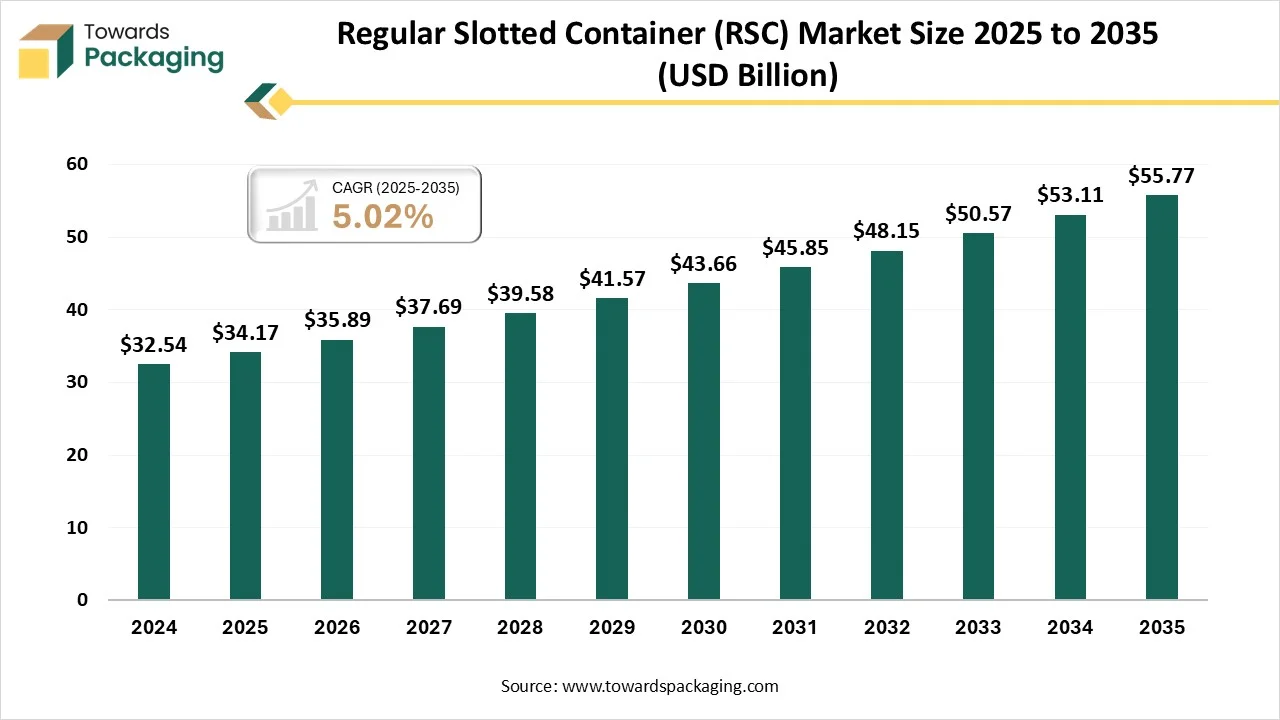

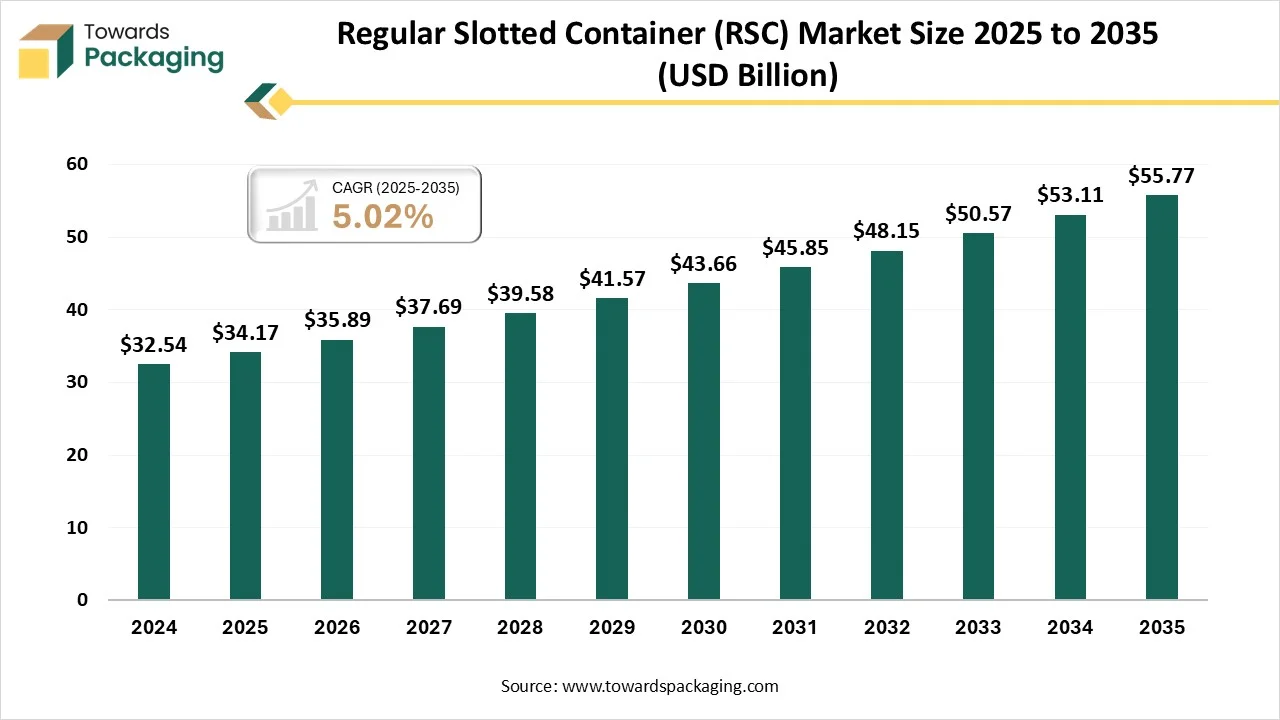

The regular slotted container (RSC) market is forecast to grow from USD 35.89 billion in 2026 to USD 55.77 billion by 2035, driven by a CAGR of 5.02% from 2026 to 2035. The increasing popularity of efficient, cost-effective packaging has driven demand for these containers. It is utilized across several applications, including storage, shipping, and industrial packaging. It can be used for a variety of requirements and goods, from small, stackable products to weightier ones. It is used for a wide range of goods and applications, particularly in e-commerce and logistics.

Regular slotted containers (RSC) continue to gain strong market traction because they offer high efficiency, versatility and cost-effectiveness for transport and storage across sectors such as food, beverages, electronics and consumer goods. Their simple yet durable structure supports safe stacking, easy palletisation and reliable protection during long supply-chain movements. RSC boxes are manufactured from a single continuous sheet of material, cut and scored to create four flaps that meet neatly at the centre when closed. This design reduces material waste, simplifies production and enables rapid, high-volume manufacturing on standard corrugation lines. As demand rises for lightweight, recyclable and economical packaging, RSC formats remain a core choice for industrial and commercial shipping needs.

Technological transformation in the regular slotted container (RSC) market is playing a major role in improving sustainability, automation and digitalization across packaging operations. Modern corrugation and converting lines are increasingly adopting advanced automated machinery for high-speed cutting, folding, creasing and gluing, along with automated case forming and sealing systems. These technologies support continuous, precise and high-volume production, which reduces reliance on manual labour and lowers operational costs. Automated systems also minimise defects by ensuring consistent scoring accuracy and flap alignment, resulting in fewer product losses and stronger structural integrity.

Digital monitoring tools and connected sensors are being integrated into production lines, helping manufacturers track quality parameters, optimise energy use and maintain better overall equipment efficiency. Through these advancements, the RSC market is achieving faster throughput, improved sustainability performance and greater manufacturing reliability.

Global exports of corrugated cartons and boxes exceeded USD 10 billion in recent reporting, indicating large annual cross-border flows of finished corrugated packaging. Leading exporters by value in 2023 include the United States (≈ USD 1.36 billion), China (≈ USD 1.36 billion), and Germany (≈ USD 1.33 billion), indicating a geographically diverse supplier base spanning large industrial economies and specialised converters.

Import demand concentrates in countries with large retail, manufacturing, and e-commerce sectors that rely on high volumes of protective transport packaging. The United States, large EU markets, Japan, and rising markets in Southeast Asia appear consistently among the largest importers of corrugated packing articles. In several developing markets, imports supplement limited domestic converting capacity.

India exported about USD 57.6 million of corrugated cartons and boxes in 2023, supplying a wide set of destination markets across Africa, the Middle East, and Europe. Export partner tables for India show a large number of small to mid-sized shipments, which is typical for contract packing and re-exports.

Shipment-tracker snapshots record very high shipment counts from regional exporters such as Vietnam and Mexico in recent tracker windows, reflecting their role as high-volume converters for neighbouring and global markets. China also remains a large volume shipper of corrugated formats to regional markets.

Trade includes finished RSC boxes, nested stackable trays, multi-compartment separators, and semi-finished slit rolls for local converting. Unit values vary widely: commodity unprinted RSCs have low per-unit values while white-top, printed or coated linerboard cases command premiums. Some customs logs and shipment portals show average export unit prices in low cents per unit for basic boxes, rising substantially for specialised printed or barrier-coated formats.

Regulatory pressure on packaging waste, recyclability requirements, and recycled-content targets in the EU and other jurisdictions is shifting buyer preference toward suppliers that can demonstrate recycled fibre content, recyclability, and lower carbon footprints. These sustainability requirements influence which exporters are selected for medium and long-term contracts.

The major raw materials utilized in this market are cellulose fiber, wooden pulp, adhesives ink, kraft paper and linerboard.

The component manufacturing in this market comprises corrugation, cutting and scoring, printing, folding and gluing.

This segment is growing focus on standardization and efficiency, stack ability and storage, protection, and versatility.

The regular slotted containers (RSC) segment dominated the regular slotted container (RSC) market with highest share in 2024 due to its cost-effectiveness. It’s simple, consistent pattern with equal length four flaps to decrease wastage of materials which is making it an inexpensive option for transportation and storing across several industries. This has generated it as the most predominant and extensively utilized corrugated box pattern for common-purpose packaging, mainly for e-commerce and transportation requirements. It offers convenience of mass manufacture, and versatility in an extensive variety of usages.

The half slotted containers (HSC) segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to its efficient design, cost-effectiveness, and versatility. It is the most widely used style for a wide range of applications, from e-commerce to industrial packaging. Its adaptability makes it suitable for a wide variety of products and sizes. Its design permits for easier admittance to contents, making them appropriate for applications connecting repeated utilization or managing.

The full overlap slotted containers (FOLC) are the fastest-growing in the regular slotted container (RSC) sector, as it comprises superior protection, strength, and enhanced stacking strength. It is experiencing rapid development and growing acceptance in exact applications because of their superior protective qualities. The extra width of the overlying flaps enhances to the box's loading strength and steadiness, avoiding failure under pressure throughout transportation or storage. It decreases or eradicates the requirement for non-sustainable interior shielding resources like packing peanuts or foam, restructuring packaging procedures and further improving sustainability.

The recycled paper segment dominated the regular slotted container (RSC) market with highest share in 2024 due to cost-effectiveness and material efficiency. The growing demand for cost-effective and sustainable packaging choices. The rising favored transversely the electronics, e-commerce, and food industries for their operational strength, versatility, and capability to fulfil brand and sustainability necessities. It frequently leads to lesser production charges, making this market more inexpensive choices, mainly for large-volume usages. It offers exceptional protection for goods throughout transportation and storage which is a main necessity for transport and logistics.

The virgin paper segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to sustainability, performance, and cost-effectiveness. It holds the highest share of this market and leads precisely within the slotted containers sector. Enhancement in recycling technology have raised the integrity and durability of virgin paper for packaging purpose. It is normally less expensive in comparison to virgin kraft linerboard.

The single-face board segment dominated the regular slotted container (RSC) industry, with the highest share in 2024, due to its strength and durability. It offers ideal stability, durability, and cost-efficiency across a wide range of goods, making it the preferred option for a variety of transport and storage applications. It contains of one fluted medium pasted to a flat linerboard. This conformation provides less shield and is commonly utilized for niche usages, like interior padding/packaging or as a factor in a seal procedure for high-value graphics.

The single wall board segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to its affordability, versatility, and lightweight nature. It offers exceptional defence for a wide-ranging of goods and is informal to accumulate and loaded. It is recyclable, positioning with ecological apprehensions and guidelines. It is widely accepted because of its cost-efficacy, convenience in mass manufacturing, and appropriateness for extensive utilization, exclusively in transport and e-commerce usage.

The double wall boards are the fastest-growing in the regular slotted container (RSC) sector, as it comprise versatility and a protective nature. Their simple, standard pattern makes them convenient to assemble and load, and they are completely well-matched with automated packing lines. These are appropriate for an extensive variety of usages, from retail packing to storing and transport which is making them an option across several industries. It offers more resistance, insulation, and protection, making it perfect for weightier and fragile products.

The e-commerce segment dominated the regular slotted container (RSC) sector with highest share in 2024 due to its compatibility, cost-effectiveness, and durability. Their design offers a proper balance of strength, resource efficacy, and versatility for transport an extensive variety of items, from apparel to electronics. Their shapes make them suitable with automated packing, picking, and sorting structures in huge e-commerce fulfilment centres, which is an important operational benefit for several online retailers.

The food & beverages segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to its sustainability and cost-effectiveness. It offers exceptional durability and strength, which are important for protecting products during transportation, storage, and management. This is mainly necessary for fragile products, processed foods & beverages, to support maintaining product quality and security, and to ensure shelf life.

Personal care & cosmetics are the fastest-growing segment in the regular slotted container (RSC) market, driven by product protection and sustainability trends. It offers superior cushioning, strength, and durability natures to decrease product damage. Rising sustainability aims, creating them an appealing substitute to out-dated plastic packaging. The increasing disposable earning has fuelled the demand for consistent packing solutions.

North America held the largest share in the regular slotted container (RSC) market in 2024, due to presence of strong e-commerce sector. The increasing demand for efficient packaging among consumers fuelled the development in this sector. These containers help in safe transportation of products which enhance its demand exponentially. Its high-strength resources to enhance logistics efficacy. Sustainability commands and recycling creativities are pushing invention in container pattern and production processes.

Rising demand for exceptional versatility and cost-effectiveness has progressed the demand for regular slotted container (RSC) in the U.S. They are manufactured in several shapes, sizes and strengths to lodge an extensive variety of goods, from heavy to lightweight products which makes them an adjustable solution for several requirements. The rapid extension of online retail sector in the U.S. has meaningfully amplified the demand for consistent, defensive packaging. Ecological considerations are a major factor, with traders and customers increasingly demanding environmentally friendly choices.

Rapid upsurge of e-commerce sector has raised the demand for the regular slotted container (RSC) market. E-commerce needs reliable, protective, and lightweight packaging for safe and effective customer delivery. This packaging is the go-to solution because of their durability, stack ability, and capacity to shield goods during transportation. Constant increasingly strict ecological laws and a robust push in the direction of a circular economy, inspiring the utilization of biodegradable and recyclable materials.

Enhanced versatility and cost-effectiveness have boosted the development process in the UK regular slotted container (RSC) industry. Customers also progressively prefer environment-friendly packaging, positioning with corporate sustainability aims. It confirms efficient resource utilization, reducing waste generation, and providing a cost-operative solution for an extensive variety of products across several industries, comprising pharmaceuticals, electronics, food & beverage, and consumer goods. The expansion of the food distribution, subscription box, and logistics sectors is driving consistent demand for durable and reliable packaging solutions.

The major factors influencing the growth of regular slotted container (RSC) market are upsurge of e-commerce sector, rapid urbanization and industrialization, cost-effectiveness, sustainable, and versatile packaging demand. Enhanced demand for strong, cost-effective, and ascendable packaging choices to confirm products are transported safely. Rising ecological consciousness among customers and stringent government guidelines on single-use plastics are driving businesses toward environmentally friendly packaging choices.

The rising demand for compatible, cost-effective, and versatility containers has fuelled the development of the regular slotted container (RSC) sector. The large-scale manufacturing of customer products, mainly in the food & beverage, retail, and electronics sectors, depend on the standardized, effectual, and durable properties of containers for transportation and storage. The growing focus on sustainability and government guidelines favor the utilization of containers manufactured from recyclable and recycled resources. These are durable, lightweight, and offer exceptional protection for a wide range of products during transportation.

By Product Type

By Material Used

By Board Type

By End Use

By Region

January 2026

January 2026

January 2026

January 2026