Wooden Pallet and Container Market Size, Demand and Trends Analysis

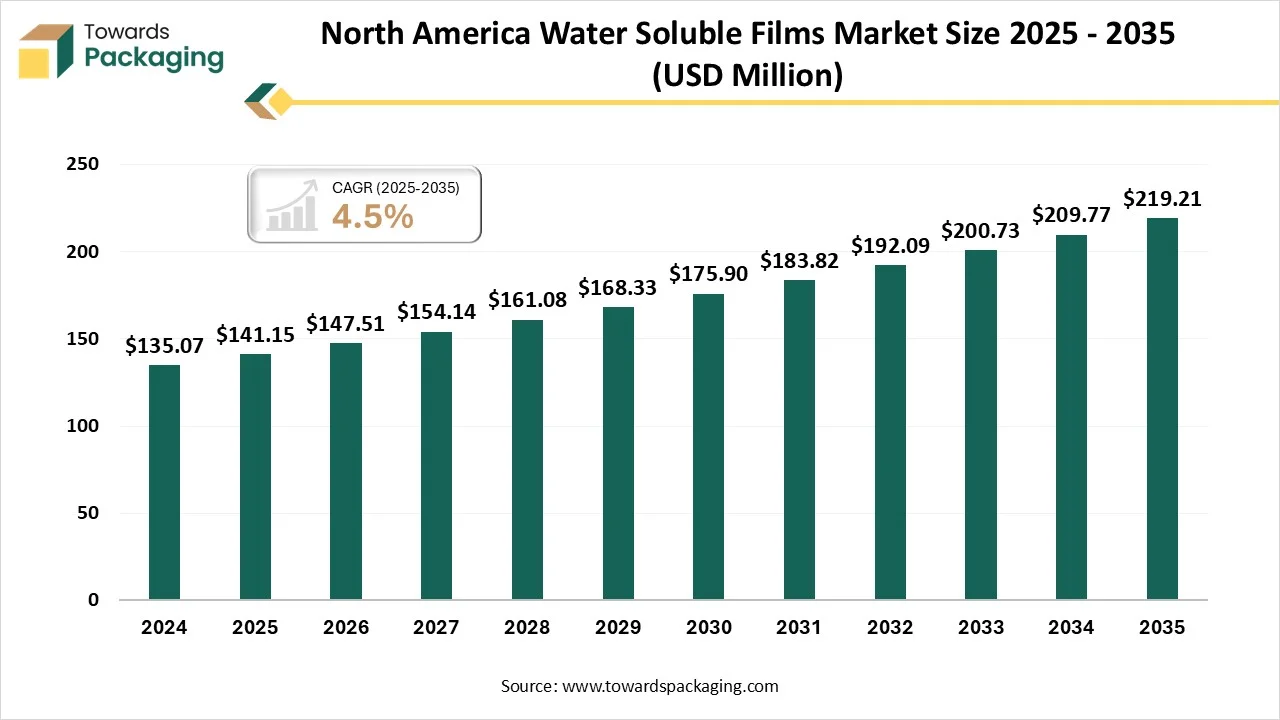

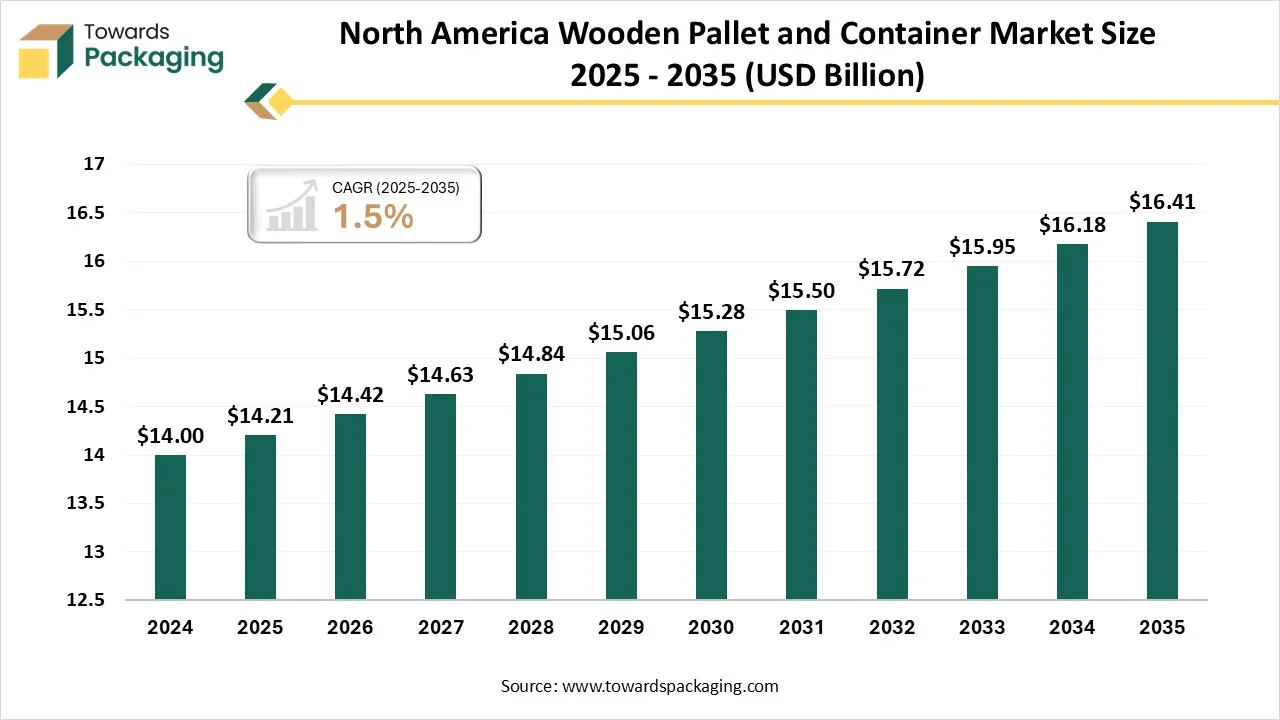

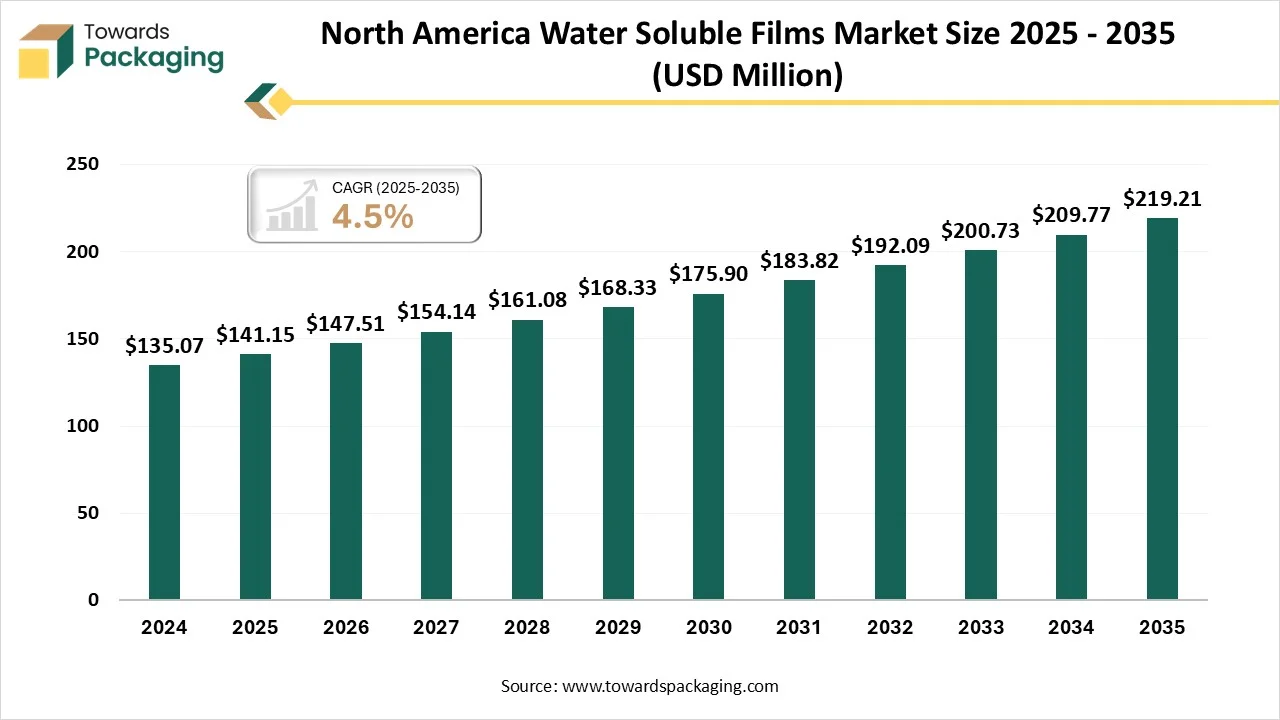

The wooden pallet and container market is expected to increase from USD 147.51 billion in 2026 to USD 219.21 billion by 2035, growing at a CAGR of 2.05% throughout the forecast period from 2026 to 2035. The rising demand for cost-effective, sustainable, and durable packaging has influenced the market to introduce innovations and develop rapidly. It is widely used in sectors like agriculture, logistics, food & beverages.

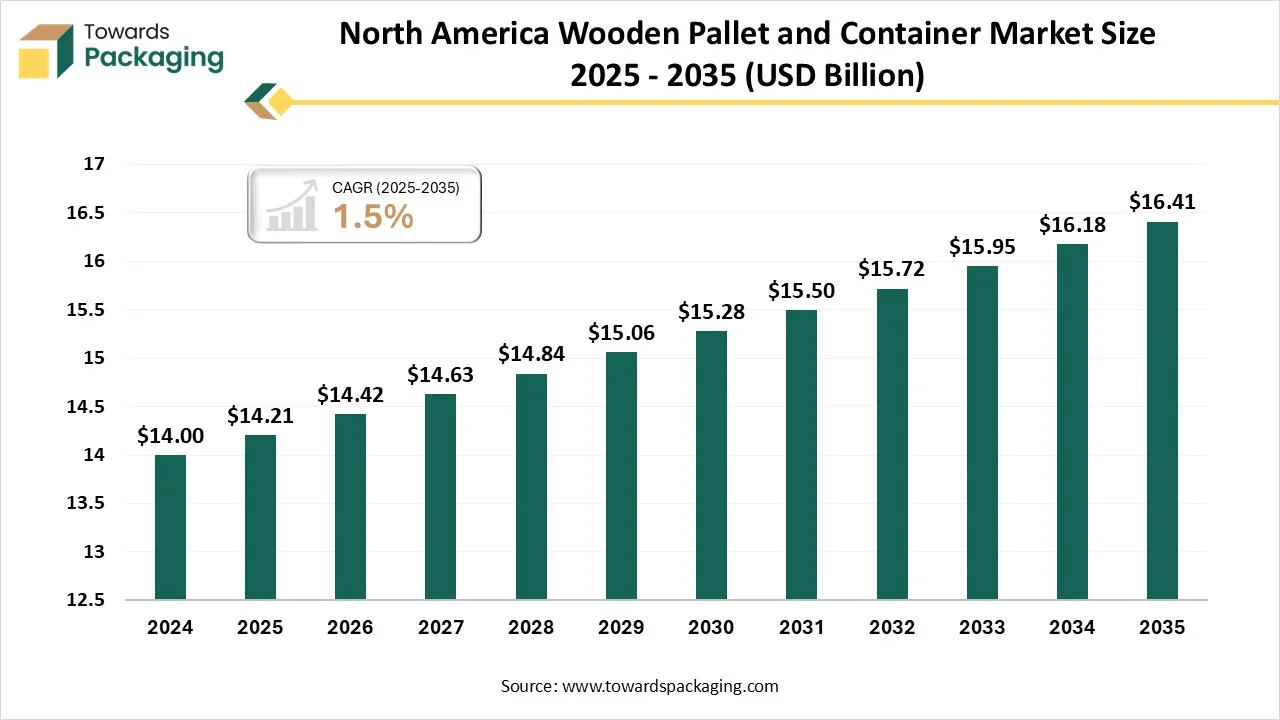

Major factors promoting the development comprises increasing emphasis towards recyclable packaging, essential sustainability of wood as a resource, and growing worldwide trade. Presence of strong logistics and retail industry has boosted the growth of this market in North America.

Major Key Insights of the Wooden Pallet and Container Market

- In terms of revenue, the market is valued at USD 35.72 billion in 2025.

- The market is projected to reach USD 219.21 billion by 2035.

- Rapid growth at a CAGR of 2.05% will be observed in the period between 2025 and 2035.

- By region, North America dominated the global market by holding highest market share of approximately 40% in 2024.

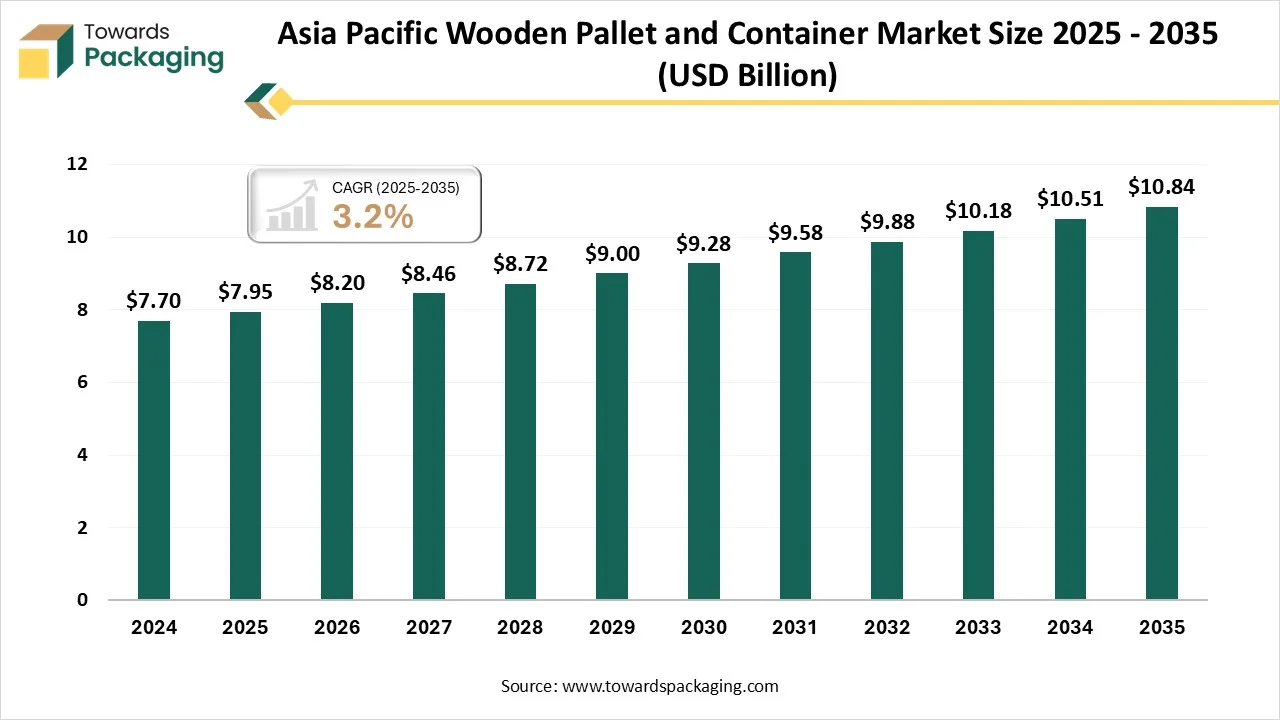

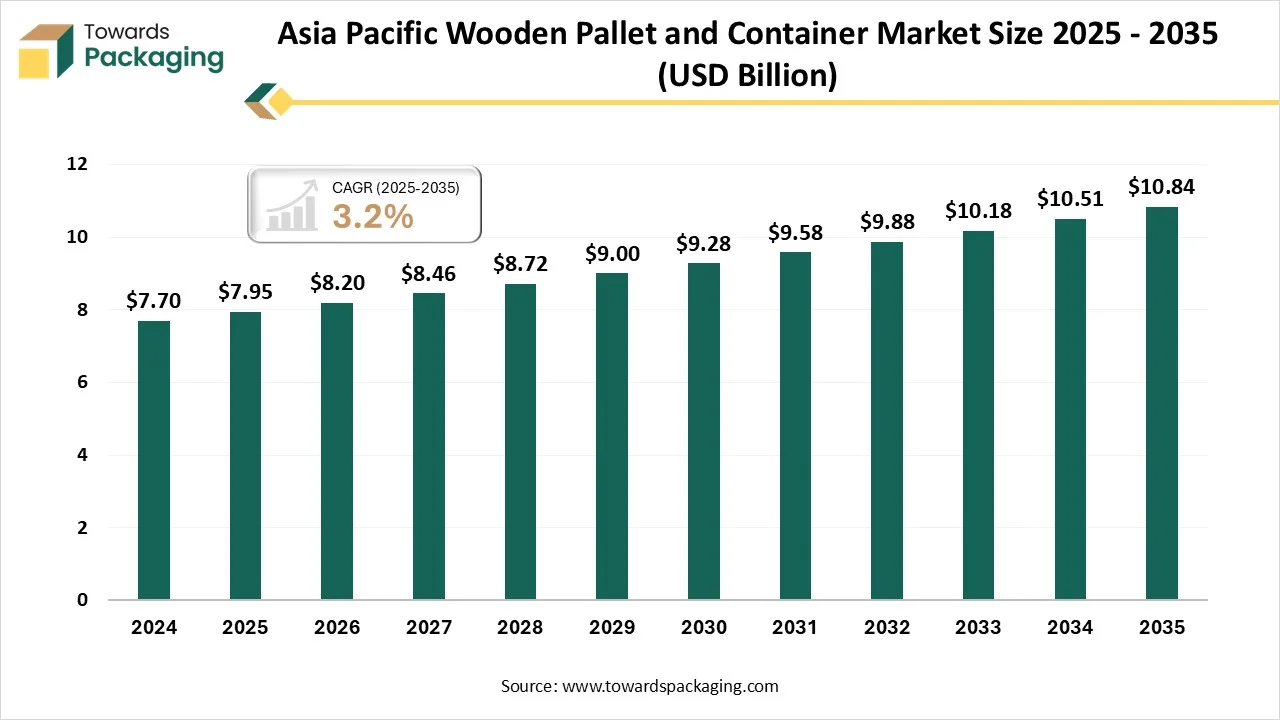

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the wooden pallets segment contributed the biggest market share of approximately 65% in 2024.

- By product type, the wooden containers segment will be expanding at a significant CAGR in between 2025 and 2034.

- By material type, the softwood segment contributed the biggest market share of approximately 70% in 2024.

- By material type, the engineered wood segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By treatment type, the heat treatment segment contributed the biggest market share of approximately 60% in 2024.

- By treatment type, the chemical treatment segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-user industry, the agriculture segment contributed the biggest market share of approximately 30% in 2024.

- By end-user industry, the retail and e-commerce segment is expanding at a significant CAGR in between 2025 and 2034.

- By distribution channel, the direct sales segment contributed the biggest market share of approximately 50% in 2024.

- By distribution channel, the chemical treatment segment is expanding at a significant CAGR in between 2025 and 2034.

What is Wooden Pallet and Container Market?

The wooden pallet and container market encompasses the global industry involved in the manufacturing, distribution, and utilization of wooden pallets and containers. These are essential for the transportation and storage of goods across various sectors, including agriculture, automotive, pharmaceuticals, and retail. The market is driven by factors such as the growth of global trade, advancements in logistics, and the increasing demand for sustainable and recyclable packaging solutions.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 35.72 Billion |

| Projected Market Size in 2035 |

USD 219.21 Billion |

| CAGR (2026 - 2035) |

2.05% |

| Leading Region |

North America |

| Market Segmentation |

By Product Type, By Material Type, By Treatment Type, By End-User Industry, By Distribution Channel and By Region |

| Top Key Players |

CHEP (Brambles Limited), PalletOne, Inc., Millwood, Inc., Kamps Pallets, UFP Industries, Inc., Pallet Consultants, Inc., Loscam, PECO Pallet, Inc., Schoeller Allibert |

Wooden Pallet and Container Market Outlook

- Enhanced Performance & Material Science: Rapid enhancement in the performance and the rising sustainability resources demand has influence the development of the market.

- Advancement in Supervisory Guidelines: The advancement in supervisory guidelines is increasing rapidly due to ecological sustainability, rising efficiency, and phytosanitary compliance.

- Enhancing Infrastructures & Industries: Enhancing the infrastructures and industries with increasing e-commerce industry, and modern logistics. It comprises sustainability and cost-effectiveness as wood is renewable source.

- Startup Ecosystem: Formulation for innovation of materials, circular economy initiatives, IoT integration for tracking and monitoring. Major emphasis towards improving efficacy and sustainability has enhanced this sector.

How Can AI Improve the Wooden Pallet and Container Market?

The incorporation of AI technology in the market plays an important role by allowing smart logistics, enhancing mechanization in production and management, augmenting inventory administration, and development traceability and quality control. The real-time monitoring facility by incorporation of AI algorithm and sensor that help in tracing lifestyle in real-time, container condition, and location. Rising demand for automation of the packaging operation, robotic palletizers, automated guided vehicles (AGVs), and optimized pallet building. Increasing inventory management and growing demand for forecasting such as decreased downtime and intelligent inventory has raised the demand for advanced technology.

Trade Analysis of Wooden Pallet and Container Market: Import & Export Statistics

- China is strongly growing export of wooden pallet growing by 30% in 2024 to 4.9 million units, and utilizing more than 100 million pallets domestically in 2023.

- India is highly exporting wooden pallet which is valued around USD 1 billion and expected to grow by 9% by 2029.

- Japan imports wooden pallet and containers majorly from the United States, Indonesia, and Vietnam. The export rate of these materials is growing around $61 million in 2024.

- Germany is importing wooden pallets and containers at around $593 million in 2023 and its growth is anticipated from 2024-2028.

- US has reported to pallet market is anticipated to develop significantly in 2024 value of around $26.8 billion.

Wooden Pallet and Container Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are softwood and hardwood such as maple, oak, pine, fir, and spruce.

- Key Players: ORBIS Corporation, Brambles Ltd (CHEP)

Component Manufacturing

The major components used in this market are blocks/ stringers, deck boards.

- Key Players: CHEP, Brambles Limited

Logistics and Distribution

This segment plays an important role in enhancing industrial demand and geographical distribution.

- Key Players: UFP Industries, PECO Pallet

Market Dynamics

Market Driver

Rising Food and Beverage Industry

The rising food and beverages transportation services has influenced the demand for the wooden pallet and container market. The rapid expansion of e-commerce sector has enhanced the demand for superior-quality of packaging which can protect products during transportation. The high durability and capacity to bear load has influenced the demand for these pallet and containers. The increasing emphasis towards ecological protection and sustainability has enhanced the demand of the market.

Market Challenges and Restraints

Volatile Charges of Raw materials

Volatile prices of the raw materials have hindered the growth of the market. Such fluctuation hampered the growth of the business and restrict the expansion of the market. Fluctuation in the charges of wood that is imported has also hindered the growth of this market profoundly.

Market Opportunity

Increasing Global Trade

Rising global trade has raised the opportunities for the market. The rapid expansion of the e-commerce sector has influenced the demand for such wooden pallet and containers for safe delivery of the food products. The increasing demand for reusable and sustainable packaging has raised several opportunities for the promotion of this market. Huge demand for advancement of the warehouse has also raised the utility of such wooden pallet and containers.

Product Type Insights

Why Wooden Pallets Segment Dominated the Wooden Pallet and Container Market In 2024?

The wooden pallets segment dominated the market in 2024 due to its cost-effectiveness and global trade. These wood pallets are cost-effective solution available in the packaging industry which result in huge adoption of these containers. The increasing international trade has promoted these pallet and containers to transport products from one place to another. Increasing focus towards sustainable and eco-friendly packaging has raised innovation in this market and enhance the demand for this segment.

The wooden containers segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its durability and sustainability. It is widely accepted in the e-commerce sectors, food & beverage industries, and various other industries which export their products. Wooden containers include crates and boxes which are reliable for safe transportation of products.

Material Type Insights

Why Softwood Segment Dominated the Wooden Pallet and Container Market In 2024?

The softwood segment dominated the market in 2024 due to its accessibility and cost-efficiency. This segment is widely used in the e-commerce sector, logistics, and retail industry for one-way or high-volume shipping requirement. Rising demand for recycled wood has boosted the huge production of this segment. The lightweight nature of the softwood segment has evolved the market by enhancing its reliability and low transportation charges.

The engineered wood segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its high strength and its dimensional stability. It provides resistance to pests and moisture which raised the adoption of this segment. The rising demand for crates and pallet offers high strength has boosted engineered wood segment. The increasing urbanization and construction activities in developing economies influence the requirement for this segment.

Treatment Type Insights

Why Heat Treatment Segment Dominated the Wooden Pallet and Container Market In 2024?

The heat treatment segment held the largest share of the market in 2024 due to technological advancement and rising demand. Continuous innovation in heating treatment technologies is enhancing efficacy, decreasing operational charges, and reducing carbon footprints for pallet production. The rising focus on eco-friendly and sustainable supply chain is promoting the huge demand for heat-treated pallet. These pallets have high upfront charges, their durability, and compliance guidelines provide long-term ROI. It kills pests and prevents their widespread which restrict expansion of diseases.

The chemical treatment segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to its capacity to prevent decaying, control pests, and resistant to fire. This method is used to control health risks and ecological concern related with chemical treatment. The increasing ecological concern and safety concern has raised the utilization of chemical treatment.

End-User Industry Type Insights

Why Agriculture Segment Dominated the Wooden Pallet and Container Market In 2024?

The agriculture segment held the largest share of the market in 2024 due to its strong requirement and cost-effectiveness. It is easy-to-handle in large volume agricultural products. These pallets are reliable source that help to transport heavy loads. These can be recycled and reused easily which has enhanced the demand for this market in agriculture sector. With the rising incorporation of wooden pallet has helped with the integration of automation in this sector.

The retail and e-commerce segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to increasing reliance towards efficient and cost-effective solutions. Rising e-commerce sector and growing international trade has influenced the growth of this sector. The durability and strength of this pallet have enhanced the necessity of the wooden protection while transporting.

Distribution Channel Type Insights

Why Direct Sales Segment Dominated the Wooden Pallet and Container Market In 2024?

The direct sales segment held the largest share of the wooden pallet and container market in 2024 due to increasing hybrid models and rising e-commerce sector. Several industries shifting towards both traditional patter as well as hybrid model to enhance sale of the products. With the enhancement of the e-commerce industry, it becomes easy for consumers to access a huge variety of products. In the rapid increasing market competition has enhanced the adoption for such segment.

The online platforms segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to supply chain efficacy and last-mile delivery. The increasing modernization and automation such as conveyor belt and robotics has enhanced the demand of the segment. The rising expansion of the e-commerce sector is the primary driver behind the growth of this market.

Regional Insights

North America held the largest share of the wooden pallet and container market in 2024, due to increasing sustainability and recyclability. The huge scope for recyclability and biodegradability has influenced the development of this market. Presence of well-developed recycling infrastructure has raised the demand for this industry. There is well-established transportation system and warehouse present in countries like the U.S. and Canada which influence the usage of this market.

Asia Pacific’s Increasing Technological Advancement Enhance Market Demand

Asia Pacific expects significant growth in the wooden pallet and container market during the forecast period. This market is growing due to increasing technological advancement in this sector. It helps to enhance recyclability of the product and support to attain sustainability goal of several sectors. Major government initiatives, rising focus on logistics, and huge investment towards infrastructures has evolved the market to grow rapidly. There is a huge demand for cost-efficient packaging with the enhancement of global trade in countries like India, Japan, China, South Korea, and several others.

Renewable Packaging’ Regulatory Landscape: Global Regulations

| Regions/ Countries |

Regulatory Bodies |

Key Regulations |

| Canada |

Environment and Climate Change Canada (ECCC) |

EPR implemented provincially |

| Japan |

Ministry of Health, Labour & Welfare (MHLW) |

Food Sanitation Act |

| United States |

FDA |

FDA look for food-contact materials |

| India |

Ministry of Environment, Forest & Climate Change (MoEFCC) |

Plastic Waste Management Rules |

| China |

National Health Commission |

National food-contact standards |

Recent Developments

- In September 2025, DP World announce the launch of its warehousing facilities for Mondelez India which is a multinational company in the US. It is designed in such a way that it contains around 4,000 pallet positions, including 2,200 positions for dry goods.

- In June 2024, PalletOne declared the launch of an automatic pallet assemblage machine redistribution program to offer enhanced pallet resolutions to consumers nationwide.

Top Companies in the Wooden Pallet and Container Market

- CHEP (Brambles Limited): It is a global leader od wood pallet pooling as well as rental service which offer cost-efficient and environment-friendly solution.

- PalletOne, Inc.: It is widely known in the North America for its production process.

- Millwood, Inc.: It provide custom and standard wood solution which comprises molded wood choices.

- Kamps Pallets: It provide major solutions on recycled pallet solutions space.

- UFP Industries, Inc.: It is an important manufacturer of wood pallet and has strong manufacturing capacity.

- Others: Pallet Consultants, Inc., Loscam, PECO Pallet, Inc., Schoeller Allibert, Cabka Group, Rehrig Pacific Company, Schoeller Arca Systems, Brambles Limited, Pallet Express, Inc., TransPak, Inc.

Wooden Pallet and Container Market Segments Covered

By Product Type

- Wooden Pallets

- Stringer Pallets

- Block Pallets

- European Pallets (Europallets)

- Customized Pallets

- Wooden Containers

- Crates

- Boxes

- Baskets

- Drums

By Material Type

- Softwood

- Hardwood

- Engineered Wood

- Plywood

- Laminated Veneer Lumber (LVL)

- Recycled Wood

By Treatment Type

- Heat Treatment (ISPM-15 Compliant)

- Chemical Treatment

- Fumigation

- Untreated

By End-User Industry

- Agriculture

- Automotive

- Pharmaceuticals

- Retail and E-commerce

- Food and Beverage

- Chemicals

- Electronics

- Construction and Demolition

By Distribution Channel

- Direct Sales

- Distributors and Dealers

- Online Platforms

- Rental Services

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait