Barrier Coatings for Flexible Packaging Market Analysis, Demand and Growth Rate Forecast

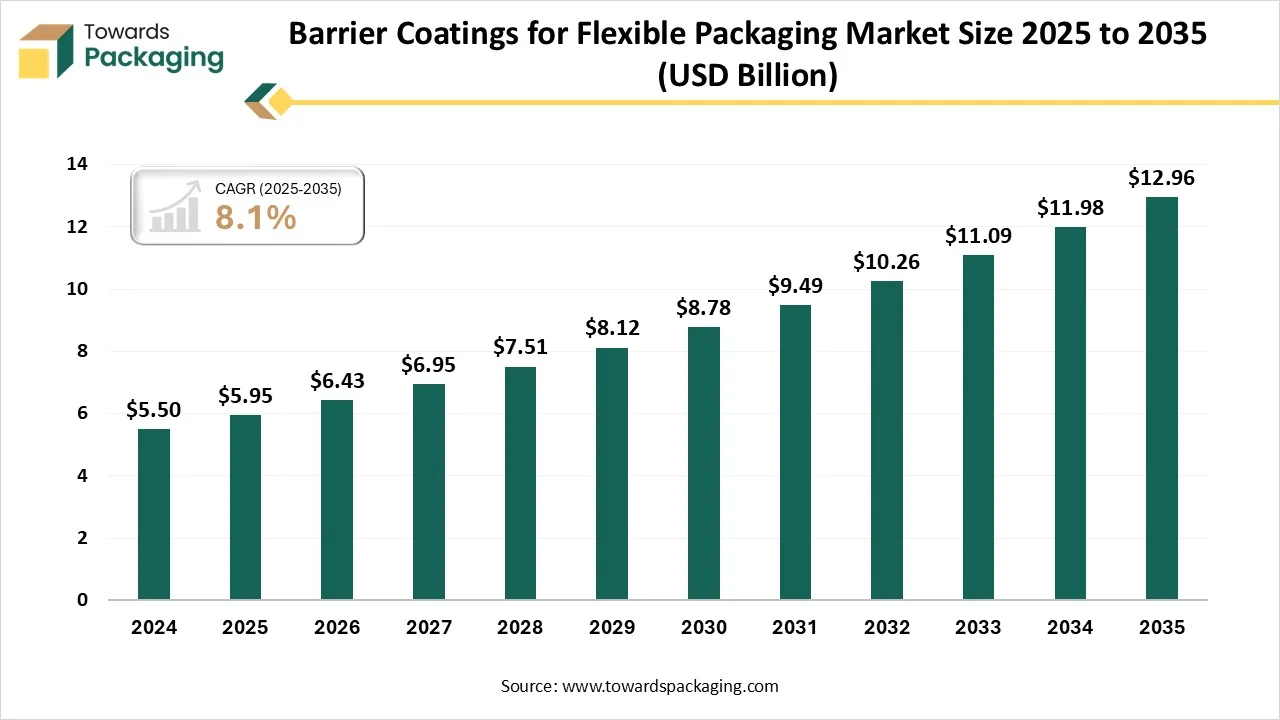

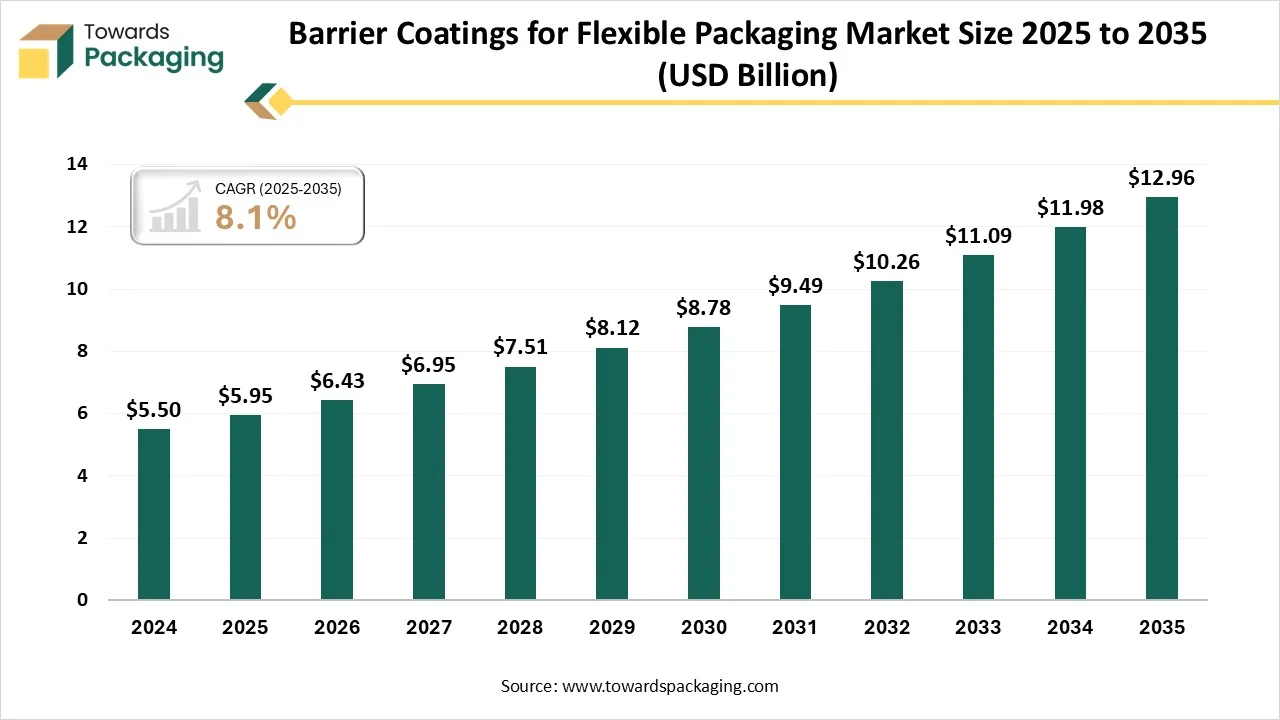

The barrier coatings for flexible packaging market is forecasted to expand from USD 6.43 billion in 2026 to USD 12.96 billion by 2035, growing at a CAGR of 8.1% from 2026 to 2035. This market is growing due to rising demand for extended shelf life, product safety, and sustainable packaging solutions across the food, beverage, and pharmaceutical industries. The market is dominating in the Asia Pacific region due to the rising of its increasing pharmaceutical industry, fast urbanization, and enormous food and beverage consumption.

Major Key Insights of the Barrier Coatings for Flexible Packaging Market

- By region, Asia Pacific holding the largest market share of approximately 45% in 2025.

- By region, Europe is expected to grow at the fastest rate in terms of market share during the forecast period.

- By coating type, the polymer-based coatings segment held the largest share of the market at approximately 40% in 2025.

- By coating type, the biopolymer & water-based coatings segment is expected to grow at the fastest rate during the forecast period.

- By substrate material, the plastic films segment held the largest share at approximately 50% in 2025.

- By substrate material, paper & bio-based films are expected to grow at the fastest rate in the network emulator market during the forecast period

- By application, the food & beverage segment held the largest market share of approximately 55% in 2025.

- By application, the pharmaceuticals & healthcare packaging segment is emerging as the fastest growing during the forecast period

- By distribution channel, the direct supply segment held the largest share at approximately 60% in 2025.

- By distribution channel, the online/specialty platforms segment is expected to grow at the fastest rate during the forecast period.

Market Overview

What Role Do Barrier Coatings Play In Flexible Packaging?

Barrier coatings play a crucial role in flexible packaging by acting as protective layers that shield products from external factors such as moisture, oxygen, UV light, and contaminants. These coatings, particularly in food and beverage applications, help preserve taste, texture, and nutritional shelf life, and maintain product freshness. They guarantee stability, safety, and adherence to regulatory standards of pharmaceuticals and personal care products. Advanced barrier coatings are a crucial part of high-performance and environmentally friendly packaging solutions because they also improve printability, increase heat resistance, and encourage the use of recyclable or bio-based packaging materials.

- In July 2025, Dow launched its INNATE TF 220 precision packaging resin to produce BOPE films that enhance recyclability and performance in flexible plastic packaging, collaborating with Liby for one of China’s first fully recyclable laundry detergent packs.

Barrier Coatings for Flexible Packaging Market Trends

Bio-based, water-based based PFAS-free coatings: To meet sustainability requirements and phase out PFAS because of health and environmental concerns, packaging manufacturers are shifting to coatings derived from renewable or water-based sources. These coatings are made to be recyclable and food safe while still providing robust barrier protection. In the food service and quick serve packaging industries, where oil and grease resistance and essential, they are especially well liked. Consumer brands are utilizing these coatings to emphasize their eco-friendly qualities, and growing regulatory prohibitions in North America and Europe are speeding up adoption.

Shift Toward Sustainable and Recyclable Packaging: Companies are under pressure to switch from conventional plastic laminates to recyclable mono materials due to international regulations and consumer awareness. Barrier coatings encourage the use of bio-based and paper-based substrates in the food, pharmaceutical, and personal care industries by giving them the same level of protection as plastics.

Mono-material recyclable barrier systems: Businesses are designing mono-material structures with barrier coatings in place of multilayer films to comply with the objectives of the circular economy. These systems resist oils, moisture, and oxygen while making recycling easier. Mono-material solutions are becoming more popular among brand owners who are dedicated to reducing their use of plastic and adhering to regulations. Additionally, they assist businesses in lowering extended producer responsibility (EPR) expenses and meeting national recycling goals.

- In July 2025, Lecta introduced Metalvac Seal Oxygen Barrier, a recyclable metalized paper that enhances packaging performance without multilayer laminates.

Key Technological Shift in the Barrier Coatings for Flexible Packaging Market?

AI can transform the barrier coatings for flexible packaging market by accelerating material discovery, optimizing production, and ensuring sustainability. Manufacturers can save time and money on R&D by using machine learning algorithms to forecast the performance of novel bio-based or PFAS-free coatings prior to extensive testing. Predictive modeling driven by A facilitates the development of more intelligent formulations by balancing recyclability with resistance to oxygen, moisture, and grease. AI-driven process control reduces waste, increases energy efficiency, and guarantees consistent coating thickness in manufacturing. Artificial intelligence-enabled vision systems to ensure consistency in barrier properties by detecting microdefects and irregularities in real time. Furthermore, AI assists businesses in examining consumer patterns and legal information to match innovation pipelines with the rising need for intelligent, sustainable, and mono-material packaging solutions. Faster innovation cycles, cost savings, and the adoption of eco-friendly packaging are being driven by this AI integration.

- In May 2025, Dow & Google X launch an AI-powered sorting system to identify and recycle flexible plastic films. Supporting barrier packaging sustainability.

Trade Analysis Of Barrier Coatings For Flexible Packaging Market

- World shipped 1,514 shipments of Barrier Coatings. The exports were handled by 183 Exporters to 173 Buyers.

- Majority of the world’s Barrier Coatings exports destined to Vietnam , United States , and Dominican Republic.

- China, South Korea, and the United States are the leading exporters of barrier coatings. In which the South Korea topped with 594 shipments, China with 317 shipments, and the United States with 243 shipments.

Value Chain Analysis

Raw Materials

Nanomaterials, polymers, biopolymers, resins, and additives are the main raw materials used in barrier coatings. Sustainable solutions rely on starch, cellulose, PHA, PLA, and water-based formulations, whereas conventional coatings frequently use EVOH, PVDA acrylics, and polyethylene-based dispersions. The cost and availability of these raw materials have a direct impact on converter pricing and production efficiency.

- Key Players: Dow Chemical Company, Kuraray, PASF SE, Novamont, NatureWorks LLC.

Component Manufacturing

The step entails creating coating materials and applying them to substrates such as paper, plastic, and bio-based films. Manufacturers create high-performance coatings to resist oxygen, moisture, odor, and grease while guaranteeing recyclable materials and adherence to food contact laws. To satisfy sustainability requirements, advanced players also concentrate on PFAS-free and compostable solutions.

- Key Players: Amcor Plc, Mondi Group, Sealed Air Corporation, Huhtamaki, Chemours, Cosmo Films & Cosmo Specialty Chemicals, Archroma.

Logistics and Distribution

For the FMCG, food, pharmaceutical, and e-commerce sectors to receive barrier-coated flexible packaging on time, effective logistics and distribution networks are necessary. While smaller players and niche converters increasingly rely on online platforms and specialty distributors, large converters and chemical companies usually maintain direct supply agreements with major brands. Because of shifting raw materials availability and the dynamics of the global trade supply chain, resilience is essential.

- Key Players: DHL Supply Chain, Kuehne + Nagel, C.H. Robinson, Brenntag, IMCD Group.

Coating Type Insights

Why the Polymer Based Coatings Segment Dominated the Barrier Coatings for Flexible Packaging Market in 2025?

Polymer-based coatings, such as EVOH and PVDC segment dominated the market with approximately 40% share in 2025 because of their superior moisture, oxygen, and fragrance blocking qualities, which make them ideal for food and drink products with extended shelf lives. Due to their widespread industrial adoption, demonstrated performance in a variety of applications demonstrated performance in a variety of applications and established use in high volume packaging and compatibility with multilayer film structures, they have established a strong market position.

The biopolymer & water-based coatings segment expects the fastest growth in the market during the forecast period, driven by increasing preference for eco-friendly packaging, regulatory pressure to phase out non-recyclable and PEAS-based materials, and growing sustainability concerns. These coatings are becoming increasingly appealing to retailers and brand owners looking for greener options because they not only offer competitive barrier protection but also support the objectives of the circular economy. Their barrier performance is being further enhanced by developments in material science and nanotechnology. Additionally, governments are speeding up adoption in this market by providing incentives for bio-based innovations.

Substrate Material Insights

Why the Plastic Films Segment Dominated the Barrier Coatings for Flexible Packaging Market in 2025?

The plastic films segments dominated the market with approximately 50% share in 2025 because they are compatible with barrier coating technologies, have superior mechanical strength, and are transparent. A large-scale demand is guaranteed by their extensive use in food, snack, and personal care packaging, as converters appreciate the harmony between established processing infrastructure, cost effectiveness, and performance. Additionally, these films are lightweight, which lowers logistics expenses for international supply chains. In high-demand applications, they are indispensable due to their consistent sealing and printability benefits.

The paper & bio-based films segment is expected to grow at the fastest rate in the market during the forecast period, as the packaging industry shifts toward renewable and compostable solutions. Particularly in applications such as food wraps, cups, and e-commerce packaging, paper and biopolymer films coated with cutting-edge water-based or biopolymer barrier solutions are rapidly gaining traction due to tightening regulations on single-use plastics and increased brand commitments to sustainable packaging. Additionally, their premium natural aesthetic appeals to customers who care about the environment.

Application Insights

Why did the Food & Beverages Segment Dominate the Barrier Coatings for Flexible Packaging Market in 2025?

The food & beverages segment dominated the market with approximately 55% share in 2025, as it requires superior protection against oxygen, moisture, and grease to extend shelf life and maintain product freshness. From snacks and confectionery to dairy and frozen foods, the industry’s reliance on barrier-coated materials ensures consistent demand and significant revenue contribution. The growth of convenience food consumption worldwide strengthens this dominance further. In addition, global brands are increasingly adopting recyclable barrier-coated solutions to meet sustainability pledges.

The pharmaceuticals & healthcare packaging segment is expected to grow at the fastest rate in the market during the forecast, because tamper-evident, sterile, and contamination-resistant flexible packaging solutions are required. The need for high-performance barrier coatings that can protect goods during storage, transportation, and patient use is being driven by the growth of biologics, injectables, and sensitive drug formulations. Additionally, driving this market is the rising demand for unit-dose and single-dose packaging formats. Protective coating technology innovation is also fueled by regulatory emphasis on patient safety and compliance.

Distribution Channel Insights

Why did Direct Supply Segment Dominate the Barrier Coatings for Flexible Packaging Market in 2025?

The direct supply to the packaging converters segment dominated the market with approximately 60% share in 2025, because converters favor collaborating closely with coating suppliers to create formulations that are tailored to barrier needs. Large-scale packaging manufacturers and multinational FMCG companies prefer this channel because it guarantees quicker turnaround, better technical support, and cost-effectiveness. Additionally, it cultivates long-term alliances that facilitate the collaborative development of creative solutions. Additionally, agreements for bulk supplies lower procurement costs for converters.

Online/specialty platforms segment is expected to grow at the fastest rate in the market during the forecast period, channel for barrier coatings, especially helping niche packaging suppliers and small and medium converters digital platforms are speeding up adoption among startups and emerging players in the packaging industry by making advanced coatings easier to obtain facilitating quicker procurement cycles and offering competitive pricing additionally they enable vendors to access new global markets without the need for extensive distribution networks. Additionally, niche players are becoming more visible due to the expansion of B2B e-commerce platforms for chemicals and coatings.

Regional Insights

Why Did Asia Pacific Dominate The Barrier Coatings For Flexible Packaging Market In 2025?

Asia Pacific dominated the market with approximately 45% share in 2025, fueled by its increasing pharmaceutical industry, fast urbanization, and enormous food and beverage consumption. Growth in the region is being driven by significant investments in environmentally friendly packaging innovations, which are bolstered by government initiatives and growing middle-class consumer demand. To cater to both domestic and international markets, local manufacturers are increasing their production capacities. Additionally, international companies are drawn to establish production hubs in the region due to its cost-competitive manufacturing ecosystem.

India seen a rapid growth in the market. In India barrier coatings are gaining importance due to rapid growth in food, FMCG, pharmaceuticals, and e-commerce packaging. The market is shifting from traditional multilayer laminates toward cost-effective, lightweight, and recyclable solutions. Water-based and bio-based barrier coatings are increasingly adopted to improve moisture, oxygen, and grease resistance while supporting sustainability goals. Rising urbanization, longer shelf-life requirements, and regulatory pressure to reduce plastic waste are encouraging innovation.

Europe expects fastest growth in the barrier coatings for flexible packaging market during the forecast period, driven by strict laws prohibiting single-use plastics, prominent FMCG companies' ambitious sustainability targets, and the growing use of recyclable and bio-based packaging options. Significant growth opportunities are being created for converters and suppliers alike by the region's strong principles and innovation in cutting-edge barrier technologies. Additionally, decisions about what to buy in this area are heavily influenced by growing consumer awareness of green packaging.

In Germany barrier coatings for flexible packaging market is gaining strong momentum as brands shift toward recyclable and circular packaging solutions. The market is driven by stringent EU regulations, high recycling targets, and demand for mono-material and paper-based packaging. Innovation in high-performance thin coatings, nano-layers, and plasma technologies supports downgauging and material reduction.

North America is experiencing strong growth in the market due to demand for sustainable, high-performance packaging in food, beverage, pharmaceuticals, and pet food. Brand owners are shifting from aluminum foil and complex laminates to recyclable mono-material and paper-based structures. Water-based, solvent-free, and bio-based barrier coatings are increasingly preferred to meet sustainability targets and regulatory expectations. Technological advancements in nano-coatings and multifunctional layers enhance moisture, oxygen, and grease resistance while enabling downgauging.

United States expects the significant growth in the market. The growth of the market driven as brands focus on recyclability, shelf-life extension, and material reduction. Food, beverage, pharmaceutical, and pet food packaging are key demand sectors. The market is shifting away from aluminum foil and complex laminates toward mono-material, paper-based, and compostable structures. Water-based and solvent-free barrier coatings are increasingly adopted to meet sustainability commitments and regulatory expectations.

Middle East and Africa expects notable growth in the market. The market is gaining traction due to rising demand for food preservation, extended shelf life, and lightweight packaging. Growth is driven by expanding food, beverage, and pharmaceutical sectors, along with increasing urbanization and retail penetration. The market is gradually shifting from traditional laminates toward cost-effective and sustainable barrier-coated films and papers. Water-based and solvent-free coatings are emerging, though adoption varies by region.

In the UAE market gaining importance as demand grows for high-quality, shelf-stable, and sustainable packaging in food, beverage, and pharmaceutical sectors. The market is influenced by strong imports, premium retail, and a hot climate that requires effective moisture and oxygen barriers. There is a gradual shift from aluminum foil laminates to lightweight, recyclable, and paper-based barrier-coated structures.

South America is witnessing steady growth in the market, the growth is driven by the food, beverage, and pharmaceutical industries. Rising demand for extended shelf life, product protection, and lightweight packaging is encouraging the adoption of moisture, oxygen, and grease-resistant coatings. The market is gradually moving from traditional multilayer laminates toward recyclable and mono-material structures, with water-based and bio-based coatings gaining traction.

Brazil expects the substantial growth in the market, due to increasing demand for food preservation, extended shelf life, and high-quality packaging. The food, beverage, and pharmaceutical sectors are the primary drivers, requiring effective moisture, oxygen, and grease barriers. The market is gradually shifting from traditional multilayer laminates to recyclable, mono-material, and paper-based structures. Adoption of water-based and bio-based coatings is rising, supported by sustainability initiatives and regulatory pressures.

Recent Developments

- In March 2025, Lecta introduced Linerset FP, a high-performance barrier base paper designed for flexible packaging solutions. This product offers converters and printers a strong, flexible, and translucent alternative for use in bags, pouches, and wrapping applications, aligning with sustainable packaging initiatives.

- In April 2025, Chemline announced the launch of barrier-coated products tailored for cup stocks and food packaging. These eco-friendly solutions aim to enhance the sustainability of packaging materials while maintaining performance standards.

Top Companies in the Market

- Mondi Group: Develops water-based and recyclable barrier coatings improving paper and flexible packaging protection.

- UPM-Kymmene: Innovates bio-based barrier coatings enhancing moisture, grease, and oxygen resistance.

- Huhtamaki Oyj: Applies sustainable barrier coatings enabling fiber-based flexible packaging alternatives.

- Amcor Plc: Integrates high-performance barrier coatings for shelf-life extension in flexible packaging.

- Stora Enso Oyj: Advances renewable barrier coating solutions replacing plastic layers in flexible packaging.

Other Major Companies

- Sappi Limited

- DS Smith Plc

- Billerud AB

- Ahlstrom-Munksjö

- WestRock Company

- Sealed Air Corporation

- Nippon Paper Industries Co., Ltd.

- APP (Asia Pulp & Paper)

- KRPA Holding CZ

- Twin Rivers Paper Company

- Felix Schoeller Group

- Ecologic Brands Inc.

Barrier Coatings for Flexible Packaging Market Segments Covered

By Coating Type

- Polymer-Based Coatings (EVOH, PVDC, PVOH, Acrylics)

- Biopolymer Coatings (PLA, Starch, Chitosan)

- Aluminum Oxide (AlOx) Coatings

- Silicon Oxide (SiOx) Coatings

- Water-Based Barrier Coatings

- Others (Wax, Nano-Coatings, Hybrid Solutions)

By Substrate Material

- Plastic Films (PET, BOPP, PE, Nylon)

- Paper & Paperboard

- Aluminum Foil

- Compostable / Bio-based Films

By Application

- Food & Beverages (snacks, dairy, confectionery, beverages, frozen food)

- Pharmaceuticals & Healthcare (blisters, sachets, medical pouches)

- Personal Care & Cosmetics

- Industrial & Chemical Packaging

- Agriculture & Pet Food Packaging

By Distribution Channel

- Direct Supply to Packaging Converters

- Packaging Material Distributors

- Online / Specialty Packaging Suppliers

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA