin resources, lower carbon emissions, and meet growing regulatory requirements and corporate ESG goals. Their compatibility with existing packaging infrastructure also allows manufacturers to adopt circular practices without significant technological or design overhauls.

The biodegradable & compostable materials segment is the fastest-growing in the circular packaging market due to rising environmental concerns, plastic bans, and demand for sustainable alternatives. Governments worldwide are implementing strict regulations to reduce single-use plastics, encouraging the adoption of materials that naturally decompose without harming ecosystems. Consumers are increasingly eco-conscious, preferring packaging that leaves no long-term waste. Additionally, advancements in biopolymers, such as PLA and PHA, have improved performance, enabling wider use in food, retail, and personal care packaging, driving rapid market expansion for these materials.

The rigid circular packaging format is dominant in the circular packaging market due to its durability, reusability, and strong protective properties. Rigid formats such as bottles, jars, and containers are ideal for closed-loop systems as they can withstand multiple uses without losing structural integrity. They are widely adopted in the food, beverage, and personal care industries where product safety and shelf life are crucial. Additionally, rigid packaging is easier to collect, clean, and refill, making it well-suited for reuse and take-back programs that support circular economy goals.

The flexible circular packaging format is growing fastest because it uniquely combines convenience, sustainability, and cost efficiency. Its lightweight, thin structure uses significantly less material, reducing production and transport emissions. Advances in mono-material films, recyclable coatings, and PCR content make it easier to integrate into existing recycling streams. Flexible formats like pouches and mailers are increasingly used in e-commerce, food, and personal-care sectors, driven by consumer demand for portability, resealability, and sustainable packaging. Regulatory pressures (e.g., EU packaging mandates, plastics tax) further accelerate this shift. Together, these innovations and market forces are fueling rapid expansion in flexible circular packaging.

The primary packaging function segment is dominant in the circular packaging market due to its essential role in directly containing and protecting products across industries such as food, beverages, pharmaceuticals, and personal care. Primary packaging is the most visible and consumer-facing layer, making it a key target for sustainability efforts. Brands focus on circular solutions like recyclable, reusable, or compostable materials for primary packaging to meet environmental regulations, enhance product shelf life, and appeal to eco-conscious consumers. Its high usage volume and direct impact on waste generation further drive innovation and adoption of circular practices in this segment.

The secondary packaging segment is growing fastest in the circular packaging market due to the booming e-commerce sector, heightened sustainability awareness, and innovations in recycled and plant-based materials. As online retail surges, brands require lightweight, yet protective packaging like mono-material films, corrugated boxes, and compostable wraps to reduce shipping emissions and material waste. Advanced automation, AI-enhanced design, and smart traceability features (RFID, QR codes) optimize resource use and supply chain efficiencies. Combined with stricter regulations and consumer demand for eco-friendly packaging, these factors are pushing the rapid adoption of sustainable secondary packaging solutions.

The food and beverage segment dominates the circular packaging market due to its immense packaging volume and strong regulatory, consumer, and corporate push toward sustainability. Governments worldwide are enforcing stricter laws to reduce single-use plastics, mandating recyclable, compostable, or recycled-content packaging in food and drink applications. Rising consumer demand for eco-friendly packaging especially among younger demographics is driving brands to innovate. Additionally, advancements in material technologies and closed-loop systems enhance the recovery and reuse. These combined forces make food and beverages the largest segment circular packaging sector.

The personal care and cosmetics industry is the fastest-growing segment in the circular packaging market due to a convergence of consumer, regulatory, and innovation-driven factors. Increasing environmental awareness has led brands like Estée Lauder, Origins, and Aveda to invest heavily in recyclable, refillable, and upcycled packaging formats, responding to consumer demand for sustainability and transparency. The rise of e‑commerce has further accelerated this trend, with lightweight yet protective packaging becoming crucial for online beauty deliveries. Technological advances such as bio-based materials (e.g., algae, mushrooms) and smart aspects like QR codes and AR-enabled designs have made eco-friendly packaging both functional and appealing. Additionally, tightening EPR laws and corporate ESG commitments are accelerating the shift away from single-use plastics toward circular, refillable, and recyclable solutions.

The recyclable packaging segment is dominant in the circular packaging market due to its widespread infrastructure support, cost efficiency, and alignment with environmental regulations and corporate sustainability goals. Recyclable materials such as paper, glass, aluminium, and certain plastics are already well-integrated into global collection and processing systems, making them easier to adopt at scale. Brands and manufacturers prefer recyclable packaging as it allows for easier compliance with Extended Producer Responsibility (EPR) laws and plastic reduction mandates. Additionally, growing consumer awareness and demand for eco-friendly packaging have made recyclability a key decision factor, reinforcing its market dominance.

Reusable packaging is the fastest-growing lifecycle model in the circular packaging market due to a combination of cost efficiencies, consumer preferences, and regulatory momentum. Although upfront investment and reverse logistics pose challenges, reusable systems offer substantial long-term savings and supply chain improvements, especially in food & beverage, e-commerce, and logistics sectors. Rising environmental awareness, especially among Gen Z and millennials, and stricter legislation (e.g., EU reuse-target mandates, single-use plastic bans) are also key growth drivers. Technological advances like RFID and IoT support tracking and inventory optimization, enabling large-scale reuse adoption. Consequently, reusable packaging is rapidly becoming a smart, resilient, and circular solution.

Europe dominates the circular packaging market for several compelling reasons. First, regulatory frameworks such as the EU Circular Economy Action Plan and Packaging and Packaging Waste Regulation (PPWR) mandate high recyclability, minimal packaging use, and extensive reuse or refill targets, shaping design and production practices. Second, the region boasts advanced recycling and reuse infrastructure, including deposit-return schemes in Germany and Scandinavia, fueling circular systems. Third, towering consumer demand for sustainability drives adoption over 84% of Europeans check recyclability info before buying. Fourth, alignment with corporate ESG goals encourages investment in recyclable materials, reuse models, and digital tracking innovations. Finally, harmonized EU standards and EPR frameworks simplify cross-border packaging and waste processes, further reinforcing Europe's leadership in circular packaging.

Germany Market Trends

Germany leads the circular packaging market in Europe due to its strong regulatory framework, advanced waste management infrastructure, and a highly developed recycling culture. The country operates one of the most efficient deposit-return systems (DRS) for beverage containers, achieving return rates over 95%. Its Packaging Act (VerpackG) enforces strict producer responsibilities and mandates high recycling targets. German manufacturers are rapidly adopting recyclable and reusable packaging formats, driven by consumer demand and corporate ESG goals. Government support for closed-loop innovation and public awareness campaigns further strengthens Germany’s position as a frontrunner in circular economy packaging across multiple industries.

U.K. Market Trends

The UK plays a key role in Europe's circular packaging market through policy reforms, corporate sustainability commitments, and innovation in eco-friendly packaging materials. The UK’s Extended Producer Responsibility (EPR) scheme and Plastic Packaging Tax incentivize the use of recycled content and penalize non-recyclable plastic usage. British retailers and FMCG brands are investing in refillable and recyclable packaging formats, especially in the food and personal care sectors. Additionally, initiatives like the UK Plastics Pact promote collaboration across the value chain to design out waste. Growing consumer awareness and government funding for packaging innovation continue to drive the UK’s leadership in circular packaging development.

North America is growing at the fastest rate in the circular packaging market due to a combination of regulatory momentum, corporate sustainability commitments, and technological innovation. The introduction of Extended Producer Responsibility (EPR) laws in several U.S. states and Canada is pushing companies to adopt recyclable, reusable, and compostable packaging. Major brands and retailers are setting aggressive ESG goals, such as achieving 100% recyclable or reusable packaging by 2025-2030. Technological advances like AI-enabled sorting, bio-based materials, and smart packaging are accelerating adoption. Additionally, strong consumer demand for sustainable products and the growth of e-commerce are further fueling the shift toward circular packaging solutions.

U.S. Market Trends

The U.S. is a key driver of circular packaging growth in North America, propelled by rising environmental awareness, state-level EPR laws, and major corporate sustainability targets. States like California, Oregon, and Maine have enacted legislation mandating recyclability and producer responsibility. Large U.S. retailers and brands, such as Walmart, Amazon, and Coca-Cola, are investing in recyclable and reusable packaging to meet 2025-2030 ESG goals. Innovation in smart packaging, bio-based materials, and AI-enabled recycling technologies further supports the market. Additionally, the growth of e-commerce and consumer demand for eco-friendly packaging continues to accelerate the adoption of circular packaging across sectors.

Canada Market Trends

Canada is rapidly advancing in the circular packaging space through federal and provincial regulations, including a national ban on single-use plastics and the implementation of EPR frameworks across provinces like British Columbia and Ontario. These policies compel producers to use recyclable or compostable materials and finance post-consumer waste management. Canadian consumers show a strong preference for sustainable packaging, especially in the food and personal care sectors. Government-backed initiatives, like the Canada Plastics Pact, promote collaboration across industries to design out waste and enhance recyclability. With strong regulatory backing and public support, Canada is emerging as a leading force in North America's circular packaging transition.

The Asia-Pacific region is growing at a notable rate in the circular packaging market due to rapid industrialization, rising environmental awareness, and supportive government policies. Countries like China, India, Japan, and South Korea are implementing stricter regulations on plastic waste and encouraging the use of recyclable and biodegradable packaging materials. The region's large consumer base and expanding e-commerce sector are increasing the demand for sustainable packaging across the food, beverage, and personal care industries. Additionally, growing investments in recycling infrastructure, circular economy initiatives, and innovations in bio-based and reusable packaging are further accelerating market growth in Asia-Pacific.

By Material Type

By Packaging Format

By Function

By End-Use Industry

By the Packaging Lifecycle Model

By Region

February 2026

February 2026

February 2026

February 2026