Diaper Packaging Market Size, Share, Trends and Growth Forecast

The diaper packaging market is predicted to expand from USD 30.29 billion in 2026 to USD 42.82 billion by 2035, growing at a CAGR of 3.92% during the forecast period from 2026 to 2035. The demand for diaper packaging is increasing because of growing hygiene awareness, demanding diapers, rising baby/elderly populations, user/brand concentration focus, and eco-friendly materials that drive invention in automated and sustainable packaging solutions.

Major Key Insights of the Diaper Packaging Market

- In terms of revenue, the market is valued at USD 30.29 billion in 2026.

- The market is projected to reach USD 42.82billion by 2035.

- Rapid growth at a CAGR of 3.92% will be observed in the period between 2026 and 2035.

- By region, North America dominated the global market by holding the highest market share in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By material type, the plastic segment has contributed to the biggest market share of 50.4% in 2025.

- By material type, the biodegradable materials segment will be expanding at a significant CAGR between 2026 and 2035.

- By packaging type, the flexible packaging segment is expected to hold the largest market share of 45.5% in 2025.

- By packaging type, the semi-rigid packaging segment will be developing at a significant CAGR between 2026 and 2035.

- By product type, the baby diapers segment has contributed to the biggest market share of 56.6% in 2025.

- By product type, the adult diapers segment will be growing at a significant CAGR between 2026 and 2035.

- By end-user, the infant care segment is expected to have the largest market share of 52.6% in 2025.

- By end-user, the adult incontinence care segment will be growing at a significant CAGR between 2026 and 2035.

- By distribution channel, the supermarkets & hypermarkets segment has invested the largest market share of 42.4% in 2025.

- By distribution channel, the online retail segments will be growing at a significant CAGR between 2026 and 2035.

What is Diaper Packaging?

The diaper packaging market comprises primary and secondary packaging solutions designed to protect, store, transport, and market baby and adult diapers. These packaging formats ensure hygiene, moisture resistance, and product integrity while enabling efficient handling and shelf presentation. Commonly manufactured using plastic films, paper-based materials, and sustainable alternatives, diaper packaging supports branding, convenience features such as resealability, and growing e-commerce requirements. The market serves infant care, toddler care, and adult incontinence segments across retail and online distribution channels globally.

Types of Diaper and its Advantages

| Diaper Type |

Materials & Features |

Typical Use & Benefits |

| Cloth |

Cotton, hemp, bamboo, microfiber |

Reusable, eco-friendly, customizable fit |

| Disposable |

Polyethylene outer, superabsorbent polymers, nonwoven fabric |

Convenient, leak-proof, with features like wetness indicators |

| Fitted Diapers |

Adjustable snaps, elastic edges, liners |

Customizable fit, used with washable or disposable inserts |

| Training Pants |

Similar materials to disposables, designed for toddlers |

Easy to pull-up, encouraging independent diapering |

Emerging Trends in Diaper Packaging Market:

- Bag Packaging (Soft Plastic with Handle): It is manufactured from flexible polyethylene (PE) film, as such bags are cost-effective, lightweight, and convenient to generate. Several count on a plastic handle for easy carrying, which is particularly valued by parents on the go.

- Eco-Friendly and Biodegradable Options: With growing user demand for sustainable solutions, some of the brands are shifting towards paper-based bags, biodegradable films, or compostable packaging. At the same time, such an approach to eco-friendly conscious users matches with global sustainability trends.

- Box Packaging: Box packaging is regularly utilised for bulk packs or luxury product lines, too. It is created from corrugated or cardboard board; these boxes serve as perfect product manufacturing and provide more space for the good-quality graphics and messaging, too.

- Move towards Reusable Diapers: It is one of the highlighted trends in the diaper packaging industry, which is gaining attention for reusable diapers. This move is being driven by the developing consumer alertness that links to environmental issues and the objective for more sustainable diapering.

- Innovative Features in Diapers: Invention is a main driver in the diaper sector, with organizations constantly striving for growth and introducing new features to align with user demands. Diaper producers are concentrating on developing softness, breathability, and leak protection to provide an optimal experience for both parents and babies.

- Market Growth Overview: The diaper packaging sector is rising quickly because of the demographic transformation, heightened environmental awareness, and technological innovations, too.

- Global Expansion: The worldwide diaper packaging industry is experiencing a drastic growth, which is driven by the move towards sustainable materials, growing demand in developing economies, and automation, too. Producers are heavily substituting regular plastic with eco-friendly alternatives like biodegradable films, recyclable paper, and bamboo-relying packaging to lower the C02 footprint.

- Startup Ecosystem: Startups are driving the transformation in the diaper packaging industry by mixing sustainable materials, direct-to-consumer, and high-tech elements delivery structures. Startups are making “smart diapers” with patches or sensors that get affected by moisture or protein, which is notified via smartphone apps when an update is demanded.

Technological Developments in the Diaper Packaging Market:

Diapers are incorporating smart technology. This develops care for both adults and babies. Indicators and sensors are becoming prevalent. Smart diapers can check the moisture levels, and so they raise awareness for caregivers to create updates. Technology in the diaper serves additional advantages as smart diapers manage health measures. Due to these characteristics, the elderly have greatly benefited from these developments. Smart features ensure timely updates, as this develops their health and comfort. Such inventions are game-changing as they serve growth differently.

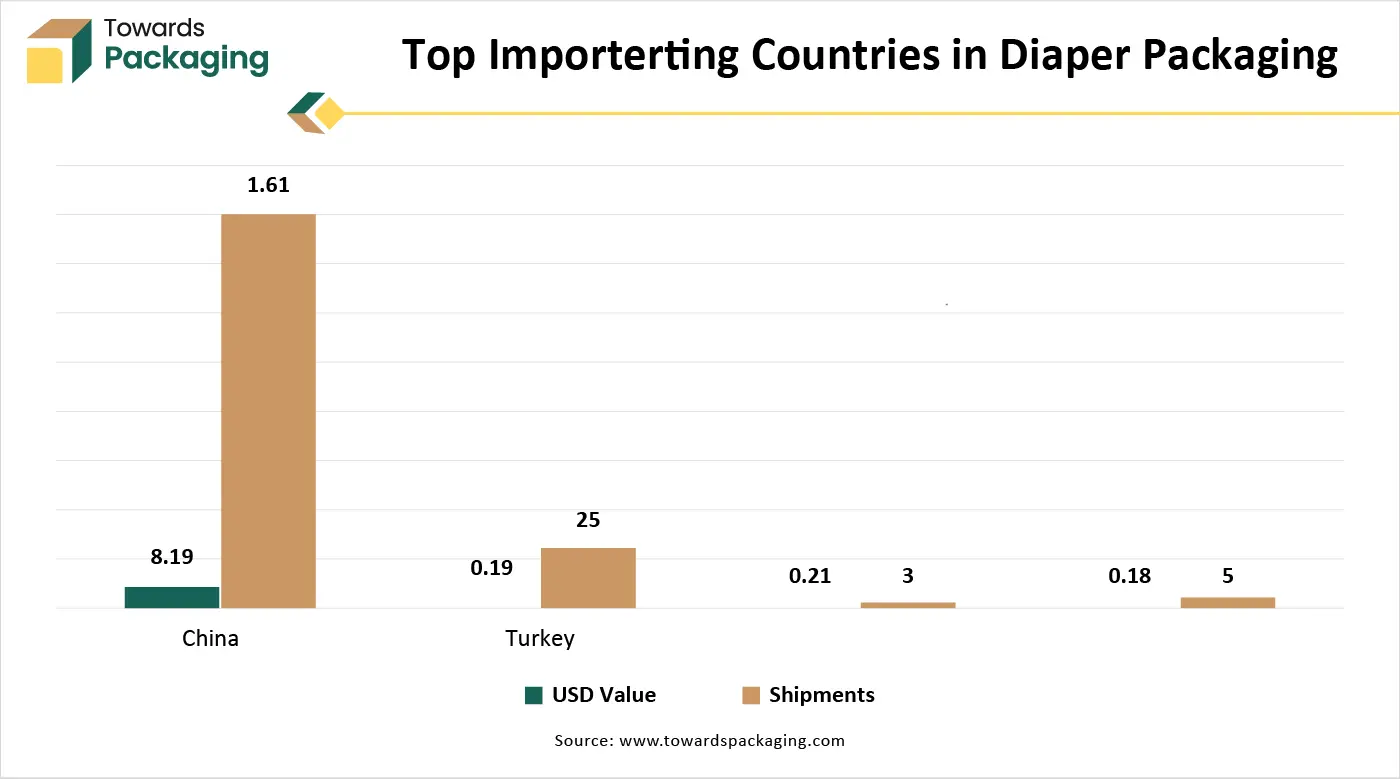

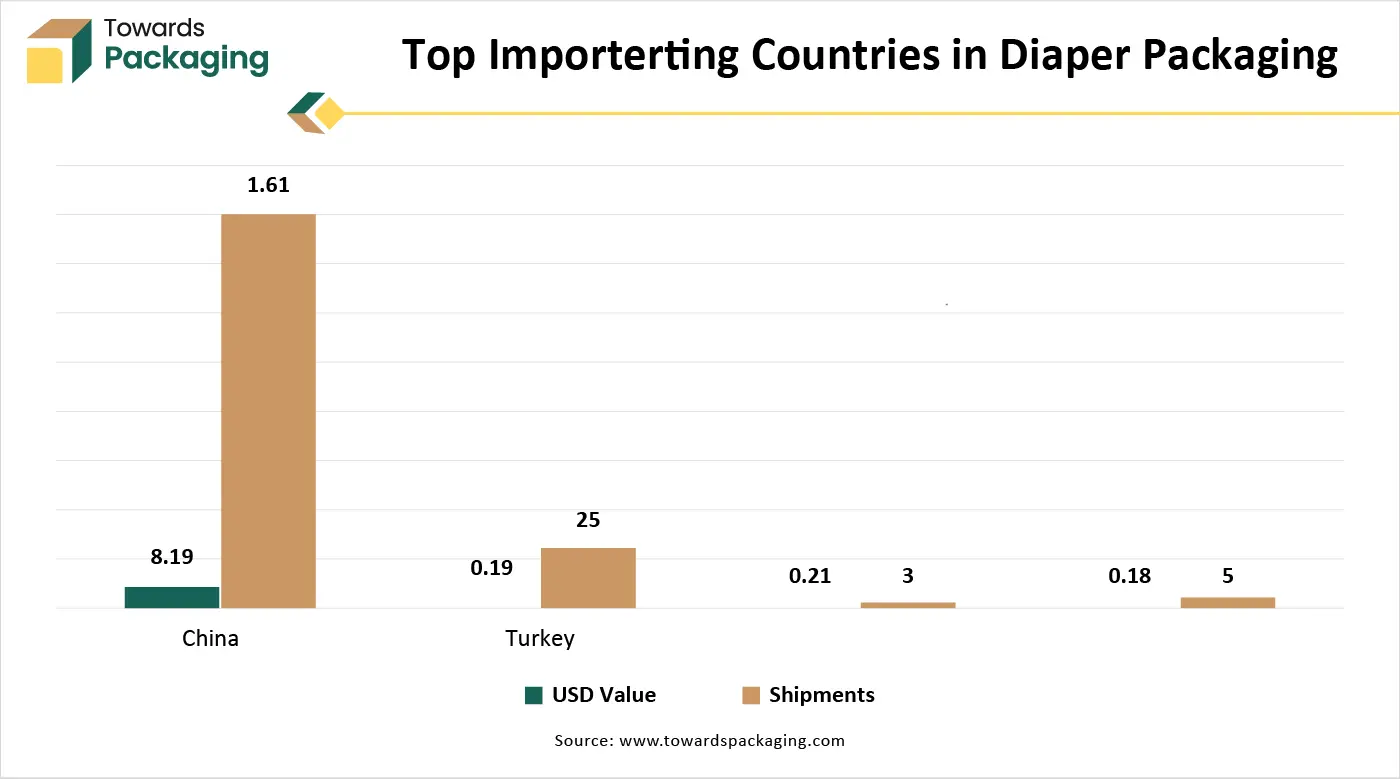

Trade Analysis of Diaper Packaging Market: Import & Export Statistics

- As per the official global data, he world has imported 13,562 shipments of the Diaper Packaging industry during the period from June 2024 to May 2025.

- Such imports were being supplied by 940 exporters to 1,170 overall buyers, which has marked a growth development rate of -18% as compared to the leading twelve months.

- Furthermore, the globe has imported 385 Diaper packaging shipments alone during the month of May 2025.

- The world imports its diaper packaging from Turkey, China, and Russia predominantly.

- Worldwide, the leading three importers of diaper packaging are Vietnam, Russia, and Uzbekistan. So, Uzbekistan has topped the globe in terms of this sector by importing 13,555 shipments executed by Vietnam, with 9,349 shipments, and Russia in third position with 4,014 shipments.

Diaper Packaging Market - Value Chain Analysis

Raw Material Sourcing: Non-woven fabrics are the crucial layer of the diapers. Such materials are usually soft, friendly to the air and nature to the skin, and hence, are quite perfect for babies and adults too. Generally, the npn-woven fabric can enable moisture to be absorbed smoothly, and at the current time, it has the potential of storing the absorbent material of the diaper still very dry despite the breakout of the moisture.

- Key Players: Amcor plc, Mondi Group, and Berry Global Inc

Component Manufacturing: The disposable diaper manufacturing procedure is a minutely managed series of steps that transforms the raw materials into the relevant baby diaper we utilise each day. At its main, it includes five main stages, like creating the absorbent, making nonwoven surfaces, setting the components, including elastic bands, and ensuring the quality with the assistance of packaging and testing.

- Key Players: Huktamaki Oyj, Sealed Air Corporation, and Smurfit Westrock.

Logistics and Distribution: Direct-to-consumer structures serve regular and automated shipments that need accurate route optimization and inventory tracking to prevent stockouts. To manage high shipping costs, producers utilise regional distribution centers to focus on targeted markets. Also, current startups frequently use OEM (Contra Manufacturing) to avoid the costs of tracking their own production and logistics machinery.

- Key Players: Packaging Corporation of America, UFlex Ltd, and Cloudalkin Group, too.

Material Insights

Why Plastics Segment Dominated the Diaper Packaging Market In 2025?

The plastics segment has dominated the market with a share of 50.4% in 2025, as polyethylene uses are big, with several sectors depending on its versatility and reliability. Polypropylene instances count automotive parts, packaging materials, personal care, and diapers, too, along with medical devices. Its power, opposition to chemicals, and flexibility make it a famous choice for the items. It is more flexible and forms to low temperatures, frequently used in products like containers and plastic bags, as polyester.

The biodegradable materials segment is expected to experience the fastest CAGR during the forecast period. There are big biodegradable disposable diapers that are accessible in the industry, produced from plant-based materials. They are an alternative for the families who choose the ease of the disposable diapers but still need to reduce their ecological footprint. They are made of bio-plastics, like PLA, which have hormonal effects and can contribute to infertility. The materials used in the diapers are cotton, bamboo, non-woven polypropylene, wheat starch, and cellulose pulp.

Packaging Type Insights

Why Did The Flexible Packaging Segment Dominate The Diaper Packaging Market In 2025?

The flexible packaging segment has dominated the market with 45.5% share in 2025, as these pouches are made from the multi-layer laminate film structures, which are crafted to serve the compulsory barrier characteristics for product security. These laminate designs generally have an outer layer for reliability and printability, which is an inner packaging layer of compatible material that has a filling item and has one or more barrier layers fixed in between.

The semi-rigid packaging segment is expected to experience the fastest CAGR during the forecast period. The semi-rigid packaging for the diapers generally has materials that serve a perfect balance of design and flexibility, like cardboard, crayons, and boxes, specific to polyethylene films and laminated materials. This kind of packaging assists in protecting the product that has its shape to some limit while staying relevant to relatively lightweight materials. This type of packaging protects the diaper from contamination, moisture, and physical pollutants during transportation and storage.

Product Type Insights

Why the Baby Diapers Segment Dominated the Diaper Packaging Market In 2025?

The baby diapers segment has dominated the market with a 56.6% share in 2025, as baby diapers are initially packaged in moisture-resistant polyethylene, durable plastic pouches, too, with a developing move towards eco-friendly and paper-based materials. The packaging is being crafted for protection, hygiene, and user convenience, which often has handles and precise product information. Also, due to rising consumer demand for environmentally friendly products, organizations are discovering innovations like paper-based and recyclable bags that have post-consumer recycled content.

The adult diapers segment is expected to experience the Fastest CAGR during the forecast period. The adult diapers industry is growing as products are now completely focusing on convenience, reliability, and discretion. When anyone is at work or commuting, it is basically for the on-the-go people. A developing share of buyers are the self-users instead of the caregiver tracked. Currently, there are about 1 million users who have already been accepted. There are different types of adult diapers available, like pant-style, tape-style, overnight diapers, gender-specific, and incontinence pads, too.

End-User Insights

Why the Infant Care Segment Dominated the Diaper Packaging Market In 2025?

The infant care segment has dominated the market with a 52.6% share in 2025 as the most crucial element of any newborn diaper is its potential to absorb moisture and to protect against leaks quickly. Newborns urinate often, and a diaper that has less absorbency can lead to rashes and discomfort. So, cloth-based or organic newborn diapers created from cotton or bamboo serve exceptional breathability. Additionally, diapers serve to ease the burden by releasing parents' time from constantly changing the soiled cloth diapers.

The adult incontinence care segment is predicted to witness the fastest CAGR during the forecast period. Relevant adult diapers can smoothly mix into bedtime and morning schedules, which helps seniors feel clean, fresh, and comfortable throughout the day or nighttime. Whether one is at home or in supported living, caregivers can perfectly plan around the toileting demands when there is reliable protection included. Adult diapers can count to outings, hobbies, and family visits too, which are convenient to get delighted without any dread of embarrassment or leaks. Predictable diapers get updates, which become a part of the schedule, lowering the stress and creating personal care that is less intrusive.

Distribution Channel Insights

Why Supermarkets and Hypermarkets Segment Dominated the Diaper Packaging Market In 2025?

The supermarkets and hypermarkets segment has dominated the market with 42.4% share in 2025, as the accurate packaging updated on the supermarket shelves is updated for the shelf appearance, cost-effectiveness, and product protection too. Flexible plastic base is the most widely used design because of its low cost, durability, light weight, and capability to be attractively branded. Boxes and cartons are frequently used for the bulk packs, which are sold in warehouse retailers or for the luxury product lines. Cartons serve perfect protection, and a big layer is for high-quality graphics.

The online retail segment is expected to experience the fastest CAGR during the forecast period. For this segment, diaper packaging is updated for the e-commerce efficiency and logistical durability that frequently has regular brick and mortar shelf packaging, as this procedure mixes high-speed automation with a particular “Ships in own Container” (SIOC). Every pack is being crafted with different code for full traceability, which goes back to the manufacturing minute. High-accuracy sensors and the checkweighers make sure each online pack has the correct number of diapers, which protects against user complaints in the subscription design.

Regional Insights

How North America is Dominating in the Diaper Packaging Market?

The North America has dominated the diaper packaging market in 2025 as rising eco-friendly awareness among users drives the urge for environmentally friendly diapers in this region. With sustainability being the latest discussion, many parents need compostable, biodegradable, and organic diapers. Giving feedback to these urges, diaper producers have mixed the natural materials, such as plant-based polymers, into the diaper products. Hence, developing users are ready to pay an additional luxury to find eco-friendly diapers, which contribute to constant updates in this trend.

How is the Diaper Packaging Market Growing in Canada?

Canada’s developing diaper packaging market is about sustainability trends and technological development. Other main drivers include growing urbanization, developing awareness of convenience and hygiene, too, and a developing concentration on environmentally friendly products. The distribution channels are stretching beyond regular retail outlets to include subscription services, e-commerce platforms, and direct-to-consumer models, which is driven by the digital transformations.

Why is the Diaper Packaging Market Growing Rapidly in the Asia Pacific?

Asia Pacific is the fastest-growing region in the diaper packaging market in 2025, as this region is initially being driven by the move towards sustainable materials, digital ease, and high-tech automation to assist fast urbanization and an aging population, too. Producers are mixing Industry 4.0 technology, such as IoT-enabled and AI-driven personalization, to develop operational smoothness. So, the high-speed machines are potential enough for generating both tape-style and pant-style diapers at scale, which are becoming standard in India, Vietnam, and Indonesia.

Why is India using the Diaper Packaging Market Importantly?

The diaper packaging industry in India is witnessing major development, which is because of developed awareness of hygiene, growing population, and developing disposable incomes. Hence, several business entrepreneurs are looking to penetrate the diaper production in India. Also, the diaper market size in India is significant and growing rapidly. Both adult and baby diapers are looking to increase their presence in the diaper packaging field in India, which is very competitive, for both new entrants and well-established brands, for market development.

The Diaper Packaging Market in the European region is growing as under EU single-use plastics limitations, several brands are updating to mono-material plastic packaging, which is convenient to recycle, or are lowering the overall thickness of the plastic films to lessen the waste. Packaging is developing in terms of digital touch as it frequently has QR codes that lead to sustainability trends, subscription services, and sourcing transparency. Also, the European Green Deal and the particular EU plastics bans are moving towards a move to a circular economy design.

Germany Diaper Packaging Market Trend

The market is experiencing a demand in terms of Research and Development for the AI-driven moisture alert machines and the intelligence fabric integration, particularly in luxury and elder-care product lines. User choices are moving towards comfort-driven, tailored designs with stretch-fit and breathable surfaces. Furthermore, developing attention in terms of metropolitan areas such as Frankfurt, Hamburg, and Munich is allowing organizations to update a micro-focused market entry method. Digital advertising and social media are becoming dominant channels for awareness and engagement, specifically among the digitally native parents.

The diaper packaging market in the Middle East &Africa (MEA) region is growing quickly as it is witnessing a major shift, which is being driven by the rising middle-class, increasing hygiene awareness, and a complicated move towards sustainable materials. Nigeria is classified as the fastest-growing market in Africa, which is predicted to look for main funding as global players like Unicharm discover local production at lower costs and reach sub-Saharan users.

UAE Diaper Packaging Market Trend

The UAE is experiencing a major update due to strict environmental regulations and a move towards luxury and health-conscious user choice. Packaging designs are concentrating on the clean and organic aesthetics to attract the Gen Z and Millennial parents, and main brands are substituting the regular plastic with bio-based and recyclable paper packaging. This shift is driven by Dubai's plastic ban and the deferral of Extended Producer Responsibility (EPR) pilots, which are compulsory for the sustainable material application and take-back schemes, too.

In South America, the diaper packaging market is growing steadily as the market is further being driven by the developed health consciousness and the remaining government policies that focus on maternal and infant health. Public campaigns that are being kept on cleanliness rules and perfect infant care are affecting buying trends, which make parents select disposable diapers over the conventional cloth options. Economic development, along with developed distribution channels, is catering to an in-depth entry of markets, particularly in the rural regions in which disposable diapers have been regularly entered.

Brazil Diaper Packaging Market Trend

Brazil is the biggest contributor, which is driven by the government-oriented health programs, which have developed hospital births and developing incomes too. The Diaper brands are contributing to reliable product series, distribution collaborations, and local manufacturing to solve the regional price sensitivity. Proliferation and urbanization of current retail channels such as supermarkets, hypermarkets, and online stores are further developing the market. Hence, economic instability and high inflation in some countries pose issues for sustained development.

Recent Developments

- In September 2025, CuteStory, which is an latest baby care brand that completely focuses on sustainability, safety and commitment, who has officially revealed its aim to develop the products in term of diaper rash crams, lotions, hair are and oral care, while also planned to penetrate Asian and Middle Eastern markets to deliver safe and sustainable baby care to more such families.

- In November 2025, Ontex Group is an International maker and generator of personal care items that has revealed its Dreamshield 360 Night Pants, which is a latest nighttime idea that is crafted to serve babies on dry nights.

- In November 2025, Pampers, as part of World Prematurity Day, which is observed on 17 November, disclosed the “ Swaddlers Preemie extra extra small (Pxxs0, described as the smallest diaper on the globe.

- In May 2025, GreenCore Solutions Corp revealed full-scale European manufacturing of its steamship named TreeFree Diaper, which has earned a major achievement in its Retail Private Label Program (RPLP).

Top Companies in the Diaper Packaging Market

- Favourite Fab: Favorite Fab stands firmly out as a custom-centric layer and dynamic too among the Diapers for Adults Producers in India, as it is a state-of-the-art producing facility which uses high-level advanced technology to generate high-quality adult diapers that align with international standards.

- Optima Packaging Group GmbH: A German company that crafts packaging machines for different industries, which includes non-woven items such as diapers, known for its modular solutions.

- Curt G, Joa, Inc.: This is a U.S.-dependent company that serves complete manufacturing lines with mixed packaging solutions. Its machines are well known for their flexibility and quick update systems, which enable smooth changing between various product sizes and designs.

- Zuiko: Zuiko is a top Japanese producer that is well known for its technical innovation, accuracy, and ultra-robust machines that are constructed to last for decades with fewer maintenance issues.

- GDM: It is an Italian company within the Coesia Group, as GDM serves high-seed and modular systems that transform and package systems, which are well-known for their smooth stacking and flexibility, that carry the sensitive items.

- Unicharm Corporation: Anime player in Asia, named Unicharm, is well known for its MamyPoko brand and for innovative inventions like the part-style diaper that is available in the latest markets and needs particular packaging solutions.

- Kao Corporation: This organization is the main contender in terms of the Asian Market and is among the top worldwide players in the diaper sector.

- Kimberly-Clark Corporation: The producers of the famous Huggies company, it carries a worldwide presence and concentrates on Research and Development for the development of comfort and overall protection in its products and packaging.

- Procter & Gamble Company: It is one of the biggest producers, which is well-known for its highly recognized Pampers brand, which has topped the product and packaging invention too.

- Ontex Group NV: It is a Belgium-based organization. Ontex is a main producer of hygiene items, which include diapers, for both the private label and branded ones across North America and Europe.

Diaper Packaging Market Segments Covered

By Material

- Plastic

- Paper & Paperboard

- Biodegradable Materials

By Packaging Type

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By Product Type

- Baby Diapers

- Training Pants

- Adult Diapers

By End Use

- Infant Care

- Toddler Care

- Adult Incontinence Care

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacies

- Online Retail

By Regions

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA