Packaging Waste Recycling Market Size, Demand and Trends Analysis

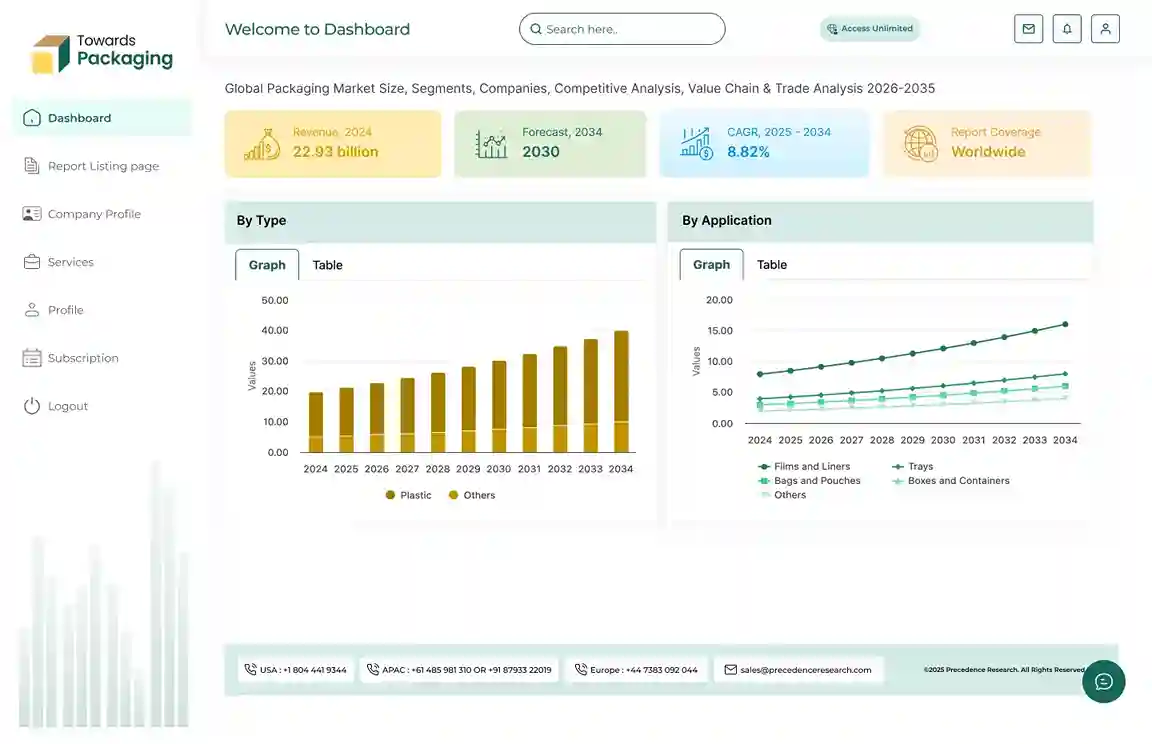

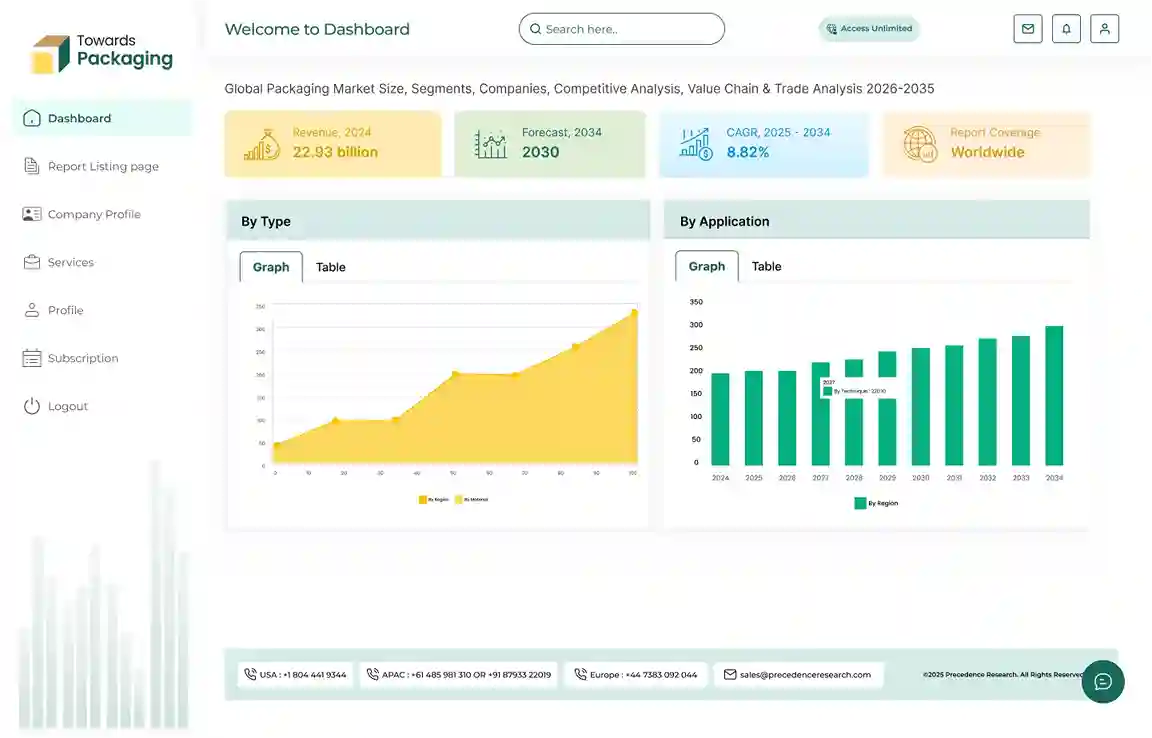

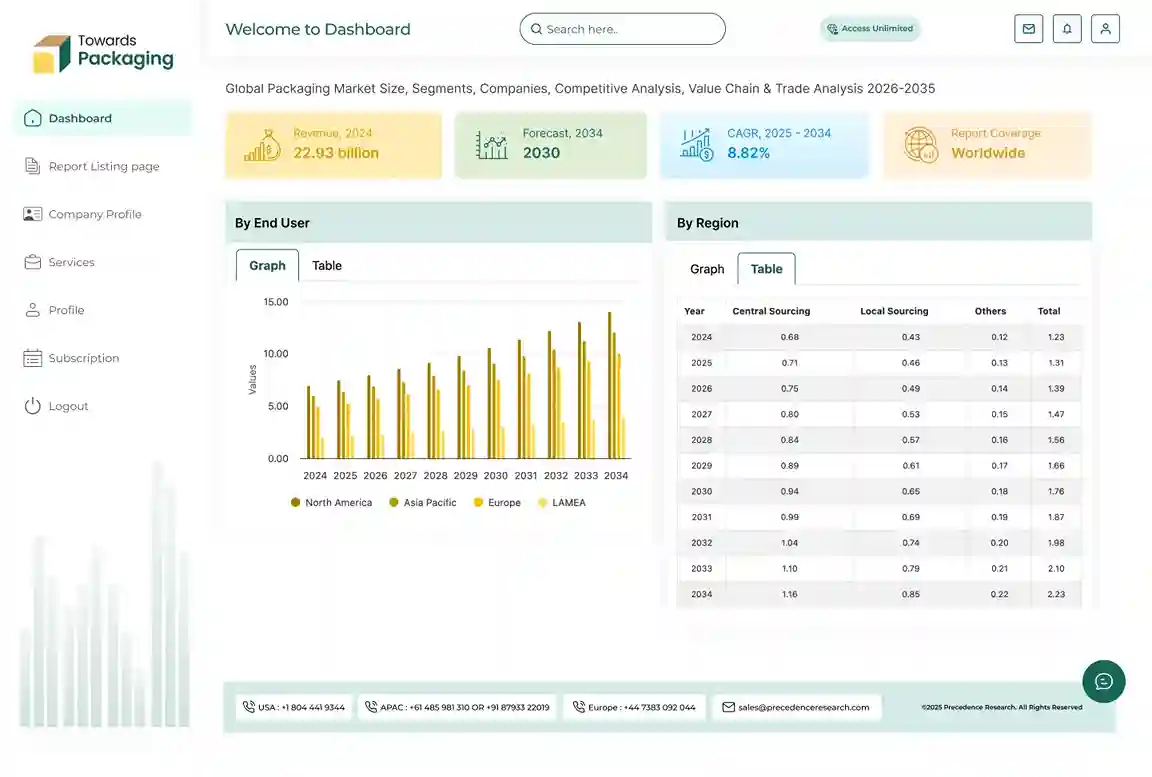

The packaging waste recycling market is projected to grow from USD 36.12 billion in 2026 to USD 54.61 billion by 2035, expanding at a CAGR of 4.7%. The market is driven by ecological guidelines, growing consumer awareness, and the integration of advanced recycling technologies. Europe dominates the market, while Asia Pacific is expected to show significant growth. Key players include Veolia, SUEZ, and Waste Management. The market covers recycling technologies such as mechanical and chemical recycling, with sectors like food & beverage and e-commerce/retail driving demand.

Major Key Insights of the Packaging Waste Recycling Market

- In terms of revenue, the market is valued at USD 34.50 billion in 2025.

- The market is projected to reach USD 54.61 billion by 2035.

- Rapid growth at a CAGR of 4.7% will be observed in the period between 2025 and 2034.

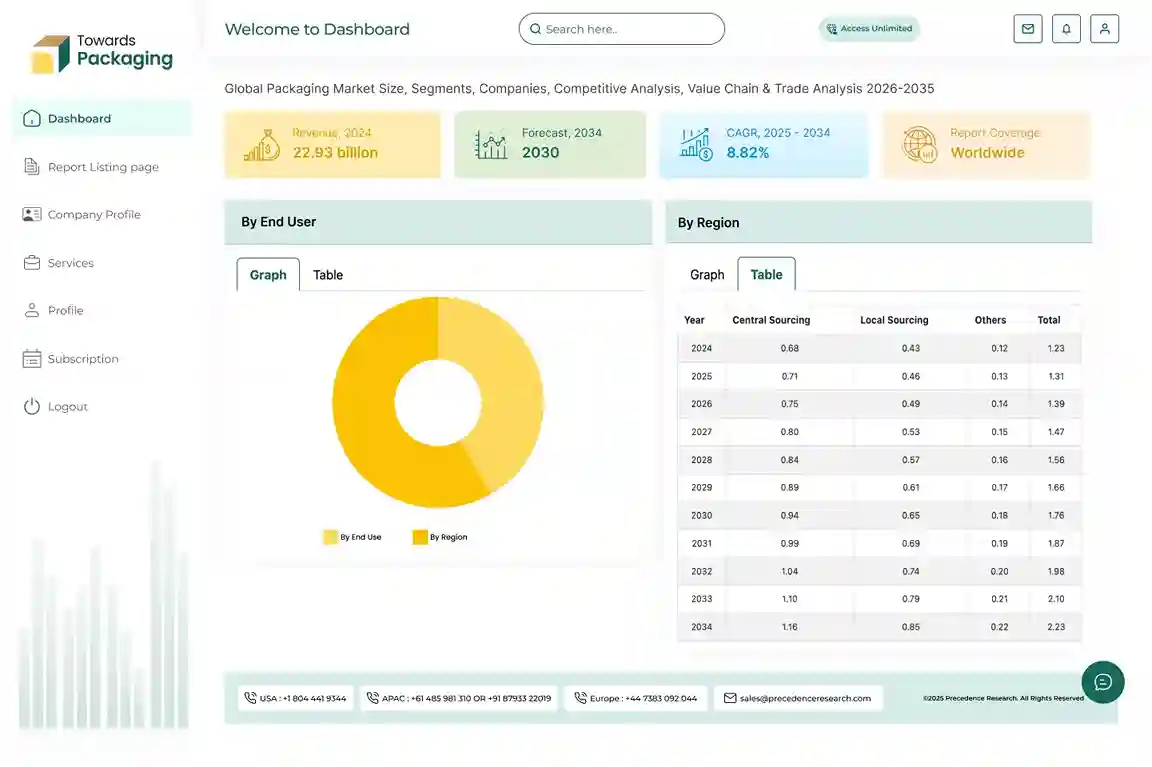

- By region, Europe dominated the global market by holding highest market share in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

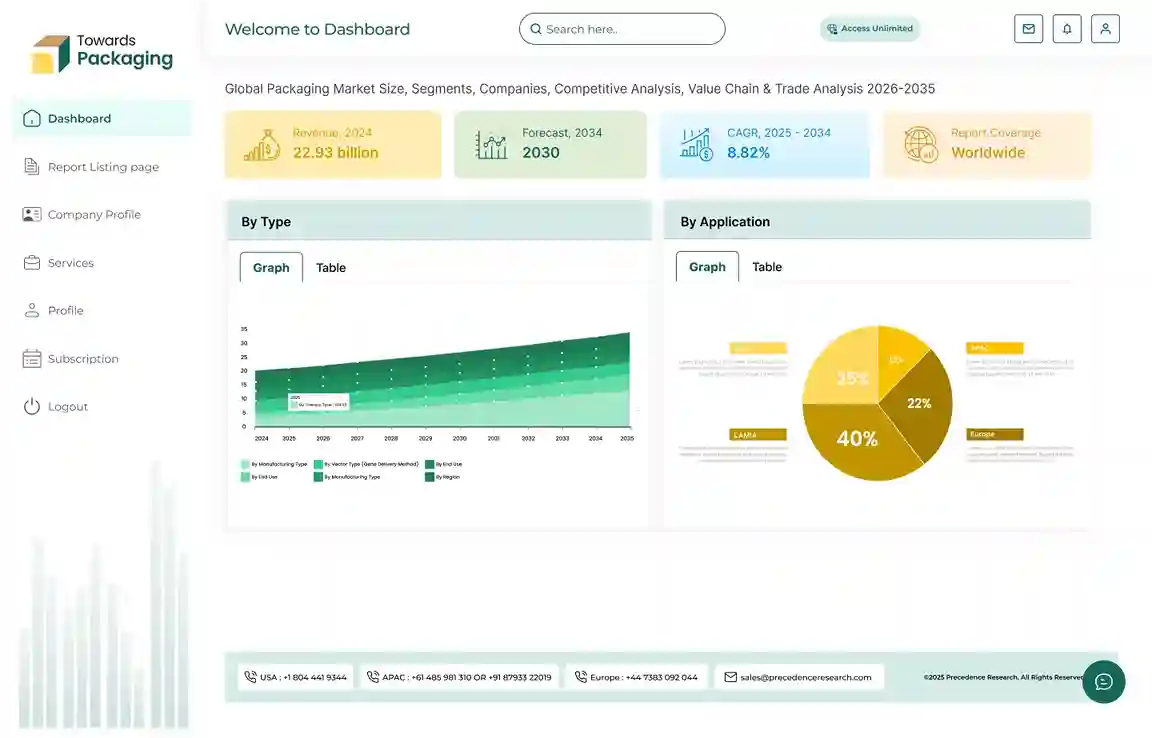

- By material type, the plastics PET, HDPE, LDPE/LLDPE (films), PP, PS, PVC, others segment contributed the biggest market share in 2024.

- By material type, the paper & cardboard (OCC, mixed paper, specialty paper) segment will be expanding at a significant CAGR in between 2025 and 2034.

- By packaging type, the rigid plastics (bottles, tubs, closures) segment contributed the biggest market share in 2024.

- By packaging type, the flexible plastics (films, pouches, sachets) segment is expanding at a significant CAGR in between 2025 and 2034.

- By sorting & processing technology, the mechanical recycling (MRF sorting, washing, flake, pelletizing, pulping) segment contributed the biggest market share in 2024.

- By sorting & processing technology, the chemical/advanced recycling (depolymerization, pyrolysis, solvent-based) segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By end-user industry, the food & beverage segment contributed the biggest market share in 2024.

- By end-user industry, the e-commerce/retail & logistics segment will be expanding at a significant CAGR in between 2025 and 2034.

Market Overview

The packaging waste recycling market refers to the industry focused on the collection, sorting, processing, and repurposing of discarded packaging materials into reusable raw materials or new products. It encompasses the recycling of various packaging formats such as plastics, paper & cardboard, metals, glass, and wood, generated from sectors like food & beverages, e-commerce, retail, healthcare, and consumer goods. The market is driven by increasing environmental concerns, stringent government regulations on waste management, rising consumer awareness of sustainability, and the growing demand for recycled materials in manufacturing.

Packaging waste recycling not only helps reduce landfill volumes and minimize carbon emissions but also promotes circular economy practices by reintroducing recovered materials into the production cycle. This market involves stakeholders such as municipal waste management authorities, recycling companies, packaging manufacturers, and end-use industries aiming to meet sustainability targets and comply with extended producer responsibility (EPR) frameworks.

What are New Trends in the Packaging Waste Recycling Market?

Rising Demand for Recycled Resources

- The rising demand for recycled packaging such as recycled packaging or integration of post-consumer recycled (PCR) boost the market development.

Advancement in Recycling Technology

- The chemical recycling resolutions are actively integrated to enhance the process of recycling packages into new packaging.

Increasing Extended Producer Responsibility (EPR)

- The rapid increase in the demand for extended producer responsibility program boosted the growth of the market.

How Can AI Improve the Packaging Waste Recycling Market?

The incorporation of AI technology in the packaging waste recycling market plays a significant role in decreasing contamination, enhancing resource recovery, and encouraging the advancement of the recycling services. With the enhancement in the selection of materials it improved the recyclability services of the packaging. These advanced technologies help in generating enhanced designed recycled packaging. It helps in analysing the demand of the market and help in manufacturing required quality and quantity of the packages.

Market Dynamics

Market Driver

Rising Ecological Guidelines Drive the Packaging Waste Recycling Market

The rising ecological guidelines to produce safe packaging has primarily driven the market. Growing ecological guidelines and strategies expected at decreasing landfill waste and endorsing recycling are noteworthy compounds. The worldwide consumers are prepared to alter their feeding habits to decrease their ecological influence. This demand inspires producers to promote sustainable packaging resolutions, additionally improving the recycling industry.

Market Challenges and Restraints

Lack of Recycling Infrastructure

The lack of effective recycling infrastructure has hindered the growth of market. The pollution of recyclable resources positions challenge, as polluted recyclables frequently result in in landfills in place of being treated. This matter is impaired by unpredictable public consciousness and instruction about appropriate recycling process, resulting in decreasing recycling charges.

Market Opportunity

Advancement in the Recycling Techniques

The advancement in the recycling technology has developed several opportunities in the packaging waste recycling market. The expansion of progressive recycling technologies, like chemical recycling which is a process with broader variability of plastics which are traditional procedures struggle. The industry for recyclable and compostable packing resources is also growth, offering substitute that can decrease the dependance on old-style plastics. Moreover, collaboration between government organisations, NGOs, and private divisions can improve recycling activities, advance infrastructure, and encourage customer education about recycling advantages.

U.S. Waste Generation and Recycling Trends in 2018

In 2018, the United States generated around 35.7 million tons of plastic products, which made up 12.2% of the total municipal solid waste (MSW). This marked a significant increase from 2010, where plastics accounted for 8.2% of waste. The rise in plastic waste was largely driven by the growing use of packaging materials and durable goods, and plastics have steadily represented between 12.2% and 13.2% of the total waste over recent years.

On the recycling front, the U.S. made notable strides. Over 69 million tons of MSW were successfully recycled, with paper and paperboard making up nearly 67% of the total recycled material. Metals contributed about 13%, and other materials like glass, plastics, and wood made up roughly 4-5% each. Some of the most recycled items included corrugated boxes, mixed paper products, newspapers, and lead-acid batteries, among others. Together, these materials accounted for 90% of the total recycling efforts in the U.S. in 2018.

Despite the progress in recycling, the country still faced significant waste challenges. Approximately 146.1 million tons of waste were sent to landfills. A large portion of this waste came from food (24%), followed by plastics (18%), paper and paperboard (12%), and rubber, leather, and textiles (11%). Other materials each contributed less than 10% to the landfill total.

Historical Overview

Over the past several decades, the landscape of waste generation and management in the United States has undergone significant transformation. In 1960, total municipal solid waste (MSW) generation was 88.1 million tons, which increased dramatically to 292.4 million tons by 2018. This growth reflects both population increases and evolving consumption habits across the country.

While there was a slight 1% decrease in waste generation between 2005 and 2010, the trend reversed, and waste generation grew by 7% from 2010 to 2017. This increase was partly attributed to the introduction of new food management pathways by the U.S. Environmental Protection Agency (EPA), which played a role in the overall uptick in waste generation.

On a per capita basis, the waste generation rate rose from 2.68 pounds per person per day in 1960 to 4.9 pounds per person per day in 2018, marking an 8% increase from 2017 to 2018.

In terms of waste management, recycling and composting have steadily gained traction. In 1960, just 6% of total MSW was recycled or composted. By 2017, this figure had risen to 35%, though it slightly dipped to 32.1% in 2018. Meanwhile, energy recovery from waste, which was nearly nonexistent in 1960, reached 12% by 2018, reflecting an increasing reliance on waste-to-energy technologies.

Landfilling, which accounted for 94% of total waste in 1960, has seen a dramatic decline over the years. By 2018, only 50% of total waste was landfilled, highlighting the country’s progress in waste diversion and its efforts to embrace more sustainable waste management practices.

This historical shift in waste management reflects significant advancements in sustainability, waste diversion, and resource recovery. However, challenges remain, particularly with increasing waste generation and the need for more efficient recycling and composting systems.

The Environmental Impact of Paper and Paperboard Recycling in 2018

In 2018, the recycling rate for paper and paperboard reached an impressive 68.2%, equating to 46 million tons recycled. This marked an increase from the 65.9% recycling rate in 2017, which was 44.2 million tons, and a significant rise from just 42.8% in 2000. As a result, paper and paperboard became the largest contributors to waste reduction in the U.S. that year.

The environmental impact of recycling paper and paperboard is substantial. In 2018, this recycling effort led to a reduction of over 155 million metric tons of carbon dioxide equivalent (MMTCO₂E), making it the most impactful material category in terms of carbon savings. To put this into perspective, the reduction is comparable to taking more than 33 million cars off the road for one year, underscoring the significant climate benefits associated with paper recycling.

The data highlights the importance of ongoing improvements in recycling infrastructure and increased public participation in waste management efforts. As these efforts continue, the U.S. is making notable strides toward reducing landfill dependency, conserving valuable resources, and cutting greenhouse gas emissions.

The success of paper and metal recycling demonstrates how focused material recovery can lead to substantial environmental and sustainability gains. Looking ahead, continued investment in recycling technologies, public awareness initiatives, and the adoption of circular economy strategies will be essential to building a cleaner, more resource-efficient future for the country.

Material Insights

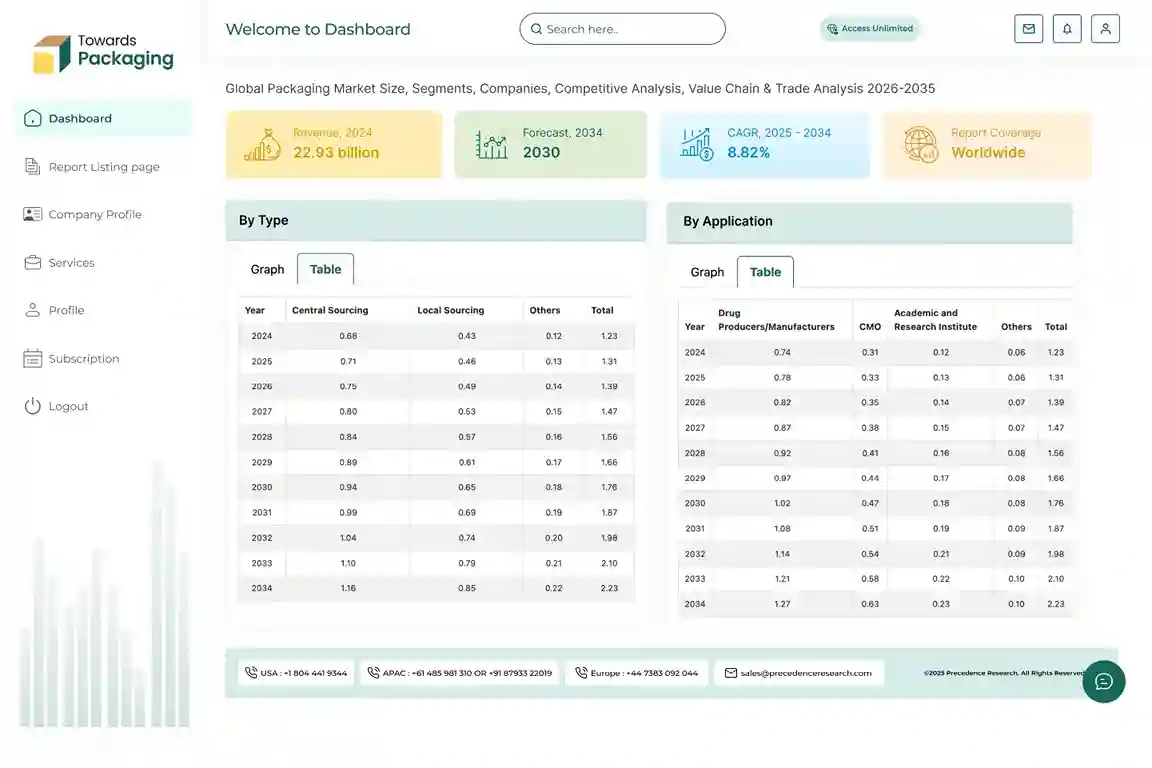

Why Plastics PET, HDPE, LDPE/LLDPE (films), PP, PS, PVC, Others Segment Dominated the Packaging Waste Recycling Market In 2024?

The plastics PET, HDPE, LDPE/LLDPE (films), PP, PS, PVC, others segment dominated the market in 2024 due to its affordability and easy accessibility. These materials are commonly used in the manufacturing of packaging such as barrels and bottles. These are first shredded into small pieces and then crushed to produce new packaging products. These can be easily customized into various shapes and sizes; this property influences the demand for these materials.

The paper & cardboard (OCC, mixed paper, specialty paper) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing significantly as it holds several ecological benefits. The growing awareness among consumers for using eco-friendly packaging has influenced the demand for this segment. It decreases landfills and reduces carbon emission which raise the demand for these materials in various industries.

Packaging Form/Type Insights

Why Rigid Plastics (Bottles, Tubs, Closures) Segment Dominated the Packaging Waste Recycling Market In 2024?

The rigid plastics (bottles, tubs, closures) segment held the largest share of the market in 2024 due to improved sorting and reduced contamination. These materials are recycled in both mechanical and chemical process. It is first sorted, washed and then grind into small pieces of plastics. These small plastic flakes are melted and then designed into convenient bottles, tubs or closures.

The flexible plastics (films, pouches, sachets) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to rising demand for single layer plastic packaging. These are delicate by nature and required innovative recycling methods for the transformation of the packaging. It can be easily expanded and crafted new designs or customized.

Sorting & Processing Technology Insights

Why Mechanical Recycling (MRF Sorting, Washing, Flake, Pelletizing, Pulping) Segment Dominated The Packaging Waste Recycling Market In 2024?

The mechanical recycling (MRF sorting, washing, flake, pelletizing, pulping) segment held the largest share of the market in 2024 due to high effectiveness and low impurity in recycled material. This process helps in generating high quality packaging by distinguish impurities efficiently. It supports in meeting huge demand for recycled packaging by accelerating the process of recycling. Packaging recycled with such advanced technology provide huge space for printing and help in creating unique designs.

The chemical/advanced recycling (depolymerization, pyrolysis, solvent-based) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing as it support in gathering virgin like and superior quality materials. This technology is highly driven by brands looking for sustainable options. It maintains the scalability during the production process and are highly cost-efficient.

End-Use Industry Insights

Why Food & Beverage Segment Dominated the Packaging Waste Recycling Market In 2024?

The food & beverage segment held the largest share of the market in 2024 due to rising consumer demand and high supervisory pressure. Some of the major drivers for the growth of adoption of recycled packaging in this segment are circular economy, consumer awareness, enhanced convenience demand, and high regulatory pressure. Increasing demand for packaged food has driven this market to develop unique style packaging.

The e-commerce/retail & logistics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to increasing demand for sustainable packaging policies of several brands. The rising trend of online shopping has enhanced the demand for recycled packaging in this sector which increase the investment of the market players for the advancement of the recycling technology.

Regional Insights

Strong Supervisory Policies in Europe Promote Dominance

Europe held the largest share of the market in 2024, due to the strong supervisory policies in the packaging industry. There is huge demand for sustainable packaging and drive innovation in the recycling technology. High investment in this sector has helped to evolve the packaging waste recycling market in Europe. The presence of well-established recycling infrastructures also boosted the expansion of this industry.

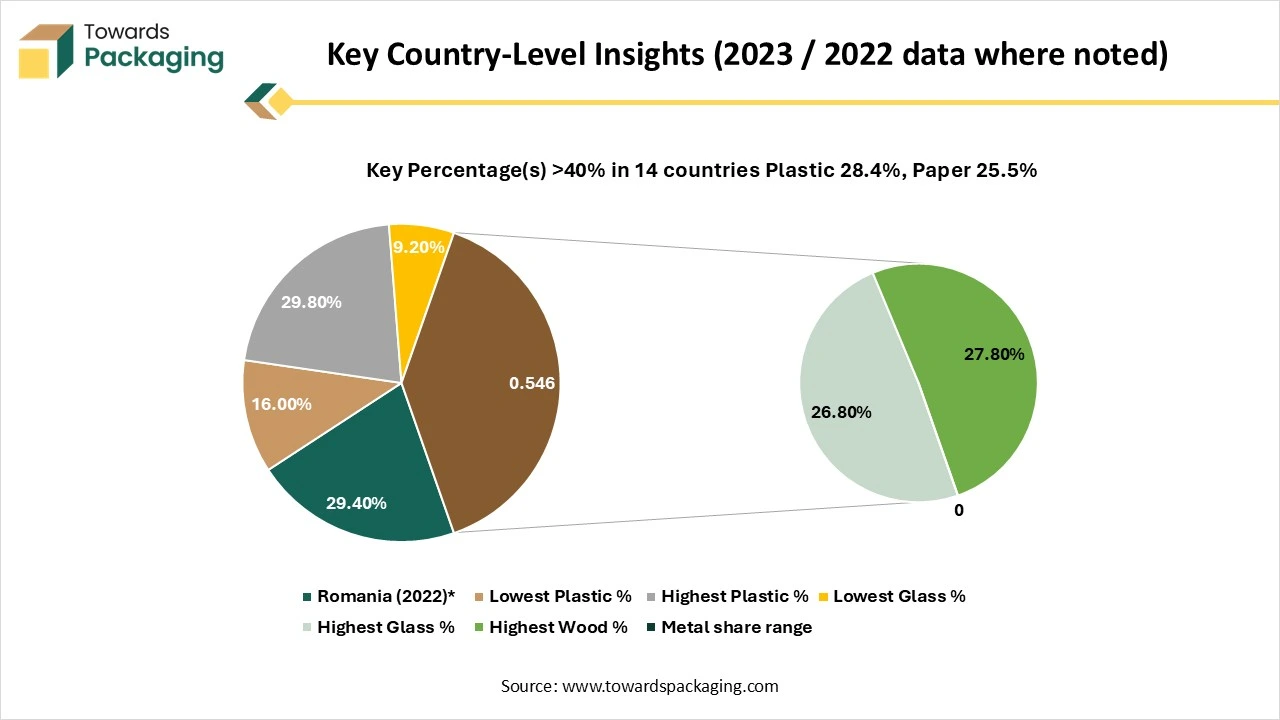

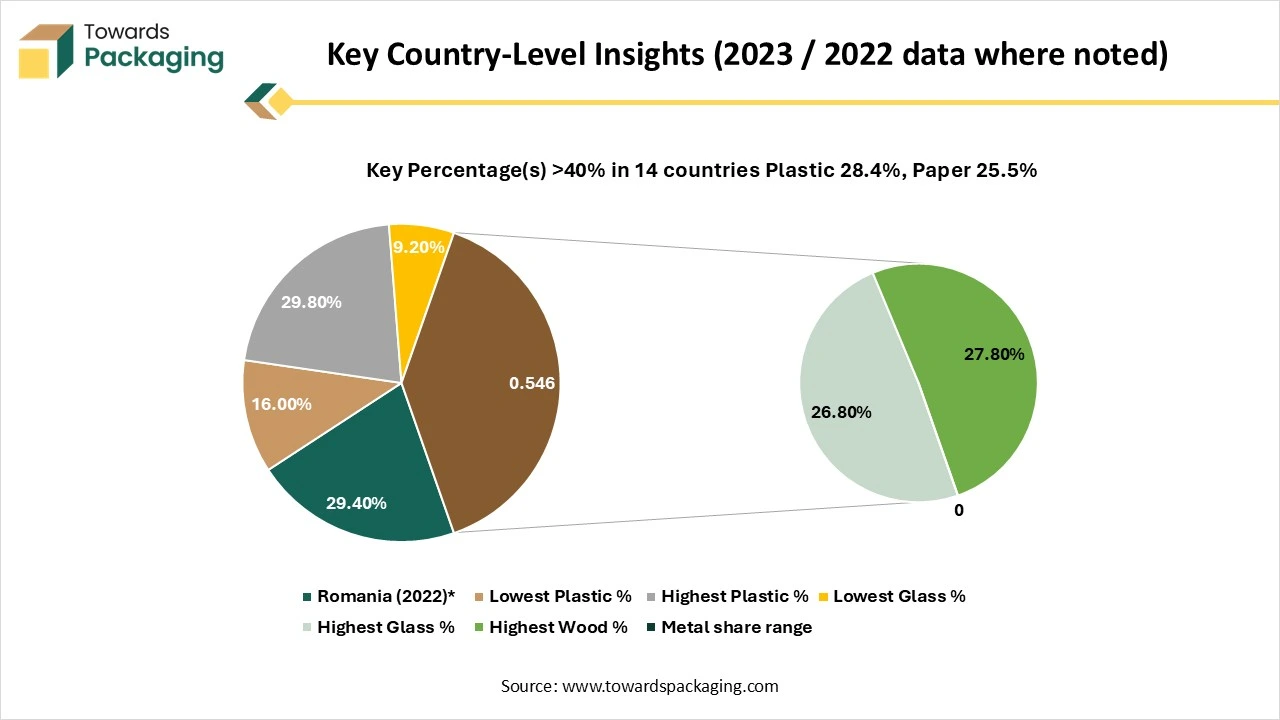

EU Packaging Waste by Material - 2023

In 2023, the European Union generated 79.7 million tonnes of packaging waste. The majority came from paper and cardboard, which accounted for over 40% of the total. Plastics and glass also contributed significantly, making up 19.8% and 18.8%, respectively. Wood represented about 15.8%, while metals and other materials formed only a small portion.

Across most EU countries, the distribution by material was similar to the EU average. Paper and cardboard were the largest source of packaging waste in 26 out of 27 countries, with Bulgaria being an exception, where plastic waste was slightly higher. Plastic waste contributed as little as 16% in Luxembourg and nearly 30% in Ireland. Glass packaging waste varied widely—from 9.2% in Finland to 26.8% in Croatia. Metal waste was generally low everywhere, remaining below 10% in all nations.

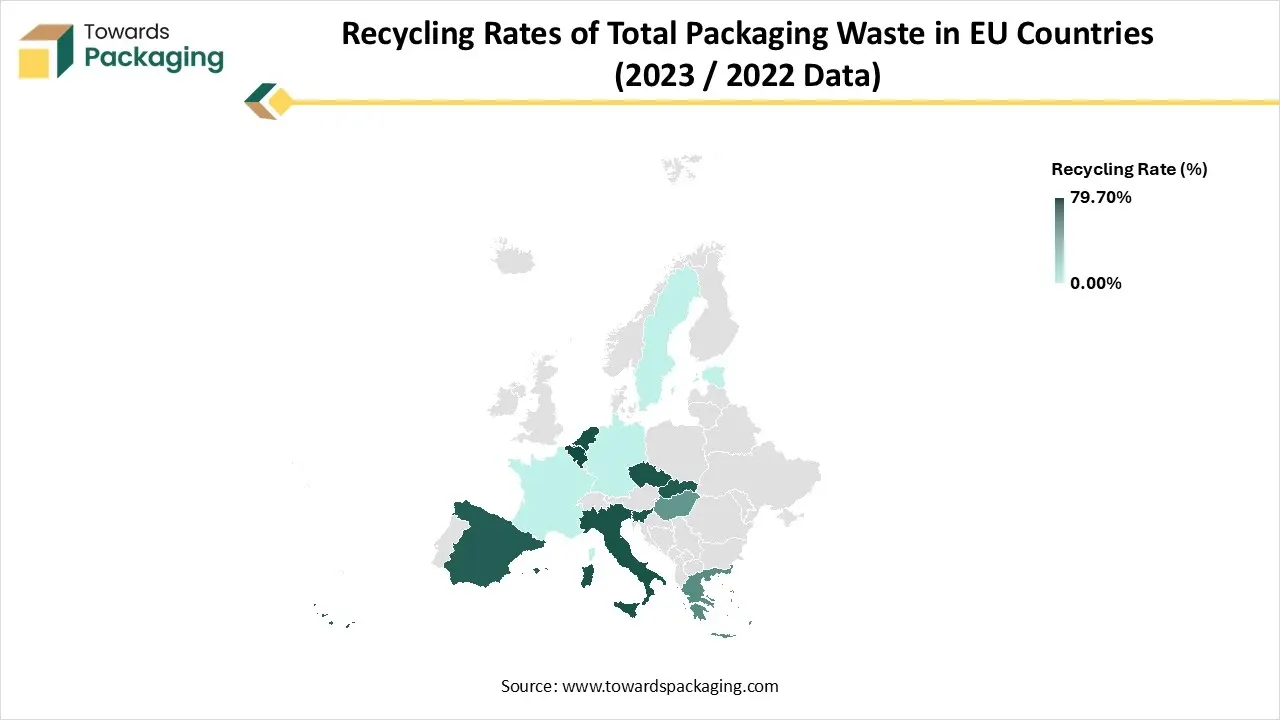

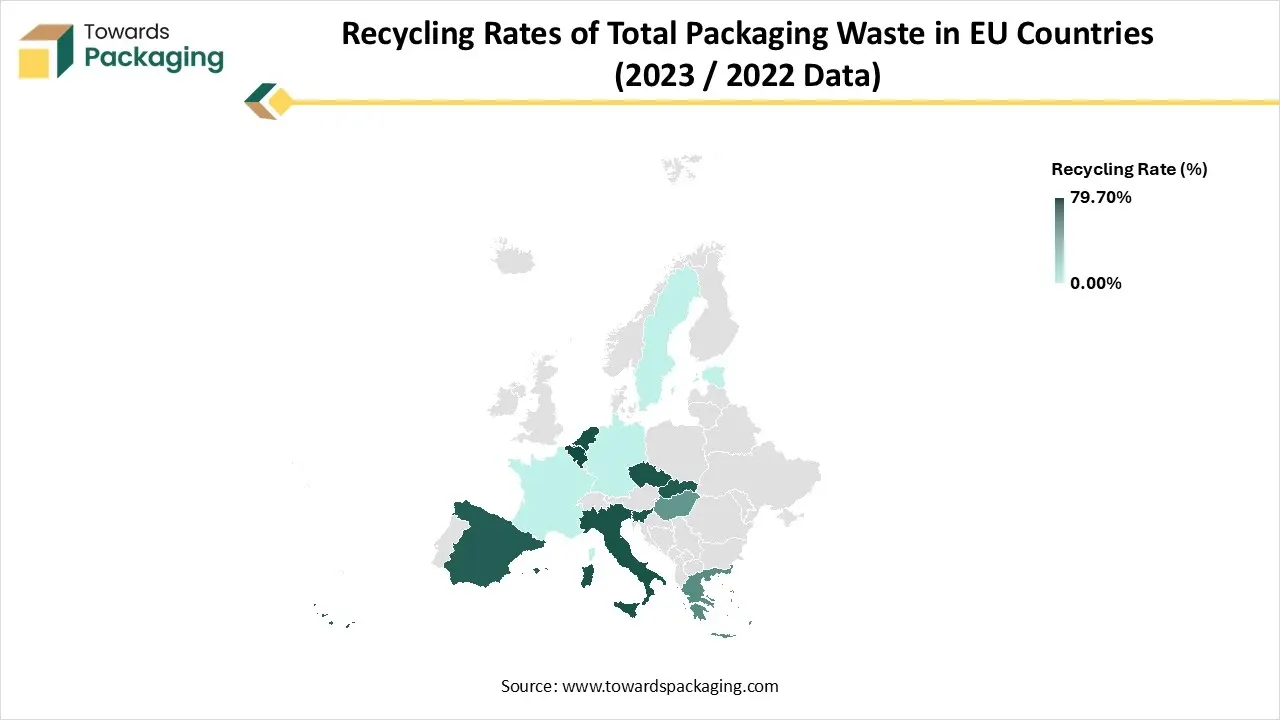

Recycling Targets and Rates for Packaging Waste (2030 Targets & 2023 Performance)

The EU aims to recycle 70% of all packaging waste by 2030, with even higher targets for specific materials like 85% for paper, 75% for glass, and 55% for plastics. In 2023, the EU was close to reaching this goal, achieving a recycling rate of 67.5%.

Seven EU countries have already surpassed the 70% target, including Belgium, Netherlands, Italy, Czechia, Slovenia, Slovakia, and Spain. Many others, such as Germany, France, Estonia, Sweden, and Cyprus, are very close, reporting recycling rates between 68.5% and 69.5%. However, some countries are struggling: Romania, Hungary, Malta, and Greece achieved recycling rates below 50%, far from the EU’s 2030 ambitions.

Presence of Strict Regulatory Framework Promote Packaging Waste Recycling Market in Germany

Presence of strict regulatory framework has raised the expansion of the market in Germany. Rapid shift of various consumers towards sustainable packaging of the products has influenced the growth of the market. Continuous innovation in the recycling technology has also influenced the expansion of this market profoundly.

Asia Pacific’s Increasing Urbanization Sector Support Growth

Asia Pacific expects the significant growth in the packaging waste recycling market during the forecast period. It is due to increasing urbanization, the demand for recycled packaging has raised significantly. Several sectors such as e-commerce, food & beverages, and healthcare has adopted recycled packaging and boost to enhance recycling technology. Presence of strict government guidelines has enhanced the usage of single-use packaging.

Packaging Waste Recycling Market- Value Chain Analysis

Raw Material Sourcing

The major aspects of raw material sourcing are types of waste materials, post-consumer recycled content, and secondary raw materials.

- Key Players: Veolia, KW Plastics

Component Manufacturing

The major components in this industry are sorting, shredding, and processing materials.

- Key Players: Antony Waste Handling, Gravita India

Logistics and Distribution

It provides efficiency on transporting goods for enhanced services for separation, treatment, and reprocessing.

- Key Players: Avangard Innovative, Veolia Environment SA

Top Companies in the Packaging Waste Recycling Market

- Veolia

- SUEZ (Recycling & Recovery)

- Waste Management (WM)

- Republic Services

- DS Smith Recycling

- Smurfit Kappa Recycling

- Paprec

- REMONDIS

- ALBA Group

- Biffa

- Indorama Ventures (recycling / rPET)

- Novelis

- Pratt Industries / Visy

- Plastipak

- EMR (European Metal Recycling)

Latest Announcements by Industry Leaders

- In July 2025, Oregon Department of Environmental Quality Recycling Program Manager, Arianne Sperry, expressed, “The expansion of recycling system depends on the speed of people who have the desire to experience changes. Oregon is now the first state that needs paper and packaging manufacturer to pay fees in a statewide waste prevention and recycling system.”

Recent Developments

- In June 2025, Greyparrot declared the development of Deepnest which is an AI-based waste intelligence system designed to provide brands direct admission to the recyclable products generated data.

- In May 2025, Oroville Flexible Packaging which is a plastic packaging company developed Oroflex which is a flexible packaging recycling system. It has helped in enhancing sustainable goals and operational efficacy.

Packaging Waste Recycling Market Segments

By Material

- Paper & Cardboard (OCC, mixed paper, specialty paper)

- Plastics: PET, HDPE, LDPE/LLDPE (films), PP, PS, PVC, Others

- Metals: Aluminum (UBCs, foil), Steel (cans)

- Glass: clear/amber/green cullet

- Multilayer/Composite (aseptic cartons, laminates)

- Wood (pallets/crates)

- Bioplastics (PLA, PHA, others)

By Packaging Form/Type

- Rigid Plastics (bottles, tubs, closures)

- Flexible Plastics (films, pouches, sachets)

- Metal Cans (aluminum, steel)

- Glass Bottles & Jars

- Paperboard & Corrugated (primary/secondary)

- Composite Cartons

By Sorting & Processing Technology

- Mechanical recycling (MRF sorting, washing, flake, pelletizing, pulping) - Dominated

- Chemical/Advanced recycling (depolymerization, pyrolysis, solvent-based) - Fastest

- Pre-processing & QA (optical sorters, NIR, robotics, de-inking, super-clean lines)

By End-User/Industry

- Food & Beverage - Dominated

- Personal Care & Household

- E-commerce/Retail & Logistics - Fastest

- Healthcare/Pharma

- Industrial/B2B

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

Tags

FAQ's

Select User License to Buy

Figures (8)