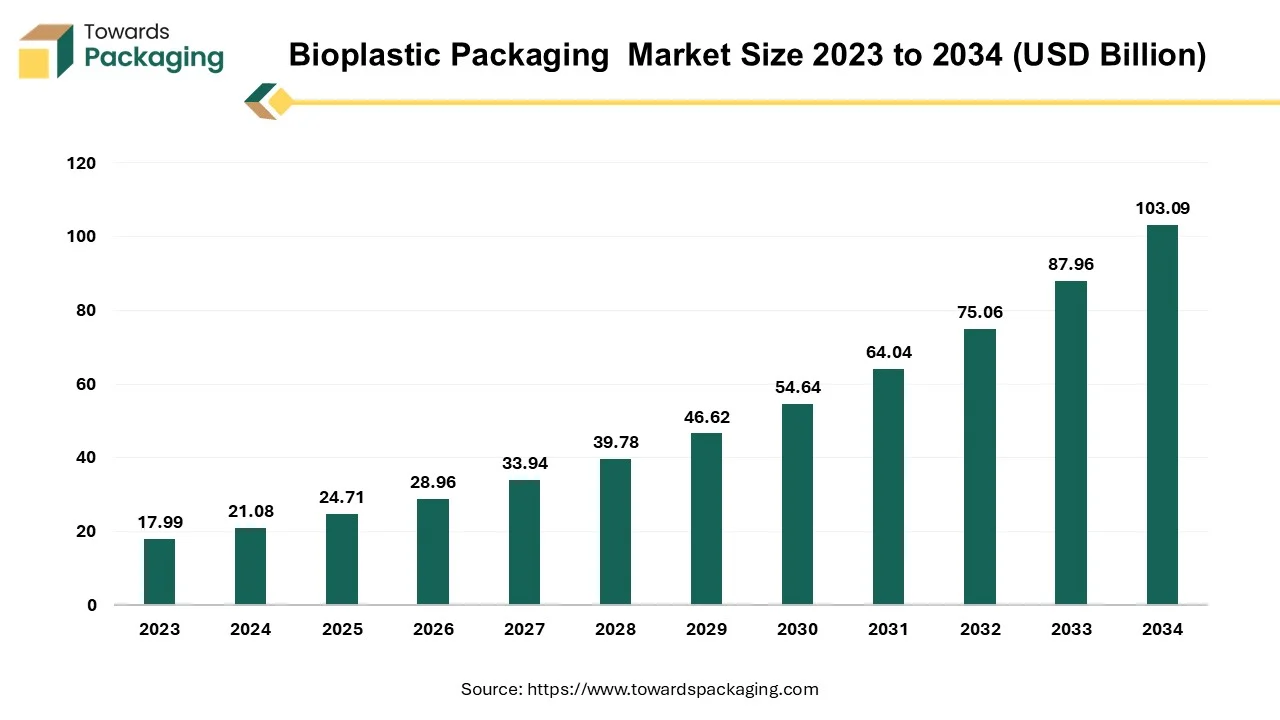

The bioplastic packaging market is forecasted to expand from USD 28.96 billion in 2026 to USD 120.80 billion by 2035, growing at a CAGR of 17.2% from 2026 to 2035. (PLA, starch blends, PBAT, bio-PE, bio-PET), type breakdown (flexible & rigid), and application insights across food & beverages, consumer goods, cosmetics, and pharmaceuticals. It provides a full regional analysis across North America, Europe, Asia Pacific, Latin America, and MEA, highlighting Europe’s 2024 dominance and APAC’s fastest growth outlook. The study also includes competitive analysis of leading companies such as Amcor, NatureWorks, Novamont, Sealed Air, Constantia Flexibles, and ALPLA, as well as value chain analysis, global production data, and bioplastic supply & trade flows, with capacity projections rising from 2.01 million tonnes (2023) to 5.67 million tonnes (2029).

Bioplastics are synthetic materials made of renewable biomass, including sawdust, maize starch, straw, vegetable fats and oils, wood chips, and recovered food waste. Bioplastic, a biodegradable substance derived from renewable resources, has the potential to mitigate the issue of plastic waste, which is strangling the world and degrading the ecosystem. Organic or bio-plastics are a type of plastic that comes from renewable biomass sources, such bacteria, pea starch, or maize starch, as opposed to fossil fuel-derived plastics that come from oil. The intended biodegradability of certain bio-plastics varies. Bio-plastics offer businesses and consumers an innovative way to contribute to environmental protection and a sustainable future. They are either bio-based or biodegradable. Based on a novel class of biodegradable materials, biodegradable plastic is primarily produced with less energy by utilizing natural resources like corn and wheat starch.

Bioplastics are primarily divided into two categories, namely PLA (polylactic acid) and PHA (polyhydroxyalkanoate). The sugars found in maize starch, cassava, or sugarcane are commonly used to make PLA (polylactic acid), which is edible, carbon-neutral, and biodegradable. Corn kernels are dissolved into carbohydrate, protein, and fiber by immersion in sulfur dioxide and hot water, which turns corn into plastic. After the kernels are processed, the starch and corn oil are separated. Long carbon molecule chains make up the starch, just as long carbon chains in plastic made from fossil fuels do. Add some citric acid to create a long-chain polymer, which is a big Wheat starch is transformed into plastic. Picture: The CSIRO molecule, which is the building block of plastic, is made up of repeated smaller units. PLA can have characteristics similar to those of polyethylene, which is used to make plastic.

The bioplastic material reduces carbon footprint. Bioplastic material saves energy in production. The non-renewable raw materials are not used for manufacturing the bioplastics. The use of bioplastics reduces non-biodegradable waste which is hazardous for environment. Bioplastic material do not contain contaminates and additives that are harmful for health such as bisphenol A or phthalates.

Is the Bioplastics Packaging Market Resilient to Cost and Scale Challenges?

Despite higher costs, the market shows growing resilience because of robust regulatory backing and sustainability requirements. Growing corporate dedication to environmentally friendly packaging ensures long-term demand stability. Performance and scalability are being improved by technological advancements. Market stability is being strengthened by consumer preference for eco-friendly alternatives. Adoption is further encouraged by government incentives. End-use application expansion promotes long-term market expansion.

One of the main factors driving the adoption of bioplastics packaging is environmental regulations restricting single-use plastics. Governments are using sustainability goals, incentives, and bans to promote compostable, biodegradable, and bio-based materials. Environmental claims are validated, and market credibility is increased through certification standards. For brands, regulatory support lowers adoption risk. Bioplastics have a significant regulatory-driven growth advantage as global regulations tighten.

To lessen reliance on traditional plastics, governments all over the world are actively promoting bioplastics packaging. Industries are being encouraged to switch to bio-based and biodegradable substitutes by measures like prohibitions or limitations on single-use plastics. Material development and scalability are supported by public funding and incentives for bioplastic research innovation and production. Bioplastics are also being incorporated into circular economy frameworks by numerous governments with a focus on recyclability and compostability. Furthermore, green public procurement policies that prioritize sustainable packaging in government-backed projects and institutions are increasing demand.

| Metric | Details |

| Market Size in 2025 | US$ 24.71 Billion |

| Projected Market Size in 2035 | US$ 120.80 Billion |

| CAGR (2025 - 2035) | 17.2% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Type, By Application and By Region |

| Top Key Players | Amcor plc, Novamont S.p.A, NatureWorks, LLC, Coveris, Sealed Air, Alpha Packaging, Constantia Flexibles Group GmbH. |

Growing public awareness of environmental sustainability is expected to propel the growth of the global bioplastic packaging market. The market for bioplastics will continue to be driven by growing worries about plastic pollution and efforts to wean off of plastics derived from petroleum. Growing consumer awareness of and preference for environmentally friendly and sustainable products is one of the main factors driving the worldwide bioplastic packaging market's expansion.

Nowadays, a greater number of consumers are choosing packaging materials made of renewable plant-based resources and with less of an adverse effect on the environment. The younger generation, who care more about the environment and are prepared to spend more for sustainable options, is driving this trend. People are becoming more and more aware of the negative environmental effects of single-use plastics and the waste they produce, which ends up in landfills and the ocean. As a result, producers of packaging are now able to provide bioplastic alternatives derived from biomass sources such as cellulose, sugarcane, maize starch, and vegetable fats and oils. Food packaging, drink bottles, containers, clamshells, and other objects are among the examples given.

The United Nations Environment Programme reports that the amount of plastic produced worldwide rose from 1.5 million tons in 1950 to almost 380 million tons in 2015. Less than 10% of it gets recycled, with the remainder finding its natural home in the environment. Concerns over plastic contamination have increased in light of these concerning data. The bioplastic packaging sector is expanding due in large part to the strict laws being enforced by governments throughout the world to reduce the use of single-use plastics. Virgin plastic bags and other non-biodegradable packaging products are subject to restrictions or steep surcharges in nations like the European Union, Canada, China, and India.

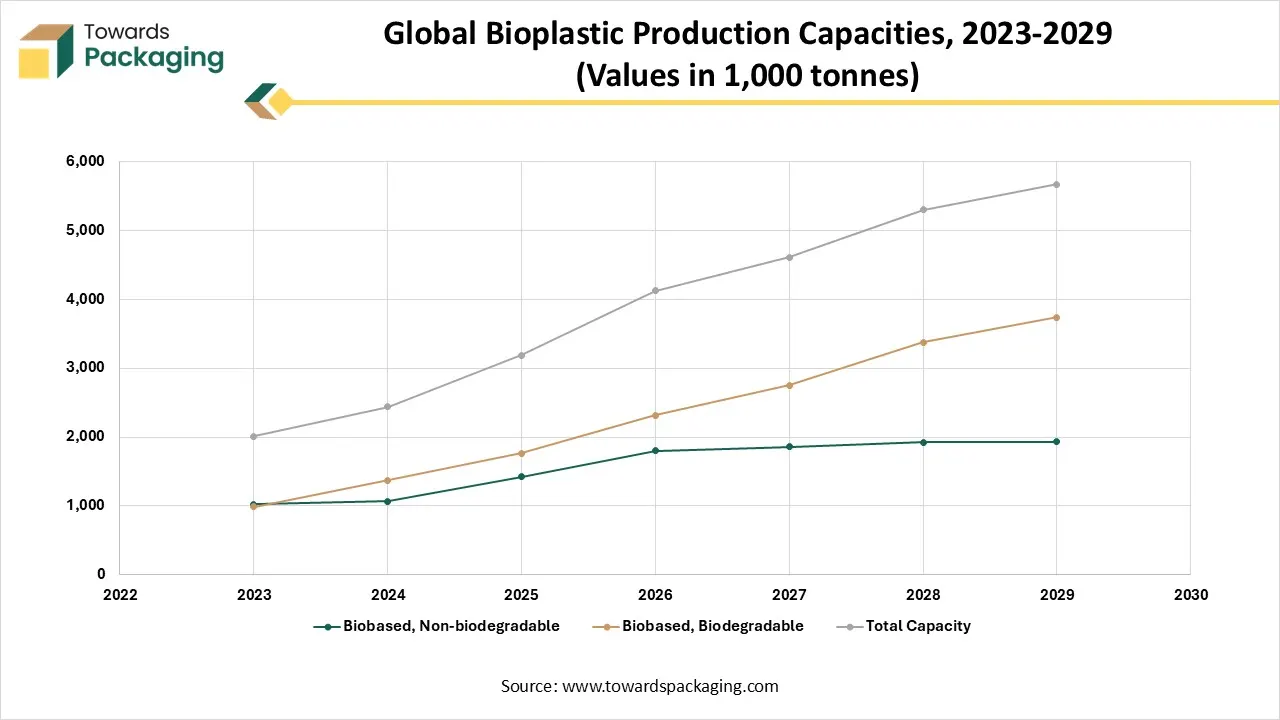

The image highlights a steady rise in global bioplastics production capacity from 2023 to 2029, demonstrating a significant increase in the use of sustainable packaging. Due to consumer demand for environmentally friendly and compostable packaging options, biobased biodegradable plastics are growing at the fastest rate.

In the meantime, applications that prioritize durability are supported by the steady growth of biobased non-biodegradable plastics. Growth in overall capacity indicates rising investments and a regulatory push for environmentally friendly packaging materials.

| Year | Biobased, Non-biodegradable | Biobased, Biodegradable | Total Capacity |

| 2023 | 1,022 | 990 | 2,012 |

| 2024 | 1,068 | 1,372 | 2,440 |

| 2025 | 1,421 | 1,763 | 3,184 |

| 2026 | 1,804 | 2,318 | 4,122 |

| 2027 | 1,859 | 2,748 | 4,607 |

| 2028 | 1,925 | 3,372 | 5,297 |

| 2029 | 1,932 | 3,735 | 5,667 |

The global production capacity of bioplastics is projected to rise steadily from just over 2 million tonnes in 2023 to nearly 5.7 million tonnes by 2029. Growth is driven mainly by biobased, biodegradable plastics, which expand almost twofold over the forecast period. Non-biodegradable biobased plastics also grow but at a slower pace, maintaining a stable baseline for applications requiring durability. Overall, the data highlights accelerating global investment in sustainable materials, particularly in biodegradable bioplastics.

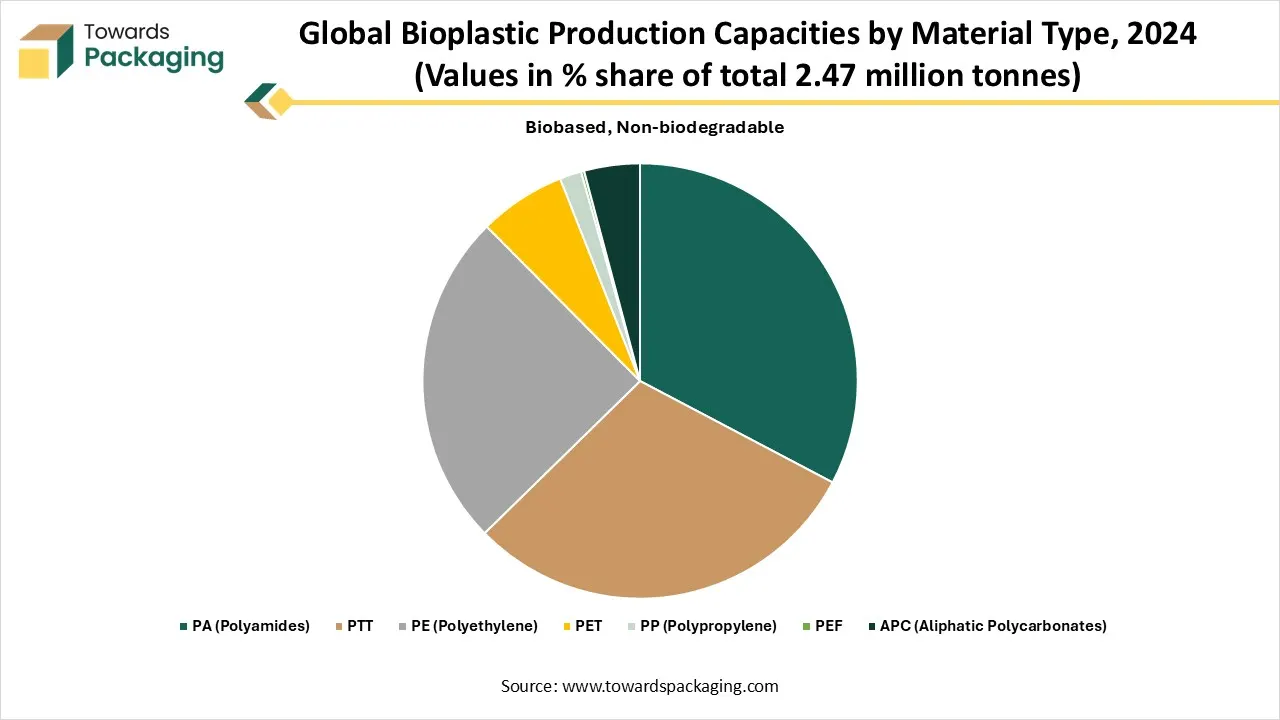

| Material | Share (%) |

| PA (Polyamides) | 14.20% |

| PTT | 13.00% |

| PE (Polyethylene) | 10.80% |

| PET | 2.80% |

| PP (Polypropylene) | 0.70% |

| PEF | 0.10% |

| APC (Aliphatic Polycarbonates) | 1.80% |

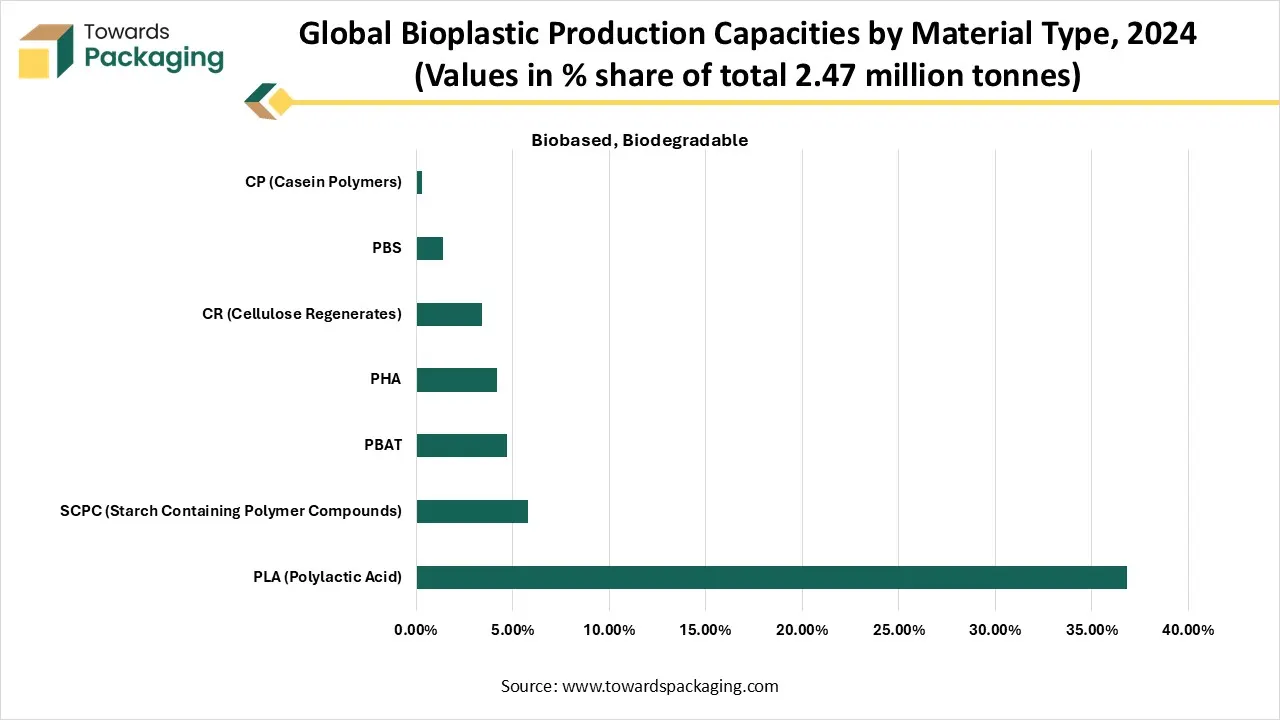

The chart and table show how different materials contribute to global bioplastics production capacity in 2024. Polyamides (PA) lead the mix with a 14.20% share, supported by their durability and suitability for demanding packaging applications. PTT and polyethylene (PE) also hold notable shares, indicating wider adoption across flexible and consumer packaging uses. In contrast, materials such as PET, APC, PP, and PEF account for smaller portions, reflecting their limited but gradually emerging role in specialized and next-generation bioplastic packaging.

In 2024, global bioplastic production reached roughly 2.47 million tonnes, split between biodegradable (over 56%) and non-biodegradable biobased materials (about 44%). PLA is the single largest material category, making up nearly 37% of global production, followed by starch-based compounds. Among non-biodegradable types, polyamides and PTT hold the largest shares. The data shows a strong global shift toward biodegradable materials, driven by sustainability policies and rising demand for compostable packaging.

The high cost required for manufacturing the bioplastic material is estimated to impose restriction on the growth of the bioplastic packaging market. One of the biggest obstacles preventing bioplastic from being widely used in the packaging business is still its high cost of production. Bioplastics still cost more to make than traditional plastics, despite their advantageous environmental qualities. Additionally, the cost of polymers derived from fossil fuels is reduced by the current petrochemical network. Exorbitant expenses restrict bioplastics to specialized uses and affect their ability to compete on price in the market.

Growing customer demand for environmentally friendly packaging offers significant opportunity for the growth of the bioplastic packaging market over the forecast period. Consumer desire for eco-friendly products and growing environmental consciousness are pushing the use of bioplastic packaging when it is available. Stringent laws designed to reduce the use of single-use plastics also encourage the usage of bioplastics. Costs are expected to decrease as manufacturing increases, making bioplastics more accessible and cheap for a larger spectrum of end users. The key players operating in the market are focused on adopting inorganic growth strategies like collaboration to develop bioplastic materials to meet the rising demand of the bioplastic packaging is expected to create lucrative opportunity for the growth of the bioplastic packaging market over the forecast period.

The biodegradable segment witnessed dominating the market share of the bioplastic packaging market in 2024. Due to consumer awareness of the environment growing and government pressure for sustainable solutions. After being disposed of, biodegradable plastic totally breaks down without leaving any hazardous traces behind. This lessens the pollution that traditional plastic, which fills landfills for centuries, causes. Several key drivers are driving the biodegradable material market. Growing inclination for environmentally friendly products: Customers are choosing more and more environmentally friendly products with smaller carbon footprints as the risks posed by climate change become more apparent. The move toward plant-based, biodegradable packaging alternatives is being accelerated by the bad press surrounding the disposal of plastic waste in seas.

Growing need for bio-based plastics in a number of end-use sectors, which is anticipated to fuel demand for them throughout the evaluation period. Polylactic acid, starch blends, PBAT, PBS, PHA, polycaprolactone, and cellulose acetate are examples of biodegradable plastics. In terms of revenue, starch blends and PBAT constituted the largest biodegradable product segment in 2021. Potatoes, tapiocas, wheat, rice, and corn are among the readily available natural materials used to make starch-based polymers. Because starch blends are so readily available, they are a great substitute for traditional plastics. However, during the course of the projection period, polylactic acid (PLA) is anticipated to increase at the highest rate. The increasing product demand in a number of applications, such as packaging, transportation, agriculture, electronics, and textiles, is predicted to fuel the segment's expansion.

The global market for polylactic acid is being significantly fueled by its lower carbon emissions as compared to conventional polymers. One kilogram of polylactic acid, for example, emits about 0.5 kg of carbon dioxide, while the production of low-density polyethylene, conventional polycarbonate, polystyrene, polyethylene terephthalate, and polypropylene releases 1.7 kg, 5.0 kg, 2.2 kg, 2.0 kg, and 1. 7 kg of carbon dioxide, respectively. Moreover, the key players operating in the market are focused on launching the new technology and expanding product portfolio which is estimated to drive the growth of the segment over the forecast period.

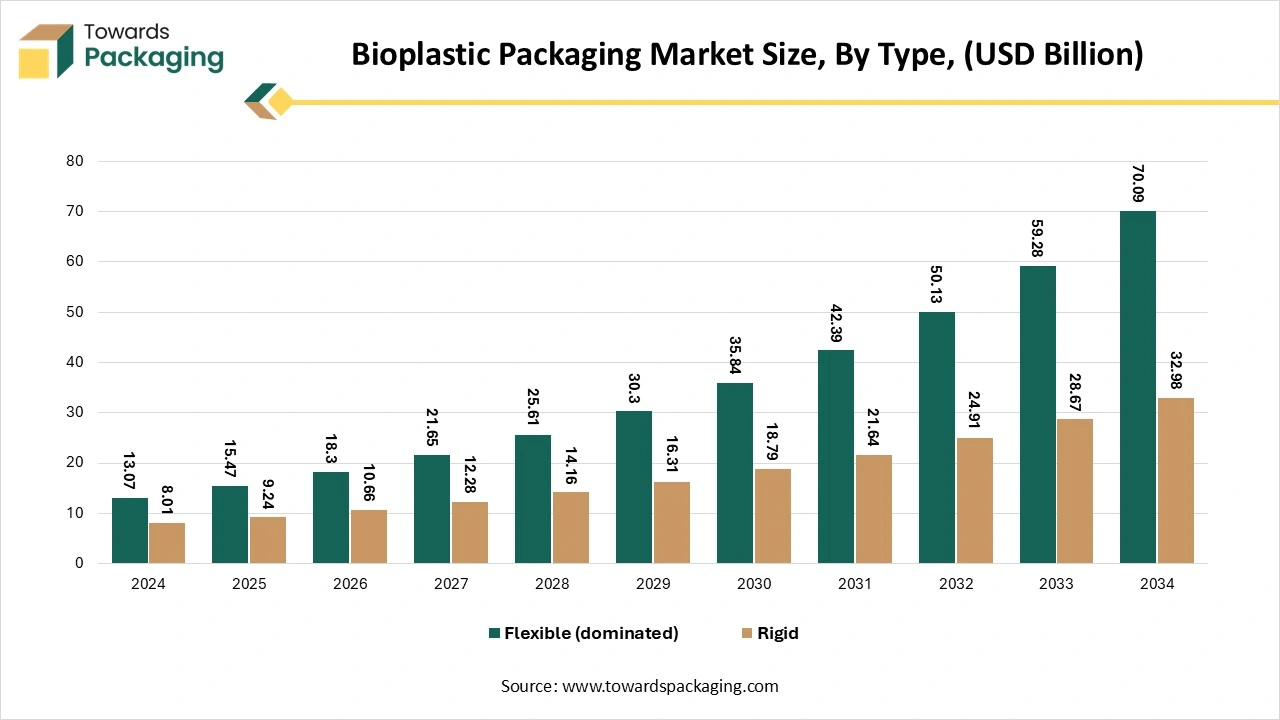

The flexible segment is expected to show significant growth over the forecast period. It is projected that advances in case-ready packaging, enhanced packaging techniques, and bioplastic production technologies would propel demand for bioplastics in flexible packaging. Additionally, there is a great need for flexible packaging, particularly for beverages and snack items. The rise in demand can be ascribed to advancements in technology, shifts in consumer lifestyles, contemporary retail industries, and the growing appeal of quick-service restaurants.

For instance,

Flexible packaging, which is mostly composed of bioplastics, has many advantages over rigid packaging, including better product protection, longer shelf lives, and lower material use. Important participants in the flexible packaging sector as well as raw material suppliers are tackling this problem by creating environmentally friendly plastic film solutions and putting in place different recycling initiatives. The goal of MRFF (Materials Recovery for the Future), for example, is to provide practical and affordable solutions for recycling and recovering plastic materials over the course of the plastic film's lifecycle.

The platform is a collaborative effort among various stakeholders, including Amor, Sealed Air, Procter and Gamble, APR, PepsiCo, FPA, and Target. The recycling efforts are additionally aided by programs like the Material Recovery Facility (MRF), Plastics Industry Recycling Action Plan (PIRAP), and Waste & Resource Action Program (WRAP). Additionally, companies like Alcoa, Tetra Pak, Klabin, and TSL Ambiental are implementing cutting-edge recycling technologies like plasma technology, which consumes less energy than traditional recycling techniques, to separate the paper, aluminium, and plastic components used in packaging. Throughout the projected period, the expanding use of these technologies will support the expansion of the global market for flexible food and beverage packaging.

The food & beverages segment held dominant position in the year 2024. The market is driven by the growing popularity of quick-service restaurants and the growing demand for packaged food. During the forecast period, the market for flexible packaging is expected to rise as a result of manufacturers raising their production capacity in response to the increased demand for packaged goods. Biodegradable films are thin layers of material that can decompose into their natural components while protecting and preserving food and drinks. Cellophane, a biodegradable film material made from plant cellulose, is one example. The environmentally benign nature of biodegradable films sets them apart from conventional plastic films.

Consider the conventional plastic overwrap used on magazines or beverage multipacks. In addition to reducing plastic waste, replacing this with a biodegradable film helps create a more sustainable end-of-life situation.Biodegradable films have a wide range of expanding uses in the food and beverage sector. Fresh produce may be preserved for longer while having a less environmental impact due to shrink wrap, a permeable but protective fabric that covers fruits and vegetables. Biodegradable films are now widely used in snack packaging, individually wrapped products, and single-serve food items.

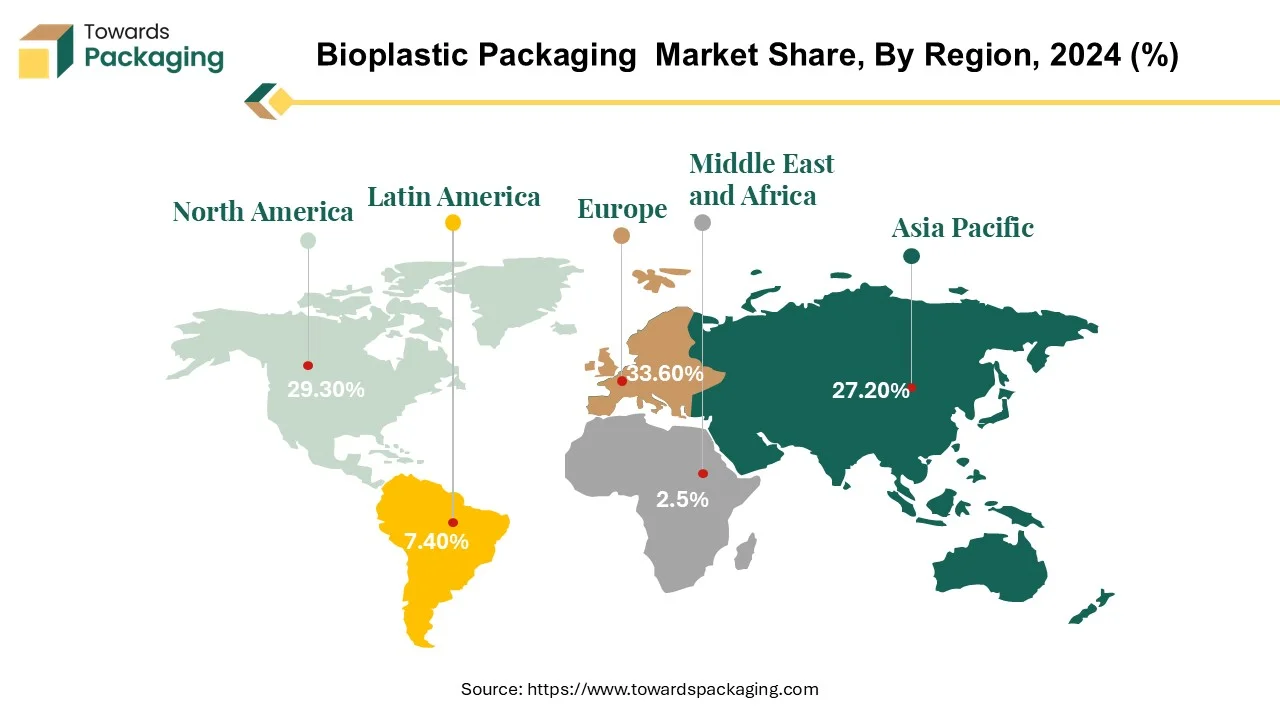

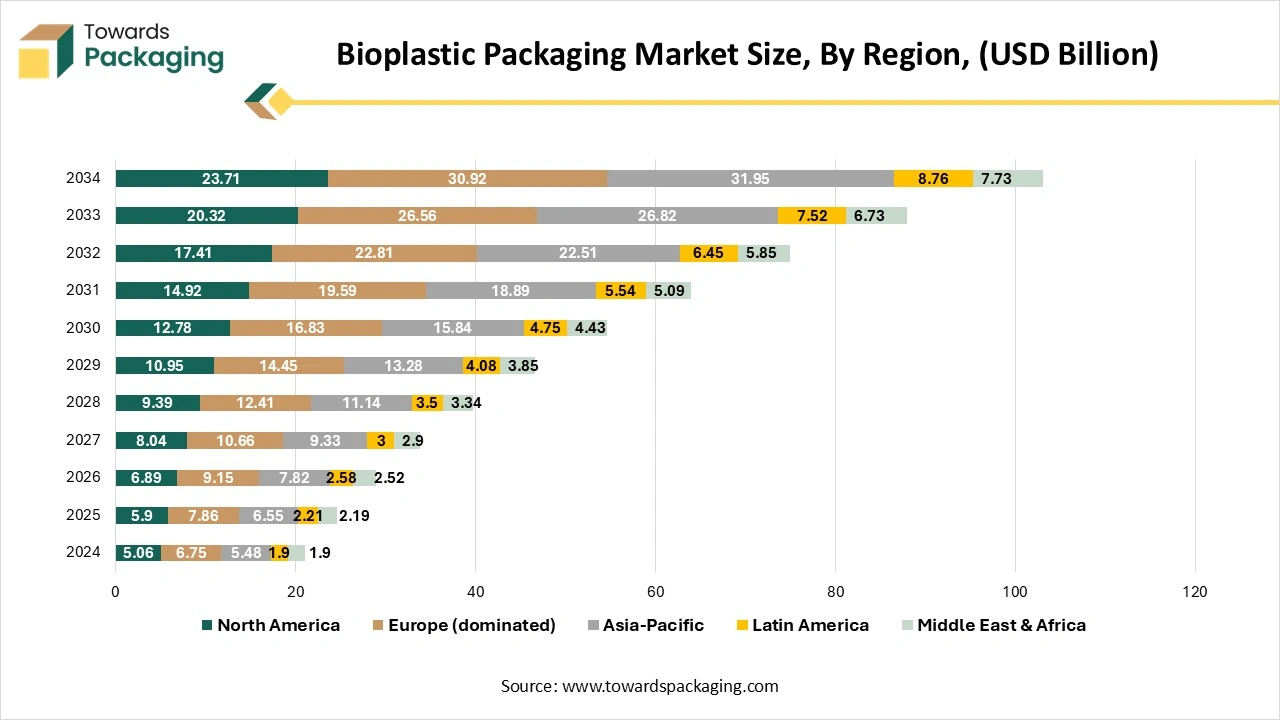

Europe held the dominant share in 2024. An enormous and well-established e-commerce market exists in nations which drives up demand for a wide range of packaging in a variety of product categories. The region's need for packaging is mostly driven by the increasing adoption of e-commerce, which is made possible by the ease of online shopping and a strong logistical infrastructure. E-retailers can also get a variety of packaging options at affordable costs because of existence of significant packaging suppliers and manufacturers in Europe. Packages that can be customized to fit heavy, awkwardly proportioned, or fragile items are widely available.

Continuous packaging improvements for attributes like tamper-proof seals, simple returns, and recyclability are another characteristic of the regional market. Packaging in the area continues to place a strong emphasis on sustainability. Moreover, the key players operating in the European market are focused on developing biopolymer for bioplastic packaging, which is estimated to drive the growth of the bioplastic packaging market over the forecast period.

Asia Pacific is estimated to witness fastest growth over the forecast period. The key factor here is the rapid rise of the internet retail industry in conjunction with rising incomes in developing nations. Online purchasing has increased by over 50% annually in China, India, and other Southeast Asian nations, surpassing that of established markets. The demand for a variety of package formats is directly impacted by this increase. Packaging manufacturers can benefit from significant market potential in the Asia Pacific area as a result of growing manufacturing localization. Other benefits include a sizable customer base and the existence of well-known internet marketplaces.

Additionally, the region's labor and inexpensive raw materials have attracted multinational brand owners to establish operations there. The fast-moving e-commerce packaging business has found Asia Pacific to be an appealing place for future expansion due to this and the growth of regional packaging solution providers. The key players operating in the market are focused on launching new manufacturing plant in different countries of Asia Pacific region, to expand its geographic presence as well as the production capacity, which is estimated to drive the growth of the bioplastic packaging market over the forecast period.

Furthermore, the key players are focused on developing and providing advanced technology for bioplastic material manufacturing and bioplastic packaging, which estimated to drive the growth of the bioplastic packaging market over the forecast period.

India Bioplastic Packaging Market Trends

India’s bioplastic packaging market is growing steadily, driven by regulations aimed at reducing plastic waste, growing environmental consciousness, and the food and FMCG industries growing need for sustainable packaging. While advanced materials are progressively emerging through pilot projects and government initiatives, materials like PE and PET-based bioplastics are gaining traction due to cost sensitivity and scalability.

Germany Bioplastic Packaging Market Trends

Germany's bioplastic packaging market is supported by robust sustainability laws, sophisticated recycling facilities, and widespread use of bio-based materials like PA and PTT. High-performance bioplastics are being used more frequently in food, automotive, and industrial packaging due to the nation's emphasis on eco-design standards and circular economy policies.

The North American bioplastic packaging market is expanding due to strong corporate commitments to sustainability, rising demand for bio-based and compostable packaging, and ongoing advancements in material science. Bioplastics like PA, PE, and PTT are being used more frequently in the area of consumer goods, e-commerce, and food packaging.

In the U.S., the bioplastic packaging market is driven by growing consumer demand for environmentally friendly packaging, brand-led sustainability goals, and state-level plastic regulations. Both biodegradable and non-biodegradable bioplastics are being adopted in both flexible and rigid packaging formats thanks to investments in domestic bioplastic production capacity and R&D.

MEA bioplastic packaging market is gradually developing, backed by waste reduction targets, sustainability roadmaps, and rising demand for substitute packaging materials. The food, beverage, and retail industries are the primary drivers of adoption, with a growing emphasis on recyclable and biobased packaging options.

The UAE bioplastic packaging market is gaining momentum due to government-led sustainability programs, investments in green manufacturing, and prohibitions on single-use plastics. With growing demand for bioplastics in retail, hospitality, and food service applications, the nation is becoming a regional center for sustainable packaging.

Recent survey findings reveal a promising new frontier in sustainable materials: mushrooms. Researchers have discovered that a particular mushroom species could potentially replace plastic in a variety of applications, from headphones and memory foam for shoes to aircraft exoskeletons.

The survey highlights how mushrooms could play a key role in reducing the immense waste generated by conventional plastics, which are notoriously difficult to recycle and often end up in landfills, landscapes, and waterways. Unlike plastics, mushroom-based materials are biodegradable and can be repurposed at the end of their life cycle.

The research unveils that this mushroom possesses remarkable versatility in material properties. It can be engineered to produce a range of textures, from soft and spongy to tough and woody. This adaptability opens up exciting possibilities for its use in various products. By examining the mushroom’s unique three-layer structure, researchers aim to develop more sustainable alternatives to traditional materials.

The outer layer of the mushroom is particularly tough and could potentially be used for impact-resistant coatings, such as those found in windshields. The soft middle layer offers a leather-like texture, which could provide a sustainable substitute for leather goods. Lastly, the inner layer resembles wood, presenting potential applications in structural materials.

The survey underscores that this mushroom’s diverse properties, coupled with advanced imaging and mechanical strength assessments, could pave the way for innovative, eco-friendly materials in the near future.

By Material

By Type

By Application

By Region

January 2026

January 2026

January 2026

January 2026