Latin America Flexible Packaging Market Trends, Growth and Market Size Analysis

The Latin America flexible packaging market is projected to grow from USD 10.77 billion in 2026 to USD 14.72 billion by 2035, expanding at a CAGR of 3.53% during 2026–2035. The report provides detailed insights into market size, segment data by material, product type, and end-use industries, along with regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It also covers competitive landscape, key company profiles, manufacturer and supplier data, trade statistics, and value chain analysis. Rising e-commerce activities, especially in Brazil, growing number of working women, and demand for convenient and portable packaging solutions are driving market growth, along with increasing adoption of recyclable and compostable packaging due to government regulations and consumer preference.

Major Key Insights of the Latin America Flexible Packaging Market:

- In terms of revenue, the market is valued at USD 10.77 billion in 2026.

- The market is projected to reach USD 14.72 billion by 2035.

- Rapid growth at a CAGR of 3.53% will be observed in the period between 2026 to 2035.

- By product type, the printed rollstock segment contributed the biggest market share in 2024.

- By product type, the preformed bags and pouches segment will be expanding at a significant CAGR in between 2026 to 2035.

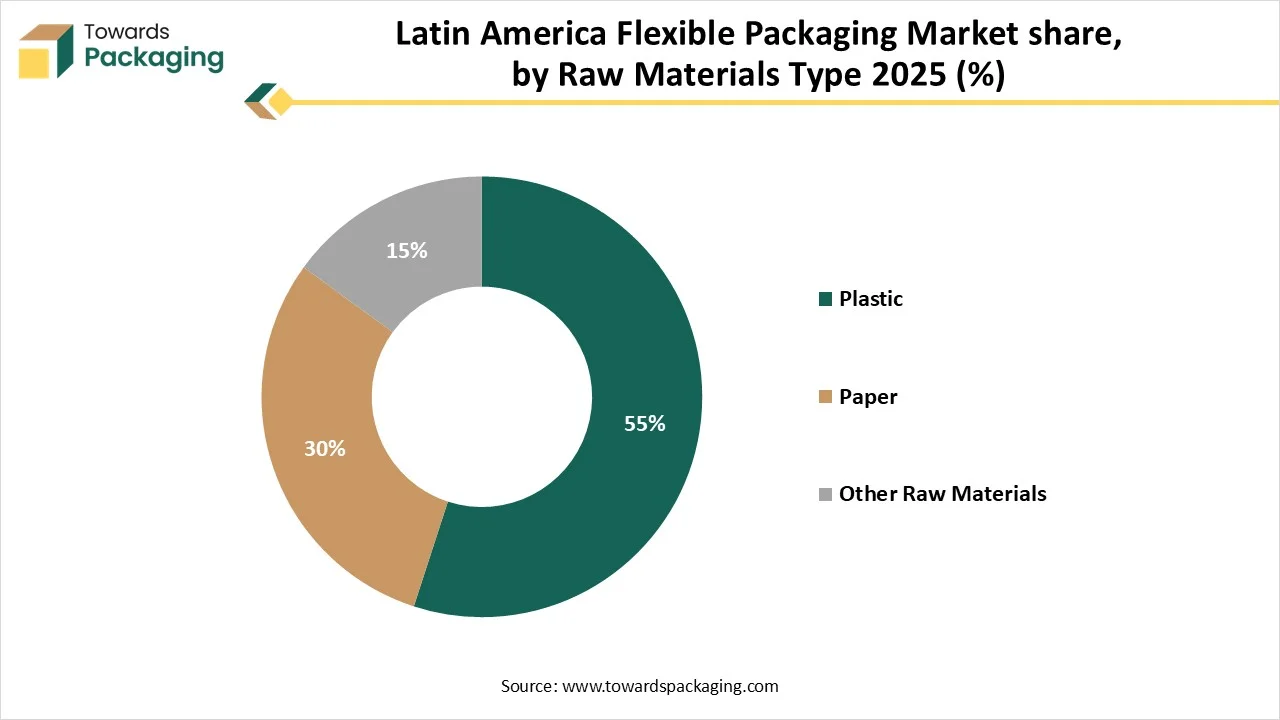

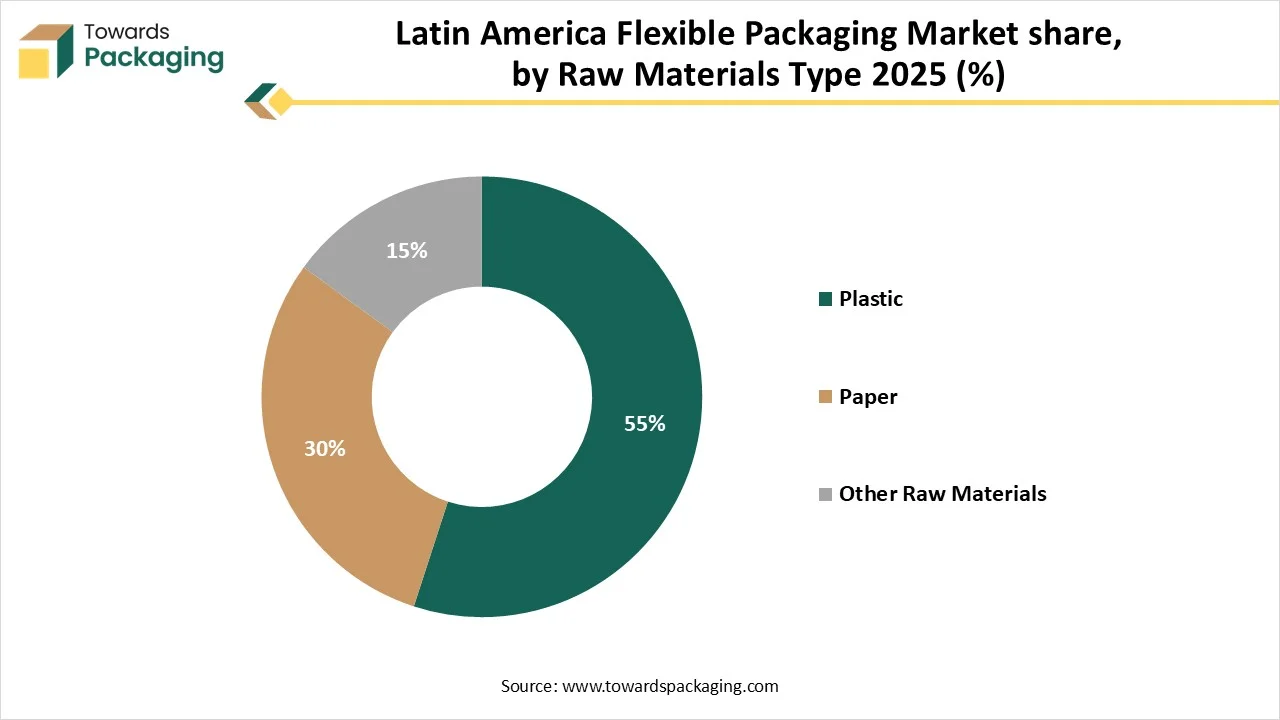

- By raw materials, the plastic segment contributed the biggest market share in 2024.

- By raw materials, the paper segment will be expanding at a significant CAGR in between 2026 to 2035.

- By printing technology, the flexography printing segment contributed the biggest market share in 2024.

- By printing technology, the digital printing segment will be expanding at a significant CAGR in between 2026 to 2035.

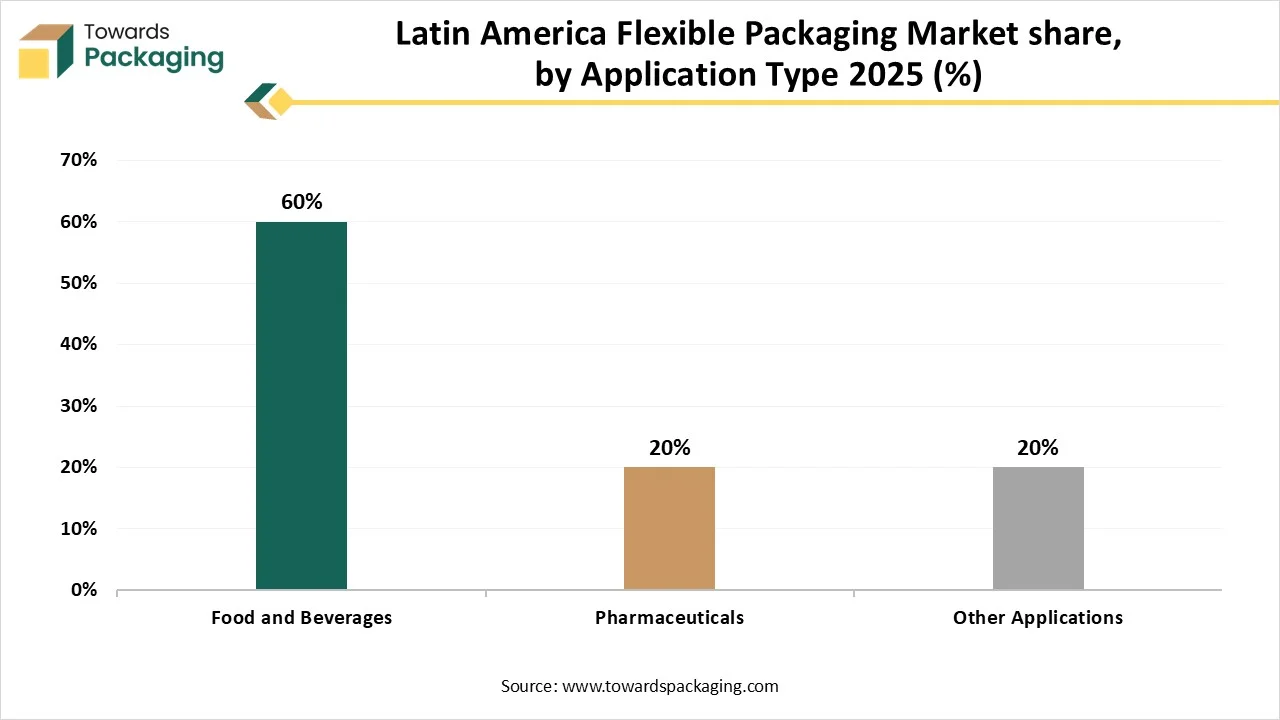

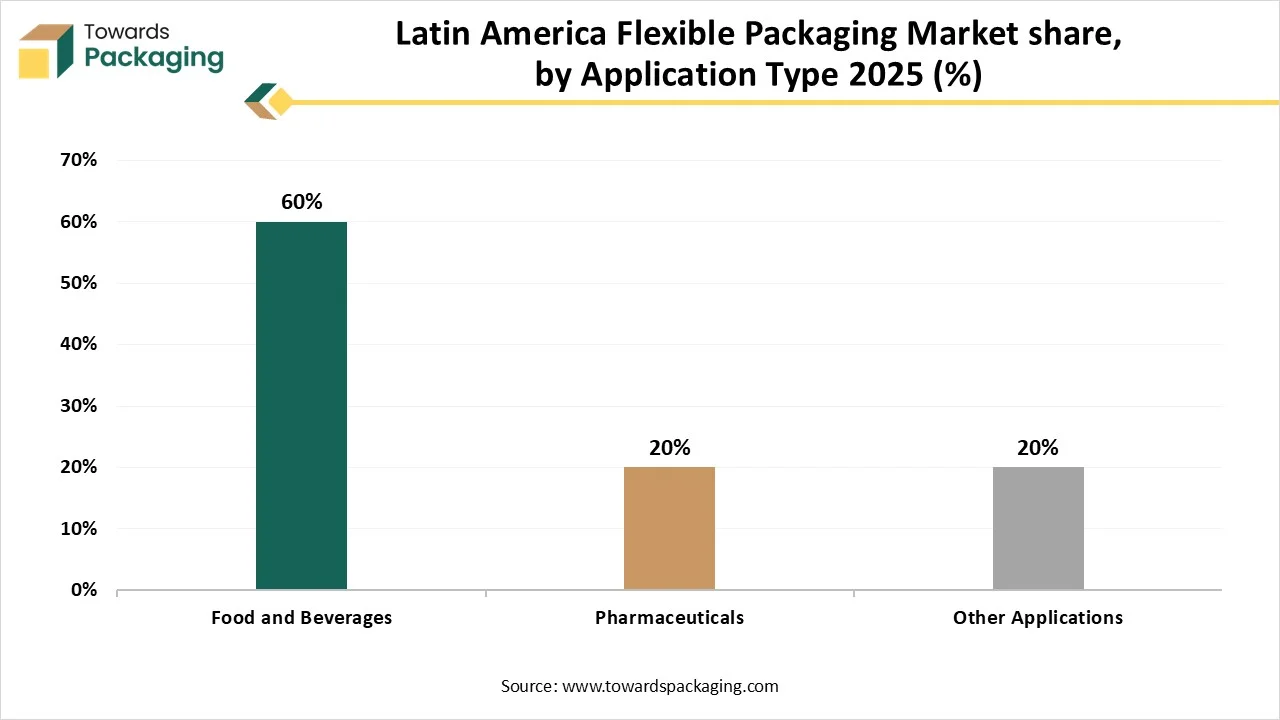

- By application, the food and beverages segment contributed the biggest market share in 2024.

- By application, the pharmaceuticals segment will be expanding at a significant CAGR in between 2026 to 2035.

What are Latin America Flexible Packaging?

Latin America flexible packaging refers to a market which is widely known for bendable packaging resources, such as wraps, pouches, and bags, manufactured from resources such as paper, plastics, and films. It is influenced by customer demand for sustainability and convenience, e-commerce development, and efficacy in sectors such as personal care, food & beverages. Major trends comprise the growing usage of environment-friendly and recyclable choices, like kraft paper and bioplastics, and the growth of "smart packaging" with services like freshness pointers.

Latin America Flexible Packaging Market Trends

- Market Growth Overview: Latin America flexible packaging market is expanding due to growing demand for sustainable packaging solution, convenient, and longer shelf life. The increasing number of working women enhanced the demand for convenient, consumer-friendly packaging choices are key drivers.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing rising demand for sustainable and convenient packaging, growing e-commerce industry, and enhancing technological advancement.

- Major Market Players: Latin America flexible packaging market includes Amcor Plc, Sealed Air Corporation, Sonoco Products Company, Berry Global Inc. and many other.

- Startup Ecosystem: The startup industries play an important role in developing convenient & extend shelf life, sustainable, durable and eco-friendly packaging.

Major Transformation in Technology of the Latin America Flexible Packaging Market

Technological transformation in the market plays a significant role in its expansion. Rising customer demand for environment-friendly choices such as recyclable films and bioplastics, the requirement to confirm food security through traceability, and the boost for cost-efficiency and higher presentation from inventions as multilayer films. Continuous innovation in the packaging process with integration of technology such as QR codes and several others.

Trade Analysis of Latin America Flexible Packaging Market: Import & Export Statistics

- Mexico: It is estimated that Mexico has huge exporter of flexible packaging material in Latin America with 5,332 shipments.

- Brazil: Approximate value of export of flexible packaging material is 2,645 shipments.

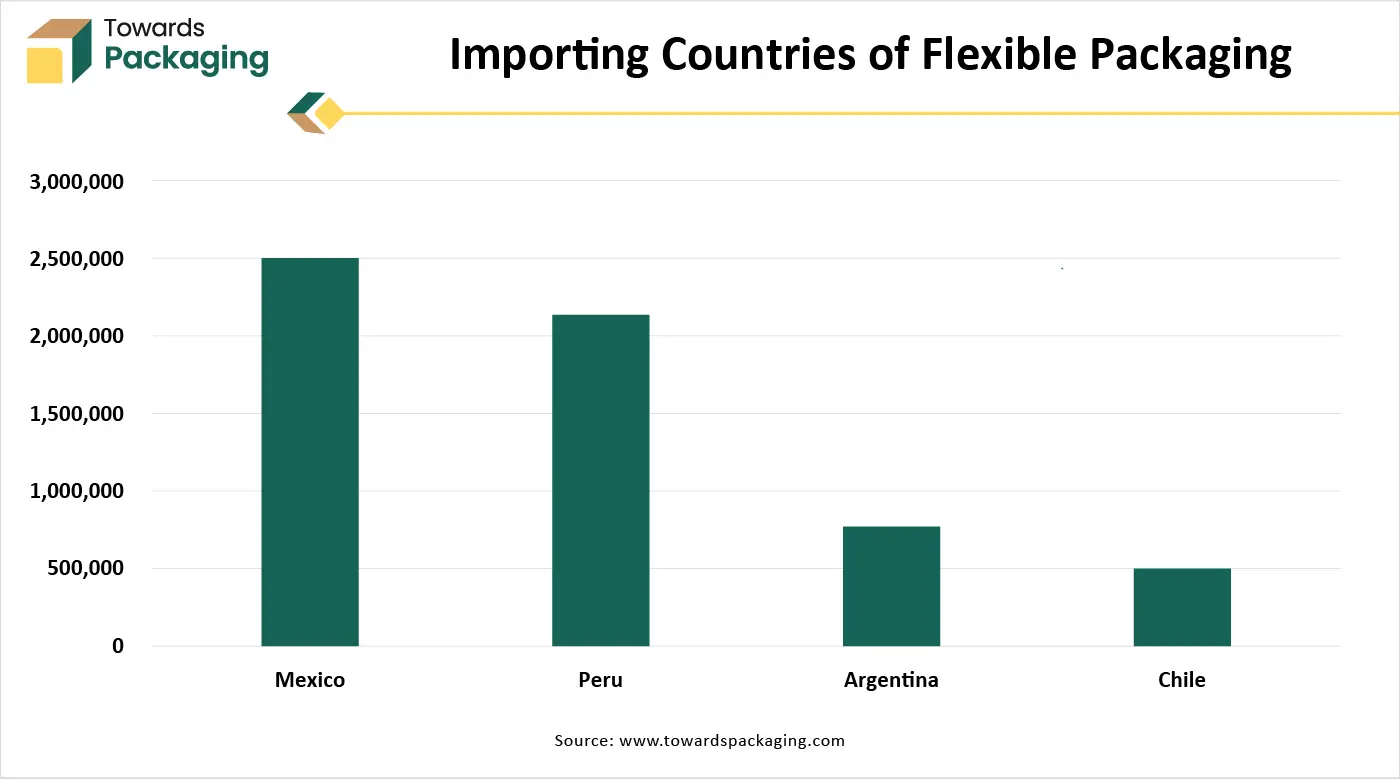

- Importers of Latin America Flexible Packaging Market

Latin America Flexible Packaging Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are plastic, paper, and foil.

- Key Players: Amcor Plc, Mondi Group

Component Manufacturing

The component manufacturing in this market comprises aluminum foil, polyethylene (PE), and polypropylene (PP).

- Key Players: Vitopel do Brasil Ltd, Sonoco Products Company

Logistics and Distribution

This segment is growing focus on the development of e-commerce, demand for convenience, and the change towards more sustainable.

- Key Players: Oben Holding Group, Transcontinental Inc.

Product Type Insights

| Product Type Segment | Market Share 2025 (%) |

| Printed Rollstock | 45% |

| Preformed Bags and Pouches | 30% |

| Other Product Types | 25% |

Why Printed Rollstock Segment Dominated the Latin America Flexible Packaging Market In 2024?

The printed rollstock segment dominated the market with highest share in 2024 due to increasing demand for sustainable packaging and technological advancement. Progressions in printing skills, particularly digital printing, are allowing more personalization. There is a trend for utilizing more sustainable resources, like paper and bio-plastics, and producing more recyclable packing options. This comprises the acceptance of environment-friendly resources like compostable and recyclable films are driving the market by applying stricter ecological guidelines.

The preformed bags and pouches segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its cost-effectiveness and convenience. The rapid extension of e-commerce sector in Latin America is growing the demand for packing options that are efficient, durable, and lightweight for transportation, all features that bags and pouches offer. The emphasis on decreasing plastic waste has resulted in the growth and acceptance of biodegradable and recyclable resources in bags and pouches packaging, positioning with rising consumer ecological concern and government guidelines.

Raw Material Type Insights

Why Plastic Segment Dominated the Latin America Flexible Packaging Market In 2024?

The plastic segment dominated the market with highest share in 2024 due to its durability, versatility, and cost-effectiveness. This segment is influenced by growing e-commerce, demand for advanced packaging, and rising emphasis on sustainability, mainly through bioplastic and recyclable choices. The growing e-commerce industry, amplified demand for cost-operative and advanced packaging in the personal care, food and beverage trades, and the growth of global exports of packed products. This material is dominating due to its impact and chemical resistance, lightweight property, and moisture absorbing properties.

The paper segment expects the fastest growth in the market during the forecast period. This segment is growing due to increasing demand for environment-friendly and sustainable packaging. Increasing customer apprehension for the ecological influence of packing and a common change towards environment-friendly options is a major driver. The rising urbanization in Latin America enhanced the demand for convenient packaging. Companies are emerging new paper-based options to enhance functionality and performance, focusing to strive with plastic packaging.

The aluminum foil segment expects the significant growth in the market, as it comprises superior barrier properties, sustainability effort, packaging trend, and expanded e-commerce sector. It offers a superior barrier to microbes, light, oxygen, and moisture, which is important for preserving goods freshness and prolonged shelf life. The extension of online shopping rises the necessity for strong packaging which can shield products at the time of shipping, a necessity that aluminum foil supports to fulfil. The growth of sustainable, recyclable aluminum foil packing resolutions is also supporting to influence adoption.

Printing Technology Type Insights

| Printing Technology Segments | Market Share 2025 (%) |

| Flexography Printing | 50% |

| Digital Printing | 35% |

| Other Printing Technologies | 15% |

Why Flexography Segment Dominated the Latin America Flexible Packaging Market In 2024?

The flexography segment dominated the market with highest share in 2024 due to evolving consumer preferences, economic factors, and cost-efficiency. Continuous rising demand for consumer packed products, beverages, and food items is a primary growth factor. It is favoured for its efficiency and affordability in comparison to old-style rigid packaging. Companies are capitalizing in options to fulfil increasing demand for environment-friendly packaging, like biodegradable resources and goods made with recycled material. Growing investments in packing infrastructure are anticipated to boost the research and development in this segment.

The digital segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its durability and lightweight nature. The growing popularity of e-commerce sector is a primary factor for the growth of this segment. It is planned to enhance supply chain efficacy for online retail requirements. It permits for more flexible and modified packaging, comprising branding and designing facilities. These technologies offer advantages such as improved traceability, freshness observing, and direct customer engagement.

The rotogravure segment expects the significant growth in the market, as it comprises high-value and high-quality printing for personal care as well as food brands. It is growing rapidly due to its capability to generate consistent and vibrant printed packaging. Its complex pattern at high speeds has made it suitable for brands emphasized on visual appearance and luxurious packaging choices. This technology provides excellent color reproduction which can manage complex patterns that is making it an ideal option for brands focusing to improve their visual branding.

Application Type Insights

Why Food and Beverages Segment Dominated the Latin America Flexible Packaging Market In 2024?

The food and beverages segment dominated the market with highest share in 2024 due to its versatility, convenience, and longer shelf life. It is widely accepted for goods like ready-to-consume food items and snacks as it spreads shelf life and provides suitability for customers on the go. The rising e-commerce industry, comprising online food shipping, is making a solid demand for flexible packaging of products, which are preferred for delivery and transport. It is utilized for an extensive variety of products, from frozen foods to snacks. There is a noteworthy push in the direction of more sustainable choices, with corporations discovering and integrating recycled resources to decrease ecological impact.

The pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing healthcare requirements and regulatory standards. Rapid shift towards flexible packaging is influenced by the necessity for shelf-life extension and convenience. Increasing focus on green and recyclable resources because of enhanced consumer consciousness and ecological regulations.

The cosmetics segment expects the significant growth in the market, as it comprises premiumization and sustainability. Rising e-commerce sector and increasing consumer consciousness of sustainable packing are noteworthy influencers, boosting brands toward environment-friendly flexible choices. There is a developing trend for premiumization of the luxury cosmetic products, which drives packaging pattern and material selections, with plastic offering a premium appearance and paper-based choices boosting their luxury appearance through finishes.

Country Insights

How Argentina is Dominating in the Latin America Flexible Packaging Market?

Argentina held the largest share in the Latin America flexible packaging market in 2024, due to government initiatives, consumer behaviour, and strong domestic industry. Customers are progressively discriminating and are influencing the demand for sustainable substitutes, like mono-material packaging and films which are manufactured from recycled content. Rise in demand of consumers is boosting companies to search for resource-effectual and strong packaging resolutions to control charges. Companies are capitalizing in new technologies to fulfil developing customers and regulatory requirements, such as progressive printing technologies and sustainable resources.

Why Latin America Flexible Packaging Market is Growing Rapidly in Brazil?

Rising e-commerce industry and increasing focus towards sustainability has enhanced the demand for the market. The rapid development of online shopping has generated a robust necessity for effectual and durable transport and delivery packaging, like flexible mailer bags. The industry is being influenced by demand for sustainable packing choices, comprising those manufactured with bio-based plastics and recycled content. Companies are answering with funding in new technologies and resources to fulfil both customer and supervisory expectations.

Which Factor is Responsible for Notable Growth of Latin America Flexible Packaging Market in Mexico?

The major factors influencing the growth of market are increasing food & beverages industry, expanding e-commerce industry, portability and convenience, and expanding pharmaceutical industry. The industry is majorly supported by wider consumer trends favouring sustainability and convenience. The growing demand for ready-to-consume food, processed, and snacked, influenced by busy consumer lifestyles and urbanization, has boosted the necessity for packaging options that provide extended shelf life and convenience. It helps decrease shipping charges and enhance logistics and storing space in comparison with heavier, rigid substitutes.

Recent Development

- In April 2025, Dole Food Company announced the launch of Oxifilm® which is recyclable stretch films expanded for commercial usage. It is an innovative macro-perforated and completely recyclable film which is developed across banana and pineapple operations. It is a substitute for clamps, straps, and corner boards.

- In October 2025, Amcor announced operational readiness and installation of a Machine Direction Orientation (MDO) line at its services in Peru. It is an efficient and sustainable option developed.

Top Companies in the Latin America Flexible Packaging

- Amcor Plc.: It is a major worldwide packaging company with a noteworthy presence in the region.

- Mondi Plc.: It is main worldwide player active in the Latin American market.

- Sealed Air Corporation: It is a large multinational corporation with operations in the region.

- Berry Global Inc.: It is a worldwide manufacturer of plastic packaging and non-woven products.

- Sonoco Products Company: It is a worldwide supplier of industrial and consumer packaging products.

- Others: Berry Global, Sonoco Products Company, Coveris, Tetra Pak, ALPLA Group, Videplast, and Zubex.

Latin America Flexible Packaging Market Segments Covered

By Product Types

- Printed Rollstock

- Preformed Bags and Pouches

- Others

By Raw Materials

- Plastic

- Paper

- Aluminium Foil

- Cellulose

By Printing Technologies

- Flexography

- Rotogravure

- Digital

- Others

By Applications

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

Tags

FAQ's

Select User License to Buy

Figures (4)