Latin America Sustainable Packaging Market Demand, Size and Growth Rate Forecast

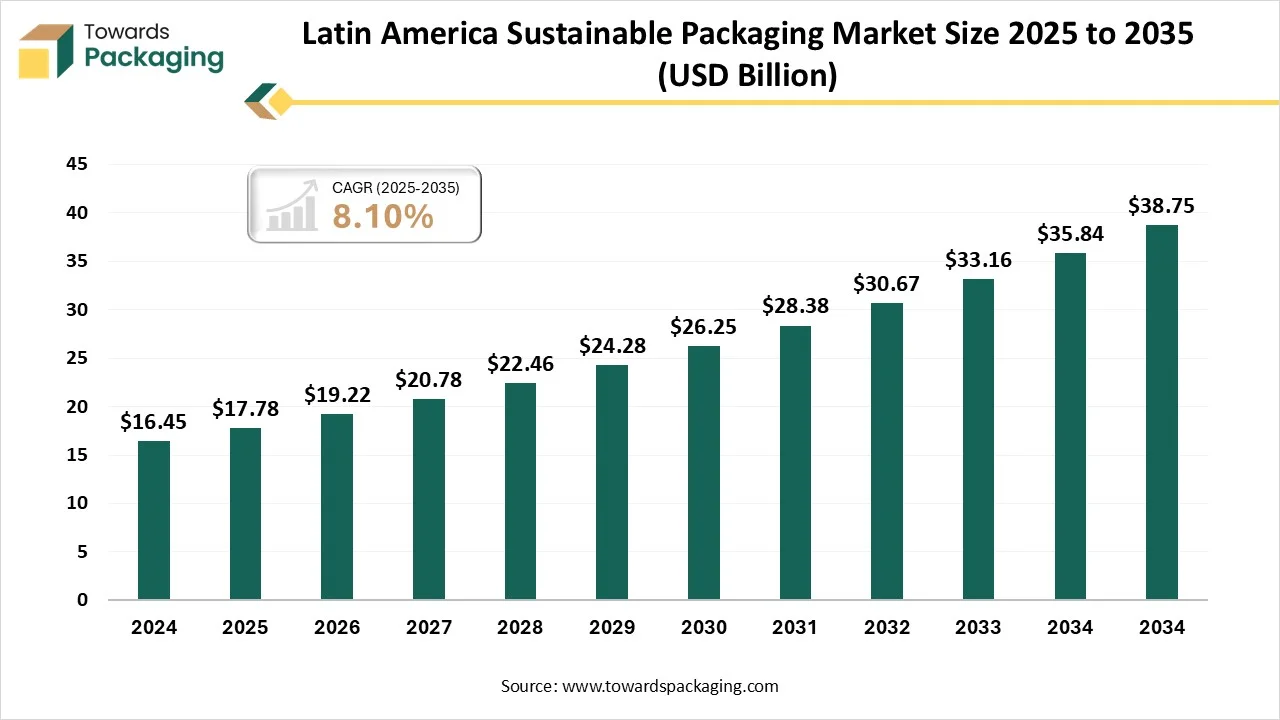

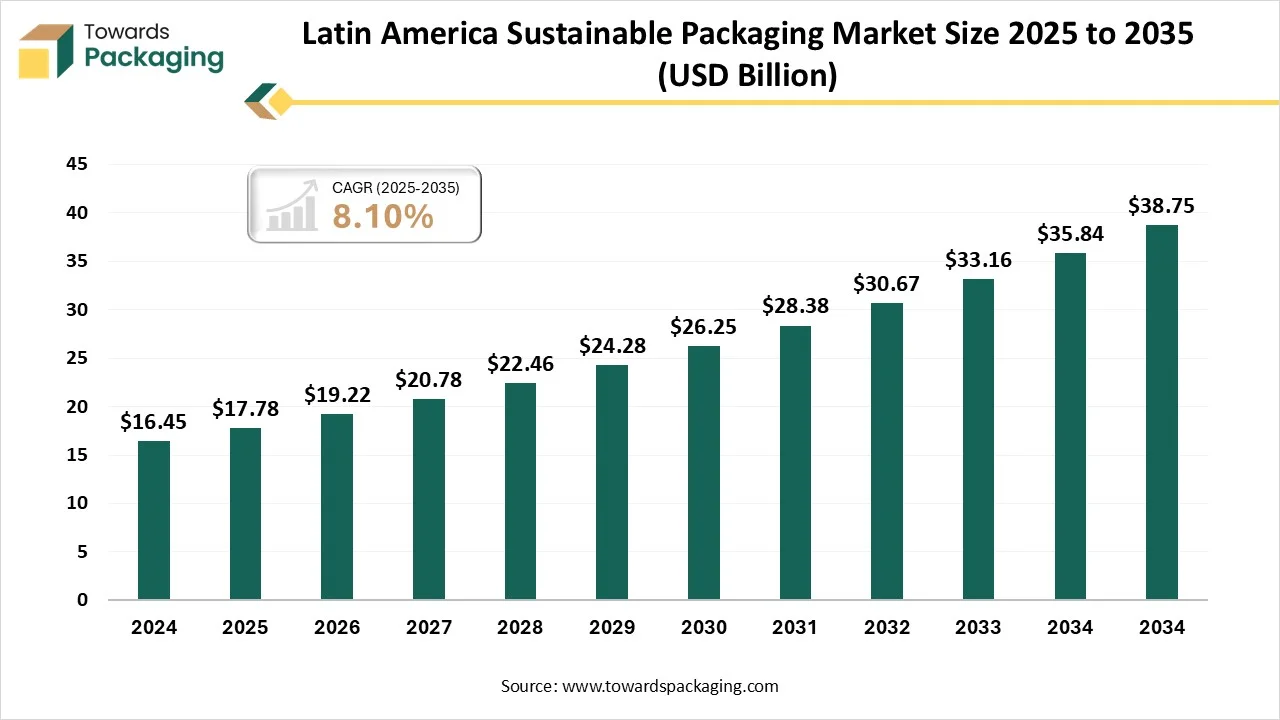

The Latin America sustainable packaging market is expected to increase from USD 19.22 billion in 2026 to USD 38.75 billion by 2035, growing at a CAGR of 8.10% throughout the forecast period from 2026 to 2035. The increasing consumer ecological consciousness, strict government guidelines for plastic waste, and the extension of e-commerce has raised the demand for market. The booming e-commerce needs effectual and protective packaging, with sustainable and lightweight choices.

Major Key Insights of the Latin America Sustainable Packaging Market

- In terms of revenue, the market is valued at USD 19.22 billion in 2026.

- The market is projected to reach USD 38.75 billion by 2035.

- Rapid growth at a CAGR of 8.10% will be observed in the period between 2025 and 2034.

- By material type, the paper & paperboard segment contributed the biggest market share of 43% in 2024.

- By material type, the bio-based plastics segment will be expanding at a significant CAGR in between 2025 and 2034.

- By packaging type, the rigid packaging segment contributed the biggest market share of 49% in 2024.

- By packaging type, the flexible packaging segment will be expanding at a significant CAGR in between 2025 and 2034.

- By application, the food & beverage segment contributed the biggest market share of 47% in 2024.

- By application, the personal & home care segment is expanding at a significant CAGR in between 2025 and 2034.

What is Sustainable Packaging?

Sustainable packaging encompasses eco-friendly packaging materials and systems designed to reduce environmental impact across the product life cycle. It includes recyclable, compostable, reusable, and bio-based solutions adopted by food & beverage, personal care, and e-commerce industries. Driven by environmental policies, consumer demand for green brands, and multinational FMCG sustainability commitments, the market integrates lightweighting, circular material flows, and energy-efficient manufacturing. Materials include recycled paper, PCR plastics, bioplastics, and plant-based or fiber composites. Countries such as Brazil, Mexico, Chile, and Colombia lead regional adoption, supported by EPR (Extended Producer Responsibility) legislation and packaging waste reduction goals.

Latin America Sustainable Packaging Market Outlook

- Market Growth Overview: The market is growing rapidly due to consumer consciousness, favourable government actions, and the growing demand for suitability and shelf-life enhancement in industries such as food & beverages.

- Regional Expansion: Countries such as Brazil, Mexico, Argentina, Chile, Colombia, and Rest of Latin America are witnessing material innovation, focus on food packaging, and e-commerce packaging which are the major factors behind the growth of this market.

- Major Market Players: Latin America sustainable packaging market includes Berry Global Group, Amcor Plc, Graham Packaging Company, SIG Group AG, AptarGroup, Graham Packaging Company, and several others.

- Startup Ecosystem: The startup industries play an important role in maintaining the strict governmental guidelines, meeting consumer demand, and focusing on the demand of expanding e-commerce sector.

Advancement in Recycling Technology Boost the Latin America Sustainable Packaging Market

The rising demand for eco-friendly packaging has influenced innovation in the recycling technology of the market. There's a rising change in the direction of resources influenced from renewable resources such as agricultural waste, cornstarch, and sugarcane. The incorporation of technology is important for enhancing efficacy and security across intricate supply chains. Modernized recyclable packing models are being mounted up, helped by united strategies and enhanced logistics.

Trade Analysis of Latin America Sustainable Packaging Market: Import & Export Statistics

- Argentina: The estimated export data of packaging materials till October 2024 is 1,635 shipments

- Mexico: The estimated export data of the green bags from June 2024 to May 2025 is approximately 1,039 shipments.

Latin America Sustainable Packaging Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are recycled PET, paper, and paperboard.

- Key Players: Amcor Plc, Tetra Pak

Component Manufacturing

The component manufacturing in this market comprises recycled plastic, bio-based plastic, paper and paperboard.

- Key Players: Berry Global Inc., Mondi Plc

Logistics and Distribution

This segment comprises advanced ways to encounter sustainability goals.

- Key Players: CEVA Logistics, Maersk

Material Type Insights

Why Paper & Paperboard Segment Dominated the Latin America Sustainable Packaging Market In 2024?

| Segment |

Percentage Share (%) |

| Paper & Paperboard |

43% |

| Recycled Plastics |

20% |

| Bio-based Plastics |

15% |

| Glass & Metal (Recyclable Formats) |

22% |

- Paper & Paperboard (43%): This segment leads due to its widespread use in various industries, especially in food and beverage packaging, driven by increasing consumer demand for sustainable, recyclable options.

- Recycled Plastics (20%): Growing focus on circular economy practices, particularly in post-consumer recycled plastics like PET and PE, is driving the demand for recycled materials.

- Bio-based Plastics (15%): The rise of bio-based plastics like PLA and PHA is gaining traction due to the growing demand for environmentally friendly alternatives to traditional plastics.

- Glass & Metal (22%): Glass and metal remain prominent due to their recyclability, especially in premium product packaging like beverages and cosmetics.

The paper & paperboard segment dominated the market with highest share in 2024 as these are easily recyclable and biodegradable. These are highly recyclable, renewable, and biodegradable, which supports in decreasing the carbon footprint connected with packaging. The resource is a cost-operative solution for packing, offering to its extensive acceptance. The rising demand for this resource is influenced by ecological concerns and its extensive utilization in the food & beverage and retail businesses.

The bio-based plastics segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its eco-friendly nature and increasing acceptance among consumers. Ecological awareness among customers is growing, causing them to favor goods with sustainable packing. These are the major component of this development, mainly in flexible applications, and it is influenced by the wider trend in the direction of sustainable choices across various packaging formats.

The recycled plastics is the fastest-growing in the market, as it includes cost-efficient solution. Growing customer and industry consciousness of plastic waste contamination is influencing demand for highly sustainable and ecologically friendly packing resolutions. Producing packing from recycled resources is frequently more cost-operative than utilizing virgin plastics, creating it a budget-friendly and sustainable substitute. It is utilized in food & beverage packing because of their chemical and heat resistance.

Packaging Type Insights

Why Rigid Packaging Segment Dominated the Latin America Sustainable Packaging Market In 2024?

| Segment |

Percentage Share (%) |

| Rigid Packaging |

49% |

| Flexible Packaging |

35% |

| Corrugated Boxes & Cartons |

16% |

- Rigid Packaging (49%): This segment captures the largest share as it is a preferred choice for robust and long-lasting packaging, especially in sectors like food and beverages.

- Flexible Packaging (35%): Flexible packaging's versatility, light weight, and lower transportation costs contribute to its strong growth, especially in consumer goods and food packaging.

- Corrugated Boxes & Cartons (16%): The increasing demand for e-commerce and industrial packaging drives the growth of corrugated packaging, although it is less dominant compared to rigid and flexible packaging.

The rigid packaging segment dominated the market with highest share in 2024 due to expansion of food & beverages industry and e-commerce sector. The growing e-commerce sector is highly concerned towards safe transit of products which has raised the demand for these types of packaging. Usage of lightweight materials has influenced the growth of this segment. There is a huge demand for durable packaging which has boosted the production of rigid packaging.

The flexible packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its efficiency and versatility of the packaging. It reduces the utilization of raw materials which result in less wastage of materials. The growing demand for suitability, ready-to-eat food products, and goods that need stretched shelf life is a key factor behind the growth of this segment.

The corrugated boxes & cartons is the fastest-growing in the market, as it is due to booming e-commerce and retail sector. Enhanced urbanization and the extension of the logistics part in Latin America additionally subsidize to the demand for this segment. This segment is majorly influenced by the requirement for protective, lightweight, and durable packaging, the rate of recyclability of corrugated resources, and a provincial move away from plastics materials.

Application Insights

Why Food & Beverage Segment Dominated the Latin America Sustainable Packaging Market In 2024?

| Segment |

Percentage Share (%) |

| Food & Beverage |

47% |

| Personal & Home Care |

25% |

| Pharmaceutical & Healthcare |

15% |

| Industrial & E-commerce Packaging |

13% |

- Food & Beverage (47%): The dominant share in this sector is due to the high demand for sustainable packaging solutions in both the food and beverage industries, where consumer demand for eco-friendly packaging is increasing.

- Personal & Home Care (25%): Personal care products, such as refill pouches and bio-based containers, are seeing a rise in demand due to the sustainability trend and a shift toward more eco-conscious consumers.

- Pharmaceutical & Healthcare (15%): The pharmaceutical sector's adoption of sustainable packaging is growing, but at a slower pace compared to food and beverage, due to stringent regulations.

- Industrial & E-commerce Packaging (13%): While this segment has been growing due to e-commerce, its share remains smaller as sustainable packaging solutions in industrial use are still evolving.

The food & beverage segment dominated the market with highest share in 2024 due to rising focus towards convenience and sustainability. This segment is dominating for its sustainability advantages, with substitutes such as stand-up pouches getting traction. High urbanization frequency means a superior focus on suitable, easy-to-transit packing. As lightweight plastic containers and bottles have a robust preference because of their suitability. Customers are progressively demanding sustainable choices.

The personal & home care segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its cost-effectiveness and versatility. There is a wide range of sizes and shapes required for the packaging of personal & home care products. There is a rising shift towards eco-friendly packaging due to ecological responsibilities as well as increasing consumers’ interest.

The pharmaceutical & healthcare is the fastest-growing in the market, as it is due to increasing demand for contamination-free packaging. Blister packages are widely used due to their convenience with increasing demand for personalized packaging. This type of packaging supports patients observe to their medicine timetables and decreases the risk of infection.

Country Insights

How Brazil is Dominating in the Latin America Sustainable Packaging Market?

Brazil held the largest share in the market in 2024, due to the presence of strong manufacturing industries. The market is accepting to customer trends, with inventions in flexible, paper-based, and various other sustainable packing resolutions to fulfil the demand from food service and e-commerce industries. The rising customer consciousness of plastic contamination and government guidelines are hastening the change in the direction more sustainable packing, comprising recycling and biodegradable resources.

Why Latin America Sustainable Packaging Market is Growing Rapidly in Mexico?

Strict government guidelines have raised the demand for market. The rapid development of the e-commerce industry in Mexico has amplified the demand for effectual, durable, and sustainable packing solutions improved for delivery and last-mile shipment. This has resulted in an increased utilization of lightweight and shielding choices, like corrugated boxes and flexible packaging. Inventions in packaging resources and engineering procedures are making sustainable choices more feasible and cost-operative.

What are the Major Factors Boost the Latin America Sustainable Packaging Market in Argentina?

The major factors influencing the growth of the market in Argentina is the presence of supportive regulatory framework. Major companies are identifying that accepting sustainable packaging solutions lifts their brand's value and improves consumer loyalty. Main international as well as local brands are setting determined sustainability aim, which inspires the complete supply chain to track suit. The consumers of this region are progressively conscious of the ecological influence of plastic waste and are enthusiastically demanding and choosing goods with environment-friendly, biodegradable or recyclable packaging choices.

Recent Developments

- In October 2025, IFC invested in America Embalagens which is a well-known Brazilian rigid plastic packaging manufacturer to support the extension and transformation of the company’s major plant that is in the state of São Paulo.

- In October 2025, Amcor Plc. Announced the launch of AmPrima Plus films to boost the trend of sustainable and efficient packaging solution in Latin America. It is a commitment of the company towards developing innovative sustainable packaging solution.

Top Companies in the Latin America Sustainable Packaging Market

Amcor plc

Corporate Information

- Amcor plc (ticker: NYSE AMCR, ASX AMC) is a global packaging company that develops and produces flexible packaging, rigid containers, specialty cartons, closures and related services for food, beverage, pharmaceutical, medicaldevice, home & personal care and other products.

- Headquarters: Zürich, Switzerland (though originally Australianrooted)

- Employees: ~77,000 globally (as of mid2025) Operates in ~40+ countries, with hundreds of sites and a broad geographic reach.

History and Background

- The company’s origins trace to papermilling businesses around Melbourne, Australia, consolidated as the Australian Paper Mills Company in 1896.

- Over time, the business shifted focus from paper/pulp toward packaging. The name “Amcor” was adopted after changing from Australian Paper Manufacturers (APM).

- In April 2000 the printingpaper divisions were spun off, so that Amcor could concentrate on global packaging.

Key Developments and Strategic Initiatives

- In June 2022, Amcor launched a productrebranding initiative to clarify its sustainable packaging portfolio: “EcoGuard™” became the label for packaging solutions with moresustainable attributes (lighter weight, recyclable content, etc.).

- Its sustainability strategy emphasises packaging that is increasingly lightweight, made with recycled content, and recyclable or reusable.

Mergers & Acquisitions

- A major recent event: On 30 April 2025, Amcor completed allstock combination with Berry Global Group, Inc.. This merger significantly expanded Amcor’s portfolio, global footprint and R&D/material science capabilities.

- The synergies identified: ~US$650 million (pretax) by FY 2028, with EPS accretion target of ~12% in FY 2026 and more than 35% by FY 2028.

Partnerships & Collaborations

- Amcor has collaborated with major brands: For example, working with Cadbury in the UK/Ireland to help achieve ~80% recycled plastic content in a sharingbar package, using Amcor’s “AmFiniti™” recycled content solutions.

- It also partnered with companies such as Fedrigoni SelfAdhesives to create a recycleready wetwipe packaging solution combining flowpack and closure systems, aligning with circular economy goals.

Product Launches / Innovations

- AmFiniti™ recycled content solutions: Incorporate postconsumer or postindustrial recycled content to reduce carbon footprint of packaging.

- Biobased PE option: Packaging material containing ~25% biobased material from sugar cane as a sustainable alternative to fossilbased polymer.

- AmPrima® solutions: Recycleready packaging for petfood and other segments, emphasising convenience + sustainability.

Key Technology Focus Areas

- AmFiniti™ recycled content solutions: Incorporate postconsumer or postindustrial recycled content to reduce carbon footprint of packaging.

- Biobased PE option: Packaging material containing ~25% biobased material from sugar cane as a sustainable alternative to fossilbased polymer.

- AmPrima® solutions: Recycleready packaging for petfood and other segments, emphasising convenience + sustainability.

R&D Organisation & Investment

- While exact R&D spend is not always public in full detail, Amcor states that its innovation and sustainability agenda is core to its strategy (as evidenced by new product platforms, material solutions).

- The merger with Berry Global is expected to unlock further R&D and innovation investment via the combined scale and materialscience capabilities.

SWOT Analysis

Strengths

Global scale & reach across many geographies, giving access to diverse markets and large customers.

- Broad product portfolio (flexible packaging, rigid containers, specialty cartons, closures) across multiple enduse industries (food, beverage, healthcare, personal care).

- Strong sustainability credentials and innovation pipeline (recycled content, biobased materials, monomaterials) which align with market trends and regulatory pressures.

- Significant M&A activity that enhances capability, market presence and synergies (e.g., Berry Global merger).

Weaknesses

- Large scale can bring complexity: integrating major acquisitions (culture, systems, processes) can raise costs and execution risk.

- Exposure to rawmaterial cost inflation, supplychain disruptions (especially given plasticsbased packaging).

- High debt levels or acquisitionrelated burdens (postmerger integration, amortisation, intangible assets) may affect financial flexibility.

Opportunities

- Growing demand for sustainable and circulareconomy packaging solutions means Amcor is wellpositioned to capture growth.

- Emerging markets (Latin America, AsiaPacific) offer growth potential, particularly as consumers demand better packaging and regulation tightens.

- Technological innovation (biobased polymers, advanced coatings, monomaterials) can provide differentiation and premiumpricing opportunities.

- Crossselling synergies and efficiencies from the Berry Global merger can open new markets and customer bases.

Threats

- Regulatory and consumer pressure: increased regulation around plastics, singleuse packaging, recycling mandates could require additional cost or changes.

- Competitive pressure: Many players in packaging space are ramping up sustainability efforts; differentiation may become harder.

- Macroeconomic factors: Commodity price volatility (plastics, oil, resin), currency fluctuations, supplychain disruptions can impact margins.

- Integration risk: If major acquisitions do not meet synergy targets, there may be financial drag or reputational risk.

Recent News & Strategic Updates

- The merger with Berry Global was completed on 30 April 2025, positioning Amcor as a more integrated global leader in consumer and healthcare packaging, with broad material science and innovation capabilities.

- Following the merger, Amcor projected about 12% EPS accretion in FY 2026 (before organic growth) and more than 35% by FY 2028, with annual cash flow expected to exceed US$3 billion by FY 2028.

Other Top Companies

- Tetra Pak: This company is dedicated to generating completely recycled or renewable cartons, attaining carbon-neutral construction, and safeguarding all packages are completely recyclable.

- Mondi Group: The company's determination is to offer advanced, sustainable packing and paper resolutions that are sustainable by pattern.

- Smurfit Kappa Group: This company provides a completely integrated procedure from forestry processes to recycling arrangements and pulp making.

- Huhtamaki Oyj: It is well-known as a major player in the worldwide sustainable plastic packaging industry and a projecting sustainable packaging corporation.

- Others: Berry Global Inc., UFlex Ltd., Sonoco Products Company, Klabin S.A., WestRock Company, Bemis Latin America (Amcor Flexibles), Bioelements Group, Grupo Gondi, Sealed Air Corporation, Constantia Flexibles.

Latin America Sustainable Packaging Market Segments Covered

By Material Type

- Paper & Paperboard

- Recycled and FSC-certified kraft papers

- Coated barrier paper (bio-based or water-based)

- Recycled Plastics

- Post-consumer recycled (PCR) PE and PET

- Mechanically and chemically recycled resins

- Bio-based Plastics

- PLA, PHA, and bio-based PE

- Glass & Metal (Recyclable Formats) Shape

By Packaging Type

- Rigid Packaging

- Bottles, jars, containers

- Flexible Packaging

- Pouches, wraps, and films

- Paper–poly laminates and bio-films

- Corrugated Boxes & Cartons

By Application

- Food & Beverage

- Confectionery, dairy, and ready meals

- Beverage bottles and refill packs

- Personal & Home Care

- Refill pouches and bio-based containers

- Pharmaceutical & Healthcare

- Industrial & E-commerce Packaging