MEA Flexible Packaging Market Size, Share, Trends and Forecast Analysis

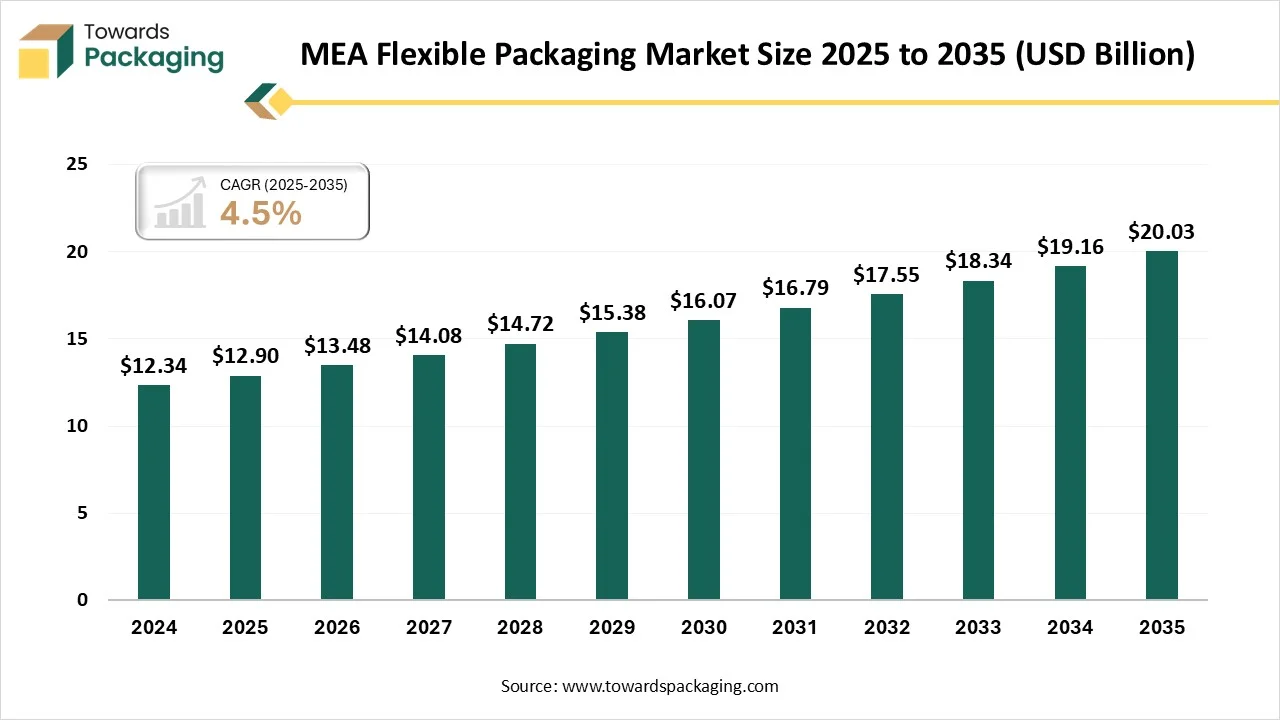

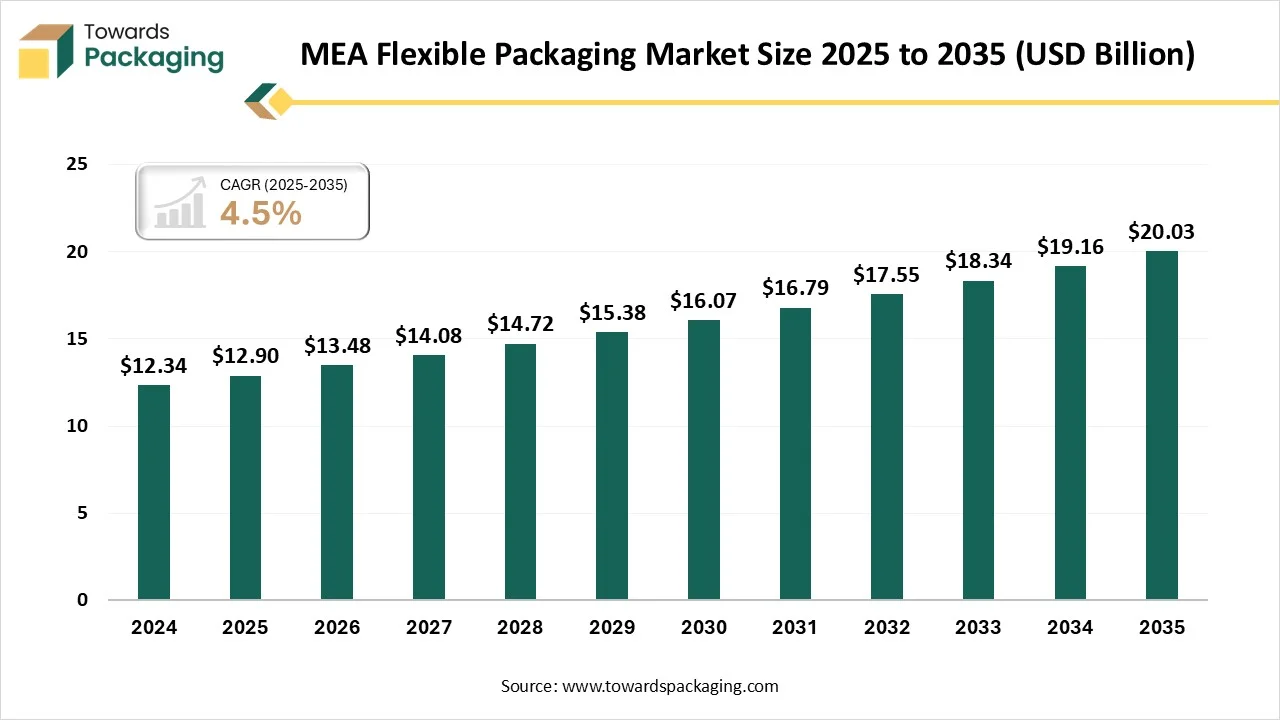

The MEA flexible packaging market is projected to reach USD 20.03 billion by 2035, growing from USD 13.48 billion in 2026, at a CAGR of 4.5% during the forecast period from 2026 to 2035.The growth of e-commerce in the Middle East and Africa has pushed the demand for lightweight and protective packaging. Flexible plastics are utilised for the padded envelopes, Custom-fit pouches, and bubble wraps. They assist in lowering shipping costs and protect goods during transportation.

Major Key Insights of the MEA Flexible Packaging Market

- In terms of revenue, the market is valued at USD 13.48 billion in 2026.

- The market is projected to reach USD 20.03 billion by 2035.

- Rapid growth at a CAGR of 4.5% will be observed in the period between 2026 and 2035.

- By material type, the plastic segment contributed the biggest market share in 2025.

- By material type, the multilayer packaging segment will be expanding at a significant CAGR between 2026 and 2035.

- By product type, the pouches segment contributed the largest market share in 2025.

- By product type, the sachets & stick packs packaging segment will be expanding at a significant CAGR between 2026 and 2035.

- By film type, the multi-layer films segment has invested the biggest market share in 2025.

- By film type, the single-layer recyclable films segment will be growing at a significant CAGR between 2026 and 2035.

- By printing technology, the rotogravure segment held the largest market share in 2025.

- By printing technology, the digital printing segment will be growing at a significant CAGR between 2026 and 2035.

- By application, the food & beverage segment contributed the biggest market share in 2025.

- By application, the e-commerce packaging segment will be developing at a significant CAGR between 2026 and 2035.

- By distribution channel, the direct sales segment had the biggest market share in 2025.

- By distribution channel, the online B2B platforms segment will be developing at a significant CAGR between 2026 and 2035.

What is the Flexible Packaging Market?

The Middle East and Africa (MEA) flexible packaging market is defined by its application of materials such as paper, plastic, bioplastics, and aluminium foil to make acceptable packages such as pouches, bags, blisters, and wraps. Main factors that shape the industry include rising demand from end-user industries like pharmaceuticals, food, and beverages, which is driven by the growing urban middle class and increasing e-commerce.

MEA Flexible Packaging Market Trends

- Market Growth Overview: The Middle East and Africa market for flexible packaging is expanding significantly due to growing sustainability trends, user choice for biodegradable and recyclable materials, and government regulations on single-use plastics.

- Global Expansion: The worldwide expansion of flexible packaging from the Middle East and Africa (MEA) is being driven by the growing urge, strategic funding by main players, and robust export growth. The MEA region is expanding its footprint as a producer and export center that develops its critical location and rising internal industry.

- Major Market Players: The market involves main players in the MEA flexible packaging market, such as Huhtamaki Oyj, ENPI Group, and Napco National, along with main companies like Hotpack Packaging Industries LLC, Mondi Group, and Amcor Plc, too. Such organizations are present in the region with the assistance of direct production, strategic expansions, and collaborations to align with rising demand.

Technological Developments of the MEA Flexible Packaging Market

One of the main advantages is the crucial development in productivity. The automated systems include filling, feeding, and labelling into a single flow that reduces the cycle times, limits manual labor, and lowers downtime. This not only lessens operational costs but also decreases the risk of fatigue and human errors. In industries like pharmaceuticals and food, this smoothness is important for aligning with fewer deadlines and tracking the product integrity.

Trade Analysis of MEA Flexible Packaging Market: Import & Export Statistics

- Worldwide, the top three exporters of Flexible Packaging are India, Vietnam, and the United Arab Emirates. The United Arab Emirates has topped the globe in terms of Flexible Packaging, with 90,340 shipments, India with 70,011 shipments, and Vietnam with 36,967 shipments.

- As per the global data, the world has exported 86,800 shipments of Flexible packaging, UAE, from June 2024 to May 2025. These exports were being created by 7,206 Exporters to 9,909 Buyers, which marks a development rate of 15% as compared to the leading twelve months.

- During this period, in May 2025 alone, 6,642 Flexible Packaging, UAE has officially exported shipments that were made globally. This has marked a year-on-year development of -6%.

Top Importing Countries of the MEA Flexible Packaging Market

- The United Arab Emirates, Saudi Arabia, and South Africa are the top importing regions of Flexible packaging in the Middle East and Africa (MEA) region.

- Saudi Arabia has dominated the market and is the biggest income shareholder in the Middle East. Its urge is being driven by the fast urbanization and the growing user demand for packaged food and beverages.

- The United Arab Emirates is a main business and trading center and a main importer of flexible packaging from countries like India. It also has a developing intr-regional trade with many countries, like Saudi Arabia.

MEA Flexible Packaging Market - Value Chain Analysis

Raw Material Sourcing: The main raw material sourcing for the Middle East and Africa (MEA flexible packaging is plastics, which include biobased polymers and fossil- along with other materials like aluminium and paper foil for tailored uses. Because of developing sustainability efforts in the MEA region, producers are typically sourcing more recyclable and bio-based plastics while continuously using conventional polymers.

- Key Players: Amcor, Sealed Air, and Berry Global

Component Manufacturing: Flexible packaging manufacturing plays a crucial role in making durable, versatile, and visually appealing packaging solutions for a huge range of products across different sectors such as beverages, food, personal care, pharmaceuticals, and household items.

- Key Players: Huhtamaki, Coveris, and UFlex

Logistics and Distribution: Flexible plastic packaging plays a main role in the logistics and e-commerce sectors, in which protection, precision, and presentation are crucial. Prevalent uses count Stretch hood film and pallet wrap, which are used to protect big shipments on planets. They assist in protecting movement during transportation and protect goods from dirt, dust, and moisture in transport and storage, too.

- Key Players: Clondalkin Group, Sonoco, and Winpak, too.

Material Type Insights

Why the Plastic Segment Dominated the MEA Flexible Packaging Market In 2025?

The plastic segment dominated the MEA flexible packaging market in 2025 as PE packaging, or the polyethylene packaging, is created from the most prevalently manufactured plastic in the world and is valued for its durability, low cost, and versatility too. The kind of PE packaging totally relies on the polyethylene’s density and its molecular pattern, with the most common variants being HDPE, LDPE, and LLDPE. On the other hand, polypropylene is an evergreen plastic that is prevalently used for a variety of work and is one of the most used plastics in plastic packaging. It is specifically famous in the pharmaceutical sector due to its reliable and chemical-opposite characteristics.

The multilayer packaging segment is predicted to witness the fastest cagr during the forecast period. This packaging is sustainable, it does not need much material, and can currently also be manufactured from chemically recycled material. It includes up to 11 single and ultra-thin layers that make it specifically thinner and lighter than comparable packaging. In addition to lowering the amount of raw materials utilised, this also includes selectively lowering C02 emissions during transportation.

Product Type Insights

Why the Pouches Segment Dominated the MEA Flexible Packaging Market In 2025?

The pouches segment dominated the MEA flexible packaging market in 2025 because flexible pouches have developed as one of the fastest-developing packaging designs across sectors due to their convenience, versatility, and sustainability advantages. Pouches use less material, which results in lower manufacturing costs as well as decreased transportation expenses. Flexible pouches also have a lesser environmental footprint, creating less greenhouse gas emissions during transportation and production.

The sachets & stick packs segment is expected to witness the fastest cagr during the forecast period. Flexible packaging continues to develop in favor among the consumer packaged goods 9CPG) producers due to several built-in benefits. The barrier properties, compact size, and cost-effectiveness of the flexible packaging create a packaging design selection for many kinds of products. Whereas, stick packs are tube-like and narrow flexible packaging pouches, which are perfect for the single-serve uses designed by busy users for convenience. They are prevalent; they are used for everything from powdered drink mixes and nutritional supplements to condiments, sweeteners, probiotics, and more.

Film Type Insights

Why did The Single-Layer Films Segment Dominate The MEA Flexible Packaging Market In 2025?

The single-layer films segment dominated the market in 2025 as they are economical and simpler. They are generally created from one kind of polymer, which makes them convenient to recycle and accurate for direct uses, such as agricultural films and shrink wraps, too. They are even recyclable, which makes them ideal for short-term or lesser urgency applications but restricted for long-term or heavy barrier uses.

The multi-layer films segment is expected to witness the fastest CAGR during the forecast period. This packaging remains at the front step of current packaging invention, changing how products are protected, preserved, and presented across industries. As users' urges for longer shelf life and sustainable results, and perfect protection continue to develop, multilayer film packaging has grown as a complicated technology that manages these complicated needs.

Printing Technology

Why the Rotogravure Segment Dominated the MEA Flexible Packaging Market In 2025?

The rotogravure segment dominated the market in 2025, as this printing is a highly effective printing technique that is specifically perfect for long periods in flexible packaging. Its direct shift strategy of updating the pattern from the cylinder to the ground enables high-quality print quality, even at very high manufacturing speeds. This makes it the selected choice for bulk printing of flexible packaging, which ensures high productivity and sharpness on each reproduction print.

The digital printing segment is predicted to witness the fastest CAGR during the forecast period. It is a current, plate-free procedure of printing directly onto the flexible packaging foundation, such as rollstock films and pouches, too. Alike regular methods which use the fixed printing plates, digital printing utilises a computer file to print he respective image directly, which makes it perfect for personalization, fast turnaround, and shorter print runs too. By excluding the demand for production printing plates, digital printing mainly condenses the production procedure.

Application Insights

Why the Food & Beverages Segment Dominated the MEA Flexible Packaging Market In 2025?

The food and beverages segment dominated the market in 2025 as by using non-rigid materials to package food and beverage, producers are perfect that are enabled to tailor the container to fit the brand and the product. Flexible packaging is accessible in a variety of sizes, shapes, and materials, which can be made in either formed or unformed arrangements. Formed packaging is being pre-shaped and can be packed and sealed in-house, whereas unformed packaging comes on a platform that is sent to co-packers for filling and making.

The e-commerce segment is predicted to experience the fastest CAGR during the forecast period. The growth of e-commerce has updated packaging demands. The flexible designs, like bags and pouches, serve a space-saving and lightweight selection that reduces shipping costs and enhances the shelf appearance. Characteristics such as spouts, resealable zippers, and easy-tear notches are heavily prevalent and need compatible premixed products that do not adjust mechanical honesty or aesthetics.

Distribution Channel Insights

Why the Direct Sales Segment Dominated the MEA Flexible Packaging Market In 2025?

The direct sales segment dominated the MEA flexible packaging market in 2025, as direct sales of the flexible packaging include producers that sell their products directly to organizations, which bypass mediators like wholesalers and distributors. A direct sale design can lower total costs by avoiding the middleman’s routine. The material -effective nature of the flexible packaging also lowers the storage and transportation expenses. It works directly with the producer that gives clients permission to technical expertise for selecting materials and developing the smoothest packaging design.

The online B2B platforms segment is expected to have the fastest CAGR during the forecast period. Flexible packaging is hugely useful for online sales with the assistance of main e-commerce sites, tailored business-to-business industry, and directly from the producers and suppliers who serve online ordering and personalization. Several producers serve direct online ordering for the high-volume flexible packaging that includes custom printing and pouches online, from the coffee bag to stand-up pouches.

Country Insights

Why the Middle East Dominated the MEA Flexible Packaging Market in 2025?

The Middle East has dominated the market in 2025 as the demand for it in this region is developing mainly due to rising disposable incomes, urbanization, and the expansion of food, beverage, and pharmaceutical industries. Market Development is filled by user choice for sustainability, convenience, and cost-effective packaging solutions, too.

Saudi Arabia is heavily funding healthcare infrastructure, and the urge for flexible packaging, which ensures integrity and product safety, is increasing. On the other hand, the UAE causes confusion for dual-language packaging -Arabic and English both. Flexible laminate pouches serve a huge space to count both languages precisely, along with nutritional data, barcodes, safety symbols, and expiration dates too.

Why is the MEA Flexible Packaging Market Growing Rapidly in Africa and Nigeria?

The MEA Flexible Packaging industry is predicted to have the fastest compound annual growth rate in Africa and Nigeria because the demand for flexible packaging in Africa is growing and developing, fueled by fast urbanization, increasing usage of packaged goods, and a growing middle class. Flexible packaging is utilised to protect and extend the shelf life of pharmaceutical products such as powders, creams, tablets, and wipes, too. As healthcare infrastructure develops, so does the urge for this kind of packaging. The move of people to the urban centres and the development of a middle class are increasing the demand for ready-to-eat, packaged, and on-the-go food and beverage products.

Recent Developments

- In August 2025, Sector veteran Zaheer Abbas disclosed the launch of his latest venture, PrimeFiber Global Paper Solutions, whose goal is to progress collaborations with chosen European paper mills and run as their indenting agent across the Middle East and South Asia.

- In August 2025, Napco National acquired Arabian Flexible Packaging, which is an established company in the Flexible Packaging Industry. The deal was smooth from August 1, 2025, with the assistance of Dubai-based subsidiary Napco Investment LLC.

- In June 2025, Siegwerk, which is one of the top worldwide suppliers of printing inks and coatings for packaging uses and labels, revealed the opening of a new site in Dubai, United Arab Emirates, that further expands its presence in the Middle East.

- In September 2025, Tipa Compostable Packaging, which is a provider of compostable flexible packaging materials, has stretched its profile to include four new high-barrier film and cover products.

- In September 2025, the Plastic Reboot Project opened in Pretoria, South Africa, to solve waste packaging pollution in the Food and Beverages industry. The project concentrates on developing the plastic packaging lifecycle with the help of interference at various stages.

- In March 2025, in commemoration of Global Recycling Day, Southern Africa Region and Nestlé East have revealed a main achievement across all its packaging, which is created from renewable materials.

Top Companies in the MEA Flexible Packaging Market

- Hotpack: Hotpack is one of the top providers of food packaging solutions. It was founded in 1995, and the organization is a producer and distributor of packaging products across different sectors that include retail, consumer goods, construction, pharmaceuticals, and healthcare.

- Integrated Plastic Packaging: Integrated Plastics Packaging produces and generates custom, good-quality flexible packaging materials, initially being driven by serving the food sector and partnering with several luxury brands.

- Emirates Printing Press: It is a packaging and printing organization with flexible packaging as one of its well-known services. It works in one of the biggest manufacturing facilities in the UAE, which has 250,000 sqft and is situated in Dubai Industrial City.

- Amber Packaging Industries L.L.C.: Amber Packaging Industries L.L.C. is a tailored packaging material producer with advanced, imaginative manufacturing technology, a team of professionals, and first-class quality standards and testing potential, too.

- Rotopak: Rotopak was established in Dubai, United Arab Emirates, in 1993. It has 250 employees, which at the beginning served offset and gravure printing services and since then has unfolded into a top one-stop server of flexible packaging and cardboard packaging solutions.

- ENPI: ENPI is a producer of packaging and plastic materials that delivers paper and plastic packaging solutions classified by various clients for its high-level technology, extensive industry experience, and manufacturing facilities.

- Radiant Packaging: Radiant Packaging Sector, which is headquartered in the United Arab Emirates, is a new firm that specializes in flexible packaging materials.

- Hexxa Flexible Packaging: Hexxa Flexible Packaging was established in the United Arab Emirates in 2006, with its main brand in Ras Al Khaimah, UAE. It provides local and multinational brands by serving tailored packaging for different products while maintaining the highest quality standards.

- Sealed Air Corporation: It is known for its food packaging and protective products. Sealed Air has a rigid regional market presence and is being classified as a main leader in the flexible packaging market.

- Mondi Group: A multinational top company in sustainable packaging and paper, Mondi is a leading name in the MEA flexible packaging sector.

MEA Flexible Packaging Market Segments Covered

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

- Paper

- Aluminum Foil

- Multilayer Packaging

By Product Type

- Pouches

- Bags & Sacks

- Wraps & Films

- Sachets & Stick Packs

- Shrink Films

- Flexible Laminates

By Film Type

- Single-Layer Films

- Multi-Layer Films

By Printing Technology

- Rotogravure

- Flexography

- Digital Printing

- Offset Printing

By Application

- Food & Beverage

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household Products

- Industrial Chemicals

- Agriculture & Fertilizers

- E-Commerce Packaging

By Distribution Channel

- Direct Sales

- Converters & Distributors

- Online B2B Platforms