Global Lubricant Containers Market Growth, Sustainability Trends, and Regional Breakdown

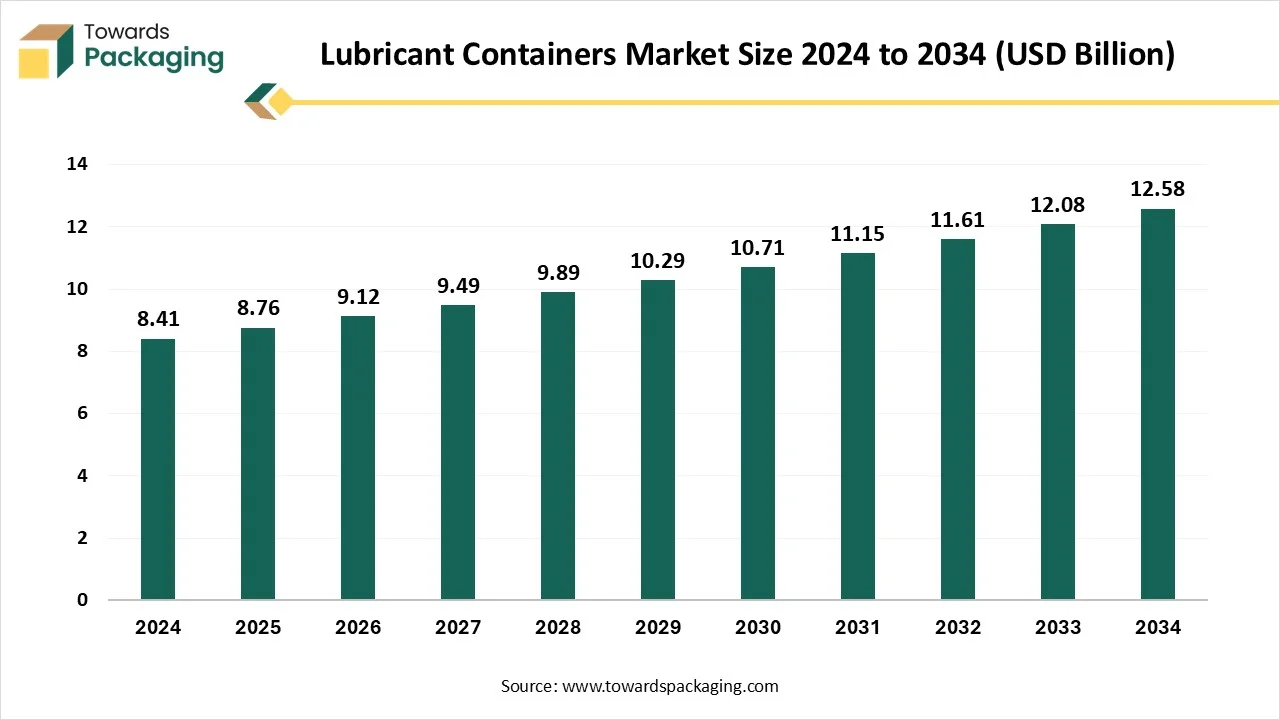

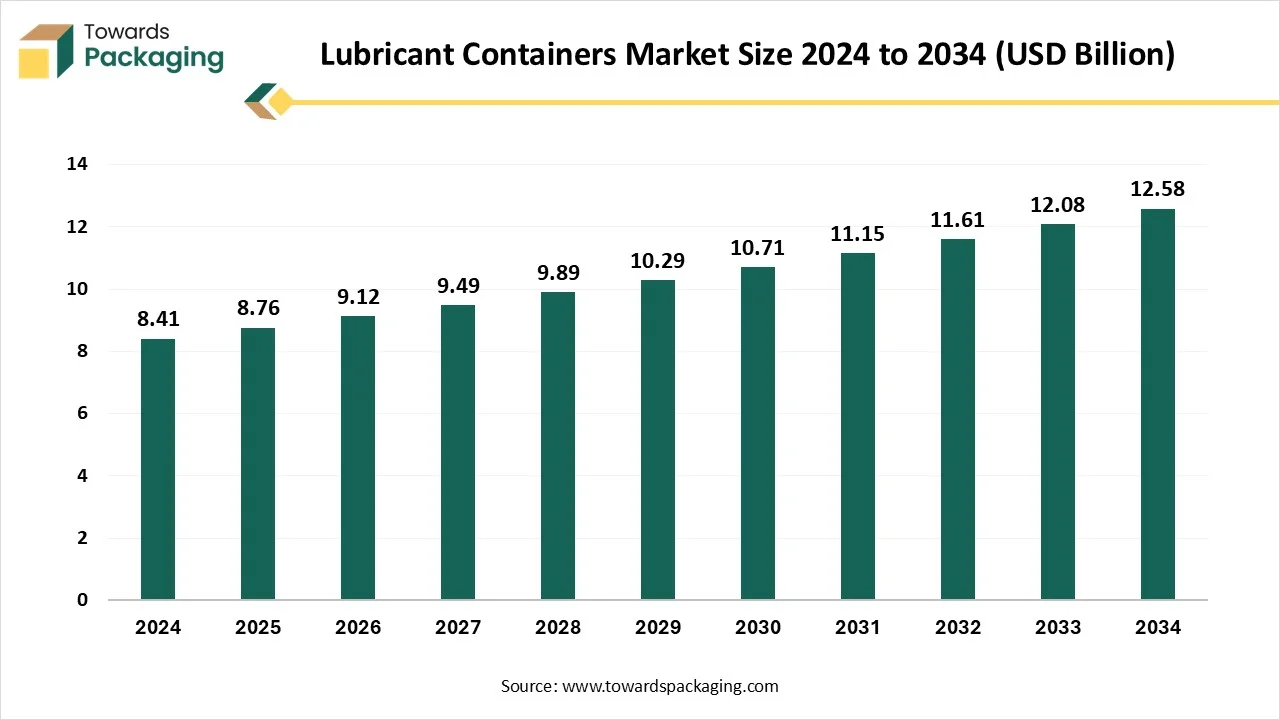

The lubricant containers market is poised for significant growth, with a projected market size of USD 8.76 billion in 2025, reaching USD 12.58 billion by 2034. This market is expanding at a CAGR of 4.12% from 2025 to 2034. Key segments include plastic, metal, and glass containers, with plastic containers dominating in 2024. The automotive sector leads as the top end-user industry, while the growing adoption of online distribution channels is expected to drive future growth. The Asia Pacific region held the highest market share in 2024, and both North America and Europe are forecast to witness the highest growth rates. Competitive players like Amcor Limited, Sonoco Products Company, and Berry Global Inc. are actively driving innovation in the market.

Key Takeaways

- In terms of revenue, the market is valued at USD 8.76 billion in 2025.

- The market is projected to reach USD 12.58 billion by 2034.

- Rapid growth at a CAGR of 4.12%% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the market with the highest share in 2024.

- North America and Europe are expected to witness the highest CAGR during the forecast period.

- By material type, in 2024, the plastic containers segment accounted for the dominating revenue share in the market.

- By material type, the metal containers segment is expected to grow rapidly over the forecast period.

- By container type, the bottles segment dominated the market in 2024.

- By container type, the can segment will grow at the fastest CAGR.

- By capacity, the less than 1 liter segment held the largest revenue share in the market.

- By end-use industry, the automotive sector accounted for the highest revenue share in 2024.

- By end-use industry, the industrial sector is expected to grow rapidly over the forecast period.

- By distribution channel, the offline channels segment led the global market in 2024.

- By distribution channel, the online channels segment will grow at the fastest CAGR.

Market Overview

Lubricant containers typically refer to the packaging in which lubricants, like grease and oil, are properly stored and transported. They are usually made of materials such as high-density polyethylene (HDPE) or polypropylene. It comes in various shapes, designs, and sizes, which often range in capacities from 1 quart to 5 gallons. Lubricant containers are specifically designed to protect the lubricant from contamination and maintain its quality. These containers are accessible with robust, leak-proof, and liner-less caps.(Source:Energy Statistics and Analysis)

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 8.41 Billion |

| Projected Market Size in 2034 |

USD 12.58 Billion |

| CAGR (2025 - 2034) |

4.12% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type, By Container Type, By Capacity, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players |

Amcor Limited, Sonoco Products Company, Mauser Group B.V., Balmer Lawrie & Co. Ltd., Berry Global Inc., RPC Group Plc |

What are the Trends in the Lubricant Containers Market?

- The increasing demand for eco-friendly and biodegradable packaging solutions is anticipated to boost the growth of the market.

- The rising consumer preference for easy-to-handle packaging options significantly fuels the market’s revenue in the coming years.

- The rapid technological innovations in container material and design to improving efficiency and sustainability, contributing to the overall growth of the market.

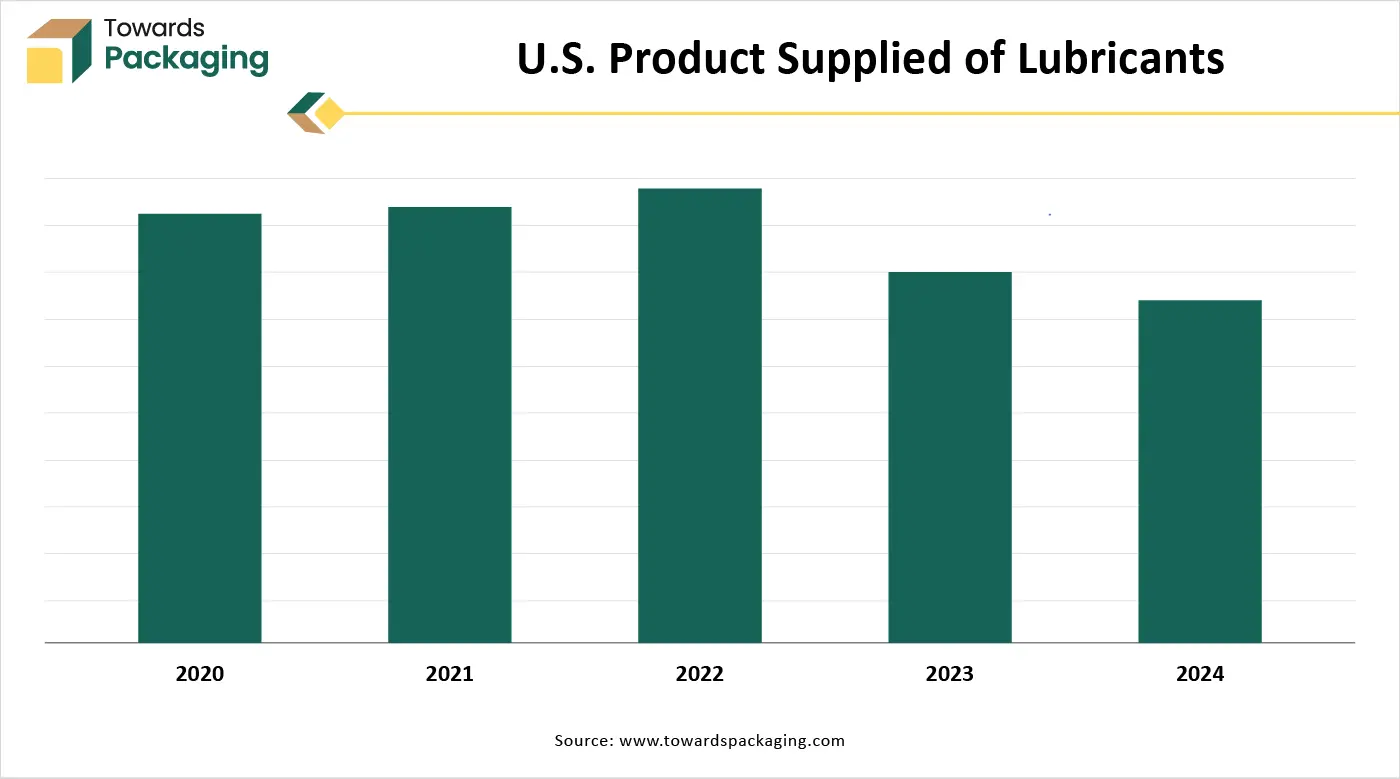

- The rising production capacity of lubricants is needed to meet the rising demand in emerging markets, driving the market’s expansion.

- The presence of stringent regulations in various countries for reducing plastic waste has significantly increased the innovation in container designs, supporting the growth of the lubricant containers market during the forecast period.

How is AI Integration Impacting the Lubricants Industry?

- In recent years, AI and IoT have become increasingly crucial components of the lubricant ecosystem. The major applications of IoT and AI in the lubricants industry include predictive maintenance, real-time quality assurance, energy optimization, customer engagement platforms, and sustainability monitoring. The adoption of these technologies is reshaping how lubricants are developed, manufactured, and distributed, while ensuring high quality, greater efficiency, and improved sustainability. AI-driven analytics platforms assist lubricant manufacturers and users in processing large amounts of data to predict potential failures, identify patterns, and optimize processes, which leads to reduced downtime and significantly increases operational efficiency.

Market Dynamics

Driver

Growing demand for spill-proof packaging solutions

The increasing spill-proof packaging solutions are expected to boost the growth of the lubricant containers market. Lubricant containers offer spill-proof packaging solutions, and these containers play a crucial role in the safe storage and transportation, ensuring the product's integrity and performance. Moreover, the rising focus on vehicle maintenance along with the increasing popularity of synthetic lubricants is expected to spur the demand for specialized containers that assist in preserving the efficacy and quality of these advanced formulations. Thus, driving the market’s revenue in the coming years.

Restraint

Fluctuation in raw materials

The fluctuation in raw material costs is anticipated to hamper the market's growth. The price volatility of materials, such as plastics resins like HDPE and PP, can lead to increased container manufacturing costs. This often impacts the profitability of manufacturers involved in the lubricant containers. Such factors are restricting the growth of the lubricant container market during the forecast period.

Opportunity

Increasing focus on eco-friendly materials and sustainable packaging solutions

The growing focus on eco-friendly materials and sustainable packaging solutions is projected to offer lucrative growth opportunities to the lubricant containers market. Biodegradable packaging and rapid innovations in container design create significant opportunities for companies to capitalize on eco-friendly and sustainable packaging trends. In addition, the rising pressures from regulatory bodies are pushing for more eco-friendly packaging solutions, which include biodegradable plastics, recycled materials, and innovative packaging designs that minimize waste. Therefore, the shift towards sustainable packaging offers significant present opportunities for key players to enter the market with groundbreaking solutions.

Segmental Insights

By Material Type

The plastic containers segment accounted for the dominating share in the lubricant containers market in 2024, owing to its low cost, versatility, and lightweight. These containers are extensively adopted in several industries, such as automotive, manufacturing, industrial, and others, due to their ability to withstand harsh environmental conditions. However, rising regulatory pressures and increasing environmental concerns are expected to accelerate the growth of sustainable alternatives, leading to the development of recyclable and biodegradable plastic materials.

On the other hand, the metal containers segment accounted for the considerable growth in the global market over the forecast period, fuelled by the rising focus on recyclability and durability. These containers are widely used in the industrial and automotive sectors for storing and transporting high-performance lubricants. Moreover, the increasing focus on sustainability and the circular economy is expected to propel the demand for metal containers, as metal lubricant containers can easily be reused and recycled.

By Container Type

The bottles dominated the lubricant containers market in 2024, owing to the increasing use of bottles in the industrial and automotive sectors for packaging small to medium volumes of lubricants. Bottles are the most widely used of lubricant container types, and their ability to protect against external factors, gaining popularity for industrial and consumer applications.

On the other hand, the cans segment is expected to grow at a notable rate. Cans are widely used in the automotive and marine sectors owing to their superior protection against contamination and are ideal for storing and transporting high-performance lubricants. Cans are available in various shapes, sizes, and designs, providing manufacturers with significant opportunities for customization. In addition, cans are increasingly gaining popularity owing to their recyclability, durability, and ability to withstand severe climatic conditions.

By Capacity

The less than 1-liter segment dominated the market share in 2024. These lubricant containers are widely utilized for the packaging of various small volumes of lubricants, gaining immense popularity for consumer applications. On the other hand, the 1 to 5 liters is expected to sustain its position throughout the forecast period, owing to the increasing usage of these containers in the automotive and industrial sectors, mainly for packaging medium volumes of lubricants.

By End-Use Industry

The automotive sector segment accounted for the highest growth rate in the lubricant containers market, owing to the rising demand for lubricant containers in the automotive sector. The rising focus on vehicle maintenance, along with the increasing popularity of synthetic lubricants, is expected to accelerate the segment’s growth in the coming years. In addition, the rising adoption of Electric Vehicles (EVs) is likely to spur the demand for lubricant containers.

On the other hand, the industrial sector is expected to grow at a significant CAGR in the lubricant containers market, owing to the growing focus on sustainability and the rising expansion of the manufacturing and energy industries. Moreover, the rising shift towards the adoption of advanced machinery across various industries is anticipated to increase the demand for lubricant containers during the forecast period.

By Distribution Channel

The offline channels segment held the largest share of the satellite data services market. Offline channels generally include retail stores, wholesalers, and distributors. The rising convenience of purchasing products in person is anticipated to accelerate the segment’s growth. In addition, the robust presence of established distribution networks in several countries around the world and the rising focus on customer service are expected to propel the demand for lubricant containers through offline channels.

On the other hand, the online segment is expected to witness remarkable growth during the forecast period, owing to the increasing popularity of e-commerce, and digitalization is likely to encourage manufacturers to explore various online distribution strategies. The growth of the segment is mainly driven by the rising demand for lubricant containers through online channels and the increasing availability of a wide range of products.

Regional Insights

Which Region is Dominating the Lubricant Containers Market?

Asia Pacific led the lubricant containers market with the highest share in 2024. In the region, Countries such as China, India, South Korea, and Japan are the major contributors to the market, owing to the rapid expansion of the automotive and industrial sectors The region's rapid growth is attributed to the rising infrastructure development, favorable government policies, rising disposable incomes, and robust presence of key lubricant manufacturers and suppliers.

The surging demand for eco-friendly materials and sustainable packaging solutions is expected to boost the regional growth of the lubricant containers market as industries are increasingly prioritizing environmentally responsible practices. Moreover, the rapid technological advancements in production processes, including AI-powered quality control and automation, are enhancing cost-efficiency and sustainability. The increasing integration of biodegradable materials focuses on addressing rising environmental concerns while meeting regulatory requirements.

North America and Europe are expected to witness the highest CAGR during the forecast period, owing to the rising expansion of the automotive and industrial sectors, which has led to the rising demand for lubricants and which in turn fuels the growth of the lubricant containers market. The growing focus on innovation and sustainability, increasing adoption of smart packaging solutions such as RFID-enabled tracking and QR-code authentication, and rising consumer preferences for sustainable packaging. The market is experiencing increasing adoption of advanced packaging solutions in the regions to meet the rising demand for lubricants.

- In March 2024, in the European lubricants industry, two key players have joined forces to design a new can cap using recycled material. TotalEnergies and Bericap announced the launch of a cap for 20-liter lubricant containers. It contains 50% post-consumer recycled plastic (PCR), in compliance with DIN 60 standard for lubricants.

Lubricant Containers Market Key Players

Latest Announcements by Market Leaders

- In August 2024, Kixx, Korea’s No.1 lubricant brand, announced its plan to incorporate recycled plastic into a wide range of its product containers, utilizing Mechanical Recycling (MR) processes to reduce the amount of plastic consumed at the production stage. Kixx is set to launch small lubricant containers incorporating 20% mechanically recycled plastic.

Recent Development

- In March 2024, Repsol launched its new lubricant containers, incorporating 60% mechanically recycled post-consumer plastic. The new compound, part of the Repsol Reciclex range of sustainable polyolefins, will be used in all 1L, 4L, and 5L lubricant containers and available in five colours for the different product ranges, including engine and transmission oils for cars, motorcycles, and heavy vehicles.

- In August 2022, the National Lubricant Container Recycling Coalition (NLCRC) announced the launch of a collaborative recycling pilot program that focuses on consumer plastic packaging for engine oil and other petroleum-based products. The recycling pilot is a one-year project involving over 40 locations in Atlanta, including retail stores and auto care centres, instant oil change locations, and several commercial facilities.

Lubricant Containers Market Segments

By Material Type

By Container Type

- Bottles

- Cans

- Drums

- Pails

- Tubes

By Capacity

- Less than 1 Liter

- 1 to 5 Liters

- 5 to 20 Liters

- Above 20 Liters

By End-Use Industry

- Automotive

- Industrial

- Marine

- Aviation

- Construction

By Distribution Channel

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)