Packaging Machinery Market Growth Drivers, Challenges and Opportunities

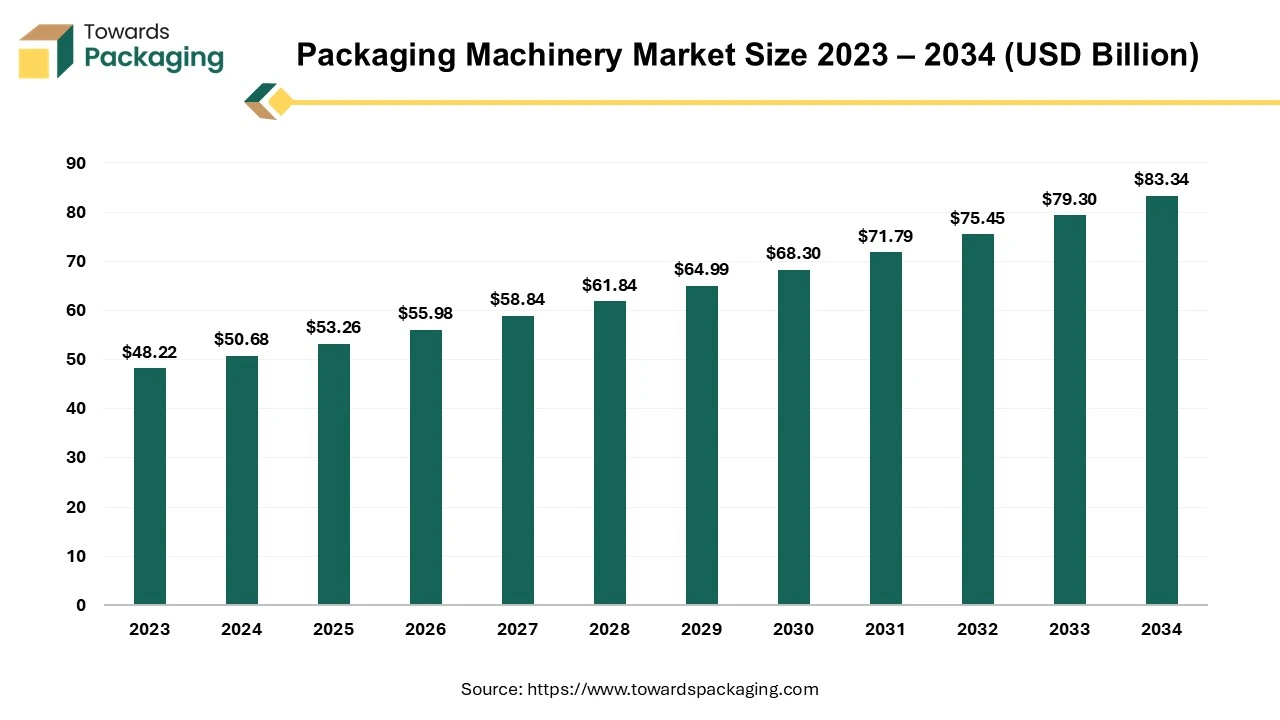

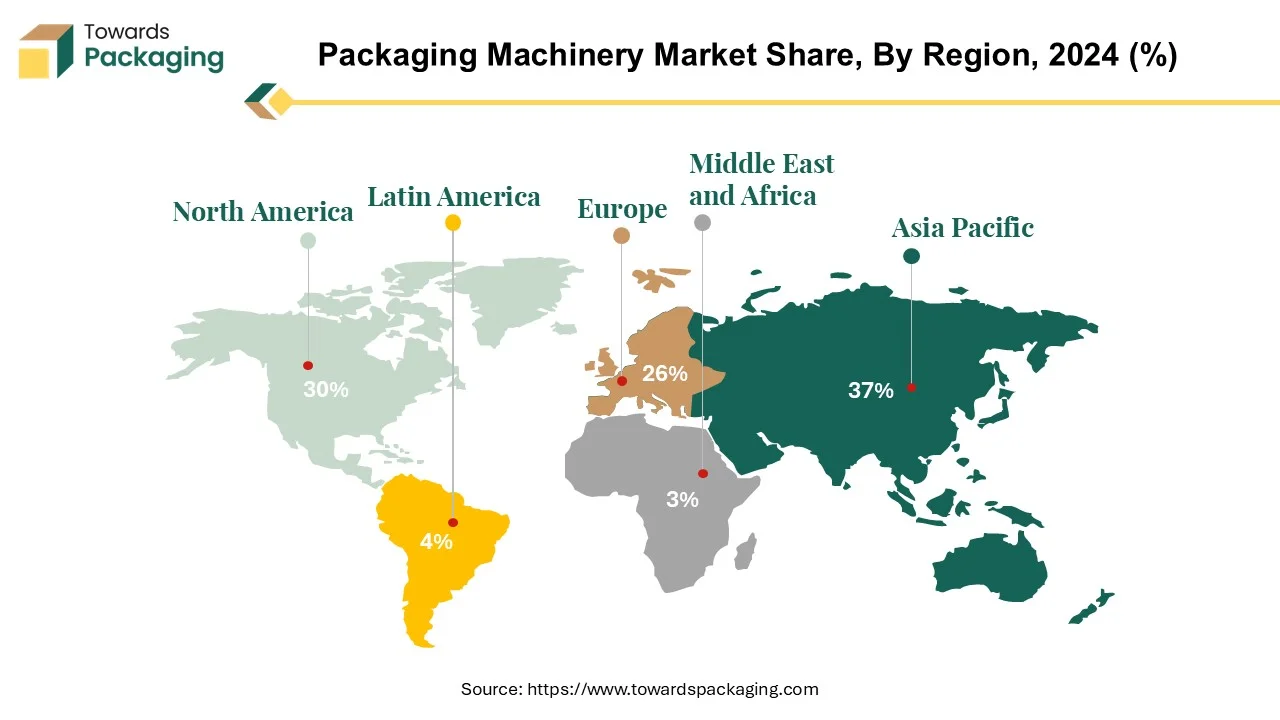

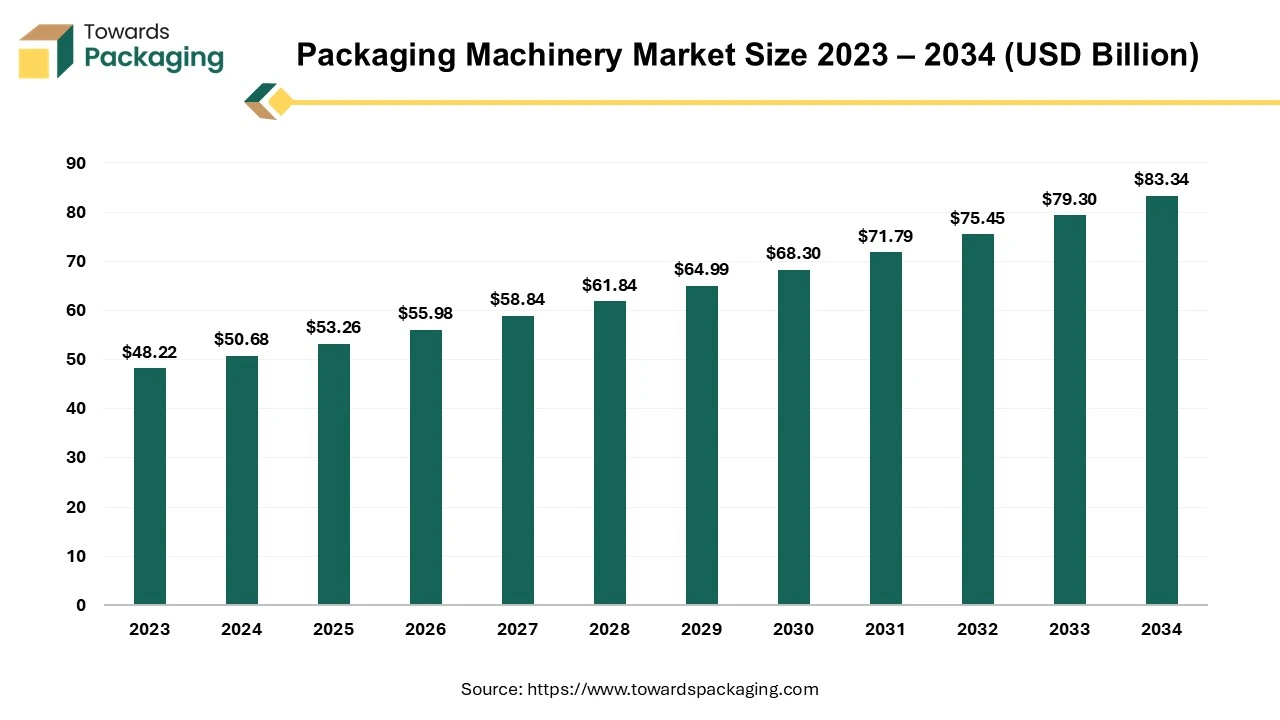

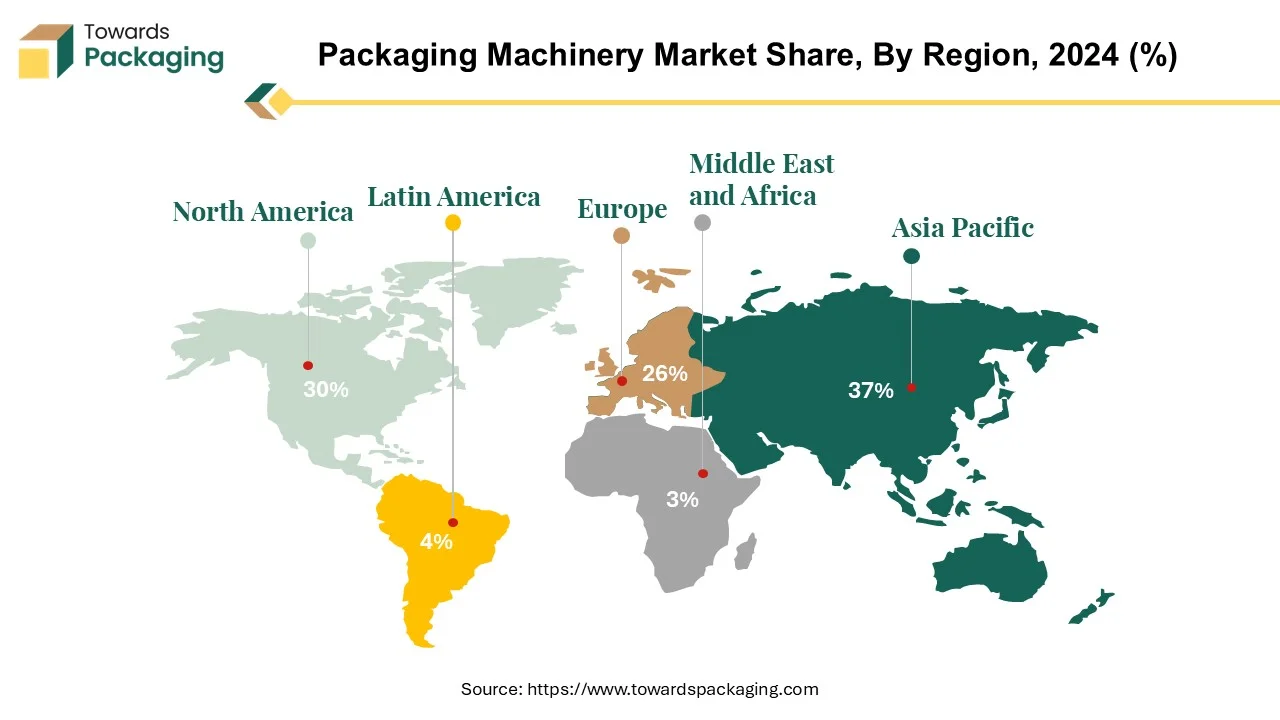

The packaging machinery market is forecasted to expand from USD 55.98 billion in 2026 to USD 87.59 billion by 2035, growing at a CAGR of 5.1% from 2026 to 2035. This comprehensive report covers market segmentation, regional insights including North America (NA), Europe (EU), Asia Pacific (APAC), Latin America (LA), and the Middle East & Africa (MEA). It also provides detailed data on market trends, value chain analysis, trade data, and statistical insights on the leading manufacturers and suppliers in the industry.

Report Highlights: Important Revelations

- Global packaging machinery sector is poised for growth, starting at a value of USD 53.26 billion in 2025.

- The market is expected to surge, reaching an estimated value of USD 87.59 billion by 2035.

- This expansion is registered at a consistent CAGR of 5.1% over the period from 2025 to 2034.

- Spearheading the global packaging machinery market with Asia-Pacific's dominance.

- Advancements enhancing productivity in North America's packaging machinery industry.

- Importance of filling machines in the packaging machinery landscape.

- Strategies for market expansion in the food and beverage packaging machinery sector.

Packaging machinery is the machinery used to package and protect goods inside containers to be sold, distributed, shipped, stored, and used. This procedure is essential to marketing because it guarantees that products are displayed appropriately and communicate the intended image and design. "Packaging equipment" refers to the machinery that quickly and effectively places goods into wrappings or containers for protection.

The market for packaging machines grew significantly by more than 13% in 2022, demonstrating its adaptability and resilience. Growth in the packaging industry was spurred by significant expenditures made by manufacturers during the epidemic, which improved production and supply chain management and raised demand for packing machines and equipment. This shows how bright the sector's future looks, giving rise to optimism about its resilience. Packaging, with its pivotal role in product protection and conveying crucial information, is greatly enhanced by the efficiency of packaging equipment. This equipment, a testament to technological advancement in the industry, optimizes packaging processes, lowers labor costs, and boosts productivity. Its ability to perform a variety of functions efficiently and affordably, including shrink wrapping, coding, marking, and case packing and sealing, reassures its ability to streamline operations.

Recognizing the vast array of products, packages, materials, and items on the market, the industry has developed a diverse range of packing equipment to cater to specific requirements. This diversity ensures no one-size-fits-all approach but a tailored solution for each packaging need, reassuring the industry's ability to meet unique demands. Strapping machines, pallet wrappers, carton and container sealers, and industrial scales are some of the most used packing devices. There are also sorting, counting, and accumulating equipment and machines for closing and sealing products with glue, caps, corks, heat seals, and other techniques.

The multifunctionality and specialized designs of packaging equipment inspire a sense of versatility. There is a distinct machine for each packaging requirement, making classification a challenge. Custom-designed machines, tailored to specific and atypical applications, further enable packing versatility and adaptability, inspiring innovation in the industry. Other equipment is designed for specialized packaging activities, such as accumulators for gathering commodities, batching machines for preparing items, and bagging, banding, sleeving, and box manufacturing machines for finishing diverse packaging procedures.

For Instance,

- In October 2023, Mespack introduced and demonstrated its case packaging solution at the PackMach Asia Expo 2023.

Future Demands

| Future Demand |

Description |

| Predictive Maintenance |

Rising demand for AI systems that predict equipment failures and reduce unplanned downtime |

| Smart Automation |

Increased need for AI-driven automation to improve speed, accuracy, and consistency in packaging lines. |

| Quality Inspection |

Growing adoption of AI-based vision systems for real-time defect detection and quality control |

| Energy Optimization |

Demand for AI tools that optimize energy usage and lower operational costs |

| Flexible Packaging Lines |

Need for AI-enabled machinery that can quickly adapt to multiple product formats and SKUs |

| Data Driven Decision Making |

Increased use of AI analytics to improve production planning and machine utilization |

Packaging Machinery Market Trends

- Waste reduction in production: Lowering waste during packaging is a priority for sustainable businesses. Accurate cutting and closed-loop systems have made it convenient to update raw material usage. By simplifying the procedure, these systems lower production costs. A horizontal form seal machine is a main example because it uses film material effectively and produces less excess scrap during production.

- Adaptability for consumer choices: Users find different and engaging purchasing experiences. And packaging machines can handle different sizes,multi-layer packaging, and tailored designs. E-commerce has furthered the urge for user-friendly packaging. An accurate example is resealable bags, which keep food fresh and portable.

- Quality control technologies: Automated quality assurance machines with built-in checking machines, leak detection tools, and vision inspection systems can spot errors instantly. Automated rejection systems eliminate defective items without slowing down manufacturing. In this way, only good quality products pass forward.

- Smart packaging machines: Smart packaging devices now attend standard operations such as system self-diagnosis, together with different support services, plus learning potential. These machines have specifically mixed capabilities to self-check their functioning with automatic adjustment characteristics as per the performance metrics.

- Automation in packaging: The execution of AI-powered packaging systems inside smart packaging machines gives the equipment the potential to create predictive outputs. The systems let brands achieve both expedited operations and constant quality results.

- The Internet of Things: The usage of IoT has changed packaging machinery into the latest modes of communication. Each step of the packaging operations generates data from which IoT Sensors in embedded machines shift between one another. The data collection procedure lets businesses detect operational delays while cutting waste and updating their delivery speed.

- Eco-friendly packaging solutions: The collaboration of customer demand and implementing official packaging rules drives manufacturing sectors to choose environmentally responsible packaging alterations. Organizations are currently developing challenging sustainable packaging goals that require growth in carbon footprint.

- Packaging machinery that encourages sustainable packaging methods is in high demand among manufacturers.

- Incorporating digital technology, such as data analytics and Internet of Things (IoT) sensors, is transforming the packaging machinery market.

- Rising demand for packaging equipment with robotics and automation technologies.

- The trend of flexible packaging formats, such as pouches and sachets, has increased the demand for packaging machinery that can handle these materials.

By facilitating automated quality inspection, real-time performance monitoring, and predictive maintenance, artificial intelligence is revolutionizing the packaging machinery industry. AI-powered systems maximize energy use throughout packaging lines, decrease unscheduled downtime, and increase machine efficiency. Manufacturers can identify flaws early and modify processes for increased throughput with the aid of advanced analytics. AI-powered packaging equipment, therefore, promises lower costs, increased output, and a quicker return on investment.

Why is Resilience Becoming a Key Factor in Packaging Machinery Investments?

Resilience is becoming a key factor in packaging machinery investments as manufacturers seek equipment that can withstand production fluctuations and supply chain challenges. Equipment that can adjust to various materials and packaging styles minimizes downtime and boosts productivity. By reducing waste and energy use, resilient systems also promote sustainability. To remain competitive in a changing market, businesses are placing a high priority on robust, adaptable, and dependable machinery.

Innovations Driving Efficiency in North America's Packaging Machinery Sector

The packaging machinery industry in North America is increasing, bringing a wide range of equipment necessary for effectively packaging items in various industries. To increase production, guarantee product quality, and comply with regulations, packing activities must be automated, which is made possible by this machinery. The need for sophisticated packaging solutions keeps growing as companies aim for increased productivity and competitiveness. Innovative machinery is becoming increasingly expensive for manufacturers who want to maximize resource utilization, minimize downtime, and streamline operations. North American modern manufacturing methods rely heavily on packing machinery for its critical role in improving operational efficiency and preserving product quality.

The value of packaging machinery shipments to North America in 2022 increased significantly from the previous year by about 12.4% to $10.2 billion. This increase is in line with the robust demand seen in the prior year when shipments increased by 15.8% at their peak. There is a backlog of orders and difficulties in the supply chain due to the pandemic's ongoing effects on the market. Despite the pandemic's continued effects, growth in the packaging machinery industry is anticipated to slow down shortly. In the first quarter of 2023, backlogs continue to expand; however, a steady decline is expected in the year's second half.

North America's packing machinery industry remains dynamic, driven by growing automation, efficiency gains, and the need to respond to changing market needs and regulatory constraints.

For Instance,

- In June 2022, A major participant in end-of-line packaging equipment, MG TECH opened offices in Montreal, Canada, to begin operations. MG has built a solid customer base in North America with its wide range of packaging equipment for solid and corrugated boards, and it is ready to take on new business through this new website.

Packaging Machinery Market, DRO

Demand

- Packaging machinery that provides automation and efficiency to optimize production processes is in high demand.

Restrain

- Acquiring packaging machinery, particularly complex and high-end equipment, can be prohibitively expensive for small and medium-sized enterprises.

Opportunity

- Packaging machinery manufacturers have the opportunity to create customized and adaptable solutions that match the specific needs of various sectors and applications.

Vitality of Filling Machines Across Packaging Machinery

The filling machine is a significant segment of the packaging machinery market. Several causes contribute to its prominence, emphasizing its essential position in various industries worldwide. Filling machines are essential in packaging various products, including beverages, medications, cosmetics, and home chemicals. Whether filling bottles, cans, pouches, or containers, these devices enable precise and effective dosing of liquid, semi-liquid, or powdered ingredients, increasing production efficiency and product quality. The adaptability of filling machines makes them helpful in handling a wide range of packing forms and container sizes. From small-scale operations to high-speed production lines, filling machines provide flexibility and scalability, allowing producers to address changing production demands and market trends.

Technological developments in filling machines have enhanced their accuracy, speed, and dependability. Sophisticated technologies, including servo motors, computerized controls, and automatic changeover systems, are present in modern filling machines, which improve performance and save downtime. Manufacturers benefit from improved output and lower costs due to this enhanced efficiency. The increasing need for personalized and innovative products is propelling the use of specialty filling machines that can manage distinct packaging needs. Filling machines offer customized solutions to fulfill various business needs, such as aseptic filling for perishable items, hot filling for temperature-sensitive products, or volumetric filling for exact dosing.

| Top Ten Packaging Companies, 2022 ($, Billion) |

| Company |

Revenue (Billion) |

| Westrock |

21.3 |

| International Paper Company |

19.4 |

| Tetra Laval International |

16.3 |

| Amcor Plc |

14.54 |

| Berry Global Group Inc |

14.5 |

| Ball Corp |

13.8 |

| Oji Holdings Corp |

13.1 |

| Stora Enso Oyj |

12 |

| Smurfit Kappa Group Plc |

11.95 |

Westrock Co. has surpassed International Paper Company to become the largest packaging company by yearly revenue. During this period, packaging businesses actively disclose their ESG (Environmental, Social, and Governance) aims. Consumer pressures, board expectations, and environmental advocacy groups all push them to make environmentally conscientious investments and collaborations while addressing operational challenges quickly.

The growth of sectors, including food and beverage, medicines, and personal care, on a global scale drives the demand for filling machines. Manufacturers look for packaging machinery to optimize manufacturing procedures, guarantee product purity, and boost brand competitiveness as customer preferences and market dynamics change.

- In July 2023, Syntegon unveiled the GKF Capsylon 6005 capsule-filling machine in Europe and the US, potentially filling 360,000 nutraceutical capsules per hour—more than twice as many as its previous model.

Navigating Market Expansion in the Food and Beverage Packaging Machinery Industry

The food and beverage sector dominates the packaging machinery market. In 2022, the food industry accounted for 43% of packaging machinery exports, with the beverage sector accounting for 15% of investments. However, in 2023, fewer significant planned expansions have been revealed in the food industry than in prior years. On the other hand, the beverage sector has a higher number of anticipated investments, albeit on a smaller scale than other industries. The beverage sector is expected to increase at a moderate rate over the projection period, notwithstanding the reduced level of investment. This suggests that the beverage industry will continue to have a consistent need for packaging machinery due to market expansion, product innovation, and changing consumer preferences. Even if anticipated expansions in the food industry may have temporarily stalled, the sector continues to play a vital role in the packaging machinery market.

China's consumption of organic packaged foods and beverages has increased significantly in recent years. This trend is primarily driven by several critical variables, including shifting consumer choices, changing lifestyles, and increased knowledge of health and sustainability.

It's crucial to remember that several factors impact the packing machines market, including technology developments, governmental regulations, and economic situations. Trends in the industry are also influenced by changes in customer behaviour, such as the growing desire for sustainability and ease. Though they still dominate the packaging machinery market, investments in the food and beverage sectors may differ in timing and amount. It is imperative to address these industries' distinct demands and requirements to effectively leverage market prospects, even if they continue to be significant drivers of demand for packing machines.

One important indicator of consumer preferences and market trends is the percentage of organic packaged food and beverage consumption relative to the overall amount of health and wellness items consumed. This ratio shows the percentage of consumers prioritizing organic options in the more significant health and wellness category.

For Instance,

Significant Rise in Packaging Productivity Driven by Technological Advances

Last year witnessed a remarkable increase in packaging productivity, driven by advancements in machinery technology and a heightened focus on productivity measurement and enhancement strategies among end users.

A comprehensive study measured both labor productivity and multifactor productivity within the packaging industry. Labor productivity, which gauges packaging output per unit of labor, saw a 7.9 percent increase, closely mirroring the 7.8 percent rise reported in 2000. While this measurement is specific to packaging, the growth compares favorably with broader industry trends.

Multifactor productivity in packaging, which takes into account employee benefits and wages, packaging material usage and costs, and capital inputs such as machinery and energy, rose by 6.8 percent in 2002. This increase reflects the impact of higher wage and benefit costs, along with rising material and energy expenses. This profit-directed measure, although less complex and more specialized in its focus on packaging, provides a comprehensive view of productivity changes.

The study revealed that 89.1 percent of respondents systematically measure their company's productivity and actively seek ways to enhance it. According to the survey, 54.6 percent of packagers reported an increase in productivity, while 7.6 percent experienced a decline, and 37.8 percent saw no change from the previous year.

Overall, the findings underscore the positive impact of technological advancements and strategic productivity management in the packaging industry, leading to significant improvements in both labor and multifactor productivity.

Competitive Landscape

The competitive landscape of the packaging machinery market is characterized by established industry leaders such as Tetra Laval International S.A., MULTIVAC Group Source, FujiMachinery Co., Ltd., ProMach, Syntegon Technology GmbH, Krones AG, SIG Combibloc Group Ltd., ROVEMA GmbH, Maillis Group, Robert Bosch GmbH and Bradman Lake Ltd. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Tetra Laval International S.A.'s responsibilities go beyond delivering machinery and equipment. The company also provides comprehensive services, such as technical support, maintenance, and training, to help customers maximise the productivity and dependability of their packing processes.

MULTIVAC understands the value of sustainable packaging solutions in today's ecologically sensitive world. The company actively develops packaging machines and materials that minimize waste, save energy, and reduce carbon footprints.

ProMach provides various packaging machinery and solutions, including filling, capping, labeling, coding, and end-of-line equipment. ProMach's vast portfolio enables it to meet the packaging needs of a wide range of products, including food and drinks, pharmaceuticals, and consumer goods.

New Advancements in the Packaging Machinery Industry

- In March 2025, Packsize, a provider of right-sized, on-demand packaging automation, announced the launch of its new X6 automated right-sized packaging system. The X6 will be shown for the first time abroad at ProMat 2025 in booth S4153 and at LogiMAT in booth 6F 61.

- In April 2025, AstroNova, a company providing data visualisation technology, revealed the launch of the digital label presses and printer presses at the FESPA Global Print Expo 2025 in Berlin, Germany.

Asia-Pacific's Leading Role in the Global Packaging Machinery Market

The Asia-Pacific region, a powerhouse in the worldwide packaging machinery market, has the largest share. This dominance is shaped by many factors influencing the region's packaging machinery sector. The Asia-Pacific packaging machinery market, projected to be valued at US$ 15.5 billion, underscores the region's significant contribution to the global landscape, presenting a wealth of opportunities for industry players. The Asia-Pacific packing machinery industry is experiencing growth, propelled by several key factors. Paramount among these is the region's burgeoning population and the rise of a prosperous middle class, particularly in developing nations. China and India have largest market for packaging machinery. This demographic shift is fuelling increased consumer spending power, driving demand for packaged goods across various sectors, and necessitating the adoption of advanced packaging technologies and machinery.

In the Asia Pacific region, a heightened awareness and concern for sustainability are catalyzing the shift towards eco-friendly packaging solutions such as recyclable or biodegradable materials. This trend, championed by consumers, governments, and corporations alike, is driving a surge in demand for packaging machinery capable of producing these sustainable materials, reflecting the changing market dynamics. The growing adoption of flexible packaging fuels market growth in the Asia Pacific. Flexible packaging has various advantages, including versatility, lightweight, and cost-effectiveness, making it a popular choice for products ranging from food and beverages to pharmaceuticals and personal care items. The need for intelligent packaging solutions that use technology like QR codes and augmented reality is also increasing in the Asia Pacific area. These technologies improve consumer interaction, product identification, and supply chain traceability, necessitating modern packaging machinery capable of effortlessly incorporating such features. Serialization technologies are also gaining traction in Asia Pacific, owing to regulatory regulations and customers' desire for product traceability and authenticity. Serialization allows producers to track and trace their products throughout the supply chain, increasing consumer confidence and regulatory compliance.

The Asia-Pacific region's dominance in the packing machinery market is driven by demographic shifts, sustainability concerns, technical improvements, and changing customer tastes. As the region's economy grows and industrial development accelerates, demand for innovative packaging machinery solutions will likely rise, creating further market expansion and prospects for industry participants.

China Market Trend

The Chinese packaging machinery market is driven by the largest e-commerce industry in the country. China's "Made in China 2025" plan aims to transform the nation from a production giant into a top-tier manufacturing power by emphasizing technological advancements and quality over quantity. This initiative has led to increased investments in high-tech industries, including packaging machinery, fostering innovation and enhancing global competitiveness.

Chinese manufacturers have significantly ramped up investments in research and development, leading to the creation of highly efficient and technologically advanced packaging machines. These innovations incorporate automation, robotics, and IoT technology, improving efficiency and reducing labor costs. Leveraging cost-effective manufacturing processes and economies of scale, Chinese firms offer high-quality machinery at competitive prices. This price advantage has been pivotal in attracting international buyers, contributing to a 40% increase in export sales.

The Chinese government has provided substantial support to the packaging machinery sector through subsidies for technological innovation and export incentives. In 2023 alone, over US$500 million in grants were allocated to the packaging machinery sector, facilitating the development of new technologies and expanded production capacities. There is a growing emphasis on sustainability among Chinese consumers, driving the adoption of eco-friendly packaging solutions. This trend has led to increased demand for biodegradable materials, reusable packaging, and energy-efficient machinery that align with sustainable practices.

For Instance,

- In July 2023, Comexi, a packaging machinery company, increased its footprint in Asia-Pacific by constructing a new factory in Bangkok, Thailand.

Value Chain Analysis

Raw Materials Sourcing

Raw materials sourcing for packaging machinery focuses on high-quality metals, plastics, and electronic components to ensure durability and precision. Companies are increasingly opting for sustainable and locally sourced materials to reduce supply risks and environmental impact.

Key players: Bosch Packaging Technology, Tetra Pak, and IMA Group.

Logistics and Distribution

Logistics and distribution in packaging machinery emphasize the timely delivery of heavy equipment and spare parts while minimizing costs. Manufacturers are leveraging regional warehouses, optimized transportation routes, and smart supply chain tools for efficiency.

Key players: DHL Supply Chain, Kuehne + Nagel, DB Schenker.

Recycling and Waste Management

Recycling and waste management practices are gaining importance as companies aim to minimize manufacturing scrap and promote circular economy initiatives. Machinery designed for minimal material waste and modular components helps improve sustainability.

Key players: Veolia, SUEZ, TOMRA.

Packaging Machinery Market Players

Recent Developments

- On 17 February 2025, under the aim #Sealing the Future, SEALPAC showcased various types of cutting-edge technology, all created in Germany, during IFFA 2025 from May 3rd to 8th. At the world’s top trade show for meat and protein producers, users will witness cutting-edge and innovative technologies at the stand of the German Packaging expert.

- On 10 June 2025, the Asian Packaging Industry Online Exhibition 2025 served international buyers a valuable platform to discover leading packaging manufacturers across Asia at one place, without the limitation of geography or Time.

- On 24 September 2024, Beko partnered with Key Australian retail partners for its EPS-Free packaging pilot project for huge appliances, marking a major step forward in its sustainability journey. Meeting with the growing preference for environmentally conscious products, Beko continues to lead the home appliance sector by pushing the limitations of what is possible.

- On 18 December 2024, CMC Packaging Automation revealed its new Genesys Compact packaging machine, which packs and scans products in custom boxes without the demand for void fillers at up to 500 units per hour. It is scanned directly on the conveyor. Products are packaged and sized from single and multiple line orders, with box sizes ranging from 270*210*48 mm to 560*380*290 mm. Substrates range from 1.2mm to 4mm in single wall, single wall E, and double wall B and E.

- On 24 April 2025, IMA Group, which is a top company in packaging equipment, attended the IDEA 2025 exhibition with its Tissue & NonWovenHub, an alliance of tailored companies with long-standing expertise in serving complete lines for the Tissue & Nonwoven sector.

- In Janaury 2022, SIG purchased Evergreen Asia, Pactiv Evergreen's business specializing in filling machinery and carton packaging.

- In January 2023, Massman Companies, a global leader in packing machines, acquired Ultra Packing Inc., a privately held firm headquartered in Chicago, Illinois.

- In December 2023, SIAT Group, an H.I.G. Capital portfolio firm has acquired a 50% share in 3M's US-based Combi Packaging Systems.

- In June 2022, ProMach, the global leader in packaging machinery solutions, announced the acquisition of Reepack.

Packaging Machinery Market Segments

By Machinery

- Filling Machines

- Liquid filling machines

- Powder filling machines

- Granule filling machines

- Aseptic filling machines

- Labelling Machines

- Pressure-sensitive labellers

- Shrink sleeve labelling machines

- Glue-based labelling machines

- Wrap-around labellers

- Palletizing Machines

- Robotic palletizers

- Conventional palletizers

- Layer palletizers

- Hybrid palletizing systems

- Extrusion Machines

- Plastic extrusion machines

- Film & sheet extrusion machines

- Pipe & profile extrusion machines

- Bottling Machines

- Automatic bottling lines

- Semi-automatic bottling machines

- Bottle rinsing & capping systems

- Cartoning Machines

- Horizontal cartoning machines

- Vertical cartoning machines

- End-load cartoners

- Top-load cartoners

- Others

- Wrapping machines

- Sealing machines

- Case packing machines

- Strapping machines

By End User

- Food & Beverage

- Packaged food

- Beverages (alcoholic & non-alcoholic)

- Dairy products

- Bakery & confectionery

- Personal Care

- Cosmetics

- Toiletries

- Hair & skin care products

- Pharmaceutical

- Solid dosage packaging

- Liquid dosage packaging

- Medical devices packaging

- Chemical

- Industrial chemicals

- Agrochemicals

- Specialty chemicals

- Others

- Household products

- Industrial goods

- Consumer electronics

By Region

- Asia Pacific

- China

- India

- Japan

- South Korea

- ASEAN countries

- North America

- Europe

- Germany

- France

- Italy

- UK

- Rest of Europe

- Latin America (LA)

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC countries

- South Africa

- Rest of MEA