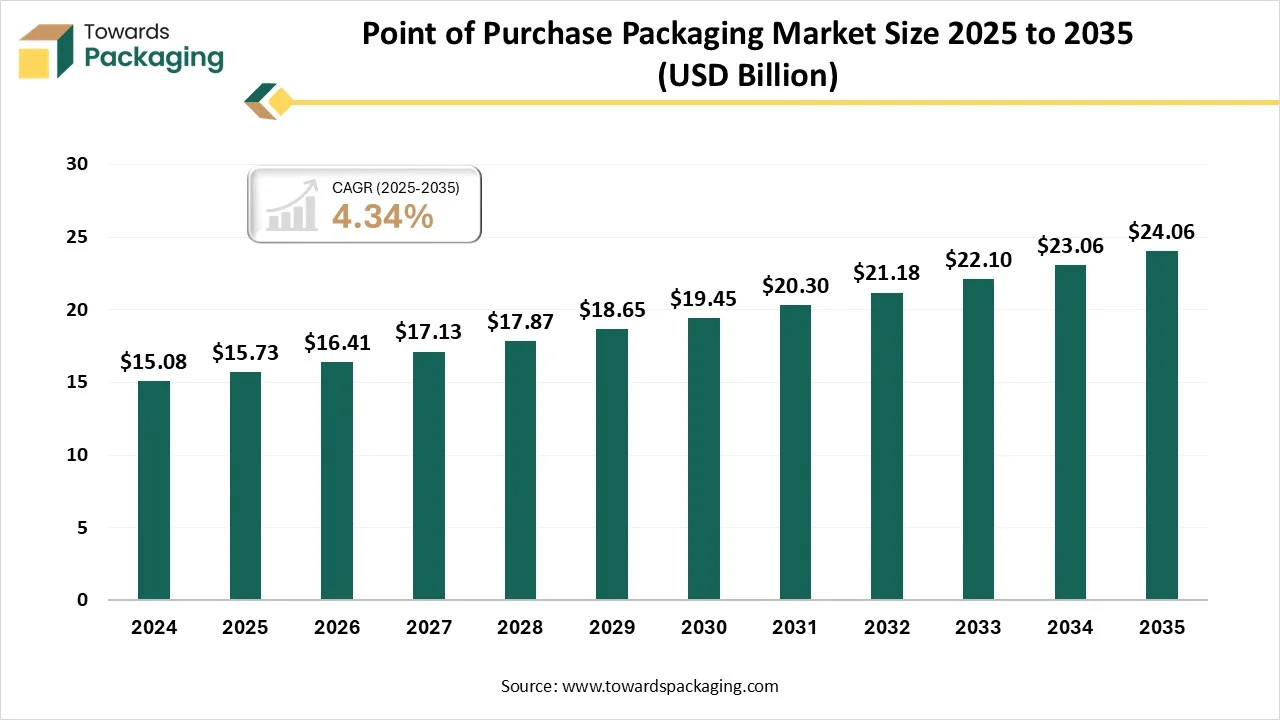

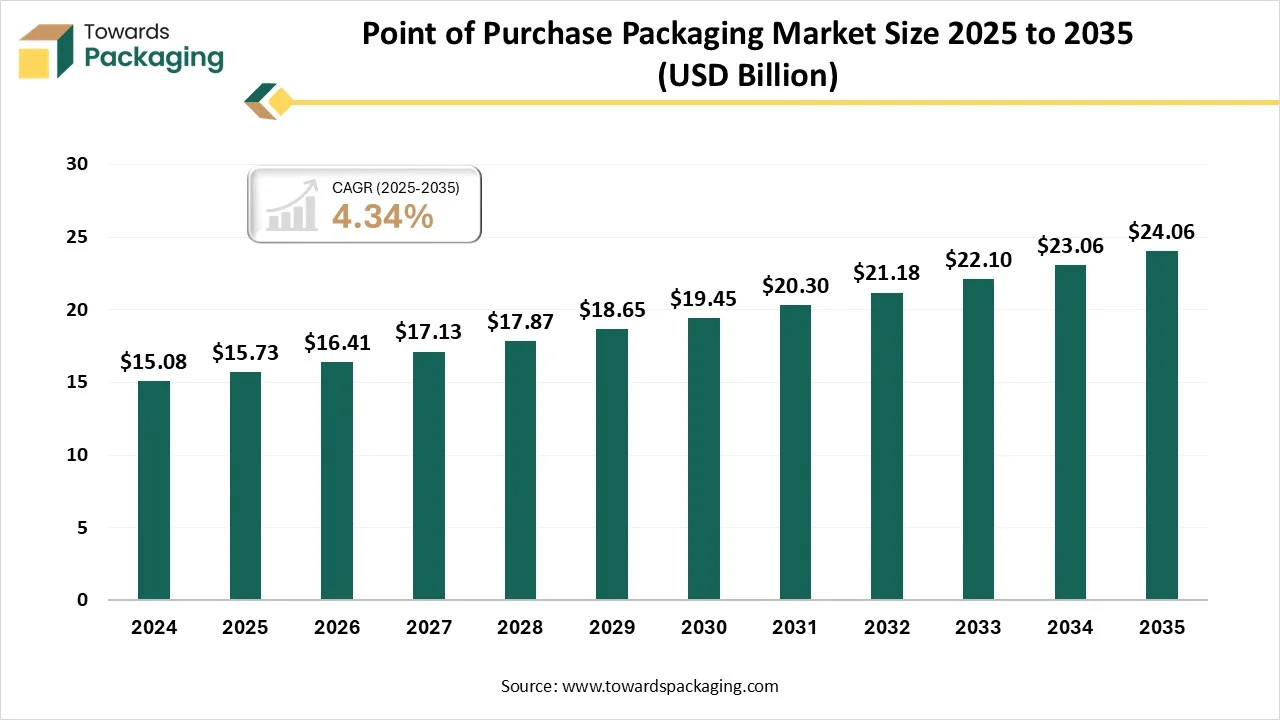

The point of purchase packaging market is projected to reach USD 24.06 billion by 2035, growing from USD 16.41 billion in 2026, at a CAGR of 4.34% during the forecast period from 2026 to 2035. This market is experiencing robust growth, driven by rising retail competition and the increasing need for visually appealing displays that boost consumer engagement and on-the-spot buying decisions.

The point of purchase packaging market is witnessing strong growth as companies depend more on eye-catching displays to draw customers into crowded retail spaces. Growing competition in the FMCG, cosmetics, and electronics industries, where shelf impact directly affects consumer purchasing decisions, is driving growth. To improve product visibility and encourage impulsive purchases, retailers are also investing in creative space-efficient display solutions. Strong market momentum is further supported by the trend toward premiumization and personalized in-store branding.

| Technological Shifts | Description |

| Smart & Interactive Packaging | POP displays now use QR codes, NFC, RFID, and AR to offer digital engagement, authentication, and immersive brand experiences. |

| Digital Printing & Personalization | On-demand digital printing enables fast customization, localized campaigns, and variable data printing for unique, personalized POP units. |

| Sustainable Material Innovation | Brands are shifting to recyclable mono-materials, biodegradable substrates, and bio-based polymers to meet sustainability standards. |

| Automation & Robotics | AI-driven robots now assemble, fold, and finish POP displays with higher efficiency, precision, and lower labor dependency. |

| Advanced Supply Chain Transparency | IoT sensors, blockchain, and smart tags offer real-time tracking, material traceability, and better inventory planning for POP displays. |

POP packaging relies on efficient processing of cardboard, paperboard, plastics, and corrugated materials. Advanced cutting, folding, and lamination techniques ensure durability, high-quality finishes, and cost-effective production.

Creative design and rapid prototyping help brands develop visually appealing, functional displays. 3D modeling and mock-ups allow quick testing of size, structure, and aesthetics before full-scale production.

Efficient logistics ensure POP units reach stores intact and on time. Compact, modular designs reduce shipping costs, while coordinated supply chains maintain consistency across multiple retail locations.

Several packaging manufacturers are allocating substantial capital to expand their production facilities. Investments in new BOPP, PET, and CPP film lines and upgraded flexible packaging plants are strengthening the supply chain for POP packaging. Companies in India, Southeast Asia, Europe, and North America are enhancing their material production capabilities to meet increasing demand for retail-ready displays, corrugated structures, and printed promotional packaging used by FMCG brands, supermarkets, and consumer goods companies.

Private equity groups are increasingly active in the packaging sector. They are acquiring packaging companies specializing in paperboard, molded fiber, corrugated displays, and flexible formats that are widely used in POP packaging. These acquisitions provide companies with greater operational scale, expanded distribution networks, and improved ability to offer integrated solutions to global retailers and consumer goods manufacturers. The consolidation trend is enhancing market efficiencies and enabling packaging groups to invest more aggressively in POP display technologies.

Private companies are directing funds toward sustainability-focused R&D, including recyclable materials, advanced paperboard engineering, nanocoatings, and barrier technologies. These innovations enhance functionality, printability, and shelf impact of POP displays. Many global packaging companies are investing in environmentally friendly packaging formats that align with retailer sustainability commitments and shifting consumer expectations. Investments in design labs and prototyping centers are helping brands develop custom POP displays that drive point-of-sale engagement.

Venture capital and private investors are funding supply chain technology platforms that connect brands with packaging manufacturers, streamline procurement, and enable faster production cycles. These platforms support the broader POP packaging ecosystem by improving access to advanced display solutions, especially for small and mid-size brands. Startups in packaging design automation, retail display software, and inventory management are also attracting investments, reflecting the shift to data-driven and tech-supported POP packaging processes.

Pallets/display pallets remain essential in the point of purchase packaging market. They facilitate high product visibility, bulk merchandising, and rapid in-store deployment with minimal handling, reducing labor costs and maintaining uniform presentation across outlets. Retailers favor these ready-to-place units for promotions, seasonal drives, and high-volume categories.

Custom fixtures & permanent merchandising units provide long-term brand presence, making them crucial for industries like electronics, personal care, and beauty that depend on frequent consumer interaction. Their longevity and high-quality finish give brands a dedicated area to sway consumer decisions while helping retailers maintain a uniform store aesthetic.

Floor displays are gaining traction for their portability, affordability, and ability to drive impulsive purchases across various retail hotspots, as they can be placed in aisles, entrances, and checkout zones without installation constraints. Brands use them extensively for new launches cross cross-merchandising, and celebratory campaigns.

Paper/ Paperboard/ Corrugated materials dominate the point of purchase packaging market thanks to their low cost, lightweight structure, and excellent printability. With retailers demanding recyclable solutions, corrugated displays have become the preferred choice for temporary and promotional setups, offering both sustainability and strong visual impact.

Composite/Mixed-material displays are rising quickly as companies seek more robust, high-end textures and structural support. These combinations, such as metal frames with printed board panels, are ideal for high-value products and longer campaign lifespans because they offer strength and visual appeal.

Plastic-based POP displays remain important for their strength, weather resistance, and ability to handle complex shapes. Although their growth is restrained by stricter sustainability standards and retailer pressure for greener alternatives, they are especially preferred in categories that call for frequent handling or moisture protection.

Food & beverage remains the dominating end-use segment in the point of purchase packaging market, driven by bulk product turnover, frequent promotions, and the requirement for high shelf visibility to sway quick buying decisions. POP displays are essential to supermarket and hypermarket merchandising because they help brands showcase flavor variations, package discounts, and new product launches.

Supermarkets & hypermarkets hold the largest share of the point of purchase packaging market, backed by high foot traffic, sizable display space, and ongoing marketing campaigns. Pallet displays, category fixtures, and seasonal merchandising are the main strategies these stores use to increase conversion and handle a variety of product lines.

E-commerce and omnichannel retail are rapidly embracing POP-inspired packaging in the form of enhanced unboxing designs, ship-ready promotional boxes, and OQ-enabled engagement tools. As brands blend online and offline journeys, these formats help maintain brand storytelling and create experiential touchpoints beyond physical aisles.

Convenience Stores utilize POP packaging to maximize limited space and drive impulse buying, especially for beverages, snacks, and daily-use items. Compact countertop displays mini floor units, and shelf talkers are commonly deployed to attract quick turnaround from high-frequency, short-duration shoppers.

North America leads the POP packaging market due to its established retail infrastructure, substantial marketing spending, and widespread use of both temporary and permanent display systems. To stay competitive, major retail chains and consumer brands consistently invest in cutting-edge merchandising solutions.

The U.S. POP packaging market is driven by well-established retail formats, substantial advertising expenditures, and widespread use of both temporary and permanent in-store display options. Pallet displays, custom fixtures, and omnichannel-ready merchandising are key tools used by supermarket chains, mass merchandisers, and specialty retailers to sway consumer decisions in a fiercely competitive market. To increase store conversion and facilitate frequent product launches, brands invest in data-driven merchandising, sustainable paper-based displays, and advanced printing.

Asia Pacific is growing rapidly, fueled by growing FMCG consumption, increased organized retail penetration, and fast urbanization. As consumer demand rises across supermarkets, hypermarkets, and convenience stores, retailers are investing in improved in store visibility and promotional execution to influence purchasing decisions. To differentiate store formats and capitalize on changing consumer purchasing patterns, retailers are progressively implementing contemporary POP solutions. These modern displays help highlight new product launches, drive impulse buying, and strengthen brand presence in competitive retail environments, supporting steady market expansion across the region.

India is growing, and the consumption of FMCG in urban and Tier II–III cities is increasing as modern retail formats expand. Rising disposable incomes and stronger penetration of supermarkets, convenience stores, and neighborhood chains are creating new opportunities for brands to present products more effectively at the point of sale. As shopper traffic increases across these formats, retailers are focusing on displays that can maximize visibility within limited space.

To increase impulsive purchases in smaller store footprints, retailers are increasingly using floor displays for corrugated promotional units and small countertop fixtures. These compact POP formats help highlight seasonal offers, new launches, and high rotation items while keeping aisles organized and easy to navigate. Their lightweight structure and quick setup make them suitable for both large and small retail environments.

South America is showing notable growth in the point of purchase packaging market due to expanding retail networks, rising FMCG consumption, and increased investment in branded in-store displays. Modern supermarkets and convenience chains in Brazil, Argentina, and Chile are using POP units to increase product visibility and support promotional campaigns. Growing demand for cost-effective promotional materials and the rise of local food and beverage brands further strengthen market adoption across the region.

Brazil is emerging as a strong market for point of purchase packaging, driven by the rapid expansion of modern retail formats and higher spending on promotional displays. Brands in categories such as snacks, beverages, beauty, and home care are using corrugated floor stands, dump bins, and countertop units to influence shopper decisions. Increased focus on sustainable materials and holiday-driven promotions continues to boost demand for affordable and high-impact POP designs across Brazilian supermarkets and hypermarkets.

Europe is a mature POP packaging market, driven by intense retail rivalry and the need for high-end, environmentally friendly displays. To encourage impulsive purchases, brands give priority to formats that are recyclable, modular, and aesthetically pleasing. Strict environmental regulations push innovation in eco design and digital printing, making Europe a leader in sustainable retail merchandising.

Germany's POP packaging market focuses on eco-friendly, durable, and cost-efficient solutions because of discount retail formats and stringent sustainability standards. Businesses invest in corrugated and digitally printed displays that are optimized for logistics and shelf space, reflecting the nation's penchant for practical and simple designs.

The POP packaging market in MEA is growing with increasing FMCG consumption and retail modernization, particularly in supermarkets and shopping centers. To increase their visibility in price-sensitive markets, brands employ lightweight, reasonably priced promotional displays. As regulations improve, these displays gradually shift toward sustainability.

The UAE market is fast-growing, shaped by a premium retail environment and high brand competition. To draw tourist and wealthy customers, POP packaging places a strong emphasis on eye-catching, visually striking displays in shopping centers and airports. Although interest in recyclable materials is growing, customization and aesthetics continue to be major motivators.

By Product / Display Type

By Material

By End-Use / Industry

By Retail Format / Channel

By Region

February 2026

February 2026

February 2026

February 2026